444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cell therapy contract development and manufacturing organization (CDMO) market represents a rapidly expanding sector within the biotechnology and pharmaceutical industries. This specialized market encompasses organizations that provide comprehensive services for the development, manufacturing, and commercialization of cell-based therapeutic products. Cell therapy CDMOs serve as critical partners for biotechnology companies, pharmaceutical firms, and academic institutions seeking to advance their cellular therapeutic programs from research through clinical trials to commercial production.

Market dynamics indicate robust growth driven by increasing investment in regenerative medicine, expanding clinical trial activities, and growing demand for outsourced manufacturing capabilities. The sector is experiencing significant expansion with a projected compound annual growth rate (CAGR) of approximately 12.8% over the forecast period. This growth trajectory reflects the increasing complexity of cell therapy manufacturing and the specialized expertise required for successful product development.

Geographic distribution shows North America maintaining the largest market share at approximately 45%, followed by Europe at 32%, with Asia-Pacific emerging as the fastest-growing region. The market encompasses various therapeutic areas including oncology, immunology, cardiovascular diseases, and neurological disorders, with CAR-T cell therapies representing the most commercially advanced segment.

The cell therapy contract development and manufacturing organization market refers to the specialized sector comprising companies that provide end-to-end services for the development, manufacturing, and commercialization of cell-based therapeutic products on behalf of biotechnology and pharmaceutical clients.

Cell therapy CDMOs offer comprehensive services spanning process development, analytical testing, regulatory support, clinical manufacturing, and commercial-scale production. These organizations possess specialized facilities, equipment, and expertise required for handling living cellular products, including clean room environments, bioreactors, cell culture systems, and quality control laboratories specifically designed for cell therapy applications.

Service offerings typically include cell line development, process optimization, scale-up activities, regulatory compliance support, supply chain management, and technology transfer. The market serves various client segments including emerging biotechnology companies lacking internal manufacturing capabilities, established pharmaceutical firms seeking specialized expertise, and academic institutions transitioning research discoveries into clinical applications.

Market expansion in the cell therapy CDMO sector is driven by increasing investment in regenerative medicine, growing clinical trial activities, and rising demand for specialized manufacturing capabilities. The market benefits from technological advancements in cell culture, automation, and quality control systems that enable more efficient and scalable production processes.

Key growth drivers include the increasing number of cell therapy programs entering clinical trials, with over 1,200 active trials currently underway globally. Regulatory approvals for cell therapy products have accelerated, creating demand for commercial manufacturing capabilities. The complexity of cell therapy manufacturing, requiring specialized facilities and expertise, continues to drive outsourcing decisions among biotechnology and pharmaceutical companies.

Competitive landscape features established CDMOs expanding their cell therapy capabilities alongside specialized pure-play cell therapy manufacturers. Market consolidation through strategic acquisitions and partnerships is creating larger, more comprehensive service providers capable of supporting clients from early development through commercial production.

Regional dynamics show North America leading in market share due to high biotechnology investment, favorable regulatory environment, and presence of major pharmaceutical companies. Europe maintains strong growth driven by supportive government initiatives and increasing clinical trial activities, while Asia-Pacific emerges as an attractive region for cost-effective manufacturing and expanding biotechnology sectors.

Market segmentation reveals distinct service categories driving growth across the cell therapy CDMO landscape:

Therapeutic applications span multiple disease areas with oncology representing the largest segment, accounting for approximately 58% of current cell therapy development activities. Immunological disorders and cardiovascular applications represent emerging growth areas with significant potential for market expansion.

Technology platforms include various cell types such as T-cells, stem cells, dendritic cells, and natural killer cells, each requiring specialized manufacturing approaches and quality control measures. The diversity of cell therapy modalities creates opportunities for CDMOs to develop specialized expertise and differentiated service offerings.

Investment acceleration in cell therapy research and development represents a primary market driver, with biotechnology companies increasingly recognizing the therapeutic potential of cellular medicines. Venture capital and private equity funding for cell therapy companies has increased substantially, creating demand for specialized manufacturing and development services.

