444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China ceramic market represents one of the most dynamic and influential segments within the global ceramics industry, demonstrating remarkable resilience and continuous innovation across multiple applications. China’s ceramic industry has evolved from traditional pottery manufacturing to sophisticated advanced ceramic production, encompassing everything from construction materials to high-tech electronic components. The market benefits from the country’s abundant raw material resources, established manufacturing infrastructure, and growing domestic consumption patterns.

Market growth in China’s ceramic sector has been driven by rapid urbanization, infrastructure development, and increasing consumer preferences for premium ceramic products. The industry encompasses various segments including construction ceramics, industrial ceramics, electronic ceramics, and decorative ceramics, each contributing to the overall market expansion. Recent data indicates the market is experiencing a compound annual growth rate of 6.2%, reflecting strong demand across both domestic and international markets.

Regional distribution shows significant concentration in traditional ceramic manufacturing hubs such as Guangdong, Jiangxi, and Shandong provinces, where established supply chains and skilled workforce contribute to production efficiency. The market’s competitive landscape features both large-scale manufacturers and specialized producers, creating a diverse ecosystem that serves various customer segments from budget-conscious consumers to premium market buyers.

The China ceramic market refers to the comprehensive ecosystem of ceramic product manufacturing, distribution, and consumption within China’s borders, encompassing traditional pottery, construction tiles, advanced technical ceramics, and decorative ceramic items. This market includes the entire value chain from raw material extraction and processing to finished product manufacturing and retail distribution across various application sectors.

Ceramic products in this context span multiple categories including building ceramics such as floor and wall tiles, sanitary ceramics including bathroom fixtures, industrial ceramics for manufacturing applications, electronic ceramics for technology components, and artistic ceramics for decorative purposes. The market encompasses both traditional manufacturing techniques passed down through generations and modern automated production processes utilizing advanced kiln technologies and quality control systems.

Market scope extends beyond domestic consumption to include significant export activities, positioning China as a major global supplier of ceramic products. The definition also includes supporting industries such as ceramic machinery manufacturing, raw material supply, glazing and decoration services, and ceramic design and development services that collectively contribute to the market’s comprehensive structure.

China’s ceramic market stands as a cornerstone of the global ceramics industry, characterized by robust production capabilities, diverse product portfolios, and strong domestic demand fundamentals. The market has demonstrated consistent growth patterns driven by urbanization trends, infrastructure investments, and evolving consumer preferences toward premium ceramic products across residential and commercial applications.

Key market drivers include China’s continued urban development, rising disposable incomes, and increasing adoption of ceramic materials in advanced manufacturing applications. The construction sector remains the largest consumer segment, accounting for approximately 68% of total ceramic consumption, while industrial and electronic applications represent rapidly growing segments with significant future potential.

Technological advancement has emerged as a critical differentiator, with manufacturers investing heavily in automated production lines, energy-efficient kilns, and advanced glazing technologies. The market benefits from government support for environmental sustainability initiatives, driving adoption of cleaner production methods and eco-friendly ceramic formulations that meet increasingly stringent environmental regulations.

Export performance remains strong, with Chinese ceramic products maintaining competitive advantages in international markets through cost efficiency, product variety, and established distribution networks. Domestic market maturation has prompted manufacturers to focus on value-added products and premium segments, creating opportunities for innovation and brand development initiatives.

Market segmentation reveals distinct growth patterns across different ceramic categories, with construction ceramics maintaining dominant market share while technical ceramics demonstrate the highest growth rates. The following key insights characterize the current market landscape:

Market dynamics indicate strong correlation between economic growth and ceramic consumption, with residential construction and commercial development projects serving as primary demand drivers. The industry’s evolution toward higher value-added products reflects maturing market conditions and increasing competition from international suppliers.

