444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China dairy market represents one of the most dynamic and rapidly evolving sectors within the global dairy industry, characterized by substantial growth potential and increasing consumer sophistication. Market dynamics indicate a transformative period driven by rising disposable incomes, urbanization trends, and evolving dietary preferences among Chinese consumers. The market encompasses a comprehensive range of dairy products including liquid milk, yogurt, cheese, butter, and specialized nutritional products designed for various demographic segments.

Consumer behavior patterns reveal a significant shift toward premium and organic dairy products, with health-conscious consumers increasingly seeking products with enhanced nutritional profiles. The market demonstrates remarkable resilience and adaptability, with domestic producers and international brands competing intensively to capture market share across diverse product categories. Growth trajectories suggest sustained expansion at approximately 6.2% CAGR over the forecast period, driven by demographic transitions and lifestyle changes.

Regional distribution shows concentrated demand in tier-one and tier-two cities, while emerging opportunities exist in lower-tier markets as infrastructure development and cold chain logistics continue expanding. The market’s evolution reflects broader economic development patterns, with increasing emphasis on food safety, quality assurance, and brand reputation influencing consumer purchasing decisions.

The China dairy market refers to the comprehensive ecosystem encompassing production, processing, distribution, and consumption of dairy products within mainland China, including traditional dairy items and innovative nutritional solutions tailored to local preferences and dietary requirements.

Market scope includes various product categories such as fresh milk, ultra-high temperature processed milk, fermented dairy products, powdered milk formulations, and specialty dairy ingredients used in food manufacturing. The market operates through multiple distribution channels including modern retail formats, traditional wet markets, e-commerce platforms, and direct-to-consumer delivery services.

Industry participants range from large-scale industrial dairy processors and international multinational corporations to regional producers and specialized organic dairy farms. The market’s definition encompasses both domestic production capabilities and imported dairy products, reflecting China’s position as both a significant producer and major importer of dairy products globally.

Strategic analysis reveals the China dairy market as a high-growth sector experiencing fundamental transformation driven by demographic shifts, income growth, and changing consumption patterns. Key market indicators demonstrate robust expansion across multiple product segments, with particular strength in premium and functional dairy categories.

Consumer trends highlight increasing demand for organic and natural dairy products, with approximately 38% of urban consumers expressing willingness to pay premium prices for certified organic dairy items. The market benefits from strong government support for domestic dairy industry development, including investments in modern farming techniques, quality control systems, and supply chain infrastructure.

Competitive landscape features intense rivalry between domestic leaders and international brands, with market consolidation trends evident as larger players acquire regional producers to expand geographic coverage and product portfolios. Innovation focus centers on product differentiation through functional ingredients, packaging innovations, and targeted nutritional solutions for specific consumer segments including children, elderly populations, and health-conscious adults.

Market intelligence indicates several critical insights shaping the China dairy market’s trajectory and competitive dynamics:

Primary growth drivers propelling the China dairy market include demographic transitions, economic development, and evolving consumer preferences that collectively create favorable conditions for sustained market expansion.

Income growth represents a fundamental driver as rising disposable incomes enable consumers to purchase higher-quality dairy products and explore premium product categories. The expanding middle class demonstrates increased willingness to invest in nutritional products that support health and wellness objectives, particularly for family members including children and elderly relatives.

Urbanization trends significantly impact dairy consumption patterns, with urban consumers adopting Western dietary habits that include regular dairy consumption. Lifestyle changes associated with urban living, including busier schedules and convenience-focused purchasing behaviors, drive demand for packaged dairy products and ready-to-consume formats.

Health awareness continues expanding as consumers become more educated about dairy’s nutritional benefits, including protein content, calcium levels, and probiotic advantages. Government health initiatives promoting balanced nutrition and dietary diversity support increased dairy consumption across population segments.

Infrastructure development enables market growth through improved cold chain logistics, modern retail formats, and enhanced distribution networks that make dairy products more accessible to consumers in previously underserved markets.

Market challenges present obstacles to growth and require strategic responses from industry participants to maintain expansion momentum and competitive positioning.

