444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cathlab sales and service market represents a critical segment within the global healthcare infrastructure, encompassing the comprehensive ecosystem of cardiac catheterization laboratory equipment, maintenance services, and technological solutions. Cardiac catheterization laboratories serve as specialized medical facilities where interventional cardiology procedures are performed, requiring sophisticated equipment and ongoing technical support to ensure optimal patient outcomes.

Market dynamics indicate robust growth driven by increasing cardiovascular disease prevalence, technological advancements in minimally invasive procedures, and expanding healthcare infrastructure globally. The market encompasses both equipment sales and comprehensive service offerings, including installation, maintenance, training, and upgrade services. Healthcare providers increasingly recognize the importance of reliable cathlab operations, with equipment downtime potentially impacting critical patient care delivery.

Regional expansion patterns show significant growth opportunities in emerging markets, where healthcare modernization initiatives drive demand for advanced cathlab facilities. The market demonstrates strong growth potential with an estimated 8.2% CAGR over the forecast period, reflecting the critical nature of cardiovascular care and continuous technological innovation in interventional cardiology equipment.

The cathlab sales and service market refers to the comprehensive commercial ecosystem encompassing the sale, installation, maintenance, and ongoing technical support of cardiac catheterization laboratory equipment and related technologies used in interventional cardiology procedures.

Cardiac catheterization laboratories represent highly specialized medical environments equipped with advanced imaging systems, patient monitoring equipment, and interventional devices necessary for diagnosing and treating cardiovascular conditions. The market includes both capital equipment sales and recurring service revenue streams, creating a sustainable business model for healthcare technology providers.

Service components encompass preventive maintenance, emergency repairs, software updates, staff training, and equipment upgrades. This comprehensive approach ensures optimal equipment performance, regulatory compliance, and clinical efficacy while minimizing operational disruptions that could impact patient care delivery.

Market expansion in the cathlab sales and service sector reflects the growing global burden of cardiovascular disease and increasing adoption of minimally invasive cardiac procedures. The market demonstrates strong fundamentals with recurring service revenue providing stability while equipment sales drive growth through technological advancement and facility expansion.

Key growth drivers include aging population demographics, rising cardiovascular disease incidence, technological innovations in imaging and intervention systems, and expanding healthcare infrastructure in developing regions. Service revenue typically accounts for 35-40% of total market value, providing predictable income streams for equipment manufacturers and service providers.

Competitive landscape features established medical device manufacturers offering integrated solutions combining equipment sales with comprehensive service packages. Market leaders focus on developing long-term customer relationships through service excellence, technological innovation, and clinical outcome improvement initiatives.

Future prospects remain positive with continued investment in healthcare infrastructure, advancing cathlab technologies, and growing emphasis on preventive cardiac care driving sustained market expansion across both developed and emerging markets.

Strategic market insights reveal several critical factors shaping the cathlab sales and service landscape:

Cardiovascular disease prevalence continues rising globally, creating sustained demand for cathlab facilities and associated services. The increasing incidence of heart disease, particularly in aging populations, drives healthcare providers to invest in advanced cardiac care capabilities and maintain existing equipment at optimal performance levels.

Technological advancement in interventional cardiology equipment necessitates regular upgrades and specialized service support. Modern cathlab systems incorporate sophisticated imaging technologies, robotic assistance, and AI-powered analytics requiring expert technical maintenance and ongoing software updates to ensure clinical effectiveness.

Healthcare infrastructure expansion in emerging markets creates significant growth opportunities for cathlab equipment sales and service providers. Government healthcare initiatives and private sector investment drive new facility construction and equipment procurement, establishing long-term service relationships.

Regulatory requirements mandate regular equipment maintenance, calibration, and compliance verification, creating consistent demand for professional service providers. Healthcare facilities must maintain detailed service records and ensure equipment meets safety and performance standards through certified maintenance programs.

Cost optimization pressures encourage healthcare providers to maximize equipment lifespan and operational efficiency through comprehensive service programs. Preventive maintenance and performance optimization services help facilities avoid costly emergency repairs and equipment replacement while maintaining high-quality patient care standards.

