444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China data center storage market represents one of the most dynamic and rapidly expanding segments within the global technology infrastructure landscape. China’s digital transformation initiatives, coupled with the explosive growth of cloud computing, artificial intelligence, and big data analytics, have created unprecedented demand for advanced storage solutions across the nation’s data centers. The market encompasses a comprehensive range of storage technologies, including solid-state drives (SSDs), hard disk drives (HDDs), hybrid storage systems, and emerging storage-class memory solutions.

Market dynamics indicate robust growth driven by the country’s commitment to digital infrastructure development and the increasing adoption of Industry 4.0 technologies. The storage market is experiencing significant expansion at a compound annual growth rate (CAGR) of 12.5%, reflecting the strong demand from hyperscale data centers, enterprise facilities, and edge computing deployments. Government initiatives supporting digital economy development and smart city projects have further accelerated the deployment of advanced storage infrastructure across major metropolitan areas.

Technology adoption patterns show a clear shift toward high-performance storage solutions, with NVMe-based SSDs gaining substantial market traction due to their superior performance characteristics. The integration of artificial intelligence workloads and machine learning applications has created specific requirements for low-latency, high-throughput storage systems, driving innovation in storage architecture design and implementation strategies.

The China data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services deployed within data center facilities across mainland China to support digital infrastructure requirements. This market encompasses all forms of primary storage, secondary storage, and backup storage solutions utilized by enterprises, cloud service providers, telecommunications companies, and government organizations to manage their data assets effectively.

Storage technologies within this market include traditional mechanical hard drives, high-performance solid-state drives, hybrid storage arrays, software-defined storage platforms, and emerging persistent memory solutions. The market also covers storage management software, data protection services, and storage-as-a-service offerings that enable organizations to optimize their data storage infrastructure while maintaining operational efficiency and cost-effectiveness.

Market participants include international storage vendors, domestic technology companies, system integrators, and specialized service providers who collectively deliver comprehensive storage solutions tailored to the unique requirements of Chinese enterprises and organizations operating within the country’s regulatory framework.

China’s data center storage market demonstrates exceptional growth momentum, driven by the nation’s aggressive digitalization strategy and the rapid expansion of cloud computing infrastructure. The market benefits from strong government support for digital economy initiatives, substantial investments in 5G network deployment, and the increasing adoption of emerging technologies such as artificial intelligence and Internet of Things applications.

Key market drivers include the explosive growth of data generation, estimated at 35% annually, the expansion of hyperscale data centers, and the increasing demand for edge computing solutions. Major technology companies are establishing significant data center footprints across tier-one and tier-two cities, creating substantial demand for advanced storage infrastructure capable of supporting diverse workload requirements.

Technology trends indicate a strong preference for all-flash storage arrays and software-defined storage platforms that offer enhanced performance, scalability, and operational flexibility. The market is witnessing increased adoption of NVMe over Fabrics technologies and storage-class memory solutions that bridge the performance gap between traditional storage and system memory.

Competitive dynamics feature a mix of established international vendors and emerging domestic players, with increasing emphasis on localized manufacturing, customized solutions, and comprehensive service offerings that address specific regulatory and operational requirements within the Chinese market environment.

Strategic market insights reveal several critical trends shaping the evolution of China’s data center storage landscape:

Digital transformation initiatives across Chinese enterprises represent the primary catalyst driving data center storage market expansion. Organizations are modernizing their IT infrastructure to support cloud-native applications, big data analytics, and artificial intelligence workloads, creating substantial demand for high-performance storage solutions capable of handling diverse data types and access patterns.

Government policy support through initiatives such as the “New Infrastructure” program and the “Digital China” strategy provides significant momentum for data center development and storage infrastructure investment. These policies encourage the deployment of advanced technologies and support the development of smart cities, industrial internet platforms, and digital government services that require robust storage capabilities.

5G network deployment is generating unprecedented data volumes and creating new requirements for edge storage solutions that can support low-latency applications and real-time data processing. The expansion of 5G infrastructure across major cities is driving demand for distributed storage architectures that can efficiently handle the massive data flows generated by connected devices and IoT applications.

