444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China car insurance market represents one of the most dynamic and rapidly evolving automotive insurance sectors globally. With the world’s largest automotive market driving unprecedented demand for comprehensive insurance coverage, China’s car insurance landscape has experienced remarkable transformation over the past decade. The market demonstrates robust growth patterns, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% through the forecast period, driven by increasing vehicle ownership, regulatory reforms, and technological innovation.

Digital transformation has become a cornerstone of market evolution, with insurtech companies and traditional insurers alike investing heavily in artificial intelligence, telematics, and mobile-first customer experiences. The penetration rate of comprehensive car insurance coverage has reached approximately 78% of all registered vehicles, indicating substantial market maturity while highlighting opportunities for further expansion in underserved segments.

Regulatory developments continue to shape market dynamics, with the China Banking and Insurance Regulatory Commission implementing progressive reforms to enhance consumer protection, promote fair competition, and encourage innovation. These regulatory changes have fostered a more competitive environment, leading to improved product offerings and more competitive pricing structures across the market.

The China car insurance market refers to the comprehensive ecosystem of automotive insurance products, services, and regulatory frameworks operating within the People’s Republic of China. This market encompasses mandatory traffic accident liability insurance, commercial vehicle insurance, and supplementary coverage options designed to protect vehicle owners against financial losses from accidents, theft, natural disasters, and third-party liabilities.

Market participants include state-owned insurance companies, private insurers, foreign joint ventures, and emerging insurtech platforms that collectively serve millions of vehicle owners across urban and rural markets. The sector operates under strict regulatory oversight while embracing technological innovation to enhance customer experience, streamline claims processing, and develop risk assessment capabilities.

Product diversity within the market ranges from basic compulsory insurance to comprehensive coverage packages that include collision protection, theft insurance, natural disaster coverage, and specialized products for commercial fleets, luxury vehicles, and new energy vehicles.

Market leadership in China’s car insurance sector remains concentrated among major state-owned enterprises and established private insurers, though digital-native companies are gaining significant traction through innovative product offerings and superior customer experiences. The competitive landscape reflects a balance between traditional insurance expertise and technological innovation, creating opportunities for both established players and new market entrants.

Consumer behavior patterns indicate increasing sophistication in insurance purchasing decisions, with buyers demonstrating greater awareness of coverage options, pricing transparency, and service quality expectations. Digital channels now account for over 65% of new policy acquisitions, reflecting the market’s rapid digital transformation and changing consumer preferences.

Regulatory support for market development continues through policies promoting fair competition, consumer protection, and technological innovation. Recent reforms have simplified product approval processes, enhanced pricing flexibility, and encouraged the development of usage-based insurance products that align premiums with actual driving behavior and risk profiles.

Technological integration has emerged as a primary differentiator among market participants, with leading insurers implementing advanced analytics, artificial intelligence, and Internet of Things (IoT) solutions to enhance underwriting accuracy, streamline operations, and improve customer satisfaction. These technological investments are generating measurable improvements in claims processing efficiency and risk assessment capabilities.

Market segmentation reveals distinct growth patterns across different vehicle categories and geographic regions:

Customer expectations continue evolving toward seamless digital experiences, transparent pricing, rapid claims settlement, and personalized service delivery, driving insurers to invest in customer-centric technology platforms and service capabilities.

Vehicle ownership growth remains the fundamental driver of market expansion, with China’s automotive market continuing to demonstrate resilience despite economic uncertainties. Rising disposable incomes, urbanization trends, and improved transportation infrastructure contribute to sustained demand for personal and commercial vehicles, directly translating to increased insurance requirements.

Regulatory mandates ensure consistent demand for basic coverage while encouraging the development of comprehensive insurance products. The mandatory nature of traffic accident liability insurance provides a stable foundation for market growth, while regulatory support for innovative products creates opportunities for premium expansion and customer value enhancement.

Digital transformation initiatives across the insurance industry are improving operational efficiency, reducing costs, and enhancing customer experiences. These technological advances enable insurers to offer more competitive pricing, faster service delivery, and personalized products that better meet individual customer needs and risk profiles.

Economic development in emerging markets and rural areas is expanding the addressable market for car insurance products. As economic prosperity spreads beyond major metropolitan areas, vehicle ownership rates increase, creating new customer segments and geographic expansion opportunities for insurance providers.

