444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Chile Mobile Insurance market has witnessed significant growth in recent years, driven by the increasing penetration of smartphones and the rising demand for mobile insurance coverage. Mobile insurance provides protection against accidental damage, theft, loss, and mechanical breakdown of mobile devices, offering peace of mind to consumers who heavily rely on their smartphones for communication, entertainment, and daily tasks. This market overview aims to provide insights into the key trends, drivers, restraints, opportunities, and dynamics shaping the Chile Mobile Insurance market.

Meaning

Mobile insurance refers to the coverage provided to mobile device owners to safeguard their smartphones against various risks and uncertainties. It offers financial protection and assistance in the event of accidental damage, loss, theft, or mechanical breakdown of the insured device. With the increasing cost and importance of smartphones in people’s lives, mobile insurance has emerged as a crucial service that provides customers with the necessary support and assistance to recover from such incidents promptly.

Executive Summary

The Chile Mobile Insurance market has experienced substantial growth in recent years, driven by the growing smartphone user base and increasing awareness about the benefits of mobile insurance coverage. The market offers various insurance plans tailored to meet the diverse needs of consumers, ranging from basic coverage for accidental damage to comprehensive plans that also protect against theft and loss. With the rising adoption of smartphones and the constant risk of device damage, mobile insurance has become an essential consideration for smartphone owners in Chile.

