Market Dynamics

-

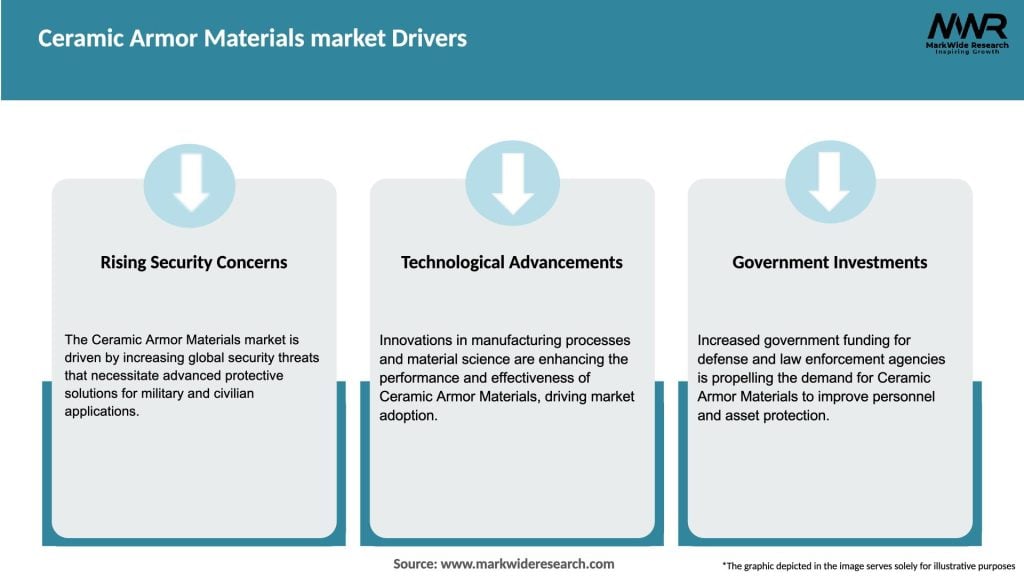

Consolidation Trend: Tier-1 defense contractors are acquiring specialized ceramic producers to vertically integrate supply chains and secure proprietary technologies.

-

Public–Private Partnerships: Government defense R&D agencies and private firms are collaborating on funded programs to accelerate ceramic armor breakthroughs.

-

Environmental Regulations: Strict emissions controls in sintering processes are prompting investment in greener manufacturing methods, such as microwave sintering.

-

Standard Harmonization: Convergence of ballistic protection standards across NATO and partner nations simplifies armor certification and export compliance.

-

Digital Simulation: Increasing use of computational modeling to predict fracture patterns and optimize ceramic microstructures before physical prototyping.

Regional Analysis

-

North America: The largest market, driven by U.S. Department of Defense procurement for personal armor and vehicular applique kits, as well as law enforcement body armor mandates.

-

Europe: Germany, France, and the UK lead in R&D collaboration and manufacturing excellence, supplying both NATO and third-party allies with high-grade ceramic armors.

-

Asia Pacific: China’s growing defense budget and India’s “Make in India” initiative are spurring domestic production of ceramic armor panels and encouraging technology transfers.

-

Middle East & Africa: Heightened regional security concerns in GCC states and North African nations are driving imports of proven ceramic armor solutions and local assembly partnerships.

-

Latin America: Brazil and Mexico are emerging markets, with modernization programs for federal police and border patrol units creating niche demand for lightweight protective gear.