Intense price competition among market participants has compressed profit margins and created challenges for sustainable business model development. The commoditization of basic insurance products has forced insurers to compete primarily on price, limiting their ability to invest in service improvements and product innovation.

Regulatory complexity and frequent policy changes create operational challenges for insurance companies, requiring continuous adaptation of business processes, product offerings, and compliance procedures. These regulatory requirements can slow product development cycles and increase operational costs for market participants.

Fraud and claims inflation continue to impact industry profitability, with sophisticated fraud schemes and rising repair costs putting pressure on loss ratios. Insurers must invest significantly in fraud detection technology and claims management systems to maintain profitability while providing fair claim settlements.

Economic uncertainties and changing consumer spending patterns can affect demand for comprehensive insurance coverage, particularly during economic downturns when consumers may opt for minimum required coverage rather than comprehensive protection packages.

New energy vehicle insurance represents a significant growth opportunity as China leads global electric vehicle adoption. These vehicles require specialized insurance products addressing unique risks such as battery damage, charging infrastructure liability, and technology-specific coverage needs, creating opportunities for product innovation and premium growth.

Insurtech partnerships offer traditional insurers opportunities to leverage cutting-edge technology, data analytics, and digital customer engagement capabilities without requiring massive internal technology investments. These collaborations can accelerate digital transformation and improve competitive positioning in the market.

Usage-based insurance products present opportunities to better align premiums with actual risk exposure while appealing to safety-conscious consumers seeking fair pricing based on their driving behavior. Telematics technology enables insurers to offer personalized pricing and risk management services that create value for both insurers and policyholders.

Cross-selling opportunities within broader financial services ecosystems allow car insurance providers to expand customer relationships and increase lifetime value through integrated product offerings including life insurance, property insurance, and financial services products.

Competitive intensity continues to shape market dynamics, with established insurers defending market share while new entrants seek to differentiate through innovative products, superior customer experience, and competitive pricing strategies. This competition drives continuous improvement in service quality and operational efficiency across the industry.

Technology adoption rates vary significantly among market participants, creating opportunities for technology leaders to gain competitive advantages through superior customer experiences, more accurate risk assessment, and operational efficiency improvements. Digital transformation initiatives are reshaping traditional insurance value chains and customer interaction models.

Consumer behavior evolution toward digital-first interactions and personalized service expectations is forcing insurers to reimagine their customer engagement strategies. Companies that successfully adapt to these changing preferences gain significant advantages in customer acquisition and retention.

Regulatory evolution continues to influence market structure and competitive dynamics, with recent reforms promoting greater competition while maintaining consumer protection standards. These regulatory changes create both challenges and opportunities for market participants seeking to optimize their strategic positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive surveys of insurance industry executives, customer interviews, and expert consultations with regulatory officials and technology providers serving the car insurance sector.

Secondary research encompasses analysis of regulatory filings, company financial reports, industry publications, and government statistical data to validate market trends and quantify market dynamics. This approach ensures comprehensive coverage of market factors influencing industry development and competitive positioning.

Data validation processes include cross-referencing multiple data sources, conducting expert interviews, and applying statistical analysis techniques to ensure research findings accurately reflect market realities. Quality assurance measures maintain high standards for data accuracy and analytical rigor throughout the research process.

Market modeling techniques incorporate econometric analysis, trend extrapolation, and scenario planning to develop reliable market projections and identify key factors driving future market development. These analytical approaches provide robust foundations for strategic decision-making and market planning initiatives.

Eastern China dominates the car insurance market, accounting for approximately 45% of total market activity, driven by high vehicle ownership rates, affluent consumer demographics, and mature insurance infrastructure. Major metropolitan areas including Shanghai, Beijing, and Guangzhou represent the most competitive and sophisticated market segments with premium product offerings and advanced service capabilities.

Central China regions demonstrate robust growth potential, with expanding middle-class populations and increasing vehicle ownership rates creating new opportunities for insurance market expansion. These markets typically show strong demand for value-oriented insurance products with comprehensive coverage options at competitive price points.

Western China represents an emerging market opportunity with significant untapped potential as economic development and infrastructure improvements drive increased vehicle ownership. Rural and semi-urban areas in these regions require tailored product offerings and distribution strategies adapted to local market conditions and consumer preferences.

