444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cell and gene therapy contract development and manufacturing organization market represents a rapidly expanding sector within the biotechnology industry, driven by unprecedented growth in advanced therapeutic modalities. Contract development and manufacturing organizations (CDMOs) specializing in cell and gene therapies have emerged as critical partners for pharmaceutical companies seeking to navigate the complex manufacturing requirements of these innovative treatments. The market encompasses specialized facilities and services that support the development, production, and commercialization of cell therapies, gene therapies, and gene-modified cell therapies.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of approximately 15.2% over the forecast period. This expansion is fueled by increasing regulatory approvals for cell and gene therapy products, growing investment in regenerative medicine, and the rising prevalence of genetic disorders and cancer. North America currently dominates the market landscape, accounting for approximately 45% of global market share, followed by Europe and the Asia-Pacific region.

Manufacturing complexity inherent in cell and gene therapies has created significant demand for specialized CDMO services. These therapies require sophisticated production processes, including viral vector manufacturing, cell culture and expansion, genetic modification techniques, and stringent quality control measures. The market serves diverse therapeutic areas, with oncology applications representing the largest segment, followed by rare genetic diseases and autoimmune disorders.

The cell and gene therapy contract development and manufacturing organization market refers to the specialized sector of companies that provide comprehensive development, manufacturing, and commercialization services for advanced therapeutic products that modify or replace defective genes or utilize living cells as therapeutic agents. These organizations offer end-to-end solutions from early-stage research and development through commercial-scale production, enabling pharmaceutical and biotechnology companies to access specialized expertise and infrastructure without substantial capital investment.

Cell therapy encompasses treatments that introduce new or modified cells into a patient’s body to treat disease, while gene therapy involves the introduction of genetic material into a patient’s cells to correct defective genes or provide new cellular functions. CDMOs in this space provide critical services including process development, analytical testing, regulatory support, clinical and commercial manufacturing, and supply chain management specifically tailored to these complex therapeutic modalities.

Strategic market positioning within the cell and gene therapy CDMO sector reflects the industry’s transition from experimental treatments to mainstream therapeutic options. The market has experienced unprecedented growth as more cell and gene therapy products receive regulatory approval and enter commercial production. Manufacturing scalability challenges have created substantial opportunities for specialized CDMOs that can provide the technical expertise and infrastructure required for these complex therapies.

Key market drivers include the increasing number of clinical trials for cell and gene therapies, with over 60% growth in trial initiations over the past three years. The complexity of manufacturing processes, requiring specialized facilities, equipment, and expertise, has led pharmaceutical companies to increasingly rely on external partners. Regulatory frameworks have evolved to support these innovative therapies, with expedited approval pathways encouraging continued investment and development.

Market segmentation reveals diverse service offerings, including viral vector manufacturing, cell line development, process optimization, analytical services, and regulatory consulting. The competitive landscape features both established pharmaceutical service providers expanding into cell and gene therapy services and specialized companies built specifically for this market segment.

Regulatory approval acceleration serves as a primary market driver, with health authorities worldwide implementing expedited pathways for cell and gene therapies. The FDA’s Regenerative Medicine Advanced Therapy (RMAT) designation and similar programs in Europe and Asia have reduced development timelines and encouraged increased investment in these therapeutic modalities. This regulatory support has translated into growing demand for specialized manufacturing services.

Rising disease prevalence in target therapeutic areas continues to drive market expansion. Cancer incidence rates, genetic disorders, and age-related diseases create substantial patient populations that could benefit from cell and gene therapies. Oncology applications represent the largest market segment, with CAR-T cell therapies demonstrating significant clinical success and commercial viability.

Investment capital influx has enabled numerous biotechnology companies to advance cell and gene therapy programs through clinical development. However, the high cost and complexity of establishing in-house manufacturing capabilities have led many companies to partner with specialized CDMOs. This trend is particularly pronounced among smaller biotechnology companies that lack the resources for internal manufacturing infrastructure.

