444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China electric vehicle lithium-ion battery separator market represents a critical component in the nation’s rapidly expanding electric vehicle ecosystem. As the world’s largest electric vehicle market, China has established itself as a dominant force in battery separator manufacturing, with domestic production capabilities experiencing unprecedented growth. The market encompasses various separator technologies including polyethylene (PE), polypropylene (PP), and advanced ceramic-coated separators that ensure optimal battery performance and safety.

Market dynamics indicate robust expansion driven by aggressive government policies supporting electric vehicle adoption and substantial investments in battery manufacturing infrastructure. The separator market benefits from China’s integrated supply chain approach, where major battery manufacturers maintain close partnerships with separator producers to ensure quality and cost optimization. Current market trends show a compound annual growth rate (CAGR) of 12.8%, reflecting the accelerating demand for high-performance battery separators across passenger vehicles, commercial vehicles, and energy storage applications.

Regional concentration remains significant in key manufacturing hubs including Guangdong, Jiangsu, and Zhejiang provinces, where established industrial clusters facilitate efficient production and distribution networks. The market demonstrates strong vertical integration tendencies, with leading battery manufacturers either acquiring separator companies or establishing in-house production capabilities to secure supply chain stability and technological advancement.

The China electric vehicle lithium-ion battery separator market refers to the specialized industry segment focused on manufacturing and distributing microporous membrane materials that physically separate positive and negative electrodes in lithium-ion batteries while allowing ionic conductivity for electric vehicle applications throughout China.

Battery separators serve as critical safety components that prevent electrical short circuits while facilitating lithium-ion movement during charging and discharging cycles. These ultra-thin membranes, typically measuring 12-25 micrometers in thickness, must demonstrate exceptional mechanical strength, thermal stability, and electrochemical compatibility to ensure optimal battery performance and longevity in demanding automotive environments.

Manufacturing processes involve sophisticated polymer processing techniques including dry stretching, wet processing, and advanced coating applications to achieve desired porosity, permeability, and safety characteristics. The market encompasses various separator grades designed for different electric vehicle applications, from high-energy density passenger car batteries to high-power commercial vehicle systems requiring enhanced thermal management and safety features.

China’s electric vehicle lithium-ion battery separator market demonstrates exceptional growth momentum supported by the nation’s leadership in electric vehicle production and battery manufacturing. The market benefits from comprehensive government support, including subsidies, tax incentives, and regulatory frameworks that accelerate electric vehicle adoption while promoting domestic battery supply chain development.

Key market characteristics include intense competition among domestic manufacturers, rapid technological advancement in separator materials and manufacturing processes, and increasing focus on safety and performance optimization. Major Chinese separator manufacturers have achieved significant scale advantages, enabling competitive pricing while maintaining quality standards that meet international automotive requirements.

Strategic developments highlight the market’s evolution toward premium separator technologies, including ceramic-coated separators and advanced polymer formulations that enhance battery safety and performance. The market shows approximately 78% domestic market share held by Chinese manufacturers, reflecting successful technology transfer and indigenous innovation capabilities that reduce dependence on foreign suppliers.

Future prospects remain highly favorable, driven by continued electric vehicle market expansion, energy storage system deployment, and ongoing technological improvements in battery chemistry and separator design. The market’s integration with China’s broader new energy vehicle strategy ensures sustained growth opportunities across multiple application segments.

Market insights reveal several critical factors shaping the China electric vehicle lithium-ion battery separator landscape:

Government policy support represents the primary driver for China’s electric vehicle lithium-ion battery separator market growth. Comprehensive policy frameworks including the New Energy Vehicle Industry Development Plan, carbon neutrality commitments, and substantial financial incentives create favorable market conditions for electric vehicle adoption and supporting infrastructure development.

Electric vehicle production growth directly drives separator demand, with China maintaining its position as the world’s largest electric vehicle manufacturer. The expanding production base across passenger vehicles, commercial vehicles, and two-wheelers creates sustained demand for high-quality battery separators across diverse performance requirements and price points.

Battery technology advancement continues driving market evolution, with increasing energy density requirements, enhanced safety standards, and improved cycle life expectations pushing separator manufacturers toward innovative materials and manufacturing processes. The transition toward higher nickel content cathode materials necessitates superior separator performance characteristics.

Supply chain localization efforts by major battery manufacturers drive domestic separator demand as companies seek to reduce supply chain risks and achieve cost optimization through local sourcing. This trend accelerates technology transfer and capacity expansion among Chinese separator manufacturers.

