444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China cosmetics products market represents one of the most dynamic and rapidly evolving beauty landscapes globally, characterized by unprecedented growth momentum and consumer sophistication. Market dynamics indicate robust expansion driven by rising disposable incomes, urbanization trends, and evolving beauty standards among Chinese consumers. The market encompasses a comprehensive range of products including skincare, makeup, fragrances, and personal care items, with skincare products commanding the largest market share at approximately 52% of total market volume.

Consumer behavior in China’s cosmetics sector reflects a unique blend of traditional beauty concepts and modern international influences. The market demonstrates strong growth potential with an estimated compound annual growth rate (CAGR) of 8.5% projected through the forecast period. Digital transformation has fundamentally reshaped purchasing patterns, with e-commerce platforms accounting for nearly 45% of total cosmetics sales in the region.

Premium and luxury segments continue to gain traction among affluent Chinese consumers, while mass-market products maintain strong penetration in tier-two and tier-three cities. The market’s evolution reflects broader socioeconomic trends, including the rise of the middle class, increased beauty consciousness, and growing influence of social media on consumer preferences.

The China cosmetics products market refers to the comprehensive ecosystem of beauty and personal care products manufactured, distributed, and consumed within the Chinese market, encompassing both domestic and international brands across multiple product categories and price segments. This market includes skincare formulations, color cosmetics, fragrances, hair care products, and specialized beauty treatments designed to meet the diverse needs and preferences of Chinese consumers.

Market scope extends beyond traditional product boundaries to include emerging categories such as men’s grooming products, organic and natural formulations, and technologically advanced beauty solutions. The definition encompasses both offline retail channels including department stores, specialty beauty retailers, and pharmacies, as well as rapidly expanding online platforms and direct-to-consumer channels.

Cultural significance plays a crucial role in market definition, as Chinese beauty standards and preferences influence product development, marketing strategies, and brand positioning. The market reflects the intersection of traditional Chinese beauty concepts with modern global trends, creating unique opportunities for both local and international cosmetics companies.

Strategic analysis reveals that China’s cosmetics products market stands as a cornerstone of the global beauty industry, driven by exceptional consumer demand and innovative market dynamics. The market demonstrates remarkable resilience and growth potential, supported by favorable demographic trends, increasing beauty awareness, and expanding distribution networks across urban and rural regions.

Key growth drivers include the rising influence of social media beauty influencers, increasing participation of male consumers in beauty routines, and growing demand for premium and personalized beauty solutions. E-commerce penetration has reached unprecedented levels, with online sales growing at approximately 12% annually, significantly outpacing traditional retail channels.

Market segmentation reveals distinct consumer preferences across different age groups, income levels, and geographic regions. Millennials and Generation Z consumers represent the most dynamic segments, driving demand for innovative products, sustainable packaging, and authentic brand experiences. International brands continue to maintain strong market positions while domestic Chinese brands are gaining significant market share through localized product development and competitive pricing strategies.

Future prospects indicate sustained growth momentum supported by continued urbanization, rising disposable incomes, and evolving consumer sophistication. The market is expected to benefit from technological innovations, regulatory improvements, and expanding retail infrastructure across China’s diverse geographic landscape.

Consumer demographics reveal fascinating insights into China’s cosmetics market evolution, with several key trends shaping purchasing behaviors and brand preferences:

Purchasing channels demonstrate clear preferences for omnichannel experiences, combining online research with offline product testing and purchase completion. Mobile commerce has emerged as the dominant platform for beauty product transactions, particularly among younger demographics.

Economic prosperity serves as the fundamental driver propelling China’s cosmetics market expansion, with rising disposable incomes enabling increased spending on beauty and personal care products. Urbanization trends continue to create new consumer bases in developing cities, expanding market reach and creating opportunities for both premium and mass-market brands.

Social media influence has revolutionized beauty product marketing and consumer engagement, with platforms like WeChat, Weibo, and Xiaohongshu driving product awareness and purchase decisions. Beauty influencers and key opinion leaders (KOLs) command significant influence over consumer preferences, creating viral trends and driving rapid product adoption.

Changing lifestyle patterns reflect increased focus on personal appearance and self-care routines, particularly among urban professionals and younger consumers. Western beauty standards integration with traditional Chinese aesthetics has created unique market opportunities for products that bridge cultural preferences.

