444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China EV battery pack market represents one of the most dynamic and rapidly evolving sectors within the global electric vehicle ecosystem. As the world’s largest automotive market and a leading manufacturer of electric vehicles, China has established itself as a dominant force in battery pack technology and production. The market encompasses various battery chemistries, including lithium-ion, lithium iron phosphate, and emerging solid-state technologies, serving both domestic and international electric vehicle manufacturers.

Market dynamics indicate robust growth driven by government policies, technological advancements, and increasing consumer adoption of electric vehicles. The Chinese government’s commitment to carbon neutrality by 2060 has accelerated investments in battery technology, with the market experiencing a compound annual growth rate of approximately 18.5% over recent years. This growth trajectory reflects the nation’s strategic focus on establishing energy independence and reducing reliance on fossil fuels.

Manufacturing capabilities in China have reached unprecedented scales, with major battery producers like CATL, BYD, and CALB leading global production volumes. The market benefits from a comprehensive supply chain ecosystem, including raw material processing, cell manufacturing, and pack assembly operations. Regional concentration in provinces such as Jiangsu, Guangdong, and Fujian has created specialized industrial clusters that drive innovation and cost optimization.

Technology advancement remains a key differentiator, with Chinese manufacturers investing heavily in research and development to improve energy density, charging speeds, and battery lifespan. The market has witnessed significant improvements in battery pack design, thermal management systems, and manufacturing processes, contributing to enhanced vehicle performance and reduced costs.

The China EV battery pack market refers to the comprehensive ecosystem of battery pack design, manufacturing, and supply within China’s electric vehicle industry. This market encompasses the complete value chain from raw material sourcing and cell production to pack assembly and integration into electric vehicles. Battery packs serve as the primary energy storage system for electric vehicles, consisting of multiple battery cells, thermal management systems, battery management systems, and protective housing.

Battery pack functionality extends beyond simple energy storage, incorporating sophisticated management systems that monitor cell performance, regulate charging and discharging cycles, and ensure operational safety. These systems integrate advanced electronics, cooling mechanisms, and structural components designed to optimize performance while maintaining safety standards. The market includes various pack configurations tailored to different vehicle types, from passenger cars and commercial vehicles to electric buses and specialty applications.

Market scope encompasses both original equipment manufacturer supply and aftermarket services, including battery recycling and second-life applications. The definition extends to emerging technologies such as battery-as-a-service models, swappable battery systems, and grid-scale energy storage applications that utilize automotive-grade battery packs.

China’s EV battery pack market has emerged as a global powerhouse, driving innovation and setting industry standards for electric vehicle energy storage solutions. The market’s exceptional growth reflects China’s strategic positioning as both the world’s largest electric vehicle market and a leading battery technology developer. With domestic manufacturers capturing approximately 75% of global battery pack production capacity, China has established technological and manufacturing leadership that extends far beyond its domestic market.

Key market drivers include aggressive government policies supporting electric vehicle adoption, substantial investments in battery technology research, and the development of comprehensive supply chain infrastructure. The market benefits from vertical integration strategies employed by major manufacturers, enabling cost optimization and quality control throughout the production process. Chinese battery pack manufacturers have successfully expanded internationally, supplying major global automotive brands and establishing manufacturing facilities in key markets worldwide.

Technological innovation continues to differentiate Chinese manufacturers, with breakthrough developments in lithium iron phosphate chemistry, structural battery pack designs, and fast-charging capabilities. The market has achieved significant cost reductions, with battery pack prices declining by approximately 65% over the past five years, making electric vehicles increasingly competitive with traditional internal combustion engine vehicles.

Market challenges include raw material supply chain dependencies, international trade tensions, and increasing competition from emerging battery technologies. However, the market’s strong foundation in manufacturing excellence, technological innovation, and government support positions it for continued growth and global expansion.

Strategic market positioning reveals several critical insights that define China’s EV battery pack market landscape. The following key insights highlight the market’s current state and future trajectory:

Market maturation indicators suggest the transition from rapid capacity expansion to focus on efficiency, quality, and technological differentiation. This evolution reflects the market’s progression toward sustainable growth and international competitiveness.

