444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Central and Eastern Europe Courier, Express, and Parcel (CEP) market represents one of the most dynamic logistics sectors in the region, experiencing unprecedented growth driven by e-commerce expansion, digital transformation, and evolving consumer expectations. This rapidly expanding market encompasses comprehensive last-mile delivery services, express shipping solutions, and integrated parcel management systems across countries including Poland, Czech Republic, Hungary, Romania, Slovakia, and other emerging economies in the region.

Market dynamics indicate robust expansion with the sector growing at a compound annual growth rate (CAGR) of 8.2%, significantly outpacing traditional logistics segments. The region’s strategic geographic position, improving infrastructure, and increasing digitalization have positioned Central and Eastern Europe as a critical hub for international trade and domestic commerce. E-commerce penetration has reached 67% of the population, driving substantial demand for reliable courier and parcel delivery services.

Regional characteristics include diverse market maturity levels, with Western-oriented countries like Poland and Czech Republic leading adoption rates, while emerging markets present significant growth opportunities. The market encompasses traditional postal services, private courier companies, and innovative last-mile delivery solutions, creating a competitive landscape that benefits consumers through improved service quality and delivery speed.

The Central and Eastern Europe Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of logistics services specializing in time-sensitive delivery of documents, packages, and parcels across the Central and Eastern European region. This market encompasses express delivery services, standard courier operations, parcel distribution networks, and integrated logistics solutions designed to meet diverse customer requirements ranging from same-day delivery to international shipping.

CEP services distinguish themselves from traditional freight and logistics through emphasis on speed, reliability, and door-to-door delivery capabilities. The market includes business-to-business (B2B) courier services, business-to-consumer (B2C) parcel delivery, consumer-to-consumer (C2C) shipping solutions, and specialized services such as cash-on-delivery, temperature-controlled transport, and high-value item handling.

Market participants range from international logistics giants to regional specialists, each contributing unique capabilities and service offerings. The sector’s evolution reflects broader economic development in Central and Eastern Europe, supporting both domestic commerce and international trade relationships with Western Europe, Asia, and global markets.

Strategic market positioning reveals the Central and Eastern Europe CEP market as a high-growth sector benefiting from multiple convergent trends including digital commerce expansion, infrastructure modernization, and changing consumer behavior patterns. The market demonstrates resilience and adaptability, successfully navigating economic uncertainties while maintaining consistent growth trajectories across key performance indicators.

Key growth drivers include e-commerce market expansion representing 45% of total parcel volume, cross-border trade facilitation, and increasing consumer expectations for faster delivery times. Urban population growth and rising disposable incomes contribute to sustained demand for premium delivery services, while rural market penetration presents significant expansion opportunities for service providers.

Competitive landscape features established international players alongside emerging regional specialists, creating dynamic market conditions that drive innovation and service improvement. Technology adoption, including route optimization, real-time tracking, and automated sorting systems, enables enhanced operational efficiency and customer satisfaction. MarkWide Research analysis indicates that companies investing in digital transformation achieve 23% higher customer retention rates compared to traditional operators.

Market outlook remains positive with projected continued expansion driven by sustained e-commerce growth, infrastructure development, and increasing integration with European Union logistics networks. Regulatory harmonization and cross-border trade facilitation support long-term market development prospects.

Market intelligence reveals several critical insights shaping the Central and Eastern Europe CEP landscape:

Consumer behavior analysis indicates increasing sophistication in delivery preferences, with customers prioritizing flexibility, transparency, and convenience over traditional cost considerations. This shift creates opportunities for premium service offerings and value-added solutions that differentiate market participants.

E-commerce expansion serves as the primary catalyst for CEP market growth, with online retail platforms generating unprecedented parcel volumes across the region. Digital marketplace proliferation, mobile commerce adoption, and changing consumer shopping patterns create sustained demand for reliable delivery services. Cross-border e-commerce particularly benefits from improved logistics infrastructure and regulatory harmonization within the European Union framework.

