444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Chile water consumption market represents a critical component of the nation’s infrastructure and economic development, encompassing residential, industrial, agricultural, and commercial water usage across diverse geographical regions. Chile’s unique geography, stretching over 4,300 kilometers from north to south, creates distinct water consumption patterns influenced by climate variations, population density, and industrial activities. The market demonstrates steady growth with consumption increasing at approximately 3.2% annually, driven by urbanization, industrial expansion, and improved water access infrastructure.

Regional disparities characterize Chile’s water consumption landscape, with the northern regions experiencing water scarcity challenges while southern areas benefit from abundant freshwater resources. The Metropolitan Region accounts for approximately 40% of total national consumption, reflecting the concentration of population and economic activities around Santiago. Mining operations, particularly copper extraction, represent a significant portion of industrial water demand, contributing to specialized consumption patterns in mineral-rich northern territories.

Sustainability initiatives are increasingly shaping consumption trends, with government policies promoting water conservation and efficiency measures across all sectors. The market exhibits growing adoption of water recycling technologies and desalination solutions, particularly in water-stressed regions, indicating a shift toward more sustainable consumption practices and resource management strategies.

The Chile water consumption market refers to the comprehensive ecosystem of water usage, distribution, and management across all sectors within Chilean territory, encompassing municipal supply systems, industrial applications, agricultural irrigation, and residential consumption patterns. This market includes the infrastructure, technologies, and services required to deliver, treat, and manage water resources for diverse end-user applications throughout the country’s varied geographical and climatic zones.

Water consumption in Chile involves multiple stakeholders including government agencies, private utilities, industrial consumers, agricultural producers, and residential users, all participating in a complex network of supply chains, regulatory frameworks, and consumption patterns. The market encompasses both traditional freshwater sources and alternative solutions such as desalinated water, recycled wastewater, and groundwater extraction systems.

Market dynamics are influenced by factors including population growth, economic development, climate change impacts, regulatory policies, and technological innovations in water treatment and distribution. The Chilean water consumption landscape reflects the country’s commitment to sustainable resource management while addressing growing demand from various sectors and regions with different water availability characteristics.

Chile’s water consumption market demonstrates resilient growth patterns despite facing significant challenges related to water scarcity, climate variability, and increasing demand from multiple sectors. The market is characterized by regional concentration with urban areas consuming approximately 65% of total treated water, while agricultural activities account for the largest share of overall water usage across the country.

Industrial consumption patterns are heavily influenced by mining operations, which represent a substantial portion of water demand in northern regions. The market shows increasing adoption of water-efficient technologies and conservation measures, driven by both regulatory requirements and economic incentives. Desalination capacity has expanded significantly, with seawater desalination contributing an increasing percentage to overall water supply in coastal regions.

Future market development is expected to focus on sustainable consumption practices, infrastructure modernization, and enhanced water recycling capabilities. The integration of smart water management systems and digital monitoring technologies represents emerging opportunities for market growth and efficiency improvements across all consumption sectors.

Strategic market insights reveal several critical trends shaping Chile’s water consumption landscape:

Market segmentation reveals distinct consumption patterns across residential, commercial, industrial, and agricultural sectors, each with specific requirements, regulatory considerations, and growth trajectories that influence overall market dynamics and development strategies.

Population growth serves as a primary driver for Chile’s water consumption market, with urban areas experiencing steady demographic expansion that directly translates to increased residential and commercial water demand. The urbanization trend concentrates consumption in metropolitan regions, requiring enhanced distribution infrastructure and treatment capacity to meet growing needs.

Economic development across various sectors drives industrial water consumption, particularly in mining, manufacturing, and food processing industries. Chile’s position as a major copper producer creates substantial water demand for mineral extraction and processing operations, while emerging industries contribute to diversified consumption patterns across different regions.

Agricultural expansion and modernization efforts increase irrigation water requirements, with improved farming techniques and crop diversification leading to more efficient but higher-volume water usage. The development of export-oriented agriculture in suitable climatic zones drives demand for reliable water supply systems and advanced irrigation technologies.

Climate change adaptation strategies necessitate increased water consumption for cooling systems, drought mitigation measures, and alternative agricultural practices. Rising temperatures and changing precipitation patterns create new consumption requirements while simultaneously affecting water availability, driving demand for alternative water sources and conservation technologies.

Water scarcity represents the most significant constraint affecting Chile’s water consumption market, particularly in northern and central regions where natural water resources are limited relative to demand. Drought conditions and reduced precipitation patterns restrict consumption growth and require implementation of stringent conservation measures across all sectors.

