444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China cakes, pastries, and sweet pies market represents one of the most dynamic and rapidly evolving segments within the country’s expansive food and beverage industry. This thriving market encompasses traditional Chinese confections alongside Western-style baked goods, creating a unique fusion that appeals to diverse consumer preferences across urban and rural regions. Market growth has been particularly robust, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years, driven by increasing disposable income, urbanization trends, and evolving consumer tastes.

Consumer demand for premium baked goods has intensified significantly, with millennials and Gen Z demographics leading the charge toward artisanal and specialty products. The market landscape features a compelling blend of international bakery chains, domestic brands, and local artisanal producers, each contributing to the sector’s remarkable diversity. E-commerce penetration has reached approximately 35% of total sales, reflecting the digital transformation of consumer purchasing behaviors and the growing importance of online retail channels.

Regional variations play a crucial role in market dynamics, with tier-one cities demonstrating higher consumption rates and preference for premium products, while tier-two and tier-three cities show increasing adoption of Western-style baked goods. The integration of traditional Chinese flavors with modern baking techniques has created innovative product categories that resonate strongly with local consumers while maintaining broad market appeal.

The China cakes, pastries, and sweet pies market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and retail of sweet baked goods throughout mainland China, including traditional Chinese confections, Western-style cakes, artisanal pastries, and various sweet pie varieties that cater to diverse consumer preferences and cultural tastes.

Market scope extends beyond simple baked goods to include specialty items such as mooncakes, egg tarts, Swiss rolls, cheesecakes, croissants, and innovative fusion products that blend Eastern and Western culinary traditions. The sector encompasses multiple distribution channels, from traditional bakeries and specialty shops to modern retail chains, online platforms, and food service establishments.

Product categories within this market include celebration cakes for special occasions, daily consumption pastries, seasonal specialties, health-conscious alternatives, and premium artisanal offerings. The market also encompasses related services such as custom cake decoration, corporate catering, and subscription-based delivery models that enhance consumer convenience and accessibility.

Market dynamics in China’s cakes, pastries, and sweet pies sector reflect a sophisticated consumer base increasingly drawn to quality, innovation, and convenience. The market has demonstrated remarkable resilience and adaptability, particularly during challenging economic periods, with online sales growth accelerating by 42% as consumers embraced digital purchasing channels and home delivery services.

Key market drivers include rising urbanization rates, growing middle-class population, increased celebration culture, and the influence of social media on food trends. Western-style bakery concepts have gained significant traction, while traditional Chinese confections continue to maintain strong cultural relevance, creating a balanced market ecosystem that serves diverse consumer segments.

Competitive landscape features both international brands establishing strong footholds and domestic companies leveraging local market knowledge and cultural preferences. Innovation remains paramount, with manufacturers investing heavily in product development, packaging improvements, and supply chain optimization to meet evolving consumer expectations and maintain competitive advantages.

Future prospects appear highly favorable, with market expansion expected to continue driven by demographic trends, technological advancement, and increasing consumer sophistication. The integration of health-conscious ingredients and sustainable practices represents emerging opportunities for market participants seeking long-term growth and differentiation.

Consumer behavior analysis reveals several critical insights that shape market development and strategic positioning. The following key insights provide comprehensive understanding of market dynamics:

Economic prosperity serves as the fundamental driver propelling market expansion, with China’s growing middle class demonstrating increased spending power and willingness to invest in premium food experiences. Rising disposable income levels enable consumers to explore diverse product categories and embrace higher-quality offerings that were previously considered luxury items.

Urbanization trends significantly impact market dynamics, as city dwellers adopt Western lifestyle patterns and consumption habits. Urban environments provide greater access to international bakery chains and specialty stores, while also fostering appreciation for convenience foods that align with fast-paced metropolitan lifestyles. The concentration of young professionals in urban centers creates substantial demand for grab-and-go pastries and celebration cakes.

Cultural evolution plays a crucial role in market development, with younger generations embracing Western celebration traditions while maintaining connections to Chinese cultural practices. Birthday parties, wedding celebrations, and corporate events increasingly feature elaborate cakes and pastries, expanding market opportunities beyond traditional consumption occasions.

Digital transformation accelerates market growth through enhanced accessibility and convenience. E-commerce platforms, mobile applications, and social media marketing enable bakeries to reach broader audiences while providing consumers with convenient ordering and delivery options. The integration of technology in retail operations improves customer experience and operational efficiency.

