444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China electric vehicle battery separator market represents a critical component in the nation’s ambitious transition toward sustainable transportation and energy storage solutions. As the world’s largest electric vehicle market, China has established itself as a dominant force in battery separator manufacturing, with domestic production capabilities experiencing unprecedented growth rates of 12.5% CAGR over recent years. The battery separator industry in China encompasses various technologies including polyethylene, polypropylene, and ceramic-coated separators that serve as essential safety barriers in lithium-ion battery cells.

Market dynamics indicate that China’s strategic focus on electric vehicle adoption has created substantial demand for high-performance battery separators. The country’s comprehensive supply chain ecosystem, from raw material processing to finished separator production, positions it uniquely in the global marketplace. Chinese manufacturers have achieved significant technological advancements in separator thickness reduction, porosity optimization, and thermal stability enhancement, contributing to improved battery performance and safety standards.

Regional concentration of separator manufacturing facilities primarily centers around industrial hubs in Guangdong, Jiangsu, and Zhejiang provinces, where established chemical processing infrastructure supports large-scale production operations. The market benefits from government policies promoting new energy vehicles, with 85% of domestic separator production dedicated to supporting the electric vehicle battery supply chain.

The China electric vehicle battery separator market refers to the domestic industry focused on manufacturing and supplying specialized polymer membranes that physically separate positive and negative electrodes within lithium-ion battery cells while allowing ionic conductivity for electric vehicle applications.

Battery separators function as critical safety components that prevent direct contact between battery electrodes while maintaining electrolyte permeability necessary for ion transport during charging and discharging cycles. In the context of China’s electric vehicle industry, these separators must meet stringent performance requirements including thermal stability, mechanical strength, and electrochemical compatibility with various battery chemistries.

Technical specifications for electric vehicle battery separators in China typically involve microporous polymer films with thickness ranging from 12 to 25 micrometers, featuring controlled porosity levels and enhanced puncture resistance. The market encompasses various separator types including single-layer polyethylene, trilayer polypropylene-polyethylene-polypropylene configurations, and ceramic-coated variants designed for high-energy density applications.

China’s electric vehicle battery separator market demonstrates remarkable growth momentum driven by the country’s leadership in electric vehicle production and battery manufacturing. The domestic separator industry has evolved from import dependence to achieving 78% self-sufficiency in meeting national demand, with leading manufacturers establishing comprehensive production capabilities across multiple separator technologies.

Key market characteristics include rapid technological advancement in separator performance, substantial manufacturing capacity expansion, and increasing integration with downstream battery cell producers. Chinese separator manufacturers have successfully developed proprietary coating technologies and advanced polymer processing techniques that enhance separator safety and performance characteristics.

Strategic positioning within the global supply chain has enabled Chinese companies to capture significant market share through competitive pricing and reliable supply capabilities. The market benefits from strong domestic demand generated by major battery manufacturers including CATL, BYD, and Gotion High-Tech, creating a robust foundation for continued expansion.

Future prospects indicate sustained growth potential as China’s electric vehicle market continues expanding and battery energy density requirements drive demand for advanced separator technologies. Government support for new energy vehicle development and battery industry localization further strengthens the market outlook.

Market intelligence reveals several critical insights shaping China’s electric vehicle battery separator landscape:

Government policy support serves as the primary catalyst driving China’s electric vehicle battery separator market expansion. The national commitment to carbon neutrality by 2060 has accelerated electric vehicle adoption targets, creating substantial downstream demand for battery separators. Regulatory frameworks including the New Energy Vehicle mandate and battery industry development guidelines provide clear market direction and investment incentives.

Electric vehicle market growth represents the fundamental demand driver for battery separators in China. With electric vehicle sales achieving 29% market penetration in major urban centers, the corresponding battery production requirements generate consistent separator demand. The transition from traditional automotive manufacturing to electric vehicle production has created new market opportunities for separator suppliers.

Technological advancement requirements drive continuous innovation in separator performance characteristics. Battery manufacturers’ pursuit of higher energy density, improved safety, and extended cycle life necessitates advanced separator technologies. The development of fast-charging capabilities and high-voltage battery systems creates specific separator performance requirements that fuel market growth.

Manufacturing localization initiatives promote domestic separator production capabilities as part of China’s strategic supply chain security objectives. Government incentives for battery industry localization encourage separator manufacturers to establish comprehensive production facilities and reduce import dependence.

