444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market represents a critical sector within global security infrastructure, encompassing comprehensive protection solutions against diverse threat vectors. This specialized market addresses the growing need for advanced detection, protection, and decontamination systems across military, homeland security, and civilian applications. Market dynamics indicate robust growth driven by escalating security concerns, technological advancements, and increased government investments in national defense capabilities.

Regional distribution shows significant concentration in North America and Europe, accounting for approximately 68% of global market share, while Asia-Pacific emerges as the fastest-growing region with projected growth rates of 9.2% CAGR through 2030. The market encompasses diverse product categories including detection equipment, protective gear, decontamination systems, and training simulators, each addressing specific aspects of CBRNe threat mitigation.

Government procurement remains the primary market driver, with defense budgets increasingly allocating resources toward CBRNe preparedness. The integration of artificial intelligence, IoT connectivity, and advanced materials science continues to revolutionize traditional defense approaches, creating opportunities for innovative solution providers and established defense contractors alike.

The Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market refers to the comprehensive ecosystem of technologies, products, and services designed to detect, protect against, and respond to threats involving chemical agents, biological pathogens, radiological materials, nuclear substances, and explosive devices. This market encompasses both preventive measures and responsive capabilities essential for national security and public safety.

CBRNe defense solutions integrate multiple technological disciplines including sensor technology, materials science, biotechnology, and information systems to create comprehensive threat mitigation frameworks. The market serves diverse end-users ranging from military forces and emergency responders to critical infrastructure operators and civilian organizations requiring specialized protection capabilities.

Market scope extends beyond traditional defense applications to include industrial safety, healthcare preparedness, and environmental monitoring, reflecting the dual-use nature of many CBRNe technologies and their broader societal applications in protecting public health and safety.

Market analysis reveals a rapidly evolving CBRNe defense landscape characterized by technological innovation, increased threat awareness, and substantial government investment. The sector demonstrates resilience and growth potential driven by persistent security challenges and the continuous evolution of threat vectors requiring advanced countermeasures.

Key market segments include detection and identification systems, personal protective equipment, collective protection systems, decontamination equipment, and training and simulation platforms. Detection systems represent the largest segment, capturing approximately 35% market share due to their critical role in early threat identification and response coordination.

Technological advancement remains a primary differentiator, with companies investing heavily in next-generation capabilities including miniaturized sensors, enhanced protective materials, and integrated command and control systems. The market benefits from cross-sector collaboration between defense contractors, technology companies, and research institutions driving innovation and capability enhancement.

Regional growth patterns show established markets in North America and Europe maintaining steady expansion while emerging markets in Asia-Pacific and Middle East demonstrate accelerated adoption rates driven by regional security concerns and infrastructure development initiatives.

Strategic insights highlight several critical factors shaping the CBRNe defense market landscape and influencing long-term growth trajectories:

Primary growth drivers propelling the CBRNe defense market include escalating global security threats, technological advancement, and increased government awareness of preparedness requirements. The persistent evolution of threat vectors necessitates continuous capability enhancement and modernization of existing defense infrastructure.

Geopolitical tensions and regional conflicts contribute significantly to market expansion, with nations prioritizing CBRNe defense capabilities as essential components of national security strategies. The proliferation of dual-use technologies and materials increases accessibility to potential threat actors, driving demand for comprehensive detection and protection systems.

Regulatory mandates and compliance requirements across various industries create sustained demand for CBRNe defense solutions. Healthcare facilities, critical infrastructure operators, and transportation hubs increasingly implement protective measures to meet safety standards and emergency preparedness requirements.

Technological innovation enables the development of more effective, user-friendly, and cost-efficient solutions, expanding market accessibility and adoption rates. Advances in sensor technology, materials science, and data analytics enhance system performance while reducing operational complexity and maintenance requirements.

Public-private partnerships facilitate market growth by combining government resources with private sector innovation and efficiency. These collaborative arrangements accelerate technology development, reduce procurement costs, and ensure alignment between capability requirements and available solutions.

Significant challenges facing the CBRNe defense market include high development costs, lengthy procurement cycles, and complex regulatory approval processes that can delay product introduction and market penetration. The specialized nature of CBRNe technologies requires substantial investment in research, testing, and certification activities.

Budget constraints within government agencies and defense organizations can limit procurement activities and delay modernization programs. Economic uncertainties and competing priorities for limited resources may result in reduced spending on CBRNe defense capabilities, particularly for non-critical applications.

