444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korean ceramic tiles market represents a dynamic and rapidly evolving sector within the country’s construction and interior design industry. South Korea’s ceramic tiles market has experienced remarkable transformation over the past decade, driven by urbanization trends, technological innovations, and changing consumer preferences toward premium flooring solutions. The market demonstrates robust growth potential with a projected CAGR of 6.2% through the forecast period, reflecting the nation’s commitment to modern infrastructure development and residential construction projects.

Market dynamics in South Korea are significantly influenced by the country’s advanced manufacturing capabilities and strong domestic demand from both residential and commercial sectors. The ceramic tiles industry benefits from South Korea’s position as a technology leader in Asia, with manufacturers incorporating cutting-edge production techniques and innovative designs. Domestic consumption accounts for approximately 78% of total production, while exports contribute to the remaining market share, particularly to neighboring Asian countries.

Consumer preferences have shifted dramatically toward large-format tiles, digital printing technologies, and eco-friendly manufacturing processes. The market shows strong adoption of premium ceramic solutions with enhanced durability and aesthetic appeal, reflecting South Korea’s affluent consumer base and sophisticated design sensibilities.

The ceramic tiles market in South Korea refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of ceramic flooring and wall covering solutions within the South Korean territory. This market includes various ceramic tile categories such as porcelain tiles, glazed ceramic tiles, unglazed tiles, and specialty ceramic products designed for residential, commercial, and industrial applications.

Ceramic tiles in the South Korean context represent more than functional building materials; they embody the country’s commitment to quality craftsmanship, technological innovation, and aesthetic excellence. The market encompasses traditional manufacturing processes alongside modern digital printing technologies, creating a diverse product portfolio that serves both domestic and international markets.

Market participants include domestic manufacturers, international suppliers, distributors, retailers, and end-users across construction, renovation, and interior design sectors. The South Korean ceramic tiles market operates within a sophisticated supply chain network that connects raw material suppliers with advanced manufacturing facilities and extensive distribution channels throughout the peninsula.

South Korea’s ceramic tiles market stands as a testament to the nation’s industrial prowess and design innovation capabilities. The market has evolved from traditional manufacturing approaches to embrace advanced technologies, sustainable practices, and premium product positioning. Key market drivers include rapid urbanization, government infrastructure investments, and growing consumer demand for high-quality interior solutions.

Market segmentation reveals strong performance across residential applications, which account for approximately 65% of total consumption, while commercial and industrial segments contribute 35% combined. The residential sector’s dominance reflects South Korea’s active housing market and renovation activities, particularly in major metropolitan areas like Seoul, Busan, and Incheon.

Technological advancement remains a cornerstone of market development, with manufacturers investing heavily in digital printing capabilities, large-format production, and eco-friendly manufacturing processes. The market demonstrates strong export potential, with South Korean ceramic tiles gaining recognition for quality and design innovation across international markets.

Competitive landscape features a mix of established domestic players and international brands, creating a dynamic environment that fosters innovation and quality improvements. The market’s future trajectory appears promising, supported by continued urbanization, infrastructure development, and evolving consumer preferences toward premium ceramic solutions.

Market insights reveal several critical trends shaping the South Korean ceramic tiles landscape. The following key observations provide comprehensive understanding of market dynamics:

Consumer behavior analysis indicates increasing sophistication in product selection, with buyers prioritizing durability, design aesthetics, and environmental considerations. The market demonstrates strong potential for continued expansion, supported by favorable demographic trends and economic stability.

Primary market drivers propelling the South Korean ceramic tiles market include robust construction activity, urbanization trends, and evolving consumer preferences. The construction sector’s expansion, supported by government infrastructure investments and private development projects, creates substantial demand for ceramic tile solutions across residential and commercial applications.

Urbanization momentum continues to drive market growth as South Korea’s urban population reaches approximately 81.4% of total population, creating sustained demand for housing and commercial spaces. This demographic shift necessitates extensive construction and renovation activities, directly benefiting ceramic tiles manufacturers and suppliers.

Technological advancement serves as a crucial growth driver, with manufacturers investing in state-of-the-art production facilities and innovative product development. Digital printing technologies, large-format capabilities, and enhanced durability features attract premium-conscious consumers and commercial buyers seeking superior performance characteristics.

