444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China energy drinks industry market represents one of the most dynamic and rapidly evolving beverage sectors in the Asia-Pacific region. China’s energy drinks market has experienced unprecedented growth over the past decade, driven by changing consumer lifestyles, urbanization trends, and increasing health consciousness among younger demographics. The market encompasses a diverse range of products including traditional herbal energy drinks, carbonated energy beverages, and functional sports drinks that cater to various consumer preferences and occasions.

Market expansion has been particularly robust in tier-one and tier-two cities, where busy professionals and students increasingly rely on energy drinks for enhanced performance and alertness. The industry has witnessed a compound annual growth rate (CAGR) of approximately 12.5% over recent years, significantly outpacing many other beverage categories. Domestic brands have established strong market positions alongside international players, creating a competitive landscape that continues to drive innovation and product diversification.

Consumer demographics show that millennials and Generation Z constitute nearly 70% of energy drink consumption in China, with urban professionals representing the largest consumer segment. The market’s evolution reflects broader socioeconomic changes, including longer working hours, increased participation in fitness activities, and growing acceptance of functional beverages as lifestyle products rather than mere refreshments.

The China energy drinks industry market refers to the comprehensive ecosystem of manufacturers, distributors, retailers, and consumers involved in the production, marketing, and consumption of energy-enhancing beverages within mainland China. This market encompasses various product categories including carbonated energy drinks, non-carbonated functional beverages, herbal energy formulations, and sports performance drinks designed to provide mental alertness, physical endurance, or nutritional supplementation.

Energy drinks in the Chinese context often incorporate traditional Chinese medicine (TCM) principles, featuring ingredients like ginseng, taurine, B-vitamins, and natural herbal extracts that align with local cultural preferences for functional foods. The market includes both ready-to-drink products and concentrated formulations, serving diverse consumption occasions from workplace productivity enhancement to athletic performance support.

Industry participants range from large multinational corporations to specialized domestic manufacturers, creating a multi-tiered market structure that serves various price points and consumer segments. The market’s definition extends beyond product manufacturing to include extensive distribution networks, marketing strategies, regulatory compliance, and consumer education initiatives that shape overall market dynamics.

China’s energy drinks market has emerged as a cornerstone of the country’s broader functional beverage industry, demonstrating remarkable resilience and growth potential despite economic uncertainties. The market’s trajectory reflects fundamental shifts in Chinese consumer behavior, with increasing emphasis on health, wellness, and performance optimization driving sustained demand for energy-enhancing products.

Key market characteristics include strong brand loyalty among consumers, particularly for established domestic brands that have successfully integrated traditional Chinese wellness concepts with modern energy drink formulations. The market benefits from robust distribution infrastructure, extensive retail penetration, and sophisticated digital marketing strategies that effectively reach target demographics through multiple touchpoints.

Competitive dynamics reveal a market where innovation and localization strategies determine success, with companies investing heavily in research and development to create products that resonate with Chinese taste preferences and cultural values. The industry has shown remarkable adaptability to regulatory changes and consumer trends, positioning itself for continued expansion across both established urban markets and emerging rural segments.

Future prospects indicate sustained growth potential, supported by demographic trends, urbanization patterns, and evolving lifestyle preferences that favor convenient, functional beverage solutions. The market’s maturation process involves increasing sophistication in product positioning, premium segment development, and expansion into adjacent categories that complement core energy drink offerings.

Market penetration analysis reveals several critical insights that define the current state and future direction of China’s energy drinks industry. MarkWide Research indicates that consumer awareness and trial rates have reached significant levels across major metropolitan areas, with brand recognition exceeding 85% among target demographics.

Urbanization trends serve as the primary catalyst for energy drinks market expansion in China, with rapid urban development creating lifestyle patterns that favor convenient, performance-enhancing beverages. The increasing pace of urban life, longer commuting times, and demanding work schedules have created a substantial consumer base that relies on energy drinks for daily productivity and alertness maintenance.

Demographic shifts significantly influence market growth, particularly the emergence of a large, affluent middle class with disposable income and willingness to spend on lifestyle products. Younger consumers demonstrate strong affinity for brands that align with their values and aspirations, driving demand for premium and innovative energy drink formulations that offer both functional benefits and social status.

Health and wellness trends increasingly shape consumer preferences, with growing awareness of fitness, nutrition, and mental performance driving demand for functional beverages. The integration of traditional Chinese medicine principles with modern energy drink formulations appeals to health-conscious consumers who seek natural, culturally relevant wellness solutions.