Technical complexity associated with CBRNe systems creates challenges in user training, maintenance, and operational deployment. The requirement for specialized expertise and ongoing support can increase total cost of ownership and limit adoption among smaller organizations with limited technical resources.

Export restrictions and technology transfer limitations constrain international market opportunities for certain CBRNe defense technologies. National security considerations and non-proliferation agreements can restrict the global distribution of advanced capabilities, limiting market expansion potential.

False alarm rates and system reliability concerns can impact user confidence and adoption rates. The critical nature of CBRNe threats demands extremely high system reliability and accuracy, creating technical challenges that may limit performance in certain operational environments.

Emerging opportunities within the CBRNe defense market include the integration of artificial intelligence and machine learning technologies to enhance detection accuracy and reduce false alarm rates. These advanced capabilities enable more sophisticated threat analysis and automated response coordination, improving overall system effectiveness.

Commercial market expansion presents significant growth potential as industrial facilities, healthcare organizations, and transportation operators recognize the value of CBRNe protection capabilities. The dual-use nature of many technologies enables market diversification beyond traditional defense applications.

International partnerships and collaborative development programs create opportunities for market expansion and technology sharing. Joint development initiatives can reduce individual country costs while accelerating capability development and standardization across allied nations.

Modernization programs in developing countries offer substantial market opportunities as nations invest in building comprehensive CBRNe defense capabilities. These markets often require complete system implementations rather than incremental upgrades, representing larger procurement opportunities.

Training and services represent growing market segments as organizations recognize the importance of proper system operation and maintenance. Comprehensive training programs, simulation systems, and ongoing support services create recurring revenue opportunities beyond initial equipment sales.

Market dynamics within the CBRNe defense sector reflect complex interactions between technological advancement, threat evolution, and regulatory requirements. The market demonstrates cyclical patterns influenced by geopolitical events, budget allocations, and technology refresh cycles that create both opportunities and challenges for market participants.

Competitive intensity varies significantly across different market segments, with established defense contractors maintaining strong positions in traditional military applications while emerging technology companies capture opportunities in commercial and dual-use markets. Innovation cycles typically span 3-5 years from concept to deployment, requiring sustained investment and long-term strategic planning.

Customer relationships play crucial roles in market success, particularly in government and defense sectors where procurement decisions involve extensive evaluation processes and long-term support requirements. Established relationships and proven track records provide significant competitive advantages in securing major contracts and program extensions.

Technology convergence creates both opportunities and challenges as traditional boundaries between different defense technologies blur. Companies must balance specialization in core competencies with broader capability development to address integrated system requirements and comprehensive threat scenarios.

Supply chain considerations increasingly influence market dynamics as customers prioritize domestic production capabilities and supply chain security. This trend creates opportunities for local manufacturers while potentially limiting global supply chain optimization and cost reduction strategies.

Comprehensive research methodology employed in analyzing the CBRNe defense market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, government officials, and end-users across various market segments and geographic regions.

Secondary research encompasses analysis of government procurement databases, industry publications, patent filings, and regulatory documents to identify market trends, competitive positioning, and technology development patterns. This approach provides comprehensive coverage of market activities and strategic initiatives across the global CBRNe defense ecosystem.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth trajectories and segment performance. Historical data analysis identifies cyclical patterns and growth drivers while scenario modeling evaluates potential market impacts of various external factors and policy changes.

Expert validation processes ensure research findings align with industry realities and stakeholder perspectives. Regular consultation with subject matter experts, including former government officials, defense contractors, and academic researchers, provides additional context and validation for market assessments and projections.

Data triangulation methods cross-reference information from multiple sources to verify accuracy and identify potential discrepancies or biases. This rigorous approach enhances the reliability of market intelligence and supports informed decision-making by industry stakeholders and investors.

North America maintains market leadership in the CBRNe defense sector, driven by substantial government investment, advanced research capabilities, and established defense industrial base. The region accounts for approximately 42% of global market share, with the United States representing the largest single country market due to extensive military and homeland security requirements.

European markets demonstrate steady growth supported by NATO alliance requirements, regional security concerns, and collaborative defense initiatives. Key markets include the United Kingdom, Germany, and France, which collectively represent 26% of global market activity. The European Union’s focus on strategic autonomy drives increased investment in domestic CBRNe defense capabilities.

Asia-Pacific region emerges as the fastest-growing market segment, with projected growth rates of 9.2% CAGR driven by regional security challenges, military modernization programs, and increasing defense budgets. Countries including Japan, South Korea, Australia, and India represent significant growth opportunities for CBRNe defense solution providers.