Technical complexity challenges present significant barriers to market entry and expansion in China’s battery separator industry. The precise manufacturing requirements for producing high-quality separators demand sophisticated equipment, specialized expertise, and substantial capital investment. Quality control standards for electric vehicle applications require consistent production processes that can be difficult to achieve and maintain.

Raw material dependencies create potential supply chain vulnerabilities for Chinese separator manufacturers. Key polymer resins and specialty chemicals required for separator production often rely on imported materials, exposing manufacturers to price volatility and supply disruptions. The concentration of raw material suppliers can limit manufacturing flexibility and cost optimization opportunities.

Intense price competition pressures profit margins across the separator manufacturing industry. The commoditization of standard separator products has led to aggressive pricing strategies that can undermine investment in research and development. Competition from established international manufacturers with advanced technologies poses ongoing challenges for domestic companies.

Environmental regulations impose additional compliance costs and operational constraints on separator manufacturing facilities. Stricter environmental standards for chemical processing and waste management require ongoing investment in pollution control equipment and sustainable manufacturing practices.

Next-generation battery technologies present substantial growth opportunities for Chinese separator manufacturers. The development of solid-state batteries, lithium-metal batteries, and other advanced energy storage systems creates demand for specialized separator solutions. Early investment in these emerging technologies can establish competitive advantages and market leadership positions.

Export market expansion offers significant revenue growth potential as global recognition of Chinese separator quality increases. International battery manufacturers seeking reliable, cost-effective separator suppliers present opportunities for Chinese companies to expand beyond domestic markets. Strategic partnerships with global automotive and energy storage companies can facilitate market entry.

Energy storage system applications beyond electric vehicles create additional market segments for separator manufacturers. Grid-scale energy storage, residential battery systems, and industrial energy storage applications require high-performance separators with different specifications than automotive applications, diversifying market opportunities.

Vertical integration strategies enable separator manufacturers to capture additional value chain segments and strengthen customer relationships. Integration with raw material suppliers or downstream battery manufacturers can improve cost structures and market positioning while reducing supply chain dependencies.

Supply and demand equilibrium in China’s electric vehicle battery separator market reflects the rapid scaling of both production capacity and consumption requirements. The market has transitioned from supply constraints to balanced conditions as domestic manufacturing capabilities have expanded to meet growing battery production needs. Capacity utilization rates across major separator manufacturers have stabilized at 82% average levels, indicating healthy market conditions.

Competitive dynamics continue evolving as market consolidation accelerates among smaller manufacturers while leading companies expand their technological capabilities and production scale. The emergence of specialized separator technologies for different battery applications has created market segmentation opportunities that allow manufacturers to differentiate their products and maintain pricing power.

Innovation cycles drive continuous product development as battery manufacturers demand improved separator performance characteristics. The development timeline for new separator technologies typically spans 18-24 months from concept to commercial production, requiring sustained research and development investment and close collaboration with battery manufacturers.

Market maturation indicators suggest the industry is transitioning from rapid capacity expansion to focus on operational efficiency and product quality optimization. Established manufacturers are investing in automation and process improvement to maintain competitiveness while newer entrants face increasing barriers to market entry.

Comprehensive market analysis of China’s electric vehicle battery separator market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include extensive interviews with industry executives, technical specialists, and market participants across the separator manufacturing value chain. These discussions provide firsthand insights into market trends, technological developments, and competitive dynamics.

Secondary research components encompass analysis of industry publications, government statistics, company financial reports, and technical literature related to battery separator technologies. Patent analysis and intellectual property research provide insights into innovation trends and competitive positioning among market participants.

Market data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Quantitative analysis includes production capacity assessments, demand forecasting models, and price trend analysis based on market transaction data.

Industry expert consultation with technical specialists, market analysts, and business strategists provides additional perspective on market dynamics and future outlook. These consultations help validate research findings and identify emerging trends that may impact market development.

Eastern China dominance characterizes the geographic distribution of electric vehicle battery separator manufacturing, with 67% of production capacity concentrated in Jiangsu, Zhejiang, and Shanghai regions. This concentration reflects the presence of established chemical processing infrastructure, skilled workforce availability, and proximity to major battery manufacturers. The region benefits from comprehensive supply chain networks and efficient logistics systems supporting separator production and distribution.

