444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Chile data center processor market represents a rapidly evolving technological landscape that serves as the backbone of the country’s digital transformation initiatives. Chile’s strategic position as a regional technology hub in South America has positioned it as a critical gateway for data center investments and processor deployment across Latin America. The market encompasses various processor technologies including central processing units (CPUs), graphics processing units (GPUs), and specialized artificial intelligence processors that power the nation’s growing digital infrastructure.

Market dynamics indicate robust growth driven by increasing cloud adoption, digital banking expansion, and government digitization programs. The Chilean market demonstrates a compound annual growth rate (CAGR) of 8.2% in processor deployments, reflecting the country’s commitment to technological advancement. Enterprise adoption of advanced processor technologies has accelerated significantly, with organizations seeking enhanced computational capabilities to support big data analytics, machine learning applications, and real-time processing requirements.

Regional significance extends beyond Chile’s borders, as the country serves as a strategic location for multinational corporations establishing South American data center operations. The market benefits from Chile’s stable political environment, reliable power infrastructure, and favorable renewable energy policies that attract international data center investments. Processor demand continues to surge as organizations migrate workloads to cloud platforms and implement edge computing solutions to serve local and regional markets effectively.

The Chile data center processor market refers to the comprehensive ecosystem of semiconductor processing units deployed within data center facilities across Chile to support computational workloads, data processing, and digital service delivery. This market encompasses the procurement, deployment, and utilization of various processor types including server processors, accelerator chips, and specialized computing units that enable data centers to deliver cloud services, host applications, and process data for businesses and consumers.

Market scope includes both traditional x86 processors from established manufacturers and emerging ARM-based processors that offer enhanced energy efficiency and performance optimization. The definition extends to cover artificial intelligence processors, field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs) that support specialized workloads such as machine learning, cryptocurrency mining, and high-performance computing applications.

Technological integration within Chile’s data center processor market reflects the convergence of traditional computing architectures with modern heterogeneous computing environments that combine multiple processor types to optimize performance and efficiency. The market represents a critical component of Chile’s digital infrastructure, enabling the country to support fintech innovations, e-commerce platforms, and government digital services that drive economic growth and technological advancement.

Chile’s data center processor market demonstrates exceptional growth momentum driven by accelerating digital transformation across multiple sectors. The market benefits from Chile’s position as a regional technology leader and its strategic importance as a gateway to South American markets. Government initiatives promoting digitalization, combined with private sector investments in cloud infrastructure, create a favorable environment for processor market expansion.

Key market drivers include the rapid adoption of artificial intelligence applications, increasing demand for edge computing solutions, and the expansion of financial technology services throughout the region. Chilean organizations demonstrate a 72% adoption rate for cloud-based services, driving substantial demand for advanced processor technologies. Energy efficiency considerations play a crucial role in processor selection, with organizations prioritizing performance-per-watt optimization to reduce operational costs and environmental impact.

Market segmentation reveals strong demand across multiple processor categories, with server processors maintaining the largest market share while AI accelerators experience the fastest growth rates. The competitive landscape features established global processor manufacturers alongside emerging regional players who provide specialized solutions for local market requirements. Investment trends indicate continued market expansion with significant capital allocation toward next-generation processor technologies and sustainable computing solutions.

Strategic market insights reveal several critical factors shaping Chile’s data center processor landscape. The market demonstrates strong correlation between economic digitization and processor demand, with financial services, retail, and government sectors leading adoption initiatives.

Digital transformation initiatives across Chilean enterprises serve as the primary catalyst for data center processor market growth. Organizations increasingly recognize the strategic importance of computational infrastructure in maintaining competitive advantages and delivering superior customer experiences. Government digitization programs create substantial demand for processing capabilities to support e-government services, digital identity systems, and smart city initiatives throughout the country.

Cloud adoption acceleration drives significant processor demand as organizations migrate workloads from traditional on-premises infrastructure to hybrid cloud environments. Chilean businesses demonstrate a 65% preference for hybrid cloud architectures that require advanced processors capable of supporting workload orchestration and dynamic resource allocation. Financial services digitization particularly contributes to market growth, with banks and fintech companies investing heavily in real-time processing capabilities to support digital payments, algorithmic trading, and risk management systems.