Technological advancement in product formulations, packaging innovations, and digital retail experiences continues to attract tech-savvy Chinese consumers. E-commerce infrastructure development has eliminated geographic barriers, enabling brands to reach consumers across China’s vast territory through sophisticated logistics networks.

Government support for the beauty and personal care industry through favorable policies and regulatory frameworks has encouraged both domestic and international investment in market development.

Regulatory complexity presents significant challenges for cosmetics companies operating in China, with stringent product registration requirements, testing protocols, and compliance standards creating barriers to market entry. Import restrictions and changing regulatory landscapes require substantial investment in regulatory expertise and local partnerships.

Intense competition among both domestic and international brands has led to price pressures and increased marketing costs, particularly in saturated product categories. Market saturation in tier-one cities has intensified competition for consumer attention and market share.

Consumer skepticism regarding product quality and authenticity, particularly for online purchases, has created challenges for brand trust building and customer retention. Counterfeit products continue to pose threats to legitimate brands and consumer confidence.

Economic uncertainties and fluctuating consumer confidence can impact discretionary spending on beauty products, particularly in premium segments. Supply chain disruptions and raw material cost fluctuations affect product pricing and availability.

Cultural sensitivity requirements demand careful navigation of local preferences and values, creating additional complexity for international brands seeking to establish market presence.

Emerging market segments present exceptional growth opportunities, particularly in men’s grooming products, anti-aging solutions, and natural/organic formulations. Rural market penetration offers substantial expansion potential as infrastructure development and income growth reach previously underserved regions.

Digital innovation creates opportunities for personalized beauty solutions, virtual try-on technologies, and AI-powered product recommendations. Live streaming commerce has emerged as a powerful sales channel, enabling real-time product demonstrations and consumer engagement.

Sustainable beauty trends align with growing environmental consciousness among Chinese consumers, creating demand for eco-friendly packaging, clean ingredients, and ethical sourcing practices. Customization services appeal to consumers seeking personalized beauty solutions tailored to individual skin types and preferences.

Cross-border e-commerce platforms facilitate international brand entry while enabling Chinese brands to expand globally. Partnership opportunities with local retailers, beauty salons, and wellness centers provide alternative distribution channels and market access.

Innovation in product categories such as K-beauty inspired products, multi-functional formulations, and technology-enhanced beauty devices continues to drive market expansion and consumer interest.

Supply and demand equilibrium in China’s cosmetics market reflects complex interactions between consumer preferences, brand strategies, and market competition. Demand patterns show seasonal fluctuations aligned with cultural events, weather changes, and promotional periods, requiring sophisticated inventory management and marketing strategies.

Price sensitivity varies significantly across consumer segments and product categories, with premium brands commanding loyalty among affluent consumers while mass-market products compete primarily on value propositions. Brand positioning strategies must carefully balance quality perceptions with accessibility to capture diverse market segments.

Distribution channel evolution continues to reshape market dynamics, with traditional retail facing pressure from e-commerce growth while omnichannel strategies become essential for market success. Logistics capabilities increasingly determine competitive advantage, particularly for online sales and rapid delivery expectations.

Innovation cycles have accelerated, with brands required to continuously introduce new products and formulations to maintain consumer interest and market relevance. Marketing effectiveness depends heavily on digital platforms and influencer partnerships, requiring sophisticated social media strategies.

Competitive intensity drives continuous improvement in product quality, customer service, and brand experiences, ultimately benefiting consumers through enhanced value propositions and innovation.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into China’s cosmetics products market. Primary research includes extensive consumer surveys, industry expert interviews, and retailer consultations across major Chinese cities and regions.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to provide comprehensive market understanding. Data triangulation methods ensure accuracy and reliability of market insights through cross-verification of multiple information sources.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Qualitative research explores consumer motivations, brand perceptions, and cultural factors influencing purchasing decisions.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific needs. Competitive analysis examines brand strategies, market positioning, and performance metrics across major market participants.

Technology integration in research methodology includes social media sentiment analysis, e-commerce data mining, and digital behavior tracking to capture evolving consumer preferences and market trends.