Cloud adoption acceleration among Chinese enterprises is creating substantial demand for scalable storage infrastructure. Organizations are migrating workloads to cloud platforms and implementing hybrid cloud strategies that require flexible storage solutions capable of supporting both on-premises and cloud-based deployments while maintaining consistent performance and data protection capabilities.

High implementation costs associated with advanced storage technologies present significant challenges for many organizations, particularly small and medium-sized enterprises seeking to modernize their data center infrastructure. The substantial capital investment required for all-flash storage arrays and software-defined storage platforms can create budget constraints that limit adoption rates among cost-sensitive organizations.

Technical complexity in storage system integration and management poses operational challenges for organizations lacking specialized expertise. The deployment of advanced storage architectures requires skilled personnel capable of managing multi-vendor environments, implementing data protection strategies, and optimizing performance across diverse workload requirements.

Regulatory compliance requirements related to data sovereignty and cybersecurity create additional complexity in storage solution selection and deployment. Organizations must ensure their storage infrastructure meets specific regulatory standards while maintaining operational efficiency and cost-effectiveness, which can limit technology choices and increase implementation complexity.

Supply chain disruptions and component shortages have impacted storage hardware availability and pricing, creating challenges for organizations planning infrastructure upgrades. The global semiconductor shortage has particularly affected SSD availability and pricing, forcing organizations to adjust their storage deployment timelines and technology selection strategies.

Edge computing expansion presents substantial opportunities for storage vendors to develop specialized solutions optimized for distributed deployment scenarios. The growth of autonomous vehicles, smart manufacturing, and augmented reality applications creates demand for storage systems that can operate effectively in challenging environmental conditions while providing consistent performance and reliability.

Artificial intelligence integration offers significant opportunities for storage innovation, particularly in developing solutions optimized for machine learning workloads and deep learning applications. The increasing adoption of AI across industries creates demand for storage architectures that can efficiently handle the unique data access patterns and performance requirements of AI workloads.

Sustainability initiatives create opportunities for vendors to develop energy-efficient storage solutions that help organizations reduce their environmental impact while maintaining operational performance. The growing focus on carbon neutrality and green data centers drives demand for storage technologies that offer superior performance per watt and reduced cooling requirements.

Industry-specific solutions present opportunities for specialized storage offerings tailored to the unique requirements of sectors such as financial services, healthcare, telecommunications, and manufacturing. These industries have specific compliance, performance, and reliability requirements that create demand for customized storage solutions and specialized service offerings.

Technology evolution continues to reshape the storage landscape, with emerging technologies such as storage-class memory, computational storage, and DNA-based storage beginning to influence market dynamics. These innovations promise to address specific performance and capacity challenges while creating new opportunities for storage vendors and service providers.

Competitive intensity is increasing as both international and domestic vendors compete for market share in the rapidly expanding Chinese market. This competition is driving innovation in product development, pricing strategies, and service offerings, ultimately benefiting customers through improved solutions and competitive pricing.

Customer requirements are becoming increasingly sophisticated, with organizations demanding storage solutions that offer seamless scalability, automated management, and integrated data protection capabilities. The shift toward consumption-based models and as-a-service offerings is changing how organizations procure and manage their storage infrastructure.

Ecosystem partnerships are becoming increasingly important as storage vendors collaborate with cloud service providers, system integrators, and technology partners to deliver comprehensive solutions that address complex customer requirements. These partnerships enable the development of integrated solutions that combine storage hardware, software, and services into cohesive offerings.

Primary research activities encompassed comprehensive interviews with key stakeholders across the China data center storage ecosystem, including storage vendors, system integrators, end-user organizations, and industry experts. These interviews provided valuable insights into market trends, technology adoption patterns, competitive dynamics, and future growth opportunities within the Chinese market context.

Secondary research involved extensive analysis of industry reports, vendor documentation, government publications, and academic research to establish a comprehensive understanding of market fundamentals, regulatory requirements, and technological developments. This research provided essential context for understanding the unique characteristics of the Chinese data center storage market.

