444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China-Europe rail transport market represents one of the most significant developments in modern international logistics and trade connectivity. This expansive network, primarily facilitated through the Belt and Road Initiative, has revolutionized cargo movement between Asian and European markets through efficient overland transportation corridors. The market encompasses multiple rail routes connecting major Chinese cities with European destinations, offering an alternative to traditional maritime and air freight options.

Market dynamics indicate substantial growth momentum, with freight volumes experiencing a remarkable 98% year-over-year increase in recent periods. The network spans approximately 12,000 kilometers, connecting over 100 cities across both continents through various route configurations. Operational efficiency has improved significantly, with transit times averaging 12-16 days compared to 30-40 days for sea freight, making it an attractive middle-ground option between cost-effective ocean transport and time-sensitive air cargo.

Infrastructure development continues to expand rapidly, with new terminals, customs facilities, and intermodal connections being established regularly. The market benefits from strong governmental support from both Chinese and European authorities, recognizing the strategic importance of this transportation corridor for bilateral trade enhancement. Cargo diversity has expanded beyond traditional manufactured goods to include automotive parts, electronics, textiles, and increasingly, e-commerce shipments reflecting changing consumer demands.

The China-Europe rail transport market refers to the comprehensive network of freight railway services connecting manufacturing and distribution centers across China with major European commercial hubs through overland rail corridors. This market encompasses various service providers, route operators, logistics coordinators, and supporting infrastructure that facilitate the movement of containerized cargo between these two major economic regions.

Operational scope includes multiple route variations, with primary corridors traversing through Kazakhstan, Russia, Belarus, and Poland before reaching various European destinations including Germany, Netherlands, Spain, and the United Kingdom. The market integrates various transportation modes, customs procedures, documentation systems, and cross-border coordination mechanisms to ensure seamless cargo flow across multiple jurisdictions and regulatory frameworks.

Service offerings within this market range from full container load shipments to less-than-container-load consolidation services, specialized handling for temperature-sensitive goods, and express delivery options for time-critical shipments. The market also encompasses value-added services such as customs clearance, warehousing, distribution, and last-mile delivery integration, creating comprehensive supply chain solutions for international trade participants.

Strategic positioning of the China-Europe rail transport market has evolved from an experimental trade route to a critical component of global supply chain infrastructure. The market demonstrates exceptional resilience and growth potential, particularly highlighted during global disruptions when traditional shipping routes faced significant challenges. Volume growth has consistently outpaced initial projections, with container throughput increasing by approximately 75% over recent measurement periods.

Competitive advantages include predictable transit times, reduced dependency on maritime chokepoints, enhanced cargo security, and improved environmental sustainability compared to air freight alternatives. The market serves diverse industry segments, from automotive and electronics to consumer goods and industrial equipment, reflecting its versatility and broad market appeal.

Investment momentum continues to accelerate, with both public and private sector participants expanding capacity, improving infrastructure, and developing new service offerings. The market benefits from favorable policy environments, international cooperation agreements, and growing recognition of rail transport as a viable alternative to traditional shipping methods. Future projections indicate sustained growth driven by increasing trade volumes, infrastructure improvements, and evolving customer preferences for reliable, cost-effective transportation solutions.

Market penetration analysis reveals significant opportunities for continued expansion, particularly in underserved route segments and emerging cargo categories. The following key insights shape market understanding:

Primary growth drivers propelling the China-Europe rail transport market stem from fundamental shifts in global trade patterns and supply chain requirements. E-commerce expansion represents a particularly significant driver, with online retail growth demanding faster, more reliable delivery options than traditional ocean freight can provide, while remaining more cost-effective than air transport.

Geopolitical considerations increasingly influence transportation route selection, with businesses seeking diversified supply chain options to reduce dependency on single transportation modes or routes. The rail corridor provides strategic alternatives during maritime disruptions, port congestion, or geopolitical tensions affecting traditional shipping lanes. Government support through policy initiatives, infrastructure investment, and diplomatic cooperation creates favorable operating environments for market expansion.

