444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China access control market represents one of the most dynamic and rapidly evolving security technology sectors in the Asia-Pacific region. China’s access control industry has experienced unprecedented growth driven by urbanization, smart city initiatives, and increasing security consciousness across commercial, residential, and government sectors. The market encompasses a comprehensive range of solutions including biometric systems, card-based access controls, mobile credentials, and integrated security platforms.

Market expansion in China has been particularly robust, with the sector demonstrating a compound annual growth rate (CAGR) of 12.3% over recent years. This growth trajectory reflects the nation’s commitment to modernizing security infrastructure and implementing advanced technological solutions across various industries. Government initiatives promoting digital transformation and smart city development have significantly contributed to market acceleration.

Regional distribution shows that tier-one cities including Beijing, Shanghai, Shenzhen, and Guangzhou account for approximately 45% of total market adoption, while tier-two and tier-three cities are experiencing rapid growth as infrastructure development expands. The market’s evolution is characterized by increasing integration of artificial intelligence, cloud-based solutions, and Internet of Things (IoT) connectivity, positioning China as a global leader in access control innovation.

The China access control market refers to the comprehensive ecosystem of security technologies, systems, and services designed to regulate and monitor entry to physical and digital spaces within the Chinese territory. This market encompasses hardware components such as card readers, biometric scanners, electronic locks, and control panels, alongside software platforms that manage user credentials, access permissions, and security protocols.

Access control systems in China integrate multiple authentication methods including traditional key cards, advanced biometric recognition (fingerprint, facial, iris), mobile-based credentials, and multi-factor authentication protocols. These solutions serve diverse applications ranging from corporate office buildings and manufacturing facilities to residential complexes, educational institutions, healthcare facilities, and government buildings.

Market significance extends beyond basic security functions to encompass comprehensive building management, visitor tracking, time and attendance monitoring, and integration with broader smart building ecosystems. The Chinese market particularly emphasizes scalability, interoperability, and compliance with national security standards and regulations.

China’s access control market stands as a cornerstone of the nation’s security technology landscape, driven by rapid urbanization, technological advancement, and evolving security requirements across multiple sectors. The market demonstrates exceptional resilience and growth potential, supported by strong government backing for digital infrastructure development and smart city initiatives.

Key market characteristics include the dominance of biometric technologies, with facial recognition systems capturing approximately 38% market share due to widespread acceptance and technological sophistication. The integration of artificial intelligence and machine learning capabilities has enhanced system accuracy and user experience, contributing to accelerated adoption rates across commercial and residential applications.

Competitive dynamics reveal a balanced mix of domestic and international players, with Chinese manufacturers increasingly gaining market share through innovation and cost-effective solutions. The market benefits from strong domestic demand, supportive regulatory frameworks, and continuous investment in research and development activities.

Future prospects indicate sustained growth momentum, with emerging technologies such as contactless access, cloud-based management platforms, and mobile integration driving next-generation solution development. The market’s evolution toward comprehensive security ecosystems positions China as a significant influence on global access control trends and standards.

Market insights reveal several critical factors shaping the China access control landscape:

Primary market drivers propelling China’s access control sector include comprehensive urbanization initiatives, evolving security threats, and technological advancement. Smart city development programs across major Chinese cities have created substantial demand for integrated security solutions that support broader urban management objectives.

Government policy support through initiatives such as the “Made in China 2025” strategy and national cybersecurity frameworks has accelerated market growth by promoting domestic innovation and establishing favorable regulatory environments. These policies encourage investment in advanced security technologies while supporting local manufacturers and solution providers.

Corporate security awareness has intensified following high-profile security incidents and data breaches, driving organizations to implement comprehensive access control measures. The growing emphasis on workplace safety, intellectual property protection, and regulatory compliance has expanded market demand across industries.

Residential market evolution reflects changing lifestyle preferences and increasing disposable income, with homeowners seeking advanced security solutions for personal safety and convenience. The integration of access control with smart home ecosystems has created new market opportunities and user adoption scenarios.

