444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China agricultural biologicals market represents one of the most dynamic and rapidly evolving sectors within the country’s agricultural landscape. Agricultural biologicals encompass a diverse range of naturally-derived products including biopesticides, biofertilizers, biostimulants, and other biological solutions that enhance crop productivity while promoting sustainable farming practices. China’s agricultural biologicals sector has experienced remarkable transformation, driven by increasing environmental consciousness, stringent regulatory frameworks, and growing demand for organic food products.

Market dynamics indicate substantial growth potential, with the sector expanding at a robust CAGR of 12.8% over recent years. This growth trajectory reflects China’s strategic shift toward sustainable agriculture and reduced chemical dependency. The market encompasses various biological solutions designed to improve soil health, enhance plant nutrition, protect crops from pests and diseases, and increase overall agricultural productivity through environmentally friendly approaches.

Regional distribution shows concentrated activity in major agricultural provinces including Shandong, Henan, Jiangsu, and Hebei, where intensive farming practices and government support for biological solutions create favorable market conditions. The integration of traditional agricultural knowledge with modern biotechnology has positioned China as a significant player in the global agricultural biologicals landscape.

The China agricultural biologicals market refers to the comprehensive ecosystem of naturally-derived agricultural inputs and solutions that utilize living organisms, natural compounds, or biological processes to enhance crop production, protect plants, and improve soil health while minimizing environmental impact through sustainable farming practices.

Agricultural biologicals encompass multiple product categories including microbial inoculants, plant extracts, beneficial insects, pheromones, and other biological agents that work in harmony with natural ecosystems. These solutions represent alternatives to synthetic chemicals, offering farmers effective tools for crop management while supporting environmental sustainability and food safety objectives.

Market scope includes research, development, manufacturing, distribution, and application of biological products across various agricultural sectors including field crops, horticulture, aquaculture, and livestock farming. The market also encompasses related services such as technical support, application guidance, and integrated pest management consulting that help farmers optimize biological solution effectiveness.

China’s agricultural biologicals market demonstrates exceptional growth momentum, positioning the country as a leading force in sustainable agriculture innovation. The market benefits from strong government support, increasing farmer awareness, and growing consumer demand for safe, residue-free agricultural products. Policy initiatives promoting green agriculture and reduced chemical pesticide usage have created favorable regulatory environments for biological solution adoption.

Key market drivers include environmental sustainability concerns, food safety requirements, export market demands, and technological advancements in biotechnology. The sector shows particular strength in biopesticide development, with microbial-based solutions accounting for approximately 45% of total biological product applications. Innovation in fermentation technology, formulation science, and delivery systems continues to enhance product efficacy and commercial viability.

Market challenges involve product standardization, quality control, farmer education, and competition from established chemical alternatives. However, increasing investment in research and development, strategic partnerships between domestic and international companies, and supportive government policies create optimistic growth prospects for sustained market expansion.

Strategic insights reveal several critical factors shaping China’s agricultural biologicals market development:

Environmental sustainability concerns serve as primary drivers for China’s agricultural biologicals market growth. Increasing awareness of chemical pesticide environmental impact, soil degradation, and water contamination has prompted government initiatives and farmer interest in biological alternatives. Regulatory pressure to reduce chemical inputs while maintaining agricultural productivity creates strong demand for effective biological solutions.

Food safety requirements drive market expansion as consumers increasingly demand residue-free agricultural products. Export market requirements for organic and sustainably produced foods create additional incentives for biological solution adoption. Premium pricing for organic and green-certified products provides economic motivation for farmers to transition toward biological farming practices.

Technological advancements in biotechnology, fermentation science, and product formulation enhance biological solution effectiveness and commercial viability. Improved product stability, extended shelf life, and enhanced field performance make biological alternatives increasingly competitive with chemical solutions. Cost reduction through improved manufacturing processes and economies of scale further supports market growth.

Government support programs including subsidies, research funding, and technical assistance accelerate biological solution development and adoption. National strategies promoting sustainable agriculture and environmental protection create policy frameworks that favor biological over chemical approaches to crop management.