Environmental regulations and corporate sustainability commitments drive modal shift toward more environmentally friendly transportation options. Rail transport offers significantly lower carbon emissions per ton-kilometer compared to air freight, aligning with corporate environmental goals and regulatory requirements. Supply chain optimization demands for improved inventory management, reduced lead times, and enhanced predictability favor rail transport’s consistent performance characteristics over ocean freight variability.

Manufacturing reshoring and nearshoring trends create new cargo flows and route requirements, with rail transport well-positioned to serve evolving production and distribution patterns. Digital transformation in logistics enables better integration of rail services into comprehensive supply chain solutions, improving visibility, control, and efficiency for shippers and logistics providers.

Infrastructure limitations present ongoing challenges for market expansion, particularly regarding capacity constraints at key border crossings, terminal facilities, and rail network bottlenecks. Gauge differences between Chinese, Central Asian, and European rail systems require time-consuming transshipment operations that add complexity and potential delays to the transportation process.

Regulatory complexity across multiple jurisdictions creates administrative burdens, with varying customs procedures, documentation requirements, and inspection protocols potentially causing delays and additional costs. Political risks and changing international relations can impact route availability, transit permissions, and operational stability, creating uncertainty for long-term planning and investment decisions.

Cost competitiveness challenges persist when compared to ocean freight for price-sensitive cargo categories, particularly for shipments where transit time is less critical than transportation cost. Service frequency limitations on certain routes may not meet the scheduling requirements of all potential customers, particularly those requiring daily or multiple weekly departures.

Weather dependencies and seasonal variations can affect service reliability, particularly in harsh winter conditions across Central Asian and Siberian route segments. Limited return cargo availability creates imbalanced trade flows, potentially increasing overall transportation costs and reducing service frequency on certain routes. Technology integration challenges across different national systems and operators can complicate tracking, documentation, and communication processes.

Emerging market segments present substantial growth opportunities, particularly in specialized cargo categories such as temperature-controlled goods, hazardous materials, and oversized equipment that benefit from rail transport’s unique capabilities. E-commerce fulfillment represents a rapidly expanding opportunity, with growing demand for faster delivery options driving modal shift from ocean to rail transport for consumer goods and retail inventory.

Route expansion possibilities include new corridor development, alternative routing options, and connections to previously underserved destinations in both Europe and China. Intermodal integration opportunities exist for developing seamless connections with maritime ports, airports, and domestic distribution networks, creating comprehensive door-to-door service offerings.

Technology advancement opportunities include implementation of blockchain for documentation, artificial intelligence for route optimization, Internet of Things for cargo monitoring, and automated systems for customs processing. Value-added services development can differentiate service providers through warehousing, consolidation, customs brokerage, and supply chain consulting capabilities.

Sustainability initiatives create opportunities for marketing rail transport’s environmental benefits and developing carbon-neutral or carbon-negative service offerings. Financial services integration, including trade financing, insurance, and payment solutions, can enhance customer value propositions. Regional development opportunities exist for establishing new logistics hubs, industrial parks, and distribution centers along major route corridors, creating economic multiplier effects and supporting market growth.

Competitive dynamics within the China-Europe rail transport market reflect a complex ecosystem of state-owned enterprises, private logistics providers, and international partnerships. Market consolidation trends indicate increasing cooperation between operators to optimize route efficiency, share capacity, and reduce operational costs through economies of scale.

Pricing dynamics demonstrate increasing sophistication, with operators developing dynamic pricing models based on capacity utilization, seasonal demand patterns, and competitive positioning relative to alternative transportation modes. Service differentiation has become increasingly important, with operators focusing on reliability, transit time consistency, and value-added services to distinguish their offerings in a competitive marketplace.

