444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China cloud computing market represents one of the most dynamic and rapidly evolving technology sectors in the Asia-Pacific region. Cloud computing adoption across Chinese enterprises has accelerated dramatically, driven by digital transformation initiatives, government support for technological innovation, and the increasing demand for scalable IT infrastructure solutions. The market encompasses various service models including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), catering to diverse industry verticals from manufacturing and finance to healthcare and education.

Market growth in China’s cloud computing sector has been particularly robust, with the industry experiencing a compound annual growth rate (CAGR) of 28.5% over recent years. This exceptional growth trajectory reflects the nation’s commitment to becoming a global leader in digital technologies and the widespread adoption of cloud solutions by both large enterprises and small-to-medium businesses. Government initiatives such as the “Digital China” strategy and “Internet Plus” action plan have provided substantial momentum for cloud infrastructure development and deployment.

Enterprise adoption rates have surged significantly, with approximately 67% of Chinese companies now utilizing some form of cloud computing services. The market landscape features both international cloud service providers and domestic players, creating a competitive environment that drives innovation and service quality improvements. Hybrid cloud solutions have gained particular traction, offering organizations the flexibility to balance security requirements with operational efficiency needs.

The China cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions specifically designed for and deployed within the Chinese business environment. This market encompasses the delivery of computing resources, applications, and data storage services over the internet, enabling organizations to access scalable technology solutions without maintaining extensive on-premises hardware infrastructure.

Cloud computing services in China include three primary service models: Infrastructure as a Service (IaaS) providing virtualized computing resources, Platform as a Service (PaaS) offering development and deployment environments, and Software as a Service (SaaS) delivering ready-to-use applications. The market also encompasses specialized services such as disaster recovery, data analytics, artificial intelligence capabilities, and Internet of Things (IoT) integration platforms tailored for Chinese regulatory requirements and business practices.

Market participants include global technology giants, domestic cloud service providers, system integrators, and specialized solution vendors. The ecosystem supports various deployment models including public cloud, private cloud, and hybrid cloud configurations, allowing organizations to select optimal solutions based on their specific security, compliance, and operational requirements within China’s unique regulatory landscape.

China’s cloud computing market has emerged as a cornerstone of the nation’s digital economy transformation, demonstrating exceptional growth momentum and technological advancement. The market benefits from strong government support, increasing enterprise digitalization initiatives, and growing demand for innovative technology solutions across multiple industry sectors. Digital transformation has become a strategic priority for Chinese organizations, driving substantial investments in cloud infrastructure and services.

Key market drivers include the rapid expansion of e-commerce platforms, the proliferation of mobile applications, increasing data generation volumes, and the need for cost-effective IT solutions. Approximately 72% of enterprises report improved operational efficiency through cloud adoption, while 65% experience reduced IT infrastructure costs. The market has witnessed significant technological advancements in areas such as edge computing, artificial intelligence integration, and multi-cloud management platforms.

Competitive dynamics feature both international cloud service providers adapting their offerings for the Chinese market and domestic players leveraging local market knowledge and regulatory compliance expertise. The market structure continues to evolve with increasing consolidation among service providers and growing specialization in vertical-specific cloud solutions. Innovation acceleration remains a defining characteristic, with continuous development of new services and capabilities to meet evolving customer demands.

Market penetration across different industry verticals reveals significant variation in cloud adoption patterns and service preferences. The following insights highlight critical market dynamics:

Government policy support serves as a fundamental driver for China’s cloud computing market expansion. The Chinese government has implemented comprehensive digital transformation strategies that prioritize cloud technology adoption across public and private sectors. Policy initiatives such as the “New Infrastructure” development plan allocate substantial resources for cloud infrastructure development, creating favorable conditions for market growth and technological advancement.

Digital transformation imperatives across Chinese enterprises have accelerated cloud adoption as organizations seek to modernize legacy systems and improve operational efficiency. Companies recognize cloud computing as essential for maintaining competitive advantages in increasingly digital business environments. Scalability requirements drive organizations to adopt cloud solutions that can accommodate rapid business growth and fluctuating demand patterns without significant capital investments.

Cost optimization pressures motivate enterprises to migrate from traditional IT infrastructure to cloud-based solutions that offer predictable operating expenses and reduced maintenance overhead. Innovation acceleration through cloud platforms enables organizations to deploy new applications and services more rapidly, supporting business agility and market responsiveness. The growing ecosystem of cloud-native applications and services provides additional incentives for comprehensive cloud adoption strategies.