Guangdong Province represents another significant manufacturing hub, accounting for substantial separator production capacity focused primarily on serving southern China’s battery manufacturers. The region’s advanced manufacturing capabilities and proximity to Hong Kong’s international trade networks facilitate both domestic supply and export activities.

Central China expansion has emerged as battery manufacturers establish production facilities in Hubei, Hunan, and Henan provinces to access lower-cost manufacturing environments. Separator manufacturers are following this geographic expansion to maintain proximity to their customers and reduce transportation costs.

Western China development remains limited but shows potential for future growth as government policies promote industrial development in interior regions. The availability of lower-cost land and labor, combined with government incentives, may attract separator manufacturing investments to support regional battery production facilities.

Market leadership in China’s electric vehicle battery separator industry is characterized by a mix of domestic companies and international manufacturers with local production facilities. The competitive environment has evolved significantly as Chinese companies have developed advanced manufacturing capabilities and technological expertise.

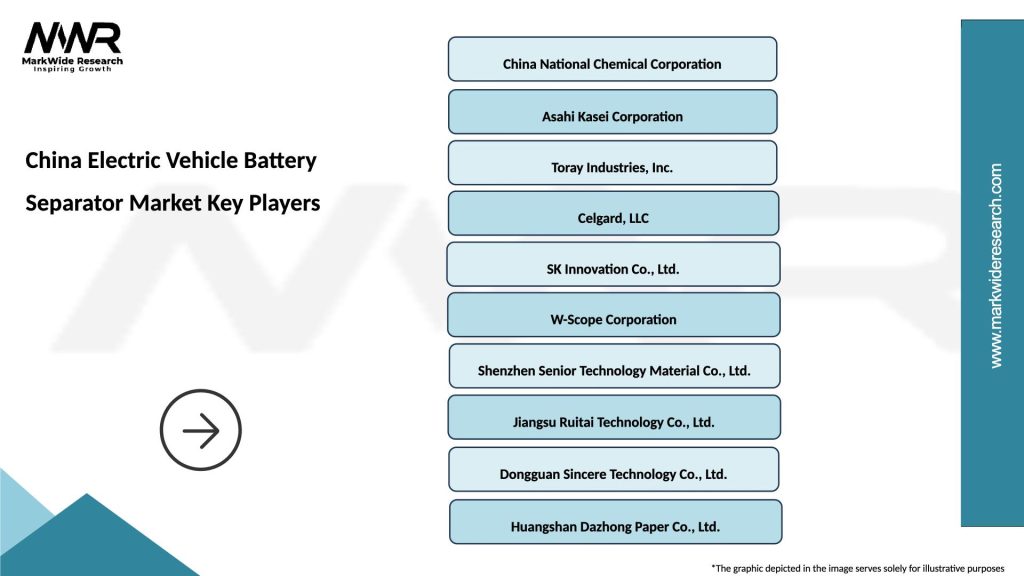

Leading market participants include:

Competitive strategies focus on technological differentiation, manufacturing scale advantages, and customer relationship development. Leading companies invest heavily in research and development to maintain technological leadership while expanding production capacity to meet growing market demand.

Technology-based segmentation divides China’s electric vehicle battery separator market into distinct categories based on material composition and manufacturing processes:

By Material Type:

By Application Segment:

By End-User Category:

Polyethylene separator category maintains the largest market share due to its cost-effectiveness and proven performance in standard electric vehicle applications. This segment benefits from mature manufacturing processes and established supply chains, enabling competitive pricing and reliable availability. Recent innovations in polyethylene separator technology have improved thermal stability and mechanical strength while maintaining cost advantages.

Trilayer separator technology represents the fastest-growing category, with adoption rates increasing by 18% annually as battery manufacturers prioritize safety and performance optimization. The PP-PE-PP configuration provides superior thermal shutdown characteristics while maintaining excellent mechanical properties, making it ideal for high-performance electric vehicle applications.

Ceramic-coated separators constitute the premium market segment, commanding higher prices due to their enhanced safety characteristics and superior thermal stability. This category serves high-end electric vehicle applications and energy storage systems where safety and performance requirements justify the additional cost. Market penetration in this segment continues expanding as battery energy density requirements increase.

