444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cell and gene therapy manufacturing market represents a transformative segment within the biopharmaceutical industry, characterized by unprecedented innovation and rapid technological advancement. This specialized sector focuses on producing therapeutic products that modify or replace genetic material to treat previously incurable diseases. Cell and gene therapies have revolutionized treatment paradigms for conditions ranging from rare genetic disorders to various cancers, establishing a robust foundation for personalized medicine.

The market demonstrates substantial growth momentum driven by increasing regulatory approvals, expanding clinical trial pipelines, and significant investments from both established pharmaceutical companies and emerging biotechnology firms. Manufacturing capabilities have evolved dramatically, with facilities adopting advanced automation, closed-system processing, and sophisticated quality control mechanisms to ensure product safety and efficacy. According to MarkWide Research analysis, the sector is experiencing remarkable expansion with projected growth at a CAGR of 18.5% through the forecast period. Regional dynamics reveal concentrated development in established markets while emerging economies invest heavily in building local manufacturing infrastructure to support domestic therapy development programs.

The cell and gene therapy manufacturing market refers to the specialized industrial sector encompassing facilities, technologies, processes, and services dedicated to producing therapeutic products that modify cellular or genetic material to treat disease. This includes manufacturing of CAR-T cell therapies, gene replacement therapies, gene editing treatments, and other advanced biological products requiring highly controlled production environments and specialized technical expertise.

Market transformation in cell and gene therapy manufacturing reflects a fundamental shift in how biopharmaceutical products are developed and produced. The sector has transitioned from academic research settings to commercial-scale production facilities capable of meeting global patient demand. Key growth drivers include expanding therapeutic applications, improved manufacturing efficiency, and growing acceptance among healthcare providers and payers. The market landscape features diverse stakeholders including contract development and manufacturing organizations (CDMOs), integrated pharmaceutical companies, and specialized technology providers. Manufacturing challenges persist around scalability, cost reduction, and supply chain complexity, yet industry participants continue developing innovative solutions. Regulatory frameworks have matured significantly, providing clearer pathways for product approval while maintaining rigorous safety standards. Investment activity remains robust with approximately 65% of venture capital in the biotechnology sector directed toward cell and gene therapy companies. Patient access expands globally as reimbursement models evolve to accommodate high-value, potentially curative treatments. The manufacturing ecosystem demonstrates increasing sophistication with dedicated facilities, specialized equipment suppliers, and comprehensive service providers supporting the entire production lifecycle from process development through commercial manufacturing.

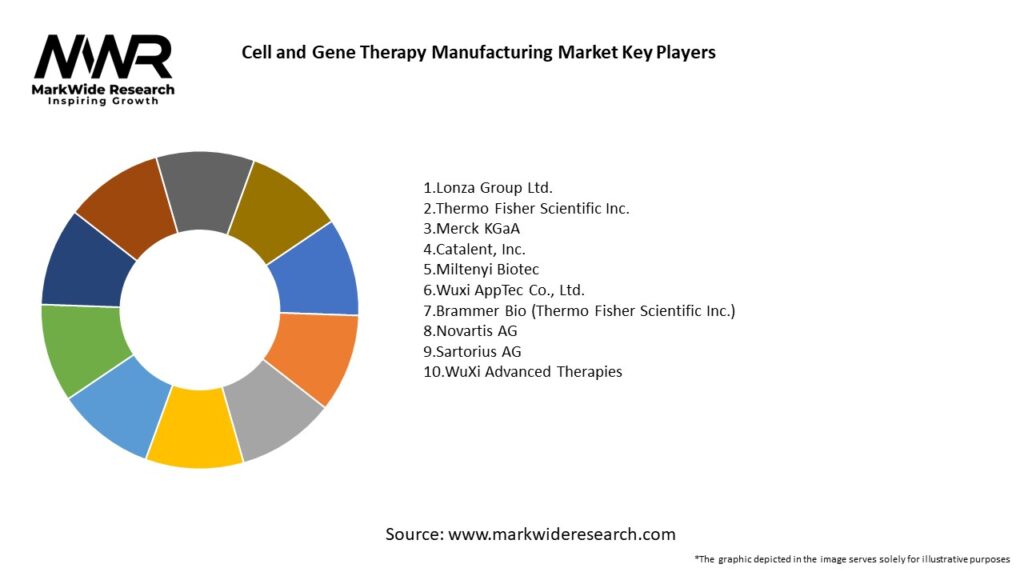

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Critical market dynamics shaping the cell and gene therapy manufacturing landscape include:

Multiple catalysts propel growth in the cell and gene therapy manufacturing market. Scientific advancement continues unlocking new therapeutic possibilities, with gene editing technologies like CRISPR enabling precise genetic modifications previously considered impossible. Clinical success demonstrated by approved therapies validates the manufacturing approaches and builds confidence among investors and healthcare stakeholders. Rare disease focus creates strong commercial incentives through regulatory advantages and premium pricing opportunities, encouraging manufacturers to develop specialized production capabilities. Oncology applications represent particularly significant growth drivers, with CAR-T therapies demonstrating remarkable efficacy in previously treatment-resistant cancers. Patient advocacy generates political and social pressure for expedited access to potentially life-saving treatments, influencing regulatory and reimbursement decisions. Pharmaceutical industry transformation sees major companies establishing dedicated advanced therapy units and acquiring manufacturing capabilities through strategic partnerships or acquisitions. Technology transfer from academic institutions to commercial entities accelerates as universities recognize the importance of scalable manufacturing in translating research discoveries to patient treatments. Reimbursement innovation through outcomes-based pricing, installment payments, and value-based contracts addresses payer concerns about high upfront costs while ensuring manufacturer revenue. Global health initiatives in emerging markets create new demand as countries prioritize access to cutting-edge medical technologies. Manufacturing efficiency improvements reduce per-dose costs, with process optimization achieving up to 40% cost reductions in some production systems, making therapies more economically sustainable.

Significant challenges constrain market growth despite favorable overall dynamics. Capital intensity remains a primary barrier, with facility construction and equipment acquisition requiring hundreds of millions in upfront investment before generating revenue. Technical complexity in manufacturing processes demands highly specialized expertise that remains scarce, creating workforce bottlenecks and limiting expansion capacity. Regulatory uncertainty persists in certain aspects of advanced therapy manufacturing, particularly around comparability assessments following manufacturing changes and long-term patient monitoring requirements. Supply chain fragility poses risks when critical raw materials face shortages or quality issues, potentially disrupting entire production campaigns. Scalability limitations inherent in autologous therapies, where each batch serves a single patient, challenge traditional manufacturing economics and operational models. Quality control complexity requires extensive testing that can consume significant time and resources, occasionally resulting in batch failures and capacity utilization challenges. Reimbursement barriers remain substantial in some markets where payer infrastructure cannot accommodate high-cost, potentially curative therapies within existing budget frameworks. Competition for resources among therapy developers creates capacity constraints at CDMOs, forcing companies to secure manufacturing slots years in advance or invest in internal capabilities. Technology obsolescence risk concerns manufacturers who must balance investing in current platforms against waiting for next-generation technologies that could offer superior performance. Patient logistics for autologous therapies involve complex coordination of cell collection, transportation, manufacturing, and product delivery, creating operational challenges and potential treatment delays.

Substantial opportunities exist for market participants across the value chain. Allogeneic therapies present transformative potential by enabling off-the-shelf products manufactured in large batches, fundamentally altering manufacturing economics and improving patient access. Emerging markets represent significant growth opportunities as countries like China, India, and Brazil develop local manufacturing capabilities and regulatory frameworks supporting advanced therapy development. Technology licensing enables smaller companies to access proven manufacturing platforms, reducing development timelines and capital requirements while creating recurring revenue for technology providers. Automation advancement continues creating opportunities for equipment manufacturers and system integrators who can deliver solutions that improve consistency, reduce labor requirements, and lower contamination risks. Digital transformation through implementation of artificial intelligence, machine learning, and advanced analytics offers opportunities to optimize processes, predict quality issues, and improve operational efficiency. Specialized services including vector manufacturing, plasmid production, quality testing, and regulatory consulting represent attractive market segments with favorable growth dynamics. Geographic expansion into underserved regions provides first-mover advantages for companies willing to invest in local infrastructure and navigate developing regulatory landscapes. Combination therapies pairing cell and gene therapies with other treatment modalities create new manufacturing requirements and service opportunities. Pediatric applications remain underexplored despite significant unmet medical need, offering opportunities for companies specializing in rare pediatric diseases. Manufacturing innovation around closed systems, single-use technologies, and modular facilities enables more flexible, cost-effective production models that can serve diverse therapy programs without massive capital investment.