Middle East and Africa markets show increasing activity driven by regional conflicts, terrorism concerns, and infrastructure protection requirements. Government investments in homeland security and critical infrastructure protection create opportunities for CBRNe defense technologies, particularly in detection and protection systems.

Latin America represents an emerging market with growing awareness of CBRNe threats and increasing investment in security capabilities. Brazil, Mexico, and Colombia lead regional adoption of CBRNe defense solutions, particularly for law enforcement and border security applications.

Market leadership in the CBRNe defense sector is characterized by a mix of large defense contractors, specialized technology companies, and emerging innovators each contributing unique capabilities and market approaches. The competitive landscape reflects the diverse nature of CBRNe threats and the corresponding variety of solution requirements.

Major market participants include established defense contractors with comprehensive CBRNe portfolios:

Competitive strategies emphasize technology innovation, strategic partnerships, and geographic expansion to capture market opportunities and strengthen competitive positioning. Companies invest heavily in research and development to maintain technology leadership while building comprehensive solution portfolios addressing diverse customer requirements.

Market segmentation within the CBRNe defense sector reflects the diverse nature of threats, applications, and end-user requirements. Understanding these segments enables targeted product development, marketing strategies, and investment allocation across different market opportunities.

By Product Type:

By Application:

By End User:

Detection and identification systems represent the largest market category, accounting for approximately 35% of total market activity. This segment benefits from continuous technological advancement in sensor capabilities, data analytics, and system integration. MarkWide Research analysis indicates strong growth potential driven by increasing demand for real-time threat assessment and automated response coordination.

Personal protective equipment demonstrates steady growth supported by expanding user base and improved material technologies. Advanced fabrics, enhanced comfort features, and integrated communication systems drive product evolution and market expansion. The segment shows particular strength in commercial applications where user acceptance and operational efficiency are critical factors.

Collective protection systems experience growth driven by infrastructure protection requirements and facility hardening initiatives. These systems provide comprehensive protection for critical facilities, command centers, and population shelters, representing significant procurement opportunities for government and private sector customers.

Decontamination equipment shows increasing importance as organizations recognize the need for comprehensive threat response capabilities. This category includes both immediate response equipment for emergency situations and permanent installation systems for high-risk facilities and transportation hubs.

Training and simulation platforms emerge as a high-growth category with approximately 12% annual growth rate as organizations invest in personnel preparedness and capability development. Virtual reality, augmented reality, and advanced simulation technologies enhance training effectiveness while reducing costs and safety risks associated with live agent training.

Government agencies benefit from enhanced national security capabilities, improved emergency preparedness, and comprehensive threat response systems. CBRNe defense investments provide multiple layers of protection while supporting broader security objectives and international cooperation initiatives.

Defense contractors gain access to substantial market opportunities with long-term growth potential and recurring revenue streams. The specialized nature of CBRNe technologies creates competitive advantages and barriers to entry that support sustainable business models and profitability.

Technology companies find opportunities to apply innovative capabilities in high-value applications with significant societal impact. The dual-use nature of many CBRNe technologies enables market diversification and cross-sector application of core competencies.

End users receive enhanced protection capabilities, improved operational effectiveness, and reduced risk exposure through advanced CBRNe defense systems. Training and support services ensure proper system utilization and maximize return on investment.

Research institutions benefit from increased funding opportunities, collaborative partnerships, and practical applications for advanced research. The critical nature of CBRNe threats attracts substantial government and private sector research investment.

Supply chain partners participate in a growing market with diverse opportunities across materials, components, and specialized services. The complex nature of CBRNe systems creates multiple entry points for suppliers with relevant capabilities and certifications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend, enabling advanced threat analysis, pattern recognition, and automated response coordination. AI-powered systems demonstrate 40% improvement in detection accuracy while reducing false alarm rates and operational complexity.

Miniaturization and portability drive product development toward more compact, lightweight solutions that maintain performance while improving user mobility and deployment flexibility. Advances in sensor technology and power management enable handheld devices with capabilities previously requiring larger, stationary systems.

Network connectivity and data sharing create integrated defense networks that enhance situational awareness and coordinate response activities across multiple agencies and organizations. Cloud-based platforms and secure communication protocols enable real-time information sharing and collaborative threat assessment.