Infrastructure development significantly enhances market capabilities through improved road networks, modernized airports, and strategic logistics hubs. Government investments in transportation infrastructure reduce delivery times and costs while enabling service expansion into previously underserved areas. Digital infrastructure improvements, including broadband connectivity and mobile networks, support technology-enabled logistics solutions.

Economic growth across Central and Eastern Europe drives increased consumer spending and business activity, directly translating to higher parcel volumes. Rising disposable incomes enable premium service adoption, while business expansion creates demand for reliable B2B courier services. Foreign direct investment and international business relationships generate cross-border shipping requirements.

Urbanization trends concentrate population in metropolitan areas with high delivery density, improving operational efficiency and service economics. Urban consumers demonstrate greater willingness to pay for convenience services, supporting premium delivery options and innovative last-mile solutions. Smart city initiatives integrate logistics planning with urban development, creating favorable operating environments.

Technology advancement enables operational improvements through route optimization, automated sorting, real-time tracking, and predictive analytics. Digital platforms facilitate customer interaction, order management, and service customization. Emerging technologies including drones, autonomous vehicles, and artificial intelligence present future enhancement opportunities.

Infrastructure limitations in certain regions constrain service expansion and operational efficiency, particularly in rural areas with inadequate road networks or limited transportation connectivity. Legacy postal systems and outdated logistics facilities require significant modernization investments to meet contemporary service standards. Geographic challenges in mountainous or remote areas increase delivery costs and complexity.

Regulatory complexity across multiple jurisdictions creates compliance challenges for cross-border operations, requiring navigation of varying customs procedures, tax regulations, and service standards. Bureaucratic processes can delay international shipments and increase operational costs. Regulatory uncertainty regarding emerging technologies like drone delivery limits innovation adoption.

Labor market constraints including driver shortages, seasonal workforce fluctuations, and increasing wage pressures impact operational costs and service reliability. High employee turnover in logistics positions requires continuous training investments and affects service quality consistency. Competition for qualified personnel intensifies as the market expands.

Economic volatility affects consumer spending patterns and business investment decisions, creating demand fluctuations that challenge capacity planning and resource allocation. Currency exchange rate variations impact cross-border service pricing and profitability. Economic downturns can reduce discretionary spending on premium delivery services.

Environmental concerns regarding carbon emissions and urban congestion create pressure for sustainable delivery solutions, requiring investments in alternative fuel vehicles and optimized routing systems. Regulatory restrictions on urban vehicle access and emissions standards increase operational complexity and costs.

Rural market expansion presents significant growth opportunities as infrastructure improvements and digital connectivity enable service extension to underserved areas. Rural e-commerce adoption creates new customer segments requiring reliable delivery solutions. Agricultural and small business sectors in rural areas generate B2B courier service demand.

Technology integration opportunities include advanced analytics for demand forecasting, artificial intelligence for route optimization, and Internet of Things (IoT) sensors for package tracking and condition monitoring. Blockchain technology can enhance supply chain transparency and security. Autonomous delivery vehicles and drones offer future operational efficiency improvements.

Cross-border expansion benefits from European Union integration, simplified customs procedures, and growing international trade relationships. Asian market connections through Belt and Road Initiative create new shipping corridors. Brexit-related trade pattern changes generate opportunities for alternative routing through Central and Eastern Europe.

Sustainability initiatives create competitive advantages through eco-friendly delivery options, electric vehicle fleets, and carbon-neutral shipping services. Green logistics solutions appeal to environmentally conscious consumers and businesses. Government incentives for sustainable transportation support investment in clean technologies.

Value-added services including installation, assembly, returns management, and specialized handling create revenue diversification opportunities. White-label logistics services for e-commerce platforms enable market expansion. Warehousing and fulfillment services complement core delivery capabilities.

