444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s commercial real estate market has experienced significant growth in recent years, driven by the country’s robust economic development and urbanization. Commercial real estate refers to properties used for business purposes, such as office buildings, retail spaces, hotels, and industrial facilities. These properties play a vital role in supporting various industries and are an essential component of China’s thriving economy.

Meaning

Commercial real estate encompasses a wide range of properties that are utilized for commercial purposes. This sector includes office buildings, shopping malls, hotels, industrial parks, and other properties that generate income through rentals, leases, or sales. Commercial real estate provides essential infrastructure for businesses to operate and serves as a catalyst for economic growth and job creation.

Executive Summary

China’s commercial real estate market has witnessed steady growth in recent years, driven by the country’s expanding economy and increasing urbanization. The market offers lucrative opportunities for investors and developers, supported by favorable government policies, growing consumer spending, and rising demand for modern commercial spaces. However, the market also faces challenges such as oversupply in certain regions and the impact of economic fluctuations. Despite these challenges, the future outlook for China’s commercial real estate market remains positive, with ongoing urbanization and the continuous development of new economic zones driving demand for commercial properties.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The commercial real estate market in China is characterized by a dynamic interplay of various factors, including economic conditions, government policies, market demand, and investor sentiment. These dynamics influence property prices, rental rates, and investment opportunities. Understanding and navigating these dynamics is crucial for market participants to make informed decisions and capitalize on emerging trends.

Regional Analysis

China’s commercial real estate market exhibits regional variations, with major cities such as Beijing, Shanghai, Guangzhou, and Shenzhen leading the way in terms of investment and development. These cities benefit from their status as economic and financial hubs, attracting multinational corporations and international investors. However, emerging cities in central and western China are also witnessing rapid growth and offer untapped opportunities for commercial real estate development.

Competitive Landscape

Leading companies in the China Commercial Real Estate market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

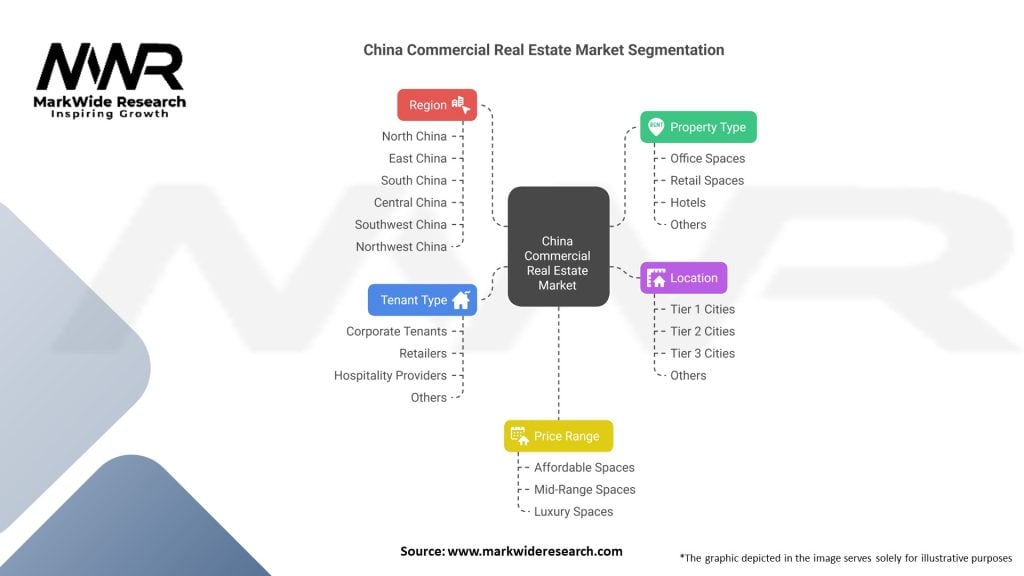

Segmentation

The commercial real estate market in China can be segmented based on property types, including office spaces, retail properties, hotels, industrial facilities, and mixed-use developments. Each segment has its unique characteristics and target audience, requiring specific expertise and strategies for development, leasing, and investment.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on China’s commercial real estate market. Lockdown measures, travel restrictions, and social distancing requirements disrupted business operations and affected the demand for commercial properties. Office spaces experienced lower occupancy rates as remote work became more prevalent, while the retail sector faced challenges due to reduced foot traffic and changing consumer behavior. However, the pandemic also accelerated certain trends, such as the adoption of technology in property management and the growth of e-commerce, which presented opportunities for the market to adapt and innovate.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for China’s commercial real estate market remains positive, supported by ongoing urbanization, government initiatives, and the country’s strong economic growth. Emerging markets, technology integration, and sustainable development will continue to shape the industry. The demand for modern office spaces, retail properties, hotels, and logistics facilities will persist as China’s economy evolves and consumer preferences change. However, industry participants should remain vigilant about market dynamics, geopolitical risks, and economic fluctuations that may impact the commercial real estate landscape.