Government policy initiatives serve as the primary catalyst driving China’s EV battery pack market expansion. The Chinese government’s comprehensive approach includes direct subsidies for electric vehicle purchases, tax incentives for battery manufacturers, and regulatory mandates requiring automakers to produce minimum percentages of electric vehicles. The New Energy Vehicle mandate requires automakers to achieve specific NEV production quotas of at least 18% of total vehicle production, creating guaranteed demand for battery packs.

Environmental regulations and carbon reduction commitments provide additional momentum for market growth. China’s pledge to achieve carbon neutrality by 2060 has accelerated the transition away from fossil fuel vehicles, with electric vehicles playing a central role in transportation decarbonization. Urban air quality improvement initiatives have led to preferential treatment for electric vehicles, including unrestricted access to city centers and priority parking privileges.

Technological advancement continues to drive market expansion through improved battery performance and reduced costs. Breakthrough developments in battery chemistry, particularly lithium iron phosphate and next-generation lithium-ion technologies, have enhanced energy density while reducing manufacturing costs. Advanced manufacturing processes, including automated production lines and quality control systems, have improved consistency and reliability while scaling production capacity.

Infrastructure development supports market growth through expanding charging networks and grid integration capabilities. The rapid deployment of fast-charging stations and battery swapping facilities has addressed range anxiety concerns, making electric vehicles more practical for consumers. Smart grid integration enables vehicle-to-grid applications, creating additional value propositions for battery pack investments.

Consumer acceptance has accelerated due to improved vehicle performance, expanded model availability, and total cost of ownership advantages. Electric vehicle performance now matches or exceeds traditional vehicles in many categories, while operating costs remain significantly lower due to reduced fuel and maintenance requirements.

Raw material supply constraints represent a significant challenge for China’s EV battery pack market, despite the country’s dominant position in processing key materials. Lithium, cobalt, and nickel supply chains face potential disruptions due to geopolitical tensions and resource concentration in specific regions. Price volatility for critical materials can impact battery pack manufacturing costs and profitability, particularly during periods of rapid demand growth.

International trade tensions and technology transfer restrictions pose ongoing challenges for Chinese battery manufacturers seeking global expansion. Export restrictions on certain technologies and materials, combined with increasing scrutiny of Chinese companies in international markets, may limit growth opportunities. Tariffs and trade barriers in key export markets can reduce competitiveness and market access for Chinese battery pack manufacturers.

Safety concerns and regulatory compliance requirements create additional complexity for battery pack manufacturers. High-profile battery fire incidents have increased regulatory scrutiny and safety testing requirements, potentially slowing product development cycles and increasing compliance costs. International safety standards may differ from domestic requirements, necessitating additional testing and certification processes for export products.

Technology transition risks emerge as next-generation battery technologies, including solid-state batteries and alternative chemistries, threaten to disrupt existing manufacturing investments. The rapid pace of technological change requires continuous investment in research and development while potentially obsoleting existing production facilities. Companies must balance current production optimization with future technology preparation.

Environmental and sustainability pressures increasingly influence market dynamics, with growing emphasis on battery recycling, responsible sourcing, and lifecycle environmental impact. Compliance with evolving environmental regulations and sustainability standards may require additional investments in recycling infrastructure and supply chain transparency systems.

Global market expansion presents substantial opportunities for Chinese EV battery pack manufacturers as international electric vehicle adoption accelerates. European and North American markets offer significant growth potential, with many automakers seeking reliable battery suppliers to meet ambitious electrification targets. Establishing local manufacturing facilities in key markets can overcome trade barriers while reducing transportation costs and delivery times.

Energy storage applications beyond automotive use create new market segments for battery pack technology. Grid-scale energy storage systems, residential energy storage, and commercial backup power applications can utilize automotive-grade battery packs, providing additional revenue streams and market diversification. The growing renewable energy sector requires large-scale storage solutions that can benefit from automotive battery pack manufacturing expertise.

Advanced technology development opportunities include solid-state batteries, silicon nanowire anodes, and next-generation battery management systems. Companies investing in breakthrough technologies can establish competitive advantages and premium market positioning. Collaboration with research institutions and technology companies can accelerate innovation while sharing development risks and costs.