Dual-use technology development expands market opportunities by creating solutions applicable to both defense and commercial applications. This approach reduces development costs, increases market addressability, and accelerates technology advancement through broader user feedback and requirements.

Sustainability and environmental considerations influence product design and operational practices as organizations prioritize environmentally responsible solutions. Green chemistry approaches, recyclable materials, and energy-efficient systems address growing environmental awareness and regulatory requirements.

Modular system architectures enable flexible configuration and scalable deployment to meet diverse customer requirements and budget constraints. This approach reduces procurement costs, simplifies maintenance, and enables incremental capability enhancement over time.

Recent industry developments highlight the dynamic nature of the CBRNe defense market and the continuous evolution of capabilities and market structures. Major defense contractors continue expanding their CBRNe portfolios through strategic acquisitions, internal development, and partnership arrangements.

Technology breakthroughs in quantum sensing, advanced materials, and biotechnology create new possibilities for CBRNe detection and protection. These innovations promise significant performance improvements while potentially disrupting existing market dynamics and competitive positions.

International collaboration initiatives strengthen through multilateral development programs and standardization efforts. NATO alliance requirements and bilateral cooperation agreements drive technology sharing and joint procurement activities that benefit participating nations and industry partners.

Regulatory updates and new standards influence product development and market requirements. Updated performance specifications, safety requirements, and interoperability standards ensure continued capability advancement while maintaining user safety and system effectiveness.

Investment activity increases as venture capital and private equity firms recognize market opportunities in CBRNe defense technologies. This funding supports innovation, accelerates product development, and enables market expansion for emerging technology companies.

Public-private partnerships expand as governments seek to leverage private sector innovation and efficiency while maintaining security and control over critical capabilities. These arrangements facilitate technology transfer, reduce development risks, and accelerate capability deployment.

Strategic recommendations for market participants emphasize the importance of technology innovation, strategic partnerships, and market diversification to capture growth opportunities and maintain competitive positioning. Companies should prioritize investment in next-generation capabilities while building comprehensive solution portfolios.

Market entry strategies for new participants should focus on specialized niches or innovative technologies that address unmet customer needs. Partnership arrangements with established players can provide market access and credibility while reducing entry barriers and development costs.

Investment priorities should emphasize artificial intelligence, advanced materials, and integrated system capabilities that provide significant performance advantages and market differentiation. MWR analysis suggests that companies investing 15-20% of revenue in R&D maintain stronger competitive positions and growth trajectories.

Geographic expansion strategies should target emerging markets with growing defense budgets and increasing security awareness. Asia-Pacific and Middle East regions offer particular opportunities for companies with appropriate technology offerings and partnership capabilities.

Customer relationship management remains critical for success in government and defense markets where procurement decisions involve extensive evaluation processes and long-term support requirements. Companies should invest in customer engagement, technical support, and training capabilities.

Supply chain optimization should balance cost efficiency with security requirements and domestic content preferences. Companies should develop resilient supply chains that can adapt to changing regulatory requirements and geopolitical conditions while maintaining competitive cost structures.

Long-term market prospects for the CBRNe defense sector remain positive, driven by persistent security threats, technological advancement, and increasing global awareness of preparedness requirements. The market is expected to maintain steady growth with projected expansion rates of 6.8% CAGR through 2030.

Technology evolution will continue transforming CBRNe defense capabilities through artificial intelligence, quantum technologies, and advanced materials science. These innovations promise significant performance improvements while creating new market opportunities and competitive dynamics.

Market expansion into commercial sectors will accelerate as organizations recognize the value of CBRNe protection capabilities for business continuity and risk management. Healthcare, transportation, and critical infrastructure sectors represent significant growth opportunities beyond traditional defense applications.

International cooperation will strengthen through multilateral programs and standardization initiatives that facilitate technology sharing and joint procurement activities. These collaborative arrangements will benefit both participating nations and industry partners through cost sharing and capability enhancement.

Regulatory development will continue influencing market requirements through updated standards, performance specifications, and safety requirements. Companies must maintain awareness of regulatory trends and invest in compliance capabilities to ensure market access and competitive positioning.

Investment activity is expected to increase as both government and private sector recognize the strategic importance of CBRNe defense capabilities. This funding will support continued innovation, market expansion, and capability development across the entire ecosystem.

The CBRNe defense market represents a critical and growing sector within the global security landscape, driven by evolving threats, technological advancement, and increasing awareness of preparedness requirements. Market participants benefit from sustained government investment, technology innovation opportunities, and expanding commercial applications that broaden market addressability beyond traditional defense sectors.

