444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The carbon capture and utilization market represents a transformative sector within the global climate technology landscape, offering innovative solutions to address mounting environmental challenges while creating economic value from captured carbon dioxide. This rapidly evolving market encompasses technologies and processes that capture CO2 emissions from industrial sources, power plants, and directly from the atmosphere, subsequently converting these emissions into valuable products and materials.

Market dynamics indicate unprecedented growth momentum driven by stringent environmental regulations, corporate sustainability commitments, and technological breakthroughs in carbon conversion processes. The sector demonstrates remarkable potential with growth rates exceeding 15% CAGR across multiple application segments, reflecting increasing adoption of carbon utilization technologies worldwide.

Industrial applications span diverse sectors including chemicals, fuels, building materials, and consumer goods, with carbon-derived products gaining significant market traction. The technology’s versatility enables transformation of waste CO2 into methanol, synthetic fuels, polymers, concrete additives, and various specialty chemicals, creating circular economy opportunities while reducing atmospheric carbon concentrations.

Regional adoption varies significantly, with North America and Europe leading implementation efforts through supportive policy frameworks and substantial investment initiatives. Asia-Pacific markets demonstrate accelerating growth patterns, driven by industrial expansion and increasing environmental awareness among major economies including China, Japan, and South Korea.

The carbon capture and utilization market refers to the comprehensive ecosystem of technologies, processes, and commercial activities focused on capturing carbon dioxide emissions from various sources and converting them into economically valuable products and materials. This market encompasses the entire value chain from CO2 capture and purification to chemical conversion and end-product commercialization.

Carbon capture involves extracting CO2 from industrial emissions, power plant exhaust, or directly from ambient air using various technological approaches including chemical absorption, physical adsorption, membrane separation, and cryogenic distillation. The captured carbon dioxide undergoes purification and conditioning processes to achieve specifications required for subsequent utilization applications.

Utilization processes transform captured CO2 into valuable products through chemical, biological, or physical conversion methods. These processes include catalytic conversion to produce fuels and chemicals, mineralization for construction materials, biological conversion using microorganisms, and direct utilization in enhanced oil recovery and beverage carbonation applications.

Market expansion in the carbon capture and utilization sector reflects growing recognition of CO2 as a valuable feedstock rather than merely a waste product requiring disposal. This paradigm shift drives innovation across multiple industries, creating new revenue streams while addressing climate change objectives through practical, economically viable solutions.

Technology advancement continues accelerating with breakthrough developments in catalyst efficiency, process optimization, and cost reduction initiatives. Recent innovations demonstrate 40% improvement in conversion efficiency for key chemical processes, making carbon utilization increasingly competitive with traditional production methods for various products.

Investment momentum reaches unprecedented levels as venture capital, corporate funding, and government support converge to accelerate market development. Major corporations across industries establish carbon utilization initiatives, recognizing both environmental benefits and commercial opportunities presented by these emerging technologies.

Policy support strengthens globally with carbon pricing mechanisms, tax incentives, and regulatory frameworks specifically designed to encourage carbon capture and utilization deployment. These supportive measures create favorable market conditions for technology adoption and commercial scaling across diverse application areas.

Technology maturation varies significantly across different carbon utilization pathways, with some applications achieving commercial viability while others remain in development phases. The following insights highlight critical market developments:

Environmental regulations serve as primary catalysts for market growth, with governments worldwide implementing increasingly stringent emissions standards and carbon pricing mechanisms. These regulatory frameworks create compelling economic incentives for industries to adopt carbon capture and utilization technologies as compliance strategies while generating additional revenue streams.

Corporate sustainability commitments drive substantial demand as companies establish net-zero targets and seek practical solutions for reducing their carbon footprints. Major corporations across sectors including technology, manufacturing, and energy invest heavily in carbon utilization projects to meet environmental goals while maintaining operational efficiency.

Technological breakthroughs continuously improve process economics and expand application possibilities. Recent advances in catalyst development, process integration, and system optimization reduce costs while enhancing product quality and conversion efficiency. These improvements make carbon utilization increasingly competitive with conventional production methods.

Economic incentives multiply through various mechanisms including tax credits, grants, and preferential financing for carbon utilization projects. Government support programs specifically targeting clean technology deployment provide crucial funding for research, development, and commercial demonstration initiatives.

Resource scarcity concerns motivate industries to explore alternative feedstock sources, with captured CO2 offering abundant, renewable raw material for chemical and fuel production. This shift toward circular economy principles creates sustainable competitive advantages for companies adopting carbon utilization technologies.

High capital costs present significant barriers to market entry and technology deployment, particularly for smaller companies and developing economies. Initial investment requirements for carbon capture infrastructure, conversion equipment, and supporting systems often exceed traditional production facility costs, limiting adoption rates despite long-term economic benefits.