Product standardization challenges represent significant market restraints, as biological products often demonstrate variable performance under different environmental conditions. Quality control difficulties in maintaining consistent product efficacy and stability create barriers to widespread commercial adoption. Limited shelf life and storage requirements for many biological products complicate distribution and inventory management.

Farmer education barriers include limited knowledge about biological solution application methods, timing, and integration with existing farming practices. Technical complexity of biological products requires more sophisticated understanding compared to conventional chemical alternatives. Resistance to change among traditional farmers accustomed to chemical solutions slows market penetration.

Economic constraints involve higher initial costs for some biological products and uncertain return on investment compared to established chemical alternatives. Performance variability under different climatic and soil conditions creates farmer reluctance to fully transition from proven chemical solutions.

Regulatory challenges include complex registration processes, limited testing protocols specific to biological products, and evolving quality standards. Market fragmentation with numerous small producers creates difficulties in establishing industry standards and maintaining consistent product quality across suppliers.

Export market expansion presents substantial opportunities as international demand for sustainably produced agricultural products continues growing. Organic food markets in developed countries offer premium pricing for products grown using biological solutions, creating economic incentives for Chinese farmers and exporters.

Technology integration opportunities include combining biological solutions with precision agriculture, digital farming platforms, and smart application systems. IoT integration can optimize biological product application timing and dosage based on real-time field conditions and crop needs.

Product innovation opportunities exist in developing specialized biological solutions for specific crops, regional conditions, and farming systems. Customized formulations addressing local pest pressures, soil conditions, and climate factors can create competitive advantages and market differentiation.

Partnership opportunities with international companies can accelerate technology transfer, market access, and product development capabilities. Research collaborations with universities and institutes can advance scientific understanding and develop next-generation biological solutions.

Value chain integration opportunities include developing comprehensive biological farming systems, technical services, and farmer support programs that enhance product effectiveness and customer loyalty.

Supply chain dynamics in China’s agricultural biologicals market involve complex interactions between research institutions, biotechnology companies, manufacturers, distributors, and end-users. Vertical integration strategies enable companies to control product quality and reduce costs through integrated research, production, and distribution capabilities.

Competitive dynamics feature both domestic and international players competing across different market segments. Domestic companies leverage local market knowledge and cost advantages, while international firms contribute advanced technology and established product portfolios. Strategic partnerships and joint ventures facilitate technology transfer and market access.

Innovation dynamics drive continuous product development and improvement in biological solution effectiveness. Research intensity remains high, with companies investing significantly in developing new microbial strains, improved formulations, and enhanced delivery systems. Collaboration between industry and academia accelerates innovation and commercialization processes.

Regulatory dynamics continue evolving as government agencies develop specific frameworks for biological product registration, quality control, and market oversight. Policy support for sustainable agriculture creates favorable conditions for market growth while ensuring product safety and efficacy standards.

Comprehensive research methodology employed in analyzing China’s agricultural biologicals market combines primary and secondary research approaches to ensure accurate and reliable market insights. Primary research involves direct engagement with industry stakeholders including manufacturers, distributors, farmers, research institutions, and government agencies through structured interviews, surveys, and field observations.

Secondary research encompasses analysis of government publications, industry reports, academic studies, patent databases, and regulatory documents to understand market trends, technological developments, and policy frameworks. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market assessments.

Market segmentation analysis examines different product categories, application areas, regional markets, and customer segments to provide detailed insights into market structure and growth opportunities. Competitive analysis evaluates key players, market positioning, product portfolios, and strategic initiatives to understand competitive dynamics.

Trend analysis identifies emerging patterns in technology development, market adoption, regulatory changes, and consumer preferences that influence market evolution. Quantitative analysis incorporates statistical methods to analyze market data, growth patterns, and performance metrics across different market segments and time periods.