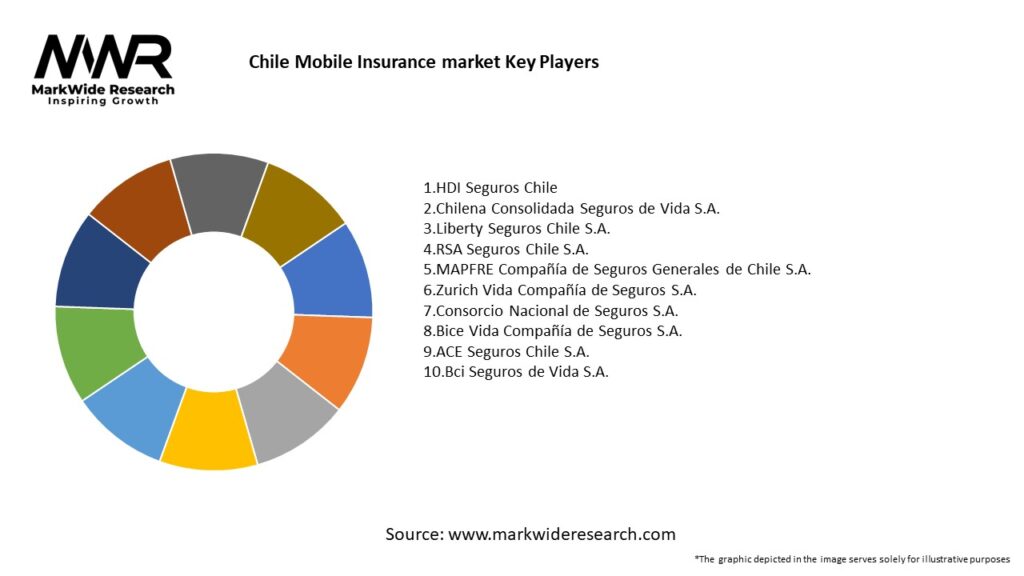

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

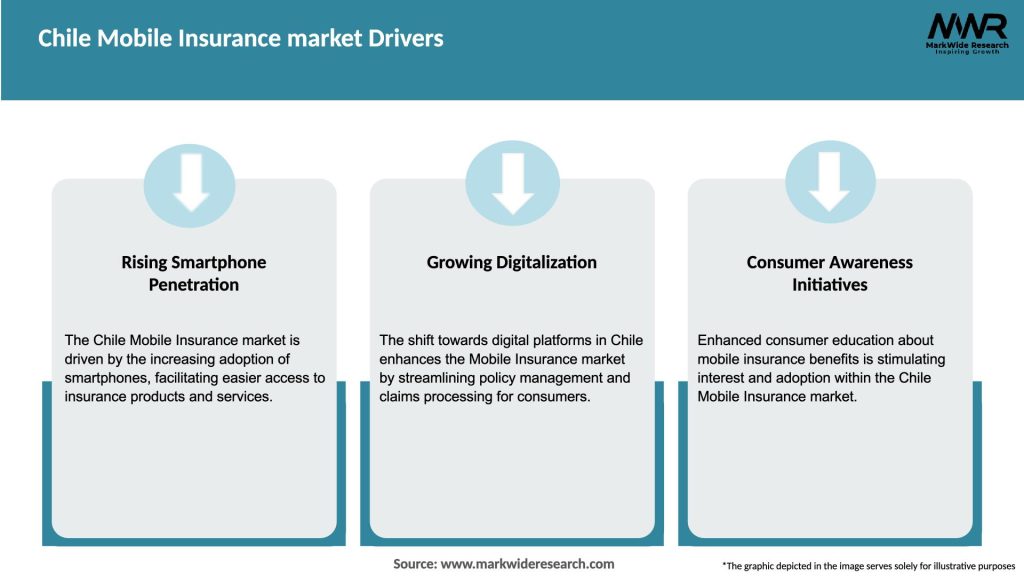

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Chile Mobile Insurance market is characterized by intense competition among insurance providers seeking to capture a larger share of the expanding market. Companies differentiate themselves through their coverage options, pricing models, customer service, and value-added services. As the market matures, insurance providers are focusing on enhancing customer experience, streamlining claim settlement processes, and leveraging technology to provide seamless and efficient services. Continuous innovation and customization of insurance plans are key strategies employed by companies to cater to the evolving needs and preferences of smartphone users.

Regional Analysis

The Chile Mobile Insurance market exhibits regional variations based on factors such as smartphone penetration, income levels, and urbanization. Major urban centers with higher smartphone adoption rates and disposable incomes present substantial market potential. Metropolitan areas, including Santiago, Valparaíso, and Concepción, account for a significant portion of mobile insurance demand. However, with increasing smartphone penetration in rural areas, there is a growing opportunity for mobile insurance providers to expand their reach and tap into previously underserved markets.

Competitive Landscape

Leading Companies in the Chile Mobile Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