Digital lifestyle adoption creates new consumption occasions and marketing opportunities, with social media influence, gaming culture, and extended screen time contributing to energy drink demand. The proliferation of e-commerce platforms and digital payment systems facilitates convenient purchasing and repeat consumption patterns that support market growth.

Economic development in secondary and tertiary cities expands the addressable market, with improving infrastructure, rising incomes, and changing lifestyle preferences creating new growth opportunities beyond traditional metropolitan markets.

Regulatory scrutiny presents ongoing challenges for energy drinks manufacturers, with government authorities implementing stricter guidelines regarding caffeine content, health claims, and marketing practices targeting younger consumers. These regulatory developments require significant compliance investments and may limit certain product formulations or promotional strategies.

Health concerns among consumers and healthcare professionals regarding excessive caffeine consumption, sugar content, and potential side effects create market headwinds. Negative publicity surrounding energy drink consumption, particularly among adolescents, influences consumer perceptions and may impact long-term market growth potential.

Market saturation in tier-one cities limits organic growth opportunities, forcing companies to compete more intensively for market share through price competition and increased marketing expenditures. The maturation of primary markets necessitates expansion into less developed regions with different consumer preferences and lower purchasing power.

Raw material costs and supply chain disruptions affect profitability and pricing strategies, particularly for ingredients like taurine, caffeine, and specialized herbal extracts. Currency fluctuations and international trade tensions may impact imported ingredient costs and overall production economics.

Cultural resistance in certain demographic segments and regions where traditional beverage preferences remain strong creates barriers to market penetration. Conservative consumer attitudes toward functional beverages and preference for traditional wellness solutions may limit adoption rates in specific market segments.

Rural market expansion represents significant untapped potential, with improving infrastructure, rising incomes, and changing lifestyle preferences in smaller cities and rural areas creating new consumer bases. The gradual urbanization of secondary markets offers substantial growth opportunities for companies willing to adapt their strategies to local preferences and economic conditions.

Product innovation in natural and functional ingredients aligns with consumer trends toward health and wellness, creating opportunities for premium product development. The integration of traditional Chinese medicine principles with modern energy drink formulations appeals to health-conscious consumers seeking culturally relevant wellness solutions.

E-commerce expansion and digital marketing channels provide cost-effective ways to reach target consumers and build brand awareness, particularly among younger demographics who prefer online shopping and social media engagement. The development of direct-to-consumer models and subscription services creates new revenue streams and customer relationship opportunities.

Sports and fitness market growth drives demand for specialized energy and performance drinks, with increasing participation in recreational sports, gym memberships, and fitness activities creating targeted consumption occasions. The development of sport-specific formulations and partnerships with fitness brands offer differentiation opportunities.

Export potential to other Asian markets leverages China’s manufacturing capabilities and brand development expertise, with successful domestic brands expanding internationally through strategic partnerships and market entry strategies.

Competitive intensity continues to escalate as both domestic and international brands vie for market share through innovation, marketing investments, and distribution expansion. The market dynamics reflect a maturing industry where differentiation becomes increasingly important for sustainable growth and profitability.

Consumer behavior evolution drives continuous adaptation in product formulations, packaging designs, and marketing messages. The shift toward health-conscious consumption patterns influences ingredient selection, nutritional positioning, and brand communication strategies across the industry.

Technology integration transforms manufacturing processes, supply chain management, and consumer engagement strategies. Advanced production technologies enable more efficient operations and consistent quality, while digital platforms facilitate direct consumer relationships and data-driven marketing approaches.

Regulatory landscape changes require ongoing adaptation and compliance investments, with evolving food safety standards, labeling requirements, and marketing restrictions shaping industry practices. Companies must balance innovation with regulatory compliance to maintain market access and consumer trust.

Supply chain optimization becomes increasingly critical for cost management and quality assurance, with companies investing in vertical integration, supplier relationships, and logistics capabilities to maintain competitive advantages in pricing and product availability.

Primary research methodologies employed in analyzing China’s energy drinks market include comprehensive consumer surveys, focus group discussions, and in-depth interviews with industry stakeholders. These qualitative and quantitative research approaches provide insights into consumer preferences, purchasing behaviors, brand perceptions, and market trends that shape strategic decision-making.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial disclosures to establish market baselines and identify growth patterns. This research foundation supports market sizing estimates, competitive analysis, and trend identification across various market segments and geographic regions.