Data analytics capabilities available through cloud platforms enable organizations to extract valuable insights from increasing data volumes generated by digital business operations. Artificial intelligence integration within cloud services provides advanced capabilities for automation, predictive analytics, and intelligent decision-making processes that enhance business performance and customer experiences.

Data security concerns represent significant challenges for cloud computing adoption in China, particularly among organizations handling sensitive information or operating in regulated industries. Cybersecurity threats and data privacy requirements create hesitation among enterprises considering cloud migration, especially for critical business applications and customer data storage. Organizations must navigate complex security frameworks while ensuring compliance with evolving data protection regulations.

Regulatory compliance complexities pose ongoing challenges as organizations must ensure cloud deployments meet specific Chinese regulatory requirements across different industry sectors. Data sovereignty requirements mandate that certain types of data remain within Chinese borders, limiting cloud service provider options and potentially increasing costs for specialized compliance solutions.

Integration challenges with existing legacy systems create technical barriers for organizations seeking to adopt cloud solutions while maintaining operational continuity. Skill shortages in cloud technologies and digital transformation expertise limit the pace of adoption as organizations struggle to find qualified professionals capable of managing complex cloud implementations and ongoing operations.

Vendor lock-in concerns discourage some organizations from committing to specific cloud platforms due to fears of reduced flexibility and increased switching costs. Network connectivity limitations in certain regions may impact cloud service performance and reliability, particularly for organizations operating in less developed areas with limited internet infrastructure capabilities.

Edge computing integration presents substantial opportunities for cloud service providers to extend their offerings closer to end users and IoT devices. 5G network deployment across China creates new possibilities for ultra-low latency cloud applications and services that can support emerging technologies such as autonomous vehicles, smart manufacturing, and augmented reality applications.

Artificial intelligence convergence with cloud computing opens significant market opportunities for providers offering AI-powered cloud services and machine learning platforms. Industry-specific solutions tailored for sectors such as healthcare, education, and smart cities represent growing market segments with substantial revenue potential and long-term growth prospects.

Small and medium enterprise market penetration offers considerable expansion opportunities as these organizations increasingly recognize cloud computing benefits for cost reduction and operational efficiency. Multi-cloud management solutions address growing enterprise needs for flexibility and vendor diversification strategies, creating opportunities for specialized service providers and integration platforms.

Sustainability initiatives drive demand for energy-efficient cloud solutions and green computing practices, creating opportunities for providers emphasizing environmental responsibility. Cross-border business expansion by Chinese companies generates demand for global cloud services that can support international operations while maintaining compliance with Chinese regulations.

Competitive intensity in China’s cloud computing market continues to escalate as both domestic and international providers vie for market share through aggressive pricing strategies, service innovation, and strategic partnerships. Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand capabilities and geographic coverage while achieving economies of scale.

Technology evolution drives continuous market transformation with emerging technologies such as quantum computing, blockchain integration, and advanced analytics reshaping service offerings and customer expectations. Customer sophistication levels have increased significantly, with organizations demanding more specialized solutions and higher service quality standards from cloud providers.

Pricing pressures intensify as market maturity increases and customers become more price-sensitive while expecting enhanced service levels and additional features. Partnership ecosystems have become critical success factors, with cloud providers forming strategic alliances with system integrators, software vendors, and industry specialists to deliver comprehensive solutions.

Regulatory evolution continues to shape market dynamics as government policies adapt to technological advances and international trade considerations. Innovation cycles have accelerated, requiring cloud providers to invest continuously in research and development to maintain competitive positioning and meet evolving customer requirements.

Comprehensive market analysis for China’s cloud computing sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, technology leaders, and end-user organizations across various sectors to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory documents to establish market context and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and growth patterns based on historical data and current market indicators.

Market segmentation analysis examines different service models, deployment types, industry verticals, and geographic regions to provide detailed insights into market structure and dynamics. Competitive landscape assessment evaluates key market participants through analysis of their service offerings, market positioning, financial performance, and strategic initiatives.

Technology trend analysis identifies emerging technologies and their potential impact on market evolution, while regulatory impact assessment examines how policy changes and compliance requirements influence market development. Expert validation processes ensure research findings accuracy through consultation with industry specialists and academic researchers.