Technological advancement in manufacturing processes has improved the feasibility and cost-effectiveness of cell and gene therapy production. Innovations in viral vector production, cell expansion technologies, and automated manufacturing systems have enhanced scalability and reduced production costs, making these therapies more commercially viable.

Manufacturing complexity presents significant challenges that can limit market growth. Cell and gene therapy production requires specialized facilities, equipment, and expertise that are expensive to develop and maintain. The need for patient-specific manufacturing in many cell therapies creates additional complexity and limits economies of scale compared to traditional pharmaceutical manufacturing.

Regulatory uncertainty in some regions continues to pose challenges for market expansion. While major markets have developed frameworks for cell and gene therapy approval, regulatory requirements can vary significantly between countries, complicating global development and commercialization strategies. Quality control standards and testing requirements are still evolving, creating potential compliance challenges.

High development costs associated with cell and gene therapy manufacturing can limit market accessibility. The specialized infrastructure, equipment, and personnel required for these therapies represent substantial capital investments. Raw material costs for specialized reagents, growth factors, and viral vectors can be significantly higher than traditional pharmaceutical ingredients.

Technical challenges in scaling production from clinical to commercial volumes remain significant. Many cell and gene therapy manufacturing processes were developed for small-scale clinical production and face substantial hurdles when scaling to meet commercial demand. Process variability and the need for extensive characterization and validation can extend development timelines and increase costs.

Emerging therapeutic areas present substantial growth opportunities for cell and gene therapy CDMOs. Beyond oncology, applications in ophthalmology, neurology, cardiovascular disease, and autoimmune disorders are showing promising clinical results. The expansion into these new therapeutic areas could significantly broaden the addressable market for CDMO services.

Geographic expansion offers significant opportunities, particularly in emerging markets where healthcare infrastructure is developing rapidly. Asia-Pacific countries are investing heavily in biotechnology capabilities, creating demand for local manufacturing services. The establishment of regional manufacturing hubs can reduce costs and improve access to cell and gene therapies in these markets.

Technology integration opportunities include the adoption of artificial intelligence and machine learning for process optimization, quality control, and predictive analytics. Advanced manufacturing technologies such as continuous processing and automated cell culture systems can improve efficiency and reduce costs. Digital twin technology and advanced process control systems offer potential for enhanced manufacturing consistency and quality.

Platform development represents a key opportunity for CDMOs to create standardized, scalable manufacturing platforms that can be adapted for multiple products. This approach can reduce development timelines and costs while improving manufacturing efficiency. Modular facility designs and flexible manufacturing systems can enable rapid adaptation to new products and technologies.

Supply and demand dynamics in the cell and gene therapy CDMO market are characterized by rapidly growing demand outpacing available manufacturing capacity. The limited number of specialized facilities capable of producing these complex therapies has created a capacity constraint that is driving market growth and investment in new manufacturing infrastructure. Capacity utilization rates at leading CDMOs exceed 85%, indicating strong demand for services.

Competitive dynamics are evolving as the market matures, with traditional pharmaceutical service providers expanding into cell and gene therapy services while specialized companies continue to emerge. Strategic partnerships and acquisitions are becoming increasingly common as companies seek to build comprehensive service capabilities and global reach. The market is witnessing consolidation among smaller players while larger organizations invest in capacity expansion.

Pricing dynamics reflect the specialized nature of cell and gene therapy manufacturing, with premium pricing for complex services. However, as the market matures and competition increases, pricing pressure is emerging in certain service segments. Value-based pricing models that align CDMO compensation with product success are becoming more prevalent, particularly for commercial-stage products.

Innovation dynamics are driving continuous evolution in manufacturing technologies and processes. CDMOs that invest in next-generation manufacturing platforms and maintain technological leadership are better positioned to capture market share. The integration of digital technologies and process automation is becoming a key differentiator in the competitive landscape.