Customer behavior evolution shows growing acceptance of rail transport as a viable alternative to traditional shipping methods, with adoption rates increasing by approximately 45% among medium and large enterprises. Supply chain integration deepens as rail services become embedded in comprehensive logistics solutions rather than standalone transportation services.

Technology adoption accelerates across all market participants, with digital platforms, tracking systems, and automated processes becoming standard rather than differentiating features. Partnership formation increases as operators recognize the benefits of collaboration in route development, capacity sharing, and service enhancement. Regulatory harmonization efforts continue to reduce administrative barriers and improve operational efficiency across international borders.

Comprehensive analysis of the China-Europe rail transport market employs multiple research methodologies to ensure accuracy, completeness, and reliability of findings. Primary research includes extensive interviews with industry executives, government officials, logistics providers, and major shippers to gather firsthand insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and academic studies to establish market baselines and identify trends. Quantitative analysis utilizes cargo volume data, route performance metrics, pricing information, and operational statistics to develop market sizing and growth projections.

Qualitative assessment incorporates expert opinions, stakeholder interviews, and industry surveys to understand market dynamics, competitive positioning, and future outlook. Data validation processes include cross-referencing multiple sources, statistical verification, and expert review to ensure information accuracy and reliability.

Market modeling techniques apply econometric analysis, scenario planning, and forecasting methodologies to project future market development under various conditions. Geographic analysis examines regional variations, route-specific performance, and local market conditions to provide comprehensive market understanding. Temporal analysis tracks market evolution over time to identify trends, cycles, and inflection points that inform strategic decision-making.

Chinese market segments demonstrate varying levels of rail transport adoption, with eastern coastal cities showing higher utilization rates of approximately 62% compared to inland regions. Shanghai and Shenzhen serve as primary departure points, benefiting from established logistics infrastructure and proximity to manufacturing centers. Chengdu and Chongqing represent rapidly growing inland hubs, leveraging their strategic positions as western China gateways.

Central Asian corridor countries, particularly Kazakhstan, play crucial roles as transit nations, with ongoing infrastructure investments improving capacity and efficiency. Russian territory provides the longest single-country segment, with Trans-Siberian Railway infrastructure supporting increasing freight volumes while balancing passenger and cargo traffic requirements.

European destination markets show differentiated demand patterns, with Germany maintaining the largest share at approximately 35% of total European volumes, followed by Netherlands and Poland. Duisburg has emerged as a primary European hub, with extensive rail connections and intermodal facilities supporting distribution throughout the continent.

Eastern European countries increasingly serve as both destinations and transit points, with Poland developing significant logistics capabilities and Belarus improving border processing efficiency. Southern European routes through Turkey and the Balkans offer alternative pathways, though with currently limited capacity compared to northern corridors. Nordic countries represent emerging markets with growing interest in rail connectivity, particularly for specialized cargo categories and seasonal trade flows.

