444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cardiovascular patch and connective tissue disease market represents a critical segment of the global medical device industry, focusing on innovative solutions for cardiac and vascular repair procedures. This specialized market encompasses a diverse range of products including cardiac patches, vascular grafts, heart valve replacements, and tissue engineering solutions designed to address various cardiovascular conditions and connective tissue disorders.

Market dynamics indicate robust growth driven by increasing prevalence of cardiovascular diseases, aging populations, and technological advancements in biomaterial sciences. The market demonstrates significant expansion potential with a projected CAGR of 8.2% over the forecast period, reflecting strong demand for minimally invasive cardiac procedures and advanced tissue repair solutions.

Regional distribution shows North America maintaining the largest market share at approximately 42%, followed by Europe at 28%, while Asia-Pacific emerges as the fastest-growing region with increasing healthcare infrastructure investments. The market benefits from continuous innovation in biocompatible materials, regenerative medicine, and surgical techniques that enhance patient outcomes and reduce recovery times.

The cardiovascular patch and connective tissue disease market refers to the comprehensive ecosystem of medical devices, biomaterials, and therapeutic solutions designed to repair, replace, or support damaged cardiovascular structures and connective tissues. This market encompasses products used in cardiac surgery, vascular reconstruction, and treatment of various connective tissue disorders affecting the heart, blood vessels, and supporting structures.

Core components include synthetic and biological patches for cardiac defect repair, vascular grafts for bypass procedures, tissue-engineered constructs for regenerative applications, and specialized materials for treating connective tissue diseases such as Marfan syndrome and Ehlers-Danlos syndrome. These solutions address critical medical needs ranging from congenital heart defects to acquired cardiovascular conditions requiring surgical intervention.

Market expansion in the cardiovascular patch and connective tissue disease sector reflects the convergence of demographic trends, technological innovation, and evolving treatment paradigms. The increasing prevalence of cardiovascular diseases, affecting approximately 655 million people globally, drives sustained demand for advanced repair solutions and tissue engineering technologies.

Key growth drivers include the rising incidence of congenital heart diseases, increasing adoption of minimally invasive surgical procedures, and growing awareness of connective tissue disorders. The market benefits from significant investments in research and development, with biotechnology companies and medical device manufacturers focusing on next-generation biomaterials and regenerative medicine approaches.

Technological advancements in tissue engineering, 3D bioprinting, and personalized medicine create new opportunities for market expansion. The integration of artificial intelligence and machine learning in surgical planning and device design enhances treatment precision and patient outcomes, supporting market growth across all major geographic regions.

Strategic insights reveal several critical factors shaping market development and competitive dynamics:

Primary market drivers encompass demographic, technological, and healthcare system factors that collectively fuel market expansion and innovation adoption.

Demographic trends represent the most significant driver, with global population aging leading to increased cardiovascular disease prevalence. The growing elderly population, particularly those over 65 years, experiences higher rates of cardiac conditions, vascular diseases, and connective tissue disorders requiring surgical intervention and advanced treatment solutions.

Technological advancement in biomaterials science enables development of superior products with enhanced biocompatibility, durability, and integration properties. Innovations in tissue engineering, nanotechnology, and 3D printing create new possibilities for personalized treatment approaches and improved patient outcomes.

Healthcare infrastructure development in emerging markets expands access to advanced cardiac care, driving demand for cardiovascular patches and connective tissue repair solutions. Government initiatives supporting healthcare modernization and medical device adoption create favorable market conditions for growth.

Clinical evidence accumulation demonstrating superior outcomes with advanced patch technologies encourages physician adoption and patient acceptance. Long-term studies showing reduced complications and improved quality of life support market expansion and product differentiation strategies.

Market challenges include several factors that may limit growth potential and create barriers to market entry and expansion.

High development costs associated with cardiovascular device innovation present significant barriers for smaller companies and startups. The extensive research and development requirements, clinical trial expenses, and regulatory compliance costs create substantial financial burdens that may limit market participation.