Infrastructure limitations constrain market expansion in certain regions, where aging distribution networks, inadequate treatment facilities, and limited storage capacity restrict the ability to meet growing consumption demands. The high cost of infrastructure development and maintenance creates financial barriers for expanding water access to underserved areas.

Regulatory restrictions and water rights allocations limit consumption flexibility, with complex legal frameworks governing water usage that can restrict industrial expansion and agricultural development. Environmental protection requirements impose additional constraints on water extraction and consumption practices, particularly in ecologically sensitive areas.

Economic factors including high treatment costs, energy requirements for water processing, and infrastructure investment needs create financial barriers that limit consumption growth in certain sectors. The cost of alternative water sources such as desalination remains relatively high, affecting adoption rates and market expansion in water-stressed regions.

Desalination technology presents substantial opportunities for market expansion, particularly along Chile’s extensive coastline where seawater can provide reliable water sources for industrial, municipal, and agricultural applications. Advancing desalination efficiency and reducing operational costs create potential for significant market growth in coastal regions.

Water recycling and wastewater treatment technologies offer opportunities to increase effective water supply without additional resource extraction. Industrial water recycling systems, municipal wastewater reuse programs, and agricultural water recovery initiatives represent growing market segments with substantial development potential.

Smart water management systems and digital monitoring technologies create opportunities for efficiency improvements and consumption optimization across all sectors. IoT-enabled water meters, automated distribution controls, and predictive maintenance systems represent emerging market opportunities that can enhance overall system performance.

Public-private partnerships in water infrastructure development offer opportunities for market expansion and service improvement. Collaborative approaches to infrastructure investment, technology implementation, and service delivery can accelerate market growth while addressing financing challenges and technical expertise requirements.

Supply-demand imbalances create dynamic market conditions across different Chilean regions, with water-abundant southern areas contrasting sharply with water-scarce northern territories. These geographical disparities drive infrastructure development, technology adoption, and policy interventions that shape overall market evolution and consumption patterns.

Seasonal fluctuations significantly impact market dynamics, with agricultural consumption peaks during growing seasons while urban demand remains relatively stable throughout the year. Climate variability introduces additional complexity, requiring flexible supply systems and adaptive consumption strategies to manage varying water availability conditions.

Technological innovation continuously reshapes market dynamics through improved efficiency, alternative water sources, and enhanced distribution systems. Digital transformation in water management creates new possibilities for consumption optimization, leak detection, and demand forecasting that influence market development trajectories.

Regulatory evolution affects market dynamics through changing policies, environmental requirements, and conservation mandates. Government initiatives promoting sustainable consumption practices and infrastructure modernization create both opportunities and challenges that influence market participant strategies and investment decisions.

Comprehensive data collection methodologies were employed to analyze Chile’s water consumption market, incorporating primary research through stakeholder interviews, government agency consultations, and industry expert discussions. Secondary research included analysis of government statistics, utility company reports, and academic studies focusing on Chilean water resources and consumption patterns.

Quantitative analysis utilized consumption data from national water authorities, regional utilities, and sector-specific organizations to establish baseline consumption patterns and growth trends. Statistical modeling techniques were applied to identify correlations between economic factors, demographic changes, and consumption variations across different regions and sectors.

Qualitative assessment involved evaluation of policy frameworks, regulatory environments, and market participant strategies through structured interviews and expert consultations. Field research in key consumption regions provided insights into operational challenges, infrastructure conditions, and local market dynamics affecting consumption patterns.

Market validation processes included cross-referencing data sources, stakeholder feedback sessions, and expert review panels to ensure accuracy and reliability of findings. Continuous monitoring of market developments and regulatory changes ensures research findings remain current and relevant to market participants and policy makers.

Northern Chile demonstrates unique consumption characteristics driven by mining operations and water scarcity challenges. The Atacama Desert region relies heavily on desalination and groundwater extraction, with industrial consumption dominating usage patterns. Mining companies account for approximately 70% of regional water consumption, creating specialized market dynamics focused on industrial applications and alternative water sources.

Central Chile encompasses the highest population density and most diverse consumption patterns, with the Metropolitan Region representing the largest single market for residential and commercial water usage. Agricultural activities in central valleys create seasonal consumption peaks, while urban areas maintain steady year-round demand. The region accounts for approximately 45% of national consumption across all sectors.