Geographic distribution of China’s cloud computing market reveals significant concentration in major economic centers while showing expanding adoption across secondary cities and rural areas. Eastern China dominates market activity with approximately 58% of total adoption, led by Shanghai, Beijing, and Guangzhou as primary cloud computing hubs with extensive infrastructure and high enterprise concentration.

Northern China represents 25% of market activity, with Beijing serving as both a technology center and government policy hub driving public sector cloud adoption. Southern China accounts for 17% of market share, benefiting from manufacturing industry concentration and proximity to Hong Kong’s international business connections.

Tier-1 cities demonstrate the highest cloud adoption rates and most sophisticated service requirements, while tier-2 and tier-3 cities show rapid growth potential as internet infrastructure improves and local businesses embrace digital transformation. Rural market penetration remains limited but presents significant long-term opportunities as government initiatives expand broadband connectivity and digital services access.

Regional specialization patterns emerge with different areas focusing on specific industry verticals and cloud service types. Cross-regional connectivity requirements drive demand for distributed cloud architectures and edge computing solutions that can serve geographically dispersed operations while maintaining performance and compliance standards.

Market leadership in China’s cloud computing sector features a dynamic mix of domestic and international providers competing across different service segments and customer categories. The competitive environment continues to evolve with changing customer preferences and technological advancement.

Competitive strategies emphasize service differentiation, pricing optimization, and strategic partnerships to capture market share and build customer loyalty. Innovation investment remains critical for maintaining competitive positioning as technology evolution accelerates and customer expectations increase.

Service model segmentation reveals distinct market characteristics and growth patterns across different cloud computing categories:

By Service Type:

By Deployment Model:

By Organization Size:

Industry vertical analysis reveals significant variation in cloud adoption patterns, service preferences, and implementation challenges across different sectors:

Financial Services: Leading cloud adoption with 78% implementation rates, focusing on regulatory compliance, data security, and customer experience enhancement. Digital banking initiatives drive demand for scalable cloud platforms supporting mobile applications and real-time transaction processing.

Manufacturing: Increasing cloud adoption for supply chain optimization, predictive maintenance, and smart factory initiatives. Industrial IoT integration creates demand for edge computing capabilities and real-time data processing solutions.

Healthcare: Growing cloud adoption for electronic health records, telemedicine platforms, and medical research applications. Data privacy requirements drive demand for specialized healthcare cloud solutions with enhanced security features.

Education: Accelerated cloud adoption for online learning platforms, student information systems, and research computing resources. Remote learning requirements have increased demand for scalable educational technology solutions.

Retail and E-commerce: Extensive cloud utilization for customer relationship management, inventory optimization, and omnichannel commerce platforms. Seasonal scalability requirements drive preference for flexible cloud resources.

Government and Public Sector: Increasing cloud adoption for citizen services, data management, and inter-agency collaboration platforms. Digital government initiatives create demand for secure, compliant cloud solutions.

Cost optimization represents the primary benefit for organizations adopting cloud computing solutions, with enterprises typically achieving 30-40% reduction in IT infrastructure costs through cloud migration. Operational efficiency improvements enable organizations to focus resources on core business activities rather than IT maintenance and management tasks.

Scalability advantages allow organizations to adjust computing resources dynamically based on demand fluctuations without significant capital investments or long-term commitments. Innovation acceleration through cloud platforms enables faster application development, testing, and deployment cycles that support business agility and market responsiveness.

Enhanced collaboration capabilities facilitate remote work arrangements and cross-functional team coordination through cloud-based communication and productivity tools. Data analytics access provides organizations with advanced capabilities for business intelligence and predictive analytics that were previously available only to large enterprises with substantial IT resources.

Disaster recovery and business continuity benefits ensure organizational resilience through automated backup systems and geographically distributed data storage. Compliance support through specialized cloud services helps organizations meet regulatory requirements while reducing the complexity and cost of compliance management.

Global reach capabilities enable Chinese organizations to expand internationally while maintaining consistent IT infrastructure and service quality across different geographic markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration has become a defining trend in China’s cloud computing market, with providers increasingly embedding AI capabilities into their service offerings. Machine learning platforms and automated decision-making tools are becoming standard features rather than premium add-ons, enabling organizations to leverage advanced analytics without specialized expertise.