Market sizing methodology utilized multiple data sources and validation techniques to ensure accuracy and reliability of growth projections and market trend analysis. The research approach incorporated both top-down and bottom-up analysis methods to provide comprehensive market insights and validate key findings across different market segments and geographic regions.

Data validation processes included cross-referencing multiple sources, conducting expert interviews, and performing statistical analysis to ensure the accuracy and reliability of research findings. The methodology incorporated feedback from industry participants to validate market assumptions and refine analytical conclusions.

Eastern China dominates the data center storage market, accounting for approximately 45% of total market activity, driven by the concentration of major cities, financial centers, and technology companies in the region. Shanghai, Beijing, and Shenzhen serve as primary hubs for data center development, with substantial investments in hyperscale facilities and enterprise data centers supporting the region’s digital economy initiatives.

Northern China represents approximately 25% of market share, with Beijing serving as a major center for government data centers, financial services infrastructure, and technology company headquarters. The region benefits from strong government support for digital infrastructure development and significant investments in smart city projects that require advanced storage capabilities.

Southern China accounts for roughly 20% of market activity, with Guangzhou and surrounding areas experiencing rapid growth in manufacturing-related data centers and logistics infrastructure. The region’s focus on industrial digitalization and supply chain optimization creates substantial demand for storage solutions supporting manufacturing and distribution operations.

Western China represents an emerging market opportunity, comprising approximately 10% of current market share but showing strong growth potential driven by government initiatives to develop digital infrastructure in less developed regions. Cities such as Chengdu and Xi’an are becoming important data center locations, supported by favorable policies and lower operational costs.

Market leadership is characterized by intense competition between established international vendors and rapidly growing domestic players, each offering distinct advantages in terms of technology capabilities, local market knowledge, and service delivery capabilities.

Competitive strategies increasingly focus on developing localized solutions, establishing strategic partnerships, and providing comprehensive service offerings that address specific requirements of Chinese enterprises and regulatory compliance needs.

By Technology:

By Application:

By End-User:

All-Flash Storage Arrays demonstrate the strongest growth trajectory, driven by declining SSD costs and increasing performance requirements for mission-critical applications. Organizations are migrating from traditional disk-based systems to all-flash architectures to achieve sub-millisecond latency and support demanding workloads such as real-time analytics and high-frequency trading applications.

Software-Defined Storage platforms are gaining significant traction as organizations seek greater flexibility and vendor independence in their storage infrastructure. These solutions enable organizations to abstract storage resources from underlying hardware and implement policy-based management across heterogeneous storage environments.

Hyper-Converged Infrastructure solutions are experiencing rapid adoption among enterprises seeking to simplify their data center operations and reduce management complexity. These integrated platforms combine compute, storage, and networking resources into unified systems that can be managed through single interfaces.

Object Storage systems are becoming increasingly important for organizations managing unstructured data and implementing cloud-native applications. These solutions provide scalable, cost-effective storage for applications such as content distribution, backup and archiving, and big data analytics.

Technology Vendors benefit from substantial market opportunities driven by China’s digital transformation initiatives and infrastructure investment programs. The large and rapidly growing market provides opportunities for both established vendors and emerging players to develop innovative solutions and capture significant market share through strategic positioning and localized offerings.

End-User Organizations gain access to advanced storage technologies that enable improved operational efficiency, enhanced data protection, and support for emerging applications such as artificial intelligence and IoT. The competitive market environment drives innovation and provides organizations with diverse technology choices and competitive pricing options.

System Integrators benefit from increasing demand for complex storage deployments and professional services as organizations implement sophisticated storage architectures. The growing complexity of storage environments creates opportunities for specialized service providers to deliver value-added services and ongoing support.

Government Entities achieve strategic objectives related to digital economy development and technological self-reliance through the growth of domestic storage capabilities and the establishment of robust digital infrastructure supporting various government initiatives and public services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming storage requirements as organizations deploy AI and machine learning applications that require specialized storage architectures. The trend toward AI-driven storage management is enabling automated optimization, predictive maintenance, and intelligent data placement that improves overall system performance and efficiency.

