444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Central and Eastern Europe freight and logistics market represents a dynamic and rapidly evolving sector that serves as a crucial bridge between Western Europe and Asia. This strategic region encompasses countries including Poland, Czech Republic, Hungary, Slovakia, Romania, Bulgaria, and the Baltic states, each contributing to a comprehensive logistics ecosystem. Market dynamics in this region are characterized by substantial infrastructure investments, technological modernization, and increasing integration with global supply chains.

Regional positioning has become increasingly important as Central and Eastern Europe establishes itself as a key logistics hub for international trade. The market benefits from strategic geographical advantages, including proximity to major European markets and access to multiple transportation corridors. Growth trajectories indicate sustained expansion driven by e-commerce proliferation, manufacturing sector development, and cross-border trade facilitation.

Infrastructure development across the region has accelerated significantly, with governments and private investors focusing on modernizing transportation networks, warehouse facilities, and digital logistics platforms. The market demonstrates resilience and adaptability, particularly in response to changing global trade patterns and supply chain disruptions. Investment flows continue to strengthen the region’s logistics capabilities, with particular emphasis on sustainable transportation solutions and automation technologies.

The Central and Eastern Europe freight and logistics market refers to the comprehensive ecosystem of transportation, warehousing, distribution, and supply chain management services operating across the region’s key economies. This market encompasses all activities related to the movement, storage, and handling of goods from origin to destination within and through Central and Eastern European countries.

Core components of this market include road freight transportation, rail logistics, air cargo services, maritime shipping, warehousing and distribution centers, last-mile delivery services, and integrated supply chain solutions. The market serves diverse industries including automotive, manufacturing, retail, e-commerce, pharmaceuticals, and agricultural sectors, providing essential connectivity between producers and consumers.

Geographic scope covers major economies such as Poland, Czech Republic, Hungary, Slovakia, Romania, Bulgaria, Slovenia, Croatia, and the Baltic states of Lithuania, Latvia, and Estonia. Each country contributes unique strengths to the regional logistics network, creating synergies that enhance overall market efficiency and competitiveness in the global logistics landscape.

Market performance in Central and Eastern Europe’s freight and logistics sector demonstrates robust growth momentum, driven by increasing trade volumes, infrastructure modernization, and digital transformation initiatives. The region has emerged as a strategic logistics gateway, connecting European markets with Asian trade routes and serving as a manufacturing hub for multinational corporations.

Key growth drivers include expanding e-commerce activities, which account for approximately 18% annual growth in logistics demand, automotive industry expansion, and increasing cross-border trade facilitation. The market benefits from substantial EU funding for infrastructure projects, private sector investments in modern logistics facilities, and government initiatives supporting transportation network development.

Competitive landscape features a mix of international logistics giants, regional specialists, and emerging technology-driven service providers. Major players are investing heavily in automation, sustainability initiatives, and digital platforms to enhance service quality and operational efficiency. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding service capabilities and geographic coverage.

Future prospects remain highly positive, with continued infrastructure investments, technology adoption, and regional economic integration supporting sustained market expansion. The sector is positioned to benefit from nearshoring trends, green logistics initiatives, and increasing demand for specialized logistics services across various industry verticals.

Strategic positioning of Central and Eastern Europe as a logistics hub continues to strengthen, with the region capturing an increasing share of European logistics activities. MarkWide Research analysis indicates several critical insights that define current market dynamics and future development trajectories.

Economic growth across Central and Eastern Europe serves as a fundamental driver for freight and logistics market expansion. Rising industrial production, increasing consumer spending, and expanding international trade create sustained demand for comprehensive logistics services. GDP growth rates averaging 4.2% annually across the region support continued logistics sector development.

E-commerce proliferation represents a transformative force driving logistics innovation and capacity expansion. Online retail growth has accelerated demand for sophisticated fulfillment networks, last-mile delivery solutions, and reverse logistics capabilities. Digital commerce expansion requires specialized warehouse facilities, automated sorting systems, and flexible delivery options to meet consumer expectations.