Urbanization acceleration continues to serve as the primary driver for China’s ceramic market, with millions of people migrating from rural to urban areas annually, creating sustained demand for residential and commercial construction projects. This demographic shift necessitates extensive infrastructure development, including housing, commercial buildings, and public facilities, all requiring significant ceramic material inputs for flooring, wall coverings, and sanitary applications.

Infrastructure investment programs initiated by the Chinese government have created substantial demand for construction ceramics, particularly in transportation, healthcare, and educational facility development. These large-scale projects typically specify high-quality ceramic materials that meet stringent durability and aesthetic requirements, driving demand for premium product categories and encouraging manufacturer innovation in performance characteristics.

Rising disposable income among Chinese consumers has led to increased spending on home improvement and renovation projects, with ceramic tiles and decorative ceramics benefiting from this trend. Consumers are increasingly willing to invest in premium ceramic products that offer superior aesthetics, durability, and brand recognition, creating opportunities for manufacturers to develop higher-margin product lines.

Industrial modernization initiatives across various manufacturing sectors have increased demand for technical ceramics used in machinery, electronics, and automotive applications. Advanced ceramic materials offer superior performance characteristics compared to traditional materials, including higher temperature resistance, better electrical insulation properties, and enhanced chemical stability, making them essential for modern manufacturing processes.

Environmental regulations have paradoxically become market drivers by encouraging adoption of ceramic materials as environmentally friendly alternatives to other construction materials. Ceramics offer advantages including recyclability, low maintenance requirements, and absence of volatile organic compounds, aligning with China’s environmental protection goals and consumer preferences for sustainable products.

Raw material costs represent a significant constraint for ceramic manufacturers, with prices of key inputs including clay, feldspar, and silica subject to volatility based on mining regulations, transportation costs, and supply-demand dynamics. These cost fluctuations directly impact manufacturing margins and can force producers to adjust pricing strategies, potentially affecting market competitiveness and consumer demand patterns.

Environmental compliance requirements have intensified operational challenges for ceramic manufacturers, with stricter emissions standards, waste disposal regulations, and energy efficiency mandates increasing production costs. Many facilities require substantial investments in pollution control equipment, cleaner production technologies, and environmental monitoring systems to maintain regulatory compliance, creating financial pressure particularly for smaller manufacturers.

Energy costs constitute a major operational expense for ceramic production due to high-temperature firing processes required for ceramic manufacturing. Fluctuating energy prices, particularly for natural gas and electricity, can significantly impact production economics and force manufacturers to implement energy conservation measures or pass costs to consumers through higher product prices.

Market saturation in certain segments, particularly basic construction ceramics, has intensified price competition and reduced profit margins for manufacturers. The proliferation of production capacity has led to oversupply conditions in some product categories, forcing companies to compete primarily on price rather than product differentiation or innovation.

International trade tensions and changing export regulations have created uncertainty for ceramic manufacturers heavily dependent on export markets. Tariffs, trade restrictions, and changing international standards can disrupt established export relationships and require manufacturers to adapt their market strategies and product specifications to maintain international competitiveness.

Smart building integration presents significant opportunities for ceramic manufacturers to develop products incorporating advanced technologies such as self-cleaning surfaces, antimicrobial properties, and integrated heating elements. These innovative ceramic solutions address growing consumer demand for intelligent building materials that enhance comfort, hygiene, and energy efficiency in residential and commercial applications.

Export market expansion offers substantial growth potential, particularly in emerging markets across Southeast Asia, Africa, and Latin America where infrastructure development is accelerating. Chinese ceramic manufacturers can leverage their cost advantages, production capacity, and product variety to capture market share in these developing regions while establishing long-term distribution partnerships.

Premium segment development represents a lucrative opportunity as Chinese consumers increasingly seek high-quality, designer ceramic products for luxury residential and commercial projects. This trend creates space for manufacturers to develop premium brands, collaborate with international designers, and command higher profit margins through product differentiation and brand positioning strategies.