Artificial intelligence proliferation creates unprecedented demand for specialized processors optimized for machine learning inference and deep learning training workloads. Chilean organizations across sectors including mining, agriculture, and telecommunications implement AI solutions that require high-performance computing capabilities. Edge computing expansion further amplifies processor demand as organizations deploy distributed computing architectures to reduce latency and improve application performance for end users.

High capital investment requirements present significant barriers to data center processor market expansion in Chile. Organizations face substantial upfront costs associated with processor procurement, infrastructure upgrades, and system integration that can strain budgets and delay implementation timelines. Technical complexity associated with modern processor architectures requires specialized expertise that may be limited within the Chilean market, creating implementation challenges and increased dependency on external consultants.

Supply chain vulnerabilities impact processor availability and pricing stability, particularly given Chile’s geographic location and dependence on international semiconductor manufacturers. Global chip shortages and geopolitical tensions create uncertainty in processor procurement timelines and costs. Energy infrastructure limitations in certain regions of Chile may constrain data center expansion and processor deployment, particularly for high-performance computing applications that require substantial power resources.

Skills shortage in specialized areas such as AI processor optimization, heterogeneous computing, and advanced system architecture limits organizations’ ability to fully leverage processor capabilities. Regulatory compliance complexity associated with data protection laws and cross-border data transfer requirements may influence processor selection and deployment strategies. Economic volatility and currency fluctuations can impact the total cost of ownership for processor investments, particularly for organizations with limited financial flexibility.

Emerging technology adoption presents substantial opportunities for processor market expansion in Chile. The growing implementation of Internet of Things (IoT) applications across industries creates demand for edge processors capable of supporting real-time data processing and local decision-making capabilities. 5G network deployment throughout Chile enables new applications requiring ultra-low latency processing and high-bandwidth connectivity, driving demand for specialized processors optimized for network function virtualization and mobile edge computing.

Sustainability initiatives create opportunities for energy-efficient processor technologies that align with Chile’s commitment to renewable energy adoption and carbon footprint reduction. Organizations increasingly prioritize green computing solutions that deliver superior performance while minimizing environmental impact. Regional expansion opportunities emerge as Chilean data centers serve as regional hubs for multinational corporations seeking to establish presence in South American markets.

Industry-specific applications present targeted opportunities for specialized processor deployment. Chile’s mining industry requires advanced processors for geological modeling, autonomous vehicle control, and predictive maintenance applications. Agricultural technology adoption creates demand for processors supporting precision farming, crop monitoring, and supply chain optimization. Financial innovation continues to drive processor demand for blockchain applications, cryptocurrency processing, and advanced risk analytics.

Competitive dynamics within Chile’s data center processor market reflect the interplay between global technology leaders and regional solution providers. Market consolidation trends indicate increasing collaboration between processor manufacturers and system integrators to deliver comprehensive solutions that address specific Chilean market requirements. Innovation cycles accelerate as manufacturers introduce next-generation architectures optimized for AI workloads, cloud computing, and edge applications.

Pricing dynamics demonstrate volatility influenced by global supply chain conditions, technology advancement cycles, and competitive positioning strategies. Organizations benefit from performance improvements of approximately 15-20% annually in processor capabilities while managing total cost of ownership through strategic procurement and lifecycle management practices. Technology refresh cycles typically span 3-5 years for enterprise deployments, creating predictable demand patterns for processor manufacturers.

Partnership ecosystems evolve to include cloud service providers, system integrators, software vendors, and managed service providers who collectively deliver integrated solutions to Chilean organizations. Market maturation drives standardization of procurement processes, performance benchmarking, and vendor evaluation criteria. Customer expectations increasingly focus on solution outcomes rather than individual component specifications, influencing how processor vendors position their offerings in the Chilean market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of Chile’s data center processor market dynamics. Primary research includes structured interviews with technology executives, procurement managers, and IT decision-makers across various industries to understand adoption patterns, challenges, and future requirements. Secondary research encompasses analysis of industry reports, vendor announcements, financial statements, and regulatory filings to establish market context and competitive positioning.

Data collection methodologies incorporate both quantitative surveys and qualitative assessments to capture comprehensive market insights. Market sizing utilizes bottom-up analysis based on processor shipment data, data center capacity metrics, and technology adoption rates across different market segments. Trend analysis examines historical performance data, technology evolution patterns, and market development trajectories to identify emerging opportunities and potential challenges.