High capital costs associated with cathlab equipment present significant barriers for smaller healthcare facilities and those in resource-constrained environments. The substantial initial investment required for comprehensive cathlab systems limits market expansion in certain regions and healthcare segments.

Technical complexity of modern cathlab equipment requires specialized expertise for service and maintenance, creating challenges in regions with limited technical infrastructure or trained personnel. The shortage of qualified service technicians can impact service quality and response times.

Budget constraints in healthcare systems may lead to deferred maintenance or reduced service contracts, potentially impacting equipment performance and longevity. Economic pressures on healthcare providers can result in cost-cutting measures that affect comprehensive service program adoption.

Regulatory compliance costs add complexity and expense to service operations, particularly for smaller service providers lacking comprehensive regulatory expertise. Meeting various international and local standards requires significant investment in training, certification, and quality systems.

Competition from refurbished equipment markets may reduce demand for new equipment sales, though this can create opportunities in the service sector for maintaining older systems. The growing acceptance of refurbished cathlab equipment impacts new equipment sales while increasing service demand.

Emerging market expansion presents substantial growth opportunities as developing countries invest in healthcare infrastructure modernization. Rising healthcare spending and government initiatives to improve cardiac care access create favorable conditions for cathlab equipment sales and service market development.

Digital transformation in healthcare opens new avenues for innovative service delivery models, including remote monitoring, predictive maintenance, and AI-powered diagnostic support. These technologies enable more efficient service operations and enhanced customer value propositions.

Preventive care emphasis drives demand for advanced cathlab capabilities and comprehensive service programs. Healthcare systems increasingly focus on early intervention and preventive cardiac procedures, requiring reliable, high-performance equipment supported by excellent service programs.

Partnership opportunities with healthcare providers through comprehensive service agreements and equipment leasing models create stable revenue streams while reducing customer capital expenditure requirements. These arrangements benefit both equipment manufacturers and healthcare facilities.

Training and education services represent growing market segments as healthcare facilities seek to optimize staff capabilities and equipment utilization. Comprehensive training programs enhance clinical outcomes while building stronger customer relationships and service revenue opportunities.

Supply chain dynamics in the cathlab sales and service market reflect the complex interplay between equipment manufacturers, service providers, healthcare facilities, and regulatory bodies. The market demonstrates strong interdependencies between equipment sales and ongoing service requirements, creating sustainable business models for industry participants.

Customer relationships in this market tend to be long-term and strategic, with healthcare providers seeking reliable partners capable of supporting critical cardiac care operations. Service quality and responsiveness significantly impact customer retention and market share, with equipment uptime being a critical performance metric.

Technology evolution continuously reshapes market dynamics, with innovations in imaging, intervention techniques, and digital health creating both opportunities and challenges. Service providers must continuously invest in training and equipment to support advancing cathlab technologies while maintaining expertise in legacy systems.

Competitive dynamics favor companies offering integrated solutions combining equipment sales with comprehensive service capabilities. Market leaders leverage their service networks to build competitive advantages and create barriers to entry for new competitors.

Economic factors influence market dynamics through healthcare spending patterns, reimbursement policies, and capital equipment procurement cycles. Economic stability and healthcare investment levels significantly impact both equipment sales and service demand patterns across different regions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with healthcare facility administrators, cathlab directors, equipment manufacturers, and service providers to understand market dynamics and trends.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and healthcare statistics from authoritative sources. This approach provides quantitative foundation for market sizing and trend analysis while validating primary research findings.

Market segmentation analysis examines various dimensions including equipment types, service categories, end-user segments, and geographic regions. This detailed segmentation approach enables precise market characterization and identification of specific growth opportunities and challenges.

Competitive intelligence gathering involves systematic analysis of key market participants, their service offerings, pricing strategies, and market positioning. This research provides insights into competitive dynamics and strategic opportunities for market participants.