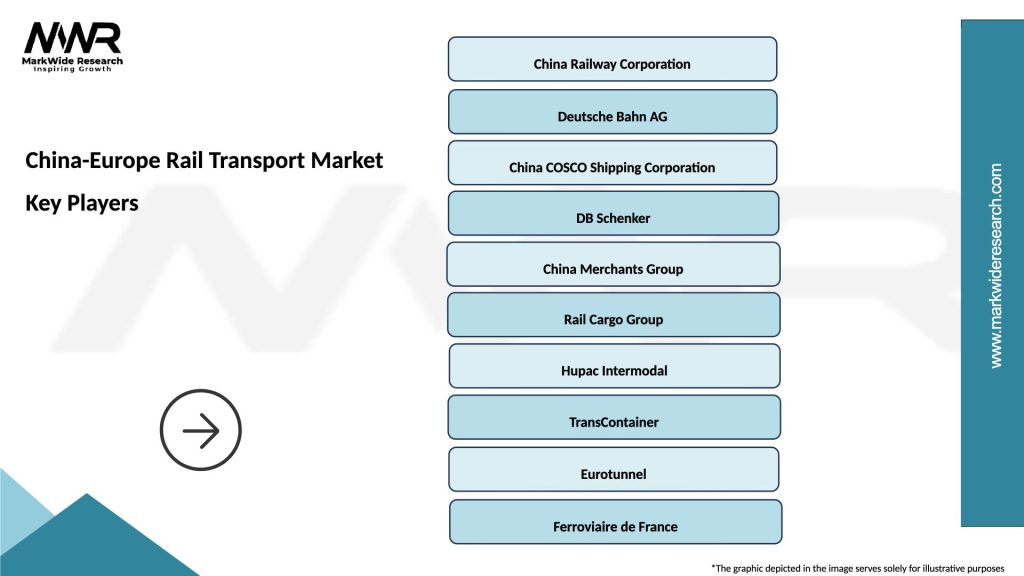

Market leadership reflects a combination of state-owned enterprises and private logistics providers, each bringing distinct capabilities and strategic advantages. The competitive environment continues evolving as new entrants emerge and existing players expand their service offerings.

Competitive strategies focus on service reliability, route optimization, customer service excellence, and value-added service development. Partnership formation between operators enables route sharing, capacity optimization, and service enhancement while reducing individual investment requirements.

By Route Configuration:

By Cargo Type:

By Service Type:

Electronics and Technology: This segment demonstrates the highest growth rates, with volume increases of approximately 85% driven by consumer demand and shorter product lifecycles requiring faster transportation. High-value cargo characteristics make rail transport attractive compared to ocean freight, while cost advantages over air transport maintain competitiveness. Packaging requirements and security considerations favor rail transport’s controlled environment and reduced handling compared to maritime alternatives.

Automotive Industry: Just-in-time manufacturing requirements align well with rail transport’s predictable scheduling and reliable performance. Component shipments benefit from rail transport’s ability to handle diverse cargo types and sizes within single shipments. Finished vehicle transport represents emerging opportunities as specialized rail cars and handling equipment become available.

Consumer Goods: E-commerce growth drives increasing demand for faster delivery options, with rail transport providing optimal balance between cost and speed. Seasonal variations in consumer demand require flexible capacity and scheduling options that rail operators increasingly provide. Retail inventory management benefits from rail transport’s predictable transit times enabling better demand planning and stock optimization.

Industrial Equipment: Project cargo and oversized equipment shipments utilize rail transport’s capability to handle non-standard cargo sizes and weights. Manufacturing expansion in both Chinese and European markets creates ongoing demand for machinery and equipment transport. Mining and energy sector equipment represents specialized market segments with specific handling and routing requirements.

Shippers and Manufacturers benefit from improved supply chain flexibility, reduced inventory carrying costs, and enhanced customer service capabilities through faster, more reliable delivery options. Cost optimization opportunities arise from rail transport’s competitive pricing compared to air freight while offering superior speed compared to ocean transport. Risk mitigation advantages include reduced dependency on single transportation modes and alternative routing options during disruptions.

Logistics Providers gain access to new service offerings, expanded geographic coverage, and opportunities for value-added service development. Revenue diversification through rail services reduces dependency on traditional maritime and air freight markets while capturing growing demand for integrated transportation solutions. Competitive differentiation through rail expertise and capabilities enhances market positioning and customer retention.

Government Stakeholders realize economic development benefits through job creation, infrastructure investment, and enhanced trade facilitation. Strategic advantages include reduced dependency on maritime chokepoints, improved energy security, and strengthened international cooperation. Environmental benefits support sustainability objectives and climate change mitigation efforts through reduced carbon emissions per ton-kilometer transported.