Regulatory advancement through streamlined approval pathways and clearer guidance from regulatory agencies has reduced development timelines and encouraged greater investment in cell therapy programs. The establishment of regenerative medicine advanced therapy (RMAT) designations and similar fast-track programs has accelerated product development cycles.

Clinical success of approved cell therapy products, particularly in oncology applications, has validated the therapeutic approach and encouraged broader investment across multiple disease areas. Success rates in clinical trials have improved with better understanding of manufacturing requirements and product characterization.

Manufacturing complexity inherent in cell therapy production drives outsourcing decisions, as companies seek specialized expertise and infrastructure. The requirement for personalized manufacturing approaches, particularly for autologous therapies, creates demand for flexible and scalable CDMO services.

Cost optimization pressures encourage biotechnology companies to leverage CDMO services rather than investing in internal manufacturing capabilities, particularly during early development phases. Outsourcing enables companies to focus resources on core research and development activities while accessing specialized manufacturing expertise.

High capital requirements for establishing cell therapy manufacturing facilities create barriers to entry and limit the number of qualified service providers. The specialized infrastructure, equipment, and expertise required for cell therapy manufacturing represent significant investments that may constrain market expansion.

Regulatory complexity surrounding cell therapy products creates challenges for both CDMOs and their clients, requiring extensive documentation, validation, and compliance activities. Evolving regulatory requirements across different jurisdictions add complexity to global development and manufacturing strategies.

Technical challenges in scaling cell therapy manufacturing from laboratory to commercial production present ongoing obstacles. Issues related to cell viability, potency maintenance, and batch-to-batch consistency require sophisticated process control and quality assurance systems.

Supply chain vulnerabilities affect the availability of specialized raw materials, reagents, and consumables required for cell therapy manufacturing. Limited supplier bases for critical components can create bottlenecks and increase production costs.

Skilled workforce shortage in cell therapy manufacturing creates capacity constraints and increases operational costs. The specialized knowledge required for cell therapy production limits the available talent pool and creates competition among service providers for qualified personnel.

Emerging therapeutic areas beyond oncology present significant expansion opportunities for cell therapy CDMOs. Applications in neurological disorders, autoimmune diseases, and regenerative medicine are gaining momentum and require specialized manufacturing support.

Geographic expansion into emerging markets offers growth potential as biotechnology sectors develop in Asia-Pacific, Latin America, and other regions. Lower manufacturing costs and growing clinical trial activities in these regions create opportunities for strategic market entry.

Technology advancement in automation, process analytical technology, and quality control systems enables more efficient and scalable manufacturing processes. CDMOs investing in advanced technologies can differentiate their service offerings and improve operational efficiency.

Allogeneic therapy development represents a major opportunity as off-the-shelf cell therapy products offer advantages in scalability and cost-effectiveness compared to personalized autologous therapies. This shift toward allogeneic approaches creates demand for larger-scale manufacturing capabilities.

Strategic partnerships with biotechnology companies, pharmaceutical firms, and academic institutions provide opportunities for long-term collaboration and revenue growth. Comprehensive service agreements spanning multiple development phases create stable revenue streams and strengthen client relationships.

Competitive intensity in the cell therapy CDMO market is increasing as established contract manufacturers expand their capabilities and new specialized providers enter the market. Competition focuses on service quality, regulatory expertise, capacity availability, and technological capabilities rather than solely on pricing.

Client relationship dynamics emphasize long-term partnerships over transactional engagements, as cell therapy development requires extensive collaboration and knowledge sharing. CDMOs that demonstrate regulatory expertise and manufacturing reliability tend to secure multi-year agreements with biotechnology clients.

Technology evolution continues to reshape manufacturing approaches, with automation and digitalization improving process control and reducing manual intervention. Process analytical technology adoption has increased by approximately 35% among leading CDMOs, enabling real-time monitoring and quality control.

Capacity utilization across the industry remains high, with leading CDMOs reporting utilization rates exceeding 85%. This high demand creates opportunities for capacity expansion and new market entrants while potentially constraining client access to manufacturing slots.

