444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Contracts for Difference (CFD) broker market serves as a pivotal component of the global financial landscape, offering investors and traders a versatile platform for speculation and hedging across various asset classes. CFDs enable market participants to capitalize on price movements without owning the underlying asset, making them popular instruments for both retail and institutional traders. This market operates 24/7, providing access to a wide range of financial products, including equities, indices, commodities, currencies, and cryptocurrencies. The CFD broker market is characterized by intense competition, technological innovation, regulatory oversight, and evolving investor preferences.

Meaning

CFD brokers facilitate trading in Contracts for Difference, which are derivative products that allow traders to speculate on the price movements of underlying assets without owning them. Instead of buying or selling the actual asset, traders enter into a contract with the broker to exchange the difference in the asset’s price from the time the contract is opened to when it is closed. CFDs offer several advantages, including leverage, flexibility, diversification, and the ability to profit from both rising and falling markets. However, they also carry risks such as leverage amplification, market volatility, counterparty risk, and regulatory restrictions.

Executive Summary

The CFD broker market has experienced significant growth in recent years, driven by increasing retail participation, technological advancements, global market volatility, and the growing popularity of online trading platforms. CFD brokers offer traders access to a wide range of financial markets, competitive pricing, advanced trading tools, and educational resources. However, the market also faces challenges such as regulatory scrutiny, margin requirements, liquidity constraints, and reputational risks. Understanding the key market dynamics, trends, opportunities, and risks is essential for CFD brokers to navigate this dynamic and competitive landscape successfully.

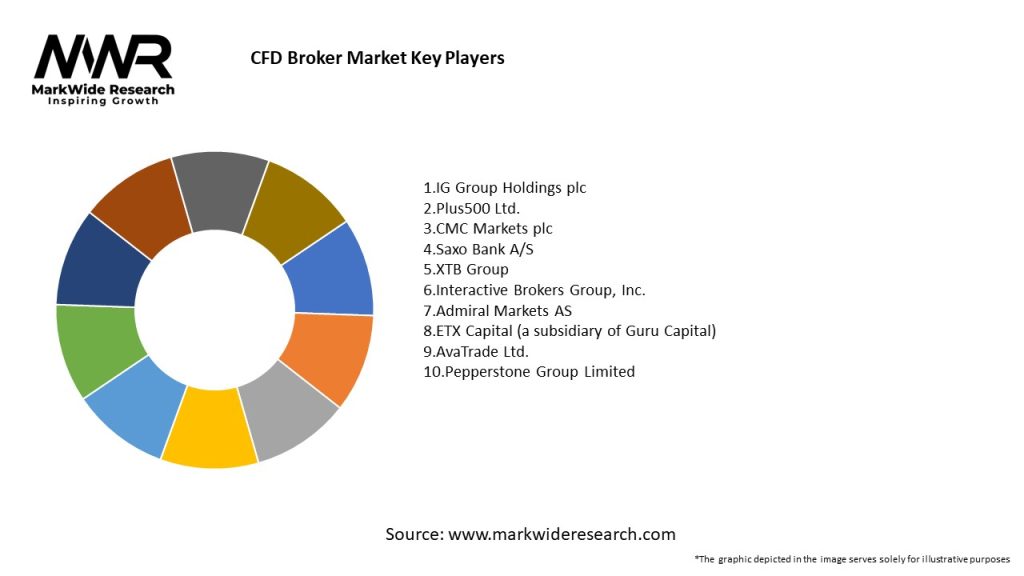

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The CFD broker market operates in a dynamic and competitive environment shaped by factors such as regulatory developments, technological advancements, market trends, and macroeconomic conditions. Market dynamics drive innovation, competition, and consolidation, influencing broker profitability, market share, and customer satisfaction. Understanding the interplay of these dynamics is essential for CFD brokers to adapt to changing market conditions, capitalize on opportunities, and mitigate risks effectively.

Regional Analysis

The CFD broker market exhibits regional variations in terms of regulatory frameworks, market maturity, investor preferences, and competitive dynamics. Key regions for CFD trading include Europe, Asia Pacific, North America, and the Middle East. Europe, particularly the United Kingdom, is a significant hub for CFD trading, with a well-established regulatory regime and a large base of retail traders. Asia Pacific, led by Australia and Singapore, is also a prominent region for CFD trading, driven by the growing popularity of online trading platforms and the increasing participation of retail investors. North America, although less prominent in CFD trading compared to other regions, offers opportunities for market expansion and innovation. The Middle East, with its affluent population and growing interest in financial markets, presents untapped potential for CFD brokers to establish a presence and cater to the region’s unique market dynamics.