Regulatory complexity in major markets requires extensive documentation, clinical evidence, and compliance with stringent safety standards. The lengthy approval processes for medical devices and biomaterials can delay market entry and increase development costs, particularly for innovative technologies requiring novel regulatory pathways.

Reimbursement challenges in various healthcare systems may limit patient access to advanced cardiovascular patch technologies. Insurance coverage limitations and cost-containment pressures from healthcare payers can restrict market adoption, particularly for premium-priced innovative solutions.

Technical complexity of advanced patch technologies requires specialized surgical expertise and training. The learning curve associated with new procedures and devices may slow adoption rates among healthcare providers, particularly in regions with limited access to specialized cardiac surgery training programs.

Emerging opportunities in the cardiovascular patch and connective tissue disease market reflect evolving healthcare needs and technological capabilities.

Regenerative medicine advancement creates unprecedented opportunities for tissue engineering solutions that can regenerate damaged cardiovascular structures. The development of stem cell therapies, growth factor delivery systems, and bioactive scaffolds opens new treatment paradigms for previously challenging conditions.

Pediatric market expansion represents a significant growth opportunity, with increasing recognition and treatment of congenital heart diseases in children. The development of growth-accommodating patches and biodegradable materials specifically designed for pediatric applications addresses unmet medical needs in this specialized segment.

Emerging market penetration offers substantial growth potential as healthcare infrastructure develops in Asia-Pacific, Latin America, and Africa. Rising healthcare expenditure and increasing awareness of cardiovascular diseases create favorable conditions for market expansion in these regions.

Digital health integration enables development of smart patches and connected devices that provide real-time monitoring and data collection capabilities. The convergence of Internet of Things (IoT) technology with cardiovascular devices creates opportunities for enhanced patient management and outcomes tracking.

Market dynamics reflect the complex interplay of forces shaping the cardiovascular patch and connective tissue disease market landscape.

Supply chain evolution demonstrates increasing vertical integration among major manufacturers seeking to control quality and reduce costs. Companies are investing in in-house manufacturing capabilities and advanced materials research to maintain competitive advantages and ensure consistent product quality.

Competitive intensity continues to increase as new entrants leverage innovative technologies and business models to challenge established players. The market witnesses growing competition from biotechnology startups, academic spin-offs, and technology companies entering the medical device space with disruptive solutions.

Innovation cycles accelerate as companies invest heavily in research and development to maintain market position. The rapid pace of technological advancement requires continuous investment in next-generation materials, manufacturing processes, and clinical validation to remain competitive.

Customer expectations evolve toward more personalized and effective solutions, driving demand for custom-designed patches and patient-specific treatments. Healthcare providers increasingly seek products that demonstrate clear clinical benefits, cost-effectiveness, and improved patient outcomes.

Comprehensive research methodology employed in analyzing the cardiovascular patch and connective tissue disease market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability.

Primary research includes extensive interviews with industry experts, healthcare professionals, and key opinion leaders across major geographic markets. Surveys of cardiac surgeons, interventional cardiologists, and hospital administrators provide insights into product preferences, adoption patterns, and future needs.

Secondary research encompasses analysis of published literature, regulatory filings, company reports, and industry publications. Comprehensive review of clinical studies, patent databases, and regulatory approvals provides detailed understanding of market trends and competitive dynamics.

Market modeling utilizes advanced analytical techniques to project market growth, segment performance, and regional trends. Statistical analysis of historical data combined with expert insights enables accurate forecasting of market development patterns and opportunity identification.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review. Regular updates and continuous monitoring of market developments maintain research currency and reliability for strategic decision-making.

North America maintains market leadership with approximately 42% market share, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of leading medical device companies. The region benefits from favorable reimbursement policies, extensive clinical research activities, and early adoption of innovative technologies.

United States dominates the North American market through significant investments in cardiovascular research and development. The presence of major medical device manufacturers, research institutions, and specialized cardiac centers creates a favorable ecosystem for market growth and innovation.