Trend analysis incorporates examination of technological developments, regulatory changes, demographic shifts, and healthcare policy evolution to identify factors influencing market growth and development patterns. MarkWide Research methodology ensures comprehensive coverage of market influencing factors.

North American markets demonstrate mature cathlab infrastructure with strong emphasis on equipment upgrades and comprehensive service programs. The region shows steady growth driven by aging population demographics and advancing cardiac care technologies, with service revenue representing approximately 42% of total market value.

European markets exhibit similar maturity patterns with strong regulatory frameworks driving consistent service demand. Healthcare system modernization initiatives and emphasis on preventive cardiac care support sustained market growth, particularly in service and maintenance segments.

Asia-Pacific regions represent the fastest-growing market segment, with rapid healthcare infrastructure development and increasing cardiovascular disease prevalence driving equipment sales and service demand. The region demonstrates 15-18% annual growth rates in cathlab installations.

Latin American markets show emerging growth potential as healthcare systems modernize and cardiac care access expands. Government healthcare initiatives and private sector investment create opportunities for both equipment sales and service market development.

Middle East and Africa markets demonstrate growing demand driven by healthcare infrastructure investment and rising cardiovascular disease awareness. The region shows particular growth in urban centers with advanced healthcare facilities requiring comprehensive cathlab solutions and services.

Market leadership in the cathlab sales and service sector is characterized by established medical device manufacturers offering integrated solutions:

Competitive strategies focus on developing comprehensive service capabilities, technological innovation, and long-term customer relationships. Market leaders invest heavily in service network expansion and technical expertise development to maintain competitive advantages.

By Equipment Type:

By Service Type:

By End User:

Equipment sales category demonstrates cyclical patterns influenced by technology advancement cycles and healthcare capital expenditure budgets. New equipment sales typically involve comprehensive service agreements, creating long-term revenue opportunities for manufacturers and service providers.

Service revenue category provides stable, recurring income streams with higher profit margins compared to equipment sales. Preventive maintenance contracts show 85-90% renewal rates, indicating strong customer satisfaction and service value recognition.

Training services category represents growing market segment as healthcare facilities seek to optimize staff capabilities and equipment utilization. Comprehensive training programs improve clinical outcomes while building stronger customer relationships and additional revenue opportunities.

Upgrade services category shows increasing importance as healthcare providers seek to extend equipment lifespan while incorporating latest technological advances. Software upgrades and hardware enhancements provide cost-effective alternatives to complete equipment replacement.

Emergency service category commands premium pricing due to critical nature of cathlab operations and impact of equipment downtime on patient care. Rapid response capabilities and technical expertise differentiate service providers in this high-value market segment.

Healthcare providers benefit from comprehensive cathlab sales and service programs through improved equipment reliability, reduced operational costs, and enhanced clinical outcomes. Professional service support ensures optimal equipment performance while minimizing disruptions to critical cardiac care delivery.

Equipment manufacturers gain sustainable revenue streams through service contracts while building stronger customer relationships and competitive differentiation. Service excellence creates barriers to competitor entry and supports premium pricing strategies for integrated solutions.

Service providers benefit from recurring revenue models with predictable income streams and opportunities for business expansion. Specialized technical expertise and customer relationships create competitive advantages and market positioning opportunities.

Patients ultimately benefit from reliable, high-quality cathlab equipment supported by professional service programs. Optimal equipment performance and minimal downtime ensure consistent access to critical cardiac care services and improved treatment outcomes.

Healthcare systems achieve cost optimization through comprehensive service programs that extend equipment lifespan, improve operational efficiency, and reduce total cost of ownership. Professional service support enables healthcare facilities to focus on patient care while ensuring equipment reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping cathlab sales and service delivery. Remote monitoring capabilities, predictive maintenance algorithms, and AI-powered diagnostic support enhance service efficiency while reducing costs and improving equipment uptime.

Integrated service solutions demonstrate growing market preference as healthcare providers seek comprehensive partnerships rather than transactional relationships. Bundled equipment and service offerings provide value optimization and simplified vendor management for healthcare facilities.