Competitive intensity drives continuous service improvement and innovation as market participants compete for market share through enhanced delivery speed, expanded coverage areas, and superior customer experience. Price competition remains significant, particularly in standard delivery segments, while premium services command higher margins through value differentiation.

Customer expectations continue evolving toward faster delivery times, greater flexibility, and enhanced transparency throughout the shipping process. Real-time tracking, delivery time windows, and alternative pickup locations become standard service features. Customer service quality increasingly influences provider selection and retention.

Technology disruption reshapes operational models through automation, digitalization, and data analytics. Traditional logistics companies must adapt to technology-driven competitors while maintaining service reliability. Investment in digital capabilities becomes essential for long-term competitiveness.

Market consolidation trends include strategic acquisitions, partnerships, and network sharing arrangements that enable expanded coverage and improved operational efficiency. International players acquire regional specialists to gain local market knowledge and established customer relationships. Vertical integration strategies encompass warehousing, sorting, and last-mile delivery capabilities.

Regulatory evolution toward harmonized standards and simplified procedures facilitates cross-border operations while maintaining service quality and security requirements. Data protection regulations influence technology implementation and customer information management practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Central and Eastern Europe CEP market. Primary research includes structured interviews with industry executives, logistics managers, and key stakeholders across major market participants. Survey data collection from customers, service providers, and industry experts provides quantitative insights into market trends and preferences.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial disclosures. Regulatory filings, patent applications, and technology announcements provide insights into innovation trends and competitive strategies. Economic indicators and demographic data support market sizing and growth projections.

Data validation processes include cross-referencing multiple sources, statistical analysis for consistency, and expert review for accuracy and completeness. Market modeling incorporates historical trends, current conditions, and forward-looking indicators to develop reliable forecasts. Sensitivity analysis examines various scenarios and their potential impact on market development.

Geographic coverage includes detailed analysis of major markets including Poland, Czech Republic, Hungary, Romania, Slovakia, Slovenia, Croatia, and other regional economies. Country-specific factors including economic conditions, regulatory environment, and competitive landscape receive individual assessment.

Temporal analysis examines historical market development, current market conditions, and projected future trends over multiple time horizons. Seasonal variations, economic cycles, and structural changes receive appropriate consideration in market assessments.

Poland represents the largest CEP market in the region, accounting for approximately 35% of total market volume, driven by robust e-commerce growth, strong economic performance, and well-developed logistics infrastructure. Major cities including Warsaw, Krakow, and Gdansk serve as key distribution hubs with extensive delivery networks. The market features intense competition among international and domestic providers.

Czech Republic demonstrates mature market characteristics with high service penetration and sophisticated customer expectations. Prague serves as a regional logistics hub connecting Western and Eastern European markets. The country’s strategic location and EU membership facilitate cross-border operations and international trade.

Hungary benefits from central European location and strong automotive industry presence, generating significant B2B courier demand. Budapest’s position as a regional business center supports premium service adoption. Government infrastructure investments improve rural connectivity and service expansion opportunities.

Romania presents high growth potential with expanding e-commerce adoption and improving economic conditions. Bucharest and major regional centers experience rapid delivery volume growth. Rural market penetration remains limited but offers significant expansion opportunities as infrastructure develops.

Slovakia leverages proximity to major European markets and strong manufacturing base to support logistics sector growth. Bratislava’s location near Vienna creates cross-border service opportunities. Small market size enables rapid service network deployment and customer relationship development.

Regional cooperation initiatives including shared distribution networks, cross-border partnerships, and harmonized service standards enhance operational efficiency and customer service quality across multiple markets simultaneously.

Market leadership features a combination of global logistics giants and regional specialists, each contributing unique strengths and capabilities to the competitive environment:

Competitive strategies focus on service differentiation through delivery speed, network coverage, technology integration, and customer service quality. Price competition remains intense in standard delivery segments, while premium services enable margin improvement through value-added offerings.