Technical complexity challenges many potential adopters, requiring specialized expertise in chemical engineering, process control, and system integration. The multidisciplinary nature of carbon utilization technologies demands substantial technical capabilities that may not exist within traditional industrial organizations.

Energy requirements for carbon capture and conversion processes can be substantial, potentially offsetting environmental benefits if powered by fossil fuel sources. Achieving net positive climate impact requires careful consideration of energy sources and process optimization to minimize overall carbon intensity.

Market acceptance varies for carbon-derived products, with some consumers and industries expressing skepticism about performance characteristics and long-term reliability. Overcoming these perceptions requires extensive testing, certification, and demonstration of product quality equivalent to or exceeding conventional alternatives.

Infrastructure limitations constrain deployment in many regions lacking adequate CO2 transport and storage capabilities. Developing comprehensive carbon management infrastructure requires substantial coordination among multiple stakeholders and significant capital investment.

Emerging applications continuously expand market potential as researchers and companies discover new uses for captured carbon dioxide. Recent developments include carbon-based textiles, pharmaceuticals, food ingredients, and advanced materials offering substantial growth opportunities for innovative companies.

Integration synergies create value through combining carbon capture with existing industrial processes, renewable energy systems, and waste management operations. These integrated approaches optimize resource utilization while reducing overall system costs and environmental impact.

Geographic expansion presents significant opportunities in developing economies where industrial growth coincides with increasing environmental awareness. Countries implementing carbon pricing and clean technology incentives offer attractive markets for carbon utilization technology deployment.

Partnership opportunities emerge as companies across different industries recognize mutual benefits from collaborative carbon utilization initiatives. Strategic alliances between capture technology providers, conversion specialists, and end-product manufacturers accelerate market development and risk sharing.

Financing innovation develops through green bonds, carbon credits, and impact investment vehicles specifically designed to support carbon utilization projects. These financial instruments reduce capital barriers while providing attractive returns for environmentally conscious investors.

Supply chain evolution transforms traditional industrial relationships as carbon dioxide transitions from waste product to valuable commodity. This shift creates new market dynamics with CO2 suppliers, capture service providers, conversion technology companies, and end-product manufacturers forming complex value networks.

Competitive landscape intensifies as established industrial companies, technology startups, and research institutions compete to develop superior carbon utilization solutions. Innovation cycles accelerate with companies racing to achieve cost advantages and performance improvements in key application areas.

Price volatility affects market development as carbon credit values, energy costs, and commodity prices fluctuate. According to MarkWide Research analysis, price stability improvements of 30% over recent periods support more predictable project economics and investment decisions.

Technology convergence occurs as carbon utilization integrates with artificial intelligence, automation, and digital monitoring systems. These combinations enhance process efficiency, reduce operational costs, and improve product quality while enabling remote monitoring and predictive maintenance capabilities.

Market consolidation begins emerging as successful companies acquire complementary technologies and capabilities to offer comprehensive carbon utilization solutions. This trend toward integrated service providers simplifies customer decision-making while accelerating technology deployment.

Primary research encompasses extensive interviews with industry executives, technology developers, policy makers, and end-users across multiple geographic regions and application sectors. This direct engagement provides insights into market challenges, opportunities, and future development priorities from key stakeholders.

Secondary analysis incorporates comprehensive review of technical literature, patent filings, regulatory documents, and commercial announcements to understand technology trends and market developments. This research foundation ensures accurate representation of current market conditions and emerging opportunities.

Market modeling utilizes advanced analytical techniques to project growth patterns, technology adoption rates, and competitive dynamics across different scenarios. These models incorporate multiple variables including policy changes, technology costs, and economic conditions to provide robust market forecasts.

Expert validation involves consultation with leading researchers, industry analysts, and technology specialists to verify findings and ensure accuracy of market assessments. This validation process enhances credibility and reliability of research conclusions.

Data triangulation combines multiple information sources and analytical approaches to confirm market insights and eliminate potential biases. This rigorous methodology ensures comprehensive understanding of complex market dynamics and emerging trends.

North America leads global carbon capture and utilization development with 35% market share, driven by supportive federal and state policies, substantial research funding, and active corporate participation. The United States demonstrates particular strength in direct air capture technologies and synthetic fuel production, while Canada excels in industrial carbon capture applications.

Europe maintains strong market position with 28% share through comprehensive climate policies, carbon pricing mechanisms, and substantial public-private partnerships. The European Union’s Green Deal initiatives accelerate technology deployment while countries like Norway, Netherlands, and Germany lead in specific application areas.

Asia-Pacific shows rapid growth momentum with 22% market share and accelerating adoption rates across major economies. China’s massive industrial base creates substantial opportunities for carbon utilization, while Japan and South Korea focus on advanced technology development and demonstration projects.