Comprehensive market analysis for the cell and gene therapy CDMO market employs a multi-faceted research approach combining primary and secondary research methodologies. Primary research includes in-depth interviews with industry executives, CDMO service providers, pharmaceutical companies, and regulatory experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of company financial reports, regulatory filings, clinical trial databases, and industry publications to establish market baselines and identify growth trends. Patent analysis and technology assessment provide insights into innovation trends and competitive positioning within the market.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and projections. Bottom-up analysis aggregates service pricing, capacity utilization, and demand metrics from individual market segments. Top-down analysis leverages overall cell and gene therapy market trends and CDMO penetration rates to validate market size estimates.

Forecasting models incorporate multiple variables including regulatory approval timelines, clinical trial success rates, investment trends, and capacity expansion plans. Scenario analysis evaluates potential market outcomes under different regulatory, technological, and competitive scenarios to provide comprehensive market projections.

North America maintains market leadership in the cell and gene therapy CDMO sector, accounting for approximately 45% of global market share. The region benefits from a well-established biotechnology ecosystem, supportive regulatory environment, and significant investment in advanced manufacturing capabilities. United States facilities lead in both clinical and commercial manufacturing capacity, with major CDMOs expanding their footprint to meet growing demand.

Europe represents the second-largest market, with approximately 30% market share, driven by strong government support for regenerative medicine and established pharmaceutical manufacturing expertise. United Kingdom, Germany, and Switzerland serve as key manufacturing hubs, with several CDMOs establishing specialized cell and gene therapy facilities in these countries. The European Medicines Agency’s supportive regulatory framework has encouraged market development.

Asia-Pacific is emerging as a high-growth region, with market share expected to reach 20% over the forecast period. China, Japan, and South Korea are investing heavily in biotechnology infrastructure and manufacturing capabilities. The region offers cost advantages and growing domestic demand for advanced therapies, attracting both local and international CDMO investments.

Rest of World markets, including Latin America and Middle East & Africa, represent emerging opportunities with growing healthcare infrastructure and increasing awareness of advanced therapies. These regions are expected to see gradual market development as regulatory frameworks mature and local manufacturing capabilities expand.

Market leadership in the cell and gene therapy CDMO sector is distributed among several key players, each with distinct competitive advantages and service offerings. The competitive landscape includes both established pharmaceutical service providers that have expanded into cell and gene therapy services and specialized companies built specifically for this market segment.

Competitive strategies focus on capacity expansion, technology innovation, and strategic partnerships. Leading companies are investing heavily in new manufacturing facilities and advanced technologies to maintain competitive advantages. Acquisition activity remains high as companies seek to build comprehensive service capabilities and expand geographic reach.

By Service Type:

By Product Type:

By Application:

By End User:

Viral Vector Manufacturing represents the largest service category, driven by the growing number of gene therapy products in development and commercialization. Adeno-associated virus (AAV) and lentiviral vectors are the most commonly manufactured vector types, with demand significantly outpacing available capacity. This segment requires highly specialized facilities and expertise, creating substantial barriers to entry and premium pricing opportunities.

Cell Therapy Manufacturing encompasses a diverse range of services from autologous to allogeneic cell therapy production. CAR-T cell manufacturing dominates this category, with several commercial products driving demand for specialized manufacturing services. The complexity of patient-specific manufacturing creates unique operational challenges and opportunities for CDMOs with advanced logistics and quality systems.

Analytical Services have become increasingly important as regulatory requirements for cell and gene therapy characterization continue to evolve. Potency assays, identity testing, and safety assessments require specialized analytical capabilities that many pharmaceutical companies prefer to outsource. This category offers high-margin opportunities for CDMOs with advanced analytical expertise.

Process Development Services are critical for translating research-stage therapies into scalable manufacturing processes. Platform approaches and modular process designs are becoming increasingly important for reducing development timelines and costs. CDMOs that can offer standardized yet flexible process development platforms are well-positioned for growth.

Pharmaceutical Companies benefit from accessing specialized expertise and infrastructure without substantial capital investment. Risk mitigation through partnering with experienced CDMOs reduces the technical and financial risks associated with cell and gene therapy manufacturing. Faster time-to-market can be achieved by leveraging established manufacturing platforms and regulatory expertise.

