444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Carbon Credit Trading Platform Market plays a crucial role in the global effort to mitigate climate change by facilitating the buying and selling of carbon credits or offsets. These platforms connect businesses, industries, and governments involved in emissions reduction projects with investors and buyers interested in offsetting their carbon footprint. The market has seen significant growth due to increased awareness of environmental sustainability and regulatory frameworks promoting carbon reduction initiatives.

Meaning

Carbon credit trading platforms serve as digital marketplaces where organizations can buy, sell, and trade carbon credits or offsets. Carbon credits represent reductions in greenhouse gas emissions achieved through renewable energy projects, reforestation efforts, energy efficiency improvements, and other sustainable practices. These platforms enable companies to meet emission reduction targets, comply with regulations, and support sustainable development projects.

Executive Summary

The Carbon Credit Trading Platform Market has experienced rapid expansion driven by the growing emphasis on environmental sustainability, corporate responsibility, and climate action. These platforms offer transparency, liquidity, and efficiency in carbon credit transactions, attracting investors, businesses, and governments seeking to address climate change challenges through market-based mechanisms.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Carbon Credit Trading Platform Market operates in a dynamic environment influenced by factors such as policy changes, technological innovations, market demand, investor sentiment, and environmental considerations. These dynamics shape market trends, participant behavior, trading volumes, and the overall impact of carbon credit trading platforms on climate change mitigation efforts.

Regional Analysis

Regional variations in the Carbon Credit Trading Platform Market include differences in regulatory frameworks, carbon pricing mechanisms, market maturity, institutional support, and market participants. Key regions driving market growth and adoption of trading platforms include Europe, North America, Asia Pacific, and emerging markets with growing climate action agendas.

Competitive Landscape

Leading companies in the Carbon Credit Trading Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

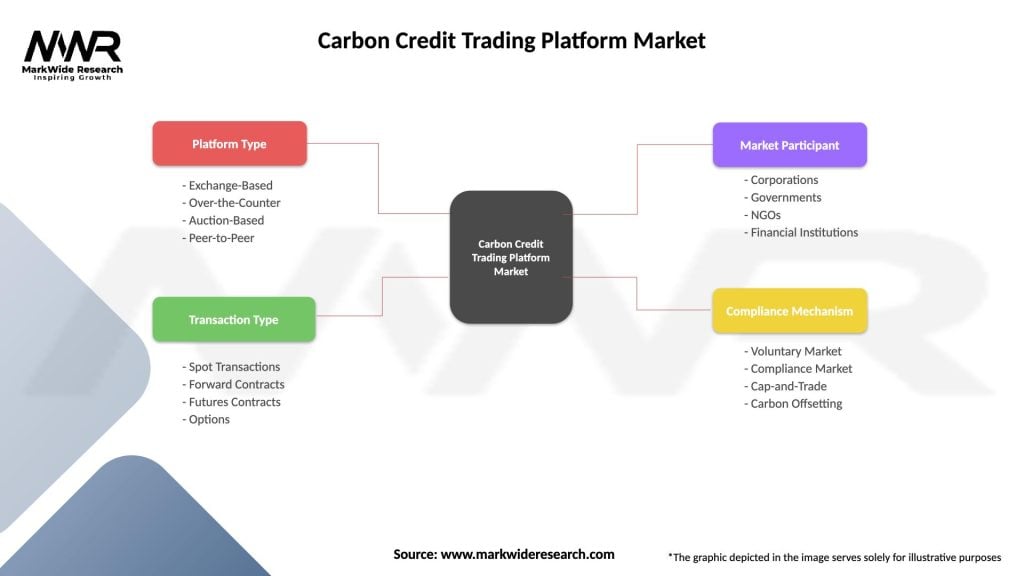

Segmentation

Segmentation in the Carbon Credit Trading Platform Market can be based on:

Category-wise Insights

Insights into different categories within the Carbon Credit Trading Platform Market include:

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders benefit from the Carbon Credit Trading Platform Market in various ways:

SWOT Analysis

A SWOT analysis provides insights into the Carbon Credit Trading Platform Market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the Carbon Credit Trading Platform Market include:

Covid-19 Impact

The COVID-19 pandemic had mixed impacts on the Carbon Credit Trading Platform Market, with initial disruptions followed by resilience and adaptation. Key impacts include:

Key Industry Developments

Recent developments in the Carbon Credit Trading Platform Market include:

Analyst Suggestions

Suggestions for industry participants and stakeholders in the Carbon Credit Trading Platform Market include:

Future Outlook

The Carbon Credit Trading Platform Market is poised for continued growth, innovation, and market expansion driven by technological advancements, regulatory support, investor interest, and climate action agendas. Future outlook includes:

Conclusion

The Carbon Credit Trading Platform Market represents a critical component of global climate action, offering market-based solutions, financial opportunities, and environmental impact through carbon credit trading. With technological innovations, policy support, investor interest, and market collaborations, the market is poised for growth, resilience, and contribution to climate goals. Industry participants, investors, and stakeholders play a crucial role in shaping the market’s future by embracing innovation, advocating for supportive policies, and driving sustainable finance in the carbon credit market. By leveraging digital platforms, market transparency, and collaborative strategies, stakeholders can unlock the full potential of carbon credit trading platforms and accelerate climate solutions in the transition to a low-carbon economy.

What is Carbon Credit Trading Platform?

A Carbon Credit Trading Platform is a digital marketplace that facilitates the buying and selling of carbon credits, which represent a permit to emit a certain amount of carbon dioxide or other greenhouse gases. These platforms help organizations offset their carbon emissions by investing in projects that reduce or remove greenhouse gases from the atmosphere.

What are the key players in the Carbon Credit Trading Platform Market?

Key players in the Carbon Credit Trading Platform Market include companies like Verra, Gold Standard, and Climate Impact Partners, which provide platforms for trading carbon credits and ensuring compliance with environmental standards. These companies are instrumental in shaping the market dynamics and facilitating transactions among various stakeholders, among others.

What are the main drivers of growth in the Carbon Credit Trading Platform Market?

The main drivers of growth in the Carbon Credit Trading Platform Market include increasing regulatory pressures for carbon emissions reduction, the rising awareness of climate change among businesses, and the growing demand for sustainable practices across industries. Additionally, advancements in technology are enhancing the efficiency of trading platforms.

What challenges does the Carbon Credit Trading Platform Market face?

The Carbon Credit Trading Platform Market faces challenges such as regulatory uncertainty, the complexity of carbon credit verification processes, and market volatility. These factors can hinder participation and investment in carbon trading initiatives.

What opportunities exist in the Carbon Credit Trading Platform Market?

Opportunities in the Carbon Credit Trading Platform Market include the potential for innovative technologies to streamline trading processes, the expansion of carbon markets into new regions, and the increasing interest from corporations in achieving net-zero emissions goals. These factors can drive further investment and participation in carbon trading.

What trends are shaping the Carbon Credit Trading Platform Market?

Trends shaping the Carbon Credit Trading Platform Market include the integration of blockchain technology for enhanced transparency, the rise of voluntary carbon markets, and the growing emphasis on corporate sustainability initiatives. These trends are influencing how carbon credits are traded and valued in the marketplace.

Carbon Credit Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Exchange-Based, Over-the-Counter, Auction-Based, Peer-to-Peer |

| Transaction Type | Spot Transactions, Forward Contracts, Futures Contracts, Options |

| Market Participant | Corporations, Governments, NGOs, Financial Institutions |

| Compliance Mechanism | Voluntary Market, Compliance Market, Cap-and-Trade, Carbon Offsetting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Carbon Credit Trading Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at