Lactose intolerance affects a significant portion of the Chinese population, limiting traditional dairy product consumption and requiring development of lactose-free alternatives or specialized processing techniques. This biological constraint necessitates product innovation and consumer education initiatives to address dietary limitations.

Food safety concerns periodically impact consumer confidence, particularly following high-profile quality incidents that create lasting skepticism about dairy product safety and quality standards. Regulatory compliance requirements impose additional costs on producers while creating barriers to entry for smaller market participants.

Price sensitivity among certain consumer segments limits market penetration for premium products, particularly in lower-tier cities and rural areas where income levels remain constrained. Competition from alternatives including plant-based milk products and traditional soy-based beverages creates market share pressure.

Supply chain complexities related to maintaining product quality and safety throughout distribution networks require significant investments in infrastructure and technology systems. Import dependencies expose the market to international price volatility and trade policy changes that can impact product availability and pricing.

Growth opportunities within the China dairy market span multiple dimensions, offering potential for both domestic and international companies to expand their market presence and develop innovative product offerings.

Rural market penetration represents substantial untapped potential as infrastructure improvements and income growth in lower-tier cities and rural areas create new consumer bases for dairy products. Distribution expansion into these markets requires tailored approaches considering local preferences, purchasing power, and logistical challenges.

Product innovation opportunities include developing functional dairy products with enhanced nutritional profiles, probiotic formulations, and specialized products for specific demographic groups such as seniors, athletes, and children. Organic and natural product segments show particular promise as health-conscious consumers seek premium alternatives.

E-commerce growth creates opportunities for direct-to-consumer sales, subscription models, and specialized product offerings that may not be viable through traditional retail channels. Cross-border e-commerce enables international brands to access Chinese consumers without establishing extensive physical distribution networks.

Partnership opportunities exist for technology transfer, joint ventures, and strategic alliances that combine international expertise with local market knowledge and distribution capabilities. Sustainability initiatives offer differentiation opportunities as environmentally conscious consumers increasingly consider environmental impact in purchasing decisions.

Market forces shaping the China dairy industry create a complex environment characterized by rapid change, intense competition, and evolving consumer expectations that require adaptive strategies from market participants.

Supply-demand dynamics reflect growing consumption outpacing domestic production capacity, creating opportunities for both increased domestic production and continued import growth. Seasonal variations in production and consumption patterns influence pricing strategies and inventory management approaches throughout the industry.

Competitive intensity drives continuous innovation, marketing investments, and strategic positioning efforts as companies compete for market share across various product categories and geographic regions. Brand loyalty patterns show increasing importance of reputation, quality consistency, and consumer trust in purchase decisions.

Regulatory dynamics continue evolving as government authorities strengthen food safety standards, environmental regulations, and industry consolidation policies. Technology adoption accelerates across the value chain, from farm-level automation to consumer-facing digital platforms that enhance product traceability and consumer engagement.

Economic factors including currency fluctuations, trade policies, and macroeconomic conditions influence import costs, domestic pricing strategies, and overall market accessibility for different consumer segments.

Comprehensive research approach employed multiple methodologies to ensure accurate and reliable market analysis, combining quantitative data collection with qualitative insights from industry stakeholders and market participants.

Primary research included structured interviews with dairy industry executives, distributors, retailers, and consumers across major Chinese cities to gather firsthand insights about market trends, challenges, and opportunities. Survey methodologies captured consumer preferences, purchasing behaviors, and brand perceptions through statistically representative sampling approaches.

Secondary research analyzed government statistics, industry reports, trade publications, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensured consistency across multiple information sources and research methodologies.

Market modeling employed statistical analysis techniques to project future market trends, growth rates, and segment performance based on historical data patterns and identified market drivers. Expert consultation with industry specialists provided additional validation and context for research findings and market projections.

Quality assurance protocols included peer review processes, data verification procedures, and continuous monitoring of market developments to ensure research accuracy and relevance throughout the analysis period.

Geographic distribution of the China dairy market reveals significant variations in consumption patterns, market maturity, and growth potential across different regions and city tiers.

Eastern China dominates market consumption with approximately 45% market share, driven by high population density, elevated income levels, and well-developed retail infrastructure in major cities including Shanghai, Beijing, and Guangzhou. Consumer sophistication in these markets supports premium product categories and international brand acceptance.