Technical ceramics growth in advanced manufacturing applications offers opportunities for manufacturers to enter high-value market segments including aerospace, medical devices, and renewable energy systems. These applications typically require specialized ceramic formulations with precise performance characteristics, creating opportunities for companies with advanced research and development capabilities.

Sustainability initiatives create opportunities for manufacturers to develop eco-friendly ceramic products and production processes that appeal to environmentally conscious consumers and meet green building certification requirements. Products featuring recycled content, reduced environmental impact, and enhanced durability can command premium pricing while supporting corporate sustainability objectives.

Supply chain evolution within China’s ceramic market reflects increasing integration between raw material suppliers, manufacturers, and distribution channels, creating more efficient operations and improved cost management. Manufacturers are establishing closer relationships with clay and mineral suppliers to ensure consistent raw material quality and pricing stability, while simultaneously developing direct relationships with major construction companies and retail chains.

Technology adoption is reshaping production processes across the ceramic industry, with manufacturers implementing automated handling systems, computer-controlled kilns, and advanced quality control technologies. These technological improvements have resulted in productivity increases of approximately 23% over recent years while simultaneously improving product consistency and reducing waste generation.

Consumer behavior shifts toward online purchasing and digital product visualization are influencing how ceramic products are marketed and sold. Manufacturers are investing in digital showrooms, augmented reality applications, and e-commerce platforms to reach consumers directly and provide enhanced product selection experiences that traditional retail channels cannot match.

Competitive intensity has increased as both domestic and international players compete for market share across various ceramic segments. This competition has driven innovation in product design, manufacturing efficiency, and customer service, ultimately benefiting consumers through improved product quality and competitive pricing structures.

Regulatory landscape continues evolving with stricter environmental standards, product safety requirements, and building code specifications affecting ceramic product development and manufacturing processes. Manufacturers must continuously adapt their operations and product formulations to meet changing regulatory requirements while maintaining cost competitiveness and product performance standards.

Primary research for analyzing China’s ceramic market involved comprehensive surveys and interviews with key industry stakeholders including manufacturers, distributors, retailers, and end-users across major ceramic production regions. This approach provided direct insights into market trends, consumer preferences, competitive dynamics, and operational challenges facing industry participants.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and company financial statements to establish market size, growth trends, and competitive positioning. Data sources included National Bureau of Statistics publications, China Building Materials Federation reports, and customs trade data to ensure comprehensive market coverage and statistical accuracy.

Market segmentation analysis utilized both quantitative and qualitative research methods to identify distinct product categories, application segments, and regional variations within China’s ceramic market. This segmentation approach enabled detailed understanding of growth drivers, competitive dynamics, and opportunity areas across different market segments.

Expert consultation involved discussions with industry experts, technology specialists, and market analysts to validate research findings and gain insights into future market developments. These consultations provided valuable perspectives on technological trends, regulatory changes, and strategic considerations affecting market participants.

Data validation processes included cross-referencing multiple data sources, conducting consistency checks, and applying statistical analysis techniques to ensure research accuracy and reliability. This rigorous validation approach supports confident market analysis and strategic decision-making for industry stakeholders.

Guangdong Province maintains its position as China’s leading ceramic production region, accounting for approximately 35% of national ceramic output through its concentration of advanced manufacturing facilities and established supply chains. The region benefits from proximity to major ports, enabling efficient export operations, while also serving the substantial domestic market in southern China’s rapidly developing urban centers.

Jiangxi Province represents the traditional heart of Chinese ceramic production, leveraging abundant kaolin clay deposits and centuries of ceramic manufacturing expertise. The region specializes in both traditional pottery and modern ceramic tiles, with production facilities ranging from artisanal workshops to large-scale automated plants serving diverse market segments.

Shandong Province has emerged as a significant ceramic production center, particularly for construction ceramics and industrial applications. The region’s strategic location provides access to both domestic and international markets, while local government support for industrial development has attracted substantial investment in modern ceramic manufacturing facilities.

