Market Overview

The Carrier Wi-Fi market has emerged as a critical component of modern telecommunications infrastructure, facilitating wireless connectivity in diverse environments such as urban areas, enterprises, public venues, and residential settings. Carrier Wi-Fi technology enables service providers to extend their networks, offload data traffic from cellular networks, and deliver high-speed wireless internet access to end-users seamlessly.

Meaning

Carrier Wi-Fi refers to a wireless networking technology that allows telecommunication service providers to offer internet access to their customers through Wi-Fi hotspots deployed across various locations. These hotspots are typically integrated with cellular networks, enabling users to connect to the internet via Wi-Fi using their smartphones, tablets, laptops, and other Wi-Fi-enabled devices.

Executive Summary

The Carrier Wi-Fi market is witnessing rapid growth driven by the increasing demand for ubiquitous connectivity, rising data traffic volumes, and the proliferation of connected devices. Service providers are investing in Carrier Wi-Fi infrastructure to enhance network capacity, improve coverage, and deliver superior user experiences. With the ongoing deployment of 5G networks and the emergence of new use cases such as smart cities, industrial IoT, and virtual reality, Carrier Wi-Fi technology is poised to play a crucial role in shaping the future of wireless communications.

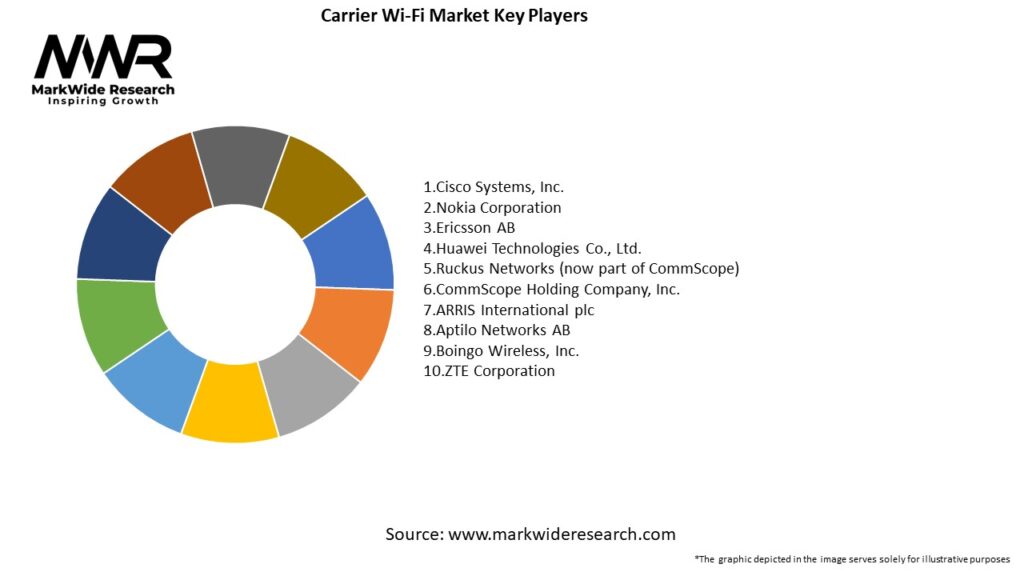

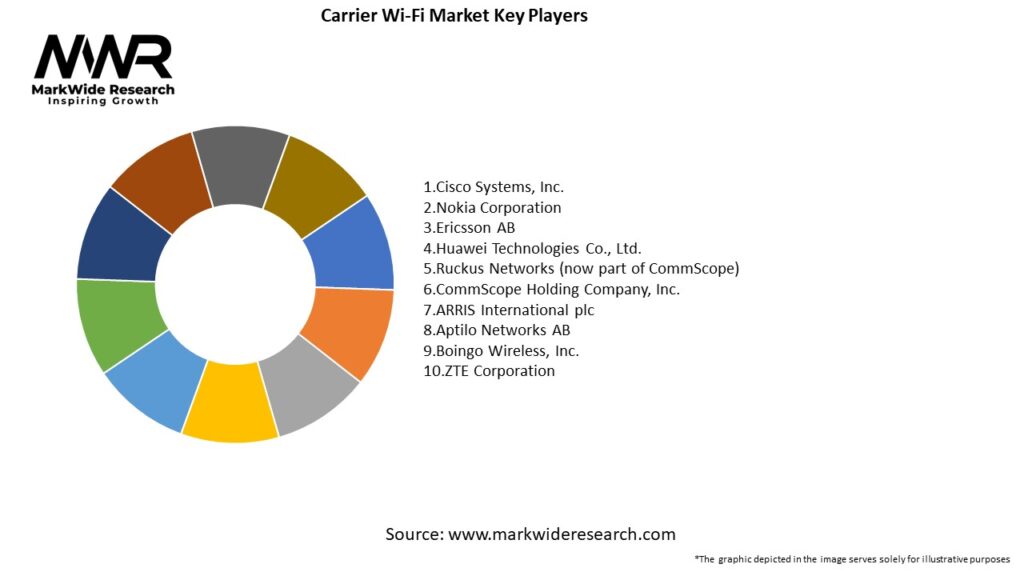

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

- Growing Data Consumption: The proliferation of bandwidth-intensive applications such as video streaming, online gaming, and social media has led to a surge in data consumption, driving the need for Carrier Wi-Fi solutions capable of supporting high-speed data transmission and seamless connectivity.

- Network Offloading: Carrier Wi-Fi enables service providers to offload data traffic from congested cellular networks onto Wi-Fi networks, thereby relieving network congestion, improving network performance, and enhancing the quality of service for end-users.

- Monetization Opportunities: Carrier Wi-Fi presents monetization opportunities for service providers through value-added services such as location-based advertising, sponsored Wi-Fi access, and premium service tiers, enabling them to generate additional revenue streams and enhance customer engagement.

- Enhanced Indoor Coverage: Carrier Wi-Fi deployments in indoor environments such as shopping malls, airports, stadiums, and office buildings address the challenge of indoor coverage and provide users with seamless connectivity, high-speed internet access, and a quality user experience.

Market Drivers

