444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China electric vehicle battery manufacturing equipment market represents a critical component of the nation’s ambitious transition toward sustainable transportation and energy independence. This rapidly expanding sector encompasses sophisticated machinery, automation systems, and specialized tools designed to produce high-performance lithium-ion batteries for electric vehicles. China’s dominance in the global EV battery supply chain has created unprecedented demand for advanced manufacturing equipment, driving innovation and technological advancement across the industry.

Market dynamics indicate robust growth driven by government policies supporting electric vehicle adoption and substantial investments in battery manufacturing capacity. The sector benefits from China’s established position as the world’s largest electric vehicle market, with domestic manufacturers requiring increasingly sophisticated production equipment to meet quality standards and scale requirements. Manufacturing efficiency improvements of approximately 35% annually demonstrate the sector’s rapid technological evolution and optimization capabilities.

Key market characteristics include the integration of Industry 4.0 technologies, automated production lines, and precision manufacturing systems designed specifically for battery cell production, module assembly, and pack integration. The market encompasses equipment for electrode preparation, cell assembly, formation and aging, testing systems, and quality control mechanisms essential for producing reliable electric vehicle batteries at commercial scale.

The China electric vehicle battery manufacturing equipment market refers to the comprehensive ecosystem of specialized machinery, automation systems, and production technologies used to manufacture lithium-ion batteries specifically designed for electric vehicles within China’s industrial landscape. This market encompasses the entire spectrum of equipment required for battery production, from raw material processing to final battery pack assembly and testing.

Manufacturing equipment categories include electrode coating machines, calendering systems, slitting equipment, winding and stacking machines, electrolyte filling systems, formation and aging equipment, testing and inspection systems, and automated assembly lines. These sophisticated systems enable manufacturers to produce high-quality battery cells with consistent performance characteristics, safety features, and longevity required for automotive applications.

Market significance extends beyond simple equipment supply, encompassing technology transfer, process optimization, quality assurance, and production scalability solutions that enable Chinese manufacturers to compete effectively in global markets while meeting stringent automotive industry standards for safety, performance, and reliability.

China’s electric vehicle battery manufacturing equipment market demonstrates exceptional growth momentum driven by the nation’s strategic commitment to electric vehicle leadership and energy security objectives. The market benefits from substantial government support, private sector investment, and technological innovation that positions China as the global leader in battery manufacturing capacity and capability.

Key growth drivers include expanding electric vehicle production, increasing battery energy density requirements, automation adoption rates of approximately 42% annually, and the need for manufacturing equipment that can produce next-generation battery technologies including solid-state and silicon-anode batteries. The market serves both domestic manufacturers and international companies establishing production facilities in China.

Competitive landscape features a mix of domestic equipment manufacturers, international technology providers, and joint venture partnerships that combine global expertise with local manufacturing capabilities. The market demonstrates strong innovation focus, with research and development investments driving continuous improvement in manufacturing efficiency, product quality, and production scalability.

Future prospects remain highly favorable, supported by China’s carbon neutrality commitments, expanding electric vehicle adoption, and the country’s position as a global battery manufacturing hub serving both domestic and international markets with increasingly sophisticated production capabilities.

Strategic market insights reveal several critical trends shaping the China electric vehicle battery manufacturing equipment landscape:

Government policy support serves as the primary catalyst for market expansion, with China’s national strategy emphasizing electric vehicle adoption and domestic battery manufacturing capability development. Substantial subsidies, tax incentives, and regulatory frameworks create favorable conditions for equipment investment and technology advancement.

Electric vehicle market growth generates unprecedented demand for battery manufacturing capacity, requiring sophisticated equipment capable of producing millions of battery cells annually. The domestic EV market expansion, combined with export opportunities, drives continuous investment in manufacturing infrastructure and advanced production technologies.

Technological innovation requirements push manufacturers to adopt cutting-edge equipment capable of producing next-generation battery technologies with improved energy density, faster charging capabilities, and enhanced safety features. Equipment manufacturers respond with increasingly sophisticated systems that enable breakthrough battery performance characteristics.

Cost reduction pressures motivate manufacturers to invest in automated equipment that reduces labor costs, improves production efficiency, and minimizes waste generation. Advanced manufacturing systems deliver production cost reductions of approximately 28% annually through optimization and automation implementation.

Quality assurance demands from automotive manufacturers require sophisticated testing and inspection equipment that ensures every battery meets stringent safety and performance standards. The automotive industry’s zero-defect expectations drive investment in advanced quality control systems and process monitoring technologies.