Eastern China regions including Jiangsu and Zhejiang provinces contribute significantly to ceramic production, particularly in technical ceramics and premium decorative products. These areas benefit from proximity to major consumer markets, advanced transportation infrastructure, and access to skilled workforce with technical expertise in ceramic manufacturing.

Regional specialization patterns have developed across China’s ceramic industry, with different provinces focusing on specific product categories based on local advantages including raw material availability, manufacturing expertise, and market access. This specialization has created efficient production clusters that serve both domestic and international markets effectively.

Market leadership in China’s ceramic industry is distributed among several major manufacturers, each with distinct competitive advantages and market positioning strategies. The competitive landscape includes both large integrated manufacturers and specialized producers focusing on specific product categories or market segments.

Competitive strategies vary significantly across market participants, with some companies focusing on cost leadership through operational efficiency and scale advantages, while others pursue differentiation through product innovation, brand development, and premium positioning. Many manufacturers are implementing vertical integration strategies to control supply chains and improve cost competitiveness.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to achieve greater scale, expand geographic coverage, and access new technologies or market segments. This consolidation is creating larger, more competitive entities capable of investing in advanced manufacturing technologies and international expansion initiatives.

By Product Type: China’s ceramic market encompasses diverse product categories, each serving specific applications and customer requirements. Construction ceramics including floor tiles, wall tiles, and roofing materials represent the largest segment, driven by ongoing urbanization and infrastructure development. Sanitary ceramics covering bathroom fixtures and plumbing components constitute another significant segment, while industrial ceramics for manufacturing applications and decorative ceramics for artistic purposes complete the major product categories.

By Application: Market segmentation by application reveals residential construction as the dominant demand driver, accounting for substantial ceramic consumption in housing projects across urban and suburban areas. Commercial construction including office buildings, retail spaces, and hospitality facilities represents another major application segment. Industrial applications encompass manufacturing, automotive, and electronics sectors, while infrastructure projects including transportation and public facilities contribute to overall market demand.

By Technology: Manufacturing technology segmentation distinguishes between traditional ceramic production utilizing conventional kilns and manual processes, and advanced ceramic manufacturing employing automated systems, computer-controlled firing, and precision molding techniques. Digital printing technology has emerged as a significant segment, enabling customized designs and complex patterns on ceramic surfaces.

By Distribution Channel: Market distribution occurs through multiple channels including direct manufacturer sales to large construction companies, wholesale distribution through building material dealers, retail sales via home improvement stores, and increasingly through online platforms serving both professional and consumer markets.

Construction Ceramics dominate market volume and revenue, with floor tiles representing the largest subcategory due to widespread use in residential and commercial flooring applications. Recent trends favor large-format tiles, wood-look designs, and stone-effect surfaces that provide aesthetic appeal while maintaining ceramic durability advantages. Innovation in this category focuses on improved slip resistance, stain resistance, and installation efficiency.

Sanitary Ceramics have experienced steady growth driven by bathroom renovation projects and new construction activities. Premium products featuring water-saving technologies, antimicrobial surfaces, and designer aesthetics command higher margins while meeting evolving consumer preferences for luxury bathroom fixtures. Manufacturing improvements have enhanced product consistency and reduced defect rates in this quality-sensitive category.

Technical Ceramics represent the fastest-growing category, with applications expanding across electronics, aerospace, medical devices, and renewable energy systems. These specialized products require precise formulations, controlled manufacturing processes, and stringent quality standards, creating opportunities for manufacturers with advanced technical capabilities and research and development resources.

Decorative Ceramics serve both functional and artistic purposes, with demand driven by interior design trends and cultural preferences for ceramic art objects. This category includes traditional pottery, contemporary ceramic sculptures, and functional decorative items that appeal to consumers seeking unique, handcrafted products that reflect personal style and cultural heritage.