Competitive Landscape

Leading Companies in the CFD Broker Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

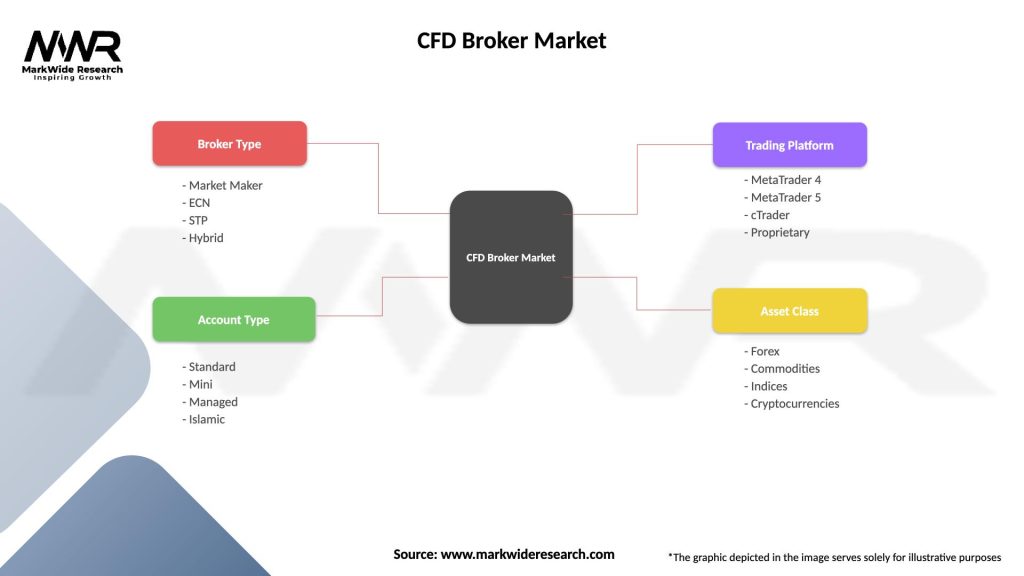

The CFD broker market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the CFD broker market. On one hand, the increased market volatility and heightened investor interest in online trading have driven higher trading volumes and revenue for CFD brokers. On the other hand, the economic uncertainty, regulatory changes, and operational challenges associated with remote work have posed risks and challenges for CFD brokers. The pandemic has underscored the importance of robust risk management, business continuity planning, and regulatory compliance for CFD brokers to navigate uncertain and volatile market conditions effectively.

Key Industry Developments

Analyst Suggestion

Future Outlook

The future outlook for the CFD broker market is characterized by continued growth, innovation, and regulatory evolution. Despite regulatory challenges and competitive pressures, the market is expected to expand as retail participation, technological adoption, and global market integration continue to drive demand for CFD trading. Key trends shaping the future of the CFD broker market include the rise of cryptocurrencies, the growing importance of ESG investing, the proliferation of mobile trading, and the increasing focus on regulatory compliance and client education. To succeed in the evolving market landscape, CFD brokers must prioritize innovation, risk management, and client-centricity while navigating regulatory complexities and market uncertainties.

Conclusion

The CFD broker market plays a vital role in the global financial ecosystem, offering traders and investors access to diverse financial markets, innovative trading platforms, and advanced trading tools. Despite regulatory challenges, market volatility, and competitive pressures, the CFD broker market continues to grow and evolve, driven by technological innovation, changing investor preferences, and regulatory developments. To thrive in this dynamic and competitive landscape, CFD brokers must adapt to changing market conditions, embrace technological advancements, prioritize regulatory compliance, and focus on delivering value to clients. By leveraging their strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats, CFD brokers can position themselves for long-term success and sustainable growth in the evolving market environment.

What is CFD Broker?

A CFD Broker is a financial service provider that allows traders to speculate on the price movements of various assets without owning the underlying assets. They facilitate trading in contracts for difference (CFDs) across multiple markets, including stocks, commodities, and currencies.

What are the key players in the CFD Broker Market?

Key players in the CFD Broker Market include companies like IG Group, Plus500, and CMC Markets, which offer a range of trading platforms and services. These brokers compete on factors such as spreads, leverage, and customer support, among others.

What are the growth factors driving the CFD Broker Market?

The CFD Broker Market is driven by factors such as the increasing popularity of online trading, the rise of retail investors, and advancements in trading technology. Additionally, the growing demand for diversified investment options contributes to market growth.

What challenges does the CFD Broker Market face?

The CFD Broker Market faces challenges such as regulatory scrutiny, market volatility, and the risk of high leverage leading to significant losses for traders. These factors can impact broker operations and trader confidence.

What opportunities exist in the CFD Broker Market?

Opportunities in the CFD Broker Market include the expansion into emerging markets, the development of mobile trading applications, and the integration of advanced trading tools like AI and machine learning. These innovations can enhance user experience and attract new clients.

What trends are shaping the CFD Broker Market?

Trends in the CFD Broker Market include the increasing use of social trading platforms, the rise of cryptocurrency CFDs, and a focus on sustainable trading practices. These trends reflect changing investor preferences and technological advancements.

CFD Broker Market

| Segmentation Details | Description |

|---|---|

| Broker Type | Market Maker, ECN, STP, Hybrid |

| Account Type | Standard, Mini, Managed, Islamic |

| Trading Platform | MetaTrader 4, MetaTrader 5, cTrader, Proprietary |

| Asset Class | Forex, Commodities, Indices, Cryptocurrencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the CFD Broker Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at