Commercial vehicle applications drive demand for specialized separator solutions designed to withstand harsh operating conditions and extended duty cycles. This segment requires separators with enhanced puncture resistance and thermal management capabilities, creating opportunities for manufacturers with advanced technology capabilities.

Battery manufacturers benefit from China’s robust separator supply base through reliable product availability, competitive pricing, and technical support capabilities. The domestic separator industry provides flexibility in product customization and rapid response to changing specifications, enabling battery manufacturers to optimize their product development cycles and maintain competitive positioning.

Electric vehicle manufacturers gain advantages from the integrated supply chain ecosystem that reduces procurement complexity and supply chain risks. Local separator production supports just-in-time manufacturing strategies while providing cost advantages that can be passed through to consumers, supporting electric vehicle market expansion.

Separator manufacturers benefit from China’s large domestic market that provides stable demand and opportunities for scale economies. The market’s growth trajectory offers expansion opportunities while government support policies create favorable operating conditions for domestic companies.

Technology developers find opportunities in China’s separator market through partnerships with manufacturers seeking advanced technologies. The market’s openness to innovation and substantial research and development investments create collaborative opportunities for technology advancement.

Investors can capitalize on the market’s growth potential through strategic investments in leading separator manufacturers or emerging technology companies. The market’s fundamental growth drivers and government policy support provide attractive investment opportunities with favorable risk-return profiles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Ultra-thin separator development represents a critical trend as battery manufacturers pursue higher energy density solutions. The industry trend toward separators with thickness below 16 micrometers requires advanced manufacturing capabilities and precise quality control systems. This trend drives innovation in polymer processing and coating technologies while creating differentiation opportunities for manufacturers with advanced capabilities.

Ceramic coating adoption continues accelerating as safety requirements become more stringent for high-energy density battery applications. The integration of ceramic particles into separator structures enhances thermal stability and provides additional safety margins for fast-charging applications. This trend creates opportunities for manufacturers with specialized coating technologies and materials expertise.

Sustainable manufacturing practices are becoming increasingly important as environmental regulations tighten and customers prioritize sustainability. Separator manufacturers are investing in recyclable materials, energy-efficient production processes, and waste reduction initiatives. This trend influences product development and manufacturing strategy decisions across the industry.

Automation and digitalization of separator manufacturing processes improve quality consistency and production efficiency. The implementation of advanced process control systems, automated quality inspection, and predictive maintenance technologies enhances manufacturing capabilities while reducing operational costs.

Customization and specialization trends reflect the diversification of battery applications and performance requirements. Separator manufacturers are developing specialized products for different market segments, including fast-charging applications, long-life energy storage systems, and extreme temperature operating conditions.

Capacity expansion announcements from major Chinese separator manufacturers indicate continued confidence in market growth prospects. Shanghai Energy New Materials recently completed a significant production facility expansion, while Cangzhou Mingzhu announced plans for additional manufacturing lines to meet growing demand from battery customers.

Technology partnerships between Chinese separator manufacturers and international technology companies are accelerating innovation development. These collaborations combine Chinese manufacturing capabilities with advanced separator technologies, creating competitive advantages and market differentiation opportunities.

Quality certification achievements by Chinese manufacturers demonstrate the industry’s commitment to meeting international standards. Several domestic companies have obtained automotive industry quality certifications that enable them to supply global battery manufacturers and automotive companies.

Research and development investments in next-generation separator technologies continue expanding as companies prepare for future battery technology transitions. Focus areas include solid-state battery separators, high-voltage applications, and enhanced safety characteristics for demanding applications.

Supply chain localization initiatives are reducing dependence on imported raw materials through domestic polymer production capacity development. These efforts strengthen supply chain security while potentially reducing material costs for separator manufacturers.

MarkWide Research analysis suggests that Chinese separator manufacturers should prioritize technological advancement and quality improvement to maintain competitive advantages in the evolving market landscape. Investment in advanced manufacturing equipment and process optimization will be critical for meeting increasingly stringent performance requirements from battery customers.

Strategic recommendations include developing specialized separator products for emerging applications such as solid-state batteries and high-voltage systems. Early investment in these technologies can establish market leadership positions as battery technology continues evolving toward higher performance solutions.

International expansion strategies should focus on building brand recognition and establishing quality credentials in global markets. Partnerships with international battery manufacturers and automotive companies can provide market entry opportunities while validating product quality and performance capabilities.