Industrial Ceramics support manufacturing processes across various industries, providing wear resistance, chemical stability, and high-temperature performance in demanding applications. Growth in this category correlates with industrial modernization and adoption of advanced manufacturing technologies requiring specialized ceramic components and materials.

Manufacturers benefit from China’s ceramic market through access to abundant raw materials, established supply chains, and diverse customer segments spanning domestic and international markets. The market’s scale enables efficient production operations, while growing demand for premium products creates opportunities for value-added manufacturing and brand development initiatives that improve profitability and competitive positioning.

Suppliers of raw materials, equipment, and services gain from the market’s substantial scale and continuous growth, providing stable demand for clay, minerals, kiln equipment, and manufacturing technologies. Long-term relationships with ceramic manufacturers create predictable revenue streams while opportunities for innovation in materials and processes support business expansion and technological advancement.

Distributors and Retailers benefit from strong consumer demand for ceramic products across multiple market segments, enabling diverse product portfolios and multiple revenue streams. The market’s evolution toward premium products and online sales channels creates opportunities for value-added services including design consultation, installation support, and customized product offerings.

Construction Companies gain access to reliable supplies of high-quality ceramic materials that meet project specifications and delivery requirements. Long-term partnerships with ceramic manufacturers can provide cost advantages, priority allocation during high-demand periods, and access to innovative products that enhance project differentiation and customer satisfaction.

Consumers benefit from extensive product variety, competitive pricing, and continuous innovation in ceramic products that enhance living spaces and provide long-term value. The market’s competitiveness ensures access to both budget-friendly options and premium products, while quality improvements enhance product durability and performance characteristics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing ceramic manufacturing through implementation of Industry 4.0 technologies including automated production lines, predictive maintenance systems, and real-time quality monitoring. These technological advances have improved production efficiency by approximately 18% while reducing waste and enhancing product consistency across manufacturing operations.

Sustainability initiatives are driving development of eco-friendly ceramic products and manufacturing processes, with companies investing in renewable energy systems, waste reduction programs, and recycled content formulations. Consumer awareness of environmental issues is creating demand for certified sustainable ceramic products that meet green building standards and environmental certification requirements.

Design innovation trends emphasize large-format tiles, realistic surface textures, and customizable patterns that enable architects and designers to create unique aesthetic effects. Digital printing technology has enabled production of ceramic surfaces that accurately replicate natural materials including wood, stone, and fabric textures while maintaining ceramic durability advantages.

Smart ceramic development incorporates functional properties including antimicrobial surfaces, self-cleaning capabilities, and integrated heating elements that enhance product performance beyond traditional aesthetic and durability characteristics. These advanced products command premium pricing while addressing evolving consumer expectations for intelligent building materials.

E-commerce expansion is transforming ceramic product distribution, with online sales channels accounting for an increasing share of total market volume. Manufacturers are developing digital marketing strategies, virtual showrooms, and direct-to-consumer sales platforms that bypass traditional distribution channels and improve customer engagement.

Manufacturing automation initiatives across major ceramic producers have resulted in significant productivity improvements and quality enhancements. Leading manufacturers have invested heavily in robotic handling systems, automated glazing lines, and computer-controlled kilns that reduce labor requirements while improving product consistency and reducing production costs.

Research and development investments have accelerated innovation in ceramic formulations, manufacturing processes, and product applications. MarkWide Research analysis indicates that R&D spending in China’s ceramic industry has increased by 31% over recent years, focusing on advanced materials, energy efficiency, and environmental sustainability initiatives.

International expansion activities by Chinese ceramic manufacturers have intensified, with companies establishing production facilities, distribution networks, and brand presence in key overseas markets. These expansion initiatives aim to reduce dependence on domestic markets while capturing growth opportunities in emerging economies with developing construction sectors.