Technological convergence enabling seamless integration between access control, video surveillance, and building automation systems has enhanced solution value propositions and market appeal. This convergence supports comprehensive security strategies while improving operational efficiency and user experience.

Market restraints affecting China’s access control sector include implementation complexity, cost considerations, and technical challenges associated with system integration and maintenance. High initial investment requirements for comprehensive access control deployments can limit adoption among small and medium enterprises, particularly in cost-sensitive market segments.

Technical integration challenges arise when organizations attempt to incorporate new access control systems with existing security infrastructure and building management platforms. Compatibility issues, data migration complexities, and system interoperability concerns can delay implementation timelines and increase project costs.

Cybersecurity vulnerabilities associated with networked access control systems create concerns about data protection and system integrity. Organizations must balance connectivity benefits with security risks, often requiring additional investment in cybersecurity measures and ongoing monitoring capabilities.

Regulatory compliance requirements can complicate system design and implementation, particularly for organizations operating across multiple jurisdictions or handling sensitive data. Evolving privacy regulations and data protection standards require continuous system updates and compliance verification.

Skills shortage in specialized technical areas such as biometric system integration, cybersecurity, and advanced analytics limits the availability of qualified implementation and maintenance personnel. This constraint can affect project quality and long-term system performance.

Significant market opportunities exist within China’s access control sector, driven by emerging technologies, expanding applications, and evolving user requirements. Artificial intelligence integration presents substantial growth potential through enhanced security analytics, predictive maintenance capabilities, and automated threat detection systems.

Smart building integration offers opportunities to develop comprehensive platforms combining access control with energy management, space utilization, and occupant experience optimization. This convergence creates value-added solutions that address multiple building management objectives simultaneously.

Mobile-first solutions represent a growing opportunity as smartphone penetration reaches saturation and users demand convenient, contactless access methods. The development of secure mobile credentials and seamless user experiences can capture significant market share among tech-savvy consumers.

Cloud-based platforms enable scalable, cost-effective solutions particularly attractive to small and medium enterprises seeking enterprise-grade security without substantial infrastructure investment. Software-as-a-Service models can democratize access to advanced security technologies.

Vertical market specialization in sectors such as healthcare, education, and manufacturing offers opportunities to develop tailored solutions addressing specific industry requirements and compliance standards. Specialized applications can command premium pricing and foster long-term customer relationships.

Market dynamics within China’s access control sector reflect the interplay between technological innovation, regulatory evolution, and changing user expectations. Competitive intensity has increased as both domestic and international players vie for market share through product differentiation and strategic partnerships.

Technology evolution continues to reshape market dynamics, with artificial intelligence, machine learning, and advanced biometrics creating new competitive advantages and market entry barriers. Companies investing in research and development maintain stronger market positions and customer loyalty.

Customer behavior patterns show increasing preference for integrated solutions offering comprehensive security management capabilities rather than standalone access control systems. This trend drives market consolidation and encourages strategic partnerships between technology providers.

Supply chain considerations have gained prominence following global disruptions, with organizations seeking reliable, locally-supported solutions. This dynamic has benefited domestic manufacturers while encouraging international companies to establish local partnerships and manufacturing capabilities.

Pricing pressures from competitive market conditions and customer cost sensitivity have encouraged innovation in business models, including subscription-based services, managed security offerings, and performance-based contracts. These alternative approaches can improve market accessibility and customer value perception.

Research methodology for analyzing China’s access control market employs comprehensive primary and secondary research approaches to ensure data accuracy and market insight validity. Primary research activities include structured interviews with industry executives, technology vendors, system integrators, and end-user organizations across multiple sectors and geographic regions.

Secondary research sources encompass industry reports, government publications, trade association data, and company financial disclosures to establish market baselines and validate primary research findings. MarkWide Research utilizes proprietary databases and analytical frameworks to synthesize information from diverse sources and identify emerging trends.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and employing statistical analysis techniques to ensure research reliability. Market sizing and forecasting methodologies incorporate both top-down and bottom-up approaches to provide comprehensive market perspectives.