Circular economy initiatives offer opportunities in battery recycling, second-life applications, and sustainable material sourcing. Developing comprehensive recycling capabilities can reduce raw material costs while addressing environmental concerns. Second-life applications for automotive battery packs in stationary energy storage can extend product lifecycles and create additional revenue streams.

Service-based business models including battery-as-a-service, leasing programs, and performance guarantees can differentiate manufacturers while creating recurring revenue streams. These models can reduce upfront costs for electric vehicle buyers while providing manufacturers with ongoing customer relationships and data insights.

Competitive intensity within China’s EV battery pack market has reached unprecedented levels as manufacturers compete for market share in both domestic and international markets. The market features several dominant players, including CATL, BYD, and CALB, each pursuing different strategic approaches to maintain competitive advantages. Price competition has intensified as manufacturing scales increase and technology matures, with battery pack costs declining approximately 15-20% annually over recent years.

Technology evolution drives continuous market transformation as manufacturers invest heavily in next-generation battery technologies. The shift toward lithium iron phosphate chemistry has gained momentum due to cost advantages and improved safety characteristics, while research continues into solid-state batteries and alternative chemistries. Manufacturing process innovations, including cell-to-pack designs and structural battery integration, are reshaping product architectures and performance capabilities.

Supply chain dynamics reflect China’s strategic focus on securing critical material supplies and maintaining manufacturing cost advantages. Vertical integration strategies have enabled leading manufacturers to control key supply chain elements, from raw material processing through final assembly. However, global supply chain diversification efforts by international customers are creating pressure for geographic expansion and local manufacturing capabilities.

Regulatory evolution continues to shape market dynamics through safety standards, environmental regulations, and trade policies. Domestic regulations support market development through favorable policies, while international regulatory requirements drive product development and compliance investments. The regulatory landscape increasingly emphasizes sustainability, recycling, and responsible sourcing throughout the battery pack lifecycle.

Market consolidation trends are emerging as smaller manufacturers struggle to compete with industry leaders’ scale and technological capabilities. Strategic partnerships, mergers, and acquisitions are reshaping the competitive landscape while enabling companies to access new technologies, markets, and manufacturing capabilities.

Comprehensive market analysis for China’s EV battery pack market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, technology experts, and government officials involved in electric vehicle and battery policy development. These interviews provide insights into market trends, competitive dynamics, and future development plans that may not be available through public sources.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and patent filings to understand market structure and technological developments. Regulatory documents and policy announcements provide crucial insights into government support mechanisms and future market direction. Trade association data and industry statistics offer quantitative foundations for market sizing and trend analysis.

Data validation processes ensure research accuracy through cross-referencing multiple sources and conducting follow-up interviews to verify key findings. Market data undergoes rigorous analysis to identify inconsistencies and validate trends across different data sources. Expert panels review preliminary findings to ensure conclusions align with industry realities and market dynamics.

Quantitative analysis includes statistical modeling of market trends, growth projections, and competitive positioning based on available data. Financial analysis of key market participants provides insights into profitability, investment patterns, and strategic priorities. Technology assessment evaluates patent filings, research publications, and product announcements to understand innovation trajectories.

Market segmentation analysis examines different battery chemistries, application segments, and geographic regions to understand market structure and growth patterns. This analysis identifies emerging opportunities and potential market disruptions that may impact future development.

Eastern China dominates the EV battery pack manufacturing landscape, with provinces including Jiangsu, Zhejiang, and Shanghai hosting major production facilities and research centers. This region benefits from established automotive supply chains, skilled workforce availability, and proximity to key export ports. The concentration of battery manufacturers in this region has created specialized industrial clusters that drive innovation and cost optimization through supplier networks and knowledge sharing.

Southern China, particularly Guangdong province, serves as a major hub for battery pack assembly and electric vehicle manufacturing. The region’s strength in electronics manufacturing and established supply chains for consumer electronics components provide advantages for battery management system development and production. Shenzhen’s technology ecosystem supports innovation in battery monitoring, thermal management, and charging technologies.

Central China regions, including Hubei and Hunan provinces, have emerged as important manufacturing centers due to lower labor costs and government incentives. These regions offer strategic locations for serving both domestic and international markets while providing cost advantages for large-scale manufacturing operations. Investment in transportation infrastructure has improved connectivity to major markets and ports.