Preventive maintenance emphasis continues growing as healthcare providers recognize the cost benefits of proactive equipment care. Scheduled maintenance programs reduce emergency repair costs while extending equipment lifespan and improving operational reliability.

Training and education integration becomes increasingly important as cathlab technologies advance and clinical procedures evolve. Comprehensive staff development programs ensure optimal equipment utilization while improving patient outcomes and safety.

Sustainability focus influences equipment design and service delivery models, with emphasis on energy efficiency, equipment longevity, and environmentally responsible service practices. Green initiatives create differentiation opportunities and align with healthcare sustainability goals.

Technology advancement in cathlab equipment continues accelerating with introduction of AI-powered imaging systems, robotic assistance technologies, and advanced visualization capabilities. These innovations require specialized service expertise and create opportunities for service providers with advanced technical capabilities.

Service model evolution toward outcome-based contracts and performance guarantees reflects healthcare provider focus on value optimization. Service providers increasingly offer equipment uptime guarantees and performance-based pricing models that align with customer objectives.

Market consolidation activities among service providers create larger, more capable organizations with enhanced geographic coverage and technical expertise. Strategic acquisitions and partnerships enable service providers to expand capabilities and market reach.

Regulatory development continues evolving with enhanced focus on equipment safety, performance standards, and service quality requirements. New regulations create both challenges and opportunities for service providers with comprehensive compliance capabilities.

Partnership expansion between equipment manufacturers and independent service providers creates new market dynamics and service delivery models. These collaborations enable broader service coverage while maintaining manufacturer quality standards and technical expertise.

Service excellence focus should remain the primary strategic priority for market participants seeking sustainable competitive advantage. Investment in technical expertise, response capabilities, and customer relationship management creates differentiation in increasingly competitive markets.

Digital capability development represents critical investment area for future market success. Remote monitoring, predictive maintenance, and data analytics capabilities enable more efficient service delivery while creating new value propositions for customers.

Geographic expansion strategies should prioritize emerging markets with growing healthcare infrastructure and cardiac care demand. Early market entry and relationship building create competitive advantages and long-term growth opportunities.

Partnership development with healthcare providers through comprehensive service agreements and strategic relationships builds market position and revenue stability. Long-term contracts and outcome-based models align provider and customer interests while creating competitive barriers.

Talent investment in technical expertise and service capabilities remains essential for market success. Continuous training and development programs ensure service quality while building organizational capabilities for future growth and technological advancement.

Market growth prospects remain positive with sustained demand driven by cardiovascular disease prevalence, aging populations, and advancing cardiac care technologies. MarkWide Research analysis indicates continued expansion opportunities across both developed and emerging markets.

Technology integration will continue reshaping service delivery models with increased emphasis on digital solutions, remote capabilities, and predictive maintenance. These advances enable more efficient service operations while improving customer value and satisfaction.

Service model evolution toward comprehensive partnerships and outcome-based contracts reflects healthcare industry trends toward value-based care and cost optimization. Service providers adapting to these models will achieve competitive advantages and stronger market positions.

Regional growth patterns show particular strength in Asia-Pacific and Latin American markets where healthcare infrastructure development creates significant opportunities. Established markets will focus on service excellence and technology advancement to maintain growth momentum.

Industry consolidation trends are expected to continue as market participants seek scale advantages and enhanced capabilities. Strategic partnerships and acquisitions will reshape competitive dynamics while creating opportunities for market leaders to expand their service capabilities and geographic reach.

The cathlab sales and service market represents a critical and growing segment within the global healthcare technology landscape, driven by increasing cardiovascular disease prevalence, advancing medical technologies, and expanding healthcare infrastructure worldwide. The market demonstrates strong fundamentals with recurring service revenue providing stability while equipment innovation drives continued growth opportunities.

Key success factors include service excellence, technical expertise, comprehensive customer relationships, and adaptation to evolving healthcare delivery models. Market participants who invest in digital capabilities, geographic expansion, and outcome-based service models will be best positioned for sustained growth and competitive advantage.