Conclusion

China’s commercial real estate market offers significant opportunities for investors and developers. The market is driven by rapid urbanization, government support, and a growing demand for modern commercial spaces. While challenges such as oversupply and economic volatility exist, the sector continues to thrive due to emerging trends such as sustainability, technology integration, and mixed-use developments. The Covid-19 pandemic has impacted the market but also accelerated certain trends and innovation. Industry participants should conduct thorough market research, embrace sustainability and technology, and monitor policy changes to navigate the market successfully and capitalize on emerging opportunities. The future outlook for China’s commercial real estate market remains positive, driven by ongoing urbanization, economic growth, and evolving consumer needs.

What is China Commercial Real Estate?

China Commercial Real Estate refers to properties used for business purposes, including office buildings, retail spaces, and industrial facilities. This sector plays a crucial role in the country’s economic development and urbanization.

What are the key players in the China Commercial Real Estate Market?

Key players in the China Commercial Real Estate Market include China Vanke, Evergrande Group, and Country Garden, among others. These companies are involved in various segments such as residential, commercial, and mixed-use developments.

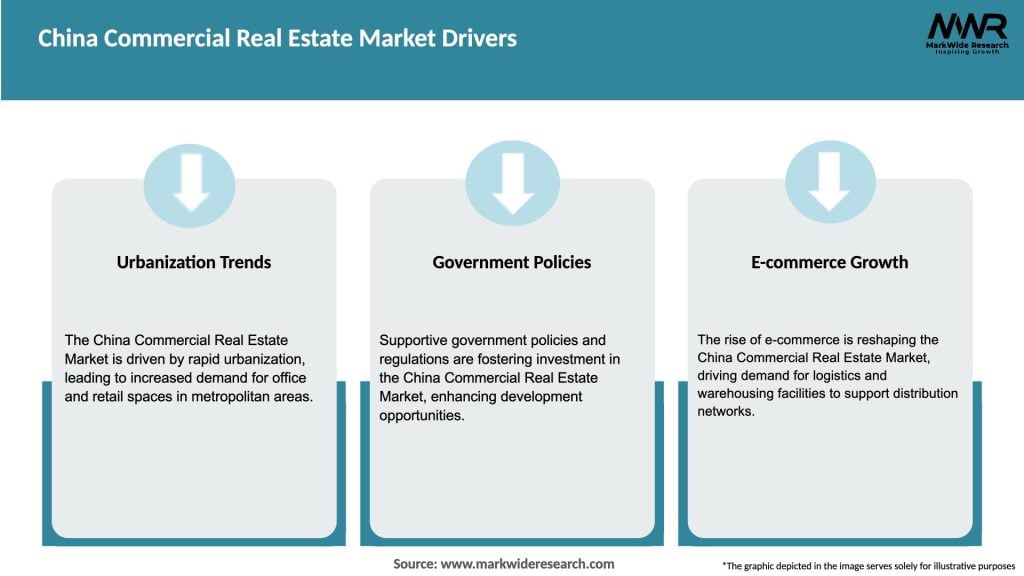

What are the main drivers of growth in the China Commercial Real Estate Market?

The main drivers of growth in the China Commercial Real Estate Market include rapid urbanization, increasing foreign investment, and a growing middle class. These factors contribute to rising demand for commercial spaces in urban areas.

What challenges does the China Commercial Real Estate Market face?

The China Commercial Real Estate Market faces challenges such as regulatory changes, economic fluctuations, and oversupply in certain regions. These factors can impact property values and investment returns.

What opportunities exist in the China Commercial Real Estate Market?

Opportunities in the China Commercial Real Estate Market include the development of smart buildings, sustainable construction practices, and the growth of e-commerce, which drives demand for logistics and warehousing spaces.

What trends are shaping the China Commercial Real Estate Market?

Trends shaping the China Commercial Real Estate Market include the rise of co-working spaces, increased focus on sustainability, and the integration of technology in property management. These trends reflect changing consumer preferences and business needs.

China Commercial Real Estate Market:

| Segment | Description |

|---|---|

| Property Type | Office Spaces, Retail Spaces, Hotels, Others |

| Location | Tier 1 Cities, Tier 2 Cities, Tier 3 Cities, Others |

| Price Range | Affordable Spaces, Mid-Range Spaces, Luxury Spaces |

| Tenant Type | Corporate Tenants, Retailers, Hospitality Providers, Others |

| Region | North China, East China, South China, Central China, Southwest China, Northwest China |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Commercial Real Estate market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at