Strategic partnerships between ceramic manufacturers and technology companies have facilitated development of advanced manufacturing capabilities and innovative product solutions. These collaborations combine ceramic expertise with cutting-edge technologies including artificial intelligence, advanced materials science, and digital manufacturing systems.

Environmental compliance initiatives have driven substantial investments in pollution control equipment, energy-efficient production technologies, and waste reduction systems. Many manufacturers have achieved significant reductions in emissions and energy consumption while maintaining production capacity and product quality standards.

Premium positioning strategies should be prioritized by manufacturers seeking to improve profitability and reduce dependence on price-competitive market segments. Companies should invest in brand development, product innovation, and customer experience enhancements that justify premium pricing and create sustainable competitive advantages in high-value market segments.

Technology adoption represents a critical success factor for maintaining competitiveness in China’s evolving ceramic market. Manufacturers should prioritize investments in automated production systems, digital quality control technologies, and advanced kiln systems that improve efficiency while reducing environmental impact and operational costs.

Market diversification across product categories, applications, and geographic regions can reduce business risk while capturing growth opportunities in emerging market segments. Companies should evaluate expansion into technical ceramics, export markets, and specialized applications that offer higher margins and growth potential compared to traditional construction ceramics.

Sustainability integration should become a core business strategy rather than a compliance requirement, with companies developing comprehensive environmental programs that encompass product design, manufacturing processes, and supply chain management. Early adoption of sustainable practices can create competitive advantages as environmental regulations intensify and consumer preferences evolve.

Digital transformation initiatives should extend beyond manufacturing to include customer engagement, supply chain management, and business analytics capabilities. Companies should develop comprehensive digital strategies that leverage data analytics, online platforms, and customer relationship management systems to improve operational efficiency and market responsiveness.

Market growth prospects for China’s ceramic industry remain positive, supported by continued urbanization, infrastructure development, and rising consumer spending on home improvement and renovation projects. MWR projections indicate the market will maintain steady growth momentum with a compound annual growth rate of 5.8% over the next five years, driven by both domestic demand and export opportunities.

Technology evolution will continue reshaping the ceramic industry through adoption of advanced manufacturing systems, artificial intelligence applications, and sustainable production technologies. These technological advances will enable manufacturers to improve product quality, reduce costs, and develop innovative ceramic solutions for emerging applications in electronics, aerospace, and renewable energy sectors.

Consumer preferences are expected to increasingly favor premium ceramic products with enhanced aesthetics, performance characteristics, and environmental credentials. This trend will create opportunities for manufacturers to develop value-added products and premium brands while reducing dependence on commodity market segments with intense price competition.

International expansion will become increasingly important as domestic market growth moderates and manufacturers seek new revenue sources. Chinese ceramic companies are expected to increase investments in overseas production facilities, distribution networks, and brand development initiatives to capture growth opportunities in emerging markets.

Regulatory environment will continue evolving toward stricter environmental standards, product safety requirements, and energy efficiency mandates. Manufacturers that proactively invest in compliance capabilities and sustainable practices will gain competitive advantages while those that delay adaptation may face operational challenges and market access restrictions.

China’s ceramic market represents a dynamic and evolving industry landscape characterized by substantial production capacity, diverse product offerings, and strong growth fundamentals driven by urbanization, infrastructure development, and rising consumer preferences for premium ceramic products. The market’s competitive structure includes both large-scale manufacturers and specialized producers, creating a diverse ecosystem that serves multiple customer segments across domestic and international markets.

Strategic opportunities exist for market participants willing to invest in technology advancement, premium product development, and sustainable manufacturing practices that align with evolving regulatory requirements and consumer expectations. The industry’s future success will depend on manufacturers’ ability to balance cost competitiveness with innovation, quality, and environmental responsibility while adapting to changing market dynamics and competitive pressures.

Market outlook remains positive despite challenges including environmental compliance costs, raw material price volatility, and international competition. Companies that successfully navigate these challenges while capitalizing on growth opportunities in premium segments, technical ceramics, and international markets are positioned to achieve sustainable competitive advantages and long-term business success in China’s evolving ceramic industry landscape.