Validation processes include cross-referencing multiple data sources, expert panel reviews, and statistical analysis to ensure data accuracy and reliability. Market forecasting employs scenario-based modeling that considers various factors including economic conditions, technology advancement rates, and regulatory changes. Geographic analysis focuses specifically on Chilean market conditions while considering regional influences and global technology trends that impact local market dynamics.

Santiago Metropolitan Region dominates Chile’s data center processor market, accounting for approximately 68% of total processor deployments due to its concentration of financial institutions, technology companies, and government agencies. The region benefits from superior telecommunications infrastructure, reliable power supply, and skilled workforce availability that support large-scale data center operations. Processor demand in Santiago reflects diverse workload requirements including high-frequency trading, digital banking, and e-commerce platforms.

Valparaíso Region emerges as a secondary market with growing significance due to its strategic coastal location and submarine cable landing points that provide international connectivity. The region attracts content delivery networks and cloud service providers seeking to establish regional presence with optimized latency characteristics. Processor requirements focus on network processing capabilities and content caching applications that support media distribution and web services.

Northern regions including Antofagasta and Atacama demonstrate specialized processor demand driven by mining industry applications and renewable energy projects. These regions require processors optimized for industrial IoT applications, autonomous equipment control, and environmental monitoring systems. Southern regions show emerging demand for processors supporting agricultural technology, tourism applications, and regional government services, though at lower volumes compared to metropolitan areas.

Market leadership in Chile’s data center processor segment reflects the dominance of established global semiconductor manufacturers who maintain strong local partnerships and distribution networks. The competitive environment demonstrates increasing diversification as organizations explore alternative processor architectures to optimize performance, cost, and energy efficiency.

Competitive strategies emphasize solution integration, local support capabilities, and technology partnerships that address specific Chilean market requirements. Vendor differentiation increasingly focuses on total cost of ownership, performance optimization, and sustainability credentials rather than purely technical specifications.

Technology-based segmentation reveals distinct processor categories serving different computational requirements within Chilean data centers. Market distribution demonstrates the evolution from traditional general-purpose processors toward specialized accelerated computing solutions that optimize specific workload performance.

By Processor Type:

By Application Segment:

Server processor category maintains the largest market share within Chile’s data center ecosystem, driven by continued demand for virtualization platforms and cloud infrastructure. Organizations prioritize processors offering high core counts, advanced memory support, and integrated security features to support multi-workload environments. Performance per watt considerations increasingly influence procurement decisions as organizations seek to optimize operational costs and environmental impact.

AI accelerator segment demonstrates the fastest growth rate, with Chilean organizations implementing machine learning applications across diverse use cases. Financial services lead adoption with fraud detection systems, algorithmic trading platforms, and customer analytics applications. Mining companies deploy AI accelerators for predictive maintenance, geological analysis, and autonomous equipment control. Government agencies utilize AI processors for citizen services, traffic management, and public safety applications.

Network processor category experiences steady growth driven by 5G infrastructure deployment and software-defined networking adoption. Chilean telecommunications providers invest in processors supporting network function virtualization and edge computing capabilities. Storage processor segment benefits from increasing data generation and compliance requirements that necessitate advanced data management capabilities and high-performance storage systems.

Technology vendors benefit from Chile’s position as a regional technology hub that provides access to broader South American markets. The Chilean market offers opportunities for product validation, reference customer development, and regional expansion strategies. Stable regulatory environment and strong intellectual property protection create favorable conditions for technology investment and innovation initiatives.

System integrators and solution providers gain access to a sophisticated customer base with advanced technology requirements and substantial procurement budgets. Chilean organizations demonstrate willingness to invest in cutting-edge technologies and comprehensive solutions that deliver measurable business outcomes. Partnership opportunities with local companies provide market access and cultural expertise essential for successful market penetration.

End-user organizations benefit from increased processor availability, competitive pricing, and comprehensive support services. Technology diversity enables organizations to select optimal processors for specific workload requirements while maintaining vendor flexibility and negotiating leverage. Local support infrastructure reduces implementation risks and ensures ongoing technical assistance for complex deployments.