Infrastructure investments continue to enhance the region’s logistics capabilities through improved transportation networks, modern warehouse facilities, and advanced technology systems. EU structural funds, government initiatives, and private sector investments collectively support comprehensive infrastructure modernization programs. Transportation corridors connecting the region to Western Europe and Asia create strategic advantages for logistics operations.

Manufacturing sector growth drives demand for specialized logistics services, including automotive parts distribution, electronics handling, and industrial supply chain management. The region’s emergence as a manufacturing hub for European and global markets requires sophisticated logistics support systems. Industrial clusters development creates concentrated demand for integrated logistics solutions and value-added services.

Infrastructure limitations in certain areas continue to constrain logistics efficiency and capacity utilization. While significant investments are underway, some transportation networks, border crossings, and intermodal facilities require further development to meet growing demand. Capacity bottlenecks during peak periods can impact service quality and operational efficiency.

Labor shortages present ongoing challenges for logistics operations, particularly in truck driving, warehouse operations, and specialized technical roles. Demographic trends, migration patterns, and competitive labor markets create recruitment and retention difficulties. Skills gaps in emerging technologies and digital logistics platforms require comprehensive training and development programs.

Regulatory complexity across multiple jurisdictions can complicate cross-border logistics operations and increase compliance costs. Varying national regulations, customs procedures, and administrative requirements create operational challenges for international logistics providers. Bureaucratic processes may slow cargo clearance and increase transit times for certain shipments.

Environmental regulations and sustainability requirements impose additional costs and operational constraints on logistics operations. Emissions standards, waste management requirements, and environmental impact assessments require significant investments in cleaner technologies and sustainable practices. Compliance costs can impact profitability, particularly for smaller logistics service providers.

Digital transformation presents substantial opportunities for logistics service providers to enhance operational efficiency, improve customer service, and develop new revenue streams. Advanced analytics, artificial intelligence, and IoT technologies enable optimized routing, predictive maintenance, and real-time visibility across supply chains. Technology adoption can differentiate service providers and create competitive advantages.

Sustainable logistics initiatives offer opportunities to develop environmentally friendly transportation solutions, reduce operational costs, and meet growing customer demand for green supply chains. Electric vehicle adoption, alternative fuel technologies, and carbon-neutral logistics services represent emerging market segments. Green logistics capabilities can attract environmentally conscious customers and comply with regulatory requirements.

Nearshoring trends create opportunities for Central and Eastern Europe to capture manufacturing and logistics activities relocating from distant markets. Companies seeking to reduce supply chain risks and transportation costs may establish operations closer to European markets. Regional positioning advantages support the development of integrated manufacturing and logistics hubs.

Specialized services development offers opportunities to serve niche markets requiring customized logistics solutions. Temperature-controlled transportation, pharmaceutical logistics, hazardous materials handling, and high-value goods security represent growing market segments. Value-added services can command premium pricing and strengthen customer relationships.

Competitive intensity in the Central and Eastern Europe freight and logistics market continues to increase as international players expand their presence and regional companies enhance their capabilities. Market consolidation trends reflect strategic efforts to achieve economies of scale, expand service portfolios, and strengthen geographic coverage.

Technology disruption is reshaping traditional logistics operations through automation, digitalization, and data-driven decision making. Companies investing in advanced technologies gain operational advantages, while those lagging behind face competitive pressures. Innovation cycles accelerate as logistics providers seek to differentiate their services and improve efficiency.

Customer expectations continue to evolve, demanding greater transparency, faster delivery times, and more flexible service options. E-commerce growth has elevated customer service standards across all logistics segments. Service quality requirements drive investments in tracking systems, customer communication platforms, and performance monitoring capabilities.

Regulatory evolution influences market dynamics through changing transportation regulations, environmental standards, and trade policies. Companies must adapt their operations to comply with evolving requirements while maintaining competitiveness. Policy changes can create both challenges and opportunities for logistics service providers operating across multiple jurisdictions.

