444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The China Big Data Analytics in Energy Market represents a crucial sector within the broader energy industry, leveraging data-driven insights to optimize operations, enhance efficiency, and drive innovation across the energy value chain. Big data analytics technologies enable energy companies to analyze vast amounts of structured and unstructured data from diverse sources, including sensors, meters, IoT devices, and enterprise systems, to gain actionable insights, improve decision-making, and achieve strategic objectives.

Meaning

Big data analytics in the energy sector involves the collection, processing, analysis, and interpretation of large volumes of data generated by energy production, distribution, consumption, and management processes. It encompasses various technologies, such as data mining, machine learning, predictive analytics, and artificial intelligence, to extract valuable insights, identify patterns, detect anomalies, and optimize energy-related operations and processes.

Executive Summary

The China Big Data Analytics in Energy Market has witnessed significant growth in recent years, driven by factors such as the increasing adoption of digital technologies, the proliferation of IoT devices, and the growing demand for energy efficiency and sustainability solutions. This market offers numerous opportunities for energy companies, technology providers, and solution vendors to harness the power of big data analytics to address operational challenges, improve asset performance, and optimize resource utilization across the energy sector.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China Big Data Analytics in Energy Market operates in a dynamic and evolving landscape shaped by technological innovations, market trends, regulatory changes, and macroeconomic factors. Key dynamics, including digital transformation, energy transition, market liberalization, and geopolitical developments, influence market growth, adoption rates, and business strategies of market participants. Understanding and navigating these dynamics are essential for stakeholders to capitalize on opportunities, mitigate risks, and stay competitive in the evolving energy analytics market landscape.

Regional Analysis

The China Big Data Analytics in Energy Market exhibits regional variations in adoption rates, technology preferences, industry focus, and regulatory environments across provinces, cities, and economic zones. Major regions such as Beijing, Shanghai, and Guangdong serve as hubs for energy innovation, research, and investment, attracting talent, capital, and infrastructure to support the growth of the energy analytics ecosystem. Regional initiatives, government policies, and industry clusters play key roles in driving regional competitiveness, collaboration, and market expansion in the China Big Data Analytics in Energy Market.

Competitive Landscape

Leading Companies in the China Big Data Analytics in Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

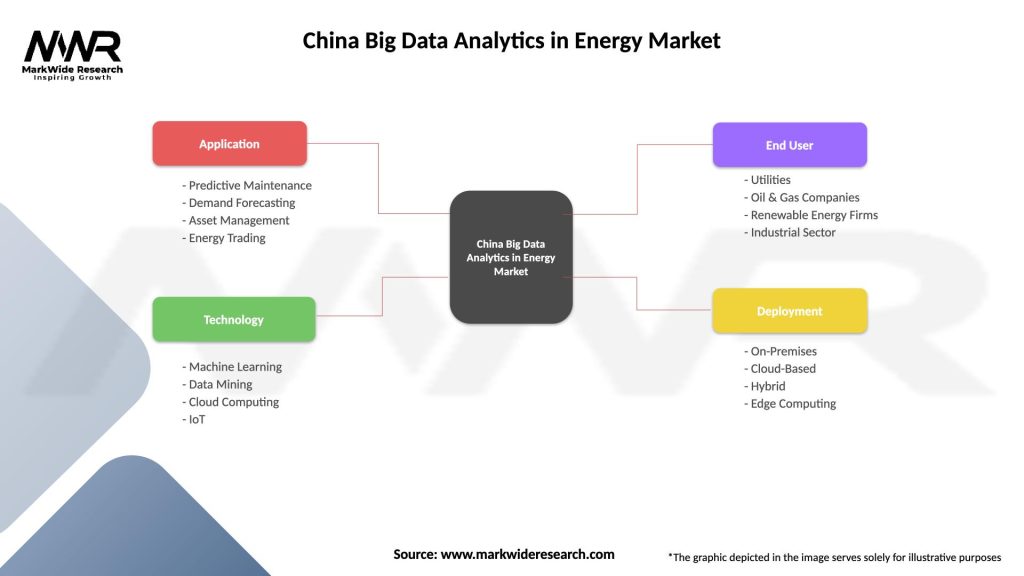

Segmentation

The China Big Data Analytics in Energy Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the China Big Data Analytics in Energy Market reveals:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the China Big Data Analytics in Energy Market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The China Big Data Analytics in Energy Market is poised for robust growth and innovation, driven by technological advancements, regulatory reforms, and market dynamics. Key trends such as digitalization, energy transition, and sustainability will shape the future of energy analytics in China, driving demand for advanced analytics solutions, talent, and expertise. As energy companies continue to invest in digital transformation and analytics-driven strategies, the market will witness increased adoption, investment, and market expansion, driving economic growth, energy efficiency, and environmental sustainability in China.

Conclusion

The China Big Data Analytics in Energy Market presents significant opportunities for energy companies, technology providers, and stakeholders to leverage data-driven insights, AI-driven analytics, and digital technologies to optimize energy operations, enhance efficiency, and drive innovation. Despite challenges such as data privacy, skills shortage, and regulatory constraints, the market offers immense potential for growth, investment, and market expansion in the world’s largest energy consumer. By embracing digital transformation, investing in analytics capabilities, and collaborating across the ecosystem, China can lead the global energy transition, accelerate sustainability goals, and drive economic prosperity in the digital age.

What is Big Data Analytics in Energy?

Big Data Analytics in Energy refers to the use of advanced analytical techniques to process and analyze large volumes of data generated in the energy sector. This includes data from smart grids, renewable energy sources, and consumption patterns to optimize operations and improve decision-making.

What are the key players in China Big Data Analytics in Energy Market?

Key players in the China Big Data Analytics in Energy Market include companies like State Grid Corporation of China, China National Petroleum Corporation, and China Southern Power Grid, among others.

What are the growth factors driving China Big Data Analytics in Energy Market?

The growth of China Big Data Analytics in Energy Market is driven by the increasing demand for energy efficiency, the rise of renewable energy sources, and the need for real-time data analysis to enhance grid management and reduce operational costs.

What challenges does the China Big Data Analytics in Energy Market face?

Challenges in the China Big Data Analytics in Energy Market include data privacy concerns, the integration of legacy systems with new technologies, and the shortage of skilled professionals in data analytics and energy management.

What future opportunities exist in China Big Data Analytics in Energy Market?

Future opportunities in the China Big Data Analytics in Energy Market include advancements in artificial intelligence for predictive analytics, the expansion of smart city initiatives, and the growing importance of sustainability in energy consumption.

What trends are shaping the China Big Data Analytics in Energy Market?

Trends shaping the China Big Data Analytics in Energy Market include the increasing adoption of IoT devices for data collection, the rise of machine learning algorithms for energy forecasting, and the focus on enhancing cybersecurity measures in energy data management.

China Big Data Analytics in Energy Market

| Segmentation Details | Description |

|---|---|

| Application | Predictive Maintenance, Demand Forecasting, Asset Management, Energy Trading |

| Technology | Machine Learning, Data Mining, Cloud Computing, IoT |

| End User | Utilities, Oil & Gas Companies, Renewable Energy Firms, Industrial Sector |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the China Big Data Analytics in Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at