Innovation leadership includes automated sorting facilities, real-time tracking systems, mobile applications, and alternative delivery solutions such as parcel lockers and pickup points. Technology investments enable operational efficiency improvements and enhanced customer experience.

By Service Type:

By End User:

By Geography:

Express Services Category demonstrates premium market positioning with higher margins and customer loyalty, driven by business customers requiring guaranteed delivery times and comprehensive service features. This segment benefits from economic growth and increasing business activity across the region. Technology integration including real-time tracking and proactive communication enhances value proposition.

E-commerce Delivery Segment represents the fastest-growing category, fueled by online retail expansion and changing consumer shopping patterns. MWR data indicates this segment growing at 14% annually, significantly outpacing traditional delivery categories. Last-mile innovation including parcel lockers and flexible delivery options addresses urban delivery challenges.

Cross-border Services benefit from European Union integration and simplified customs procedures, enabling efficient international commerce. This category requires specialized expertise in regulatory compliance, customs clearance, and international logistics coordination. Growth opportunities exist in Asian trade connections and emerging market relationships.

Rural Delivery Services present expansion opportunities as infrastructure improvements enable service extension to underserved areas. While challenging from cost and logistics perspectives, rural markets offer customer loyalty and reduced competition. Government initiatives supporting rural development create favorable conditions for service expansion.

Value-added Services including installation, returns management, and specialized handling create revenue diversification opportunities beyond basic delivery services. These offerings enable margin improvement and customer relationship strengthening through comprehensive logistics solutions.

Service Providers benefit from expanding market opportunities, revenue growth potential, and operational efficiency improvements through technology adoption and network optimization. Competitive differentiation through service quality and innovation creates sustainable competitive advantages. Geographic expansion and market diversification reduce business risk and enhance growth prospects.

E-commerce Businesses gain access to reliable logistics partners enabling business expansion, customer satisfaction improvement, and operational cost optimization. Integrated logistics solutions support inventory management, order fulfillment, and customer service enhancement. Flexible delivery options increase conversion rates and customer retention.

Consumers enjoy improved service quality, faster delivery times, and greater convenience through expanded delivery options and enhanced tracking capabilities. Competitive market conditions result in better pricing and service innovation. Alternative delivery solutions including parcel lockers provide flexibility for busy lifestyles.

Businesses achieve supply chain efficiency improvements, reduced logistics costs, and enhanced customer service capabilities through reliable courier partnerships. Document delivery services support business operations and compliance requirements. International shipping capabilities enable market expansion and global business relationships.

Economic Development benefits include job creation in logistics and transportation sectors, infrastructure utilization improvements, and enhanced connectivity between urban and rural areas. International trade facilitation supports economic growth and business competitiveness. Technology adoption drives digital economy development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across the CEP sector with companies investing in advanced analytics, artificial intelligence, and automated systems to improve operational efficiency and customer service. Mobile applications, real-time tracking, and predictive delivery notifications become standard service features. Digital platforms enable seamless integration between e-commerce businesses and logistics providers.

Last-mile Innovation addresses urban delivery challenges through alternative solutions including parcel lockers, pickup points, and crowd-sourced delivery networks. Autonomous delivery vehicles and drone technology pilot programs explore future delivery methods. Smart city integration optimizes delivery routes and reduces urban congestion.

Sustainability Initiatives gain prominence as companies adopt electric vehicle fleets, optimize delivery routes for fuel efficiency, and offer carbon-neutral shipping options. Green logistics practices appeal to environmentally conscious consumers and support corporate sustainability goals. Government incentives encourage clean technology adoption.

Cross-border Simplification continues through regulatory harmonization, digital customs procedures, and streamlined documentation requirements. European Union initiatives facilitate intra-regional trade while maintaining security standards. Blockchain technology enhances supply chain transparency and customs processing efficiency.

