444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The cheque scanner market is experiencing significant growth and is poised to expand even further in the coming years. Cheque scanners are devices used to capture and process cheque images and data, providing efficient and accurate cheque processing solutions for banks, financial institutions, and businesses. These scanners offer numerous benefits, including improved operational efficiency, enhanced security, and reduced manual errors in cheque processing.

Meaning

A cheque scanner is a specialized device that enables the digitization of cheques, transforming them into electronic images and data. It works by capturing high-quality images of the cheque and extracting relevant information such as the cheque number, amount, and account details using advanced optical character recognition (OCR) technology. This information can then be used for further processing, including clearing, verification, and archival purposes.

Executive Summary

The global cheque scanner market has witnessed substantial growth in recent years, driven by the increasing demand for efficient cheque processing solutions. The market is characterized by the presence of several key players offering technologically advanced cheque scanners. These devices are capable of high-speed scanning, accurate data extraction, and seamless integration with existing banking systems. The market is expected to continue its upward trajectory, driven by the growing adoption of digital payment systems and the need for streamlined cheque processing workflows.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The cheque scanner market is driven by various dynamic factors that influence its growth and evolution. These dynamics include technological advancements, changing customer preferences, regulatory developments, and competitive forces. Understanding and adapting to these dynamics are essential for companies operating in this market to sustain their competitive edge and capitalize on growth opportunities.

Regional Analysis

The cheque scanner market exhibits a strong presence across various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique market characteristics, influenced by factors such as digital payment adoption rates, regulatory frameworks, and technological advancements. The market is witnessing robust growth in regions with a high concentration of financial institutions and a significant shift towards digital payment systems.

In North America, the cheque scanner market is driven by the presence of established banking institutions and the increasing emphasis on streamlining payment processes. Europe follows a similar growth trajectory, with the adoption of digital payment solutions and the need for efficient cheque processing driving market growth. Asia Pacific represents a lucrative market due to the rapid digital transformation in countries like India and China, resulting in increased demand for cheque scanning solutions.

Latin America, the Middle East, and Africa are also witnessing significant growth opportunities. These regions are experiencing a gradual shift from cash-based transactions to digital payments, creating a demand for cheque scanners. Governments in these regions are implementing initiatives to promote digital payments, further boosting market growth.

Competitive Landscape

Leading Companies in the Cheque Scanner Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

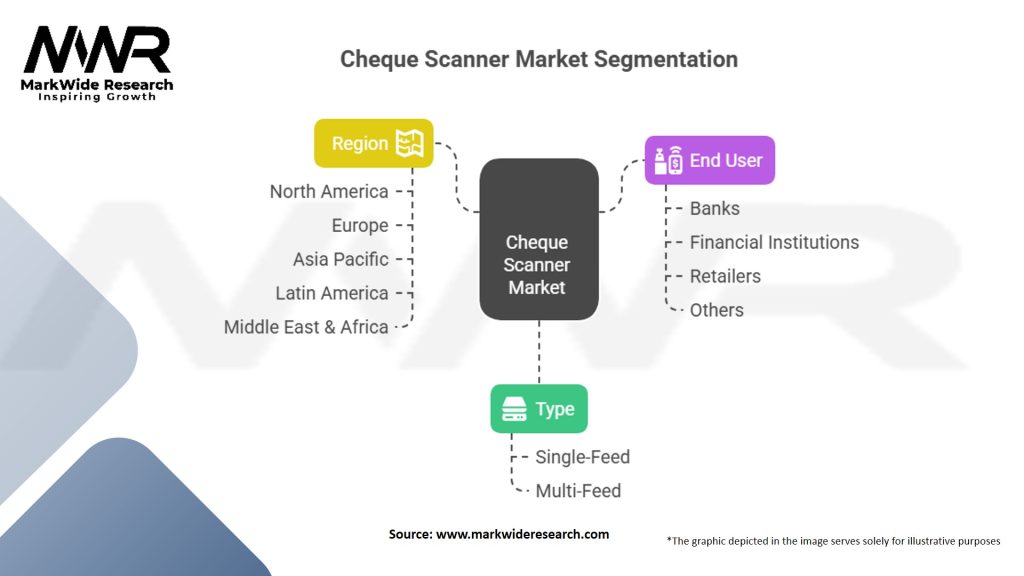

The cheque scanner market can be segmented based on product type, end-user industry, and geography.