Regional Communities along route corridors benefit from economic development, employment opportunities, and infrastructure improvements. Investment attraction in logistics facilities, industrial parks, and supporting services creates multiplier effects throughout local economies. International connectivity enhances regional competitiveness and access to global markets for local businesses and industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across all aspects of rail transport operations, with blockchain technology, artificial intelligence, and Internet of Things applications improving efficiency, transparency, and customer experience. Real-time tracking capabilities and predictive analytics enable proactive problem-solving and enhanced service reliability.

Sustainability Integration becomes increasingly important, with operators developing carbon-neutral service offerings and customers prioritizing environmentally responsible transportation options. Green logistics initiatives and renewable energy adoption along route corridors support environmental objectives while potentially reducing operational costs.

Service Customization trends toward specialized offerings for different industry segments, cargo types, and customer requirements. Express services, temperature-controlled transport, and hazardous materials handling represent growing specialization areas. Integrated logistics solutions combining rail transport with warehousing, distribution, and value-added services become standard market offerings.

Infrastructure Modernization continues with investments in terminal automation, customs processing efficiency, and intermodal connectivity. Smart infrastructure implementation includes automated cargo handling, digital documentation systems, and predictive maintenance capabilities. Capacity expansion projects address growing demand while improving service reliability and efficiency.

Partnership Evolution toward deeper cooperation between operators, with joint ventures, capacity sharing agreements, and integrated service development becoming common. Public-private partnerships facilitate infrastructure investment and service development while sharing risks and benefits among stakeholders.

Infrastructure Expansion projects continue advancing, with new terminal facilities, border crossing improvements, and rail line upgrades enhancing capacity and efficiency. Duisburg terminal expansions and Malaszewicze border crossing modernization represent significant recent developments improving European gateway capabilities.

Service Innovation includes introduction of express services, specialized cargo handling capabilities, and integrated digital platforms. Temperature-controlled transport options expand market opportunities for pharmaceutical, food, and chemical shipments requiring climate control throughout transit.

Technology Implementation advances include blockchain-based documentation systems, AI-powered route optimization, and IoT-enabled cargo monitoring. Customs automation projects reduce processing times and improve border crossing efficiency through electronic documentation and pre-clearance procedures.

Route Development encompasses new corridor establishment, alternative routing options, and connection improvements to previously underserved destinations. Southern corridor development through Turkey and southeastern Europe provides additional routing flexibility and capacity options.

Regulatory Harmonization efforts continue improving cross-border procedures, documentation requirements, and operational standards. International cooperation agreements facilitate smoother operations and reduced administrative burdens for operators and customers.

MarkWide Research analysis indicates that market participants should prioritize infrastructure investment, technology adoption, and service differentiation to maintain competitive advantages in the rapidly evolving China-Europe rail transport market. Strategic partnerships and route diversification represent critical success factors for long-term market positioning.

Investment priorities should focus on terminal capacity expansion, digital platform development, and specialized equipment acquisition to serve growing market demand and evolving customer requirements. Technology integration across operations, customer service, and supply chain visibility becomes essential for competitive differentiation and operational efficiency.

Market entry strategies for new participants should emphasize niche specialization, partnership development, and value-added service offerings rather than direct competition with established operators on standard routes. Geographic expansion opportunities exist in underserved regions and emerging trade corridors requiring careful market analysis and strategic planning.

Risk management approaches should address geopolitical uncertainties, infrastructure dependencies, and market volatility through diversification strategies, contingency planning, and flexible operational capabilities. Sustainability initiatives should be integrated into business strategies to meet evolving customer expectations and regulatory requirements.

Customer relationship development requires focus on service reliability, communication transparency, and integrated solution offerings that address comprehensive supply chain requirements rather than standalone transportation services.

Long-term growth prospects remain highly positive, with MWR projecting continued expansion driven by increasing trade volumes, infrastructure improvements, and growing acceptance of rail transport as a viable alternative to traditional shipping methods. Market maturation will likely result in improved service standardization, enhanced reliability, and more sophisticated pricing mechanisms.