Edge computing adoption accelerates as organizations seek to reduce latency and improve performance for real-time applications. 5G network deployment creates new opportunities for edge-cloud integration, supporting applications such as autonomous vehicles, smart manufacturing, and augmented reality experiences.

Multi-cloud strategies gain popularity as organizations seek to avoid vendor lock-in while optimizing service capabilities and costs across different providers. Cloud-native development approaches become mainstream as organizations design applications specifically for cloud environments rather than migrating legacy systems.

Sustainability focus drives demand for energy-efficient cloud solutions and green computing practices as organizations prioritize environmental responsibility. Industry-specific solutions proliferate as cloud providers develop specialized offerings tailored to specific vertical market requirements and regulatory frameworks.

Serverless computing adoption increases as organizations seek to optimize costs and reduce infrastructure management overhead. Container technologies become standard deployment methods for cloud applications, enabling greater portability and resource efficiency.

Strategic partnerships between cloud providers and system integrators have intensified, creating comprehensive solution ecosystems that address complex enterprise requirements. Alibaba Cloud has expanded its international presence while strengthening domestic market leadership through continuous service innovation and strategic acquisitions.

Government initiatives such as the “Digital China” strategy have accelerated public sector cloud adoption and created favorable conditions for private sector digital transformation. Regulatory frameworks continue to evolve, providing clearer guidelines for data protection, cross-border data transfer, and cloud service provider compliance requirements.

Technology investments in quantum computing research and development signal future cloud computing capabilities that could revolutionize processing power and security features. 5G infrastructure deployment creates new possibilities for ultra-low latency cloud applications and edge computing solutions.

Merger and acquisition activity has increased as cloud providers seek to expand capabilities and market coverage through strategic consolidation. International expansion by Chinese cloud providers demonstrates growing confidence and capability in global markets.

Innovation centers and research facilities established by major cloud providers indicate long-term commitment to technology advancement and market leadership. MarkWide Research analysis indicates that these developments position China’s cloud computing market for sustained growth and technological leadership in the Asia-Pacific region.

Market participants should prioritize security and compliance capabilities to address persistent customer concerns about data protection and regulatory requirements. Investment in talent development programs will be crucial for addressing skill shortages and building organizational capabilities for cloud computing implementation and management.

Service differentiation through industry-specific solutions and vertical expertise will become increasingly important as market competition intensifies. Partnership strategies with system integrators, software vendors, and industry specialists can help cloud providers deliver comprehensive solutions that address complex customer requirements.

Geographic expansion into tier-2 and tier-3 cities presents significant growth opportunities as internet infrastructure improves and local businesses embrace digital transformation. Edge computing capabilities should be developed to support emerging applications requiring low latency and real-time processing.

Pricing strategies must balance competitive pressures with profitability requirements while providing clear value propositions for different customer segments. Innovation investment in emerging technologies such as artificial intelligence, quantum computing, and blockchain integration will be essential for maintaining competitive positioning.

Customer education and support programs can help accelerate adoption among organizations hesitant about cloud migration. Sustainability initiatives should be integrated into service offerings to address growing environmental concerns and corporate responsibility requirements.

Market trajectory for China’s cloud computing sector indicates continued robust growth driven by digital transformation initiatives, government support, and increasing enterprise adoption across all industry verticals. MarkWide Research projections suggest the market will maintain strong momentum with expanding service capabilities and geographic coverage.

Technology evolution will continue to reshape the cloud computing landscape with artificial intelligence, edge computing, and 5G integration creating new service categories and business models. Market maturation is expected to drive consolidation among service providers while increasing specialization in vertical-specific solutions.

Regulatory environment development will provide greater clarity for cloud service providers and customers while potentially creating new compliance requirements and operational considerations. International expansion by Chinese cloud providers will increase as domestic market success provides foundation for global growth strategies.

Customer sophistication levels will continue to increase, driving demand for more advanced services and higher quality standards from cloud providers. Sustainability considerations will become increasingly important in customer selection criteria and service provider positioning strategies.

Innovation acceleration will require continuous investment in research and development to maintain competitive positioning and meet evolving customer expectations. Market growth rates are projected to remain strong with CAGR exceeding 25% over the next five years, supported by expanding adoption and service innovation.