Complex interactions between technological, regulatory, and commercial forces shape market evolution. Technology advancement drives manufacturing improvements while creating challenges for companies committed to legacy platforms, forcing continuous evaluation of when to adopt new approaches. Regulatory harmonization efforts across major markets reduce duplicative requirements but progress remains incomplete, requiring manufacturers to navigate varying standards. Competitive intensity increases as new entrants challenge established players, driving innovation while potentially commoditizing certain services and pressuring pricing.

Vertical integration trends see therapy developers bringing manufacturing in-house to secure capacity and retain control, competing with specialized CDMOs for talent and resources. Partnership models evolve beyond traditional fee-for-service arrangements to include risk-sharing, equity investments, and long-term strategic alliances aligning partner interests. Industry consolidation occurs periodically as larger organizations acquire specialized capabilities, though the market maintains sufficient fragmentation to support numerous independent players. Patient advocacy influence shapes development priorities and regulatory approaches, with patient organizations increasingly sophisticated in understanding manufacturing challenges and opportunities. Scientific uncertainty around optimal manufacturing approaches for emerging modalities like in vivo gene editing requires flexible strategies that can adapt as understanding improves. Economic cycles impact investment availability and risk tolerance, affecting expansion plans and new program initiation, though the sector demonstrates relative resilience due to strong fundamental demand. Sustainability considerations grow in importance with approximately 35% of manufacturers implementing programs to reduce environmental impact through energy efficiency, waste reduction, and sustainable supply chain practices.

Comprehensive research underpinning this analysis employed multiple methodologies to ensure accuracy and reliability. Primary research included structured interviews with manufacturing executives, technology providers, regulatory consultants, and industry analysts providing firsthand insights into operational realities and strategic priorities. Secondary research synthesized information from regulatory filings, company announcements, scientific publications, and industry presentations to understand technological trends and competitive positioning. Market sizing utilized bottom-up analysis examining therapy development pipelines, manufacturing capacity utilization, and service pricing to build comprehensive market models. Trend analysis evaluated historical patterns in regulatory approvals, investment activity, and technology adoption to project future market trajectories.

Expert validation involved consulting with technical specialists, regulatory experts, and industry veterans to verify findings and challenge assumptions. Comparative assessment benchmarked cell and gene therapy manufacturing against adjacent sectors including biologics manufacturing and pharmaceutical production to identify transferable lessons and unique characteristics. Regional analysis examined market development across major geographies, considering regulatory environments, healthcare infrastructure, and economic factors influencing local market dynamics. Technology evaluation assessed emerging platforms and methodologies to understand their potential impact on manufacturing economics and operational models. Stakeholder mapping identified key players across the value chain, analyzing their capabilities, strategies, and competitive positioning. Risk assessment evaluated potential disruptions including regulatory changes, technology shifts, and macroeconomic factors that could impact market development, ensuring the analysis accounts for uncertainty and potential scenario variations.

North America maintains market leadership with approximately 55% global market share, driven by concentration of therapy developers, established regulatory frameworks, and substantial manufacturing infrastructure. The United States particularly benefits from FDA leadership in creating clear regulatory pathways for advanced therapies, attracting global investment in domestic manufacturing facilities. Workforce availability in established biopharmaceutical hubs provides access to specialized talent while universities produce graduates trained in advanced therapy technologies. Europe represents the second-largest market with sophisticated regulatory approaches through the European Medicines Agency and strong scientific capabilities, particularly in countries like Germany, United Kingdom, and Switzerland. Regional diversity creates both opportunities and challenges, with varying national reimbursement approaches affecting market access timelines.