Middle East and Africa demonstrate emerging potential with 10% combined market share, leveraging abundant CO2 sources from oil and gas operations. Countries like Saudi Arabia and UAE invest heavily in carbon utilization as part of economic diversification strategies.

Latin America represents 5% market share with growing interest in carbon utilization for industrial applications and sustainable development objectives. Brazil and Mexico lead regional adoption efforts with supportive policy frameworks and international collaboration initiatives.

Market leaders establish competitive advantages through comprehensive technology portfolios, strategic partnerships, and proven commercial deployments. The competitive environment features diverse participants ranging from established industrial companies to innovative startups:

Strategic positioning varies among competitors with some focusing on specific technologies while others pursue integrated solutions across the carbon utilization value chain. Companies differentiate through technology performance, cost effectiveness, scalability, and customer service capabilities.

By Technology:

By Source:

By Application:

By End-User:

Chemical conversion dominates market applications with proven commercial viability and established value chains. Methanol production represents the largest segment within this category, offering clear economic benefits and multiple end-use applications including fuel blending, chemical feedstock, and industrial solvents.

Fuel synthesis attracts substantial investment despite current cost challenges, driven by aviation industry requirements for sustainable fuels and transportation sector decarbonization objectives. Recent technological advances demonstrate 20% cost reduction potential through process optimization and scale economies.

Building materials show strong growth momentum as construction industry seeks sustainable alternatives to traditional cement and concrete. Carbon-cured products offer performance advantages including increased strength and durability while providing permanent carbon storage benefits.

Direct utilization applications provide immediate market opportunities with established technologies and proven economics. Enhanced oil recovery remains the largest direct utilization segment, though beverage carbonation and greenhouse applications demonstrate steady growth.

Emerging categories including pharmaceuticals, food ingredients, and advanced materials present significant future potential as research advances and regulatory approvals progress. These high-value applications could transform market economics through premium pricing opportunities.

Environmental benefits provide primary value proposition for carbon capture and utilization adoption, enabling companies to reduce greenhouse gas emissions while creating valuable products. This dual benefit addresses climate objectives while generating economic returns, making environmental responsibility financially attractive.

Revenue diversification opportunities emerge as companies transform waste CO2 streams into profit centers. Industrial facilities can monetize emissions through carbon utilization rather than paying disposal or penalty costs, improving overall operational economics and competitive positioning.

Regulatory compliance advantages help companies meet increasingly stringent environmental standards while avoiding potential penalties and restrictions. Proactive adoption of carbon utilization technologies positions organizations favorably for future regulatory developments.

Innovation leadership benefits accrue to early adopters who develop expertise and market presence in emerging carbon utilization applications. These first-mover advantages include technology learning curves, customer relationships, and intellectual property development.

Supply chain resilience improves through access to alternative feedstock sources and reduced dependence on traditional raw materials. Carbon utilization provides supply security while supporting circular economy principles and sustainable business practices.

Investment attraction increases for companies demonstrating commitment to carbon utilization and environmental sustainability. ESG-focused investors actively seek opportunities in clean technology sectors, providing access to capital for growth and expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence accelerates as carbon utilization integrates with artificial intelligence, machine learning, and advanced process control systems. These combinations optimize conversion efficiency, reduce energy consumption, and enable predictive maintenance capabilities that improve overall system performance and economics.

Modular deployment gains popularity as companies seek flexible, scalable solutions that can adapt to changing needs and market conditions. Standardized, containerized systems reduce deployment time and costs while enabling easier financing and operational management.

Circular economy integration expands as carbon utilization becomes component of comprehensive waste-to-value strategies. Companies increasingly view CO2 as valuable resource rather than waste product, leading to innovative business models and partnership structures.

Direct air capture scaling accelerates with MWR data indicating 50% annual growth in deployment capacity. This technology enables carbon utilization independent of industrial emission sources, expanding potential applications and geographic deployment opportunities.

Product certification develops as standards organizations and regulatory bodies establish frameworks for carbon-derived products. These certification systems build consumer confidence while enabling premium pricing for verified sustainable products.

Financial innovation creates new funding mechanisms including carbon credit monetization, green bonds, and impact investment vehicles specifically designed for carbon utilization projects. These financial tools reduce capital barriers and improve project economics.

Commercial deployments multiply across various applications as companies transition from pilot projects to full-scale operations. Recent announcements include major chemical companies implementing carbon-to-methanol facilities and construction companies adopting carbon-cured concrete in large infrastructure projects.

Technology partnerships form between traditional industries and clean technology companies to accelerate development and deployment. These collaborations combine established market presence with innovative technologies, reducing risks while expanding market reach.

Investment milestones reflect growing confidence in carbon utilization potential, with venture capital, corporate venture arms, and government agencies providing substantial funding for research, development, and commercialization initiatives.