Government initiatives supporting green building practices and sustainable construction materials create favorable conditions for eco-friendly ceramic tile products. Environmental regulations and incentives encourage manufacturers to adopt cleaner production processes and develop sustainable product lines.

Export opportunities provide additional growth momentum as South Korean ceramic tiles gain international recognition for quality and design innovation. Strategic export initiatives and trade partnerships expand market reach beyond domestic boundaries, contributing to overall industry growth.

Market restraints present challenges that could potentially limit growth in the South Korean ceramic tiles market. Raw material costs represent a significant concern, as fluctuating prices for clay, feldspar, and other essential materials impact production economics and profit margins for manufacturers.

Environmental regulations impose stringent requirements on manufacturing processes, necessitating substantial investments in pollution control equipment and sustainable production technologies. While these regulations promote environmental responsibility, they also increase operational costs and complexity for market participants.

Competition intensity from both domestic and international players creates pricing pressures and margin compression challenges. The market’s maturity in certain segments limits opportunities for dramatic growth, requiring companies to focus on differentiation and value-added solutions.

Economic volatility and potential construction sector fluctuations could impact demand patterns, particularly in commercial and industrial applications. Economic uncertainties may lead to delayed construction projects and reduced renovation activities, affecting overall market consumption.

Labor shortage in skilled manufacturing and installation sectors poses operational challenges for industry participants. The aging workforce and limited availability of trained professionals could constrain production capacity and service quality in certain market segments.

Significant opportunities exist within the South Korean ceramic tiles market, driven by emerging trends and evolving consumer preferences. Smart building integration presents substantial potential as ceramic tiles incorporate advanced technologies such as heating elements, antimicrobial properties, and digital connectivity features.

Export expansion offers considerable growth prospects, with South Korean ceramic tiles gaining recognition in international markets for superior quality and innovative designs. Strategic partnerships with global distributors and participation in international trade exhibitions can enhance market penetration and brand recognition.

Sustainable product development creates opportunities for manufacturers to differentiate their offerings through eco-friendly materials, energy-efficient production processes, and recyclable product designs. Growing environmental consciousness among consumers and businesses drives demand for sustainable ceramic solutions.

Digital transformation enables new business models and customer engagement strategies, including online sales platforms, virtual showrooms, and augmented reality design tools. These technologies enhance customer experience and expand market reach beyond traditional distribution channels.

Renovation market growth presents substantial opportunities as existing buildings undergo modernization and aesthetic upgrades. The renovation segment often commands premium pricing and offers higher profit margins compared to new construction applications.

Market dynamics in the South Korean ceramic tiles sector reflect complex interactions between supply and demand factors, technological innovations, and competitive forces. Supply chain optimization has become increasingly important as manufacturers seek to reduce costs and improve delivery efficiency through strategic partnerships and vertical integration initiatives.

Demand patterns show seasonal variations, with peak activity during spring and autumn months when construction and renovation projects are most active. This cyclical nature requires manufacturers and distributors to manage inventory levels and production capacity effectively to meet market demands.

Price dynamics are influenced by raw material costs, energy prices, and competitive positioning strategies. Premium segments demonstrate greater price stability and higher margins, while commodity segments face more intense price competition and margin pressure.

Innovation cycles drive market evolution as manufacturers continuously introduce new products, designs, and technologies to maintain competitive advantages. The rapid pace of innovation requires substantial research and development investments and close collaboration with design professionals and end-users.

Regulatory environment shapes market dynamics through building codes, environmental standards, and trade policies. Compliance requirements influence product development priorities and manufacturing processes, creating both challenges and opportunities for market participants.

Research methodology employed for analyzing the South Korean ceramic tiles market incorporates comprehensive primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research includes extensive interviews with industry executives, manufacturers, distributors, contractors, and end-users across various market segments and geographic regions.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements to validate primary findings and provide comprehensive market context. MarkWide Research utilizes advanced analytical frameworks to process and interpret market data, ensuring robust and actionable insights.

Data collection methods include structured surveys, focus group discussions, expert interviews, and market observation studies conducted across major metropolitan areas and regional markets throughout South Korea. This multi-faceted approach ensures comprehensive coverage of market dynamics and stakeholder perspectives.

Analytical techniques employ statistical modeling, trend analysis, and comparative assessments to identify market patterns, growth drivers, and future opportunities. Cross-validation of findings through multiple data sources enhances research reliability and confidence levels.