Market observation techniques include retail audits, distribution channel analysis, and promotional activity monitoring to understand market dynamics and competitive strategies. Field research in key markets provides ground-truth validation of market trends and consumer behaviors identified through other research methods.

Expert consultations with industry veterans, regulatory specialists, and market analysts provide contextual understanding of market developments and future outlook scenarios. These expert insights help validate research findings and provide strategic perspectives on market evolution and growth opportunities.

Data validation processes ensure research accuracy through triangulation of multiple data sources, statistical analysis, and peer review procedures that maintain research quality and reliability standards throughout the analytical process.

Eastern China dominates energy drinks consumption, with major metropolitan areas including Shanghai, Beijing, and Guangzhou representing approximately 45% of total market volume. These tier-one cities demonstrate the highest per-capita consumption rates, sophisticated consumer preferences, and willingness to pay premium prices for innovative products and established brands.

Southern China shows robust growth potential, particularly in Guangdong, Fujian, and Hainan provinces where economic development and lifestyle changes drive increasing energy drinks adoption. The region’s proximity to Hong Kong and international trade centers influences consumer preferences toward international brands and premium product categories.

Central China represents emerging market opportunities with cities like Wuhan, Changsha, and Zhengzhou experiencing rapid urbanization and rising disposable incomes. The region’s growth trajectory indicates strong potential for market expansion, though consumer preferences may differ from coastal metropolitan areas.

Western China presents long-term growth opportunities despite current lower consumption levels, with cities like Chengdu, Xi’an, and Chongqing showing increasing openness to functional beverages. Government infrastructure investments and economic development initiatives support market expansion potential in these regions.

Northern China demonstrates seasonal consumption patterns influenced by climate conditions, with higher energy drinks consumption during warmer months and preference for warming beverages during winter periods. The region’s industrial economy and student populations create specific market segments with distinct consumption patterns.

Market leadership in China’s energy drinks industry reflects a dynamic competitive environment where both domestic and international brands compete through differentiated positioning strategies, extensive distribution networks, and targeted marketing campaigns.

Competitive strategies include product innovation, celebrity endorsements, sports sponsorships, and digital marketing campaigns that resonate with target demographics. Companies invest heavily in research and development to create formulations that appeal to Chinese taste preferences while maintaining functional benefits.

Market positioning varies significantly among competitors, with some brands emphasizing traditional wellness benefits while others focus on modern lifestyle enhancement and performance optimization. This diversity in positioning strategies creates multiple market segments and consumer choice options.

By Product Type: The market segments into carbonated energy drinks, non-carbonated functional beverages, herbal energy formulations, and sports performance drinks. Each segment serves distinct consumer needs and consumption occasions, with carbonated varieties maintaining the largest market share while functional and herbal segments show the fastest growth rates.

By Distribution Channel: Convenience stores represent the dominant distribution channel, accounting for approximately 35% of total sales, followed by supermarkets, online platforms, and specialty retailers. The channel mix continues evolving with increasing e-commerce penetration and changing consumer shopping preferences.

By Consumer Demographics: Market segmentation reveals distinct consumption patterns across age groups, with consumers aged 18-35 representing the primary market segment. Income levels, education, and lifestyle preferences further subdivide the market into distinct consumer clusters with specific product preferences.

By Geographic Region: Regional segmentation reflects varying consumption patterns, brand preferences, and price sensitivity across different Chinese provinces and city tiers. Urban-rural divides create additional segmentation opportunities with distinct marketing and distribution requirements.

By Price Point: Premium, mid-tier, and value segments serve different consumer needs and purchasing power levels, with premium products showing increasing acceptance among affluent urban consumers while value products maintain strong positions in price-sensitive markets.

Traditional Herbal Energy Drinks represent a uniquely Chinese market category that combines ancient wellness principles with modern energy drink functionality. These products typically feature ingredients like ginseng, cordyceps, and other traditional Chinese medicine components, appealing to consumers who prefer natural and culturally familiar wellness solutions.

Carbonated Energy Drinks maintain the largest market share through established consumer preferences and extensive brand marketing. This category benefits from strong brand loyalty and consistent consumption patterns, though growth rates may moderate as health-conscious trends influence consumer preferences toward non-carbonated alternatives.