Biotechnology Companies gain access to commercial-scale manufacturing capabilities that would be prohibitively expensive to develop internally. Flexible capacity arrangements allow companies to scale production based on clinical and commercial success. Technical expertise from CDMOs can accelerate product development and improve manufacturing efficiency.

Patients benefit from improved access to innovative therapies as CDMO services help reduce development costs and accelerate product availability. Quality assurance from specialized manufacturers helps ensure product safety and efficacy. Global availability of therapies is enhanced through international CDMO networks.

Healthcare Systems benefit from the cost-effectiveness and efficiency gains achieved through specialized manufacturing. Supply chain reliability is improved through professional CDMO services, reducing the risk of product shortages. Innovation acceleration supports the development of new treatment options for previously untreatable conditions.

Investors benefit from the attractive growth prospects and market dynamics in the cell and gene therapy CDMO sector. Recurring revenue models from long-term manufacturing partnerships provide stable cash flows. Market expansion opportunities offer potential for significant returns on investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration is transforming cell and gene therapy manufacturing, with CDMOs investing heavily in automated cell culture systems, robotic handling equipment, and integrated manufacturing platforms. These technologies improve manufacturing consistency, reduce contamination risks, and enable scalable production processes. Closed-system processing is becoming standard practice to ensure product quality and regulatory compliance.

Platform Standardization represents a key trend as CDMOs develop standardized manufacturing platforms that can be adapted for multiple products. This approach reduces development timelines and costs while improving manufacturing efficiency. Modular facility designs and flexible manufacturing systems enable rapid adaptation to new products and technologies.

Digital Transformation is revolutionizing manufacturing operations through the integration of artificial intelligence, machine learning, and advanced analytics. Digital twin technology enables virtual process optimization and predictive maintenance. Real-time monitoring systems provide continuous oversight of critical process parameters and quality attributes.

Sustainability Focus is driving adoption of environmentally friendly manufacturing practices and technologies. Single-use systems reduce cleaning validation requirements and water consumption. Energy-efficient equipment and waste reduction programs are becoming standard practices in new facility designs.

Regional Localization is emerging as companies seek to establish manufacturing capabilities closer to key markets. This trend is driven by supply chain resilience considerations, regulatory requirements, and cost optimization strategies. Distributed manufacturing networks are becoming increasingly important for global product supply.

Capacity Expansion Initiatives continue across the industry, with major CDMOs announcing significant investments in new manufacturing facilities. MarkWide Research analysis indicates that announced capacity expansions could increase global manufacturing capacity by over 40% within the next three years. These investments are concentrated in key markets including the United States, Europe, and Asia-Pacific.

Strategic Partnerships and alliances are becoming increasingly common as companies seek to combine complementary capabilities and expand service offerings. Technology licensing agreements enable CDMOs to access proprietary manufacturing platforms and processes. Joint ventures are being established to develop specialized manufacturing capabilities for specific therapeutic areas.

Regulatory Milestone Achievements include the approval of additional cell and gene therapy products, validating manufacturing processes and quality systems. Regulatory harmonization efforts are simplifying global development and commercialization strategies. Quality standards evolution continues to refine manufacturing requirements and best practices.

Technology Acquisitions are accelerating as CDMOs seek to enhance their technological capabilities and service offerings. Manufacturing technology companies and analytical service providers are common acquisition targets. These transactions enable rapid capability expansion and technology integration.

Market Consolidation activities include mergers and acquisitions among CDMO providers seeking to achieve scale advantages and comprehensive service capabilities. Vertical integration strategies are being pursued to control critical supply chain elements and improve service delivery.

Investment Prioritization should focus on companies with proven manufacturing capabilities, strong regulatory track records, and strategic market positioning. Technology leadership and innovation capabilities are critical differentiators in this rapidly evolving market. Companies with comprehensive service offerings and global reach are better positioned for long-term success.

Risk Management strategies should address the technical complexity and regulatory requirements inherent in cell and gene therapy manufacturing. Diversification across therapeutic areas, product types, and geographic markets can reduce concentration risks. Quality system robustness is essential for maintaining regulatory compliance and customer confidence.