Energy storage applications provide additional growth drivers beyond automotive markets, with utility-scale energy storage projects and residential energy storage systems requiring substantial separator volumes. The market shows energy storage applications growing at 18.5% annually, creating diversified demand streams for separator manufacturers.

Raw material price volatility poses significant challenges for separator manufacturers, with petroleum-based polymer feedstocks subject to global commodity price fluctuations that impact production costs and profit margins. Supply chain disruptions and geopolitical tensions can exacerbate material availability and pricing pressures.

Intense price competition among domestic manufacturers creates margin pressure, particularly in standard separator grades where differentiation is limited. The commoditization of basic separator products forces manufacturers to compete primarily on price, potentially impacting research and development investment capabilities.

Technical complexity in separator manufacturing requires substantial capital investment in specialized equipment and quality control systems. The precision required in achieving consistent porosity, thickness uniformity, and mechanical properties demands sophisticated manufacturing capabilities that create barriers for new market entrants.

Quality consistency challenges remain significant as automotive applications demand extremely high reliability and safety standards. Any quality issues can result in costly recalls and damage to manufacturer reputations, requiring continuous investment in quality assurance and process control systems.

Environmental regulations impose increasing compliance costs related to manufacturing processes, waste management, and product lifecycle considerations. Stricter environmental standards require ongoing investment in cleaner production technologies and waste reduction initiatives.

Premium separator segments offer substantial growth opportunities as battery manufacturers increasingly demand high-performance separators with enhanced safety features, thermal stability, and electrochemical properties. Ceramic-coated separators and advanced polymer formulations command premium pricing while providing superior performance characteristics.

Export market expansion presents significant opportunities for Chinese separator manufacturers to leverage cost advantages and manufacturing scale in serving global electric vehicle and energy storage markets. International automotive manufacturers increasingly consider Chinese suppliers for cost-competitive, high-quality separator solutions.

Next-generation battery technologies create opportunities for separator innovation, including solid-state battery applications, silicon anode compatibility, and high-voltage cathode systems. Early investment in these emerging technologies can establish competitive advantages in future market segments.

Recycling and sustainability initiatives offer new business model opportunities as circular economy principles gain importance in battery supply chains. Separator manufacturers can develop recycling capabilities and sustainable material alternatives to meet growing environmental requirements.

Vertical integration opportunities allow separator manufacturers to expand into adjacent value chain segments including coating materials, adhesives, and specialized manufacturing equipment. This integration can improve margins and strengthen customer relationships through comprehensive solution offerings.

Supply and demand dynamics in China’s electric vehicle lithium-ion battery separator market reflect the rapid scaling of electric vehicle production and the corresponding need for high-quality separator materials. The market demonstrates strong demand elasticity, with separator consumption closely correlated to electric vehicle production volumes and battery capacity requirements.

Competitive dynamics show increasing consolidation among separator manufacturers as scale advantages become more critical for cost competitiveness and technology development. Leading manufacturers invest heavily in capacity expansion and technology advancement to maintain market position, while smaller players face pressure to specialize in niche applications or consider consolidation opportunities.

Technology dynamics drive continuous innovation in separator materials, manufacturing processes, and performance characteristics. The market shows research and development spending increasing by 15.2% annually as manufacturers pursue next-generation separator technologies that enable higher energy density, improved safety, and enhanced durability in electric vehicle applications.

Price dynamics reflect the balance between raw material costs, manufacturing efficiency improvements, and competitive pressures. While standard separator grades experience downward price pressure, premium products with advanced features maintain stable or improving pricing power through value-added performance benefits.

Primary research methodology encompasses comprehensive interviews with key industry stakeholders including separator manufacturers, battery producers, electric vehicle manufacturers, and technology suppliers. Direct engagement with industry participants provides insights into market trends, competitive dynamics, and future development priorities that shape market evolution.

Secondary research analysis incorporates extensive review of industry publications, government statistics, patent filings, and corporate financial reports to establish market sizing, growth trends, and competitive positioning. This approach ensures comprehensive coverage of market dynamics and validates primary research findings through multiple data sources.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth trajectories, segment development patterns, and regional distribution trends. Advanced analytical tools enable scenario planning and sensitivity analysis to account for various market development possibilities.

Data validation processes ensure research accuracy through triangulation of multiple information sources, expert review panels, and continuous monitoring of market developments. Quality assurance protocols maintain research integrity and reliability for strategic decision-making applications.