- Rising Demand for Mobile Data: The increasing adoption of smartphones, tablets, and other connected devices, coupled with growing consumer demand for mobile data services, is driving the need for Carrier Wi-Fi solutions to augment existing cellular networks and meet the escalating demand for wireless connectivity.

- 5G Network Evolution: The evolution of 5G networks presents opportunities for Carrier Wi-Fi integration, enabling service providers to leverage Wi-Fi offload capabilities, deliver enhanced broadband services, and support new use cases such as IoT, augmented reality, and immersive multimedia experiences.

- Internet of Things (IoT) Growth: The proliferation of IoT devices and applications across various industries, including healthcare, manufacturing, transportation, and smart cities, fuels the demand for Carrier Wi-Fi connectivity to support IoT deployments, enable device connectivity, and facilitate data exchange.

- Consumer Expectations: Consumers expect ubiquitous connectivity, high-speed internet access, and seamless roaming experiences, driving service providers to invest in Carrier Wi-Fi infrastructure to meet customer expectations, enhance brand loyalty, and differentiate their offerings in the competitive market landscape.

Market Restraints

- Spectrum Constraints: Spectrum availability and regulatory constraints pose challenges to Carrier Wi-Fi deployment, particularly in densely populated urban areas where spectrum resources are limited and subject to interference from neighboring networks.

- Security Concerns: Security vulnerabilities associated with public Wi-Fi networks, such as data breaches, man-in-the-middle attacks, and unauthorized access, raise concerns among users and inhibit the widespread adoption of Carrier Wi-Fi services, necessitating robust security measures and encryption protocols.

- Interoperability Challenges: Interoperability issues between different Carrier Wi-Fi equipment vendors, network elements, and software platforms hinder seamless integration, interoperability, and scalability, limiting the deployment flexibility and agility of Carrier Wi-Fi solutions.

- Quality of Service (QoS) Assurance: Ensuring consistent QoS across Carrier Wi-Fi networks, maintaining high service availability, and managing network congestion in high-density environments pose operational challenges for service providers, requiring sophisticated traffic management and QoS enforcement mechanisms.

Market Opportunities

- Enterprise Wi-Fi Offload: Enterprise Wi-Fi offload solutions enable service providers to target enterprise customers with Carrier Wi-Fi as a service offering, providing seamless integration with existing corporate networks, enhanced security features, and centralized management capabilities.

- Public Wi-Fi Roaming: Public Wi-Fi roaming agreements and federated authentication frameworks enable service providers to expand their footprint, enhance network coverage, and offer seamless roaming experiences to subscribers across different networks and geographic locations.