Customer Experience Enhancement focuses on delivery flexibility, communication quality, and problem resolution efficiency. Personalized delivery options, proactive notifications, and seamless returns processes differentiate service providers. Customer feedback integration drives continuous service improvement.

Infrastructure Investments include major sorting facility expansions, automated warehouse deployments, and transportation network enhancements across key regional markets. Companies invest in technology-enabled facilities to improve processing capacity and operational efficiency. Government infrastructure projects support logistics sector development.

Strategic Partnerships between international logistics providers and regional specialists enable market expansion, service enhancement, and cost optimization. E-commerce platform integrations streamline order fulfillment and delivery processes. Cross-border cooperation agreements facilitate international service expansion.

Technology Deployments encompass advanced tracking systems, route optimization software, and customer communication platforms. Artificial intelligence applications improve demand forecasting and resource allocation. Internet of Things sensors enhance package monitoring and security.

Regulatory Developments include updated postal regulations, cross-border trade facilitation measures, and environmental compliance requirements. Data protection regulations influence customer information management practices. Drone delivery regulations enable pilot program expansion.

Market Consolidation activities feature strategic acquisitions, merger announcements, and partnership formations that reshape competitive dynamics. International players acquire regional specialists to gain local market expertise and customer relationships. Vertical integration strategies encompass comprehensive logistics capabilities.

Technology Investment recommendations emphasize digital transformation priorities including automated sorting systems, real-time tracking capabilities, and customer communication platforms. Companies should prioritize technology solutions that improve operational efficiency while enhancing customer experience. Data analytics investments enable demand forecasting and resource optimization.

Market Expansion Strategies should focus on underserved rural markets and cross-border opportunities while maintaining service quality standards. Geographic diversification reduces market risk and creates growth opportunities. Strategic partnerships enable market entry with reduced investment requirements.

Service Differentiation through premium offerings, value-added services, and specialized capabilities creates competitive advantages and margin improvement opportunities. MarkWide Research analysis suggests companies offering comprehensive logistics solutions achieve 18% higher customer retention compared to basic delivery providers.

Sustainability Integration should encompass environmental initiatives, social responsibility programs, and governance improvements that appeal to stakeholders and support long-term business sustainability. Green delivery options create competitive differentiation while addressing regulatory requirements.

Customer Experience Focus requires investment in service quality improvements, communication enhancement, and problem resolution capabilities. Customer feedback integration and continuous service improvement drive loyalty and market share growth.

Market trajectory indicates continued robust growth driven by sustained e-commerce expansion, infrastructure development, and technology adoption across the Central and Eastern Europe region. The sector’s evolution toward integrated logistics solutions and value-added services creates opportunities for revenue diversification and margin improvement.

Technology integration will accelerate with artificial intelligence, machine learning, and automation becoming standard operational tools. Autonomous delivery vehicles and drone technology may transform last-mile delivery in urban areas. Blockchain applications could enhance supply chain transparency and security.

Geographic expansion opportunities exist in rural markets and cross-border corridors as infrastructure improvements enable service extension. Asian trade connections through Belt and Road Initiative create new shipping opportunities. Brexit-related trade pattern changes may benefit regional logistics hubs.

Regulatory evolution toward harmonized standards and simplified procedures will facilitate cross-border operations while maintaining service quality and security requirements. Environmental regulations will drive sustainable logistics practices and clean technology adoption.

Competitive dynamics will continue favoring companies that successfully integrate technology, maintain service quality, and adapt to changing customer expectations. Market consolidation may accelerate as companies seek scale advantages and geographic expansion capabilities.

The Central and Eastern Europe Courier, Express, and Parcel market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by e-commerce expansion, digital transformation, and improving economic conditions across the region. Market participants benefit from favorable demographic trends, infrastructure development, and increasing consumer sophistication that drives demand for reliable and innovative delivery services.