Government stakeholders benefit from enhanced digital infrastructure capabilities that support economic development, citizen services, and international competitiveness. Advanced processor technologies enable smart city initiatives, e-government services, and digital transformation programs that improve public service delivery and administrative efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Heterogeneous computing adoption emerges as a dominant trend within Chile’s data center processor market, with organizations implementing mixed processor architectures to optimize performance and cost efficiency. Workload-specific optimization drives demand for specialized processors that excel in particular applications rather than general-purpose computing. MarkWide Research analysis indicates that 78% of Chilean enterprises plan to implement heterogeneous computing strategies within the next two years.

Edge computing proliferation creates new processor requirements as organizations deploy distributed computing architectures to reduce latency and improve application performance. 5G network deployment accelerates edge computing adoption, requiring processors optimized for real-time processing and low-power operation. IoT integration drives demand for processors capable of handling massive data ingestion and real-time analytics at the network edge.

Sustainability focus influences processor selection criteria as organizations prioritize energy efficiency and carbon footprint reduction. Green computing initiatives drive adoption of processors with superior performance-per-watt ratios and advanced power management capabilities. Liquid cooling adoption enables deployment of higher-performance processors while maintaining energy efficiency targets. Circular economy principles influence processor lifecycle management and equipment refresh strategies.

Major processor manufacturers announce significant investments in Chilean market development, including establishment of local support centers and technical training programs. Partnership agreements between global vendors and Chilean system integrators enhance solution delivery capabilities and customer support services. Technology refresh cycles accelerate as organizations upgrade legacy infrastructure to support modern workload requirements.

Government initiatives promote digital infrastructure development through favorable policies and investment incentives for data center construction and processor deployment. Regulatory frameworks evolve to address data protection requirements and cross-border data transfer while maintaining innovation-friendly policies. Public-private partnerships facilitate smart city projects and digital government initiatives that drive processor demand.

Industry consolidation continues as system integrators and managed service providers expand capabilities through strategic acquisitions and technology partnerships. Cloud service providers establish regional presence in Chile to serve South American markets, creating substantial processor demand. Startup ecosystem development in areas such as fintech, agtech, and cleantech generates demand for specialized processor capabilities.

Strategic procurement approaches should emphasize total cost of ownership optimization rather than initial purchase price considerations. Organizations benefit from implementing standardized processor platforms that simplify management overhead and skill requirements while maintaining performance flexibility. Vendor diversification strategies reduce supply chain risks and provide negotiating leverage for better pricing and support terms.

Technology roadmap alignment requires careful consideration of workload evolution and future performance requirements. Organizations should evaluate processors based on forward-looking capabilities including AI acceleration, security features, and energy efficiency improvements. Pilot program implementation enables organizations to validate processor performance before large-scale deployments.

Skills development initiatives should focus on processor optimization, workload tuning, and performance monitoring capabilities. Organizations benefit from establishing centers of excellence that develop internal expertise in advanced processor technologies. Vendor training programs and certification initiatives help build necessary technical capabilities within Chilean organizations.

Partnership strategies should leverage local system integrators and managed service providers who understand Chilean market requirements and regulatory environment. Regional collaboration with other South American organizations can provide economies of scale and shared expertise for processor deployments.

Market trajectory indicates sustained growth in Chile’s data center processor market driven by continued digital transformation and technology adoption across multiple sectors. Artificial intelligence integration will accelerate, with Chilean organizations implementing AI-powered applications that require specialized processor capabilities. Edge computing expansion creates new market segments and processor requirements optimized for distributed computing environments.

Technology evolution toward quantum computing and neuromorphic processors may create new market opportunities, though mainstream adoption remains several years away. Processor architectures will continue evolving toward domain-specific optimization and heterogeneous computing models that combine multiple processor types for optimal performance. MWR projections indicate the market will maintain a compound annual growth rate of 9.1% through the next five years.

Sustainability requirements will increasingly influence processor selection, with organizations prioritizing energy-efficient technologies and circular economy principles. Regional integration will strengthen Chile’s position as a South American technology hub, creating opportunities for cross-border collaboration and shared infrastructure investments. Government support for digital infrastructure development will continue driving market growth and technology advancement.

Chile’s data center processor market represents a dynamic and rapidly evolving ecosystem that serves as a critical foundation for the country’s digital transformation journey. The market demonstrates strong growth momentum driven by cloud adoption, AI implementation, and edge computing expansion across diverse industry sectors. Strategic geographic positioning and stable political environment create favorable conditions for sustained market development and international investment.