- Smart City Deployments: Smart city initiatives, including connected transportation, public safety, environmental monitoring, and citizen services, create opportunities for Carrier Wi-Fi deployments to support IoT applications, urban infrastructure, and municipal Wi-Fi networks.

- Wi-Fi 6 and Beyond: The evolution of Wi-Fi standards, including Wi-Fi 6 (802.11ax) and beyond, presents opportunities for service providers to upgrade their Carrier Wi-Fi infrastructure, deliver higher throughput, lower latency, and improved spectral efficiency, and support emerging use cases such as AR/VR, 4K video streaming, and ultra-low-latency applications.

Market Dynamics

The Carrier Wi-Fi market operates in a dynamic environment influenced by technological innovation, regulatory developments, market competition, and shifting consumer preferences. Key market dynamics shaping the Carrier Wi-Fi landscape include:

- Technology Innovation: Continuous innovation in Carrier Wi-Fi technology, including multi-access point deployments, virtualized Wi-Fi controllers, cloud-managed services, and self-organizing networks (SON), drives network scalability, flexibility, and performance optimization.

- Regulatory Environment: Regulatory initiatives, spectrum policies, and compliance requirements impact Carrier Wi-Fi deployment strategies, spectrum allocation, and licensing frameworks, influencing market entry barriers, investment decisions, and competitive dynamics.

- Market Consolidation: Market consolidation, mergers, and acquisitions among Carrier Wi-Fi vendors, service providers, and ecosystem players reshape the competitive landscape, drive industry consolidation, and foster strategic partnerships to address market demand and innovation imperatives.

- Consumer Behavior: Evolving consumer behaviors, preferences, and usage patterns shape Carrier Wi-Fi service adoption, pricing models, and service differentiation strategies, prompting service providers to align their offerings with customer needs, lifestyles, and digital experiences.

Regional Analysis

The Carrier Wi-Fi market exhibits regional variations in adoption, deployment models, and market dynamics across different geographical regions:

- North America: North America leads the Carrier Wi-Fi market, driven by extensive Wi-Fi hotspot deployments, advanced network infrastructure, and high smartphone penetration, with service providers focusing on Wi-Fi offload, public Wi-Fi deployments, and seamless user experiences.

- Europe: Europe represents a mature Carrier Wi-Fi market, characterized by widespread Wi-Fi coverage, regulatory support for Wi-Fi offload, and public Wi-Fi initiatives in urban areas, transport hubs, and tourist destinations, with service providers emphasizing Wi-Fi quality, security, and roaming capabilities.

- Asia Pacific: Asia Pacific experiences rapid Carrier Wi-Fi growth, fueled by increasing mobile data traffic, smartphone adoption, and digitalization trends, with service providers deploying Carrier Wi-Fi networks to address capacity constraints, enhance network performance, and support emerging IoT applications.

- Latin America: Latin America emerges as an emerging Carrier Wi-Fi market, driven by expanding broadband connectivity, rising internet penetration, and government-led initiatives to bridge the digital divide, with service providers leveraging Carrier Wi-Fi to extend network coverage, deliver affordable internet access, and bridge connectivity gaps in underserved areas.

Competitive Landscape

Leading Companies in the Carrier Wi-Fi Market:

- Cisco Systems, Inc.

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Ruckus Networks (now part of CommScope)

- CommScope Holding Company, Inc.

- ARRIS International plc

- Aptilo Networks AB

- Boingo Wireless, Inc.