Functional Sports Drinks experience rapid growth driven by increasing fitness participation and sports culture development. These products target specific performance needs and recovery requirements, creating opportunities for specialized formulations and targeted marketing strategies.

Natural and Organic Variants emerge as high-growth subcategories, reflecting consumer trends toward clean labels, natural ingredients, and health-conscious consumption. These products command premium pricing and appeal to affluent, educated consumers who prioritize ingredient quality and health benefits.

Sugar-free and Low-calorie Options gain market traction as health awareness increases and dietary preferences evolve. These variants address consumer concerns about sugar consumption while maintaining energy-enhancing benefits through alternative formulations and natural sweeteners.

Manufacturers benefit from strong market growth potential, diverse consumer segments, and opportunities for product innovation that create competitive advantages. The market’s expansion into secondary cities and rural areas provides new revenue streams and market development opportunities for companies with appropriate strategies and resources.

Retailers gain from high-margin products with strong consumer demand and frequent purchase cycles. Energy drinks generate significant foot traffic and impulse purchases, particularly in convenience store formats where consumers often purchase these products alongside other items.

Distributors benefit from established supply chains, consistent demand patterns, and opportunities for geographic expansion. The market’s growth trajectory supports distribution network investments and relationship building with retail partners across various channel formats.

Consumers enjoy increasing product variety, improved formulations, and competitive pricing driven by market competition. The availability of products tailored to specific needs and preferences enhances consumer choice and satisfaction levels.

Investors find attractive opportunities in a growing market with strong demographic trends and expanding addressable market size. The industry’s consolidation potential and export opportunities create additional value creation possibilities for strategic investors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Focus dominates current market trends, with consumers increasingly seeking energy drinks that offer functional benefits beyond basic energy enhancement. This trend drives demand for products containing vitamins, minerals, adaptogens, and natural ingredients that support overall health and wellness goals.

Premium Product Development reflects growing consumer willingness to pay higher prices for perceived quality, unique formulations, and brand prestige. Premium products often feature exotic ingredients, sophisticated packaging, and targeted marketing that appeals to affluent urban consumers seeking differentiated experiences.

Digital Marketing Evolution transforms how brands engage with consumers, utilizing social media platforms, influencer partnerships, and interactive campaigns to build brand awareness and loyalty. MWR analysis indicates that digital marketing effectiveness has improved significantly, with engagement rates increasing by over 25% year-over-year.

Sustainability Initiatives gain importance as environmentally conscious consumers prefer brands that demonstrate commitment to sustainable packaging, responsible sourcing, and environmental stewardship. These initiatives create brand differentiation opportunities while addressing growing consumer expectations for corporate responsibility.

Personalization Trends emerge as companies develop products and marketing strategies tailored to specific consumer segments, lifestyle preferences, and consumption occasions. This trend toward customization reflects broader consumer expectations for products that meet individual needs and preferences.

Regulatory Framework Evolution includes new guidelines for energy drink marketing, labeling requirements, and ingredient restrictions that shape industry practices. Recent developments focus on protecting younger consumers while maintaining market access for compliant products and responsible marketing practices.

Technology Integration advances include smart packaging solutions, blockchain supply chain tracking, and artificial intelligence applications in consumer behavior analysis. These technological developments enhance operational efficiency, product authentication, and consumer engagement capabilities.

Strategic Partnerships between energy drink brands and sports organizations, fitness centers, and lifestyle brands create new marketing opportunities and consumer touchpoints. These collaborations enhance brand visibility and credibility while accessing targeted consumer segments.

Manufacturing Innovations improve production efficiency, quality consistency, and cost management through advanced processing technologies and automation systems. These developments support market expansion while maintaining competitive pricing and product quality standards.

Market Consolidation activities include mergers, acquisitions, and strategic investments that reshape competitive dynamics and market structure. These developments create opportunities for scale advantages and market position strengthening among industry participants.

Market Entry Strategies should focus on understanding local consumer preferences, regulatory requirements, and distribution channel dynamics before launching products. Successful market entry requires significant investment in brand building, consumer education, and relationship development with key retail partners.

Product Development Priorities should emphasize natural ingredients, functional benefits, and cultural relevance to Chinese consumers. Innovation efforts should balance international best practices with local taste preferences and traditional wellness concepts that resonate with target demographics.

Distribution Channel Optimization requires multi-channel strategies that leverage both traditional retail networks and emerging digital platforms. Companies should invest in convenience store relationships while building direct-to-consumer capabilities through e-commerce and social commerce platforms.