Geographic coverage spans major Chinese cities and regions, with particular attention to tier-one, tier-two, and emerging tier-three markets to capture regional variations and growth patterns. Industry segmentation analysis covers commercial, residential, government, and industrial applications.

Temporal analysis examines historical market development, current conditions, and future projections to identify cyclical patterns, growth drivers, and potential disruptions affecting market evolution.

Regional analysis of China’s access control market reveals significant geographic variations in adoption patterns, technology preferences, and growth trajectories. Eastern coastal regions including Beijing, Shanghai, and Shenzhen maintain market leadership with approximately 52% of total market concentration, driven by high urbanization rates, economic development, and technology adoption.

Tier-one cities demonstrate mature market characteristics with emphasis on advanced biometric systems, integrated platforms, and premium solution features. These markets show steady growth rates while focusing on system upgrades and technology refresh cycles rather than new installations.

Tier-two cities including Chengdu, Wuhan, Xi’an, and Nanjing exhibit the highest growth rates, with market expansion driven by rapid urbanization, infrastructure development, and increasing security awareness. These regions show strong preference for cost-effective solutions with growth potential.

Southern regions particularly Guangdong and Fujian provinces benefit from manufacturing sector concentration and export-oriented business activities, creating demand for industrial access control applications and supply chain security solutions.

Western and central regions represent emerging markets with substantial growth potential as government investment in infrastructure development and smart city initiatives expands. These areas show increasing adoption of standardized, scalable solutions suitable for rapid deployment.

Competitive landscape analysis reveals a dynamic market structure combining established international players with innovative domestic companies. Market leadership is distributed among several key categories of participants:

Competitive strategies emphasize product innovation, strategic partnerships, and market-specific customization to address diverse customer requirements and regional preferences. Companies increasingly focus on software capabilities and service offerings to differentiate from hardware-centric competitors.

Market segmentation analysis provides detailed insights into China’s access control market structure across multiple dimensions:

By Technology:

By Application:

By Component:

Category-wise analysis reveals distinct market dynamics and growth patterns across different access control segments:

Biometric Systems Category: Dominates market share with facial recognition technology leading at 38% adoption due to accuracy improvements and user acceptance. This category benefits from AI advancement and contactless operation preferences, particularly following health and safety considerations.

Mobile Credentials Category: Represents the fastest-growing segment with annual growth rates exceeding 25% as smartphone integration becomes standard. This category appeals to tech-savvy users and organizations seeking flexible, scalable access management solutions.

Commercial Application Category: Maintains largest market share driven by office building construction and corporate security requirements. Integration with building management systems and visitor management platforms enhances category value propositions.

Residential Application Category: Shows strong growth potential as smart home adoption increases and residential security awareness expands. This category benefits from declining technology costs and improved user interfaces.

Software and Services Category: Experiences rapid expansion as organizations prioritize ongoing support, system optimization, and advanced analytics capabilities. Subscription-based models improve market accessibility and customer relationships.

Industry participants and stakeholders realize substantial benefits from China’s expanding access control market across multiple dimensions:

For Technology Vendors:

For End Users:

For System Integrators:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping China’s access control landscape reflect technological evolution, user behavior changes, and industry transformation:

Contactless Technology Adoption: Accelerated preference for touchless access methods driven by health considerations and user convenience. Facial recognition and mobile credentials show increased adoption rates as organizations prioritize hygiene and user safety.

AI-Powered Analytics: Integration of artificial intelligence for behavioral analysis, threat detection, and predictive maintenance capabilities. These advanced features enhance security effectiveness while reducing operational costs and false alarm rates.

Cloud-Based Management: Migration toward cloud platforms enabling centralized management, scalability, and remote administration capabilities. This trend particularly appeals to multi-site organizations and companies seeking reduced IT infrastructure requirements.