Northern regions demonstrate strong dairy consumption traditions and account for roughly 28% of total market demand, with particular strength in liquid milk and traditional dairy products. Production capabilities in these areas support both local consumption and distribution to other regions.

Southern China represents emerging growth opportunities with increasing urbanization and rising incomes driving market expansion. Cultural preferences in these regions traditionally favored non-dairy beverages, but changing dietary habits create substantial growth potential.

Western regions show the highest growth rates despite smaller absolute market sizes, with infrastructure development and income growth supporting increased dairy product accessibility and consumption. Rural-urban migration patterns influence consumption trends as populations adopt urban dietary preferences.

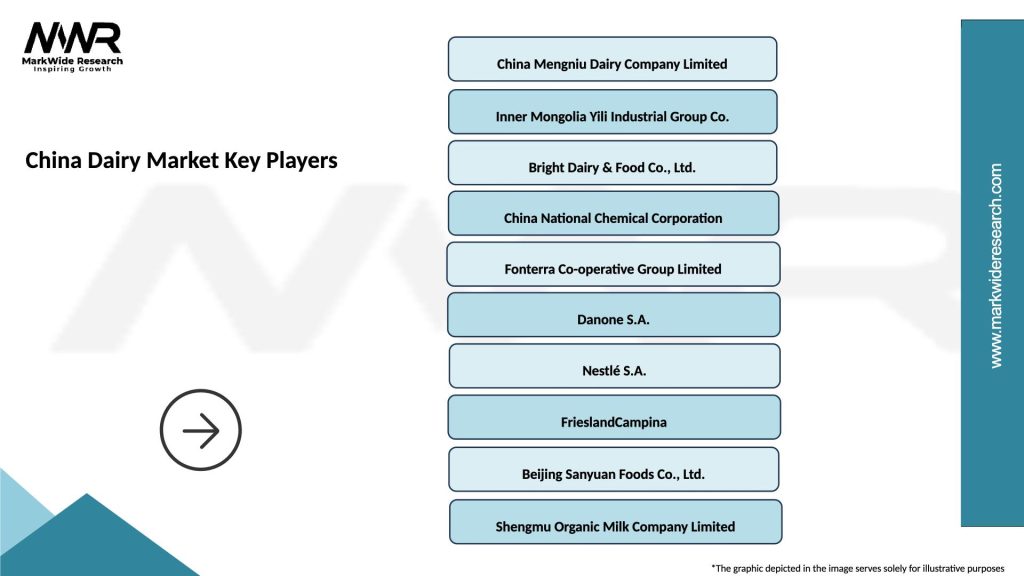

Market competition features a diverse mix of domestic industry leaders, international multinational corporations, and specialized regional producers competing across various product segments and distribution channels.

Leading market participants include:

Competitive strategies emphasize brand building, product innovation, distribution expansion, and strategic partnerships to capture market share and defend competitive positions. Market consolidation trends continue as larger players acquire regional brands and specialized producers to enhance market coverage and product capabilities.

Market segmentation analysis reveals distinct product categories, consumer demographics, and distribution channels that define competitive dynamics and growth opportunities within the China dairy market.

By Product Type:

By Distribution Channel:

Product category analysis reveals distinct growth patterns, consumer preferences, and competitive dynamics across different dairy product segments within the Chinese market.

Liquid Milk Category maintains market leadership with steady growth driven by increased per-capita consumption and premiumization trends. UHT milk products dominate due to extended shelf life and distribution advantages, while fresh milk gains traction in urban markets with improved cold chain infrastructure.

Yogurt Segment demonstrates exceptional growth potential with approximately 12% annual growth rate, driven by health consciousness and probiotic awareness among consumers. Greek yogurt and specialty formulations capture premium market segments, while traditional yogurt maintains broad market appeal.

Cheese Market shows rapid expansion from a small base as Western dietary influences increase cheese consumption, particularly among younger urban consumers. Processed cheese leads adoption due to familiar flavors and convenient packaging formats.