What is Ceramic?

Ceramic refers to a wide range of inorganic, non-metallic materials that are typically made from clay and other raw materials. These materials are known for their durability, heat resistance, and aesthetic appeal, making them popular in various applications such as pottery, tiles, and sanitary ware.

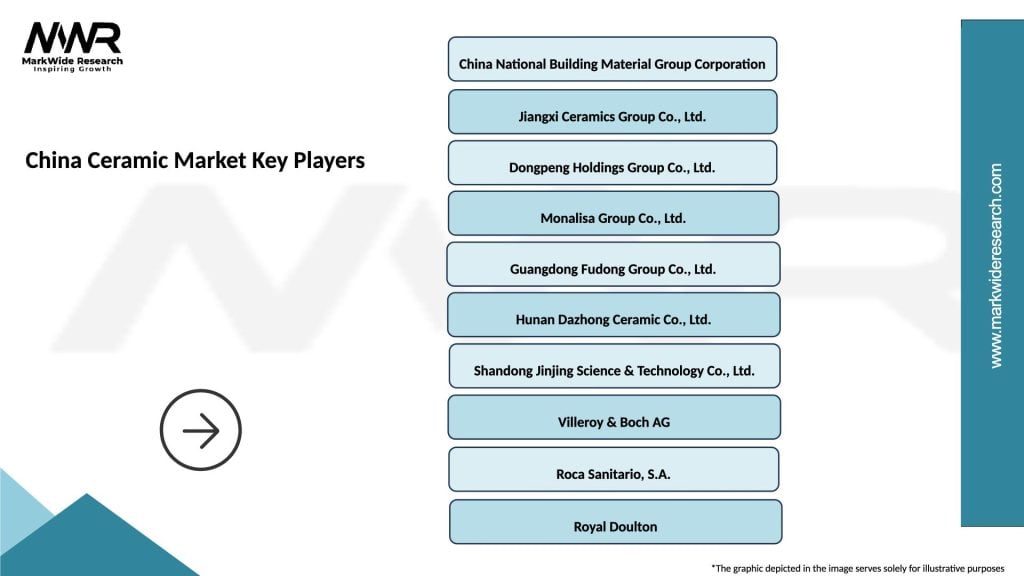

What are the key players in the China Ceramic Market?

Key players in the China Ceramic Market include companies like China National Building Material Group Corporation, Dongpeng Holdings, and Huida Sanitary Ware, among others. These companies are involved in the production and distribution of various ceramic products, catering to both domestic and international markets.

What are the growth factors driving the China Ceramic Market?

The growth of the China Ceramic Market is driven by increasing urbanization, rising demand for construction materials, and the growing popularity of ceramic tiles in interior design. Additionally, advancements in manufacturing technologies are enhancing product quality and variety.

What challenges does the China Ceramic Market face?

The China Ceramic Market faces challenges such as environmental regulations, high energy consumption during production, and competition from alternative materials. These factors can impact production costs and market dynamics.

What opportunities exist in the China Ceramic Market?

Opportunities in the China Ceramic Market include the growing demand for eco-friendly and sustainable ceramic products, innovations in design and technology, and the expansion of e-commerce platforms for ceramic sales. These trends are likely to shape the future of the market.

What trends are currently shaping the China Ceramic Market?

Current trends in the China Ceramic Market include the increasing use of digital technologies in manufacturing, the rise of customized ceramic products, and a shift towards sustainable practices. These trends are influencing consumer preferences and production methods.

China Ceramic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tableware, Tiles, Sanitary Ware, Decorative Items |

| Application | Residential, Commercial, Industrial, Hospitality |

| End User | Contractors, Retailers, Manufacturers, Designers |

| Distribution Channel | Online, Direct Sales, Wholesalers, Showrooms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Ceramic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at