Brand Positioning Strategies must differentiate products in an increasingly crowded marketplace through unique value propositions, targeted messaging, and consistent brand experiences across all consumer touchpoints. Successful positioning requires deep understanding of consumer motivations and competitive landscape dynamics.

Regulatory Compliance Planning should anticipate future regulatory developments and maintain proactive compliance strategies that ensure continued market access. Companies should engage with regulatory authorities and industry associations to stay informed about policy developments and compliance requirements.

Market growth prospects remain positive despite increasing competition and regulatory challenges, with demographic trends and lifestyle changes supporting continued expansion. The market is expected to maintain robust growth rates, particularly in secondary cities and among health-conscious consumer segments seeking functional beverage solutions.

Innovation trajectories will likely focus on natural ingredients, personalized formulations, and sustainable packaging solutions that address evolving consumer preferences and environmental concerns. MarkWide Research projects that innovation-driven products will capture an increasing share of market growth, with natural and functional variants expected to grow at rates exceeding 15% annually.

Geographic expansion into underserved markets presents significant opportunities for companies with appropriate strategies and resources. The gradual urbanization of secondary markets and improving economic conditions in rural areas create new consumer bases with distinct preferences and requirements.

Digital transformation will continue reshaping industry dynamics through e-commerce growth, data-driven marketing, and direct consumer relationships. Companies that successfully integrate digital strategies with traditional marketing and distribution approaches will likely capture disproportionate market share growth.

Competitive landscape evolution may include further consolidation, international expansion by successful domestic brands, and emergence of new market entrants with innovative positioning strategies. The market’s maturation process will likely reward companies with strong brand equity, operational efficiency, and consumer loyalty.

China’s energy drinks industry market represents a dynamic and evolving sector with substantial growth potential driven by demographic trends, lifestyle changes, and increasing consumer sophistication. The market’s development reflects broader economic and social transformations occurring throughout Chinese society, creating opportunities for companies that understand and adapt to local market conditions.

Success factors in this market include deep consumer insight, product innovation, effective distribution strategies, and regulatory compliance capabilities. Companies that successfully balance international best practices with local market requirements will likely achieve sustainable competitive advantages and long-term growth.

Future market development will depend on industry participants’ ability to navigate regulatory challenges, address health concerns, and meet evolving consumer expectations for quality, functionality, and sustainability. The market’s continued expansion into secondary cities and rural areas provides substantial growth opportunities for companies with appropriate strategies and resources.

The China energy drinks industry market stands poised for continued growth and evolution, offering significant opportunities for stakeholders who understand market dynamics and consumer trends while maintaining focus on product quality, brand building, and operational excellence in an increasingly competitive environment.

What is Energy Drinks?

Energy drinks are beverages that contain stimulants, primarily caffeine, along with other ingredients such as vitamins, amino acids, and herbal extracts, designed to boost energy and alertness. They are popular among consumers looking for a quick energy boost, especially in the context of busy lifestyles and increased physical activity.