Pricing dynamics reflect the specialized nature of cell therapy manufacturing, with premium pricing for complex services and regulatory expertise. However, increasing competition and process improvements are beginning to moderate pricing growth in certain service categories.

Primary research for this market analysis involved comprehensive interviews with industry executives, including CDMO leadership, biotechnology company management, and regulatory experts. Survey data was collected from over 150 industry participants across different market segments and geographic regions.

Secondary research encompassed analysis of company financial reports, regulatory filings, clinical trial databases, and industry publications. Patent analysis and technology assessment provided insights into innovation trends and competitive positioning within the market.

Market sizing methodology utilized bottom-up analysis based on service pricing, capacity utilization, and client demand patterns. Cross-validation was performed using top-down approaches incorporating industry growth rates and market penetration analysis.

Competitive analysis included detailed assessment of service portfolios, geographic presence, client relationships, and technological capabilities across major market participants. Financial performance analysis provided insights into market dynamics and growth strategies.

Regulatory landscape analysis examined approval pathways, compliance requirements, and policy developments across major markets. Expert interviews with regulatory consultants and agency representatives provided additional insights into market dynamics and future trends.

North America maintains market leadership with approximately 45% of global market share, driven by high biotechnology investment, favorable regulatory environment, and presence of major pharmaceutical companies. The region benefits from established infrastructure, skilled workforce, and strong intellectual property protection.

United States represents the largest individual market, supported by significant venture capital investment in cell therapy companies and streamlined regulatory pathways through the FDA. The presence of leading academic medical centers and biotechnology clusters creates a favorable ecosystem for cell therapy development.

Europe accounts for approximately 32% of market share, with strong growth driven by supportive government initiatives and increasing clinical trial activities. The European Medicines Agency’s adaptive pathways program has accelerated cell therapy development timelines and encouraged greater investment.

Germany and United Kingdom lead European market development, with established biotechnology sectors and supportive regulatory frameworks. Brexit implications have created some uncertainty but also opportunities for UK-based CDMOs to serve both European and global markets.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 15% CAGR. Lower manufacturing costs, expanding biotechnology sectors, and increasing clinical trial activities drive market expansion in countries including China, Japan, and South Korea.

Market leadership is distributed among several categories of service providers, each bringing different strengths and capabilities to the cell therapy CDMO market:

Strategic positioning varies among competitors, with some focusing on comprehensive end-to-end services while others specialize in specific therapeutic areas or technology platforms. Market consolidation through acquisitions and partnerships continues to reshape the competitive landscape.

Differentiation strategies include technological innovation, regulatory expertise, geographic presence, and specialized therapeutic focus. Companies investing in automation and process improvement technologies are gaining competitive advantages in efficiency and scalability.

By Service Type:

By Cell Type:

By Therapeutic Area:

Manufacturing Services represent the largest revenue segment, accounting for approximately 42% of total market activity. This category includes both clinical and commercial manufacturing, with clinical manufacturing experiencing faster growth due to increasing trial activities.

Process Development Services show strong growth as biotechnology companies seek to optimize manufacturing processes for improved efficiency and scalability. MarkWide Research analysis indicates this segment is growing at approximately 14.5% CAGR, driven by increasing complexity of cell therapy products.

Analytical Testing Services are becoming increasingly important as regulatory requirements for cell therapy characterization become more stringent. Advanced analytical capabilities including potency assays, identity testing, and safety assessments are in high demand.

CAR-T Cell Therapies dominate the cell type segment, representing the most commercially advanced cell therapy modality. However, other cell types including stem cells and natural killer cells are gaining momentum as clinical evidence supporting their therapeutic potential continues to develop.

Autologous Therapies currently represent the majority of manufacturing activity, but allogeneic approaches are gaining traction due to their potential for improved scalability and cost-effectiveness. The shift toward allogeneic therapies is expected to reshape manufacturing requirements and capacity planning.

Biotechnology Companies benefit from access to specialized manufacturing expertise and infrastructure without significant capital investment. CDMO partnerships enable faster time-to-market, reduced development risks, and improved focus on core research and development activities.