Geographic distribution of China’s cosmetics market reveals distinct regional characteristics and growth patterns across the country’s diverse economic landscape. Eastern coastal regions including Shanghai, Beijing, and Guangzhou maintain market leadership with approximately 48% of total market consumption, driven by higher disposable incomes and international brand presence.

Tier-one cities demonstrate mature market characteristics with sophisticated consumer preferences, premium brand dominance, and advanced retail infrastructure. Consumer behavior in these markets reflects global beauty trends and willingness to invest in high-quality products and services.

Tier-two cities represent the fastest-growing market segment, with expanding middle-class populations driving increased cosmetics consumption. Market penetration in these regions shows significant potential, with growth rates exceeding 11% annually as infrastructure development and income growth accelerate.

Western and central regions present emerging opportunities as economic development programs and urbanization initiatives create new consumer bases. Rural markets show increasing sophistication and purchasing power, though distribution challenges remain significant.

Regional preferences vary considerably, with northern consumers favoring moisturizing and protective products while southern regions show preference for oil-control and brightening formulations. Cultural influences continue to shape regional market dynamics and product preferences.

Market competition in China’s cosmetics sector features intense rivalry among international luxury brands, mass-market multinational companies, and rapidly growing domestic brands. Competitive positioning strategies vary significantly across different market segments and consumer demographics.

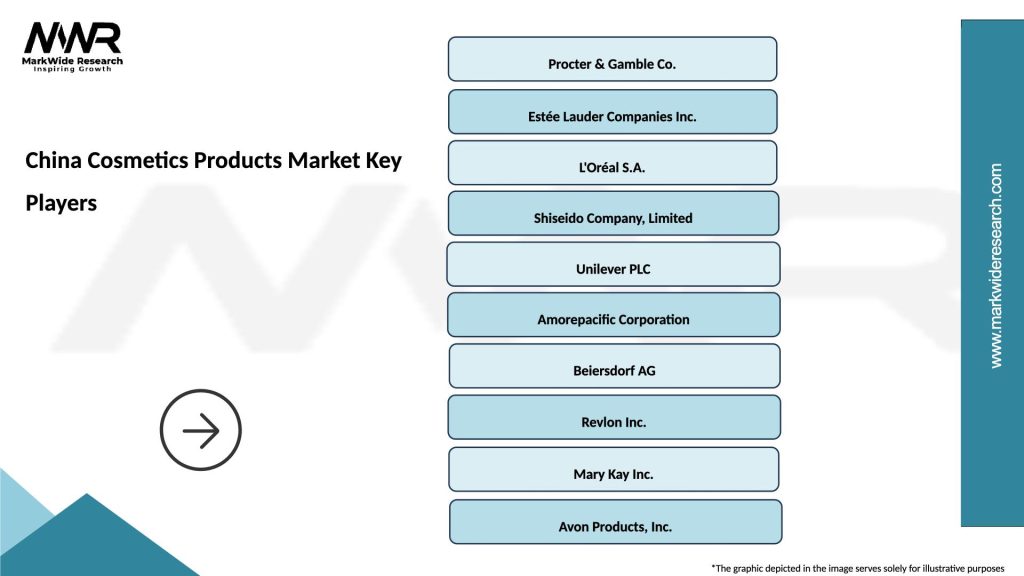

Leading market participants include:

Competitive strategies focus on digital marketing excellence, influencer partnerships, product localization, and omnichannel retail presence. Innovation capabilities and speed-to-market have become critical success factors in the rapidly evolving Chinese market.

Market consolidation trends indicate increasing importance of scale advantages and distribution capabilities, while niche brands find success through specialized positioning and targeted consumer segments.

Product category segmentation reveals distinct market dynamics and growth patterns across different cosmetics segments:

By Product Type:

By Price Segment:

By Distribution Channel:

Skincare category dominates China’s cosmetics market with comprehensive product ranges addressing diverse skin concerns and consumer needs. Anti-aging products show exceptional growth as aging population demographics drive demand for preventive and corrective solutions. Moisturizing products maintain consistent demand across all seasons and regions, while sun protection products gain importance with increasing health consciousness.

Color cosmetics segment demonstrates strong growth momentum driven by social media influence and younger consumer adoption. Lip products lead category growth with innovative formulations and trendy color options. Foundation products show increasing sophistication with shade range expansion and formula improvements tailored to Asian skin tones.