Growth Strategy Development should consider both organic expansion and strategic acquisitions to build comprehensive capabilities. Platform development and technology innovation investments can create competitive advantages and improve operational efficiency. Partnership strategies with pharmaceutical and biotechnology companies can provide stable revenue streams and growth opportunities.

Operational Excellence initiatives should focus on manufacturing efficiency, quality improvement, and cost optimization. Digital transformation investments can enhance operational capabilities and customer service delivery. Talent development programs are essential for maintaining specialized expertise and supporting growth initiatives.

Market Positioning strategies should emphasize unique capabilities, service quality, and customer success stories. Thought leadership and industry participation can enhance market visibility and credibility. Customer relationship management is critical for maintaining long-term partnerships and securing new business opportunities.

Market growth trajectory remains highly positive, with the cell and gene therapy CDMO market expected to maintain robust expansion over the forecast period. Regulatory approval acceleration and increasing investment in advanced therapies will continue to drive demand for specialized manufacturing services. The market is projected to experience a compound annual growth rate exceeding 15% through the next decade.

Technology evolution will continue to transform manufacturing capabilities, with automation, digitalization, and artificial intelligence playing increasingly important roles. Next-generation manufacturing platforms will enable more efficient and cost-effective production processes. Continuous manufacturing and real-time quality control technologies will become standard practices.

Geographic expansion will accelerate as emerging markets develop healthcare infrastructure and regulatory frameworks to support advanced therapies. Asia-Pacific is expected to experience the highest growth rates, with market share projected to reach 25% by the end of the forecast period. Local manufacturing requirements and cost advantages will drive regional capacity development.

Therapeutic area diversification will broaden the addressable market beyond oncology into areas such as ophthalmology, neurology, and cardiovascular disease. Allogeneic cell therapies and in vivo gene therapies represent significant growth opportunities with more scalable manufacturing requirements.

Industry maturation will lead to improved manufacturing efficiency, standardized processes, and enhanced quality systems. MWR projects that manufacturing costs could decrease by 30-40% over the next five years through technology advancement and economies of scale. This cost reduction will improve therapy accessibility and market penetration.

The cell and gene therapy contract development and manufacturing organization market represents one of the most dynamic and rapidly growing sectors within the biotechnology industry. Market fundamentals remain exceptionally strong, driven by increasing regulatory approvals, substantial investment in advanced therapies, and growing recognition of the therapeutic potential of cell and gene therapies across diverse disease areas.

Strategic positioning within this market requires significant investment in specialized capabilities, regulatory expertise, and advanced manufacturing technologies. Companies that can successfully navigate the technical complexity and regulatory requirements while maintaining operational excellence are well-positioned to capture substantial market opportunities. Innovation leadership and customer partnership capabilities will continue to be key differentiators in this competitive landscape.

Future market evolution will be characterized by continued capacity expansion, technology advancement, and geographic diversification. The integration of digital technologies and automation systems will transform manufacturing operations, improving efficiency and reducing costs. Platform standardization and modular manufacturing approaches will enable more scalable and flexible production capabilities.

Long-term outlook for the cell and gene therapy CDMO market remains highly favorable, with sustained growth expected as these innovative therapies transition from experimental treatments to mainstream medical options. The market will continue to evolve rapidly, creating opportunities for companies that can adapt to changing technologies, regulatory requirements, and customer needs while maintaining the highest standards of quality and compliance.

What is Cell And Gene Therapy Contract Development And Manufacturing Organization?

Cell And Gene Therapy Contract Development And Manufacturing Organization refers to companies that provide specialized services for the development and manufacturing of cell and gene therapies. These organizations support biopharmaceutical companies in bringing innovative therapies to market by offering expertise in process development, regulatory compliance, and production.