Market segmentation analysis utilizes detailed categorization frameworks to examine performance across product types, applications, distribution channels, and geographic regions, providing granular insights for strategic decision-making.

Regional analysis reveals distinct market characteristics across South Korea’s major metropolitan areas and provincial regions. Seoul Metropolitan Area dominates market consumption, accounting for approximately 42% of total demand, driven by high population density, active construction projects, and affluent consumer base with strong preferences for premium ceramic solutions.

Busan and surrounding regions represent the second-largest market segment, contributing roughly 18% of national consumption. The region’s industrial base and port facilities support both domestic consumption and export activities, creating diverse demand patterns across residential and commercial applications.

Incheon and Gyeonggi Province demonstrate rapid growth potential, with market share increasing to approximately 15% of total consumption. New town developments, industrial complexes, and proximity to Seoul drive sustained demand for ceramic tile solutions across various applications.

Regional manufacturing centers are strategically located to serve local markets while maintaining cost-effective distribution networks. Major production facilities concentrate in areas with favorable logistics infrastructure and raw material access, optimizing supply chain efficiency.

Provincial markets show steady growth as urbanization spreads beyond major metropolitan areas. Government infrastructure investments and regional development initiatives create new opportunities for ceramic tiles manufacturers and distributors in previously underserved areas.

Competitive landscape in the South Korean ceramic tiles market features a dynamic mix of established domestic manufacturers and international brands competing across various market segments. Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies.

Competitive strategies emphasize product differentiation, technological innovation, and customer service excellence. Companies invest heavily in research and development, manufacturing capabilities, and brand building to maintain market position and drive growth.

Market consolidation trends include strategic partnerships, acquisitions, and joint ventures aimed at enhancing competitive capabilities and market reach. These activities reshape industry dynamics and create new opportunities for market expansion and efficiency improvements.

Market segmentation analysis reveals distinct performance characteristics across various product categories, applications, and distribution channels within the South Korean ceramic tiles market. Product segmentation encompasses multiple tile types, each serving specific market needs and consumer preferences.

By Product Type:

By Application:

By Size Format:

Category-wise analysis provides detailed insights into performance characteristics and growth potential across different ceramic tiles segments. Porcelain tiles category demonstrates the strongest growth momentum, driven by superior technical properties, design versatility, and premium market positioning.

Residential category insights reveal strong preference for large-format tiles with natural stone and wood-look designs. Consumer trends favor products that combine aesthetic appeal with practical benefits such as easy maintenance and durability. The segment shows 8.1% annual growth in premium product adoption.

Commercial category performance emphasizes functionality, durability, and design consistency across large installations. Specification-driven purchasing decisions prioritize technical performance, warranty coverage, and supplier reliability. This segment demonstrates steady growth with increasing focus on sustainable and healthy building materials.

Technology category trends include digital printing advancement, large-format production capabilities, and enhanced surface treatments. Manufacturers invest in cutting-edge equipment to produce tiles with superior aesthetics and performance characteristics that command premium pricing.

Distribution category analysis shows evolution toward multi-channel approaches combining traditional retail, specialty showrooms, and digital platforms. Online sales channels experience rapid growth, particularly for residential consumers seeking convenience and broader product selection.

Industry participants and stakeholders realize substantial benefits from the dynamic South Korean ceramic tiles market environment. Manufacturers benefit from strong domestic demand, advanced production technologies, and export opportunities that enable scale economies and profitability optimization.

Distributors and retailers capitalize on diverse product portfolios, premium market positioning, and growing consumer sophistication that supports healthy margins and business expansion opportunities. The market’s stability and growth trajectory provide predictable revenue streams and investment returns.

Contractors and installers benefit from consistent project flow, premium product availability, and technical support from manufacturers. Professional development programs and certification initiatives enhance skills and service quality, creating competitive advantages in the marketplace.

End-users and consumers enjoy access to high-quality products, innovative designs, and competitive pricing resulting from market competition and technological advancement. Product warranties, technical support, and installation services enhance overall value proposition and customer satisfaction.