High capital investment requirements present significant barriers for smaller manufacturers seeking to establish or expand battery production capabilities. Advanced manufacturing equipment requires substantial upfront investment, creating financial challenges for companies with limited access to capital or uncertain market demand projections.

Technical complexity associated with modern battery manufacturing equipment demands specialized expertise for operation, maintenance, and optimization. The shortage of skilled technicians and engineers capable of managing sophisticated production systems creates operational challenges and limits market expansion potential.

Technology obsolescence risks concern manufacturers investing in rapidly evolving equipment technologies. The pace of innovation in battery manufacturing processes creates uncertainty about equipment longevity and return on investment, particularly for companies making large-scale infrastructure commitments.

Supply chain dependencies on critical components and materials create vulnerabilities for equipment manufacturers and end users. International trade tensions, raw material availability, and component shortages can disrupt production schedules and increase operational costs.

Regulatory compliance requirements add complexity and cost to equipment design and manufacturing processes. Evolving safety standards, environmental regulations, and quality certifications require continuous adaptation and investment in compliance capabilities.

Export market expansion presents significant growth opportunities as Chinese equipment manufacturers leverage domestic expertise to serve international battery manufacturers. The global transition to electric vehicles creates demand for proven manufacturing technologies and cost-effective production solutions.

Next-generation battery technologies including solid-state batteries, silicon anodes, and advanced cathode materials require specialized manufacturing equipment, creating opportunities for innovation and market differentiation. Early movers in advanced battery manufacturing equipment can establish competitive advantages and premium pricing positions.

Recycling and sustainability initiatives drive demand for equipment capable of processing recycled battery materials and implementing circular economy principles. Environmental consciousness and resource scarcity create opportunities for equipment manufacturers focusing on sustainable production technologies.

Industry 4.0 integration enables equipment manufacturers to offer value-added services including predictive maintenance, remote monitoring, and data analytics capabilities. Digital transformation opportunities enhance customer relationships and create recurring revenue streams beyond initial equipment sales.

Vertical integration trends among battery manufacturers create opportunities for comprehensive production line solutions and turnkey manufacturing systems. Equipment providers can capture larger market share by offering integrated solutions that address multiple production stages and operational requirements.

Supply and demand dynamics reflect the rapid expansion of China’s electric vehicle battery manufacturing capacity and the corresponding need for advanced production equipment. Strong demand from established manufacturers expanding capacity and new entrants establishing production facilities creates favorable market conditions for equipment suppliers.

Competitive dynamics feature intense competition between domestic and international equipment manufacturers, driving continuous innovation and competitive pricing strategies. Market leaders focus on technological differentiation, comprehensive service offerings, and strategic partnerships to maintain competitive advantages.

Technology evolution accelerates as manufacturers seek equipment capable of producing increasingly sophisticated battery technologies with improved performance characteristics. The transition toward higher energy density batteries and faster charging capabilities requires corresponding advances in manufacturing equipment and processes.

Investment patterns show strong capital allocation toward automation, quality control systems, and flexible manufacturing platforms that can adapt to changing battery specifications and production requirements. Equipment utilization rates exceed 78% industry-wide, indicating strong demand and efficient capacity deployment.

Market consolidation trends emerge as larger equipment manufacturers acquire specialized technology companies and smaller competitors to expand capabilities and market reach. Strategic partnerships between equipment manufacturers and battery producers create integrated value chains and technology development collaborations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the China electric vehicle battery manufacturing equipment market. Primary research includes extensive interviews with industry executives, equipment manufacturers, battery producers, and technology specialists across the value chain.

Data collection processes incorporate both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, focus groups, and expert consultations. Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technical literature from academic and research institutions.

Market validation procedures include cross-referencing multiple data sources, conducting follow-up interviews to verify findings, and employing statistical analysis techniques to ensure data accuracy and reliability. Industry experts and market participants review preliminary findings to validate conclusions and identify potential gaps or inconsistencies.

Analytical frameworks utilize established market research methodologies including Porter’s Five Forces analysis, SWOT assessment, value chain analysis, and competitive benchmarking to provide comprehensive market understanding. Quantitative modeling techniques project future market trends and growth scenarios based on historical data and identified market drivers.