Western China plays a crucial role in raw material processing and mining operations that support the battery pack supply chain. Provinces such as Sichuan and Qinghai host lithium processing facilities and renewable energy generation that supports sustainable battery manufacturing. The region’s abundant renewable energy resources align with sustainability goals for battery production.

Northern China regions contribute to the market through research and development activities, with Beijing hosting major research institutions and technology companies focused on battery innovation. The region’s universities and research centers collaborate with industry to develop next-generation battery technologies and manufacturing processes.

Market leadership in China’s EV battery pack sector is characterized by intense competition among several dominant players, each pursuing distinct strategic approaches to maintain competitive advantages. The competitive landscape reflects a combination of established industry leaders and emerging technology innovators.

Competitive strategies vary among market participants, with some focusing on technological innovation while others emphasize manufacturing scale and cost optimization. Vertical integration has become increasingly important, with leading companies controlling supply chains from raw materials through final assembly. International expansion strategies include establishing overseas manufacturing facilities and forming strategic partnerships with global automotive manufacturers.

Innovation competition drives continuous technology advancement, with companies investing heavily in research and development to maintain competitive positioning. Patent portfolios and intellectual property development have become crucial competitive assets as technology complexity increases.

By Battery Chemistry: The market segments into distinct chemistry categories, each serving specific performance and cost requirements. Lithium iron phosphate batteries have gained substantial market share of approximately 45% due to safety advantages and cost effectiveness, particularly for commercial vehicles and energy storage applications. Ternary lithium-ion batteries maintain strong positions in passenger vehicles requiring high energy density and performance characteristics.

By Application Segment: Market applications span diverse vehicle categories and use cases, each with specific performance and cost requirements. Passenger vehicles represent the largest segment, while commercial vehicles and specialty applications offer high-growth opportunities.

By Capacity Range: Battery pack capacity segmentation reflects different vehicle types and performance requirements, from compact urban vehicles to long-range luxury cars and commercial applications.

Passenger Vehicle Segment dominates market volume and revenue, driven by rapid consumer adoption of electric vehicles and expanding model availability. This segment emphasizes energy density, charging speed, and lifecycle performance to meet consumer expectations for range and convenience. Premium vehicle applications demand high-performance battery packs with advanced thermal management and fast-charging capabilities, while mass-market vehicles prioritize cost optimization and reliability.

Commercial Vehicle Applications present unique requirements emphasizing durability, total cost of ownership, and operational efficiency. Electric buses and delivery vehicles require battery packs designed for frequent charging cycles and extended operational life. Fleet operators focus on predictable performance and maintenance costs, driving demand for robust battery management systems and comprehensive service support.

Energy Storage Integration creates new opportunities for battery pack manufacturers to leverage automotive manufacturing scale for stationary applications. Grid-scale energy storage projects benefit from automotive battery pack technology while offering additional revenue streams for manufacturers. Residential energy storage applications require different packaging and integration approaches while maintaining safety and performance standards.

Technology Categories reflect different performance and cost optimization strategies. Lithium iron phosphate technology has gained momentum due to improved safety characteristics and cost advantages, particularly for commercial applications and energy storage. Ternary lithium-ion batteries maintain advantages in high-performance applications requiring maximum energy density and fast-charging capabilities.

Manufacturing Categories include both original equipment manufacturer supply and aftermarket services. OEM supply relationships require long-term partnerships and technology collaboration, while aftermarket services including battery replacement and recycling create additional business opportunities. MarkWide Research analysis indicates growing importance of service-based revenue models in the battery pack market.

Manufacturers benefit from China’s comprehensive supply chain ecosystem, enabling cost optimization and quality control throughout the production process. Access to skilled workforce, advanced manufacturing equipment, and established supplier networks provides competitive advantages in global markets. Government support through subsidies, tax incentives, and favorable regulations creates favorable operating conditions for battery pack manufacturers.

Automotive Companies gain access to reliable, cost-effective battery pack suppliers with proven manufacturing capabilities and technological expertise. Chinese manufacturers offer flexible partnership models, from component supply to complete battery system integration, enabling automakers to focus on vehicle design and marketing. Rapid innovation cycles and continuous cost reduction support automotive companies’ electrification strategies.