Economic stakeholders including suppliers, logistics providers, and service companies participate in a robust ecosystem that generates employment, tax revenue, and economic multiplier effects throughout South Korea’s economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the South Korean ceramic tiles industry reflect evolving consumer preferences, technological innovations, and sustainability imperatives. Large-format tile adoption continues accelerating, with formats exceeding 1200mm gaining popularity in both residential and commercial applications due to their modern aesthetic and reduced grout lines.

Digital printing technology revolutionizes design possibilities, enabling realistic reproduction of natural materials including wood, stone, and fabric textures. This trend supports premium positioning and allows manufacturers to respond quickly to changing design preferences and market demands.

Sustainability focus drives development of eco-friendly products incorporating recycled materials, reduced energy consumption in production, and improved end-of-life recyclability. Green building certifications increasingly influence product selection in commercial and institutional projects.

Smart tile integration emerges as manufacturers explore incorporation of heating elements, antimicrobial properties, and digital connectivity features. These innovations create new value propositions and differentiation opportunities in premium market segments.

Customization capabilities expand as digital technologies enable cost-effective production of personalized designs and limited-edition collections. This trend supports premium pricing and enhances customer engagement through unique product offerings.

Recent industry developments demonstrate the dynamic nature of South Korea’s ceramic tiles market and the continuous evolution of competitive strategies. Technology investments by major manufacturers include installation of advanced digital printing equipment and large-format production lines to meet growing market demand for premium products.

Strategic partnerships between domestic manufacturers and international design firms enhance product development capabilities and global market access. These collaborations combine South Korean manufacturing excellence with international design expertise and market knowledge.

Sustainability initiatives include implementation of cleaner production technologies, waste reduction programs, and development of eco-friendly product lines. Several manufacturers achieve environmental certifications and participate in green building programs to enhance market positioning.

Export expansion activities focus on Southeast Asian and Middle Eastern markets where South Korean ceramic tiles gain recognition for quality and design innovation. Trade missions, exhibition participation, and distributor partnerships support international market development efforts.

Digital transformation projects include development of e-commerce platforms, virtual showrooms, and augmented reality design tools that enhance customer experience and expand market reach beyond traditional distribution channels.

Strategic recommendations for market participants focus on leveraging growth opportunities while addressing competitive challenges in the South Korean ceramic tiles market. MWR analysis suggests that manufacturers should prioritize technology investments in digital printing and large-format production capabilities to capture premium market segments and maintain competitive advantages.

Product development strategies should emphasize sustainability, customization, and smart technology integration to differentiate offerings and command premium pricing. Companies should invest in research and development capabilities to stay ahead of evolving consumer preferences and market trends.

Market expansion recommendations include developing export capabilities through strategic partnerships, trade missions, and international certification programs. Domestic market growth should focus on underserved regional areas and emerging application segments such as renovation and specialty installations.

Distribution strategy optimization should incorporate multi-channel approaches combining traditional retail, specialty showrooms, and digital platforms. Investment in customer education and technical support services can enhance value proposition and customer loyalty.

Operational excellence initiatives should focus on supply chain optimization, quality management, and cost reduction programs to maintain competitiveness while improving profitability. Strategic partnerships with suppliers and service providers can enhance operational efficiency and market responsiveness.

Future outlook for the South Korean ceramic tiles market appears promising, supported by favorable demographic trends, continued urbanization, and evolving consumer preferences toward premium products. Market growth projections indicate sustained expansion at a CAGR of 6.2% through the forecast period, driven by robust construction activity and renovation market development.

Technology evolution will continue shaping market dynamics as manufacturers adopt advanced production techniques, digital integration, and sustainable manufacturing processes. Innovation in product design, functionality, and customer experience will drive competitive differentiation and premium positioning opportunities.

Export market development presents significant growth potential as South Korean ceramic tiles gain international recognition for quality and design excellence. Strategic market entry initiatives and brand building efforts will support expansion into new geographic markets and application segments.

Sustainability imperatives will increasingly influence market development as environmental regulations strengthen and consumer awareness grows. Companies investing in eco-friendly products and production processes will gain competitive advantages and access to premium market segments.

Digital transformation will reshape business models, customer engagement strategies, and distribution channels. Companies embracing digital technologies and data-driven decision making will achieve superior market performance and customer satisfaction levels.

South Korea’s ceramic tiles market represents a dynamic and evolving industry characterized by technological innovation, premium positioning, and strong growth potential. The market benefits from robust domestic demand, advanced manufacturing capabilities, and increasing international recognition for quality and design excellence.