Success factors in this market include continuous technology innovation, strong customer relationships, and comprehensive solution portfolios that address diverse threat scenarios and user requirements. Companies that invest in next-generation capabilities while maintaining operational excellence and customer focus will capture the greatest opportunities in this expanding market.

Future growth will be driven by artificial intelligence integration, international market expansion, and commercial sector adoption of CBRNe defense technologies. The market’s essential nature and continuous threat evolution ensure sustained demand and investment opportunities for qualified participants across the entire value chain.

What is Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense?

Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense refers to the measures and technologies used to protect against threats posed by chemical agents, biological pathogens, radiological materials, nuclear weapons, and explosive devices. This field encompasses detection, protection, and decontamination strategies to ensure safety in various environments.

What are the key players in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market?

Key players in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market include companies like Raytheon Technologies, Northrop Grumman, and BAE Systems, which provide advanced technologies and solutions for CBRNe threats. These companies focus on developing detection systems, protective equipment, and response strategies, among others.

What are the growth factors driving the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market?

The growth of the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market is driven by increasing geopolitical tensions, rising terrorist threats, and the need for enhanced security measures in public spaces. Additionally, advancements in detection technologies and government investments in defense capabilities contribute to market expansion.

What challenges does the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market face?

The Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market faces challenges such as high costs of advanced technologies, the complexity of integrating various defense systems, and regulatory hurdles. Additionally, the rapid evolution of threats requires continuous innovation and adaptation, which can strain resources.

What opportunities exist in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market?

Opportunities in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market include the development of new technologies for real-time threat detection and response, as well as increased collaboration between public and private sectors. The growing emphasis on homeland security and emergency preparedness also presents avenues for market growth.

What trends are shaping the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market?

Trends in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market include the integration of artificial intelligence and machine learning for enhanced threat analysis, the development of portable detection systems, and a focus on sustainability in defense technologies. These innovations aim to improve response times and operational efficiency.

Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market

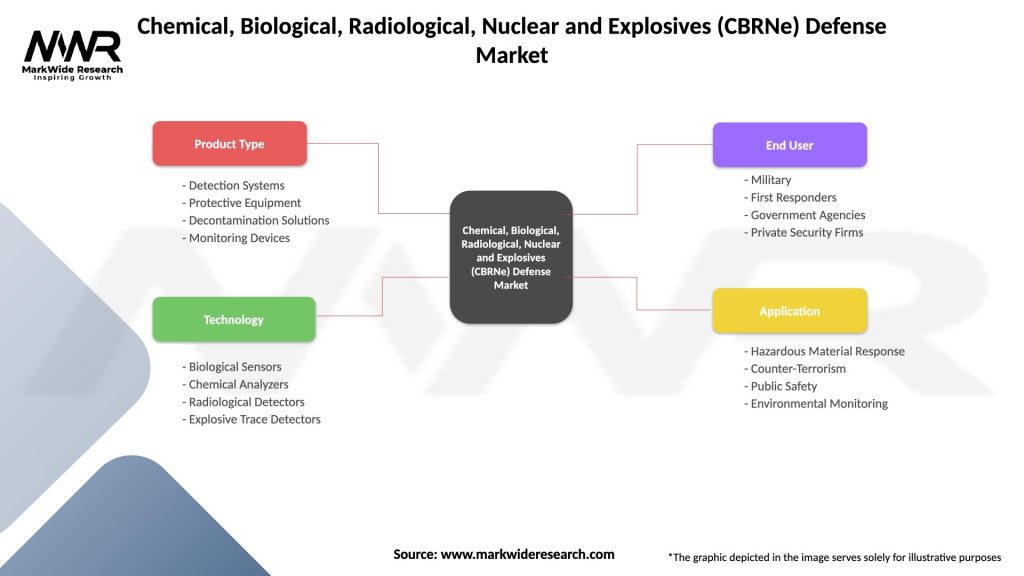

| Segmentation Details | Description |

|---|---|

| Product Type | Detection Systems, Protective Equipment, Decontamination Solutions, Monitoring Devices |

| Technology | Biological Sensors, Chemical Analyzers, Radiological Detectors, Explosive Trace Detectors |

| End User | Military, First Responders, Government Agencies, Private Security Firms |

| Application | Hazardous Material Response, Counter-Terrorism, Public Safety, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Chemical, Biological, Radiological, Nuclear and Explosives (CBRNe) Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at