Infant Formula represents a high-value segment with strict quality requirements and strong brand loyalty patterns. Premium positioning dominates this category as parents prioritize nutritional quality and safety for infant nutrition.

Functional Dairy Products emerge as growth drivers with enhanced nutritional profiles, including protein-enriched, vitamin-fortified, and probiotic formulations targeting health-conscious consumers across age groups.

Market participation in the China dairy sector offers substantial benefits for various stakeholders including producers, distributors, retailers, and investors seeking growth opportunities in the world’s most populous consumer market.

Revenue Growth Potential provides companies with access to a large and expanding consumer base with increasing purchasing power and evolving dietary preferences that favor dairy consumption. Market size and growth trajectory offer scalability opportunities for both domestic and international market participants.

Product Innovation Opportunities allow companies to develop specialized products tailored to Chinese consumer preferences, dietary requirements, and cultural considerations. Functional product development enables differentiation through nutritional enhancement and health-focused positioning strategies.

Distribution Network Benefits include access to diverse retail channels, e-commerce platforms, and direct-to-consumer opportunities that maximize market reach and consumer accessibility. Partnership opportunities with local distributors and retailers facilitate market entry and expansion strategies.

Brand Building Advantages enable companies to establish strong market positions through quality reputation, consumer trust, and loyalty development in a market where brand recognition significantly influences purchasing decisions.

Supply Chain Integration opportunities allow vertical integration strategies that enhance quality control, cost management, and market responsiveness while building competitive advantages through operational efficiency.

Strategic assessment of the China dairy market reveals key strengths, weaknesses, opportunities, and threats that influence market dynamics and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the China dairy market reflect evolving consumer preferences, technological advances, and industry innovations that define future market direction and competitive strategies.

Health and Wellness Focus drives increasing demand for functional dairy products with enhanced nutritional profiles, including probiotic yogurts, protein-enriched milk, and vitamin-fortified formulations. Consumer education about dairy’s health benefits supports market expansion across age demographics.

Premium Product Adoption accelerates as middle-class consumers prioritize quality over price, seeking organic, natural, and artisanal dairy products that offer superior taste and nutritional value. Brand premiumization strategies capitalize on this trend through positioning and marketing initiatives.

Digital Commerce Integration transforms distribution strategies with approximately 25% of dairy purchases now occurring through online channels, including subscription services, direct-to-consumer delivery, and social commerce platforms. Omnichannel approaches become essential for market success.

Sustainability Consciousness influences consumer choices as environmental awareness grows, creating demand for eco-friendly packaging, sustainable farming practices, and carbon-neutral production methods. Corporate responsibility initiatives become competitive differentiators.

Personalization Trends drive demand for customized nutrition solutions, age-specific formulations, and dietary requirement accommodations that address individual consumer needs and preferences.

Recent industry developments demonstrate the dynamic nature of the China dairy market and highlight strategic initiatives by major market participants to strengthen competitive positions and capture growth opportunities.

Capacity Expansion Projects by leading domestic producers include new manufacturing facilities, upgraded processing equipment, and expanded distribution networks to meet growing demand and improve market coverage. Technology investments focus on automation, quality control systems, and traceability solutions.

Strategic Acquisitions and partnerships reshape the competitive landscape as companies seek to expand product portfolios, access new markets, and leverage complementary capabilities. International collaborations bring advanced technologies and expertise to the Chinese market.

Product Launch Activities intensify across all major players, with emphasis on innovative formulations, premium positioning, and targeted demographic segments. Functional products receive particular attention as companies develop specialized nutritional solutions.

Regulatory Compliance Initiatives drive industry-wide investments in quality assurance systems, testing capabilities, and certification processes to meet evolving food safety standards. Transparency measures include enhanced labeling and traceability systems.

Sustainability Programs gain prominence as companies implement environmental initiatives, sustainable packaging solutions, and responsible sourcing practices to address growing consumer environmental consciousness.

Strategic recommendations for market participants focus on leveraging growth opportunities while addressing market challenges through targeted approaches and innovative solutions.

Market Entry Strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution channel dynamics. Partnership approaches with established local players can accelerate market penetration and reduce entry barriers for international companies.

