444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China chartered air transport market represents a dynamic and rapidly evolving sector within the country’s aviation industry, characterized by increasing demand for personalized air travel solutions and specialized cargo services. Market dynamics indicate substantial growth potential driven by China’s expanding economy, rising disposable incomes, and the growing need for flexible transportation options across various industries. The market encompasses both passenger charter services and cargo charter operations, serving diverse sectors including business aviation, emergency medical services, tourism, and specialized freight transportation.

Growth trajectories in the Chinese chartered air transport sector reflect the nation’s broader economic development and urbanization trends. With a projected compound annual growth rate of 8.2% CAGR over the forecast period, the market demonstrates resilience and adaptability to changing consumer preferences and business requirements. Regional distribution shows concentrated activity in major economic hubs including Beijing, Shanghai, Guangzhou, and Shenzhen, while secondary cities are experiencing increased charter service adoption at approximately 15% annually.

Industry participants range from established international operators to emerging domestic charter companies, creating a competitive landscape that fosters innovation and service diversification. The market’s evolution is closely tied to regulatory developments, infrastructure improvements, and technological advancements in aviation systems and booking platforms.

The China chartered air transport market refers to the comprehensive ecosystem of on-demand aviation services that provide customized flight solutions for passengers and cargo within, to, and from China. This market encompasses private jet charters, helicopter services, cargo charter flights, and specialized aviation services that operate outside regular scheduled airline routes.

Charter services distinguish themselves from commercial airlines by offering flexible scheduling, personalized routing, and tailored service packages that meet specific client requirements. The market includes various aircraft types ranging from light jets and turboprops to heavy cargo aircraft and luxury long-range jets, each serving distinct market segments and operational needs.

Service categories within the market include business aviation for corporate travel, leisure charters for tourism and special events, medical evacuation services, cargo charters for time-sensitive or specialized freight, and government or diplomatic charter services. The market operates under China’s evolving aviation regulatory framework, which continues to adapt to support growth while maintaining safety and security standards.

Market fundamentals of China’s chartered air transport sector reveal a robust growth trajectory supported by economic expansion, infrastructure development, and evolving consumer preferences toward premium travel experiences. The market benefits from China’s position as a global manufacturing and business hub, generating substantial demand for flexible air transportation solutions across multiple sectors.

Key performance indicators demonstrate strong market momentum with passenger charter services experiencing growth rates of approximately 12% annually, while cargo charter operations maintain steady expansion driven by e-commerce growth and just-in-time logistics requirements. Market penetration in tier-one cities reaches approximately 35% of potential demand, indicating significant room for expansion in emerging markets.

Competitive dynamics feature a mix of international charter operators, domestic aviation companies, and specialized service providers, each targeting specific market niches and geographic regions. The market’s future prospects remain positive, supported by continued economic growth, regulatory liberalization, and increasing acceptance of charter services among Chinese businesses and affluent consumers.

Strategic insights from comprehensive market analysis reveal several critical factors shaping the China chartered air transport landscape:

Economic prosperity serves as the primary catalyst for chartered air transport market expansion in China, with rising corporate profits and individual wealth creating increased demand for premium transportation services. Business efficiency requirements drive corporate adoption of charter services, as companies seek to optimize executive travel time and maintain competitive advantages through flexible scheduling capabilities.

Infrastructure limitations in China’s scheduled airline network create opportunities for charter operators to serve underserved routes and destinations. Many secondary cities and industrial centers lack adequate commercial airline connectivity, making charter services essential for business operations and economic development in these regions.

Regulatory evolution continues to support market growth through gradual liberalization of aviation policies and streamlined approval processes for charter operations. Recent regulatory changes have reduced bureaucratic barriers and enabled more efficient charter flight approvals, contributing to market accessibility and operational flexibility.

Tourism development initiatives across China are incorporating chartered air services into destination marketing strategies, particularly for luxury tourism segments and remote scenic areas. Government support for general aviation development includes infrastructure investments and policy frameworks designed to encourage private aviation growth while maintaining safety standards.

Regulatory complexity remains a significant challenge for charter operators, with approval processes for flight operations, aircraft registration, and route permissions requiring substantial administrative resources and time investments. Airspace restrictions limit operational flexibility in certain regions, particularly around major cities and sensitive areas, constraining charter service efficiency and routing options.