Europe represents the second-largest market with approximately 28% market share, characterized by strong regulatory frameworks and emphasis on clinical evidence. Countries including Germany, France, and the United Kingdom lead regional adoption through advanced healthcare systems and government support for medical innovation.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 10% annually. Rapid healthcare infrastructure development, increasing healthcare expenditure, and growing awareness of cardiovascular diseases drive market expansion across China, India, Japan, and South Korea.

Latin America and Middle East & Africa represent emerging opportunities with improving healthcare access and increasing investment in cardiac care capabilities. These regions show growing adoption of advanced cardiovascular technologies as healthcare systems modernize and expand coverage.

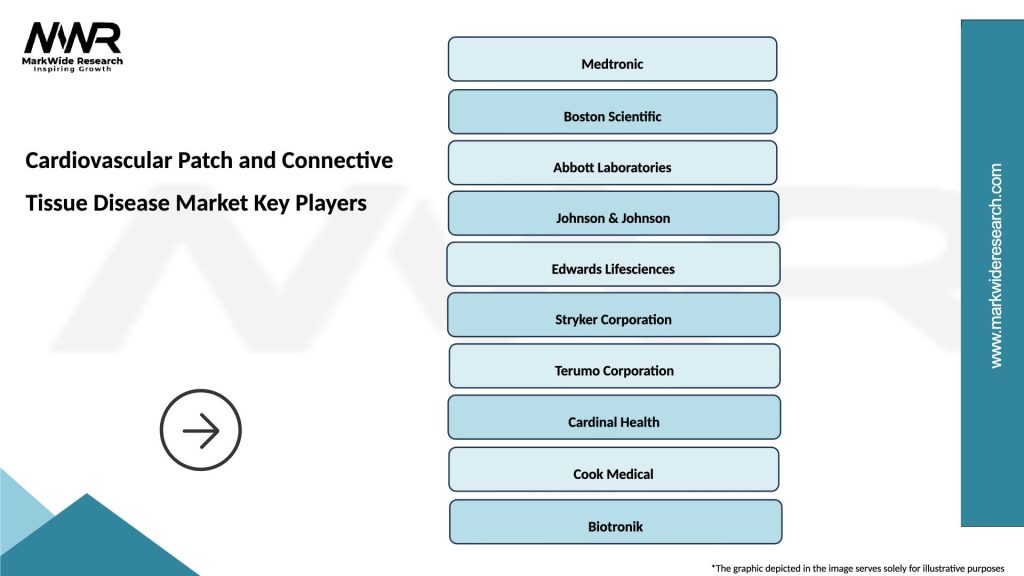

Market leadership is distributed among several key players with distinct competitive advantages and strategic focus areas:

Competitive strategies focus on product innovation, clinical evidence generation, and geographic expansion. Companies invest heavily in research and development, strategic acquisitions, and partnership development to maintain market position and drive growth.

Market segmentation reveals distinct categories based on product type, application, material composition, and end-user preferences.

By Product Type:

By Material Composition:

By Application:

Cardiac patches represent the largest product category, accounting for approximately 38% of market share. This segment benefits from increasing prevalence of congenital heart diseases and growing adoption of minimally invasive repair techniques. Innovation focuses on biocompatible materials that promote tissue integration and reduce inflammatory responses.

Vascular grafts demonstrate strong growth potential driven by increasing peripheral artery disease prevalence and aging populations. The segment shows particular strength in synthetic graft technologies offering improved patency rates and reduced infection risks. MarkWide Research analysis indicates growing preference for antimicrobial-coated grafts and drug-eluting technologies.

Heart valve replacements experience robust demand from demographic trends and technological advancement. The category benefits from development of transcatheter valve technologies enabling treatment of high-risk patients previously considered inoperable. Biological valve prostheses gain market share due to improved durability and reduced anticoagulation requirements.

Tissue engineering products represent the fastest-growing category with significant innovation potential. This emerging segment focuses on regenerative solutions that can restore native tissue function rather than simply replacing damaged structures. Investment in stem cell research and 3D bioprinting drives category development.