Product Development Focus should emphasize functional benefits, premium positioning, and cultural adaptation to Chinese taste preferences and dietary habits. Innovation investments in probiotic formulations, organic products, and specialized nutrition solutions offer competitive advantages.

Distribution Strategy recommendations include omnichannel approaches that integrate traditional retail, modern trade, and digital commerce platforms. E-commerce capabilities become essential for reaching younger consumers and accessing emerging market segments.

Brand Building Initiatives should emphasize quality, safety, and nutritional benefits while building consumer trust through transparency and consistent product performance. Marketing strategies must address cultural nuances and regional preferences.

Supply Chain Optimization requires investments in cold chain infrastructure, quality control systems, and traceability technologies to ensure product integrity and regulatory compliance throughout the distribution network.

Market projections indicate continued robust growth for the China dairy market, with MarkWide Research analysis suggesting sustained expansion driven by demographic trends, income growth, and evolving consumer preferences over the forecast period.

Growth trajectory expectations point to accelerating demand across multiple product categories, with premium and functional dairy products showing particularly strong potential. Market maturation in tier-one cities creates opportunities for geographic expansion into emerging markets with developing infrastructure and rising incomes.

Technology integration will increasingly influence market dynamics through improved production efficiency, enhanced product quality, and innovative consumer engagement strategies. Digital transformation affects all aspects of the value chain from farm management to consumer delivery systems.

Regulatory evolution continues shaping industry standards with strengthened food safety requirements, environmental regulations, and quality certification processes that favor well-capitalized and technologically advanced market participants.

Consumer sophistication drives demand for transparency, sustainability, and personalized nutrition solutions that require ongoing innovation and adaptation by market participants. Health consciousness trends support long-term market growth as dairy products align with wellness-focused lifestyle choices.

International integration deepens as trade relationships evolve and global supply chains become more sophisticated, creating opportunities for both imports and exports while increasing competitive intensity across all market segments.

Market assessment reveals the China dairy market as a dynamic and rapidly evolving sector offering substantial growth opportunities for both domestic and international participants. Fundamental drivers including urbanization, income growth, and health consciousness create favorable conditions for sustained market expansion across diverse product categories and consumer segments.

Strategic success in this market requires understanding of local consumer preferences, regulatory compliance, and distribution channel dynamics while maintaining focus on product quality, innovation, and brand building initiatives. Competitive advantages emerge through differentiation strategies that emphasize premium positioning, functional benefits, and consumer trust development.

Future prospects remain positive with continued growth expected across all major market segments, particularly in premium and functional dairy categories that align with evolving consumer preferences for health and wellness products. Market participants who successfully navigate regulatory requirements, build strong distribution networks, and develop innovative products tailored to Chinese consumer needs will be well-positioned to capture the substantial opportunities available in this expanding market.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. It includes a variety of items such as milk, cheese, yogurt, and butter, which are essential in many diets worldwide, including in China.

What are the key companies in the China Dairy Market?

Key companies in the China Dairy Market include Mengniu Dairy, Yili Group, and Bright Dairy. These companies are significant players in the production and distribution of dairy products across the country, among others.

What are the growth factors driving the China Dairy Market?

The China Dairy Market is driven by increasing consumer demand for nutritious food, rising health awareness, and the growing popularity of dairy-based products. Additionally, urbanization and changing lifestyles contribute to the market’s expansion.

What challenges does the China Dairy Market face?

The China Dairy Market faces challenges such as fluctuating raw milk prices, stringent food safety regulations, and competition from plant-based alternatives. These factors can impact profitability and market stability.

What opportunities exist in the China Dairy Market?

Opportunities in the China Dairy Market include the rising demand for premium dairy products, innovations in dairy processing technology, and the expansion of e-commerce platforms for dairy distribution. These trends can enhance market growth.

What trends are shaping the China Dairy Market?

Trends in the China Dairy Market include a shift towards organic and health-focused dairy products, increased investment in sustainable practices, and the introduction of new flavors and product lines. These trends reflect changing consumer preferences.

China Dairy Market

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| End User | Households, Restaurants, Cafes, Food Manufacturers |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Dairy Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at