Health and wellness awareness drives innovation in product development, with manufacturers responding to consumer demands for healthier alternatives. The incorporation of functional ingredients, reduced sugar content, and organic components appeals to health-conscious consumers while maintaining taste and quality standards.

Intense competition presents significant challenges for market participants, with numerous domestic and international brands competing for market share. Price pressures from low-cost competitors can impact profitability, while the need for continuous innovation requires substantial investment in research and development capabilities.

Supply chain complexities affect market operations, particularly regarding ingredient sourcing, quality control, and distribution logistics. Fluctuating raw material costs, seasonal availability of certain ingredients, and cold chain requirements for perishable products create operational challenges that impact pricing and profitability.

Regulatory compliance requirements impose additional costs and operational constraints on market participants. Food safety regulations, labeling requirements, and quality standards necessitate ongoing investment in compliance systems and procedures, particularly for companies operating across multiple regions with varying regulatory frameworks.

Consumer price sensitivity in certain market segments limits premium positioning opportunities. While urban consumers demonstrate willingness to pay higher prices for quality products, price-conscious segments require careful balance between quality and affordability to maintain market accessibility.

Seasonal demand fluctuations create inventory management challenges and impact revenue predictability. The concentration of sales during specific festivals and holidays requires careful production planning and working capital management to optimize profitability throughout the year.

Product innovation represents substantial growth opportunities, particularly in developing fusion flavors that combine traditional Chinese ingredients with modern baking techniques. The creation of unique products that appeal to local tastes while maintaining international appeal can establish strong competitive advantages and premium positioning.

Market penetration in tier-two and tier-three cities offers significant expansion potential as these regions experience economic development and lifestyle changes. Lower competition levels and growing consumer sophistication in these markets create favorable conditions for brand establishment and market share capture.

Health-focused segments present emerging opportunities as consumers increasingly prioritize wellness and nutritional value. The development of functional baked goods, diabetic-friendly options, and products featuring superfoods can tap into growing health consciousness while commanding premium prices.

Digital commerce expansion enables market participants to reach broader audiences and improve customer engagement. Investment in e-commerce capabilities, mobile applications, and digital marketing can enhance market reach while providing valuable consumer data for product development and marketing optimization.

Corporate and institutional markets offer stable revenue streams through catering services, office delivery programs, and event partnerships. Building relationships with businesses, schools, and organizations can provide consistent demand that complements retail operations.

Supply and demand equilibrium in the China cakes, pastries, and sweet pies market demonstrates remarkable stability despite rapid growth and evolving consumer preferences. Market dynamics reflect the interplay between traditional consumption patterns and modern lifestyle influences, creating a complex but manageable operating environment for industry participants.

Price elasticity varies significantly across different consumer segments and product categories. Premium products targeting affluent urban consumers demonstrate relatively low price sensitivity, while mass market offerings require careful pricing strategies to maintain accessibility. Average price increases of 5.3% annually have been absorbed by the market without significant demand reduction, indicating healthy market fundamentals.

Seasonal patterns create predictable demand cycles that enable effective inventory management and production planning. Peak seasons during Chinese New Year and Mid-Autumn Festival can generate up to 40% of annual sales for certain product categories, requiring sophisticated supply chain coordination and working capital management.

Innovation cycles accelerate as consumer preferences evolve rapidly, particularly among younger demographics. The introduction of new flavors, formats, and presentation styles occurs frequently, with successful innovations often achieving market penetration within 6-12 months of launch.

Distribution channel evolution reflects changing consumer shopping behaviors and technological advancement. Traditional retail channels maintain importance while online platforms gain market share, creating omnichannel opportunities for brands that can effectively integrate multiple touchpoints.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes consumer surveys, industry interviews, and focus group discussions conducted across major Chinese cities to capture diverse perspectives and regional variations in consumer behavior and preferences.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to provide quantitative foundation for market assessment. Data triangulation techniques validate findings across multiple sources to enhance credibility and reduce potential bias in conclusions.

Quantitative analysis utilizes statistical modeling and trend analysis to project market development patterns and identify growth opportunities. Historical data spanning five years provides baseline for forecasting while accounting for cyclical patterns and external factors that influence market performance.

Qualitative insights emerge from in-depth interviews with industry executives, retail partners, and supply chain participants. These discussions provide contextual understanding of market dynamics, competitive strategies, and emerging trends that quantitative data alone cannot capture.