Eastern China dominates the electric vehicle battery manufacturing equipment market, with provinces including Jiangsu, Zhejiang, and Shanghai hosting major battery manufacturers and equipment suppliers. This region benefits from established industrial infrastructure, skilled workforce availability, and proximity to key automotive manufacturing centers, capturing approximately 45% market share of equipment installations.

Southern China represents a rapidly growing market segment, with Guangdong Province leading development through its concentration of electronics manufacturers transitioning into battery production. The region’s established supply chains, manufacturing expertise, and export infrastructure support both domestic market service and international equipment sales.

Central China emerges as an important manufacturing hub, with provinces like Hubei and Hunan attracting battery manufacturing investments through favorable policies and lower operational costs. Government incentives and strategic location advantages drive equipment demand growth of approximately 38% annually in this region.

Western China shows increasing market activity as manufacturers seek cost advantages and government policies promote industrial development in less developed regions. Sichuan and Chongqing attract battery manufacturing investments, creating demand for equipment suppliers willing to serve emerging market segments.

Northern China maintains significant market presence through established industrial bases in Beijing, Tianjin, and Shandong, with particular strength in research and development activities and high-end equipment manufacturing capabilities serving both domestic and international markets.

Market leadership features a diverse ecosystem of domestic and international equipment manufacturers competing across different technology segments and market applications:

International competitors maintain significant market presence through technology licensing, joint ventures, and direct investment in Chinese manufacturing facilities, bringing advanced technologies and global best practices to the domestic market.

By Equipment Type:

By Technology:

By Application:

Electrode Manufacturing Equipment represents the largest market segment, driven by the critical importance of electrode quality in battery performance and the need for precision coating and calendering processes. Advanced coating technologies enable manufacturers to achieve uniform electrode thickness and optimal active material distribution, directly impacting battery energy density and cycle life.

Cell Assembly Equipment demonstrates rapid growth as manufacturers adopt automated winding and stacking systems to improve production efficiency and consistency. Modern assembly equipment incorporates vision systems, precision positioning, and quality control mechanisms that ensure proper cell construction and minimize defect rates.

Formation and Aging Equipment gains importance as battery manufacturers focus on optimizing cell performance through controlled activation processes. Advanced formation systems enable precise control of charging profiles, temperature management, and aging conditions that maximize battery capacity and longevity.

Testing and Inspection Equipment shows strong demand growth driven by automotive industry quality requirements and safety standards. Comprehensive testing systems evaluate electrical performance, safety characteristics, and reliability parameters essential for automotive applications.

Automated Systems capture increasing market share as manufacturers seek to reduce labor costs, improve consistency, and scale production capacity. Automation adoption rates reach approximately 52% among large-scale manufacturers, with continued growth expected as technology costs decrease and capabilities expand.

Battery Manufacturers benefit from advanced equipment that enables higher production efficiency, improved product quality, and reduced manufacturing costs. Modern manufacturing systems deliver consistent performance, minimize waste generation, and support rapid scaling of production capacity to meet market demand.

Equipment Suppliers gain access to a rapidly expanding market with strong growth prospects and opportunities for technology innovation. The market rewards companies that can deliver reliable, efficient, and cost-effective manufacturing solutions while providing comprehensive technical support and service capabilities.

Automotive Manufacturers benefit from improved battery quality, consistency, and cost-effectiveness that advanced manufacturing equipment enables. Better manufacturing processes result in batteries with enhanced performance characteristics, improved safety features, and competitive pricing for electric vehicle applications.

Government Stakeholders achieve strategic objectives including industrial development, technology advancement, and environmental sustainability through a robust battery manufacturing equipment sector. The industry supports job creation, technology transfer, and China’s position as a global leader in clean energy technologies.

Research Institutions find opportunities for collaboration, technology development, and knowledge transfer through partnerships with equipment manufacturers and battery producers. The dynamic market environment supports innovation and provides platforms for commercializing advanced manufacturing technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration accelerates across all manufacturing segments as companies seek to improve efficiency, consistency, and scalability. Advanced robotics, artificial intelligence, and machine learning technologies transform traditional manufacturing processes, enabling lights-out production capabilities and predictive maintenance systems.

Digitalization Adoption drives implementation of Industry 4.0 technologies including IoT sensors, real-time monitoring systems, and data analytics platforms. Digital integration rates approach 41% among leading manufacturers, enabling optimization of production processes and predictive quality control.