Supply chain optimization initiatives should address raw material dependencies through strategic partnerships or vertical integration opportunities. Securing reliable access to high-quality polymer resins and specialty chemicals will be essential for maintaining production stability and cost competitiveness.

Sustainability initiatives should be integrated into long-term strategic planning as environmental regulations and customer preferences increasingly favor sustainable manufacturing practices. Investment in recyclable materials and energy-efficient production processes will become competitive advantages.

Long-term growth prospects for China’s electric vehicle battery separator market remain highly favorable, driven by the country’s commitment to electric vehicle adoption and battery industry development. MWR projects continued market expansion as electric vehicle penetration rates increase and battery energy density requirements drive demand for advanced separator technologies.

Technology evolution will continue shaping market dynamics as next-generation battery technologies create new separator requirements. The development of solid-state batteries, lithium-metal systems, and other advanced energy storage technologies will create opportunities for separator manufacturers with innovative capabilities and flexible manufacturing systems.

Market consolidation trends are expected to continue as smaller manufacturers face increasing competitive pressures and capital requirements for technology development. Leading companies with strong financial resources and technological capabilities are likely to gain market share through organic growth and strategic acquisitions.

International competitiveness of Chinese separator manufacturers will continue improving as quality standards advance and brand recognition develops in global markets. Export opportunities are expected to expand as international customers recognize the value proposition of Chinese separator products.

Innovation acceleration will be driven by collaboration between separator manufacturers, battery companies, and research institutions. The development of breakthrough separator technologies could create new market opportunities and competitive advantages for companies with advanced research and development capabilities.

China’s electric vehicle battery separator market represents a dynamic and rapidly evolving industry that has achieved remarkable transformation from import dependence to technological leadership and manufacturing excellence. The market’s growth trajectory reflects the successful integration of government policy support, private sector investment, and technological innovation that has established China as a global leader in separator manufacturing.

Strategic positioning within the global supply chain provides Chinese separator manufacturers with significant competitive advantages through cost-effectiveness, manufacturing scale, and proximity to the world’s largest battery production base. The industry’s continued investment in research and development, quality improvement, and capacity expansion demonstrates strong commitment to maintaining market leadership and technological advancement.

Future success in China’s electric vehicle battery separator market will depend on manufacturers’ ability to adapt to evolving technology requirements, maintain quality standards, and develop innovative solutions for next-generation battery applications. The market’s fundamental growth drivers remain strong, supported by government policies, electric vehicle adoption trends, and the ongoing transition toward sustainable transportation systems that position the industry for continued expansion and global competitiveness.

What is Electric Vehicle Battery Separator?

Electric Vehicle Battery Separator is a critical component used in lithium-ion batteries, designed to prevent short circuits while allowing the flow of ions between the anode and cathode. These separators are essential for the performance and safety of electric vehicle batteries.

What are the key players in the China Electric Vehicle Battery Separator Market?

Key players in the China Electric Vehicle Battery Separator Market include companies like Asahi Kasei, Toray Industries, and Celgard, which are known for their advanced separator technologies and contributions to the electric vehicle industry, among others.

What are the growth factors driving the China Electric Vehicle Battery Separator Market?

The growth of the China Electric Vehicle Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions. Additionally, the rise in consumer awareness regarding environmental issues is fueling market expansion.

What challenges does the China Electric Vehicle Battery Separator Market face?

The China Electric Vehicle Battery Separator Market faces challenges such as high production costs, the need for continuous innovation in separator materials, and competition from alternative battery technologies. These factors can hinder market growth and affect profitability.

What opportunities exist in the China Electric Vehicle Battery Separator Market?

Opportunities in the China Electric Vehicle Battery Separator Market include the development of new materials that enhance battery performance, the expansion of electric vehicle production, and increasing investments in renewable energy sources. These factors are likely to create a favorable environment for market players.

What trends are shaping the China Electric Vehicle Battery Separator Market?

Trends shaping the China Electric Vehicle Battery Separator Market include the shift towards higher energy density batteries, the integration of smart technologies in battery management systems, and a growing focus on sustainability and recycling of battery components. These trends are influencing product development and market strategies.

China Electric Vehicle Battery Separator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyethylene, Composite, Others |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Process, Wet Process, Coating Technology, Others |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Buses |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Electric Vehicle Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at