Market validation occurs through cross-referencing findings with industry benchmarks and expert opinions. MarkWide Research methodology ensures comprehensive coverage of market segments while maintaining analytical rigor and objectivity in assessment and forecasting processes.

Eastern China dominates market consumption, accounting for approximately 45% of total market demand, driven by high population density, economic prosperity, and cultural openness to international food trends. Cities like Shanghai, Hangzhou, and Nanjing demonstrate sophisticated consumer preferences and willingness to embrace premium products and innovative flavors.

Northern China represents 28% of market share, with Beijing leading consumption patterns and setting trends that influence surrounding regions. The presence of international businesses and educational institutions creates diverse consumer base with appreciation for both traditional and Western-style baked goods.

Southern China contributes 18% of market volume, characterized by strong preference for traditional Chinese confections alongside growing acceptance of Western pastries. Guangzhou and Shenzhen serve as key markets with significant influence on regional consumption patterns and product preferences.

Western China shows emerging market potential with 9% current market share but demonstrates rapid growth rates as economic development accelerates. Cities like Chengdu and Chongqing exhibit increasing consumer sophistication and growing demand for premium baked goods.

Regional preferences vary significantly, with coastal areas showing greater acceptance of international flavors while inland regions maintain stronger connections to traditional Chinese confections. Understanding these regional nuances enables effective market entry strategies and product positioning for different geographic segments.

Market leadership reflects a diverse ecosystem of international chains, domestic brands, and regional specialists, each contributing unique strengths and market positioning. The competitive environment encourages innovation while providing consumers with extensive choice across price points and product categories.

Competitive strategies focus on differentiation through product innovation, store experience enhancement, and digital engagement. Successful brands invest heavily in research and development while maintaining consistent quality standards across all locations and product categories.

By Product Type: The market segments into distinct categories based on product characteristics and consumer usage patterns. Traditional Chinese confections maintain cultural significance while Western-style products gain market share among younger demographics.

By Distribution Channel: Multiple channels serve different consumer preferences and shopping behaviors, with omnichannel strategies becoming increasingly important for market success.

By Consumer Segment: Different demographic groups demonstrate distinct preferences and purchasing behaviors that influence product development and marketing strategies.

Celebration Cakes represent the highest-value segment within the market, driven by Chinese cultural emphasis on special occasions and growing adoption of Western celebration traditions. This category benefits from premium pricing and strong emotional connections, with consumers willing to invest significantly in memorable experiences.

Daily Consumption Pastries form the volume backbone of the market, providing consistent revenue streams for retailers and manufacturers. Products in this category emphasize convenience, affordability, and consistent quality to meet routine consumption needs of busy consumers.

Seasonal Specialties create significant revenue spikes during specific periods, particularly mooncakes during Mid-Autumn Festival and themed products during Chinese New Year. These products command premium prices and require sophisticated supply chain management to optimize profitability.

Health-Conscious Alternatives emerge as a rapidly growing category, appealing to wellness-focused consumers seeking reduced sugar, organic, or functional ingredient options. This segment demonstrates strong growth potential and premium pricing opportunities.

Artisanal Products cater to sophisticated consumers seeking unique experiences and premium quality. This category emphasizes craftsmanship, ingredient quality, and presentation excellence to justify higher price points and build brand differentiation.

Manufacturers benefit from expanding market opportunities, diverse product categories, and growing consumer sophistication that supports premium positioning. The market provides multiple growth avenues through geographic expansion, product innovation, and channel diversification strategies.

Retailers gain from high-margin product categories, frequent purchase cycles, and strong customer traffic generation. Bakery sections often serve as destination categories that drive overall store visits and basket size increases.

Suppliers enjoy stable demand for raw materials, ingredients, and packaging materials as market growth continues. Long-term relationships with manufacturers provide predictable revenue streams and opportunities for value-added services.

Consumers benefit from increased product variety, improved quality standards, competitive pricing, and enhanced convenience through multiple distribution channels. The market evolution provides greater choice and accessibility to premium products.

Investors find attractive opportunities in a growing market with strong fundamentals, demographic tailwinds, and innovation potential. The sector offers multiple investment avenues from established brands to emerging concepts and technology solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization continues to shape market development as consumers increasingly prioritize quality over price. This trend drives innovation in ingredients, presentation, and packaging while supporting higher margin opportunities for manufacturers and retailers.

Health and Wellness Integration influences product development across all categories, with manufacturers incorporating functional ingredients, reducing sugar content, and developing allergen-free alternatives. Organic product demand has increased by 23% annually as health consciousness grows among urban consumers.