Regional market distribution across China shows significant variation based on agricultural intensity, crop types, economic development, and policy implementation. Eastern provinces including Shandong, Jiangsu, and Zhejiang demonstrate the highest adoption rates, accounting for approximately 38% of total market activity due to intensive farming practices and strong economic capabilities.

Northern regions including Hebei, Henan, and Inner Mongolia focus primarily on grain crop applications, with wheat and corn production driving demand for biological solutions. These regions show growing interest in soil health improvement and sustainable farming practices supported by government initiatives.

Southern provinces including Guangdong, Guangxi, and Hainan emphasize horticultural applications, with fruit and vegetable production creating demand for specialized biological solutions. Tropical and subtropical climates in these regions provide favorable conditions for biological product effectiveness.

Western regions including Xinjiang, Gansu, and Qinghai show emerging market potential, particularly in cotton production and specialty crops. Government development programs and infrastructure improvements support market expansion in these areas.

Central provinces including Hubei, Hunan, and Jiangxi demonstrate balanced growth across multiple crop categories, with rice production systems increasingly adopting biological solutions for sustainable intensification.

Market leadership in China’s agricultural biologicals sector involves both established domestic companies and international players with strong technological capabilities. Competitive positioning varies across different product segments and regional markets, with companies pursuing diverse strategies for market penetration and growth.

Strategic initiatives include research and development investments, strategic partnerships, acquisition activities, and market expansion programs. Innovation focus remains critical for competitive advantage, with companies investing heavily in new product development and technology advancement.

Product-based segmentation reveals diverse categories within China’s agricultural biologicals market:

By Product Type:

By Application Method:

By Crop Category:

Biopesticide category represents the largest market segment, with microbial-based solutions showing particularly strong growth. Bacillus-based products dominate this segment due to proven efficacy against various plant pathogens and pests. Recent innovations in formulation technology have improved product stability and field performance, driving increased adoption rates.

Biofertilizer segment demonstrates rapid expansion, particularly in nitrogen-fixing bacterial inoculants for legume crops and cereals. Mycorrhizal fungi products show growing popularity for improving nutrient uptake efficiency and plant stress tolerance. Integration with precision agriculture technologies enhances application effectiveness and farmer acceptance.

Biostimulant category emerges as a high-growth segment, with seaweed extracts and amino acid-based products leading market development. These products address increasing farmer interest in crop quality improvement and stress management. Humic acid-based biostimulants show particular strength in soil health improvement applications.

Soil amendment products focus on organic matter enhancement and microbial diversity improvement. Compost-based inoculants and specialized microbial blends address soil degradation concerns in intensive farming systems. Integration with sustainable farming practices creates synergistic benefits for long-term soil health.

Farmers benefit from reduced chemical input costs, improved crop quality, and access to premium markets for sustainably produced products. Environmental advantages include reduced soil and water contamination, enhanced biodiversity, and improved ecosystem health. Economic benefits encompass potential premium pricing for organic products and reduced long-term production costs through improved soil health.

Manufacturers gain from expanding market opportunities, technological innovation potential, and alignment with sustainability trends. Product differentiation through biological solutions creates competitive advantages and customer loyalty. Research and development investments in biological solutions position companies for future market leadership.

Government stakeholders achieve environmental protection objectives, food safety improvements, and sustainable agriculture development goals. Policy alignment with international sustainability standards enhances trade relationships and export opportunities. Rural development through sustainable farming practices supports broader economic and social objectives.

Consumers receive safer food products with reduced chemical residues and improved nutritional quality. Environmental benefits include reduced pollution and enhanced ecosystem services from sustainable farming practices. Long-term food security improvements through sustainable production systems benefit society broadly.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture integration represents a major trend, with biological solutions increasingly combined with digital farming technologies. Smart application systems optimize product timing and dosage based on real-time field conditions, improving effectiveness and reducing waste. Data-driven farming approaches enhance biological solution performance through better understanding of application requirements.

Customized product development addresses specific regional and crop requirements through tailored biological formulations. Local strain selection and adaptation improve product effectiveness under Chinese growing conditions. Specialized solutions for high-value crops create premium market opportunities and enhanced farmer returns.