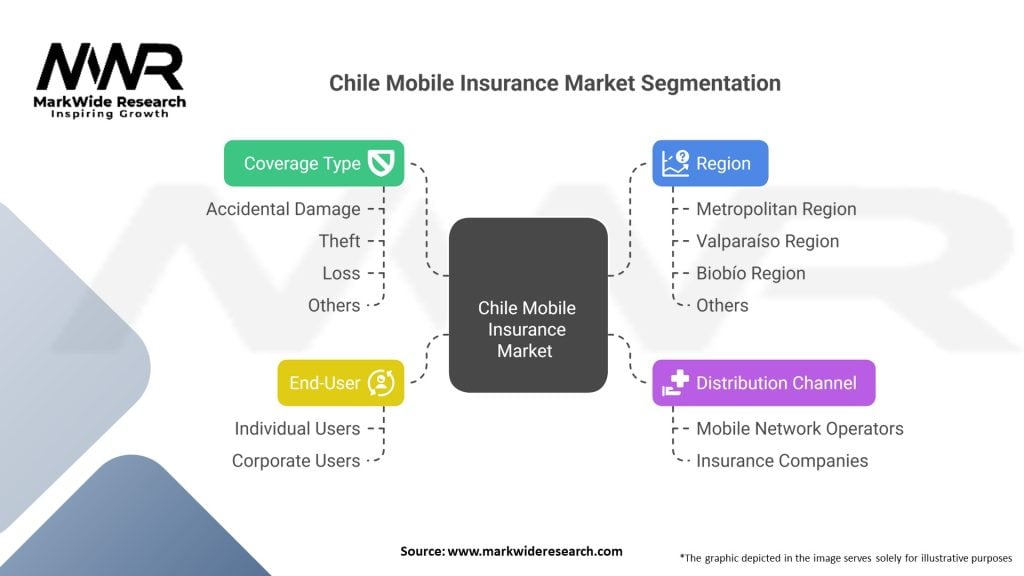

Segmentation

The Chile Mobile Insurance market can be segmented based on various factors, including coverage type, distribution channel, and customer demographics. Common coverage types offered by insurance providers include accidental damage, theft and loss, mechanical breakdown, and extended warranty. Distribution channels for mobile insurance include insurance agents, online platforms, mobile apps, and partnerships with smartphone retailers. Demographic segmentation may focus on age groups, income levels, or occupation types to tailor insurance plans to specific customer segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative effects on the Chile Mobile Insurance market.

Positive impacts:

Negative impacts:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Chile Mobile Insurance market is promising, driven by factors such as increasing smartphone penetration, growing awareness about mobile insurance, and technological advancements. The market is expected to witness continued growth as insurance providers focus on customization, innovation, and partnerships to cater to evolving customer needs. Digital transformation and the adoption of advanced technologies will play a crucial role in shaping the market’s future, enhancing customer experience, and streamlining insurance operations.

Conclusion

The Chile Mobile Insurance market has experienced significant growth, propelled by the rising smartphone penetration and increasing awareness about the need for mobile insurance coverage. The market offers various coverage options, including accidental damage, theft and loss, mechanical breakdown, and extended warranty. While affordability concerns and limited awareness remain challenges, the market presents opportunities for partnerships, product innovation, and digital marketing strategies. The future outlook for the market is positive, with continued growth expected as insurance providers focus on enhancing customer experience, leveraging technology, and catering to evolving customer preferences.

What is Mobile Insurance?

Mobile Insurance refers to insurance products specifically designed for mobile devices, providing coverage against risks such as theft, damage, and loss. This type of insurance is increasingly popular as mobile devices become essential in daily life.

Who are the key players in the Chile Mobile Insurance market?

Key players in the Chile Mobile Insurance market include companies like BICE Vida, Consorcio, and Mapfre, which offer various mobile insurance products tailored to consumer needs. These companies are competing to enhance their offerings and customer service, among others.

What are the main drivers of growth in the Chile Mobile Insurance market?

The main drivers of growth in the Chile Mobile Insurance market include the increasing penetration of smartphones, rising consumer awareness about device protection, and the growing trend of online shopping. Additionally, the demand for comprehensive coverage options is also contributing to market expansion.

What challenges does the Chile Mobile Insurance market face?

The Chile Mobile Insurance market faces challenges such as low consumer awareness regarding mobile insurance products and the perception of high premiums. Additionally, competition from alternative protection plans and warranty services can hinder market growth.

What opportunities exist in the Chile Mobile Insurance market?

Opportunities in the Chile Mobile Insurance market include the potential for partnerships with mobile service providers and retailers to offer bundled insurance products. Furthermore, the rise of e-commerce presents a chance to reach a broader audience seeking device protection.

What trends are shaping the Chile Mobile Insurance market?

Trends shaping the Chile Mobile Insurance market include the integration of technology in policy management and claims processing, as well as the rise of customizable insurance plans. Additionally, the focus on customer-centric services is becoming increasingly important in attracting and retaining clients.

Chile Mobile Insurance Market

| Segmentation | Details |

|---|---|

| Coverage Type | Accidental Damage, Theft, Loss, Others |

| Distribution Channel | Mobile Network Operators, Insurance Companies |

| End-User | Individual Users, Corporate Users |

| Region | Metropolitan Region, Valparaíso Region, Biobío Region, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Chile Mobile Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at