High operational costs associated with aircraft acquisition, maintenance, insurance, and crew training create barriers to entry for new operators and limit market accessibility for price-sensitive customers. Fuel price volatility directly impacts charter service pricing and profitability, creating challenges for long-term contract planning and customer retention.

Infrastructure constraints at many Chinese airports limit charter operations through inadequate general aviation facilities, limited hangar space, and insufficient ground support services. Skilled personnel shortages in areas including pilots, maintenance technicians, and aviation management professionals constrain industry growth and operational capacity expansion.

Market perception challenges persist among potential customers who may view charter services as unnecessarily expensive or complex compared to commercial airline alternatives, limiting market penetration in certain segments and geographic regions.

Emerging market segments present substantial growth opportunities, particularly in medical aviation services, cargo charters for e-commerce logistics, and specialized transportation for China’s growing entertainment and sports industries. Regional expansion into tier-two and tier-three cities offers significant potential as these markets develop economically and require enhanced connectivity solutions.

Technology integration opportunities include developing advanced booking platforms, implementing artificial intelligence for route optimization, and creating integrated service ecosystems that combine air transport with ground transportation and hospitality services. Partnership strategies with hotels, tourism operators, and corporate travel management companies can expand market reach and create comprehensive service offerings.

Fleet diversification opportunities exist in specialized aircraft categories including seaplanes for coastal and island destinations, helicopters for urban transportation and emergency services, and environmentally friendly aircraft to meet sustainability requirements. International expansion potential includes serving Chinese outbound tourism markets and facilitating business travel between China and key trading partner countries.

Sustainability initiatives create opportunities for operators to differentiate through environmental responsibility programs, sustainable aviation fuel adoption, and carbon offset services that appeal to environmentally conscious customers and corporate clients with sustainability mandates.

Supply and demand dynamics in the China chartered air transport market reflect the interplay between growing customer requirements and expanding service capabilities. Demand drivers include increasing business travel needs, luxury tourism growth, and specialized cargo transportation requirements, while supply factors encompass aircraft availability, operational capacity, and service provider expansion.

Competitive pressures are intensifying as more operators enter the market, leading to service innovation, pricing competition, and market segmentation strategies. Customer expectations continue to evolve toward higher service standards, greater convenience, and integrated travel solutions that combine air transport with complementary services.

Technological disruption is reshaping market dynamics through digital booking platforms, mobile applications, and data analytics capabilities that enhance customer experience and operational efficiency. Regulatory changes periodically impact market dynamics by altering operational requirements, safety standards, and competitive conditions for charter operators.

Economic cycles influence market dynamics through their impact on corporate travel budgets, luxury spending patterns, and cargo transportation volumes, requiring operators to maintain operational flexibility and diversified service portfolios to manage market volatility effectively.

Comprehensive research approaches employed in analyzing the China chartered air transport market combine quantitative data analysis with qualitative industry insights to provide accurate market assessments and forecasts. Primary research methods include structured interviews with industry executives, charter operators, customers, and regulatory officials to gather firsthand market intelligence and trend insights.

Secondary research sources encompass industry reports, government aviation statistics, trade association publications, and academic research studies focused on Chinese aviation markets and charter service trends. Data validation processes ensure accuracy through cross-referencing multiple sources and conducting follow-up verification with industry participants.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key growth drivers and constraints. Regional analysis methodologies examine market variations across different Chinese provinces and cities to understand local market dynamics and opportunities.

Industry expert consultations provide specialized insights into regulatory developments, technological trends, and competitive dynamics that shape market evolution and future prospects for charter air transport services in China.

Eastern China dominates the chartered air transport market with approximately 45% market share, driven by the economic powerhouses of Shanghai, Beijing, and surrounding metropolitan areas. This region benefits from high concentrations of multinational corporations, financial institutions, and manufacturing enterprises that generate substantial demand for business charter services.

Southern China represents approximately 25% of market activity, centered around Guangzhou, Shenzhen, and the Pearl River Delta region. The area’s role as a manufacturing and export hub creates significant cargo charter demand, while growing wealth levels support passenger charter service expansion.

Northern China accounts for roughly 20% of charter operations, with Beijing serving as the primary hub for government and diplomatic charter services alongside corporate travel requirements. The region’s industrial base and energy sector generate specialized cargo charter needs for equipment and personnel transportation.