China’s cloud computing market represents one of the most dynamic and promising technology sectors globally, characterized by exceptional growth rates, strong government support, and increasing enterprise adoption across diverse industry verticals. The market has demonstrated remarkable resilience and adaptability, successfully navigating regulatory challenges while maintaining innovation momentum and competitive intensity.

Key success factors for market participants include security and compliance expertise, service differentiation through industry specialization, strategic partnerships, and continuous technology innovation. The market outlook remains highly positive with sustained growth expected across all service categories and geographic regions, driven by digital transformation imperatives and emerging technology integration.

Strategic opportunities abound for organizations capable of addressing evolving customer needs while maintaining competitive positioning through service quality, pricing optimization, and technological advancement. The convergence of cloud computing with artificial intelligence, edge computing, and 5G technologies creates unprecedented possibilities for service innovation and market expansion, positioning China’s cloud computing market for continued leadership in the global digital economy transformation.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing, and software. It allows users to access and manage data and applications remotely, enhancing flexibility and scalability.

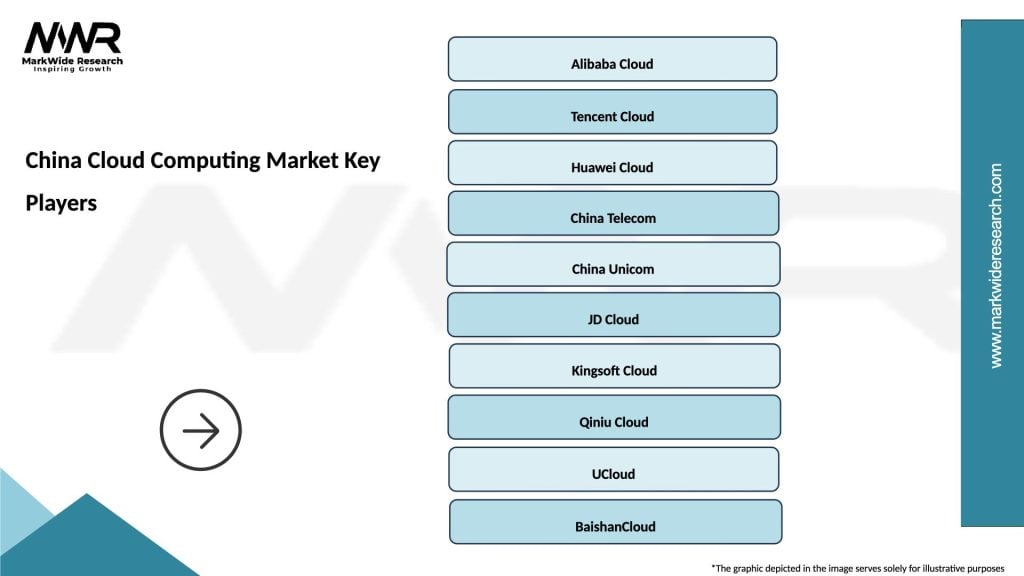

What are the key players in the China Cloud Computing Market?

Key players in the China Cloud Computing Market include Alibaba Cloud, Tencent Cloud, and Huawei Cloud, among others. These companies provide a range of services such as infrastructure as a service (IaaS) and platform as a service (PaaS).

What are the main drivers of growth in the China Cloud Computing Market?

The main drivers of growth in the China Cloud Computing Market include the increasing demand for digital transformation, the rise of big data analytics, and the growing adoption of artificial intelligence technologies across various sectors.

What challenges does the China Cloud Computing Market face?

Challenges in the China Cloud Computing Market include data security concerns, regulatory compliance issues, and the need for skilled professionals to manage cloud infrastructure effectively.

What opportunities exist in the China Cloud Computing Market?

Opportunities in the China Cloud Computing Market include the expansion of cloud services in small and medium-sized enterprises, the integration of cloud solutions with Internet of Things (IoT) technologies, and the potential for innovation in sectors like healthcare and finance.

What trends are shaping the China Cloud Computing Market?

Trends shaping the China Cloud Computing Market include the increasing focus on hybrid cloud solutions, the rise of edge computing, and the growing importance of sustainability in cloud operations.

China Cloud Computing Market

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| End User | Government, Education, Healthcare, Manufacturing |

| Service Type | IaaS, PaaS, SaaS, FaaS |

| Industry Vertical | Retail, BFSI, Telecommunications, Media |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at