444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China Dynamic Random Access Memory (DRAM) market represents one of the most critical segments in the global semiconductor industry, experiencing unprecedented growth driven by digital transformation and technological advancement. China’s DRAM market has emerged as a pivotal force in the global memory landscape, with domestic demand surging at an impressive 12.5% CAGR over recent years. The market encompasses various DRAM technologies including DDR4, DDR5, and emerging next-generation memory solutions that power everything from smartphones and computers to data centers and automotive applications.

Market dynamics in China’s DRAM sector are characterized by rapid technological evolution, increasing domestic production capabilities, and growing demand from key end-user industries. The country’s strategic focus on semiconductor self-sufficiency has accelerated investments in memory manufacturing facilities, with domestic production capacity expected to account for approximately 15% of global DRAM output by 2025. This transformation reflects China’s commitment to reducing dependence on foreign memory suppliers while meeting the escalating demand from its thriving electronics manufacturing ecosystem.

Regional concentration of DRAM activities in China is primarily focused in key technology hubs including Beijing, Shanghai, Shenzhen, and Xi’an, where major semiconductor companies have established manufacturing and research facilities. The market benefits from strong government support through initiatives like the National Integrated Circuit Industry Development Fund, which has channeled substantial resources into memory technology development and production capacity expansion.

The China Dynamic Random Access Memory (DRAM) market refers to the comprehensive ecosystem of memory semiconductor products, manufacturing capabilities, and related services within China’s borders, encompassing both domestic production and consumption of volatile memory solutions used in electronic devices and computing systems.

DRAM technology represents a fundamental component of modern computing infrastructure, providing temporary data storage that enables rapid access and processing of information in electronic devices. In the Chinese context, this market includes manufacturing facilities operated by domestic companies like ChangXin Memory Technologies (CXMT) and international players with local operations, alongside the vast consumption base driven by China’s position as the world’s largest electronics manufacturer.

Market scope encompasses various DRAM product categories including standard DDR modules, specialized memory for mobile devices, server-grade memory solutions, and emerging technologies like High Bandwidth Memory (HBM) and Graphics DDR (GDDR). The Chinese market’s unique characteristics include strong government policy support, significant domestic demand from local OEMs, and ambitious goals for achieving technological independence in critical semiconductor segments.

China’s DRAM market stands at a transformative juncture, driven by the convergence of domestic manufacturing ambitions and explosive demand growth across multiple technology sectors. The market has demonstrated remarkable resilience and growth potential, with mobile DRAM applications representing approximately 45% of total consumption, followed by PC and server applications. This distribution reflects China’s dominance in smartphone manufacturing and the rapid expansion of its data center infrastructure.

Key market drivers include the accelerating adoption of 5G technology, artificial intelligence applications, and cloud computing services, all of which require substantial memory resources. The automotive sector’s digital transformation, particularly in electric vehicles and autonomous driving systems, has emerged as a significant growth catalyst, with automotive DRAM demand growing at an exceptional 25% annually. Additionally, the Internet of Things (IoT) ecosystem expansion continues to create new demand streams for specialized memory solutions.

Strategic initiatives by the Chinese government have created a favorable environment for DRAM market development, with policies encouraging domestic production and technological innovation. According to MarkWide Research analysis, these initiatives have resulted in accelerated capacity building and technology transfer programs that position China as an increasingly important player in the global memory landscape.

Market insights reveal several critical trends shaping China’s DRAM landscape:

Market maturation is evident in the increasing sophistication of Chinese DRAM products and their growing acceptance in international markets. The development of specialized memory solutions for AI accelerators and high-performance computing applications demonstrates the market’s evolution beyond commodity memory products.

Primary market drivers propelling China’s DRAM market growth encompass both demand-side and supply-side factors that create a robust foundation for sustained expansion. The most significant driver is the explosive growth in data generation and processing requirements across Chinese industries, with data center expansion contributing to approximately 30% of enterprise DRAM demand growth.

Digital transformation initiatives across manufacturing, finance, healthcare, and government sectors have created unprecedented demand for memory-intensive applications. The rise of artificial intelligence and machine learning applications requires substantial memory resources, with AI workloads typically consuming 3-5 times more DRAM than traditional computing tasks. This trend is particularly pronounced in China’s tech sector, where companies are aggressively deploying AI solutions across various business functions.