Digital Integration transforms customer engagement and purchasing behaviors, with social media marketing, online ordering, and mobile applications becoming essential business tools. The integration of technology enhances customer experience while providing valuable data for business optimization.

Customization Services gain popularity as consumers seek personalized products for special occasions. Custom cake decoration, personalized flavors, and bespoke packaging options create differentiation opportunities and premium pricing potential.

Sustainability Focus emerges as consumers become more environmentally conscious. Eco-friendly packaging, sustainable ingredient sourcing, and waste reduction initiatives appeal to socially responsible consumers while supporting brand reputation.

Fusion Innovation continues to create unique product categories that blend Eastern and Western culinary traditions. These innovative products appeal to adventurous consumers while maintaining cultural relevance and market differentiation.

Technology Integration accelerates across the industry, with automated production systems, digital ordering platforms, and data analytics improving operational efficiency and customer experience. MarkWide Research analysis indicates that technology adoption has improved productivity by 18% across leading market participants.

Strategic Partnerships between international brands and local companies facilitate market entry and expansion while combining global expertise with local market knowledge. These collaborations enable rapid scaling and risk mitigation for foreign brands entering the Chinese market.

Supply Chain Optimization initiatives focus on cold chain development, inventory management systems, and logistics efficiency to reduce costs and improve product quality. Investment in supply chain infrastructure supports market expansion and profitability improvement.

Product Innovation Acceleration responds to evolving consumer preferences and competitive pressures. Companies invest heavily in research and development to create unique products that capture market attention and build brand loyalty.

Regulatory Compliance Enhancement drives industry standards improvement as companies invest in quality control systems, traceability technologies, and certification processes to meet evolving regulatory requirements and consumer expectations.

Market Entry Strategy should prioritize tier-one cities for initial establishment while developing scalable business models that can expand to secondary markets. Understanding local preferences and cultural nuances remains critical for successful market penetration and brand acceptance.

Product Portfolio Optimization requires balancing traditional offerings with innovative products that appeal to evolving consumer preferences. Companies should invest in research and development while maintaining core product quality and consistency across all categories.

Digital Transformation represents essential investment for long-term competitiveness. Companies should develop comprehensive digital strategies encompassing e-commerce, social media marketing, customer relationship management, and data analytics capabilities.

Supply Chain Excellence demands continuous improvement in logistics, quality control, and inventory management. Investment in cold chain infrastructure and technology systems will support market expansion while maintaining product quality and safety standards.

Brand Differentiation through unique value propositions, consistent quality delivery, and emotional connection with consumers will determine long-term market success. Companies should focus on building strong brand equity while maintaining operational excellence.

Market expansion prospects remain highly favorable, driven by continued economic development, urbanization trends, and evolving consumer preferences. The sector is projected to maintain robust growth rates with CAGR expectations of 7.5% over the next five years, supported by demographic tailwinds and increasing consumer sophistication.

Innovation acceleration will continue shaping market development as companies invest in product development, technology integration, and customer experience enhancement. The successful integration of health-conscious ingredients with traditional flavors represents significant opportunity for market differentiation and premium positioning.

Geographic expansion into tier-two and tier-three cities offers substantial growth potential as these markets develop economically and culturally. Companies that establish early presence in emerging markets while maintaining quality standards will benefit from first-mover advantages and market share capture.

Digital commerce evolution will transform industry operations and customer relationships. MWR projections indicate that online sales could reach 50% of total market volume within five years, requiring comprehensive digital strategies and omnichannel capabilities for sustained competitiveness.

Sustainability integration will become increasingly important as environmental consciousness grows among consumers and regulatory requirements evolve. Companies that proactively adopt sustainable practices will benefit from enhanced brand reputation and regulatory compliance advantages.

The China cakes, pastries, and sweet pies market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, economic development, and cultural evolution. The successful integration of traditional Chinese confections with Western baking traditions creates unique market opportunities while serving diverse consumer preferences across multiple segments.

Market fundamentals remain strong, supported by rising disposable income, urbanization trends, and growing consumer sophistication. The sector demonstrates remarkable resilience and adaptability, with companies successfully navigating challenges while capitalizing on emerging opportunities through innovation and strategic positioning.

Future success will depend on companies’ ability to balance tradition with innovation, maintain quality standards while scaling operations, and effectively integrate digital technologies with traditional retail approaches. The market rewards participants who understand local preferences while embracing global best practices in product development and customer service.