- ZTE Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

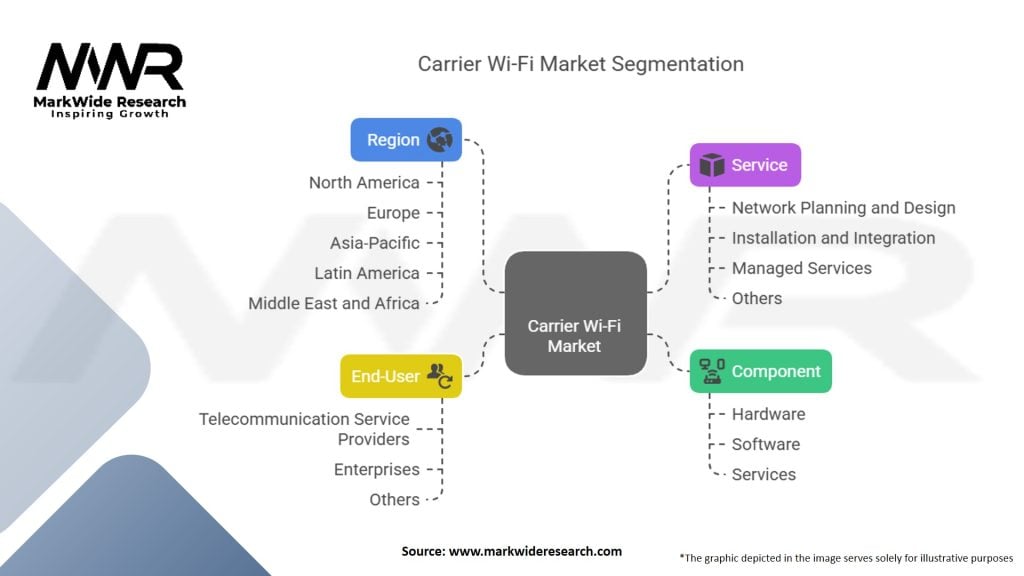

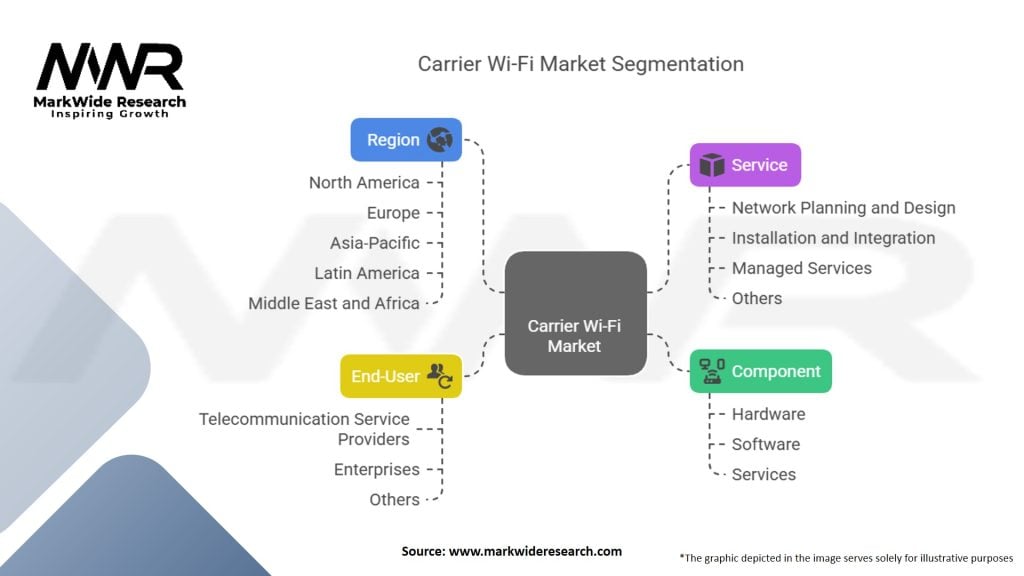

Segmentation

The Carrier Wi-Fi market can be segmented based on various factors, including:

- Component Type: Segmentation by component type includes access points, controllers, management software, services, and analytics platforms.

- Deployment Mode: Segmentation by deployment mode includes indoor, outdoor, public venues, enterprises, and residential deployments.

- Service Model: Segmentation by service model includes managed Wi-Fi services, Wi-Fi as a service (WaaS), and cloud-managed Wi-Fi solutions.

- End-User Vertical: Segmentation by end-user vertical includes telecom operators, cable operators, enterprises, public venues, hospitality, transportation, healthcare, education, and government.

Segmentation provides a comprehensive understanding of market dynamics, customer needs, and competitive positioning, enabling vendors and service providers to tailor their offerings, pricing strategies, and go-to-market approaches to specific market segments and vertical industries.

Category-wise Insights

- Wi-Fi Access Points: Wi-Fi access points represent a key category in the Carrier Wi-Fi market, offering wireless connectivity, network access, and coverage extension capabilities for end-users across diverse environments and use cases.