Pharmaceutical Companies gain access to cutting-edge cell therapy capabilities and can expand their therapeutic portfolios without internal capability development. Strategic CDMO relationships provide flexibility to scale manufacturing based on product success and market demand.

Investors benefit from reduced capital requirements for biotechnology investments and improved risk profiles through outsourced manufacturing strategies. CDMO partnerships can enhance the attractiveness of cell therapy investments by reducing operational complexity.

Patients ultimately benefit from accelerated access to innovative cell therapy treatments through more efficient development and manufacturing processes. CDMO expertise can improve product quality and consistency while reducing development timelines.

Healthcare Systems gain access to advanced therapeutic options with improved treatment outcomes and potentially reduced long-term healthcare costs. Efficient manufacturing through CDMO partnerships can help control therapy pricing and improve accessibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration is transforming cell therapy manufacturing with advanced robotics and process control systems reducing manual intervention and improving consistency. Leading CDMOs are investing heavily in automated systems to enhance scalability and reduce production costs.

Allogeneic Therapy Focus is shifting market dynamics as companies develop off-the-shelf cell therapy products that offer improved scalability compared to personalized autologous approaches. This trend is driving demand for larger-scale manufacturing capabilities and different quality control approaches.

Digital Technology Adoption including artificial intelligence, machine learning, and advanced analytics is improving process optimization and quality control. Digital twins and predictive modeling are becoming important tools for manufacturing optimization and risk management.

Regional Manufacturing Networks are developing as CDMOs establish facilities in multiple geographic regions to serve local markets and reduce supply chain risks. This trend is particularly evident in Asia-Pacific where local manufacturing capabilities are expanding rapidly.

Integrated Service Offerings are becoming more comprehensive as CDMOs expand beyond manufacturing to include development services, regulatory support, and commercial capabilities. This integration provides clients with end-to-end solutions and creates stronger partnership relationships.

Facility Expansion activities are accelerating across major CDMOs as companies invest in additional manufacturing capacity to meet growing demand. Recent announcements include multiple new facility developments in North America, Europe, and Asia-Pacific regions.

Strategic Acquisitions continue to reshape the competitive landscape as larger CDMOs acquire specialized capabilities and smaller companies seek scale and resources. These transactions are creating more comprehensive service providers with broader geographic reach.

Technology Partnerships between CDMOs and equipment manufacturers are advancing automation and process improvement capabilities. Collaborative development programs are creating next-generation manufacturing solutions specifically designed for cell therapy applications.

Regulatory Milestone achievements include successful facility inspections and approvals for commercial manufacturing, validating CDMO capabilities and creating precedents for future regulatory interactions. These successes build confidence in outsourced manufacturing approaches.

Client Partnership announcements demonstrate the long-term nature of CDMO relationships, with multi-year agreements and strategic collaborations becoming more common. These partnerships often include technology sharing and joint development activities.

Investment Strategy recommendations focus on CDMOs with comprehensive service offerings, strong regulatory track records, and geographic diversification. Companies demonstrating technological innovation and automation capabilities are positioned for long-term success in the evolving market.

Capacity Planning should consider the shift toward allogeneic therapies and the potential for larger batch sizes and different manufacturing requirements. CDMOs need to balance flexibility with efficiency in their facility design and equipment selection.

Technology Investment priorities should include automation, process analytical technology, and digital systems that improve manufacturing efficiency and quality control. MWR analysis suggests that technology leaders will capture disproportionate market share growth.

Geographic Expansion strategies should consider emerging markets with growing biotechnology sectors and favorable regulatory environments. Asia-Pacific represents the highest growth potential, but requires careful assessment of local capabilities and partnerships.

Partnership Development should focus on long-term strategic relationships rather than transactional engagements. CDMOs that can demonstrate value beyond manufacturing through development support and regulatory expertise will secure preferred partner status.

Market trajectory indicates continued strong growth driven by expanding cell therapy pipelines, increasing clinical trial activities, and growing commercial approvals. The market is expected to maintain robust growth rates exceeding 12% CAGR through the forecast period.