Asia-Pacific demonstrates the fastest growth trajectory with CAGR exceeding 22%, led by significant investments in China, Japan, and South Korea. China specifically has emerged as a major manufacturing hub with supportive government policies, growing scientific expertise, and rapidly expanding domestic demand for advanced therapies. Japan offers favorable regulatory incentives for regenerative medicine manufacturing, attracting both domestic and international investment. Latin America shows emerging potential with countries like Brazil developing regulatory frameworks and manufacturing capabilities, though market development remains constrained by economic challenges and healthcare infrastructure limitations. Middle East witnesses selective investment in advanced therapy manufacturing, particularly in Gulf Cooperation Council countries pursuing healthcare sector diversification. Africa remains largely underdeveloped for advanced therapy manufacturing, though South Africa demonstrates some capabilities and several countries explore partnerships to enable local production or regional access to these transformative treatments.

The competitive environment features diverse participants with varying strategies and capabilities:

By Product Type: The market segments into cell therapy manufacturing and gene therapy manufacturing, each with distinct technical requirements and operational characteristics. Cell therapy manufacturing encompasses CAR-T cells, tumor-infiltrating lymphocytes, natural killer cells, and stem cell therapies requiring specialized cell processing capabilities. Gene therapy manufacturing includes viral vector production, plasmid manufacturing, and gene-edited cell production utilizing advanced molecular biology techniques.

By Therapy Type: Classification includes autologous therapies manufactured from patient-derived cells, allogeneic therapies using donor cells for multiple patients, and in vivo gene therapies administered directly to patients. Autologous approaches dominate current commercial products while allogeneic therapies represent significant future growth potential.

By Application: Market applications span oncology treatments, rare genetic disorders, cardiovascular diseases, neurological conditions, and infectious diseases. Oncology applications currently represent the largest segment with proven clinical success and favorable reimbursement environments.

By End User: Segments include pharmaceutical and biotechnology companies developing proprietary therapies, contract development and manufacturing organizations providing services to multiple clients, academic and research institutions, and hospitals with specialized manufacturing capabilities.

By Scale: Manufacturing operations categorize into clinical-scale production supporting early development and commercial-scale manufacturing for approved products, with distinct facility requirements and regulatory expectations for each category.

Viral Vector Manufacturing represents a critical subsegment with specialized technical requirements and capacity constraints. Adeno-associated virus (AAV) production dominates gene therapy manufacturing with growing demand challenging industry capacity. Lentiviral vectors serve CAR-T and other cell therapy applications requiring efficient gene transfer capabilities. Production platforms range from adherent cell culture to suspension systems and newer producer cell lines, each offering distinct advantages regarding scalability and productivity.

CAR-T Manufacturing constitutes the most mature commercial segment with multiple approved products and established manufacturing processes. Process duration typically spans 2-4 weeks from patient cell collection to final product release, creating logistical complexity and operational challenges. Success rates have improved significantly with manufacturers achieving over 90% manufacturing success for established products, though variability in patient starting material remains a challenge.

Quality Control Services form an essential supporting segment with extensive testing requirements consuming significant resources and time. Analytical methods continue evolving to better characterize complex therapeutic products while balancing thoroughness with practical manufacturing timelines. Specialized testing for potency, purity, identity, and safety requires sophisticated instrumentation and expert interpretation.

Automation Technology emerges as a rapidly growing subsegment addressing manufacturing consistency and labor intensity challenges. Closed system processing reduces contamination risk while enabling more flexible facility design without extensive cleanroom requirements. Integrated platforms combining multiple unit operations in single systems simplify manufacturing and potentially reduce footprint requirements.

Supply Chain Services encompass specialized logistics, cold chain management, and inventory coordination essential for successful therapy delivery. Temperature-sensitive shipping requires validated packaging systems and monitoring technologies ensuring product integrity throughout distribution. Chain of custody tracking becomes critical for autologous therapies where patient identity must be maintained throughout manufacturing and delivery processes.

Therapy Developers gain access to specialized manufacturing expertise and infrastructure without massive capital investment, enabling focus on core competencies in research and clinical development. Flexibility in partnering with CDMOs allows companies to scale production as programs advance through development while maintaining optionality for internal manufacturing at commercial stages.

Contract Manufacturers benefit from strong demand and favorable pricing dynamics driven by capacity constraints and technical complexity. Long-term partnerships create predictable revenue streams while opportunities for technology licensing and platform development generate additional value beyond manufacturing services.