Healthcare providers benefit from access to advanced cardiovascular repair solutions that improve patient outcomes and reduce complications. Enhanced surgical techniques and innovative materials enable treatment of previously challenging cases while reducing procedure complexity and recovery times.

Patients experience improved quality of life through access to less invasive procedures and more durable repair solutions. Advanced biomaterials and tissue engineering technologies offer better long-term outcomes with reduced risk of complications and repeat procedures.

Medical device manufacturers gain opportunities for revenue growth and market expansion through innovation and product differentiation. Investment in research and development creates competitive advantages and enables premium pricing for advanced solutions.

Healthcare systems benefit from cost-effective solutions that reduce hospital stays, complications, and long-term care requirements. Improved patient outcomes and reduced readmission rates contribute to overall healthcare cost management and resource optimization.

Research institutions access new funding opportunities and collaboration possibilities with industry partners. The growing focus on translational research and clinical validation creates opportunities for academic-industry partnerships and technology transfer.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine integration emerges as a dominant trend, with companies developing patient-specific patches and custom-designed solutions based on individual anatomy and genetic profiles. This approach enhances treatment effectiveness and reduces complications through precise fit and optimal biocompatibility.

Minimally invasive procedures gain increasing adoption as surgeons and patients prefer techniques that reduce trauma and recovery time. Development of catheter-deliverable patches and percutaneous repair systems enables treatment of high-risk patients and expands treatment options.

Bioengineered materials represent a significant innovation trend, with focus on developing patches that promote natural tissue regeneration and integration. Advanced scaffold technologies and growth factor delivery systems create opportunities for superior long-term outcomes.

Digital health integration transforms patient monitoring and outcomes tracking through smart patches equipped with sensors and connectivity features. These technologies enable real-time monitoring of patch performance and early detection of complications.

Sustainability focus drives development of biodegradable materials and environmentally friendly manufacturing processes. Companies increasingly consider environmental impact in product design and lifecycle management.

Recent innovations demonstrate the dynamic nature of the cardiovascular patch and connective tissue disease market with breakthrough technologies and strategic initiatives.

3D bioprinting advancement enables creation of complex tissue structures with precise cellular organization and vascular networks. Several companies have achieved successful preclinical trials of bioprinted cardiac patches, moving toward clinical applications.

Stem cell integration technologies combine cardiovascular patches with regenerative cell therapies to enhance healing and tissue regeneration. Clinical trials demonstrate promising results for mesenchymal stem cell-seeded patches in cardiac repair applications.

Nanotechnology applications create opportunities for enhanced patch performance through nanofiber structures and drug-eluting capabilities. These technologies enable controlled release of therapeutic agents and improved mechanical properties.

Artificial intelligence integration supports surgical planning and patch design optimization through machine learning algorithms and predictive modeling. AI-powered systems assist surgeons in selecting optimal patch sizes and placement strategies.

Strategic partnerships between medical device companies and biotechnology firms accelerate innovation and market development. Collaborative research initiatives focus on next-generation materials and regenerative medicine applications.

Investment priorities should focus on companies demonstrating strong clinical evidence, innovative technologies, and robust regulatory strategies. Organizations with comprehensive product portfolios and established market presence offer lower risk profiles for investors.

Technology evaluation requires careful assessment of intellectual property positions, clinical validation status, and regulatory pathway clarity. Companies with breakthrough technologies should demonstrate clear paths to market approval and commercialization.

Market entry strategies should consider regional regulatory requirements, reimbursement landscapes, and competitive dynamics. MWR analysis suggests focusing on markets with favorable regulatory environments and strong healthcare infrastructure.

Partnership opportunities exist for companies seeking to expand geographic reach or enhance technological capabilities. Strategic alliances with research institutions, healthcare providers, and distribution partners can accelerate market penetration.

Risk management requires attention to regulatory changes, competitive threats, and technology disruption potential. Companies should maintain diversified product portfolios and flexible development strategies to adapt to market evolution.