Sustainability Focus influences equipment design and manufacturing processes as companies prioritize environmental responsibility and resource efficiency. Energy-efficient equipment, waste reduction systems, and circular economy principles become standard requirements for modern manufacturing facilities.

Customization Capabilities gain importance as battery manufacturers require flexible equipment that can accommodate diverse product specifications and rapid design changes. Modular equipment designs and programmable systems enable quick reconfiguration for different battery formats and chemistries.

Quality Enhancement drives investment in advanced testing and inspection systems that ensure every battery meets stringent automotive standards. In-line quality control, real-time monitoring, and statistical process control become integral components of modern manufacturing systems.

Technology Partnerships between Chinese and international companies accelerate knowledge transfer and capability development. Strategic alliances enable domestic manufacturers to access advanced technologies while international companies gain market access and manufacturing scale advantages.

Capacity Expansion projects across China drive substantial equipment demand as battery manufacturers scale production to meet growing electric vehicle demand. MarkWide Research analysis indicates that major manufacturers are investing heavily in automated production lines and advanced manufacturing systems.

Innovation Initiatives focus on developing equipment for next-generation battery technologies including solid-state batteries, silicon anodes, and advanced cathode materials. Research and development investments support breakthrough manufacturing processes and production scalability solutions.

Quality Certification programs establish industry standards for equipment performance, safety, and reliability. Certification requirements drive continuous improvement in equipment design and manufacturing processes while ensuring compatibility with automotive industry standards.

Export Market Development sees Chinese equipment manufacturers expanding international presence through direct sales, technology licensing, and joint venture partnerships. Growing global demand for battery manufacturing equipment creates opportunities for proven Chinese technologies and cost-effective solutions.

Investment Prioritization should focus on automation technologies, quality control systems, and flexible manufacturing platforms that can adapt to evolving battery technologies and market requirements. Companies should prioritize equipment that delivers measurable improvements in efficiency, quality, and scalability.

Technology Development efforts should concentrate on areas where China can achieve competitive advantages, including cost-effective automation solutions, specialized manufacturing processes, and integrated production systems. Collaboration with research institutions and international partners can accelerate innovation and capability development.

Market Expansion strategies should leverage China’s manufacturing expertise and cost advantages to capture international market opportunities. Export development, technology licensing, and strategic partnerships can help Chinese equipment manufacturers establish global market presence.

Talent Development initiatives should address the shortage of skilled technicians and engineers through training programs, educational partnerships, and knowledge transfer initiatives. Building domestic expertise in advanced manufacturing technologies is essential for long-term competitiveness.

Quality Improvement programs should establish consistent standards across the industry and ensure equipment meets international quality and safety requirements. Certification programs and best practice sharing can elevate overall industry capabilities and market reputation.

Market growth prospects remain exceptionally strong, driven by China’s continued leadership in electric vehicle adoption and battery manufacturing. The market is expected to maintain robust expansion as manufacturers invest in advanced equipment to support next-generation battery technologies and increased production capacity.

Technology evolution will accelerate as manufacturers adopt Industry 4.0 technologies, artificial intelligence, and advanced automation systems. MWR projects that automation penetration rates will exceed 65% within the next five years, transforming manufacturing processes and operational efficiency.

International expansion opportunities will grow as Chinese equipment manufacturers leverage domestic expertise to serve global markets. The worldwide transition to electric vehicles creates substantial demand for proven manufacturing technologies and cost-effective production solutions.

Innovation focus will shift toward equipment capable of producing advanced battery technologies including solid-state batteries, silicon anodes, and next-generation cathode materials. Early development of specialized manufacturing equipment for breakthrough battery technologies will create competitive advantages and market leadership positions.

Sustainability integration will become increasingly important as manufacturers prioritize environmental responsibility and resource efficiency. Equipment designed for circular economy principles, energy efficiency, and waste reduction will gain market preference and regulatory support.

The China electric vehicle battery manufacturing equipment market represents a dynamic and rapidly expanding sector that plays a crucial role in the nation’s electric vehicle industry leadership and clean energy transition. Strong government support, robust domestic demand, and continuous technological innovation create favorable conditions for sustained market growth and development.

Market fundamentals remain exceptionally strong, supported by China’s position as the world’s largest electric vehicle market and leading battery manufacturer. The combination of domestic market demand, export opportunities, and technological advancement drives continuous investment in advanced manufacturing equipment and production capabilities.