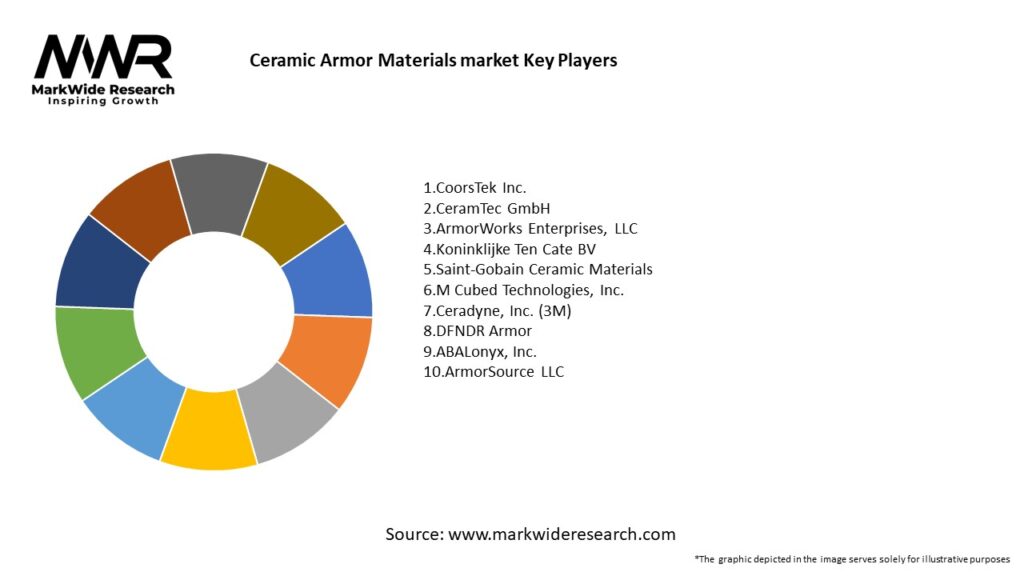

Competitive Landscape

Leading companies in the Ceramic Armor Materials market:

- CoorsTek Inc.

- CeramTec GmbH

- ArmorWorks Enterprises, LLC

- Koninklijke Ten Cate BV

- Saint-Gobain Ceramic Materials

- M Cubed Technologies, Inc.

- Ceradyne, Inc. (3M)

- DFNDR Armor

- ABALonyx, Inc.

- ArmorSource LLC

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

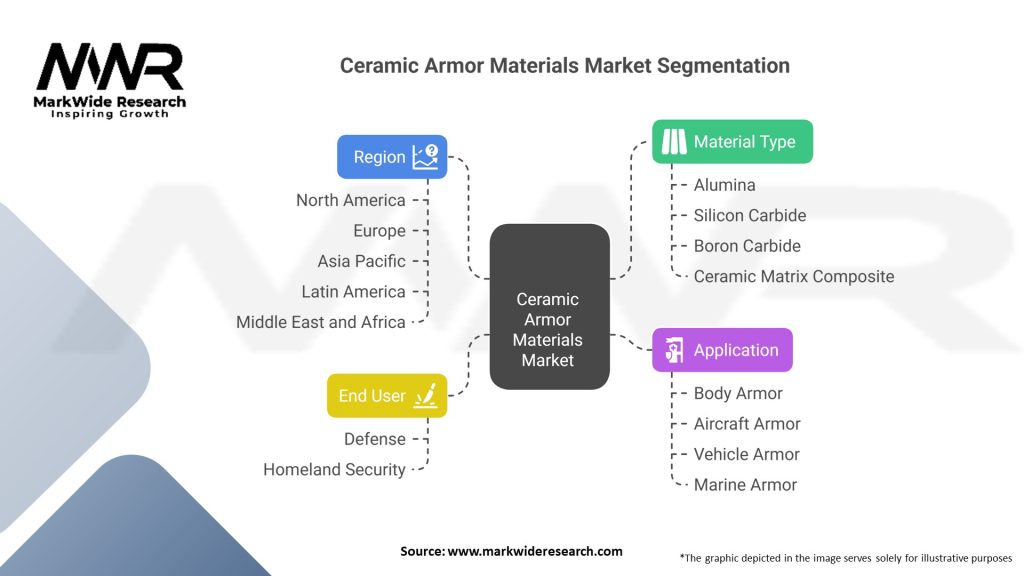

Segmentation

-

By Material Type: Alumina, Silicon Carbide, Boron Carbide, Others (e.g., AlON, BN).

-

By Application: Personal Body Armor, Vehicle Armor (land, naval, air), Structural & Infrastructure Armor.

-

By End User: Military & Defense, Law Enforcement, Private Security, Homeland Security, Industrial Safety.

-

By Process Technology: Conventional Sintering, Hot Pressing, Spark Plasma Sintering, Additive Manufacturing.

-

By Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America.

Category-wise Insights

-

Alumina-Based Armors: Cost-effective and widely used for lower threat levels; often paired with high-performance backing layers to improve multi-hit resistance.

-

Silicon Carbide Armors: Balance of cost and performance makes SiC the fastest-growing segment; ideal for medium- to high-threat applications in both personal and vehicular systems.

-

Boron Carbide Armors: Highest hardness-to-weight ratio, preferred for applications where weight is critical (special operations, airborne vehicles), despite premium pricing.

-

Advanced Phases (AlON, BN): Niche applications—such as transparent windows and extreme temperature environments—are emerging but remain nascent due to high production costs.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Protection: Superior ballistic stopping power enables lighter armor systems without sacrificing safety.