Long-term market prospects remain highly favorable with projected growth rates of 8-10% annually driven by demographic trends, technological advancement, and expanding treatment applications. The market benefits from increasing healthcare expenditure and growing recognition of cardiovascular disease burden globally.

Technology evolution will likely focus on regenerative medicine, personalized treatment approaches, and minimally invasive delivery systems. The convergence of biotechnology, materials science, and digital health creates unprecedented opportunities for innovation and market expansion.

Geographic expansion into emerging markets presents significant growth potential as healthcare infrastructure develops and access to advanced cardiac care improves. Countries in Asia-Pacific and Latin America show particularly strong growth prospects with increasing healthcare investment and rising disease awareness.

Regulatory evolution may streamline approval processes for breakthrough technologies while maintaining safety standards. Adaptive regulatory pathways and accelerated approval mechanisms could reduce time-to-market for innovative solutions.

Market consolidation may occur as larger companies acquire innovative technologies and smaller firms seek resources for development and commercialization. Strategic partnerships and collaborations will likely increase as companies seek to access complementary capabilities and market reach.

The cardiovascular patch and connective tissue disease market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, technological innovation, and expanding treatment applications. Market analysis reveals strong fundamentals supporting continued expansion, with projected growth rates reflecting increasing demand for advanced cardiovascular repair solutions.

Key success factors include investment in research and development, focus on clinical evidence generation, and strategic positioning in high-growth market segments. Companies that successfully navigate regulatory requirements while delivering innovative solutions addressing unmet medical needs are positioned for sustained competitive advantage.

Future opportunities emerge from convergence of regenerative medicine, personalized treatment approaches, and digital health technologies. The market benefits from increasing recognition of cardiovascular disease burden and growing investment in advanced treatment solutions across global healthcare systems. Strategic focus on innovation, clinical validation, and market expansion will determine long-term success in this critical healthcare market segment.

What is Cardiovascular Patch and Connective Tissue Disease?

Cardiovascular Patch and Connective Tissue Disease refers to medical conditions and treatments related to the heart and blood vessels, as well as disorders affecting connective tissues. These patches are often used in surgical procedures to repair or replace damaged tissues.

What are the key players in the Cardiovascular Patch and Connective Tissue Disease Market?

Key players in the Cardiovascular Patch and Connective Tissue Disease Market include Medtronic, Boston Scientific, and Edwards Lifesciences. These companies are known for their innovative products and technologies in cardiovascular treatments, among others.

What are the growth factors driving the Cardiovascular Patch and Connective Tissue Disease Market?

The growth of the Cardiovascular Patch and Connective Tissue Disease Market is driven by an increasing prevalence of cardiovascular diseases, advancements in surgical techniques, and a rising aging population. Additionally, the demand for minimally invasive procedures is contributing to market expansion.

What challenges does the Cardiovascular Patch and Connective Tissue Disease Market face?

The Cardiovascular Patch and Connective Tissue Disease Market faces challenges such as high costs of advanced medical devices and stringent regulatory requirements. Furthermore, the complexity of surgical procedures can limit the adoption of new technologies.

What future opportunities exist in the Cardiovascular Patch and Connective Tissue Disease Market?

Future opportunities in the Cardiovascular Patch and Connective Tissue Disease Market include the development of bioengineered patches and personalized medicine approaches. Innovations in materials science and regenerative medicine are also expected to enhance treatment options.

What trends are currently shaping the Cardiovascular Patch and Connective Tissue Disease Market?

Current trends in the Cardiovascular Patch and Connective Tissue Disease Market include the integration of digital health technologies and telemedicine in patient management. Additionally, there is a growing focus on patient-centered care and improved surgical outcomes.

Cardiovascular Patch and Connective Tissue Disease Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biodegradable Patches, Synthetic Patches, Biological Patches, Composite Patches |

| Application | Cardiac Surgery, Vascular Surgery, Tissue Repair, Wound Healing |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Institutions |

| Technology | 3D Printing, Nanotechnology, Bioengineering, Laser Technology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cardiovascular Patch and Connective Tissue Disease Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at