Future success will depend on continued innovation, quality improvement, and international market expansion. Companies that can deliver reliable, efficient, and cost-effective manufacturing solutions while adapting to evolving battery technologies and market requirements will capture the greatest opportunities in this transformative industry sector.

What is Electric Vehicle Battery Manufacturing Equipment?

Electric Vehicle Battery Manufacturing Equipment refers to the specialized machinery and tools used in the production of batteries for electric vehicles. This includes equipment for cell assembly, battery pack formation, and quality testing, which are essential for ensuring the performance and safety of electric vehicle batteries.

What are the key players in the China Electric Vehicle Battery Manufacturing Equipment Market?

Key players in the China Electric Vehicle Battery Manufacturing Equipment Market include companies like CATL, BYD, and Panasonic, which are known for their advanced battery technologies and manufacturing capabilities. These companies are competing to enhance production efficiency and battery performance, among others.

What are the main drivers of the China Electric Vehicle Battery Manufacturing Equipment Market?

The main drivers of the China Electric Vehicle Battery Manufacturing Equipment Market include the increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting electric mobility. Additionally, the push for sustainable energy solutions is fueling growth in this sector.

What challenges does the China Electric Vehicle Battery Manufacturing Equipment Market face?

Challenges in the China Electric Vehicle Battery Manufacturing Equipment Market include high manufacturing costs, supply chain disruptions, and the need for continuous innovation to keep up with rapid technological advancements. These factors can hinder the scalability and efficiency of production processes.

What opportunities exist in the China Electric Vehicle Battery Manufacturing Equipment Market?

Opportunities in the China Electric Vehicle Battery Manufacturing Equipment Market include the potential for partnerships with automotive manufacturers, the development of next-generation battery technologies, and the expansion into international markets. These avenues can enhance competitiveness and market reach.

What trends are shaping the China Electric Vehicle Battery Manufacturing Equipment Market?

Trends shaping the China Electric Vehicle Battery Manufacturing Equipment Market include the rise of automation in manufacturing processes, the integration of artificial intelligence for quality control, and the focus on sustainable production methods. These trends are driving efficiency and reducing environmental impact.

China Electric Vehicle Battery Manufacturing Equipment Market

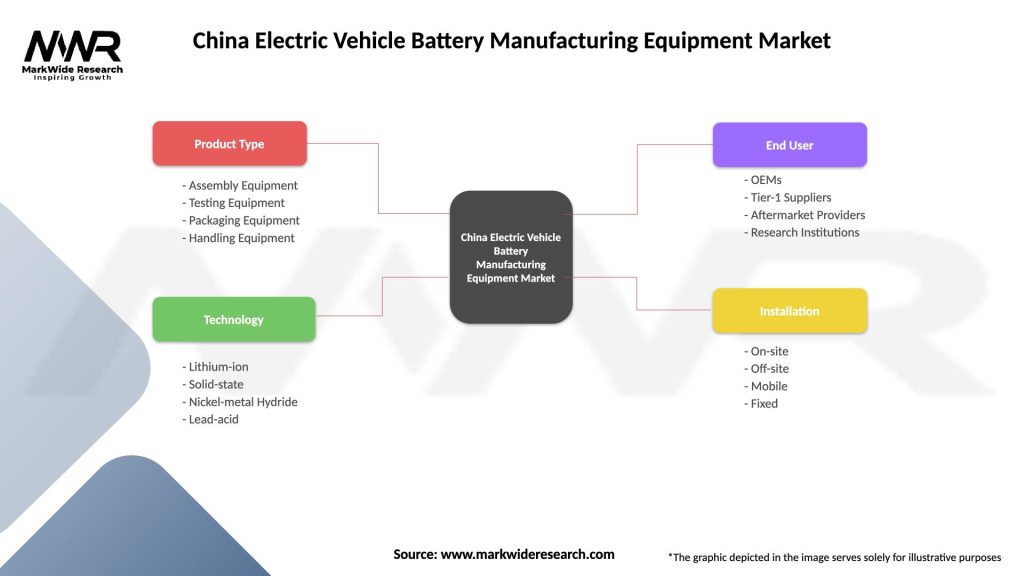

| Segmentation Details | Description |

|---|---|

| Product Type | Assembly Equipment, Testing Equipment, Packaging Equipment, Handling Equipment |

| Technology | Lithium-ion, Solid-state, Nickel-metal Hydride, Lead-acid |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Research Institutions |

| Installation | On-site, Off-site, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Electric Vehicle Battery Manufacturing Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at