Strategic opportunities abound for companies that successfully navigate competitive challenges while investing in technology, service quality, and geographic expansion. The market’s evolution toward integrated logistics solutions and value-added services creates revenue diversification opportunities beyond traditional delivery operations. Sustainability initiatives and customer experience enhancement become increasingly important competitive differentiators.

Future success will depend on companies’ ability to adapt to changing market conditions, embrace technological innovation, and maintain service excellence while managing operational costs and competitive pressures. The region’s strategic position, growing economy, and improving infrastructure provide a solid foundation for continued market development and expansion opportunities in both domestic and international segments.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the rapid delivery of packages and documents. This includes various delivery options such as same-day, next-day, and scheduled deliveries, catering to both businesses and individual consumers.

What are the key players in the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market?

Key players in the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market include DHL, UPS, and DPD, which provide a range of logistics and delivery services. These companies compete on factors such as delivery speed, reliability, and customer service, among others.

What are the growth factors driving the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market?

The growth of the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and advancements in logistics technology. Additionally, the expansion of cross-border trade is contributing to market growth.

What challenges does the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market face?

The Central and Eastern Europe Courier, Express, and Parcel (CEP) Market faces challenges such as regulatory hurdles, fluctuating fuel prices, and competition from local and international players. These factors can impact operational efficiency and profitability.

What opportunities exist in the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market?

Opportunities in the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market include the potential for growth in last-mile delivery solutions, the integration of sustainable practices, and the adoption of advanced technologies like automation and AI. These trends can enhance service offerings and operational efficiency.

What trends are shaping the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market?

Trends shaping the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market include the increasing use of technology for tracking and managing deliveries, the rise of green logistics initiatives, and the growing demand for personalized delivery options. These trends reflect changing consumer preferences and environmental considerations.

Central and Eastern Europe Courier, Express, and Parcel (CEP) Market

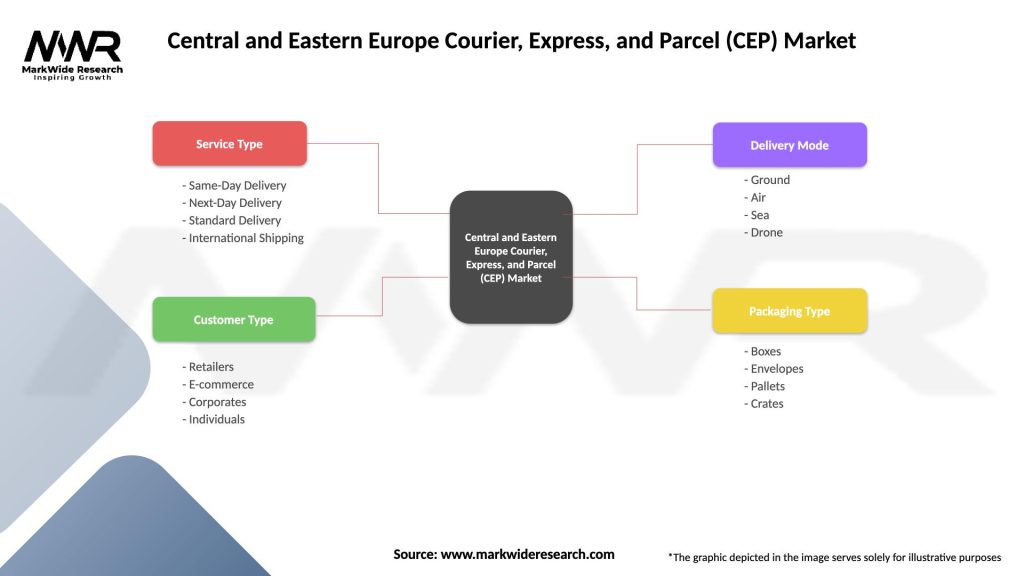

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Standard Delivery, International Shipping |

| Customer Type | Retailers, E-commerce, Corporates, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxes, Envelopes, Pallets, Crates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Central and Eastern Europe Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at