Technology Providers find attractive markets for specialized equipment, consumables, and software as the industry standardizes around best practices and regulatory requirements drive adoption of advanced technologies. Recurring revenue from consumables and service contracts provides stable business models supplementing equipment sales.

Patients ultimately benefit from improved access to potentially curative therapies as manufacturing capabilities expand and costs decline. Manufacturing improvements reduce treatment delays and increase success rates, translating scientific promise into clinical reality for individuals facing serious diseases.

Healthcare Systems gain opportunities to deliver high-value care that may reduce long-term costs by addressing disease root causes rather than managing chronic conditions. Specialized treatment centers enhance institutional reputation while attracting patients and research funding.

Investors access a dynamic sector with strong growth fundamentals and multiple successful exits validating commercial viability. Portfolio diversification across the value chain enables participation in sector growth while managing risks inherent in drug development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Decentralized Manufacturing emerges as a significant trend with companies exploring smaller, regional facilities closer to patient populations. Point-of-care manufacturing concepts envision hospital-based production systems enabling same-day therapy delivery while eliminating complex logistics. Implementation challenges around regulatory compliance, quality assurance, and economic viability require continued innovation before widespread adoption becomes practical.

Digital Integration transforms manufacturing operations through implementation of electronic batch records, real-time process monitoring, and data analytics. Artificial intelligence applications increasingly support process optimization, quality prediction, and supply chain management. Cybersecurity considerations grow in importance as connectivity increases, requiring robust protections for sensitive patient and proprietary information.

Sustainability Focus drives initiatives to reduce environmental impact through energy efficiency, waste minimization, and sustainable sourcing. Single-use technologies paradoxically both support and challenge sustainability goals by reducing cleaning-related water and chemical consumption while increasing plastic waste. Life cycle assessments help companies understand total environmental impact and identify improvement opportunities.

Modular Facility Design enables more flexible manufacturing infrastructure that can adapt to changing production requirements without extensive reconstruction. Prefabricated cleanroom systems reduce construction timelines and costs while maintaining compliance with regulatory standards. Multi-product facilities become increasingly common as manufacturers seek to maximize asset utilization across diverse therapy programs.

Gene Editing Integration represents a transformative trend with CRISPR and other editing technologies enabling more precise genetic modifications. Manufacturing implications include new quality control requirements and process considerations for edited cell products. In vivo editing approaches could fundamentally alter manufacturing models by moving production inside patient bodies rather than external facilities.

Recent years have witnessed numerous significant developments shaping market trajectories. Major pharmaceutical companies established dedicated advanced therapy units through organic investment and strategic acquisitions, validating market potential and accelerating capability development. CDMO expansion occurred globally with multiple organizations announcing substantial facility investments to address capacity constraints and serve regional markets. Technology partnerships between equipment manufacturers and CDMOs created integrated solutions optimizing manufacturing efficiency and product quality. Regulatory guidance from major health authorities provided clarity on critical issues including manufacturing comparability, process validation, and long-term patient follow-up requirements.

Reimbursement innovations emerged with outcomes-based contracts, annuity payment models, and other creative approaches addressing payer concerns about high upfront costs. Clinical successes in new therapeutic applications expanded addressable markets beyond initial oncology focus into rare diseases, cardiovascular conditions, and other areas. Academic technology transfers accelerated as universities recognized the importance of scalable manufacturing in translating discoveries to patient treatments. Investment records were established with unprecedented capital flowing into cell and gene therapy companies and supporting infrastructure. Standards development through industry consortia and professional organizations created more consistent expectations around manufacturing practices and quality requirements. Workforce initiatives by educational institutions and industry groups addressed talent shortages through specialized training programs and curriculum development.

Strategic planning for market participants should prioritize flexibility given rapid technological and regulatory evolution. Therapy developers should carefully evaluate build-versus-buy decisions for manufacturing capabilities, considering factors including development timeline, capital availability, and long-term strategic positioning. Early engagement with regulatory authorities helps clarify expectations and potentially streamlines approval processes, though companies must balance transparency with intellectual property protection. Manufacturing partnerships require thorough due diligence assessing technical capabilities, quality track records, and cultural fit beyond simple capacity and pricing considerations.