Strategic positioning for long-term success requires comprehensive understanding of regional variations, consumer behavior patterns, and competitive dynamics. Companies that invest in brand building, operational excellence, and customer relationship development will be best positioned to capture market opportunities and achieve sustainable growth in this vibrant and expanding market.

What is Cakes, Pastries, & Sweet Pies?

Cakes, Pastries, & Sweet Pies refer to a variety of baked goods that are typically sweet and enjoyed as desserts or snacks. These products include items like cakes, tarts, and various types of pastries that are popular in many cultures, including China.

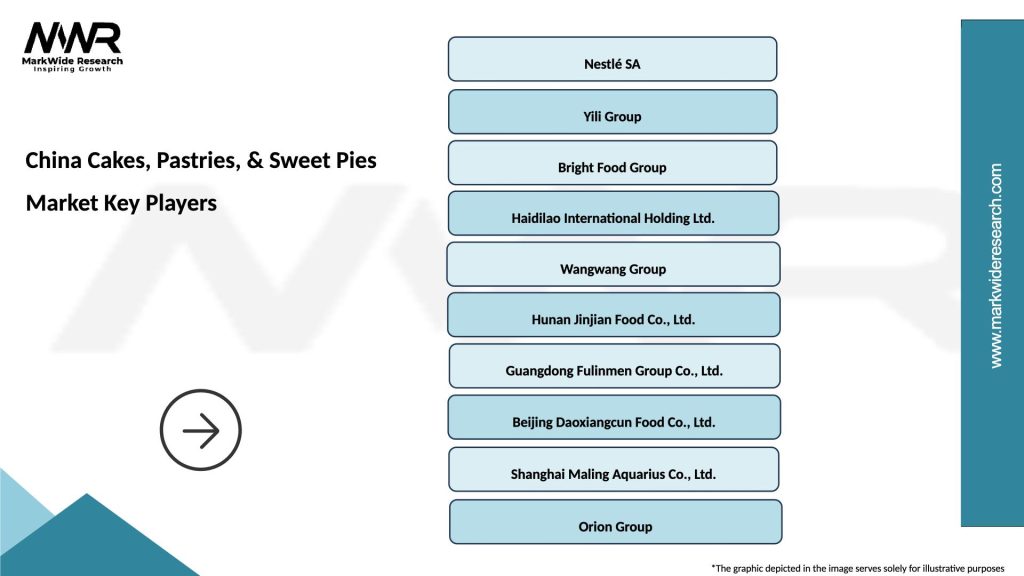

What are the key players in the China Cakes, Pastries, & Sweet Pies Market?

Key players in the China Cakes, Pastries, & Sweet Pies Market include companies like Arawana, Aosaikang, and Hsu Fu Chi, which are known for their diverse range of baked goods. These companies compete on quality, innovation, and distribution channels, among others.

What are the growth factors driving the China Cakes, Pastries, & Sweet Pies Market?

The growth of the China Cakes, Pastries, & Sweet Pies Market is driven by increasing consumer demand for convenient and indulgent snacks, the rise of online food delivery services, and the growing popularity of Western-style desserts among Chinese consumers.

What challenges does the China Cakes, Pastries, & Sweet Pies Market face?

The China Cakes, Pastries, & Sweet Pies Market faces challenges such as rising raw material costs, stringent food safety regulations, and competition from local and international brands that can affect market share and pricing strategies.

What opportunities exist in the China Cakes, Pastries, & Sweet Pies Market?

Opportunities in the China Cakes, Pastries, & Sweet Pies Market include the potential for product innovation, such as healthier options and unique flavor combinations, as well as expanding into untapped rural markets where demand for baked goods is increasing.

What trends are shaping the China Cakes, Pastries, & Sweet Pies Market?

Trends in the China Cakes, Pastries, & Sweet Pies Market include a growing interest in artisanal and handmade products, the incorporation of traditional Chinese flavors into Western-style pastries, and an increasing focus on sustainable packaging solutions.

China Cakes, Pastries, & Sweet Pies Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cakes, Pastries, Tarts, Pies |

| Flavor Profile | Chocolate, Vanilla, Fruit, Nut |

| Packaging Type | Boxed, Wrapped, Tray, Bulk |

| Distribution Channel | Supermarkets, Online, Bakeries, Cafés |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Cakes, Pastries, & Sweet Pies Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at