Western China represents an emerging market with approximately 10% current market share but demonstrates the highest growth potential as economic development initiatives and tourism promotion efforts create new demand for charter services in previously underserved areas.

Regional connectivity patterns show increasing charter service routes linking major economic centers with secondary cities, industrial zones, and tourist destinations, reflecting China’s ongoing urbanization and economic diversification trends.

Market leadership in China’s chartered air transport sector features a diverse mix of international operators, domestic aviation companies, and specialized charter service providers competing across different market segments and geographic regions.

Competitive strategies focus on service differentiation, fleet modernization, geographic expansion, and technology integration to capture market share and enhance customer loyalty in this growing sector.

By Service Type:

By Aircraft Type:

By End User:

Business Aviation Segment represents the largest market category, driven by corporate demand for flexible travel solutions and executive transportation efficiency. Growth patterns show increasing adoption among Chinese enterprises expanding internationally and multinational companies operating in China, with utilization rates improving by approximately 18% annually.

Leisure Charter Services demonstrate strong growth potential as affluent Chinese consumers increasingly seek unique travel experiences and personalized service offerings. Market development in this segment focuses on luxury tourism packages, special event transportation, and destination-specific charter services that cater to high-net-worth individuals.

Cargo Charter Operations serve critical logistics needs for time-sensitive shipments, specialized equipment transportation, and emergency supply deliveries. Industry applications include pharmaceutical distribution, automotive parts delivery, and high-tech equipment transportation that requires precise handling and scheduling.

Medical Aviation Services represent a specialized but growing segment addressing emergency medical transportation, organ transport, and specialized healthcare logistics needs across China’s vast geographic area and diverse healthcare infrastructure.

Charter Operators benefit from growing market demand, diversified revenue streams, and opportunities for service expansion into emerging market segments and geographic regions. Operational advantages include flexible scheduling capabilities, premium pricing potential, and the ability to develop specialized service offerings that differentiate from commercial airline alternatives.

Aircraft Manufacturers gain from increased demand for diverse aircraft types, modernization requirements, and opportunities to develop China-specific aircraft configurations and service packages. Market opportunities include partnerships with Chinese operators and participation in the country’s growing general aviation infrastructure development.

Service Providers including ground handling companies, maintenance organizations, and aviation service specialists benefit from expanded charter operations and increasing demand for specialized support services. Growth opportunities exist in developing comprehensive service ecosystems that support charter operations across multiple touchpoints.

Customers benefit from enhanced travel flexibility, time savings, personalized service experiences, and access to destinations not served by commercial airlines. Value propositions include productivity improvements for business travelers, unique experiences for leisure customers, and critical transportation solutions for specialized requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation is revolutionizing charter service booking and management through mobile applications, online platforms, and integrated service ecosystems that enhance customer convenience and operational efficiency. Technology adoption includes real-time flight tracking, digital payment systems, and personalized service customization capabilities.

Sustainability Focus is driving charter operators to adopt environmentally friendly practices including sustainable aviation fuel usage, carbon offset programs, and fuel-efficient aircraft selection. Environmental initiatives respond to growing customer awareness and corporate sustainability mandates that influence transportation choices.

Service Integration trends show charter operators expanding beyond basic transportation to offer comprehensive travel solutions including ground transportation, accommodation, and concierge services. Partnership strategies with luxury hotels, ground transportation providers, and travel management companies create seamless customer experiences.

Fleet Modernization continues as operators invest in newer, more efficient aircraft that meet evolving customer expectations for comfort, technology, and environmental performance. Aircraft selection increasingly emphasizes fuel efficiency, advanced avionics, and passenger amenities that differentiate charter services from commercial alternatives.

Regulatory Evolution includes recent policy changes that streamline charter flight approval processes and expand operational permissions for general aviation activities. MarkWide Research analysis indicates these regulatory improvements have contributed to increased operational efficiency and market accessibility for charter service providers.

Infrastructure Investments in general aviation facilities at major Chinese airports are expanding charter operation capabilities and improving service quality. Facility developments include dedicated general aviation terminals, enhanced ground support services, and improved aircraft maintenance capabilities.

Technology Partnerships between charter operators and technology companies are creating innovative booking platforms, flight management systems, and customer service applications that enhance market competitiveness and operational efficiency.