Sustainable intensification trends focus on maintaining or increasing productivity while reducing environmental impact. Integrated pest management systems combine biological and conventional approaches for optimal results. Soil health emphasis drives demand for products that improve long-term soil fertility and structure.

Quality certification systems develop to ensure product efficacy and safety standards. Organic certification requirements drive demand for approved biological inputs. Traceability systems enable verification of sustainable production practices throughout the supply chain.

Recent industry developments highlight significant progress in China’s agricultural biologicals sector. Government initiatives including the National Green Development Plan for Agriculture create supportive policy frameworks for biological solution adoption. Regulatory improvements streamline product registration processes and establish clear quality standards.

Technology partnerships between domestic and international companies accelerate innovation and market development. Research collaborations with universities and institutes advance scientific understanding and product development capabilities. Investment increases in biotechnology infrastructure support expanded production capacity and improved product quality.

Market consolidation activities include strategic acquisitions and partnerships that strengthen company capabilities and market positions. Vertical integration strategies enable better quality control and cost management throughout the value chain. Distribution network expansion improves product accessibility and farmer support services.

Innovation breakthroughs in fermentation technology, formulation science, and delivery systems enhance product performance and commercial viability. Digital platform development provides farmers with technical support and application guidance. Sustainability certifications validate environmental benefits and support market differentiation.

MarkWide Research analysis suggests that companies should prioritize product quality and consistency to build farmer confidence and market acceptance. Investment in research and development remains critical for developing effective biological solutions adapted to Chinese agricultural conditions. Farmer education programs should be expanded to improve understanding of biological solution applications and benefits.

Strategic partnerships with research institutions, government agencies, and international companies can accelerate technology development and market penetration. Distribution network strengthening through partnerships with agricultural cooperatives and extension services improves product accessibility and technical support.

Quality certification and standardization initiatives should be prioritized to establish industry credibility and consumer confidence. Regulatory engagement helps shape favorable policy frameworks and ensures compliance with evolving standards. Market segmentation strategies focusing on high-value crops and premium applications can improve profitability and competitive positioning.

Technology integration with precision agriculture and digital farming platforms creates opportunities for enhanced product effectiveness and customer value. Sustainability positioning aligns with market trends and government objectives while differentiating products from conventional alternatives.

Long-term market prospects for China’s agricultural biologicals sector remain highly positive, supported by continued government emphasis on sustainable agriculture and environmental protection. Market expansion is expected to accelerate, with growth rates potentially reaching 15-18% annually over the next five years as farmer adoption increases and product effectiveness improves.

Technology advancement will drive next-generation biological solutions with enhanced efficacy, stability, and ease of application. Biotechnology innovations including genetic engineering, synthetic biology, and advanced fermentation will create new product categories and improved performance characteristics. Digital integration will optimize application timing and methods for maximum effectiveness.

Market maturation will lead to industry consolidation, improved quality standards, and more sophisticated distribution networks. Export opportunities will expand as Chinese biological products gain international recognition and acceptance. Value chain integration will create comprehensive biological farming systems and services.

Regulatory evolution will establish clearer frameworks for product approval, quality control, and market oversight. International harmonization of standards will facilitate trade and technology transfer. Sustainability metrics will become increasingly important for market access and premium positioning.

China’s agricultural biologicals market represents a transformative force in the country’s agricultural sector, offering sustainable solutions that address environmental concerns while maintaining productivity and profitability. The market demonstrates exceptional growth potential, supported by favorable government policies, increasing farmer awareness, and growing consumer demand for safe, sustainable food products.

Key success factors include continued investment in research and development, improved product quality and consistency, expanded farmer education programs, and strategic partnerships that accelerate technology transfer and market penetration. Market opportunities span across diverse product categories, application methods, and crop systems, creating multiple pathways for growth and development.