Mobile Integration: Smartphone-based access credentials gaining traction with 23% of new installations incorporating mobile capabilities. This trend reflects user preference for convenient, personalized access experiences.

Unified Security Platforms: Increasing demand for integrated solutions combining access control with video surveillance, intrusion detection, and building management systems. This convergence improves operational efficiency and provides comprehensive security oversight.

Recent industry developments highlight the dynamic nature of China’s access control market and emerging competitive dynamics:

Technology Partnerships: Strategic alliances between access control vendors and AI companies to enhance biometric accuracy and system intelligence. These collaborations accelerate innovation while expanding market reach and capabilities.

Product Launches: Introduction of next-generation biometric systems featuring improved accuracy, speed, and user experience. New products emphasize contactless operation, multi-modal authentication, and seamless integration capabilities.

Market Consolidation: Merger and acquisition activities as companies seek to expand capabilities, market presence, and technology portfolios. This consolidation trend creates stronger market players while potentially reducing competitive intensity.

Regulatory Compliance: Implementation of enhanced data protection and cybersecurity standards affecting system design and deployment practices. Companies invest in compliance capabilities to maintain market access and customer confidence.

International Expansion: Chinese access control companies expanding globally while international players strengthen local presence through partnerships and acquisitions. This trend increases competitive dynamics while expanding market opportunities.

Analyst recommendations for China’s access control market participants focus on strategic positioning, technology investment, and market development approaches:

Technology Investment: MarkWide Research suggests prioritizing AI integration, mobile capabilities, and cloud platform development to maintain competitive relevance. Companies should allocate significant resources to R&D activities addressing emerging customer requirements and technology trends.

Market Segmentation: Focus on vertical market specialization to develop deep industry expertise and differentiated value propositions. Healthcare, education, and manufacturing sectors offer substantial growth opportunities for tailored solutions.

Partnership Strategy: Establish strategic alliances with system integrators, technology partners, and channel distributors to expand market reach and implementation capabilities. Collaborative approaches can accelerate market penetration while reducing investment requirements.

Service Development: Expand service offerings including managed security, maintenance, and consulting to create recurring revenue streams and strengthen customer relationships. Service capabilities increasingly differentiate vendors in competitive markets.

Geographic Expansion: Target tier-two and tier-three cities where market growth rates exceed mature markets while competition remains manageable. These regions offer substantial long-term growth potential with appropriate market entry strategies.

Future outlook for China’s access control market indicates sustained growth momentum driven by technological advancement, urbanization, and evolving security requirements. Market projections suggest continued expansion with annual growth rates maintaining 12-15% range over the next five years.

Technology evolution will emphasize artificial intelligence integration, enhanced biometric capabilities, and seamless mobile experiences. The convergence of access control with broader security ecosystems and smart building platforms will create comprehensive solution offerings addressing multiple customer objectives.

Market maturation in tier-one cities will shift focus toward system upgrades, feature enhancement, and service-based revenue models. Meanwhile, tier-two and tier-three cities will drive volume growth through new installations and infrastructure development projects.

Regulatory environment evolution will continue shaping market dynamics through data protection requirements, cybersecurity standards, and industry-specific compliance mandates. Companies maintaining strong compliance capabilities will benefit from competitive advantages and market access opportunities.

International integration will increase as Chinese companies expand globally while international players strengthen local presence. This trend will enhance technology transfer, competitive dynamics, and market sophistication across the access control ecosystem.

China’s access control market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and expanding application opportunities. The market benefits from supportive government policies, robust domestic demand, and continuous investment in security infrastructure across multiple industries and geographic regions.

Key success factors for market participants include technology leadership, strategic partnerships, vertical market expertise, and comprehensive service capabilities. Companies that effectively combine innovation with market understanding and customer focus will capture the most significant growth opportunities in this expanding market.

Market evolution toward integrated, intelligent, and user-friendly solutions reflects broader trends in security technology and customer expectations. The emphasis on contactless operation, mobile integration, and AI-powered analytics will continue driving product development and competitive differentiation strategies.