International Collaborations are expanding as Chinese charter operators form partnerships with international aviation companies to enhance service capabilities, expand geographic reach, and access advanced operational expertise and aircraft technologies.

Market Entry Strategies for new operators should focus on specialized market segments and geographic niches where established competitors have limited presence. Differentiation approaches should emphasize unique service offerings, technology integration, and customer experience innovations that create competitive advantages.

Investment Priorities should include technology platform development, fleet modernization, and staff training programs that enhance operational capabilities and service quality. Strategic partnerships with complementary service providers can accelerate market penetration and expand service offerings without significant capital investments.

Regulatory Engagement remains critical for market participants to influence policy development and ensure operational compliance with evolving aviation regulations. Industry collaboration through trade associations and professional organizations can help shape favorable regulatory environments and industry standards.

Customer Education initiatives should focus on demonstrating charter service value propositions and addressing misconceptions about cost, complexity, and accessibility. Marketing strategies should emphasize time savings, convenience, and unique experiences that justify premium pricing compared to commercial alternatives.

Growth projections for the China chartered air transport market remain positive, with continued expansion expected across all major market segments and geographic regions. MWR forecasts indicate sustained growth momentum driven by economic development, infrastructure improvements, and evolving customer preferences toward personalized transportation solutions.

Market evolution will likely feature increased service sophistication, technology integration, and operational efficiency improvements that enhance customer value and expand market accessibility. Emerging trends include electric aircraft adoption, autonomous flight technologies, and integrated mobility solutions that combine air transport with other transportation modes.

Competitive dynamics will intensify as more operators enter the market and existing players expand their service offerings and geographic coverage. Success factors will include operational excellence, customer service quality, technology adoption, and the ability to adapt to changing market conditions and regulatory requirements.

Long-term prospects suggest the market will mature into a more sophisticated and diverse ecosystem serving multiple customer segments with specialized service offerings tailored to specific transportation needs and preferences across China’s expanding economy.

The China chartered air transport market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic expansion, infrastructure development, and changing customer preferences toward premium transportation services. Market fundamentals demonstrate strong demand across business aviation, leisure charter, and specialized cargo services, supported by China’s position as a global economic hub and the growing affluence of its population.

Key success factors for market participants include operational excellence, regulatory compliance, technology adoption, and the ability to deliver personalized service experiences that justify premium pricing. The market’s future development will depend on continued regulatory evolution, infrastructure improvements, and the industry’s ability to address challenges related to costs, complexity, and market accessibility.

Strategic opportunities exist for operators who can effectively serve emerging market segments, expand into underserved geographic regions, and develop innovative service offerings that meet evolving customer requirements. The market’s long-term prospects remain positive, positioning China’s chartered air transport sector as a significant contributor to the country’s broader aviation industry growth and economic development objectives.

What is Chartered Air Transport?

Chartered Air Transport refers to the service of hiring an entire aircraft for a specific journey, rather than purchasing individual tickets on a scheduled flight. This service is often utilized for business travel, cargo transport, and special events, providing flexibility and convenience.

What are the key players in the China Chartered Air Transport Market?