Future market evolution will be shaped by technological innovation, regulatory development, and changing farmer preferences toward sustainable farming practices. Companies that prioritize quality, innovation, and farmer support services are well-positioned to capitalize on the substantial growth opportunities in China’s expanding agricultural biologicals market. The sector’s alignment with national sustainability objectives and international market trends ensures continued policy support and market expansion potential.

What is Agricultural Biologicals?

Agricultural biologicals refer to products derived from natural materials, including microorganisms, plant extracts, and other biological substances, used to enhance agricultural productivity and sustainability. They play a crucial role in pest management, soil health, and crop protection.

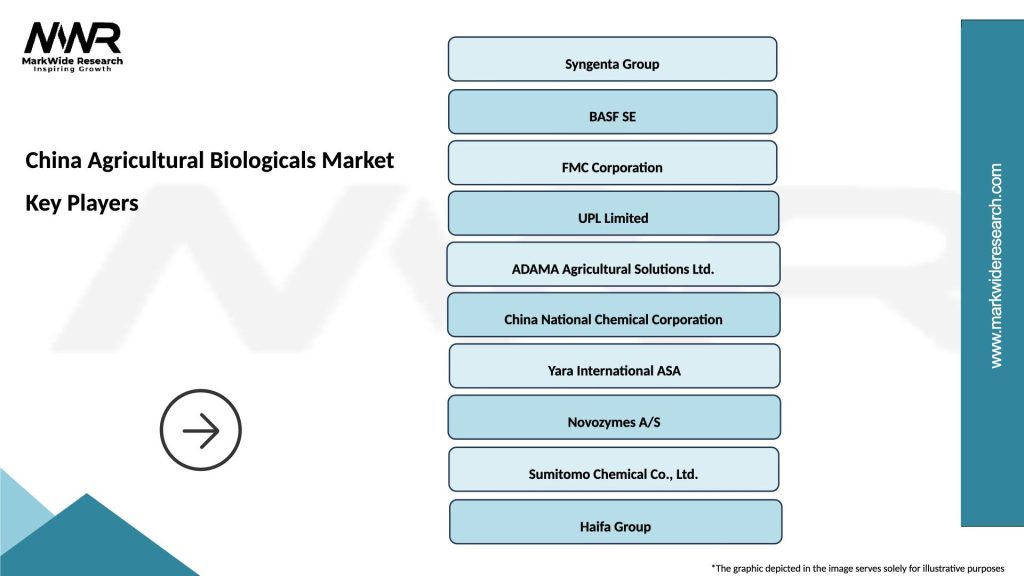

What are the key players in the China Agricultural Biologicals Market?

Key players in the China Agricultural Biologicals Market include companies like Bayer AG, Syngenta AG, and BASF SE, which are known for their innovative biological products and solutions for agriculture, among others.

What are the main drivers of the China Agricultural Biologicals Market?

The main drivers of the China Agricultural Biologicals Market include the increasing demand for sustainable farming practices, the need for effective pest control solutions, and the growing awareness of environmental impacts associated with chemical fertilizers and pesticides.

What challenges does the China Agricultural Biologicals Market face?

Challenges in the China Agricultural Biologicals Market include regulatory hurdles, the need for extensive research and development, and competition from traditional chemical agricultural products, which may hinder market growth.

What opportunities exist in the China Agricultural Biologicals Market?

Opportunities in the China Agricultural Biologicals Market include the rising trend of organic farming, advancements in biotechnology, and increasing investments in research and development for innovative biological solutions.

What trends are shaping the China Agricultural Biologicals Market?

Trends shaping the China Agricultural Biologicals Market include the integration of digital agriculture technologies, the development of biopesticides and biofertilizers, and a growing focus on sustainable agricultural practices among farmers.

China Agricultural Biologicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biofertilizers, Biopesticides, Biostimulants, Microbial Inoculants |

| Application | Crops, Soil Health, Seed Treatment, Foliar Application |

| End User | Farmers, Agricultural Cooperatives, Research Institutions, Crop Consultants |

| Distribution Channel | Online Retail, Agricultural Supply Stores, Direct Sales, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Agricultural Biologicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at