5G network deployment represents another crucial driver, as next-generation wireless infrastructure requires advanced memory solutions for base stations, edge computing nodes, and connected devices. The Chinese government’s commitment to 5G leadership has accelerated network rollout, creating substantial demand for specialized DRAM products optimized for telecommunications applications.

Automotive electrification and the development of smart vehicles have emerged as significant growth catalysts. Modern electric vehicles incorporate numerous electronic control units, infotainment systems, and advanced driver assistance features, all requiring substantial memory resources. The Chinese automotive market’s rapid transition to electric and hybrid vehicles has created a substantial new demand stream for automotive-grade DRAM products.

Market restraints in China’s DRAM sector primarily stem from technological challenges, competitive pressures, and supply chain complexities that impact market development. The most significant constraint is the technology gap between domestic Chinese manufacturers and established global leaders, particularly in advanced process nodes and cutting-edge memory architectures.

Capital intensity of DRAM manufacturing presents substantial barriers to entry and expansion. Building state-of-the-art memory fabrication facilities requires investments in the tens of billions of dollars, along with ongoing R&D expenditures to maintain technological competitiveness. This financial burden limits the number of companies capable of participating in advanced DRAM manufacturing.

Intellectual property challenges continue to constrain Chinese DRAM companies’ ability to freely develop and commercialize certain memory technologies. Patent restrictions and licensing requirements can limit access to critical technologies and increase development costs. Additionally, international trade tensions have created uncertainties around technology transfer and equipment access for Chinese semiconductor companies.

Cyclical market dynamics inherent to the semiconductor industry create periodic challenges for DRAM manufacturers. Memory markets typically experience boom-bust cycles driven by supply-demand imbalances, which can result in significant price volatility and profitability pressures. Chinese companies, particularly newer entrants, may be more vulnerable to these cyclical downturns due to their developing market positions.

Market opportunities in China’s DRAM sector are abundant, driven by emerging technologies and evolving application requirements that create new demand categories. The most promising opportunity lies in next-generation memory technologies, including High Bandwidth Memory (HBM), Processing-in-Memory (PIM), and neuromorphic computing solutions that address the growing performance requirements of AI and high-performance computing applications.

Edge computing expansion presents significant opportunities as enterprises deploy distributed computing infrastructure to reduce latency and improve performance. Edge applications require specialized memory solutions optimized for power efficiency and reliability in diverse operating environments. The Chinese market’s rapid adoption of edge computing across industries creates substantial demand potential for tailored DRAM products.

Industrial Internet of Things (IIoT) development offers opportunities for specialized memory solutions designed for industrial automation, smart manufacturing, and connected infrastructure applications. China’s focus on Industry 4.0 initiatives and smart city development creates demand for memory products that can operate reliably in harsh industrial environments while providing the performance needed for real-time data processing.

Export market development represents a significant opportunity for Chinese DRAM manufacturers to expand beyond domestic markets. As Chinese companies achieve quality parity with international competitors, they can leverage cost advantages and manufacturing scale to compete in global markets, particularly in price-sensitive segments and emerging applications.

Market dynamics in China’s DRAM sector are characterized by rapid technological evolution, intense competition, and evolving supply chain relationships that shape industry development patterns. The interplay between domestic production capabilities and international market forces creates a complex dynamic environment where companies must navigate both local and global competitive pressures.

Supply chain dynamics have evolved significantly as Chinese companies work to develop domestic capabilities across the entire DRAM value chain. This includes not only memory chip manufacturing but also supporting industries such as equipment manufacturing, materials supply, and packaging services. The development of these supporting ecosystems is crucial for long-term competitiveness and supply chain security.

Technology transfer mechanisms continue to play important roles in market dynamics, with Chinese companies pursuing various strategies to access advanced memory technologies. These include joint ventures with international partners, acquisition of overseas technology companies, and aggressive recruitment of experienced engineers from established memory manufacturers.