- Wi-Fi Controllers: Wi-Fi controllers play a crucial role in Carrier Wi-Fi deployments, providing centralized management, configuration, and optimization of Wi-Fi networks, ensuring seamless roaming, load balancing, and QoS enforcement.

- Managed Wi-Fi Services: Managed Wi-Fi services enable service providers to offer turnkey Wi-Fi solutions to enterprise customers, including design, deployment, monitoring, and maintenance of Carrier Wi-Fi networks, backed by service-level agreements (SLAs) and technical support.

- Cloud-Managed Wi-Fi: Cloud-managed Wi-Fi solutions leverage cloud-based platforms and software-as-a-service (SaaS) models to deliver remote management, provisioning, and analytics capabilities for Carrier Wi-Fi networks, enabling scalable deployments and operational efficiencies.

Key Benefits for Industry Participants and Stakeholders

- Expanded Network Capacity: Carrier Wi-Fi solutions enable service providers to expand network capacity, offload data traffic, and support growing data consumption trends, enhancing network performance and user experiences.

- Improved Coverage and Connectivity: Carrier Wi-Fi deployments improve coverage in indoor and outdoor environments, address network coverage gaps, and provide seamless connectivity for subscribers across different locations and devices.

- Cost-effective Offload: Carrier Wi-Fi offload reduces operational costs, network congestion, and capital expenditures for service providers by leveraging existing Wi-Fi infrastructure and optimizing network resource utilization.

- Enhanced User Experience: Carrier Wi-Fi delivers high-speed internet access, low-latency connectivity, and quality of service (QoS) enhancements, enhancing the user experience for subscribers, reducing churn, and increasing customer satisfaction.

- Monetization Opportunities: Carrier Wi-Fi presents monetization opportunities for service providers through value-added services, sponsored access, location-based advertising, and premium service tiers, enabling revenue generation and business growth.

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the Carrier Wi-Fi market:

- Strengths:

- Ubiquitous Wi-Fi coverage

- Scalable and cost-effective deployments

- Enhanced user experiences

- Monetization opportunities

- Weaknesses:

- Security vulnerabilities

- Interoperability challenges

- Spectrum constraints

- Quality of service concerns

- Opportunities:

- 5G network evolution

- IoT growth

- Smart city deployments

- Wi-Fi 6 adoption

- Threats:

- Regulatory hurdles

- Security risks

- Market competition

- Technological disruptions

Understanding these internal strengths and weaknesses, as well as external opportunities and threats, enables industry participants to formulate strategic decisions, address challenges, and capitalize on market opportunities in the dynamic Carrier Wi-Fi landscape.

Market Key Trends

- Wi-Fi 6 Adoption: The adoption of Wi-Fi 6 (802.11ax) technology drives network performance improvements, higher throughput, and enhanced spectral efficiency, supporting Carrier Wi-Fi deployments and next-generation wireless experiences.

- Cloud-Managed Services: The shift towards cloud-managed Wi-Fi services enables centralized management, remote monitoring, and analytics-driven insights, empowering service providers to streamline operations, optimize network performance, and deliver superior user experiences.

- Multi-Access Point Deployments: Multi-access point deployments, including mesh networks, distributed antenna systems (DAS), and small cells, extend Wi-Fi coverage, increase network capacity, and support seamless roaming across diverse environments and use cases.

- AI-driven Analytics: AI-driven analytics and machine learning algorithms enable predictive analytics, network optimization, and anomaly detection, empowering service providers to proactively manage Carrier Wi-Fi networks, identify performance bottlenecks, and deliver personalized services.

Covid-19 Impact

The COVID-19 pandemic has reshaped the Carrier Wi-Fi market landscape, with the following key impacts:

- Remote Work and Learning: The shift towards remote work, virtual learning, and online collaboration during the pandemic increased demand for reliable Wi-Fi connectivity, driving investments in Carrier Wi-Fi infrastructure to support remote connectivity and digital lifestyles.

- E-commerce and Digital Services: The surge in e-commerce, digital entertainment, and streaming services during lockdowns and social distancing measures placed strain on network capacity, prompting service providers to optimize Wi-Fi networks, manage traffic congestion, and ensure quality of service.

- Telehealth and Telemedicine: The adoption of telehealth and telemedicine solutions surged during the pandemic, requiring robust Wi-Fi connectivity for virtual consultations, remote patient monitoring, and healthcare delivery, driving investments in Carrier Wi-Fi for healthcare facilities and practitioners.