Technology evolution will continue to reshape manufacturing approaches with greater automation, improved process control, and enhanced quality systems. These advances will enable more efficient production and better cost management for cell therapy products.

Regulatory maturation is expected to provide greater clarity and consistency in requirements, reducing development risks and encouraging increased investment in cell therapy programs. Harmonization of international standards will facilitate global development strategies.

Market consolidation will likely continue as smaller specialized providers seek scale and resources while larger CDMOs expand their capabilities through acquisitions. This consolidation will create more comprehensive service providers capable of supporting complex global programs.

Therapeutic expansion beyond current focus areas will create new growth opportunities as cell therapy applications broaden into additional disease areas. Success in oncology is encouraging exploration of applications in neurological, cardiovascular, and other therapeutic areas.

The cell therapy contract development and manufacturing organization market represents a dynamic and rapidly growing sector positioned at the intersection of biotechnology innovation and specialized manufacturing expertise. Market fundamentals remain strong with robust demand driven by expanding cell therapy pipelines, increasing clinical trial activities, and growing commercial approvals across multiple therapeutic areas.

Strategic positioning within this market requires comprehensive service capabilities, regulatory expertise, and technological innovation to meet the complex requirements of cell therapy development and manufacturing. Companies that successfully combine specialized knowledge with scalable infrastructure and quality systems are best positioned to capture market opportunities and build long-term client relationships.

Future success will depend on continued investment in technology advancement, geographic expansion, and service portfolio development. The shift toward allogeneic therapies, increasing automation, and evolving regulatory landscape will create both opportunities and challenges for market participants. Organizations that can adapt to these changes while maintaining high quality standards and regulatory compliance will thrive in this expanding market.

What is Cell Therapy Contract Development And Manufacturing Organization?

Cell Therapy Contract Development And Manufacturing Organization refers to specialized companies that provide services for the development and manufacturing of cell therapies. These organizations support biopharmaceutical companies in producing cell-based products for various therapeutic applications, including oncology and regenerative medicine.

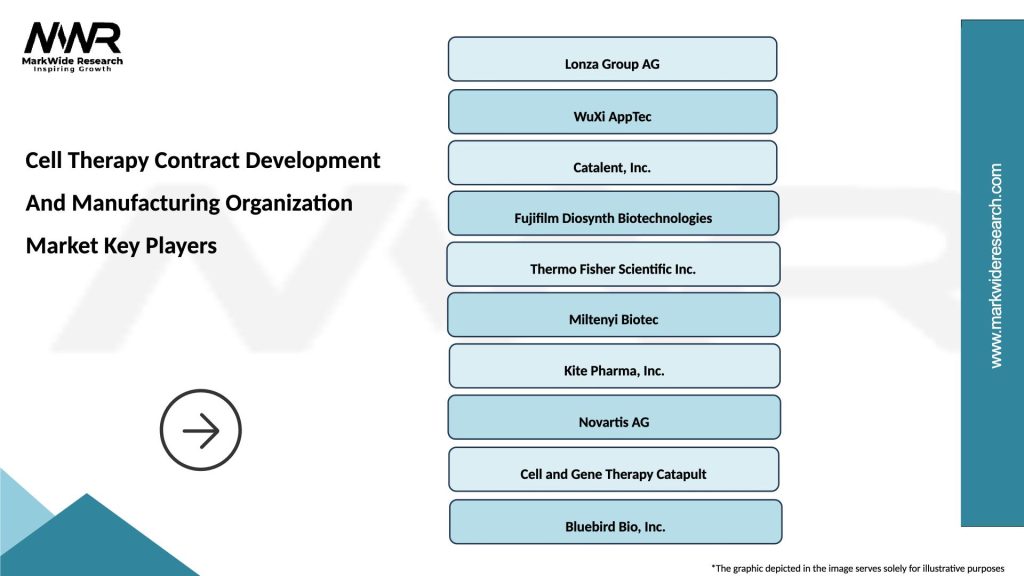

What are the key players in the Cell Therapy Contract Development And Manufacturing Organization Market?