Long-term prospects remain highly favorable as urbanization, digitalization, and security awareness continue expanding across China’s diverse market segments. The access control market will play an increasingly important role in supporting smart city initiatives, building automation, and comprehensive security strategies that address evolving threats and operational requirements.

What is Access Control?

Access control refers to the security technique that regulates who or what can view or use resources in a computing environment. It is essential in various applications, including physical security systems, IT security, and data protection.

What are the key players in the China Access Control Market?

Key players in the China Access Control Market include Hikvision, Dahua Technology, and ZKTeco, which provide a range of access control solutions such as biometric systems, card readers, and integrated security systems, among others.

What are the growth factors driving the China Access Control Market?

The China Access Control Market is driven by increasing security concerns, the rise in smart building technologies, and the growing adoption of biometric authentication methods across various sectors, including banking and healthcare.

What challenges does the China Access Control Market face?

Challenges in the China Access Control Market include the high costs associated with advanced security systems, concerns over privacy and data protection, and the need for continuous technological updates to combat evolving security threats.

What opportunities exist in the China Access Control Market?

Opportunities in the China Access Control Market include the expansion of IoT-enabled security solutions, the integration of AI for enhanced security analytics, and the increasing demand for cloud-based access control systems in various industries.

What trends are shaping the China Access Control Market?

Trends in the China Access Control Market include the shift towards mobile access control solutions, the integration of access control with video surveillance systems, and the growing emphasis on user-friendly interfaces and remote management capabilities.

China Access Control Market

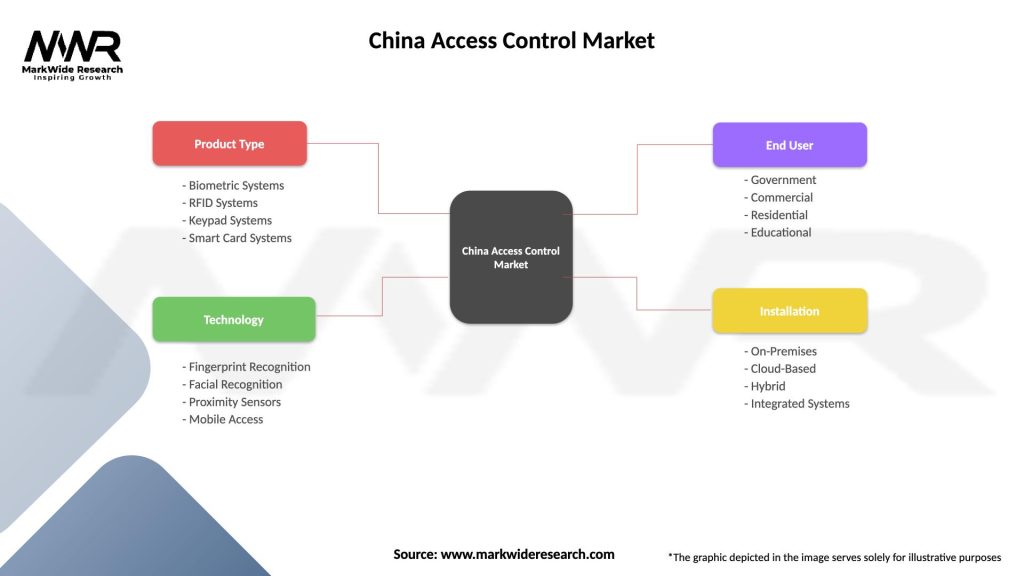

| Segmentation Details | Description |

|---|---|

| Product Type | Biometric Systems, RFID Systems, Keypad Systems, Smart Card Systems |

| Technology | Fingerprint Recognition, Facial Recognition, Proximity Sensors, Mobile Access |

| End User | Government, Commercial, Residential, Educational |

| Installation | On-Premises, Cloud-Based, Hybrid, Integrated Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Access Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at