Key success factors include continuous investment in technology and innovation, focus on sustainability and environmental responsibility, and development of premium product portfolios that meet evolving consumer preferences. Companies that effectively balance these priorities while maintaining operational excellence will achieve sustainable competitive advantages.

Market opportunities abound in export expansion, sustainable product development, digital transformation, and premium market segments. Strategic investments in these areas will drive long-term growth and profitability for industry participants.

Future success in the South Korean ceramic tiles market will depend on adaptability, innovation, and customer-centric strategies that respond effectively to changing market dynamics and consumer needs. The industry’s strong foundation and growth trajectory position it well for continued expansion and development in the years ahead.

What is Ceramic Tiles?

Ceramic tiles are durable, hard-wearing materials made from clay and other natural substances, often used for flooring, walls, and decorative purposes in residential and commercial spaces.

What are the key players in the Ceramic Tiles in South Korean Market?

Key players in the Ceramic Tiles in South Korean Market include LG Hausys, KCC Corporation, and Dongpeng Ceramic, among others.

What are the growth factors driving the Ceramic Tiles in South Korean Market?

The growth of the Ceramic Tiles in South Korean Market is driven by increasing urbanization, rising disposable incomes, and a growing demand for aesthetically pleasing interior designs.

What challenges does the Ceramic Tiles in South Korean Market face?

Challenges in the Ceramic Tiles in South Korean Market include intense competition, fluctuating raw material prices, and environmental regulations affecting production processes.

What opportunities exist in the Ceramic Tiles in South Korean Market?

Opportunities in the Ceramic Tiles in South Korean Market include the rising trend of eco-friendly tiles, advancements in manufacturing technology, and the growing popularity of customized designs.

What trends are shaping the Ceramic Tiles in South Korean Market?

Trends in the Ceramic Tiles in South Korean Market include the increasing use of large-format tiles, the integration of smart technology in tile designs, and a focus on sustainable materials.

Ceramic Tiles in South Korean Market

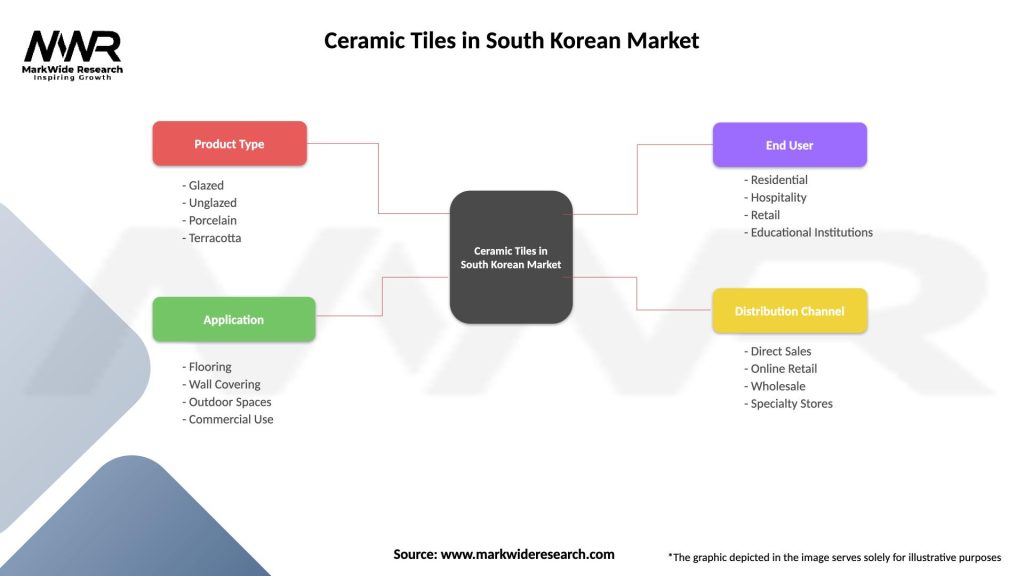

| Segmentation Details | Description |

|---|---|

| Product Type | Glazed, Unglazed, Porcelain, Terracotta |

| Application | Flooring, Wall Covering, Outdoor Spaces, Commercial Use |

| End User | Residential, Hospitality, Retail, Educational Institutions |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ceramic Tiles in South Korean Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at