Comprehensive analysis of the Central and Eastern Europe freight and logistics market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, logistics service providers, customers, and regulatory officials across the region.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements. Data sources include national statistical offices, transportation ministries, logistics associations, and international trade organizations. Market intelligence gathering focuses on current trends, competitive dynamics, and future development prospects.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market developments and identify growth opportunities. Data validation processes ensure consistency and accuracy across multiple sources. Analytical frameworks incorporate economic indicators, industry metrics, and performance benchmarks.

Regional coverage includes detailed analysis of major markets including Poland, Czech Republic, Hungary, Slovakia, Romania, Bulgaria, and Baltic states. Country-specific research examines local market conditions, regulatory environments, and competitive landscapes. Cross-border analysis evaluates regional integration trends and international logistics flows.

Poland dominates the regional freight and logistics market, accounting for approximately 35% market share due to its large economy, strategic location, and advanced infrastructure. The country serves as a major logistics hub connecting Western Europe with Eastern markets. Warsaw and surrounding regions host numerous distribution centers and logistics facilities serving international companies.

Czech Republic maintains a strong logistics position with approximately 15% regional market share, benefiting from its central European location and well-developed transportation infrastructure. Prague serves as a key logistics center, while border regions facilitate significant cross-border trade flows. The country’s logistics sector supports robust manufacturing and automotive industries.

Hungary captures roughly 12% market share through its strategic position and strong automotive manufacturing base. Budapest functions as a major logistics hub, while the country’s transportation networks provide excellent connectivity to Western Europe and the Balkans. Logistics investments support the country’s role as a manufacturing center.

Romania represents approximately 18% market share with significant growth potential driven by its large domestic market and Black Sea access. Bucharest serves as the primary logistics center, while port cities like Constanta provide important maritime connections. Infrastructure investments continue to enhance the country’s logistics capabilities.

Baltic states collectively account for about 8% market share, with strong maritime logistics capabilities and connections to Nordic markets. Ports in Lithuania, Latvia, and Estonia serve as important gateways for trade with Russia and other CIS countries. The region benefits from advanced digital infrastructure and efficient customs procedures.

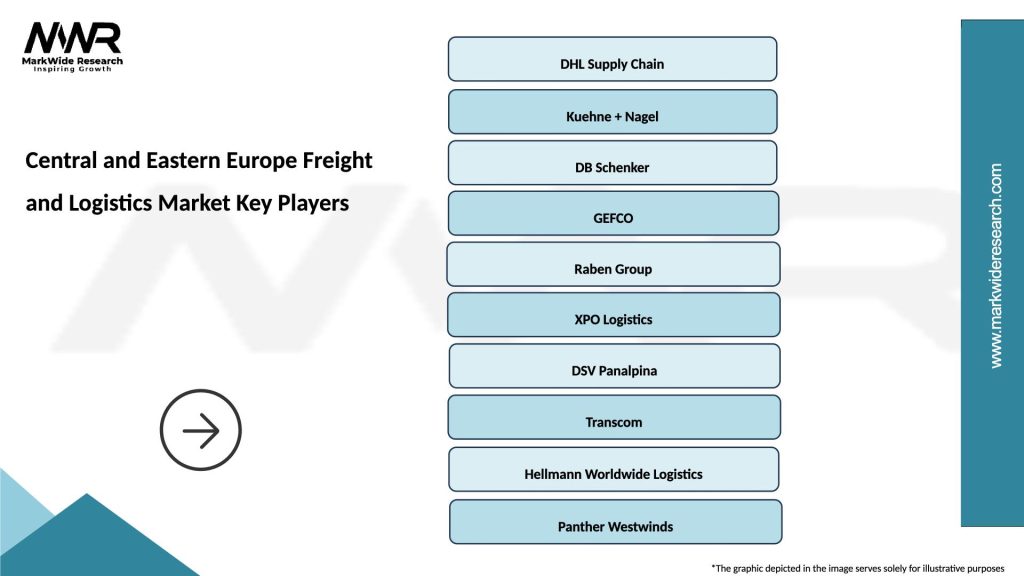

Market leadership in Central and Eastern Europe’s freight and logistics sector features a diverse mix of international corporations, regional specialists, and emerging technology-driven companies. Competitive dynamics reflect ongoing consolidation trends, strategic partnerships, and investments in advanced logistics capabilities.