Technology Companies find opportunities to collaborate with battery manufacturers on advanced technologies including battery management systems, thermal management, and charging infrastructure. The market’s scale and growth provide platforms for testing and deploying new technologies while accessing manufacturing expertise and market channels.

Investors benefit from the market’s strong growth trajectory and government policy support, with opportunities ranging from established manufacturers to emerging technology companies. The market’s international expansion potential and diversification into energy storage applications provide multiple growth avenues and risk mitigation strategies.

End Users benefit from improved battery performance, reduced costs, and expanding charging infrastructure that make electric vehicles more practical and cost-effective. Competition among manufacturers drives continuous improvement in battery pack performance, safety, and reliability while reducing total cost of ownership.

Government Stakeholders achieve policy objectives including carbon emission reduction, energy security, and industrial development through a thriving domestic battery pack industry. Export success generates foreign exchange earnings while establishing China as a global technology leader in clean energy transportation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Structural Battery Integration represents a transformative trend where battery packs become integral structural components of electric vehicles, reducing weight and improving packaging efficiency. This approach eliminates traditional battery pack housing while integrating cells directly into vehicle structure, achieving weight reduction of approximately 10-15% compared to conventional designs. Chinese manufacturers are pioneering these technologies through collaboration with automotive partners and advanced manufacturing techniques.

Fast-Charging Technology advancement continues accelerating, with new battery pack designs supporting charging speeds exceeding 300kW and enabling 10-80% charging in under 15 minutes. Silicon nanowire anodes and advanced thermal management systems enable these capabilities while maintaining battery safety and longevity. Infrastructure development supports these technologies through high-power charging networks and grid integration capabilities.

Battery Chemistry Diversification reflects manufacturers’ strategies to optimize performance and cost for different applications. Lithium iron phosphate technology has experienced renewed growth due to cost advantages and safety characteristics, while research continues into sodium-ion, solid-state, and other alternative chemistries. This diversification enables manufacturers to serve broader market segments while reducing dependence on specific raw materials.

Circular Economy Implementation is gaining momentum through battery recycling programs, second-life applications, and sustainable manufacturing practices. Companies are developing comprehensive recycling capabilities to recover valuable materials while addressing environmental concerns. Second-life applications in energy storage extend battery pack useful life while creating additional revenue streams.

Digital Integration includes advanced battery management systems with cloud connectivity, predictive maintenance capabilities, and over-the-air updates. These systems optimize battery performance while providing valuable data for manufacturers and fleet operators. Artificial intelligence applications improve charging strategies and predict maintenance requirements.

Manufacturing Automation continues advancing through robotics, artificial intelligence, and quality control systems that improve consistency while reducing costs. Automated production lines enable rapid scaling while maintaining quality standards across high-volume manufacturing operations.

Technology Breakthrough Announcements have accelerated throughout the industry, with major manufacturers announcing significant improvements in energy density, charging speed, and cost reduction. CATL’s introduction of Qilin battery technology promises charging speeds enabling 10-80% capacity in 10 minutes, while BYD’s Blade Battery design emphasizes safety and structural integration. These developments demonstrate the rapid pace of innovation driving market evolution.

International Expansion Projects reflect Chinese manufacturers’ strategies to establish global manufacturing presence and serve international customers. Major investments in European and North American manufacturing facilities enable local supply while addressing trade concerns and reducing transportation costs. These projects represent billions of dollars in investment and thousands of new jobs in international markets.

Strategic Partnership Formation includes collaborations between Chinese battery manufacturers and international automotive companies, technology firms, and research institutions. These partnerships enable technology sharing, market access, and risk mitigation while accelerating innovation and commercialization of new technologies. Joint ventures and licensing agreements facilitate technology transfer and market development.

Recycling Infrastructure Development addresses growing concerns about battery lifecycle management and raw material security. Major manufacturers are investing in recycling facilities capable of recovering lithium, cobalt, nickel, and other valuable materials from used battery packs. These investments support circular economy objectives while reducing raw material costs and supply chain dependencies.

Government Policy Updates continue shaping market development through revised subsidy programs, safety regulations, and environmental standards. Recent policy changes emphasize technology advancement, manufacturing quality, and international competitiveness while maintaining support for market development. These policies balance market support with fiscal responsibility and technology advancement objectives.