Hair care products reflect evolving consumer preferences toward premium formulations and specialized treatments. Shampoo and conditioner products maintain stable market positions while hair styling products gain popularity among younger consumers. Hair treatment products show growth potential with increasing hair health awareness.

Men’s grooming represents the most dynamic category with rapid expansion across multiple product types. Facial cleansers and moisturizers lead male adoption rates while beard care products emerge as niche growth segments. Male fragrance products show increasing acceptance and market penetration.

Fragrance category demonstrates significant growth potential as Chinese consumers develop appreciation for personal scents and luxury experiences. Premium fragrances gain traction in tier-one cities while accessible fragrances expand in emerging markets.

Manufacturers benefit from China’s cosmetics market through access to the world’s largest consumer base, enabling significant scale advantages and revenue growth opportunities. Production efficiency improvements result from large-volume manufacturing and established supply chain networks throughout the region.

Retailers gain advantages through diverse product portfolios, multiple price points, and omnichannel distribution strategies that maximize market coverage and consumer accessibility. E-commerce platforms benefit from high transaction volumes and sophisticated consumer data analytics capabilities.

Consumers enjoy extensive product choices, competitive pricing, and innovative formulations tailored to local preferences and needs. Quality improvements result from intense market competition and regulatory standards, ensuring safer and more effective products.

Investors find attractive opportunities in a rapidly growing market with strong fundamentals and long-term growth prospects. Technology companies benefit from increasing digitalization of beauty retail and growing demand for beauty-tech solutions.

Supply chain partners including packaging companies, ingredient suppliers, and logistics providers benefit from sustained market growth and increasing sophistication of beauty product requirements. Marketing agencies and digital platforms gain from substantial advertising investments and innovative campaign strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape China’s cosmetics market with live streaming commerce, social media marketing, and AI-powered personalization driving consumer engagement and sales growth. Influencer marketing has evolved beyond traditional celebrity endorsements to include micro-influencers and authentic user-generated content.

Clean beauty movement gains momentum as Chinese consumers increasingly prioritize natural ingredients, sustainable packaging, and ethical sourcing practices. Transparency demands require brands to provide detailed ingredient information and manufacturing processes to build consumer trust.

Personalization trends drive demand for customized beauty solutions, with brands offering skin analysis services, personalized product recommendations, and bespoke formulations. Technology integration includes virtual try-on applications, augmented reality experiences, and AI-powered beauty consultations.

Cross-cultural beauty influences blend traditional Chinese aesthetics with international trends, creating unique product positioning opportunities. K-beauty and J-beauty concepts continue to influence Chinese consumer preferences and product development strategies.

Wellness integration expands beauty concepts beyond appearance to include holistic health and self-care routines. Multi-functional products that combine beauty benefits with health and wellness features gain popularity among time-conscious consumers.

Regulatory evolution has streamlined cosmetics registration processes while maintaining safety standards, enabling faster market entry for innovative products. MarkWide Research analysis indicates that recent regulatory changes have reduced average product approval timelines by approximately 25%, benefiting both domestic and international brands.

Technology advancement in manufacturing processes has improved product quality and enabled mass customization capabilities. Digital retail innovation includes virtual beauty consultations, AI-powered skin analysis, and augmented reality try-on experiences that enhance consumer engagement.

Sustainability initiatives have gained prominence with major brands implementing eco-friendly packaging, carbon-neutral shipping, and ingredient transparency programs. Circular economy concepts are being integrated into product lifecycle management and consumer education programs.

Market consolidation activities include strategic acquisitions of domestic brands by international companies and partnerships between traditional retailers and e-commerce platforms. Investment flows into beauty-tech startups and innovative cosmetics companies continue to accelerate.

Cross-border commerce expansion has facilitated international brand entry while enabling Chinese brands to explore global markets through established e-commerce platforms and distribution networks.

Strategic recommendations for cosmetics companies operating in China emphasize the importance of digital-first approaches and localized product development. Brand positioning should carefully balance international appeal with local cultural relevance to maximize market acceptance and consumer loyalty.

Investment priorities should focus on e-commerce capabilities, influencer partnerships, and supply chain optimization to maintain competitive advantages. Product innovation must address specific Chinese consumer needs while incorporating global beauty trends and technological advancements.