Eastern China regions dominate separator manufacturing, with Jiangsu, Zhejiang, and Guangdong provinces accounting for approximately 68% of national production capacity. These regions benefit from established industrial clusters, proximity to major battery manufacturers, and well-developed transportation infrastructure that facilitates efficient supply chain operations.

Guangdong Province leads in separator production volume and technological advancement, hosting major manufacturers including leading domestic companies that serve both domestic and international markets. The region’s proximity to Hong Kong provides advantages for international trade and technology transfer activities.

Jiangsu Province demonstrates strong growth in separator manufacturing capacity, with significant investments in advanced production facilities and research and development centers. The region benefits from its central location and excellent transportation connectivity to major battery manufacturing hubs.

Zhejiang Province focuses on high-end separator products and specialized applications, with manufacturers emphasizing quality and performance differentiation. The region’s strong private sector presence drives innovation and competitive dynamics in premium market segments.

Central and Western regions show emerging importance as battery manufacturers expand production capacity inland to access lower labor costs and government incentives. These regions represent growing market share of approximately 23% as industrial development policies encourage geographic diversification of manufacturing activities.

Market leadership in China’s electric vehicle lithium-ion battery separator market is characterized by intense competition among both domestic and international players, with Chinese manufacturers increasingly gaining market share through technological advancement and cost competitiveness.

Leading market participants include:

Competitive strategies focus on capacity expansion, technology development, cost optimization, and strategic partnerships with major battery manufacturers. Companies invest heavily in research and development to maintain technological leadership while pursuing vertical integration opportunities to strengthen supply chain control.

By Material Type:

By Manufacturing Process:

By Application:

Polyethylene separator category maintains market leadership through proven performance characteristics and established manufacturing infrastructure. This segment benefits from continuous technology improvements in pore structure optimization, thickness reduction, and mechanical property enhancement. The category shows market penetration of approximately 58% across various electric vehicle applications.

Ceramic-coated separator category represents the fastest-growing premium segment, driven by increasing safety requirements and performance demands in high-energy density battery applications. These separators provide superior thermal stability and shutdown characteristics that enhance battery safety in automotive environments.

Wet-process manufacturing category dominates production volume due to its ability to create high-porosity separators with excellent electrolyte wettability and ionic conductivity. This manufacturing approach enables precise control over separator properties while maintaining cost competitiveness for large-scale production.

Passenger vehicle application category drives the majority of separator demand, requiring materials that balance energy density, safety, and cost considerations. This segment pushes technological advancement in separator design to enable longer driving ranges and faster charging capabilities.

Energy storage application category emerges as a significant growth driver, demanding separators optimized for long cycle life and calendar life performance. This category requires different performance priorities compared to automotive applications, creating opportunities for specialized separator products.

Battery manufacturers benefit from China’s robust separator supply base through competitive pricing, reliable supply security, and continuous technology advancement. Local sourcing reduces supply chain risks while enabling close collaboration on product development and quality optimization initiatives.

Electric vehicle manufacturers gain advantages through cost-effective battery solutions enabled by competitive separator pricing and performance improvements. The domestic separator industry supports overall electric vehicle cost reduction while maintaining safety and performance standards required for market acceptance.

Separator manufacturers capitalize on the rapidly expanding electric vehicle market through sustained demand growth, opportunities for technology leadership, and potential for international market expansion. The market provides platforms for innovation and scale development that strengthen competitive positioning.

Government stakeholders achieve strategic objectives including industrial development, technology advancement, and environmental goals through a thriving domestic separator industry. The sector contributes to employment generation, export earnings, and technological self-reliance in critical battery supply chains.

Investors and financial institutions find attractive opportunities in a growing market with strong government support, clear demand drivers, and potential for technology leadership. The sector offers investment opportunities across the value chain from raw materials to advanced manufacturing technologies.

Research institutions benefit from industry collaboration opportunities, funding for advanced materials research, and technology transfer possibilities. The dynamic market environment creates demand for continuous innovation and scientific advancement in separator technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence trends show increasing integration between separator design and battery chemistry optimization, with manufacturers developing application-specific separator solutions that enhance overall battery performance. This trend drives closer collaboration between separator producers and battery manufacturers throughout the product development process.

Safety enhancement trends emphasize the development of separators with improved thermal stability, shutdown characteristics, and mechanical integrity to address growing safety requirements in automotive applications. MarkWide Research analysis indicates that safety-focused separator innovations represent a key differentiation factor in premium market segments.