Technology adoption decisions demand careful analysis balancing potential benefits against implementation risks and costs. Proven platforms offer lower risk but may lack competitive advantages that newer technologies provide. Phased implementation approaches enable learning while managing risk, though may delay full benefit realization. Technology roadmaps should align manufacturing capabilities with product pipeline requirements while maintaining flexibility for unexpected opportunities or challenges.

Geographic expansion strategies should consider regulatory maturity, market access dynamics, and local partnership opportunities. Emerging markets offer growth potential but require patience and risk tolerance given developing infrastructure and regulatory frameworks. Regional manufacturing can reduce logistics complexity and improve market access, though must be balanced against efficiency benefits of consolidated production.

Talent development represents a critical success factor requiring proactive strategies. Internal training programs build institutional knowledge and culture while reducing dependence on external hiring. University partnerships create talent pipelines while potentially accessing research capabilities. Competitive compensation remains essential given strong demand for experienced personnel across the industry.

Quality management should emphasize risk-based approaches and continuous improvement rather than purely compliance-driven activities. Process understanding enables more robust manufacturing and facilitates regulatory discussions around proposed changes. Data analytics can identify improvement opportunities and predict potential quality issues before they impact production.

Long-term prospects for the cell and gene therapy manufacturing market remain exceptionally positive despite near-term challenges. MarkWide Research projects continued robust growth with the sector achieving sustained double-digit expansion throughout the next decade as approved therapies increase and manufacturing efficiencies improve. Allogeneic therapies reaching commercial success would represent a transformative inflection point, dramatically expanding manufacturing capacity utilization and improving patient access. Technology convergence between cell and gene therapy approaches creates increasingly sophisticated treatment modalities addressing complex diseases through multiple mechanisms.

Manufacturing evolution continues with automation, digitalization, and process intensification reducing costs and improving consistency. Next-generation facilities incorporate flexible design principles enabling adaptation to changing production requirements without extensive capital reinvestment. Quality-by-design principles become more deeply embedded in development processes, resulting in more robust manufacturing from initial clinical trials through commercial production.

Regulatory frameworks continue maturing with increased harmonization reducing duplicative requirements for global products. Expedited pathways for breakthrough therapies balance rigorous safety evaluation with recognition of urgent patient needs. Post-approval flexibility improves as regulators and manufacturers gain experience managing manufacturing changes for advanced therapies.

Market access expands globally as more countries develop regulatory pathways and reimbursement mechanisms for advanced therapies. Local manufacturing in major markets increases driven by both economic considerations and national healthcare security objectives. Pricing pressures intensify gradually as competition increases and healthcare systems demand value demonstration, though premium positioning persists for truly transformative therapies.

Scientific advancement unlocks new therapeutic possibilities with expanded understanding of disease biology and cellular mechanisms. Combination approaches pairing cell and gene therapies with other modalities enhance efficacy and expand treatable patient populations. Novel delivery systems and targeting mechanisms improve precision while potentially simplifying manufacturing requirements.

The cell and gene therapy manufacturing market stands at a remarkable intersection of scientific innovation, technological advancement, and commercial opportunity. Transformative therapies delivering unprecedented clinical benefits for previously untreatable diseases have established a robust foundation for sustained market growth. Despite significant challenges around manufacturing complexity, capacity constraints, and cost considerations, the sector demonstrates remarkable resilience and innovation in addressing obstacles. Diverse stakeholders including therapy developers, contract manufacturers, technology providers, and supporting service organizations collectively advance the industry toward greater efficiency, scalability, and patient accessibility. Regional dynamics reveal strong growth across established and emerging markets as manufacturing capabilities proliferate globally. Technological evolution through automation, digitalization, and novel manufacturing platforms continues enhancing operational performance while reducing costs.

Regulatory maturation provides clearer pathways for product development and approval, though ongoing adaptation remains necessary as understanding evolves. Investment activity persists at elevated levels reflecting confidence in long-term market potential despite inherent risks in therapeutic development. The cell and gene therapy manufacturing market represents not merely an industrial sector but a fundamental transformation in how medicine approaches disease treatment, with manufacturing capabilities serving as the critical bridge between scientific discovery and patient benefit. As capabilities continue advancing and therapies demonstrate sustained clinical success, the sector appears poised for continued robust expansion serving growing patient populations worldwide with potentially curative treatments.