Investment Prioritization should focus on next-generation battery technologies that offer breakthrough performance improvements and competitive differentiation. Companies should balance current production optimization with future technology development to maintain competitive positioning as the market evolves. MarkWide Research analysis suggests prioritizing solid-state battery development and advanced manufacturing automation to prepare for future market requirements.

International Expansion Strategy requires careful consideration of geopolitical factors, local regulations, and market requirements. Establishing manufacturing presence in key markets can overcome trade barriers while reducing transportation costs and delivery times. Companies should develop flexible partnership models that enable market entry while maintaining technology control and competitive advantages.

Supply Chain Diversification becomes increasingly important as raw material security and trade tensions create potential vulnerabilities. Companies should develop alternative sourcing strategies and invest in recycling capabilities to reduce dependence on imported materials. Vertical integration in critical supply chain elements can provide competitive advantages and cost control.

Sustainability Integration should encompass manufacturing processes, product design, and end-of-life management to address growing environmental concerns and regulatory requirements. Companies that proactively address sustainability challenges can differentiate themselves while preparing for evolving regulations and customer expectations.

Technology Partnership Development enables access to complementary technologies and expertise while sharing development costs and risks. Collaborations with automotive companies, technology firms, and research institutions can accelerate innovation while providing market access and validation opportunities.

Service Business Model Development including battery-as-a-service, leasing programs, and performance guarantees can create recurring revenue streams while differentiating manufacturers from competitors. These models can reduce customer acquisition costs while providing ongoing customer relationships and data insights.

Market evolution over the next decade will be characterized by continued rapid growth, technological advancement, and international expansion as China’s EV battery pack manufacturers solidify their global leadership position. The market is projected to maintain strong growth momentum with compound annual growth rates exceeding 15% through 2030, driven by accelerating electric vehicle adoption and expanding energy storage applications.

Technology advancement will focus on breakthrough developments in solid-state batteries, silicon nanowire anodes, and advanced battery management systems that enable significant performance improvements. Energy density improvements of 30-50% over current technologies are anticipated through next-generation battery chemistries and structural integration approaches. Fast-charging capabilities will continue advancing, with mainstream adoption of ultra-fast charging enabling complete battery charging in under 10 minutes.

Manufacturing transformation will emphasize automation, artificial intelligence, and sustainable production processes that optimize efficiency while reducing environmental impact. Fully automated production lines will enable consistent quality and rapid scaling while reducing labor costs and improving safety. Circular economy integration will become standard practice, with comprehensive recycling capabilities and second-life applications creating additional value streams.

Global market expansion will accelerate as Chinese manufacturers establish manufacturing presence in key international markets while serving growing demand for electric vehicle batteries worldwide. International partnerships and joint ventures will facilitate technology transfer and market access while addressing geopolitical concerns and trade barriers.

Application diversification beyond automotive markets will create new growth opportunities in grid-scale energy storage, residential applications, and specialty markets. The convergence of automotive and stationary energy storage technologies will enable manufacturers to leverage automotive manufacturing scale for broader market applications.

Competitive landscape evolution will feature continued consolidation among smaller manufacturers while leading companies strengthen their positions through technology advancement and international expansion. Strategic partnerships and vertical integration will become increasingly important for maintaining competitive advantages in a rapidly evolving market environment.

China’s EV battery pack market has established itself as a global powerhouse driving innovation and setting industry standards for electric vehicle energy storage solutions. The market’s exceptional growth trajectory, technological leadership, and manufacturing excellence position it at the forefront of the global transition to electric mobility. With domestic manufacturers capturing the majority of global production capacity and serving major international automotive brands, China has demonstrated the strategic importance of comprehensive industrial policy and sustained investment in clean energy technologies.

Market fundamentals remain exceptionally strong, supported by government policy commitment, technological innovation, and expanding global demand for electric vehicle batteries. The combination of manufacturing scale, supply chain integration, and continuous technology advancement creates sustainable competitive advantages that extend far beyond cost leadership. As the market matures, focus is shifting toward quality, sustainability, and international expansion while maintaining the innovation momentum that has driven remarkable growth.