Sustainability trends drive development of environmentally friendly separator materials and manufacturing processes, including recyclable materials and reduced environmental impact production methods. The market shows increasing adoption of sustainable practices at 22% annually as environmental considerations gain importance in supply chain decisions.

Digitalization trends encompass the adoption of advanced manufacturing technologies including artificial intelligence, machine learning, and IoT systems to optimize production processes and quality control. These technologies enable real-time monitoring and predictive maintenance that improve manufacturing efficiency and product consistency.

Customization trends reflect growing demand for application-specific separator solutions tailored to particular battery chemistries, vehicle types, and performance requirements. This trend creates opportunities for specialized manufacturers while challenging commodity producers to develop differentiation strategies.

Capacity expansion initiatives dominate recent industry developments, with major Chinese separator manufacturers announcing substantial production capacity increases to meet growing demand from domestic and international battery manufacturers. These expansions often incorporate advanced manufacturing technologies and automation systems to improve efficiency and quality.

Technology partnerships between Chinese separator manufacturers and international battery companies facilitate technology transfer and market access opportunities. These collaborations enable Chinese companies to access advanced technologies while providing international partners with cost-competitive manufacturing capabilities.

Research and development investments continue increasing as manufacturers pursue next-generation separator technologies including solid-state battery applications, enhanced safety features, and improved performance characteristics. Industry participants allocate growing resources to innovation activities that support long-term competitive positioning.

Vertical integration activities include acquisitions and partnerships that strengthen supply chain control and technology capabilities. Battery manufacturers increasingly seek to secure separator supply through direct investment or long-term supply agreements that ensure quality and availability.

International expansion efforts by leading Chinese separator manufacturers include establishing overseas production facilities and sales offices to serve global markets. These initiatives reflect growing confidence in Chinese separator technology and manufacturing capabilities.

Technology investment priorities should focus on developing next-generation separator materials that address emerging battery chemistry requirements and safety standards. Companies should prioritize research and development in ceramic coating technologies, advanced polymer formulations, and manufacturing process innovations that enable superior product performance.

Quality assurance enhancement represents a critical success factor for Chinese separator manufacturers seeking to compete in premium market segments and international markets. Investment in advanced quality control systems, testing capabilities, and certification processes will support market expansion and customer confidence building.

Strategic partnership development with major battery manufacturers and electric vehicle companies can provide market access, technology sharing opportunities, and long-term supply security. These relationships should focus on collaborative product development and mutual technology advancement initiatives.

Market diversification strategies should explore opportunities beyond automotive applications including energy storage systems, consumer electronics, and emerging battery applications. This diversification can reduce market concentration risks while leveraging separator manufacturing capabilities across multiple growth segments.

International market development requires careful planning including local partnership strategies, regulatory compliance preparation, and quality certification processes. Companies should prioritize markets with strong electric vehicle growth prospects and favorable trade relationships with China.

Market growth prospects remain highly favorable for China’s electric vehicle lithium-ion battery separator market, driven by sustained electric vehicle adoption, energy storage deployment, and continuous technology advancement. The market is projected to maintain robust growth rates exceeding 11% annually through the forecast period, supported by strong domestic demand and expanding export opportunities.

Technology evolution will continue driving market development, with next-generation separator materials and manufacturing processes enabling higher performance, enhanced safety, and improved cost-effectiveness. Solid-state battery development may create new separator requirements and market opportunities for innovative manufacturers.

Competitive landscape evolution suggests increasing consolidation among smaller manufacturers while leading companies strengthen market positions through scale advantages and technology leadership. International competition may intensify as global players establish local presence to serve the Chinese market.

Supply chain development will emphasize greater integration between separator manufacturers and battery producers, with long-term partnerships and potential vertical integration activities strengthening supply security and technology collaboration. MWR projects that integrated supply chain models will account for approximately 45% of separator supply by the end of the forecast period.

Regulatory environment evolution will likely include stricter safety standards, environmental requirements, and quality certifications that favor established manufacturers with strong technical capabilities and quality assurance systems. These developments may create barriers for new entrants while benefiting companies with proven track records.

China’s electric vehicle lithium-ion battery separator market represents a dynamic and rapidly expanding industry segment that plays a crucial role in the nation’s electric vehicle ecosystem and broader new energy strategy. The market demonstrates exceptional growth potential driven by strong government support, robust domestic demand, and increasing international recognition of Chinese separator technology and manufacturing capabilities.