What is Cell and Gene Therapy Manufacturing?

Cell and Gene Therapy Manufacturing refers to the processes involved in producing therapeutic products that modify or manipulate genes and cells to treat diseases. This includes the development of viral vectors, cell culture systems, and purification techniques essential for creating effective therapies.

Who are the key players in the Cell and Gene Therapy Manufacturing Market?

Key players in the Cell and Gene Therapy Manufacturing Market include Novartis, Gilead Sciences, and Amgen, among others. These companies are actively involved in developing and commercializing innovative therapies that leverage advanced manufacturing techniques.

What are the main drivers of growth in the Cell and Gene Therapy Manufacturing Market?

The main drivers of growth in the Cell and Gene Therapy Manufacturing Market include increasing investments in research and development, a rising prevalence of genetic disorders, and advancements in manufacturing technologies that enhance production efficiency.

What challenges does the Cell and Gene Therapy Manufacturing Market face?

The Cell and Gene Therapy Manufacturing Market faces challenges such as regulatory hurdles, high production costs, and the complexity of manufacturing processes. These factors can hinder the scalability and accessibility of therapies.

What opportunities exist in the Cell and Gene Therapy Manufacturing Market?

Opportunities in the Cell and Gene Therapy Manufacturing Market include the potential for personalized medicine, collaborations between biotech firms and academic institutions, and the expansion of manufacturing capabilities to meet growing demand.

What trends are shaping the Cell and Gene Therapy Manufacturing Market?

Trends shaping the Cell and Gene Therapy Manufacturing Market include the increasing use of automation in production processes, the development of novel delivery systems for gene therapies, and a focus on sustainable manufacturing practices to reduce environmental impact.

Cell and Gene Therapy Manufacturing Market

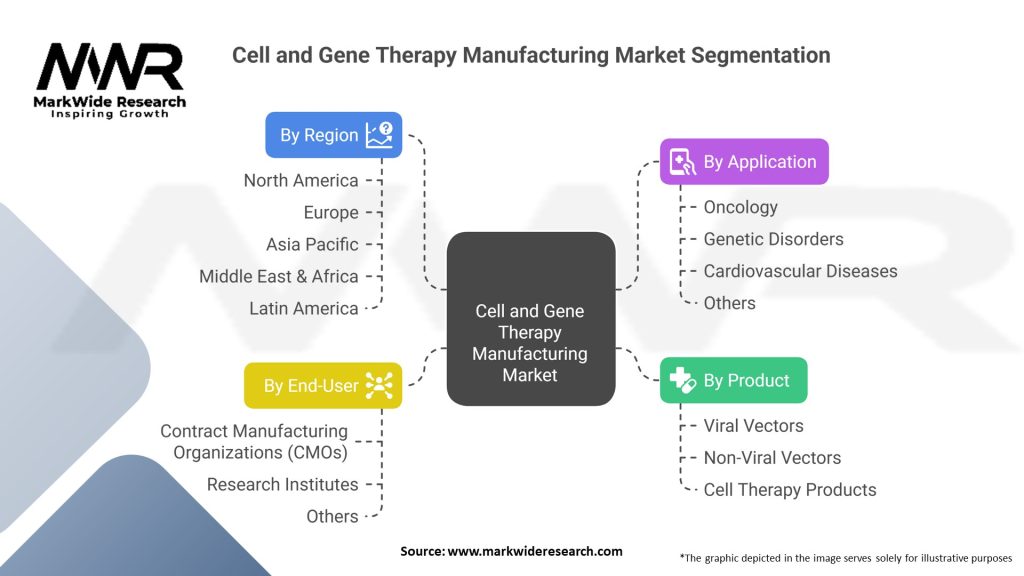

| Segmentation Details | Description |

|---|---|

| By Product | Viral Vectors, Non-Viral Vectors, Cell Therapy Products |

| By Application | Oncology, Genetic Disorders, Cardiovascular Diseases, Others |

| By End-User | Contract Manufacturing Organizations (CMOs), Research Institutes, Others |

| By Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cell and Gene Therapy Manufacturing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at