Northern China markets show distinct seasonal patterns and risk profiles related to weather conditions and driving environments. Insurance providers in these regions must adapt their product offerings and pricing strategies to account for regional risk factors while capitalizing on strong economic growth and urbanization trends.

Market leadership remains concentrated among several key players who have established strong competitive positions through comprehensive product portfolios, extensive distribution networks, and superior customer service capabilities. The competitive environment reflects a balance between traditional insurance expertise and innovative technology adoption.

Emerging competitors include insurtech companies and digital-native insurers that leverage technology advantages to offer innovative products and superior customer experiences. These new entrants are driving industry innovation and forcing established players to accelerate their digital transformation initiatives.

By Coverage Type: The market segments into mandatory traffic accident liability insurance, commercial comprehensive coverage, theft insurance, natural disaster protection, and specialized coverage for luxury and commercial vehicles. Each segment demonstrates distinct growth patterns and customer preferences that influence product development and marketing strategies.

By Vehicle Type: Segmentation includes passenger cars, commercial vehicles, motorcycles, and new energy vehicles, with each category requiring tailored insurance products addressing specific risk profiles and customer needs. The new energy vehicle segment shows particularly strong growth potential as electric vehicle adoption accelerates.

By Distribution Channel: Traditional agent networks, direct sales, online platforms, and mobile applications represent the primary distribution channels, with digital channels gaining market share rapidly. Insurance companies are investing heavily in omnichannel distribution strategies to meet diverse customer preferences and optimize market reach.

By Customer Segment: Individual consumers, small businesses, commercial fleets, and government entities represent distinct market segments with unique insurance requirements and purchasing behaviors. Each segment requires specialized product offerings and service approaches to maximize customer satisfaction and business profitability.

Mandatory Insurance: Traffic accident liability insurance represents the foundation of the market, providing stable revenue streams while serving as an entry point for comprehensive coverage upselling. This category demonstrates consistent demand growth aligned with vehicle registration trends and regulatory compliance requirements.

Comprehensive Coverage: Voluntary comprehensive insurance products show strong growth potential, particularly among affluent consumers and commercial fleet operators seeking complete protection against various risks. Product innovation in this category focuses on personalized coverage options and value-added services.

Specialty Products: Niche insurance products for luxury vehicles, classic cars, and specialized commercial applications represent high-margin opportunities for insurers with expertise in risk assessment and claims management for unique vehicle categories.

Usage-Based Insurance: Telematics-enabled products that adjust premiums based on driving behavior and vehicle usage patterns are gaining traction among safety-conscious consumers and fleet operators seeking cost optimization through risk management.

Insurance Companies benefit from expanding market opportunities, technological advancement capabilities, and regulatory support for innovation. The growing market provides multiple avenues for revenue growth, customer base expansion, and profitability improvement through operational efficiency gains and product diversification strategies.

Consumers gain access to increasingly sophisticated insurance products, competitive pricing, and improved service delivery through digital transformation initiatives. Enhanced product transparency, faster claims processing, and personalized coverage options create significant value for policyholders across all market segments.

Technology Providers find substantial opportunities to support industry digital transformation through advanced analytics, artificial intelligence, IoT solutions, and mobile platform development. The insurance industry’s technology adoption creates sustained demand for innovative solutions and services.

Regulatory Authorities achieve improved market oversight, consumer protection, and industry stability through enhanced data collection, standardized reporting, and technology-enabled monitoring capabilities. Digital transformation supports regulatory objectives while promoting market development and competition.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experiences are becoming standard expectations rather than competitive differentiators, with insurers investing heavily in mobile applications, online platforms, and automated service delivery capabilities. According to MarkWide Research analysis, digital channel adoption rates have increased by over 40% in the past two years, fundamentally changing how customers interact with insurance providers.

Artificial intelligence integration is transforming underwriting processes, claims management, and customer service delivery through automated risk assessment, fraud detection, and personalized product recommendations. These technological advances enable insurers to improve accuracy while reducing operational costs and processing times.

Sustainability focus is driving demand for green insurance products that support environmental objectives while providing comprehensive coverage for new energy vehicles and environmentally conscious consumers. This trend aligns with broader societal shifts toward sustainable transportation and environmental responsibility.

Personalization trends are pushing insurers to develop customized products and services that address individual customer needs, risk profiles, and preferences. Usage-based insurance, flexible coverage options, and personalized pricing models represent key manifestations of this market trend.