Competitive dynamics are intensifying as domestic Chinese companies scale their operations and improve their technological capabilities. This has led to increased price competition in certain market segments while also driving innovation as companies seek to differentiate their products through advanced features and specialized applications. MWR analysis indicates that this competitive environment is accelerating the pace of technological development and market maturation.

Research methodology for analyzing China’s DRAM market employs a comprehensive multi-source approach that combines primary industry research, secondary data analysis, and expert insights to provide accurate market intelligence. The methodology incorporates both quantitative and qualitative research techniques to capture the full spectrum of market dynamics and trends.

Primary research activities include extensive interviews with key industry stakeholders including DRAM manufacturers, equipment suppliers, end-user companies, and government officials involved in semiconductor policy development. These interviews provide insights into market trends, competitive dynamics, technology developments, and future growth prospects that are not readily available through secondary sources.

Secondary research encompasses analysis of company financial reports, industry publications, government statistics, patent databases, and trade data to quantify market trends and validate primary research findings. This includes detailed analysis of production capacity data, technology roadmaps, and investment announcements from major market participants.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. The methodology also incorporates scenario analysis to account for various potential market development paths and their implications for different industry segments and geographic regions.

Regional analysis of China’s DRAM market reveals distinct geographic concentrations of manufacturing, research, and consumption activities that reflect the country’s semiconductor industry development strategy. The Yangtze River Delta region, anchored by Shanghai, accounts for approximately 40% of China’s DRAM manufacturing capacity, benefiting from established semiconductor ecosystems and proximity to major electronics manufacturers.

Beijing-Tianjin-Hebei region serves as a major hub for DRAM research and development activities, hosting several leading Chinese memory companies’ headquarters and R&D centers. This region benefits from proximity to top universities and research institutions, creating a talent pool that supports advanced technology development. The region’s focus on high-end manufacturing and technology innovation aligns well with the sophisticated requirements of DRAM development.

Pearl River Delta region, centered around Shenzhen and Guangzhou, represents the largest consumption center for DRAM products due to its concentration of electronics manufacturing companies. Major smartphone manufacturers, computer assemblers, and consumer electronics companies in this region drive substantial demand for various types of memory products. The region accounts for approximately 35% of China’s total DRAM consumption.

Western regions including Xi’an and Chengdu are emerging as important DRAM manufacturing centers, supported by government incentives and lower operational costs. These regions are attracting significant investments from both domestic and international memory companies seeking to expand production capacity while managing costs effectively.

Competitive landscape in China’s DRAM market features a mix of domestic champions and international players, creating a dynamic environment characterized by rapid technological advancement and intense competition across multiple market segments.

Market positioning strategies vary significantly among competitors, with domestic companies typically focusing on cost competitiveness and local market knowledge, while international players leverage advanced technology and established customer relationships. The competitive dynamics are further complicated by government policies that favor domestic companies while maintaining openness to international investment and technology transfer.

Innovation competition is particularly intense in emerging application areas such as AI accelerators, automotive memory, and edge computing solutions, where companies are racing to develop specialized products that meet evolving performance requirements.

Market segmentation of China’s DRAM market reveals diverse application categories and technology types that serve different end-user requirements and performance specifications.

By Technology:

By Application:

Mobile DRAM category represents the largest segment in China’s market, driven by the country’s position as the world’s largest smartphone manufacturer. LPDDR technology dominates this segment, with LPDDR5 adoption reaching approximately 60% in premium smartphone models. Chinese smartphone manufacturers are increasingly demanding higher memory capacities and faster performance to support advanced features like AI photography, augmented reality, and 5G connectivity.

Server DRAM category is experiencing rapid growth driven by cloud computing expansion and data center construction. Chinese cloud service providers and internet companies are major consumers of server memory, with demand for high-capacity modules and advanced technologies like DDR5 and HBM growing significantly. This segment values reliability, performance, and energy efficiency over cost considerations.

PC DRAM category remains stable with gradual technology transitions from DDR4 to DDR5. The gaming market within this category shows particular strength, with enthusiast users driving demand for high-performance memory modules. Chinese PC manufacturers are increasingly incorporating faster memory to differentiate their products in competitive markets.