Southern Chile benefits from abundant freshwater resources, supporting both agricultural and industrial activities with relatively lower water stress compared to northern regions. Forestry operations and food processing industries represent significant consumption sectors, while hydroelectric generation creates additional water management considerations affecting regional consumption patterns.

Coastal regions across all zones show increasing adoption of desalination technologies and seawater utilization for industrial applications. Port cities demonstrate growing consumption from shipping-related activities and coastal industrial development, while tourism in certain areas creates seasonal consumption variations that influence regional market dynamics.

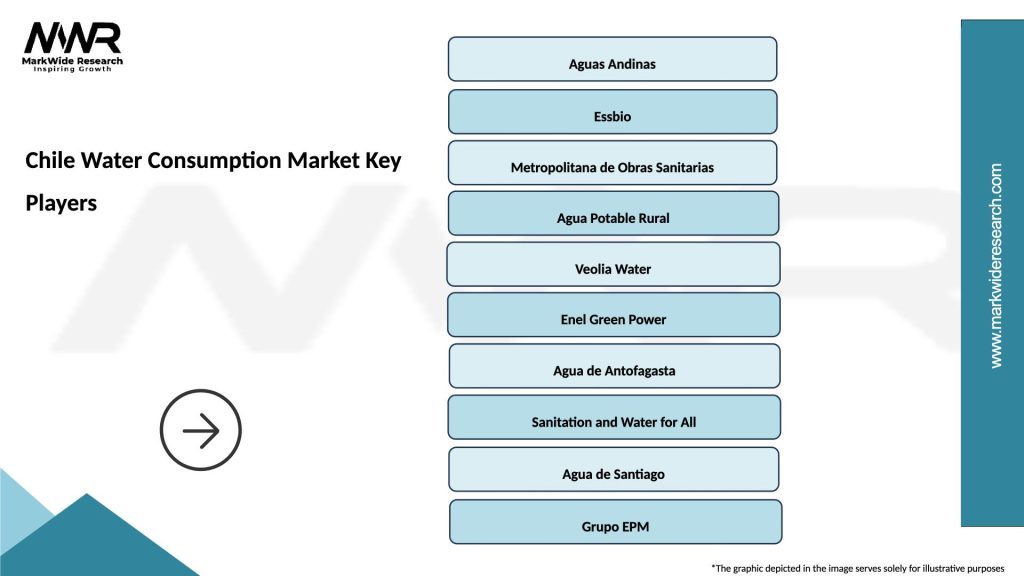

Major market participants in Chile’s water consumption sector include both public and private entities providing water services, infrastructure development, and consumption management solutions:

Market competition focuses on service quality, infrastructure efficiency, and sustainable consumption practices rather than traditional price competition. Utility companies compete through technological innovation, customer service excellence, and environmental stewardship while operating within regulated pricing frameworks.

Technology providers and infrastructure developers represent additional competitive elements, offering solutions for water treatment, distribution efficiency, and consumption monitoring that influence overall market dynamics and service delivery capabilities.

By Sector:

By Source:

By Region:

Residential consumption patterns show steady growth aligned with population increases and improved living standards. Urban households demonstrate higher per-capita consumption compared to rural areas, with growing adoption of water-efficient appliances and conservation practices. Smart metering implementation reaches approximately 25% of residential connections in major urban areas.

Industrial consumption varies significantly by sector, with mining operations requiring substantial water volumes for mineral processing while manufacturing industries focus on efficiency and recycling. Copper mining represents the largest single industrial consumption category, driving demand for alternative water sources and advanced treatment technologies in northern regions.

Agricultural consumption demonstrates seasonal patterns with peak usage during growing seasons and irrigation periods. Modern irrigation systems show improved efficiency compared to traditional methods, with drip irrigation and precision agriculture techniques gaining adoption. Export-oriented agriculture drives approximately 15% annual growth in specialized crop irrigation requirements.

Commercial consumption reflects economic activity patterns with higher usage in business districts and tourist areas. Service sector growth contributes to steady consumption increases, while hospitality and retail sectors implement water conservation measures to reduce operational costs and environmental impact.

Utility companies benefit from stable revenue streams and regulated return structures while gaining opportunities to implement innovative technologies and improve service delivery. Infrastructure investment programs provide long-term growth opportunities and enhanced operational efficiency through modernization initiatives and system upgrades.

Industrial consumers gain access to reliable water supplies essential for production processes while benefiting from improved efficiency and cost management through advanced treatment and recycling technologies. Mining companies achieve operational sustainability and regulatory compliance through proper water management and conservation practices.