Regulatory reforms have streamlined product approval processes, enhanced pricing flexibility, and promoted fair competition while maintaining consumer protection standards. Recent policy changes have created more favorable conditions for innovation and market entry, benefiting both established insurers and new market participants.

Technology partnerships between traditional insurers and fintech companies are accelerating digital transformation initiatives and enabling rapid deployment of advanced capabilities. These collaborations combine insurance expertise with technological innovation to create superior customer experiences and operational efficiency.

Product innovation continues with the introduction of usage-based insurance, parametric coverage, and specialized products for emerging vehicle technologies. Insurers are developing increasingly sophisticated products that better align with customer needs and risk profiles while supporting business profitability objectives.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures that strengthen competitive positions and expand market reach. These developments are reshaping the competitive landscape while creating opportunities for operational synergies and enhanced customer value propositions.

Technology investment should remain a top priority for insurance companies seeking to maintain competitive relevance in an increasingly digital marketplace. Companies that fail to invest adequately in digital transformation risk losing market share to more technologically advanced competitors.

Customer experience optimization requires continuous focus on service quality, response times, and digital interaction capabilities. Insurers should prioritize investments in customer-facing technology and service delivery processes to meet evolving customer expectations and maintain competitive differentiation.

Risk management capabilities must evolve to address emerging risks associated with new vehicle technologies, changing driving patterns, and evolving fraud schemes. Advanced analytics and artificial intelligence can enhance risk assessment accuracy while supporting profitable growth initiatives.

Strategic partnerships with technology providers, automotive manufacturers, and other ecosystem participants can accelerate innovation and market expansion while sharing development costs and risks. Collaborative approaches often deliver superior results compared to purely internal development initiatives.

Market growth projections indicate sustained expansion driven by continued vehicle ownership growth, regulatory support, and technological innovation. MWR forecasts suggest the market will maintain robust growth momentum with annual growth rates exceeding 8% through the medium-term forecast period, supported by favorable demographic and economic trends.

Technology integration will continue reshaping industry operations, customer interactions, and product development processes. Artificial intelligence, machine learning, and IoT technologies will become increasingly central to insurance company operations and competitive strategies.

Product evolution toward more personalized, flexible, and technology-enabled offerings will accelerate as customer expectations continue rising and competitive pressures intensify. Usage-based insurance and parametric products will gain broader market acceptance and adoption.

Market structure may experience continued evolution through consolidation, new market entry, and strategic partnership formation. The competitive landscape will likely become more diverse while maintaining intense competition across all market segments and customer categories.

The China car insurance market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, regulatory support, and technological innovation. Market participants who successfully navigate competitive challenges while investing in digital transformation and customer experience optimization are positioned to capture significant opportunities in this expanding market.

Strategic success in this market requires balancing traditional insurance expertise with innovative technology adoption, customer-centric service delivery, and adaptive business model development. Companies that achieve this balance while maintaining operational efficiency and risk management discipline will likely emerge as market leaders in the evolving competitive landscape.

Future market development will be shaped by continued technological advancement, regulatory evolution, and changing consumer preferences toward digital-first experiences and personalized products. The market outlook remains positive for participants who embrace change while maintaining focus on fundamental insurance principles and customer value creation.

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents involving the vehicle. It typically covers various aspects such as property damage, medical expenses, and theft.