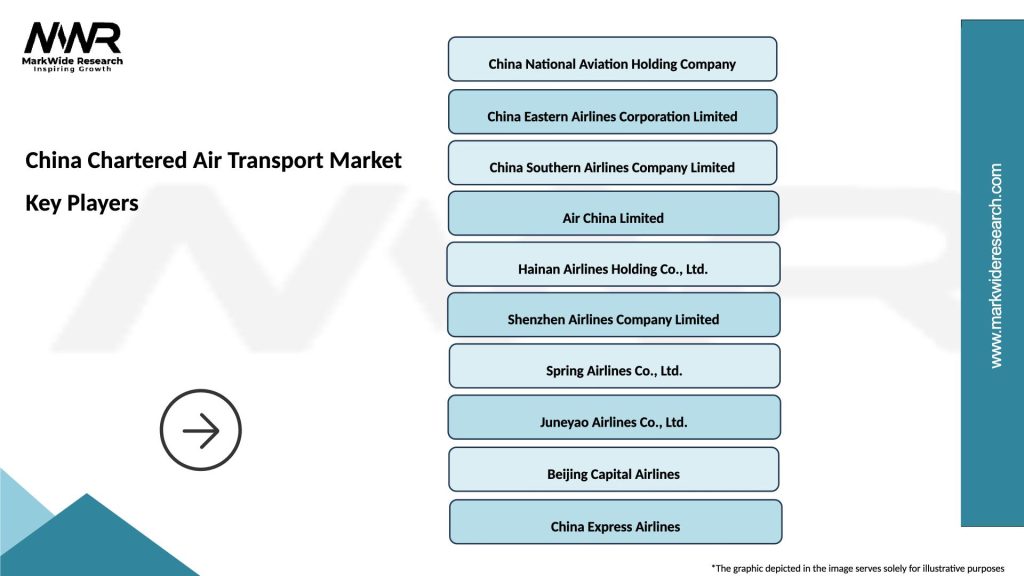

Key players in the China Chartered Air Transport Market include companies like Deer Jet, China National Aviation Holding, and HNA Group, which offer a range of charter services for both passenger and cargo transport, among others.

What are the growth factors driving the China Chartered Air Transport Market?

The growth of the China Chartered Air Transport Market is driven by increasing demand for business travel, the rise of e-commerce requiring expedited cargo services, and a growing preference for personalized travel experiences among affluent consumers.

What challenges does the China Chartered Air Transport Market face?

Challenges in the China Chartered Air Transport Market include regulatory hurdles, high operational costs, and competition from low-cost airlines that offer scheduled services, which can limit the appeal of chartered options.

What opportunities exist in the China Chartered Air Transport Market?

Opportunities in the China Chartered Air Transport Market include expanding services to underserved regions, increasing partnerships with luxury travel providers, and leveraging technology for enhanced customer experience and operational efficiency.

What trends are shaping the China Chartered Air Transport Market?

Trends in the China Chartered Air Transport Market include a growing emphasis on sustainability, the adoption of advanced booking technologies, and an increase in demand for private jets as a response to health and safety concerns.

China Chartered Air Transport Market

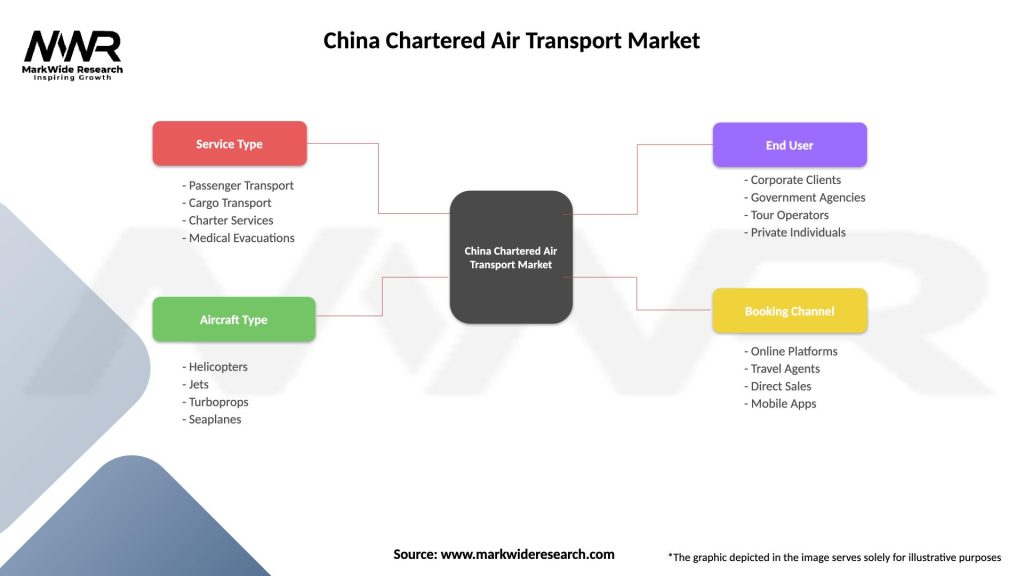

| Segmentation Details | Description |

|---|---|

| Service Type | Passenger Transport, Cargo Transport, Charter Services, Medical Evacuations |

| Aircraft Type | Helicopters, Jets, Turboprops, Seaplanes |

| End User | Corporate Clients, Government Agencies, Tour Operators, Private Individuals |

| Booking Channel | Online Platforms, Travel Agents, Direct Sales, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Chartered Air Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at