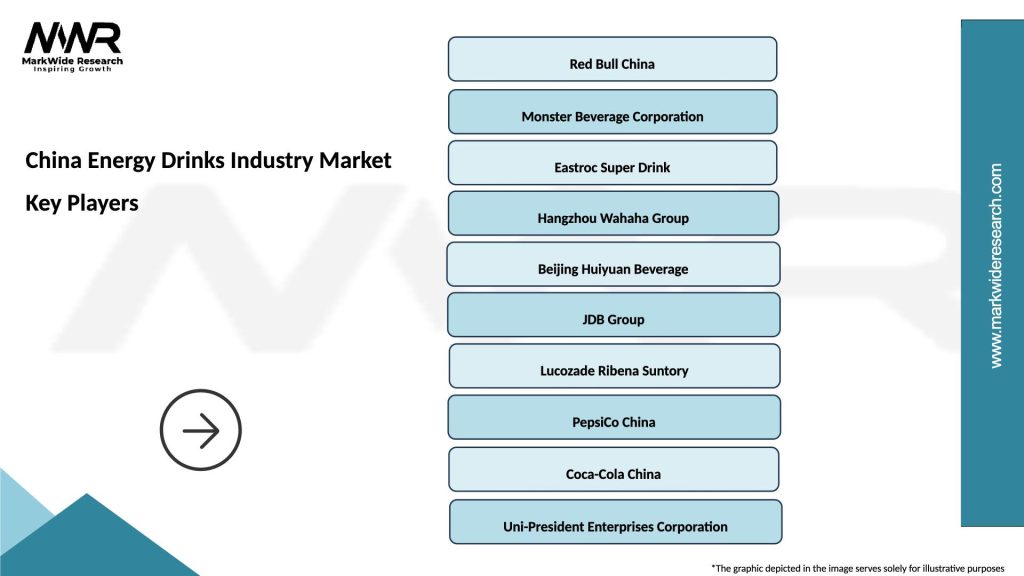

What are the key players in the China Energy Drinks Industry Market?

Key players in the China Energy Drinks Industry Market include Red Bull, Monster Beverage Corporation, and PepsiCo, which offer a variety of energy drink products targeting different consumer segments. These companies compete on factors such as flavor, branding, and marketing strategies to capture market share, among others.

What are the growth factors driving the China Energy Drinks Industry Market?

The growth of the China Energy Drinks Industry Market is driven by increasing consumer demand for energy-boosting products, rising health consciousness, and the growing trend of fitness and sports activities. Additionally, the expansion of distribution channels and innovative product offerings contribute to market growth.

What challenges does the China Energy Drinks Industry Market face?

The China Energy Drinks Industry Market faces challenges such as regulatory scrutiny regarding health claims and caffeine content, as well as growing concerns about the health effects of excessive consumption. Additionally, competition from alternative beverages like natural energy drinks and functional beverages poses a challenge.

What opportunities exist in the China Energy Drinks Industry Market?

Opportunities in the China Energy Drinks Industry Market include the potential for product innovation, such as organic and low-sugar energy drinks, and the expansion into untapped rural markets. Furthermore, increasing collaborations with fitness centers and sports events can enhance brand visibility and consumer engagement.

What trends are shaping the China Energy Drinks Industry Market?

Trends shaping the China Energy Drinks Industry Market include a shift towards healthier formulations, such as natural ingredients and reduced sugar content, as well as the rise of functional energy drinks that offer additional health benefits. Additionally, marketing strategies focusing on lifestyle branding and social media engagement are becoming increasingly important.

China Energy Drinks Industry Market

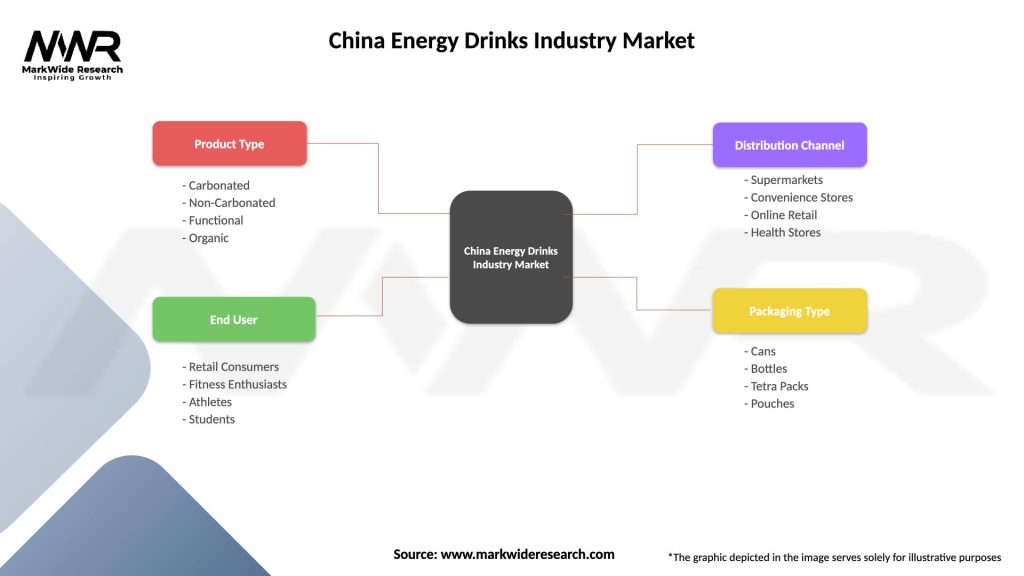

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Functional, Organic |

| End User | Retail Consumers, Fitness Enthusiasts, Athletes, Students |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Health Stores |

| Packaging Type | Cans, Bottles, Tetra Packs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Energy Drinks Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at