444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China Enterprise Risk Management (ERM) market refers to the practices, strategies, and tools implemented by organizations in China to identify, assess, and mitigate potential risks that could affect their operations and objectives. ERM is a crucial aspect of business management, as it helps companies proactively manage uncertainties and make informed decisions to protect their financial stability, reputation, and overall success.

Enterprise Risk Management (ERM) is a comprehensive approach to managing risks within an organization. It involves the identification, assessment, and prioritization of potential risks, followed by the implementation of strategies and controls to mitigate or eliminate these risks. ERM encompasses a wide range of risks, including financial, operational, strategic, regulatory, and reputational risks. By adopting ERM practices, companies in China can improve their risk management capabilities, enhance decision-making processes, and achieve sustainable growth.

Executive Summary

The China Enterprise Risk Management market has witnessed significant growth in recent years, driven by the increasing complexity of business environments, evolving regulatory frameworks, and growing awareness of the importance of risk management. Companies across various industries are recognizing the need to adopt robust ERM practices to navigate uncertainties and secure their long-term viability. This report provides key insights into the China Enterprise Risk Management market, including market drivers, restraints, opportunities, regional analysis, competitive landscape, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China Enterprise Risk Management market is characterized by dynamic factors that influence its growth and development. These dynamics include regulatory changes, technological advancements, market competition, and the evolving needs and expectations of companies. Understanding these dynamics is crucial for market participants to adapt to the changing landscape and capitalize on emerging opportunities.

Regional Analysis

The China Enterprise Risk Management market exhibits regional variations in terms of adoption, industry focus, and regulatory environments. Major economic hubs such as Beijing, Shanghai, and Guangzhou have higher adoption rates due to the concentration of large corporations and stringent regulatory frameworks. Regional analysis helps companies identify specific market dynamics and tailor their strategies to regional requirements.

Competitive Landscape

Leading Companies in the China Enterprise Risk Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The China Enterprise Risk Management market can be segmented based on industry verticals, organization size, and types of solutions. Industry vertical segmentation includes finance, healthcare, manufacturing, energy, IT, and others. Organization size segmentation includes small and medium-sized enterprises (SMEs) and large enterprises. Solution types include risk assessment and analysis, compliance management, incident management, business continuity planning, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the China Enterprise Risk Management market. The outbreak exposed vulnerabilities in business continuity planning, supply chain management, and operational resilience. As a result, companies have increased their focus on ERM practices to better prepare for future crises and disruptions. The pandemic has also accelerated the adoption of digital technologies for risk management and highlighted the importance of scenario planning and flexibility in risk mitigation strategies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the China Enterprise Risk Management market looks promising, driven by the increasing recognition of the importance of risk management, evolving regulatory frameworks, and the integration of advanced technologies. Companies will continue to prioritize ERM practices to navigate uncertainties, protect financial stability, and maintain a positive reputation. The market is expected to witness further advancements in AI, ML, and data analytics, leading to more sophisticated and proactive risk management solutions. Collaboration and knowledge sharing will play a key role in shaping the future of the ERM market in China.

Conclusion

The China Enterprise Risk Management market has experienced significant growth and transformation in recent years. Companies across industries are increasingly adopting ERM practices to proactively identify, assess, and mitigate risks that could impact their operations and objectives. The market is driven by regulatory requirements, the growing complexity of business environments, and the integration of advanced technologies. While challenges such as resistance to change and resource constraints exist, opportunities lie in AI integration, industry-specific solutions, and consulting services. As the market continues to evolve, companies that prioritize ERM, foster a risk-aware culture, and leverage innovative solutions will be well-positioned for sustainable growth and competitive advantage in China’s dynamic business landscape.

What is China Enterprise Risk Management?

China Enterprise Risk Management refers to the systematic approach organizations in China use to identify, assess, and mitigate risks that could impact their operations and objectives. This includes financial, operational, strategic, and compliance risks.

Who are the key players in the China Enterprise Risk Management Market?

Key players in the China Enterprise Risk Management Market include companies like Deloitte, PwC, and KPMG, which provide consulting services, as well as software providers like SAP and Oracle, among others.

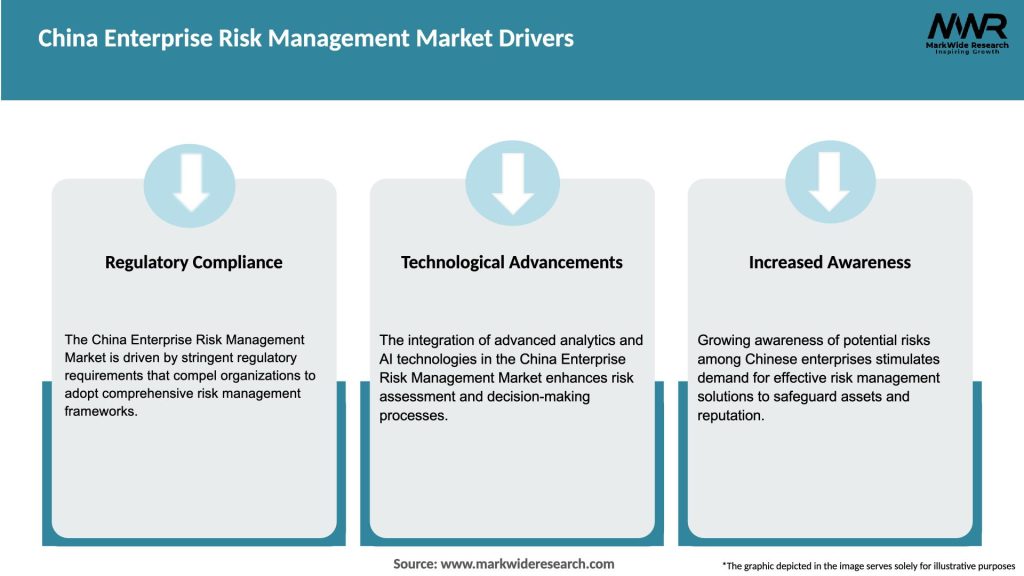

What are the main drivers of the China Enterprise Risk Management Market?

The main drivers of the China Enterprise Risk Management Market include increasing regulatory requirements, the growing complexity of business operations, and the rising awareness of risk management’s importance in strategic decision-making.

What challenges does the China Enterprise Risk Management Market face?

Challenges in the China Enterprise Risk Management Market include a lack of skilled professionals, resistance to change within organizations, and the difficulty of integrating risk management practices into existing business processes.

What opportunities exist in the China Enterprise Risk Management Market?

Opportunities in the China Enterprise Risk Management Market include the adoption of advanced technologies like AI and big data analytics, which can enhance risk assessment and management capabilities, as well as the increasing demand for customized risk management solutions.

What trends are shaping the China Enterprise Risk Management Market?

Trends shaping the China Enterprise Risk Management Market include the integration of digital tools for real-time risk monitoring, a focus on sustainability and ESG factors in risk assessments, and the growing importance of cybersecurity in enterprise risk management.

China Enterprise Risk Management Market

| Segmentation Details | Description |

|---|---|

| Component | Solutions, Services |

| Deployment Mode | On-premises, Cloud |

| Organization Size | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Industry Vertical | BFSI, Government & Defense, Healthcare, IT & Telecom, Others |

| Region | China |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the China Enterprise Risk Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at