Key success factors for market participants include continuous technology innovation, quality excellence, cost competitiveness, and strategic partnerships with major battery manufacturers and electric vehicle companies. The market rewards companies that can balance these requirements while maintaining operational efficiency and customer satisfaction.

Future market development will be characterized by ongoing technology advancement, increasing safety requirements, growing international competition, and expanding application diversity beyond traditional automotive markets. Companies that successfully navigate these trends while maintaining focus on core competencies will be well-positioned for sustained growth and market leadership in this critical industry segment.

What is Electric Vehicle Lithium-Ion Battery Separator?

Electric Vehicle Lithium-Ion Battery Separator refers to a critical component used in lithium-ion batteries that prevents short circuits while allowing the flow of lithium ions. These separators are essential for the performance and safety of electric vehicle batteries.

What are the key players in the China Electric Vehicle Lithium-Ion Battery Separator Market?

Key players in the China Electric Vehicle Lithium-Ion Battery Separator Market include companies like Asahi Kasei, Toray Industries, and Celgard, which are known for their advanced separator technologies and contributions to the electric vehicle battery industry, among others.

What are the growth factors driving the China Electric Vehicle Lithium-Ion Battery Separator Market?

The growth of the China Electric Vehicle Lithium-Ion Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions.

What challenges does the China Electric Vehicle Lithium-Ion Battery Separator Market face?

Challenges in the China Electric Vehicle Lithium-Ion Battery Separator Market include the high cost of advanced materials, competition from alternative battery technologies, and regulatory hurdles related to manufacturing and safety standards.

What opportunities exist in the China Electric Vehicle Lithium-Ion Battery Separator Market?

Opportunities in the China Electric Vehicle Lithium-Ion Battery Separator Market include the potential for innovation in separator materials, the expansion of electric vehicle production, and increasing investments in renewable energy technologies.

What trends are shaping the China Electric Vehicle Lithium-Ion Battery Separator Market?

Trends in the China Electric Vehicle Lithium-Ion Battery Separator Market include the development of high-performance separators, the integration of smart technologies in battery management systems, and a growing focus on sustainability and recycling of battery components.

China Electric Vehicle Lithium-Ion Battery Separator Market

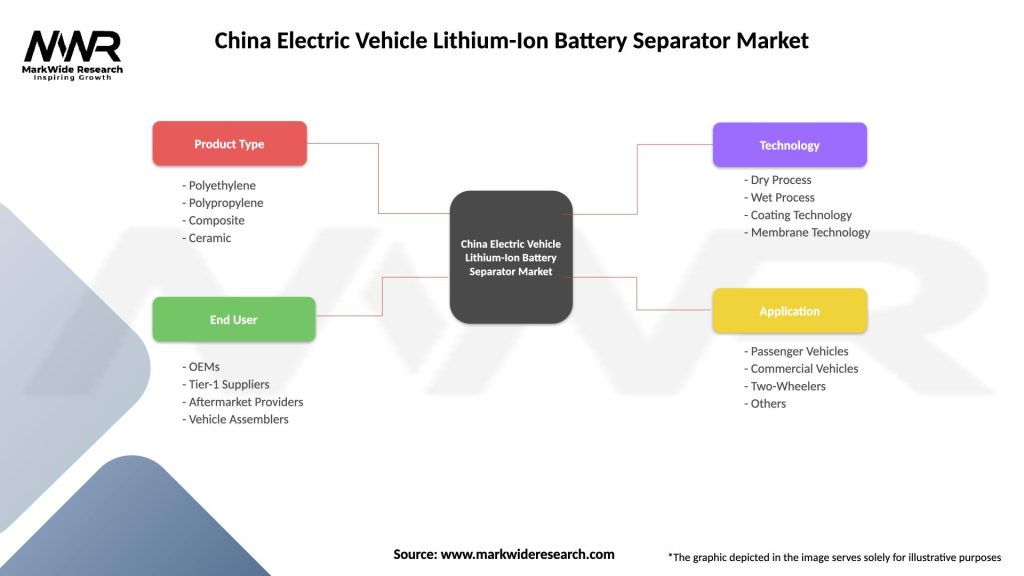

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Composite, Ceramic |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Process, Wet Process, Coating Technology, Membrane Technology |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Electric Vehicle Lithium-Ion Battery Separator Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at