- Workplace Safety Measures: The implementation of workplace safety measures, including contact tracing, occupancy management, and touchless interactions, accelerated demand for Carrier Wi-Fi solutions to support IoT sensors, wearables, and smart building technologies for workplace safety and compliance.

Key Industry Developments

- Wi-Fi 6E Spectrum: The introduction of Wi-Fi 6E spectrum (6 GHz band) expands available spectrum resources for Carrier Wi-Fi deployments, enabling higher data rates, lower latency, and increased network capacity for Wi-Fi 6E-enabled devices and applications.

- OpenRoaming Initiative: The OpenRoaming initiative, led by the Wireless Broadband Alliance (WBA), promotes seamless Wi-Fi roaming experiences across different networks and service providers, facilitating simplified connectivity, enhanced security, and improved user experiences.

- Wi-Fi CERTIFIED 6™ Program: The Wi-Fi Alliance’s Wi-Fi CERTIFIED 6™ program certifies Wi-Fi 6 devices for interoperability, performance, and security compliance, ensuring compatibility and consistency across Carrier Wi-Fi deployments and ecosystem devices.

- Passpoint® Certification: The Wi-Fi Alliance’s Passpoint® certification program enables seamless, secure, and automatic Wi-Fi network authentication and roaming, enhancing connectivity experiences for users across public Wi-Fi hotspots and Carrier Wi-Fi networks.

Analyst Suggestions

- Invest in Wi-Fi 6 Infrastructure: Service providers should invest in Wi-Fi 6 infrastructure to support increased network capacity, improved performance, and emerging use cases such as AR/VR, 4K video streaming, and IoT applications.

- Enhance Security Measures: Implement robust security measures, encryption protocols, and authentication mechanisms to mitigate security risks, protect user privacy, and ensure the integrity of Carrier Wi-Fi networks against cyber threats and malicious attacks.

- Leverage AI-driven Analytics: Utilize AI-driven analytics and machine learning algorithms to optimize network performance, predict traffic patterns, and proactively manage Carrier Wi-Fi networks, ensuring quality of service, reliability, and scalability.

- Embrace OpenRoaming: Participate in the OpenRoaming initiative to enable seamless Wi-Fi roaming experiences for subscribers, simplify network access, and enhance user mobility across different networks, venues, and service providers.

Future Outlook

The Carrier Wi-Fi market is poised for continued growth and innovation, driven by the proliferation of connected devices, rising data consumption, and evolving connectivity demands. Key trends shaping the future of the Carrier Wi-Fi market include:

- Wi-Fi 6 and Wi-Fi 6E Adoption: The widespread adoption of Wi-Fi 6 and Wi-Fi 6E technology will drive network upgrades, device proliferation, and enhanced wireless experiences, supporting emerging use cases and applications across diverse industries.

- 5G and Wi-Fi Integration: The convergence of 5G and Wi-Fi technologies will enable seamless handoff, network slicing, and hybrid connectivity models, leveraging the complementary strengths of cellular and Wi-Fi networks to deliver ubiquitous, high-performance connectivity.

- Edge Computing and IoT Integration: The integration of Carrier Wi-Fi with edge computing and IoT platforms will enable distributed intelligence, real-time data processing, and low-latency applications, supporting IoT deployments, smart city initiatives, and Industry 4.0 transformation.

- AI-driven Network Optimization: AI-driven analytics and automation will play a pivotal role in optimizing Carrier Wi-Fi networks, predicting network demand, and dynamically allocating resources to ensure efficient network operation, performance optimization, and cost-effective scalability.

Conclusion

The Carrier Wi-Fi market represents a dynamic and evolving ecosystem, driven by technological innovation, changing consumer behaviors, and industry convergence trends. With the proliferation of connected devices, rising data consumption, and the emergence of new use cases such as IoT, AR/VR, and smart city applications, Carrier Wi-Fi technology is poised to play a pivotal role in enabling ubiquitous connectivity, enhancing user experiences, and driving digital transformation across industries. By embracing Wi-Fi 6, leveraging AI-driven analytics, and embracing industry initiatives such as OpenRoaming, service providers can capitalize on market opportunities, address evolving customer needs, and shape the future of wireless communications in the digital age.