Strategic initiatives among leading companies include investments in automation technologies, sustainability programs, and digital platform development. Market positioning strategies focus on service differentiation, geographic expansion, and vertical market specialization to maintain competitive advantages.

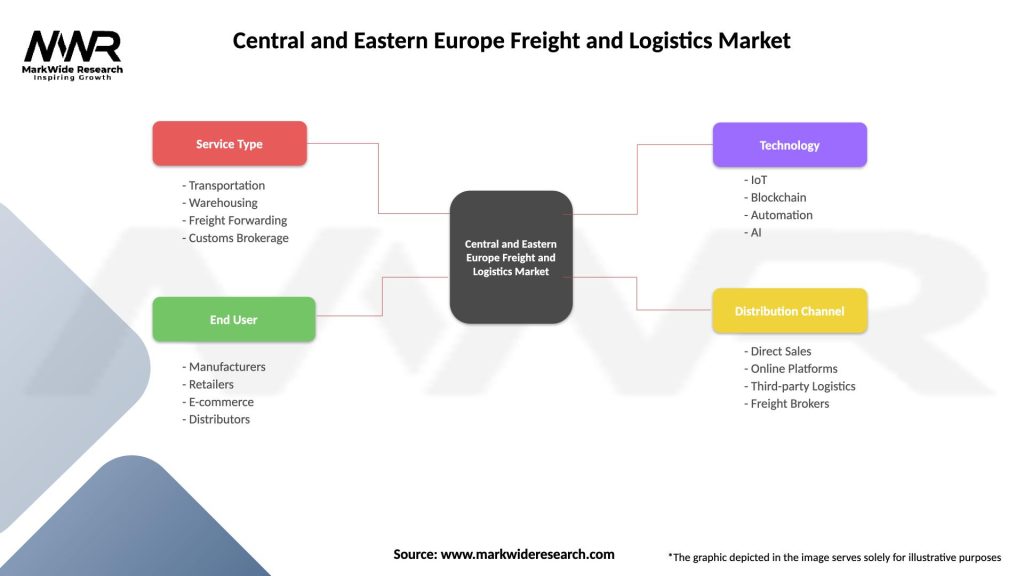

Service type segmentation reveals diverse logistics offerings tailored to specific customer requirements and industry needs. Market distribution across service categories reflects varying demand patterns and growth opportunities within the regional logistics ecosystem.

By Service Type:

By Industry Vertical:

Road freight transportation maintains market dominance with approximately 65% segment share, driven by flexibility, door-to-door service capabilities, and extensive network coverage. Trucking operations benefit from improved highway infrastructure, reduced border crossing times, and advanced fleet management technologies. The segment faces challenges from driver shortages and environmental regulations but continues to innovate through electric vehicles and autonomous driving technologies.

Rail logistics demonstrates strong growth potential with increasing focus on sustainable transportation solutions and intermodal connectivity. Railway networks across the region are undergoing modernization to improve capacity, speed, and reliability. Container transportation and bulk cargo movements drive rail logistics demand, particularly for long-distance shipments and environmentally conscious customers.

Warehousing and distribution services experience robust growth driven by e-commerce expansion and inventory optimization strategies. Modern facilities incorporate automation technologies, advanced warehouse management systems, and flexible space configurations. Location strategies focus on proximity to major population centers, transportation hubs, and manufacturing clusters to optimize distribution efficiency.

Last-mile delivery represents the fastest-growing segment with 25% annual expansion driven by online shopping proliferation and changing consumer expectations. Urban logistics solutions include parcel lockers, micro-fulfillment centers, and alternative delivery methods to address congestion and sustainability concerns. Technology integration enables route optimization, real-time tracking, and flexible delivery options.

Logistics service providers benefit from expanding market opportunities, infrastructure improvements, and technology advancement supporting operational efficiency and service quality enhancement. Revenue growth potential exists across multiple service segments and industry verticals, while strategic positioning in the region provides access to broader European and Asian markets.