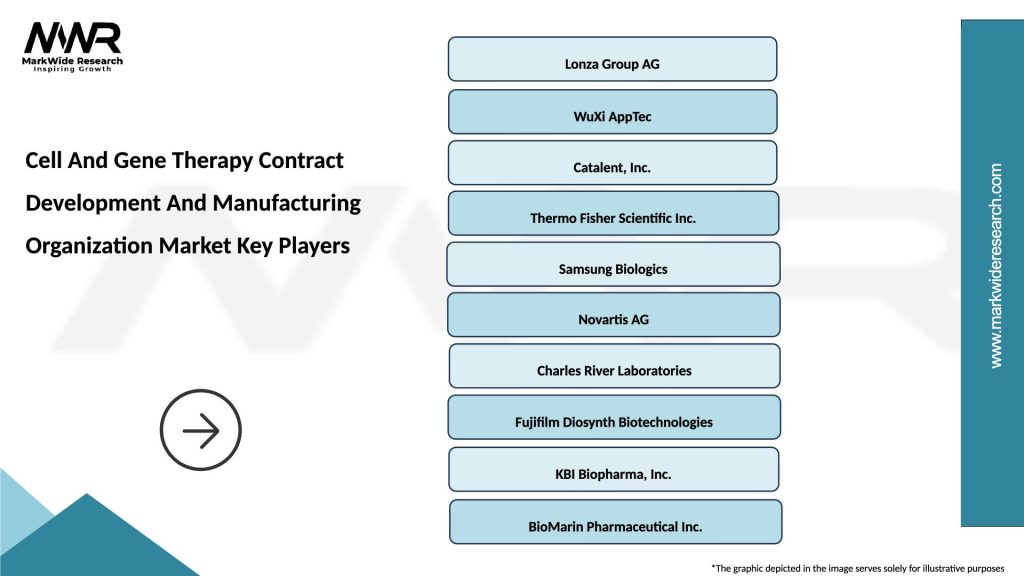

What are the key players in the Cell And Gene Therapy Contract Development And Manufacturing Organization Market?

Key players in the Cell And Gene Therapy Contract Development And Manufacturing Organization Market include Lonza Group, Catalent, and WuXi AppTec, among others. These companies are known for their advanced capabilities in cell and gene therapy manufacturing and development.

What are the growth factors driving the Cell And Gene Therapy Contract Development And Manufacturing Organization Market?

The growth of the Cell And Gene Therapy Contract Development And Manufacturing Organization Market is driven by increasing investments in biotechnology, a rise in the prevalence of genetic disorders, and advancements in gene editing technologies. These factors contribute to a growing demand for specialized manufacturing services.

What challenges does the Cell And Gene Therapy Contract Development And Manufacturing Organization Market face?

The Cell And Gene Therapy Contract Development And Manufacturing Organization Market faces challenges such as stringent regulatory requirements, high production costs, and the complexity of manufacturing processes. These factors can hinder the scalability and accessibility of therapies.

What opportunities exist in the Cell And Gene Therapy Contract Development And Manufacturing Organization Market?

Opportunities in the Cell And Gene Therapy Contract Development And Manufacturing Organization Market include the expansion of personalized medicine, collaborations between biotech firms and CDMOs, and the development of novel therapies for rare diseases. These trends are expected to enhance market growth.

What trends are shaping the Cell And Gene Therapy Contract Development And Manufacturing Organization Market?

Trends shaping the Cell And Gene Therapy Contract Development And Manufacturing Organization Market include the increasing adoption of automation in manufacturing processes, advancements in cell culture technologies, and a focus on sustainable practices. These trends are influencing how therapies are developed and produced.

Cell And Gene Therapy Contract Development And Manufacturing Organization Market

| Segmentation Details | Description |

|---|---|

| Product Type | Viral Vectors, Plasmid DNA, Cell Lines, Microbial Systems |

| Therapy Area | Oncology, Cardiovascular, Neurology, Rare Diseases |

| End User | Biopharmaceutical Companies, Research Institutions, Contract Research Organizations, Academic Labs |

| Delivery Mode | Intravenous, Subcutaneous, Intramuscular, Intra-arterial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cell And Gene Therapy Contract Development And Manufacturing Organization Market

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at