Automotive DRAM category represents the fastest-growing segment, with Chinese electric vehicle manufacturers driving substantial demand growth. Advanced driver assistance systems, infotainment platforms, and autonomous driving capabilities require specialized memory solutions that can operate reliably in automotive environments while providing the performance needed for real-time processing.

Industry participants in China’s DRAM market enjoy numerous benefits from the sector’s rapid development and government support initiatives that create favorable business conditions.

For DRAM Manufacturers:

For End-User Companies:

For Technology Partners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping China’s DRAM market reflect broader technological and economic developments that influence industry evolution and competitive dynamics.

Technology Migration Acceleration: The transition from DDR4 to DDR5 technology is occurring faster than initially anticipated, driven by performance requirements from AI applications and high-end computing systems. Chinese manufacturers are investing heavily in DDR5 production capabilities to capture this growing market segment.

Specialized Memory Development: Growing focus on developing specialized DRAM products for specific applications such as automotive, industrial IoT, and edge computing. These specialized products typically offer higher margins and reduced competition compared to commodity memory markets.

Sustainability Initiatives: Increasing emphasis on energy-efficient memory solutions and sustainable manufacturing practices. Chinese companies are investing in green manufacturing technologies and developing low-power memory products to meet environmental regulations and customer requirements.

AI Integration: Integration of artificial intelligence capabilities into memory controllers and system designs to optimize performance and reliability. This trend is particularly relevant for data center and enterprise applications where intelligent memory management can significantly improve system efficiency.

Supply Chain Localization: Accelerating efforts to develop domestic supply chains for critical components and materials used in DRAM manufacturing. This includes development of local equipment suppliers, chemical suppliers, and packaging services to reduce dependence on international suppliers.

Industry developments in China’s DRAM market demonstrate the rapid pace of technological advancement and capacity expansion that characterizes this dynamic sector.

Manufacturing Capacity Expansion: Major Chinese DRAM manufacturers have announced significant capacity expansion plans, with new fabrication facilities coming online to meet growing demand. ChangXin Memory Technologies has successfully ramped production of advanced DDR4 and DDR5 products, achieving quality levels comparable to international competitors.

Technology Partnerships: Strategic partnerships between Chinese companies and international technology providers have accelerated technology transfer and capability development. These collaborations have enabled Chinese manufacturers to access advanced process technologies and manufacturing know-how more rapidly than through independent development.

Research Investment: Substantial increases in R&D spending by Chinese DRAM companies, with focus on next-generation memory technologies including Processing-in-Memory (PIM) and neuromorphic computing solutions. These investments position Chinese companies to compete in emerging high-value market segments.

Quality Certifications: Chinese DRAM manufacturers have achieved important quality certifications and customer qualifications, enabling them to supply major international OEMs. This represents a significant milestone in establishing credibility and market acceptance for Chinese memory products.

Government Policy Support: Continued government support through funding programs, tax incentives, and infrastructure development that creates favorable conditions for DRAM industry growth. Recent policy initiatives have focused on supporting advanced technology development and international competitiveness.

Analyst recommendations for stakeholders in China’s DRAM market emphasize strategic positioning, technology development, and market expansion approaches that can maximize opportunities while managing inherent risks.

For DRAM Manufacturers: Focus on developing specialized memory products for high-growth applications such as automotive, AI accelerators, and edge computing. These segments offer better margins and reduced competition compared to commodity memory markets. Invest in advanced packaging technologies and system-level integration capabilities to differentiate products and create additional value for customers.

For End-User Companies: Develop dual-sourcing strategies that include both domestic Chinese suppliers and international manufacturers to ensure supply security while managing costs. Engage early with Chinese DRAM manufacturers to influence product development and secure favorable pricing and allocation terms as these companies scale their operations.

For International Players: Consider partnership strategies with Chinese companies to access the local market while contributing technology and expertise. Focus on high-end market segments where advanced technology and established customer relationships provide competitive advantages. According to MarkWide Research analysis, companies that establish strong local partnerships are better positioned to succeed in the Chinese market.

For Investors: Focus on companies with strong technology roadmaps, established customer relationships, and sustainable competitive advantages. The DRAM market’s cyclical nature requires careful timing of investments and focus on companies with strong balance sheets that can weather industry downturns.