Manufacturing companies gain access to efficient supply chain solutions, reduced logistics costs, and improved market connectivity through regional logistics networks. Operational advantages include shorter lead times, flexible distribution options, and integrated logistics services supporting manufacturing and distribution activities.

E-commerce businesses benefit from sophisticated fulfillment networks, last-mile delivery capabilities, and technology-enabled logistics solutions supporting online retail growth. Customer satisfaction improvements result from faster delivery times, shipment visibility, and flexible delivery options enabled by advanced logistics infrastructure.

Government stakeholders realize economic development benefits through job creation, tax revenue generation, and improved trade facilitation. Infrastructure investments in logistics capabilities support broader economic competitiveness and regional integration objectives while attracting foreign investment and supporting export activities.

Technology providers find growing opportunities to supply advanced logistics solutions, including warehouse automation, transportation management systems, and digital platforms. Innovation partnerships with logistics companies drive technology adoption and create new market opportunities for specialized solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the logistics sector with companies investing heavily in advanced technologies to improve operational efficiency and customer service. Automation adoption includes warehouse robotics, automated sorting systems, and AI-powered logistics optimization platforms. These technologies enable faster processing, reduced errors, and improved scalability for growing logistics operations.

Sustainability initiatives gain momentum as companies respond to environmental regulations and customer demands for green logistics solutions. Electric vehicle adoption increases for last-mile delivery and urban transportation, while alternative fuel technologies support long-distance freight operations. Carbon footprint reduction programs and circular economy principles influence logistics network design and operational practices.

E-commerce integration drives logistics network reconfiguration to support omnichannel retail strategies and direct-to-consumer fulfillment. Micro-fulfillment centers and urban logistics hubs enable faster delivery times and reduced transportation costs. Same-day and next-day delivery capabilities become standard requirements for competitive logistics service providers.

Supply chain resilience becomes a strategic priority following recent global disruptions, leading to diversified supplier networks and flexible logistics arrangements. Risk management strategies include multiple transportation modes, backup facilities, and enhanced visibility systems. Companies invest in supply chain mapping and scenario planning capabilities to improve preparedness for future disruptions.

Infrastructure investments continue to transform the regional logistics landscape through major transportation projects, port expansions, and logistics park developments. EU funding programs support cross-border transportation corridors, intermodal terminals, and digital infrastructure improvements. These investments enhance connectivity, reduce transit times, and improve overall logistics efficiency across the region.

Technology partnerships between logistics companies and technology providers accelerate innovation adoption and service enhancement. MWR analysis indicates increasing collaboration on autonomous vehicles, blockchain applications, and IoT solutions for supply chain visibility. Strategic alliances enable faster technology deployment and shared development costs for advanced logistics capabilities.

Market consolidation activities include strategic acquisitions, mergers, and partnership formations aimed at expanding service capabilities and geographic coverage. International expansion by regional logistics companies and foreign investment in local operations create more integrated and competitive market structures. These developments enhance service quality and operational efficiency across the logistics ecosystem.

Regulatory harmonization efforts improve cross-border logistics efficiency through standardized procedures, digital customs processes, and mutual recognition agreements. Trade facilitation initiatives reduce administrative burdens and transit times for international shipments. Enhanced cooperation between national authorities supports smoother logistics operations and improved competitiveness.

Strategic positioning recommendations for logistics service providers include focusing on technology adoption, sustainability initiatives, and specialized service development to maintain competitive advantages. Investment priorities should emphasize automation technologies, digital platforms, and green logistics capabilities to meet evolving customer requirements and regulatory standards.

Market expansion strategies should consider geographic diversification within the region, vertical market specialization, and value-added service development. Partnership opportunities with technology providers, manufacturing companies, and e-commerce platforms can create synergies and accelerate growth. Companies should evaluate acquisition targets and strategic alliances to enhance capabilities and market presence.

Operational excellence initiatives should focus on process optimization, quality improvement, and customer service enhancement through technology integration and workforce development. Performance metrics should include sustainability indicators, customer satisfaction scores, and operational efficiency measures to drive continuous improvement and competitive differentiation.