By product type, the market can be divided into:

Based on the end-user industry, the market can be categorized into:

Geographically, the market can be segmented into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on various industries, including the cheque scanner market. The crisis accelerated the adoption of digital payment solutions, as physical distancing measures and safety concerns led to a significant reduction in cash-based transactions. This shift towards digital payments created a demand for efficient cheque scanning solutions, as organizations needed to process cheques remotely and securely.

Additionally, the pandemic highlighted the importance of automation and contactless solutions. Cheque scanners provided businesses with the means to process cheques efficiently while adhering to health and safety guidelines. The market experienced increased demand as companies sought to streamline their cheque processing workflows and reduce manual handling.

However, the pandemic also posed challenges for the market. Supply chain disruptions and manufacturing delays affected the availability of cheque scanning equipment, causing temporary setbacks. Moreover, economic uncertainties and budget constraints in the wake of the pandemic may have impacted the investment decisions of businesses, particularly in sectors heavily impacted by the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The cheque scanner market is poised for continued growth in the coming years. Factors such as the increasing adoption of digital payment systems, the need for secure and efficient cheque processing solutions, and advancements in scanning technologies will drive market expansion. The integration of AI, ML, and data analytics will further enhance the capabilities of cheque scanning solutions, making them an integral part of modern banking and financial operations.

The market is likely to witness collaborations between industry players, software providers, and fintech startups to deliver comprehensive cheque processing solutions. Emerging markets, with their growing digital adoption rates, will offer lucrative opportunities for market expansion. However, manufacturers must address concerns related to data security, compatibility, and initial investment costs to unlock the full potential of the market.

Conclusion

The cheque scanner market is experiencing significant growth driven by the increasing demand for efficient and secure cheque processing solutions. Cheque scanners enable organizations to streamline their payment processes, enhance operational efficiency, and mitigate the risk of fraud. Technological advancements, integration with digital banking systems, and the adoption of cloud-based solutions are key market trends.

While the market offers numerous opportunities, challenges such as initial investment costs, security concerns, and resistance to change in traditional banking institutions need to be addressed. Collaboration with fintech startups, expansion in emerging markets, and a focus on data analytics and AI integration will shape the future of the cheque scanner market. Overall, the market is expected to witness sustained growth as digital payment adoption continues to rise and organizations strive for more efficient cheque processing workflows.

What is Cheque Scanner?

A cheque scanner is a device used to capture images of cheques for processing and verification. It is commonly used in banking and financial institutions to streamline cheque handling and improve accuracy in transactions.

What are the key players in the Cheque Scanner Market?

Key players in the Cheque Scanner Market include companies like Canon, Epson, and Panini, which offer a range of cheque scanning solutions for various applications, including retail banking and remote deposit capture, among others.

What are the growth factors driving the Cheque Scanner Market?

The Cheque Scanner Market is driven by the increasing adoption of digital banking solutions, the need for efficient cheque processing, and the growing demand for automation in financial transactions. These factors contribute to enhanced operational efficiency and reduced processing times.

What challenges does the Cheque Scanner Market face?

Challenges in the Cheque Scanner Market include the need for compliance with regulatory standards, the risk of fraud in cheque processing, and the high initial investment costs for advanced scanning technology. These factors can hinder market growth and adoption.

What opportunities exist in the Cheque Scanner Market?

Opportunities in the Cheque Scanner Market include the expansion of mobile banking applications, the integration of artificial intelligence for improved fraud detection, and the increasing demand for contactless payment solutions. These trends are expected to shape the future of cheque scanning technology.

What trends are currently influencing the Cheque Scanner Market?

Current trends in the Cheque Scanner Market include the shift towards cloud-based solutions, advancements in image processing technology, and the growing emphasis on security features. These innovations are enhancing the functionality and reliability of cheque scanners.

Cheque Scanner Market

| Segmentation Details | Details |

|---|---|

| Type | Single-Feed Cheque Scanners, Multi-Feed Cheque Scanners |

| End User | Banks, Financial Institutions, Retailers, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Cheque Scanner Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at