Agricultural producers benefit from improved irrigation infrastructure and water-efficient technologies that enhance crop yields while reducing resource consumption. Government support for agricultural water projects provides access to funding and technical assistance for modernization efforts.

Technology providers find growing market opportunities in water treatment, distribution efficiency, and monitoring systems. Innovation incentives and sustainability requirements create demand for advanced solutions that improve overall system performance and environmental compliance.

Communities and consumers benefit from improved water access, quality, and reliability while gaining opportunities to participate in conservation programs and sustainable consumption practices that reduce costs and environmental impact.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents a dominant trend across Chile’s water consumption market, with all sectors implementing conservation measures and efficiency improvements. Circular economy principles drive adoption of water recycling and reuse technologies, while environmental stewardship becomes increasingly important for corporate and government water management strategies.

Digital transformation accelerates through smart meter deployment, automated monitoring systems, and data-driven consumption optimization. IoT technologies enable real-time tracking of water usage patterns, leak detection, and predictive maintenance that improve overall system efficiency and reduce operational costs.

Alternative water sources gain prominence as traditional supplies face increasing pressure from demand growth and climate variability. Desalination capacity expansion and advanced treatment technologies provide new supply options, while atmospheric water generation and other innovative sources emerge as potential solutions for water-stressed regions.

Public-private collaboration increases through infrastructure development partnerships, technology sharing agreements, and joint sustainability initiatives. Investment attraction from international sources supports market development while bringing advanced technologies and management expertise to Chilean water consumption sectors.

Infrastructure modernization projects across major Chilean cities focus on replacing aging distribution networks and implementing smart water management systems. Government investment programs support utility companies in upgrading treatment facilities and expanding service coverage to underserved areas.

Desalination facility expansion continues along Chile’s northern coast, with new plants coming online to serve both industrial and municipal consumers. Technology improvements in desalination processes reduce energy consumption and operational costs while increasing treatment capacity and water quality.

Regulatory updates strengthen water conservation requirements and environmental protection standards while providing incentives for efficiency improvements and alternative source development. Policy initiatives promote sustainable consumption practices across all sectors and support investment in water-saving technologies.

International partnerships bring advanced water management technologies and expertise to Chilean markets through technology transfer agreements and joint venture projects. MarkWide Research analysis indicates that these collaborations contribute to accelerated innovation adoption and improved system performance across multiple consumption sectors.

Infrastructure investment should prioritize regions with the greatest consumption growth potential while addressing existing service gaps in underserved areas. Strategic planning must consider long-term demographic trends, economic development patterns, and climate change impacts to ensure sustainable system development and adequate capacity.

Technology adoption recommendations focus on smart water management systems that provide real-time monitoring, consumption optimization, and predictive maintenance capabilities. Digital integration across all consumption sectors can improve efficiency while reducing operational costs and environmental impact through better resource management.

Sustainability initiatives should emphasize water recycling, conservation programs, and alternative source development to reduce pressure on traditional water resources. Circular economy approaches can create new revenue streams while improving overall system resilience and environmental performance.

Stakeholder collaboration between government agencies, utility companies, industrial consumers, and technology providers can accelerate market development while ensuring coordinated approaches to infrastructure investment and resource management. Public-private partnerships offer opportunities to leverage expertise and financing for large-scale development projects.

Market growth projections indicate continued expansion in Chile’s water consumption sector, driven by population growth, economic development, and improved access to water services. Consumption patterns are expected to evolve toward greater efficiency and sustainability, with advanced technologies enabling better resource management across all sectors.

Infrastructure development will focus on modernization and capacity expansion, particularly in high-growth regions and areas with existing service gaps. Investment requirements for system upgrades and new facilities are expected to drive market opportunities for technology providers and infrastructure developers over the next decade.

Alternative water sources will play an increasingly important role in meeting consumption demands, with desalination capacity expected to grow by approximately 8% annually in coastal regions. Water recycling and reuse applications are projected to expand significantly across industrial and agricultural sectors as technology costs decrease and regulatory support increases.

Digital transformation will accelerate through widespread adoption of smart water management systems, with MWR projections indicating that connected water infrastructure could reach 60% penetration in major urban areas within five years. These technological advances will enable more efficient consumption patterns and improved system performance across Chile’s diverse water market landscape.

Chile’s water consumption market presents a complex and dynamic landscape characterized by regional diversity, sectoral specialization, and evolving sustainability requirements. The market demonstrates resilient growth potential despite facing significant challenges related to water scarcity, climate variability, and infrastructure development needs across diverse geographical and economic conditions.