Future outlook for China’s DRAM market remains highly positive, with multiple growth drivers supporting sustained expansion and technological advancement over the next decade. The market is expected to maintain robust growth momentum, with compound annual growth rates projected to exceed 10% through 2030, driven by emerging applications and continued capacity expansion.

Technology evolution will play a crucial role in market development, with next-generation memory technologies like DDR6, HBM4, and Processing-in-Memory solutions creating new market opportunities. Chinese companies are investing heavily in these advanced technologies to establish competitive positions in high-value market segments before they reach commercial maturity.

Application diversification will continue expanding the addressable market, with automotive electronics, industrial IoT, and edge computing applications driving demand for specialized memory solutions. The automotive segment alone is projected to grow at exceptional rates as electric vehicle adoption accelerates and autonomous driving capabilities advance.

Supply chain development will enhance China’s position in the global DRAM market, with domestic companies achieving greater self-sufficiency in critical components and materials. This development will improve cost competitiveness and supply chain resilience while reducing dependence on international suppliers.

International expansion opportunities will emerge as Chinese DRAM manufacturers achieve quality parity with established competitors and develop brand recognition in international markets. Export growth will provide additional revenue streams and reduce dependence on domestic market conditions.

China’s Dynamic Random Access Memory (DRAM) market represents a transformative force in the global semiconductor industry, characterized by rapid technological advancement, substantial government support, and growing domestic manufacturing capabilities. The market has evolved from primarily being a consumption center to becoming a significant production hub with ambitious goals for technological independence and international competitiveness.

Market fundamentals remain strong, supported by robust demand from diverse end-user industries including mobile devices, data centers, automotive electronics, and emerging applications in AI and edge computing. The successful development of domestic DRAM manufacturing capabilities, led by companies like ChangXin Memory Technologies, demonstrates China’s commitment to building a complete semiconductor ecosystem.

Strategic opportunities abound for various stakeholders, from manufacturers seeking to capitalize on growing demand to end-users looking to secure reliable supply chains. The market’s evolution toward specialized memory solutions and advanced technologies creates numerous avenues for differentiation and value creation. As China continues to invest in semiconductor technology development and manufacturing capacity, the DRAM market will remain a critical component of the country’s broader technology strategy and economic development goals.

What is Dynamic Random Access Memory (DRAM)?

Dynamic Random Access Memory (DRAM) is a type of volatile memory used in computers and other devices to store data temporarily. It is characterized by its ability to store each bit of data in a separate capacitor within an integrated circuit, making it essential for high-speed data processing.

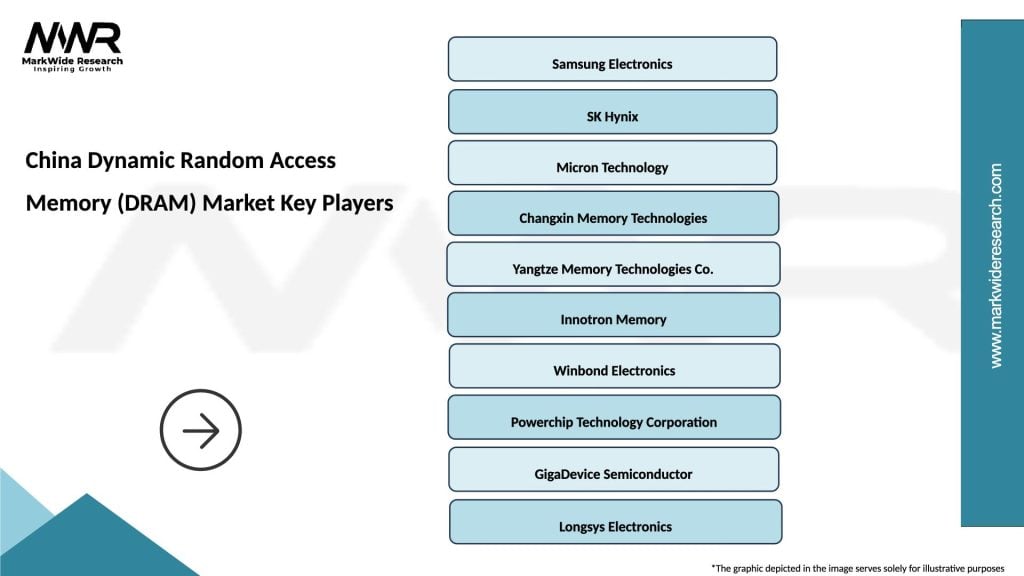

What are the key players in the China Dynamic Random Access Memory (DRAM) Market?