Distribution strategy optimization requires omnichannel approaches that seamlessly integrate online and offline touchpoints. Customer experience enhancement through personalized services and premium retail environments can differentiate brands in competitive market segments.

Regulatory compliance investment is essential for sustainable market participation, requiring dedicated resources for product registration, quality assurance, and ongoing compliance monitoring. Partnership strategies with local distributors, retailers, and digital platforms can accelerate market penetration and reduce operational complexity.

Sustainability integration should be prioritized as consumer awareness and regulatory requirements continue to evolve. Data analytics capabilities must be developed to understand consumer behavior patterns and optimize marketing effectiveness across digital platforms.

Long-term growth prospects for China’s cosmetics products market remain exceptionally positive, supported by favorable demographic trends, continued urbanization, and evolving consumer sophistication. MWR projections indicate sustained growth momentum with the market expected to maintain robust expansion rates exceeding 8% annually through the forecast period.

Technology integration will continue to transform market dynamics through artificial intelligence, augmented reality, and personalized beauty solutions. Digital commerce evolution will likely include virtual reality shopping experiences, advanced recommendation systems, and seamless omnichannel integration.

Consumer preferences are expected to increasingly favor sustainable, personalized, and technologically advanced products that align with evolving lifestyle patterns. Premium segment growth will likely outpace mass-market categories as disposable incomes continue to rise across Chinese demographics.

Market expansion into lower-tier cities and rural areas presents significant opportunities as infrastructure development and income growth reach previously underserved regions. International brand competition will intensify while domestic brands continue to gain market share through innovation and localized strategies.

Regulatory environment improvements are expected to further streamline market access while maintaining product safety standards. Cross-border commerce will likely expand, facilitating both inbound international brands and outbound Chinese brand expansion into global markets.

The China cosmetics products market represents a dynamic and rapidly evolving landscape that continues to offer exceptional opportunities for growth and innovation. Market fundamentals remain strong, supported by favorable demographics, rising disposable incomes, and increasing beauty consciousness among Chinese consumers across all age groups and geographic regions.

Digital transformation has fundamentally reshaped market dynamics, creating new opportunities for consumer engagement, product discovery, and sales conversion through sophisticated e-commerce platforms and social media integration. Competitive intensity drives continuous innovation and improvement in product quality, customer service, and brand experiences, ultimately benefiting consumers through enhanced value propositions.

Future success in China’s cosmetics market will depend on brands’ ability to balance global appeal with local cultural relevance, invest in digital capabilities, and maintain agility in responding to rapidly evolving consumer preferences. Sustainability considerations and technological innovation will increasingly influence consumer choices and brand differentiation strategies. The market’s continued expansion into emerging regions and demographic segments ensures sustained growth opportunities for well-positioned companies that can navigate the complex but rewarding Chinese cosmetics landscape.

What is China Cosmetics Products?

China Cosmetics Products refer to a wide range of beauty and personal care items, including skincare, makeup, haircare, and fragrance products that are manufactured and sold in China.

What are the key players in the China Cosmetics Products Market?

Key players in the China Cosmetics Products Market include L’Oréal, Estée Lauder, Procter & Gamble, and Shiseido, among others.

What are the main drivers of growth in the China Cosmetics Products Market?

The growth of the China Cosmetics Products Market is driven by increasing disposable incomes, a growing middle class, and rising consumer awareness about personal grooming and beauty standards.

What challenges does the China Cosmetics Products Market face?

Challenges in the China Cosmetics Products Market include intense competition, regulatory compliance issues, and changing consumer preferences towards natural and organic products.

What opportunities exist in the China Cosmetics Products Market?

Opportunities in the China Cosmetics Products Market include the rising demand for e-commerce platforms, the growth of the male grooming segment, and increasing interest in sustainable and eco-friendly products.

What trends are shaping the China Cosmetics Products Market?

Trends in the China Cosmetics Products Market include the rise of K-beauty influences, the popularity of personalized beauty products, and the integration of technology in beauty applications, such as augmented reality for virtual try-ons.

China Cosmetics Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Makeup, Fragrance, Haircare |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Supermarkets |

| Customer Type | Women, Men, Teens, Professionals |

| Packaging Type | Tubes, Jars, Bottles, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Cosmetics Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at