Risk management strategies should address potential challenges including labor shortages, regulatory changes, and economic volatility through diversification, contingency planning, and flexible operational arrangements. Scenario planning capabilities enable proactive responses to market changes and disruption events while maintaining service continuity and customer satisfaction.

Growth prospects for the Central and Eastern Europe freight and logistics market remain highly positive, supported by continued economic development, infrastructure investments, and technology advancement. Market expansion is expected to accelerate with projected growth rates of 6.5% annually driven by e-commerce proliferation, manufacturing sector development, and regional integration initiatives.

Technology transformation will continue reshaping logistics operations through automation, artificial intelligence, and digital platform integration. Innovation adoption rates are expected to increase as companies seek competitive advantages and operational efficiencies. Autonomous vehicles, drone delivery systems, and blockchain applications represent emerging technologies with significant potential impact on future logistics operations.

Sustainability requirements will drive substantial changes in logistics networks, transportation modes, and operational practices. Green logistics capabilities will become essential for market competitiveness as environmental regulations strengthen and customer preferences shift toward sustainable solutions. Electric vehicle adoption and carbon-neutral logistics services will expand significantly across the region.

Market integration will deepen through enhanced cross-border cooperation, standardized procedures, and regional logistics network development. MarkWide Research projections indicate increasing coordination between national logistics systems and improved connectivity with global supply chains. These developments will strengthen the region’s position as a strategic logistics hub connecting European and Asian markets.

The Central and Eastern Europe freight and logistics market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance for regional and global supply chains. Market fundamentals remain strong, supported by favorable geographic positioning, ongoing infrastructure investments, and increasing integration with international trade networks.

Key success factors for market participants include technology adoption, sustainability initiatives, operational excellence, and strategic positioning to capture emerging opportunities. The sector’s transformation through digitalization, automation, and green logistics solutions creates both challenges and opportunities for logistics service providers, customers, and stakeholders across the region.

Future development will be shaped by continued e-commerce growth, manufacturing sector expansion, and evolving customer expectations for faster, more flexible, and sustainable logistics services. Companies that invest in advanced capabilities, strategic partnerships, and innovative solutions will be best positioned to capitalize on the region’s substantial growth potential and contribute to its emergence as a leading global logistics hub.

What is Freight and Logistics?

Freight and logistics refer to the processes involved in the transportation, warehousing, and distribution of goods. This includes various activities such as shipping, inventory management, and supply chain coordination.

What are the key players in the Central and Eastern Europe Freight and Logistics Market?

Key players in the Central and Eastern Europe Freight and Logistics Market include companies like DB Schenker, DPDgroup, and Kuehne + Nagel, which provide comprehensive logistics solutions across the region, among others.

What are the main drivers of growth in the Central and Eastern Europe Freight and Logistics Market?

The main drivers of growth in the Central and Eastern Europe Freight and Logistics Market include increasing e-commerce activities, the expansion of manufacturing sectors, and improvements in transportation infrastructure.

What challenges does the Central and Eastern Europe Freight and Logistics Market face?

Challenges in the Central and Eastern Europe Freight and Logistics Market include regulatory complexities, fluctuating fuel prices, and the need for technological advancements to enhance efficiency.

What opportunities exist in the Central and Eastern Europe Freight and Logistics Market?

Opportunities in the Central and Eastern Europe Freight and Logistics Market include the growth of digital logistics solutions, the rise of sustainable transportation practices, and the potential for increased foreign investment in logistics infrastructure.

What trends are shaping the Central and Eastern Europe Freight and Logistics Market?

Trends shaping the Central and Eastern Europe Freight and Logistics Market include the adoption of automation and AI in logistics operations, the shift towards green logistics, and the integration of advanced tracking technologies.

Central and Eastern Europe Freight and Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Customs Brokerage |

| End User | Manufacturers, Retailers, E-commerce, Distributors |

| Technology | IoT, Blockchain, Automation, AI |

| Distribution Channel | Direct Sales, Online Platforms, Third-party Logistics, Freight Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Central and Eastern Europe Freight and Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at