Edge Computing Expansion is creating new requirements for distributed storage solutions that can operate effectively in challenging environments while maintaining connectivity with centralized data centers. The deployment of 5G networks and IoT applications is driving demand for storage systems optimized for edge deployment scenarios.

Sustainability Focus is becoming increasingly important as organizations seek to reduce their environmental impact and achieve carbon neutrality goals. This trend is driving adoption of energy-efficient storage technologies and green data center practices that minimize power consumption and cooling requirements.

As-a-Service Models are gaining popularity as organizations seek to reduce capital expenditure and improve operational flexibility. Storage-as-a-Service and consumption-based pricing models are enabling organizations to align storage costs with actual usage while reducing management complexity.

Technology Partnerships between international vendors and domestic companies are accelerating innovation and market development. These collaborations enable knowledge transfer, joint product development, and the creation of solutions specifically tailored to Chinese market requirements and regulatory compliance needs.

Manufacturing Localization initiatives are reducing dependence on international supply chains while improving cost competitiveness and delivery times. Major storage vendors are establishing local manufacturing facilities and research and development centers to better serve the Chinese market and support government objectives for technological self-reliance.

Standards Development activities are progressing to establish common technical standards and interoperability requirements for storage systems deployed in Chinese data centers. These efforts aim to improve system integration, reduce vendor lock-in, and enhance overall market efficiency.

Investment Acceleration in storage infrastructure is being driven by major cloud service providers and enterprises implementing digital transformation initiatives. MarkWide Research analysis indicates that investment levels are reaching new highs as organizations prioritize storage modernization and capacity expansion to support growing data requirements.

Technology vendors should focus on developing localized solutions that address specific Chinese market requirements while building strong partnerships with domestic system integrators and service providers. Investment in local R&D capabilities and manufacturing facilities will be essential for long-term success in the competitive Chinese market environment.

End-user organizations should develop comprehensive storage strategies that balance performance requirements, cost considerations, and regulatory compliance needs. Organizations should prioritize vendor diversification and technology standardization to reduce risks and improve operational flexibility while ensuring compliance with evolving regulatory requirements.

System integrators should invest in developing specialized expertise in emerging storage technologies and industry-specific solutions to differentiate their service offerings. Building capabilities in AI-driven storage management, edge computing deployments, and hybrid cloud integration will be critical for capturing growth opportunities.

Government policymakers should continue supporting digital infrastructure development while promoting technology innovation and domestic capability building. Policies that encourage international collaboration, standards development, and talent development will be essential for maintaining market growth momentum and achieving strategic technology objectives.

Market growth is expected to continue at a robust pace, driven by ongoing digital transformation initiatives, 5G network deployment, and the increasing adoption of emerging technologies such as artificial intelligence and edge computing. MarkWide Research projects sustained growth momentum with the market expanding at a CAGR of 12.5% over the forecast period.

Technology evolution will continue to reshape the storage landscape, with emerging technologies such as computational storage, persistent memory, and quantum storage beginning to influence market dynamics. These innovations will create new opportunities for vendors while addressing evolving customer requirements for performance, efficiency, and scalability.

Market consolidation may occur as smaller vendors struggle to compete with larger players offering comprehensive solutions and global support capabilities. However, opportunities will remain for specialized vendors focusing on niche applications or innovative technologies that address specific market needs.

Regulatory development will continue to influence market dynamics as government policies evolve to address data sovereignty, cybersecurity, and technology self-reliance objectives. Organizations will need to adapt their storage strategies to comply with changing regulatory requirements while maintaining operational efficiency and competitive advantage.

The China data center storage market represents a dynamic and rapidly evolving ecosystem driven by the nation’s commitment to digital transformation and technological innovation. Strong government support, substantial infrastructure investment, and the increasing adoption of emerging technologies create a favorable environment for sustained market growth and development.