Technology advancement will continue transforming operations, with autonomous systems, predictive analytics, and integrated digital platforms becoming standard rather than differentiating features. Sustainability requirements will increasingly influence route selection, equipment choices, and operational practices as environmental considerations become more prominent in transportation decision-making.

Geographic expansion opportunities include new route development, alternative corridor establishment, and connections to emerging markets in both Asia and Europe. Service evolution toward comprehensive logistics solutions will integrate rail transport with warehousing, distribution, and value-added services creating end-to-end supply chain offerings.

Market consolidation may occur as operators seek economies of scale, route optimization, and service enhancement through mergers, acquisitions, and strategic partnerships. Regulatory harmonization efforts will continue reducing administrative barriers and improving operational efficiency across international borders.

Innovation acceleration in areas such as cargo handling automation, predictive maintenance, and customer service platforms will drive operational improvements and competitive differentiation. Sustainability integration will become increasingly important as carbon reduction requirements and environmental regulations influence transportation choices and operational practices.

The China-Europe rail transport market represents a transformative development in international logistics, offering compelling advantages in transit time, cost efficiency, and environmental sustainability compared to traditional transportation alternatives. Market growth continues exceeding initial projections, driven by expanding trade volumes, infrastructure improvements, and increasing recognition of rail transport’s strategic value in global supply chains.

Competitive dynamics reflect a maturing market with established operators expanding capabilities while new entrants seek specialized niches and innovative service offerings. Technology integration and digital transformation initiatives enhance operational efficiency, customer service, and supply chain visibility, creating additional value for market participants and customers alike.

Future success in this market will depend on continued infrastructure investment, service innovation, and strategic partnership development to address evolving customer requirements and competitive challenges. The China-Europe rail transport market is well-positioned for sustained growth, offering significant opportunities for stakeholders committed to long-term investment and strategic development in this critical transportation corridor.

What is China-Europe Rail Transport?

China-Europe Rail Transport refers to the logistics and transportation services that facilitate the movement of goods between China and Europe via rail networks. This mode of transport is known for its efficiency and cost-effectiveness compared to air freight, while being faster than sea shipping.

What are the key players in the China-Europe Rail Transport Market?

Key players in the China-Europe Rail Transport Market include companies like DB Schenker, Kuehne + Nagel, and China Railway Corporation, which provide comprehensive logistics solutions and rail freight services, among others.

What are the main drivers of the China-Europe Rail Transport Market?

The main drivers of the China-Europe Rail Transport Market include the increasing demand for faster shipping solutions, the growth of e-commerce, and the need for reliable supply chain logistics. Additionally, the Belt and Road Initiative has significantly boosted rail connectivity between the two regions.

What challenges does the China-Europe Rail Transport Market face?

Challenges in the China-Europe Rail Transport Market include infrastructure limitations, regulatory hurdles, and competition from other transport modes like air and sea freight. Additionally, geopolitical tensions can impact trade routes and logistics operations.

What opportunities exist in the China-Europe Rail Transport Market?

Opportunities in the China-Europe Rail Transport Market include expanding rail networks, increasing trade agreements, and the potential for technological advancements in logistics management. The growing focus on sustainability also presents avenues for greener transport solutions.

What trends are shaping the China-Europe Rail Transport Market?

Trends shaping the China-Europe Rail Transport Market include the rise of digitalization in logistics, the adoption of real-time tracking technologies, and the increasing emphasis on sustainability practices. Additionally, the integration of multimodal transport solutions is becoming more prevalent.

China-Europe Rail Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Freight Transport, Passenger Services, Intermodal Solutions, Logistics Management |

| Technology | High-Speed Rail, Electrified Rail, Automated Systems, Signal Control |

| End User | Manufacturers, Retailers, Government Agencies, Logistics Providers |

| Capacity | Heavy Cargo, Light Cargo, Passenger Capacity, Bulk Transport |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China-Europe Rail Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at