Future market development will be shaped by continued technological advancement, demographic trends, and healthcare system evolution toward value-based care models. The integration of digital technologies and emphasis on preventive maintenance will create new opportunities while requiring continuous investment in capabilities and expertise. MWR projects sustained market expansion with particular strength in emerging markets and service-focused business models that align with healthcare provider objectives and patient care requirements.

What is Cathlab Sales and Service?

Cathlab Sales and Service refers to the provision and maintenance of equipment used in catheterization laboratories, which are essential for diagnostic and therapeutic procedures in cardiology and other medical fields.

What are the key players in the Cathlab Sales and Service Market?

Key players in the Cathlab Sales and Service Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others.

What are the main drivers of growth in the Cathlab Sales and Service Market?

The growth of the Cathlab Sales and Service Market is driven by the increasing prevalence of cardiovascular diseases, advancements in catheterization technology, and the rising demand for minimally invasive procedures.

What challenges does the Cathlab Sales and Service Market face?

Challenges in the Cathlab Sales and Service Market include high operational costs, the need for skilled technicians, and regulatory compliance issues that can affect service delivery.

What opportunities exist in the Cathlab Sales and Service Market?

Opportunities in the Cathlab Sales and Service Market include the expansion of healthcare facilities, the integration of AI and machine learning in diagnostic processes, and the growing focus on preventive healthcare.

What trends are shaping the Cathlab Sales and Service Market?

Trends in the Cathlab Sales and Service Market include the increasing adoption of hybrid cath labs, advancements in imaging technologies, and a shift towards patient-centered care models.

Cathlab Sales and Service Market

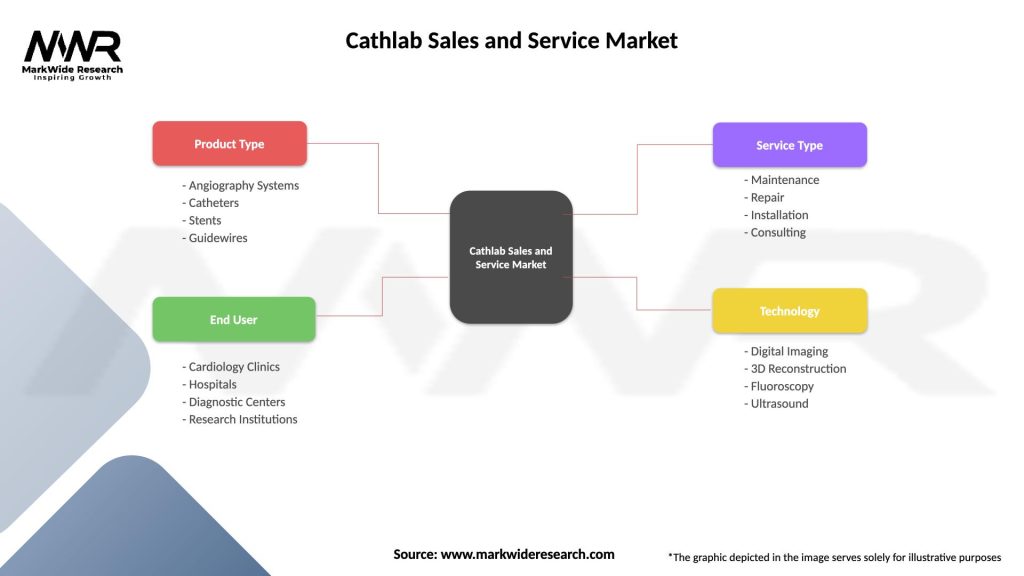

| Segmentation Details | Description |

|---|---|

| Product Type | Angiography Systems, Catheters, Stents, Guidewires |

| End User | Cardiology Clinics, Hospitals, Diagnostic Centers, Research Institutions |

| Service Type | Maintenance, Repair, Installation, Consulting |

| Technology | Digital Imaging, 3D Reconstruction, Fluoroscopy, Ultrasound |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cathlab Sales and Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at