Key players in the China Dynamic Random Access Memory (DRAM) Market include Samsung Electronics, SK Hynix, and Micron Technology, which are known for their advanced memory solutions and significant market share, among others.

What are the growth factors driving the China Dynamic Random Access Memory (DRAM) Market?

The growth of the China Dynamic Random Access Memory (DRAM) Market is driven by the increasing demand for high-performance computing, the expansion of the smartphone industry, and the rise of artificial intelligence applications that require efficient memory solutions.

What challenges does the China Dynamic Random Access Memory (DRAM) Market face?

The China Dynamic Random Access Memory (DRAM) Market faces challenges such as fluctuating raw material prices, intense competition among manufacturers, and the rapid pace of technological advancements that require continuous innovation.

What opportunities exist in the China Dynamic Random Access Memory (DRAM) Market?

Opportunities in the China Dynamic Random Access Memory (DRAM) Market include the growing adoption of cloud computing, the development of next-generation memory technologies, and the increasing integration of DRAM in emerging technologies like IoT and autonomous vehicles.

What trends are shaping the China Dynamic Random Access Memory (DRAM) Market?

Trends shaping the China Dynamic Random Access Memory (DRAM) Market include the shift towards higher capacity memory modules, advancements in memory architecture such as DDR5, and the increasing focus on energy-efficient memory solutions to meet sustainability goals.

China Dynamic Random Access Memory (DRAM) Market

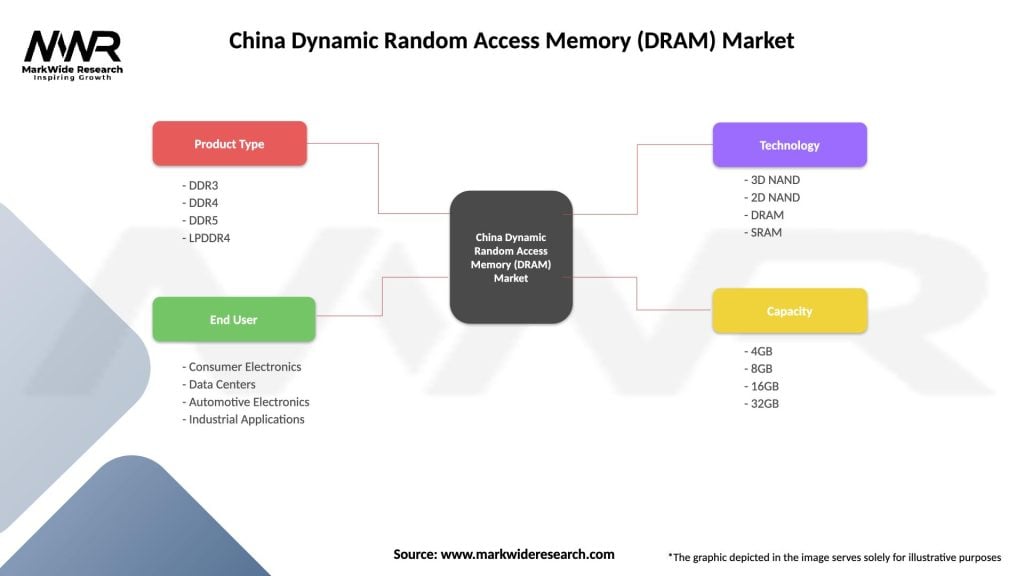

| Segmentation Details | Description |

|---|---|

| Product Type | DDR3, DDR4, DDR5, LPDDR4 |

| End User | Consumer Electronics, Data Centers, Automotive Electronics, Industrial Applications |

| Technology | 3D NAND, 2D NAND, DRAM, SRAM |

| Capacity | 4GB, 8GB, 16GB, 32GB |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Dynamic Random Access Memory (DRAM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at