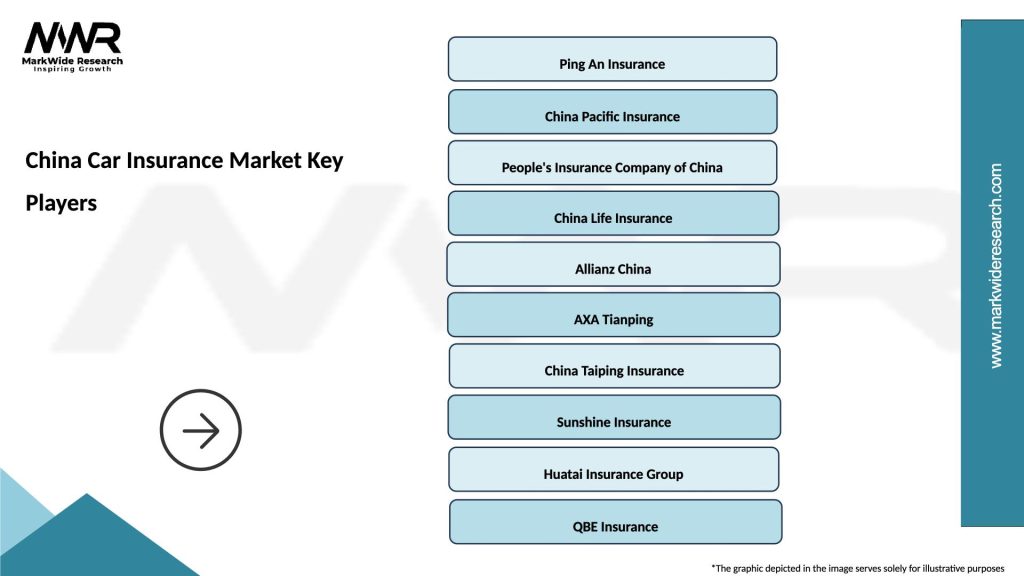

What are the key players in the China Car Insurance Market?

Key players in the China Car Insurance Market include Ping An Insurance, China Pacific Insurance, and China Life Insurance, among others. These companies offer a range of car insurance products tailored to meet the needs of consumers in the region.

What are the growth factors driving the China Car Insurance Market?

The growth of the China Car Insurance Market is driven by increasing vehicle ownership, rising awareness of insurance benefits, and the expansion of online insurance platforms. Additionally, government regulations promoting mandatory insurance coverage contribute to market growth.

What challenges does the China Car Insurance Market face?

The China Car Insurance Market faces challenges such as intense competition among insurers, regulatory changes, and the need for technological advancements in claims processing. These factors can impact profitability and customer satisfaction.

What opportunities exist in the China Car Insurance Market?

Opportunities in the China Car Insurance Market include the growing demand for personalized insurance products, the integration of telematics for premium pricing, and the potential for expansion into underserved regions. Insurers can leverage these trends to enhance their offerings.

What trends are shaping the China Car Insurance Market?

Trends shaping the China Car Insurance Market include the rise of digital insurance solutions, increased focus on customer experience, and the adoption of artificial intelligence for risk assessment. These innovations are transforming how insurance products are developed and delivered.

China Car Insurance Market

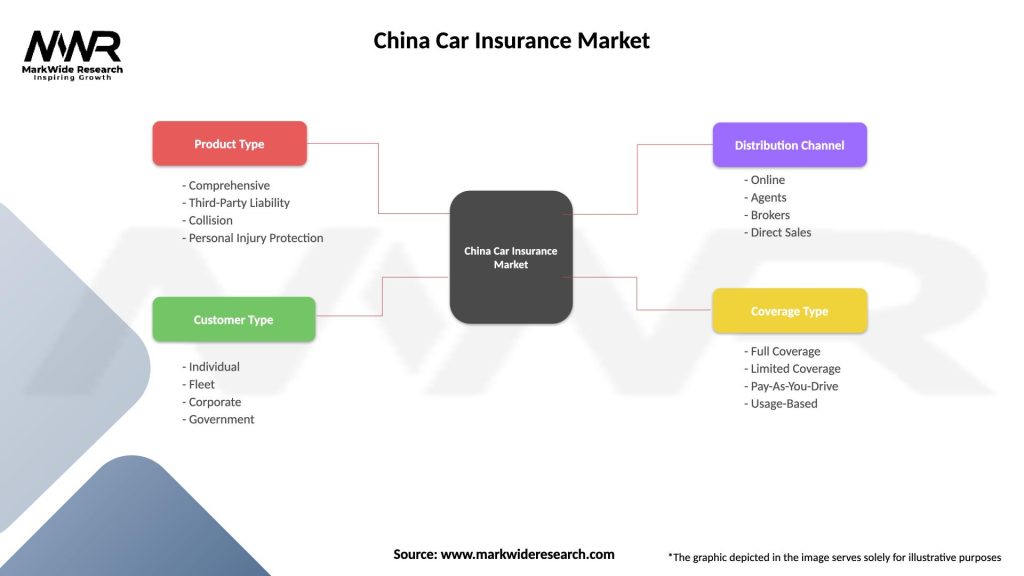

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Third-Party Liability, Collision, Personal Injury Protection |

| Customer Type | Individual, Fleet, Corporate, Government |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

| Coverage Type | Full Coverage, Limited Coverage, Pay-As-You-Drive, Usage-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at