Strategic opportunities exist in technology adoption, alternative water source development, and infrastructure modernization that can address current market constraints while supporting future consumption growth. The integration of smart water management systems, expansion of desalination capacity, and implementation of comprehensive recycling programs represent key pathways for sustainable market development.

Stakeholder collaboration and coordinated investment approaches will be essential for realizing the market’s full potential while ensuring equitable access to water resources across all regions and sectors. The continued evolution of regulatory frameworks, technology capabilities, and sustainability practices will shape Chile’s water consumption market trajectory and its contribution to national economic development and environmental stewardship objectives.

What is Water Consumption?

Water consumption refers to the total amount of water used by individuals, industries, and agriculture within a specific area. In Chile, this includes domestic use, agricultural irrigation, and industrial processes that require significant water resources.

What are the key players in the Chile Water Consumption Market?

Key players in the Chile Water Consumption Market include Aguas Andinas, Essbio, and Aguas del Altiplano, which provide essential water services and infrastructure. These companies play a crucial role in managing water supply and distribution across various regions in Chile, among others.

What are the main drivers of the Chile Water Consumption Market?

The main drivers of the Chile Water Consumption Market include population growth, increased agricultural activities, and urbanization. These factors contribute to higher demand for water resources in both domestic and industrial sectors.

What challenges does the Chile Water Consumption Market face?

The Chile Water Consumption Market faces challenges such as water scarcity, climate change impacts, and regulatory constraints. These issues can affect the availability and quality of water resources, posing risks to both consumers and industries.

What opportunities exist in the Chile Water Consumption Market?

Opportunities in the Chile Water Consumption Market include investments in water-efficient technologies, sustainable water management practices, and infrastructure development. These initiatives can enhance water conservation and improve service delivery in urban and rural areas.

What trends are shaping the Chile Water Consumption Market?

Trends shaping the Chile Water Consumption Market include the adoption of smart water management systems, increased focus on sustainability, and the integration of renewable energy in water treatment processes. These trends aim to optimize water use and reduce environmental impact.

Chile Water Consumption Market

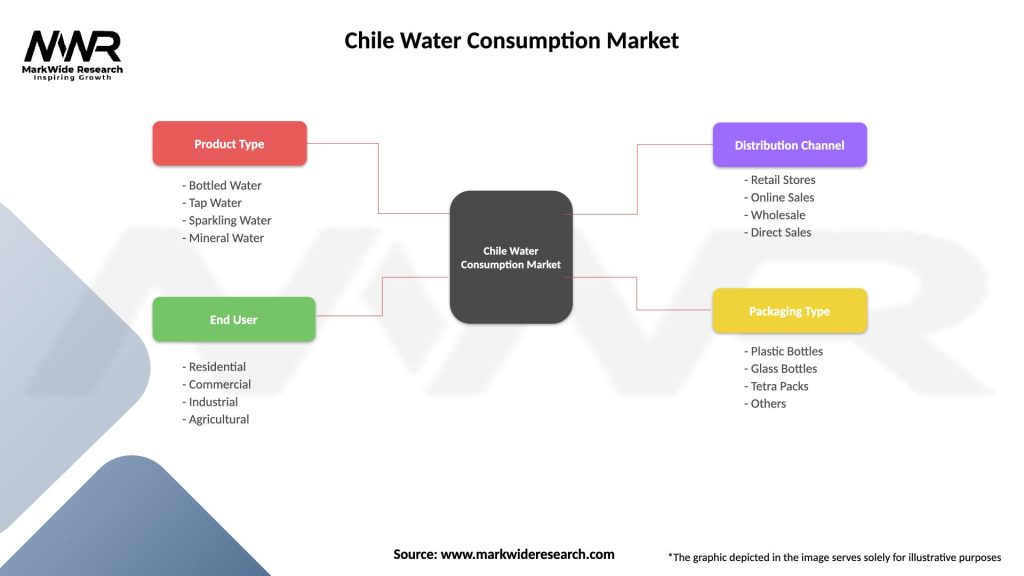

| Segmentation Details | Description |

|---|---|

| Product Type | Bottled Water, Tap Water, Sparkling Water, Mineral Water |

| End User | Residential, Commercial, Industrial, Agricultural |

| Distribution Channel | Retail Stores, Online Sales, Wholesale, Direct Sales |

| Packaging Type | Plastic Bottles, Glass Bottles, Tetra Packs, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Chile Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at