-

Operational Mobility: Weight reductions translate into improved endurance and maneuverability for soldiers and vehicles.

-

Lifecycle Cost Savings: Longer service life and reduced maintenance compared to metal armors lower total cost of ownership.

-

Market Differentiation: Suppliers with proprietary ceramic formulations can command premium pricing and long-term contracts.

-

Dual-Use Potential: Civilian and industrial safety applications provide additional revenue streams, mitigating defense budget cyclicality.

SWOT Analysis

-

Strengths: Exceptional hardness and energy absorption; proven battlefield performance; growing civilian adoption.

-

Weaknesses: High material and processing costs; inherent brittleness requiring complex multi-layer designs.

-

Opportunities: Additive manufacturing for bespoke geometries; development of hybrid ceramic–metal composites; expansion into aerospace shielding.

-

Threats: Supply chain concentration of critical powders; disruptive alternative materials (e.g., advanced polymers); evolving threat profiles requiring frequent material upgrades.

Market Key Trends

-

Nano-Engineered Ceramics: Incorporation of nano-scale grains and engineered porosity to enhance toughness and control crack propagation.

-

Hybrid Composite Layers: Integrating ceramics with advanced polymers (UHMWPE) and light metals (aluminum) in graded structures for optimal multi-hit performance.

-

3D-Printed Armor: Pilot projects using binder-jetting and laser sintering to fabricate complex armor shapes with integrated mounting features.

-

Sustainable Processing: Adoption of low-energy sintering methods (microwave, spark plasma) and recycling of ceramic offcuts to reduce environmental footprint.

-

Smart Armor Monitoring: Embedding sensors within ceramic plates to detect impact events and assess armor integrity in real time.

Covid-19 Impact

The pandemic initially disrupted global supply chains for ceramic powders and slowed non-essential defense procurements. However, increased focus on law enforcement and homeland security in post-Covid recovery plans has sustained demand for personal protective equipment. Manufacturers accelerated digital collaboration tools and diversified supplier networks to enhance resilience. Additionally, cross-application learnings from medical ceramic supply chains helped stabilize production of armor ceramics under stringent health protocols.

Key Industry Developments

-

CoorsTek–DARPA Partnership: Joint project to develop ultra-thin boron carbide composites targeting next-generation soldier protection.

-

3M’s Acquisition of Ceradyne: Expanded its ceramic armor portfolio and integrated advanced backing systems into turnkey body armor solutions.

-

European Union Funding: Grants awarded to consortia developing transparent ceramic windows (AlON) for armored vehicles and checkpoints.

-

Chinese Tech Transfer Deals: Collaborations between domestic ceramics firms and foreign technology providers to scale boron carbide production.

Analyst Suggestions

-

Invest in Process Innovation: Prioritize research into cost-effective powder synthesis and low-energy densification techniques to reduce unit costs.

-

Focus on Multi-Hit Performance: Develop hybrid armor architectures that maintain ballistic integrity across successive impacts.

-

Expand Dual-Use Applications: Leverage military-grade ceramics in civilian sectors—such as critical infrastructure and aerospace—to diversify revenue.

-

Strengthen Regional Footprint: Establish local manufacturing and R&D centers in key defense markets to meet offset requirements and reduce lead times.

Future Outlook

The Ceramic Armor Materials market is set for sustained growth, driven by evolving threat landscapes, continuous material innovations, and expanding civilian security applications. Advancements in nano-engineered ceramics and additive manufacturing will unlock new design possibilities, while hybrid composite systems will overcome traditional brittleness limitations. Regional diversification of production and strategic partnerships between material innovators and defense integrators will be critical to meet rising demand. As global defense budgets stabilize and private security markets expand, ceramic armor suppliers that optimize performance, cost, and supply resilience will emerge as industry leaders.

Conclusion

In an era where agility, protection, and weight savings are paramount, ceramic armor materials stand at the forefront of ballistic defense technology. Their exceptional hardness-to-weight ratios, when combined with advanced composites and processing innovations, deliver unmatched protective performance. While challenges around cost, toughness, and supply chain concentration persist, the market’s ongoing R&D, strategic collaborations, and diversification into dual-use applications herald a promising future. Stakeholders who invest in process efficiencies, multi-hit solutions, and regional manufacturing capabilities will be best positioned to capitalize on the growing global demand for high-performance ceramic armor systems.