Market opportunities are substantial for vendors, system integrators, and service providers who can develop solutions that address the unique requirements of Chinese organizations while complying with evolving regulatory frameworks. The shift toward AI-driven applications, edge computing deployments, and sustainable data center operations creates new demand for innovative storage solutions and specialized services.

Success factors in this market include the ability to provide localized solutions, establish strong partnerships with domestic organizations, and maintain competitive pricing while delivering superior performance and reliability. Organizations that can effectively balance these requirements while adapting to changing market conditions will be well-positioned to capture significant growth opportunities in China’s expanding data center storage market.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store, manage, and retrieve data in data centers. This includes various storage solutions such as hard drives, solid-state drives, and cloud storage services that support enterprise applications and data management needs.

What are the key players in the China Data Center Storage Market?

Key players in the China Data Center Storage Market include Huawei Technologies, Alibaba Cloud, Inspur, and Lenovo. These companies are known for their innovative storage solutions and significant contributions to the data center infrastructure in China, among others.

What are the main drivers of growth in the China Data Center Storage Market?

The main drivers of growth in the China Data Center Storage Market include the increasing demand for cloud computing services, the rise of big data analytics, and the expansion of e-commerce platforms. These factors are pushing organizations to invest in robust storage solutions to handle vast amounts of data.

What challenges does the China Data Center Storage Market face?

The China Data Center Storage Market faces challenges such as data security concerns, high operational costs, and the complexity of managing hybrid storage environments. These issues can hinder the adoption of advanced storage technologies among businesses.

What opportunities exist in the China Data Center Storage Market?

Opportunities in the China Data Center Storage Market include the growing adoption of artificial intelligence and machine learning, which require advanced storage capabilities. Additionally, the shift towards edge computing presents new avenues for innovative storage solutions.

What trends are shaping the China Data Center Storage Market?

Trends shaping the China Data Center Storage Market include the increasing use of software-defined storage, the rise of flash storage technologies, and the integration of AI for data management. These trends are enhancing efficiency and performance in data storage solutions.

China Data Center Storage Market

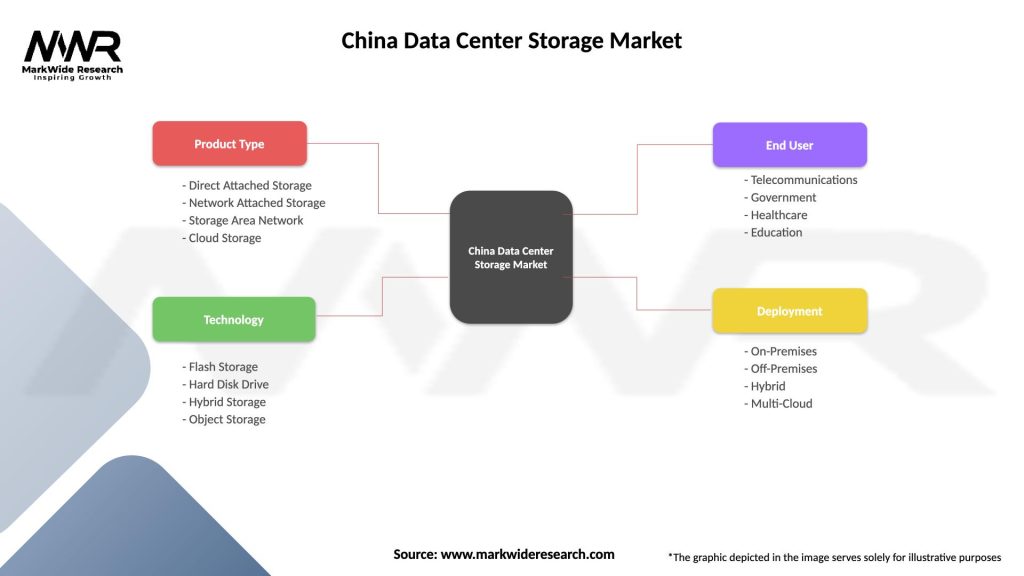

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Data Center Storage Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at