Future prospects indicate continued market leadership as Chinese manufacturers expand internationally while developing next-generation technologies that will define the industry’s future direction. The market’s evolution toward circular economy principles, advanced manufacturing automation, and application diversification demonstrates the sector’s commitment to sustainable growth and long-term competitiveness. Success in addressing challenges including raw material security, international trade tensions, and environmental sustainability will determine the market’s continued global leadership position.

Strategic implications for industry participants emphasize the importance of technology innovation, international expansion, and sustainable business practices in maintaining competitive positioning. The market’s rapid evolution requires continuous adaptation and investment in emerging technologies while building the manufacturing capabilities and partnerships necessary for global success. China’s EV battery pack market represents not only a commercial success story but also a demonstration of how strategic industrial policy and sustained innovation investment can create global technology leadership in critical clean energy sectors.

What is EV Battery Pack?

EV Battery Pack refers to a collection of battery cells that are assembled together to power electric vehicles. These packs are crucial for the performance, range, and efficiency of electric vehicles in the automotive industry.

What are the key players in the China EV Battery Pack Market?

Key players in the China EV Battery Pack Market include CATL, BYD, and LG Energy Solution, which are known for their innovative battery technologies and significant market share in electric vehicle production, among others.

What are the main drivers of the China EV Battery Pack Market?

The main drivers of the China EV Battery Pack Market include the increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology that enhance energy density and reduce costs.

What challenges does the China EV Battery Pack Market face?

The China EV Battery Pack Market faces challenges such as supply chain disruptions, the high cost of raw materials, and competition from alternative energy storage solutions that may impact market growth.

What opportunities exist in the China EV Battery Pack Market?

Opportunities in the China EV Battery Pack Market include the expansion of charging infrastructure, the rise of energy storage systems, and increasing investments in research and development for next-generation battery technologies.

What trends are shaping the China EV Battery Pack Market?

Trends shaping the China EV Battery Pack Market include the shift towards solid-state batteries, the integration of smart technologies for battery management, and a growing focus on sustainability and recycling of battery materials.

China EV Battery Pack Market

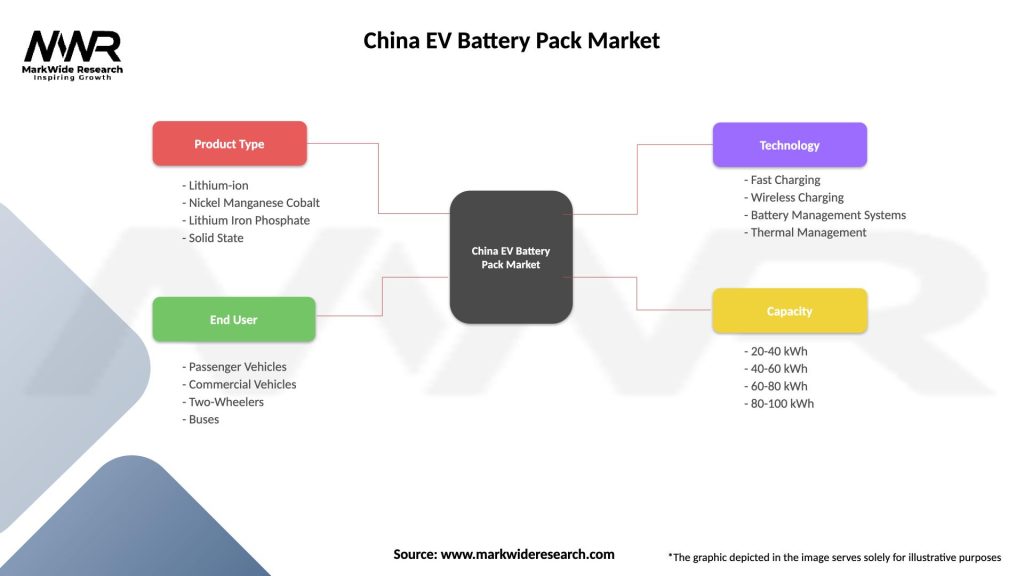

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel Manganese Cobalt, Lithium Iron Phosphate, Solid State |

| End User | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Buses |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| Capacity | 20-40 kWh, 40-60 kWh, 60-80 kWh, 80-100 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China EV Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at