Market opportunities abound in specialized applications including mining technology, financial services, and government digitization that require advanced processor capabilities. The evolution toward heterogeneous computing architectures and sustainability-focused solutions will continue shaping market dynamics and vendor strategies. Skills development and local partnership strategies remain critical success factors for organizations seeking to maximize processor investment returns.

Future market success will depend on organizations’ ability to align processor strategies with business objectives while maintaining flexibility for technology evolution and changing workload requirements. The Chile data center processor market is positioned for continued growth and innovation, serving as a model for technology adoption and digital infrastructure development throughout South America.

What is Data Center Processor?

Data Center Processors are specialized computing units designed to handle the high-performance demands of data centers. They are optimized for tasks such as data processing, storage management, and virtualization, playing a crucial role in cloud computing and enterprise applications.

What are the key players in the Chile Data Center Processor Market?

Key players in the Chile Data Center Processor Market include Intel Corporation, AMD, and NVIDIA, which provide a range of processors tailored for data center applications. These companies focus on enhancing performance, energy efficiency, and scalability, among others.

What are the growth factors driving the Chile Data Center Processor Market?

The Chile Data Center Processor Market is driven by the increasing demand for cloud services, the rise of big data analytics, and the need for efficient data processing solutions. Additionally, the expansion of digital infrastructure in various sectors contributes to market growth.

What challenges does the Chile Data Center Processor Market face?

Challenges in the Chile Data Center Processor Market include the high costs associated with advanced processor technologies and the rapid pace of technological change. Additionally, competition from alternative computing solutions can impact market dynamics.

What opportunities exist in the Chile Data Center Processor Market?

Opportunities in the Chile Data Center Processor Market include the growing adoption of artificial intelligence and machine learning applications, which require powerful processing capabilities. Furthermore, advancements in processor technology present avenues for innovation and improved performance.

What trends are shaping the Chile Data Center Processor Market?

Trends in the Chile Data Center Processor Market include the shift towards energy-efficient processors and the integration of AI capabilities into data center operations. Additionally, the increasing focus on edge computing is influencing processor design and deployment strategies.

Chile Data Center Processor Market

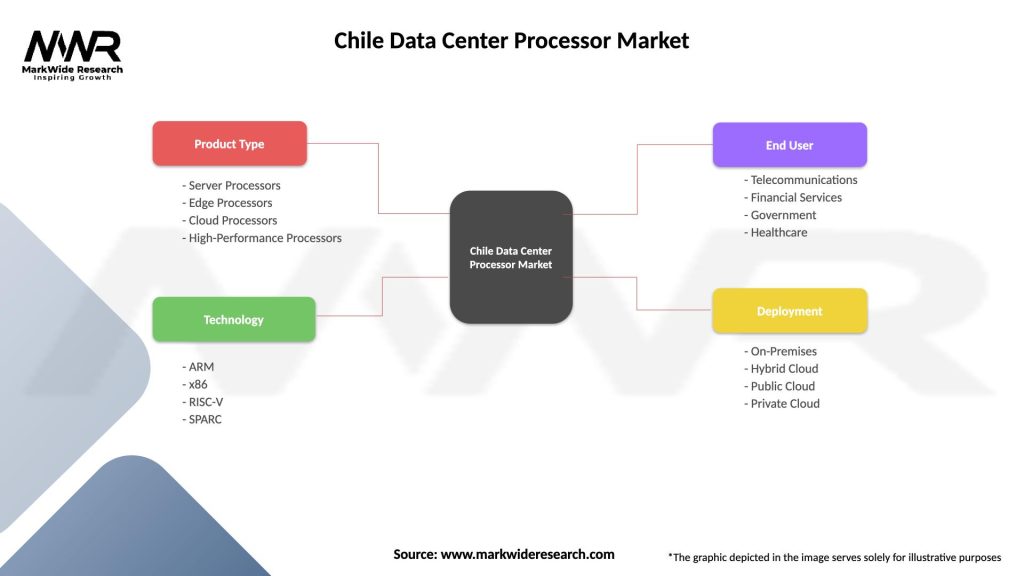

| Segmentation Details | Description |

|---|---|

| Product Type | Server Processors, Edge Processors, Cloud Processors, High-Performance Processors |

| Technology | ARM, x86, RISC-V, SPARC |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Deployment | On-Premises, Hybrid Cloud, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Chile Data Center Processor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at