Key players in the Cell Therapy Contract Development And Manufacturing Organization Market include Lonza Group, Catalent, and WuXi AppTec, among others. These companies are known for their expertise in cell therapy development and manufacturing processes.

What are the main drivers of growth in the Cell Therapy Contract Development And Manufacturing Organization Market?

The growth of the Cell Therapy Contract Development And Manufacturing Organization Market is driven by increasing investments in cell-based therapies, advancements in biomanufacturing technologies, and a rising prevalence of chronic diseases that require innovative treatment options.

What challenges does the Cell Therapy Contract Development And Manufacturing Organization Market face?

Challenges in the Cell Therapy Contract Development And Manufacturing Organization Market include regulatory hurdles, high production costs, and the complexity of manufacturing processes. These factors can hinder the scalability and accessibility of cell therapies.

What opportunities exist in the Cell Therapy Contract Development And Manufacturing Organization Market?

Opportunities in the Cell Therapy Contract Development And Manufacturing Organization Market include the growing demand for personalized medicine, advancements in gene editing technologies, and collaborations between biotech firms and contract manufacturers to enhance production capabilities.

What trends are shaping the Cell Therapy Contract Development And Manufacturing Organization Market?

Trends in the Cell Therapy Contract Development And Manufacturing Organization Market include the increasing adoption of automation in manufacturing processes, the rise of allogeneic cell therapies, and a focus on improving supply chain efficiencies to meet growing demand.

Cell Therapy Contract Development And Manufacturing Organization Market

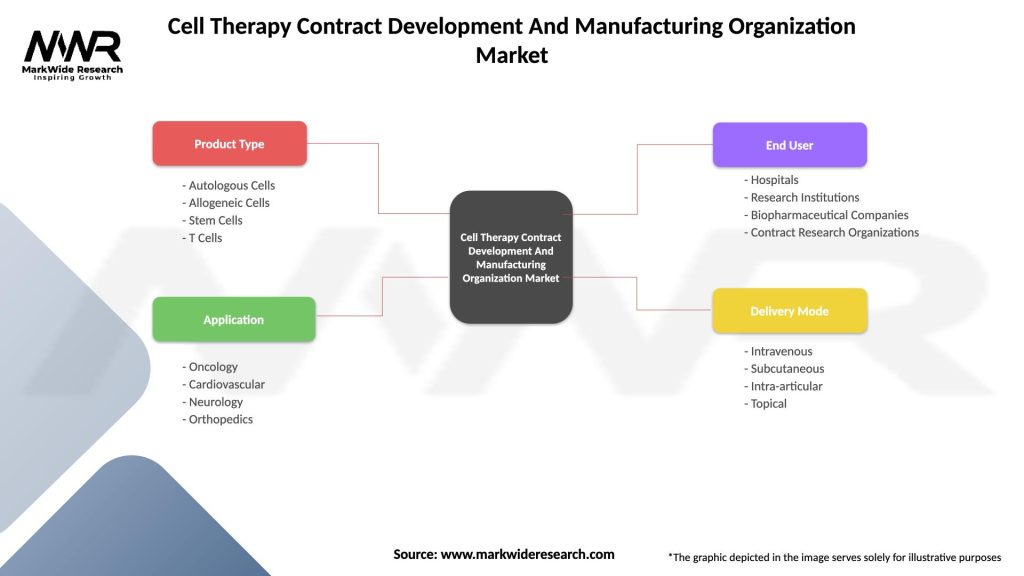

| Segmentation Details | Description |

|---|---|

| Product Type | Autologous Cells, Allogeneic Cells, Stem Cells, T Cells |

| Application | Oncology, Cardiovascular, Neurology, Orthopedics |

| End User | Hospitals, Research Institutions, Biopharmaceutical Companies, Contract Research Organizations |

| Delivery Mode | Intravenous, Subcutaneous, Intra-articular, Topical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cell Therapy Contract Development And Manufacturing Organization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at