Regulatory developments advance supportive policy frameworks including enhanced tax credits, streamlined permitting processes, and mandatory carbon utilization requirements for certain industries. These policy changes create favorable market conditions for technology adoption.

International cooperation increases through bilateral agreements, technology sharing initiatives, and joint research programs focused on carbon utilization development. These collaborative efforts accelerate innovation while reducing development costs and risks.

Technology focus should prioritize applications with proven commercial viability and clear value propositions. Companies entering the market should concentrate on established pathways like methanol production and enhanced oil recovery before pursuing more speculative applications.

Partnership strategies prove essential for success given the complex, multidisciplinary nature of carbon utilization technologies. Organizations should seek strategic alliances with complementary capabilities rather than attempting to develop all required expertise internally.

Geographic prioritization should target regions with supportive policy frameworks, adequate infrastructure, and strong industrial demand. Early market entry in favorable jurisdictions provides competitive advantages and learning opportunities.

Financial planning must account for substantial capital requirements and longer payback periods compared to traditional industrial projects. Companies should explore innovative financing mechanisms and government incentive programs to improve project economics.

Risk management requires careful consideration of technology, market, and regulatory risks inherent in emerging markets. Diversified approaches across multiple technologies and applications can reduce overall portfolio risk while maximizing upside potential.

Market expansion continues accelerating with MarkWide Research projecting sustained growth rates exceeding 18% CAGR through the next decade. This growth reflects improving technology economics, expanding applications, and strengthening policy support across major markets worldwide.

Technology maturation progresses rapidly with multiple pathways approaching commercial viability and cost competitiveness. Breakthrough developments in catalyst efficiency, process integration, and system optimization continue reducing costs while improving performance characteristics.

Application diversity expands as researchers discover new uses for captured carbon dioxide across industries including pharmaceuticals, textiles, electronics, and agriculture. These emerging applications offer high-value opportunities that could transform market economics and growth potential.

Infrastructure development accelerates with governments and private companies investing in comprehensive carbon management networks including capture, transport, and utilization facilities. These infrastructure investments create enabling conditions for widespread technology deployment.

Global adoption spreads as developing economies implement carbon pricing mechanisms and clean technology incentives. International technology transfer and financing mechanisms support deployment in emerging markets, expanding global market potential significantly.

The carbon capture and utilization market represents a transformative opportunity to address climate change while creating substantial economic value through innovative technologies and business models. Market dynamics demonstrate strong growth momentum driven by environmental regulations, corporate sustainability commitments, and continuous technological advancement across multiple application areas.

Technology development progresses rapidly with improving economics and expanding commercial viability across diverse applications from chemical production to building materials. The sector’s evolution from experimental concept to commercial reality reflects successful collaboration between research institutions, technology companies, and industrial partners committed to sustainable solutions.

Market opportunities continue expanding as new applications emerge and existing technologies achieve cost competitiveness with conventional alternatives. Geographic expansion into emerging markets, integration with renewable energy systems, and development of circular economy business models provide substantial growth potential for innovative companies and investors.

Future success in the carbon capture and utilization market requires strategic focus on proven technologies, strong partnership development, and careful risk management while maintaining flexibility to capitalize on emerging opportunities. Companies that effectively navigate these requirements while delivering environmental and economic benefits will establish leadership positions in this rapidly evolving market.

What is Carbon Capture And Utilization?

Carbon Capture And Utilization refers to the process of capturing carbon dioxide emissions from sources like power plants and industrial processes and converting it into useful products, such as fuels, chemicals, and building materials.

What are the key players in the Carbon Capture And Utilization Market?

Key players in the Carbon Capture And Utilization Market include companies like Climeworks, Carbon Clean Solutions, and LanzaTech, which are actively developing technologies to capture and utilize carbon emissions, among others.

What are the main drivers of the Carbon Capture And Utilization Market?

The main drivers of the Carbon Capture And Utilization Market include increasing regulatory pressures to reduce greenhouse gas emissions, advancements in capture technologies, and the growing demand for sustainable products across various industries.

What challenges does the Carbon Capture And Utilization Market face?

Challenges in the Carbon Capture And Utilization Market include high operational costs, the need for significant infrastructure investment, and public acceptance of new technologies and processes.

What opportunities exist in the Carbon Capture And Utilization Market?

Opportunities in the Carbon Capture And Utilization Market include the potential for innovation in carbon utilization technologies, partnerships between industries and governments, and the expansion of carbon markets that incentivize carbon capture efforts.

What trends are shaping the Carbon Capture And Utilization Market?

Trends shaping the Carbon Capture And Utilization Market include the integration of artificial intelligence for optimizing capture processes, increased investment in research and development, and a focus on circular economy principles to enhance sustainability.

Carbon Capture And Utilization Market

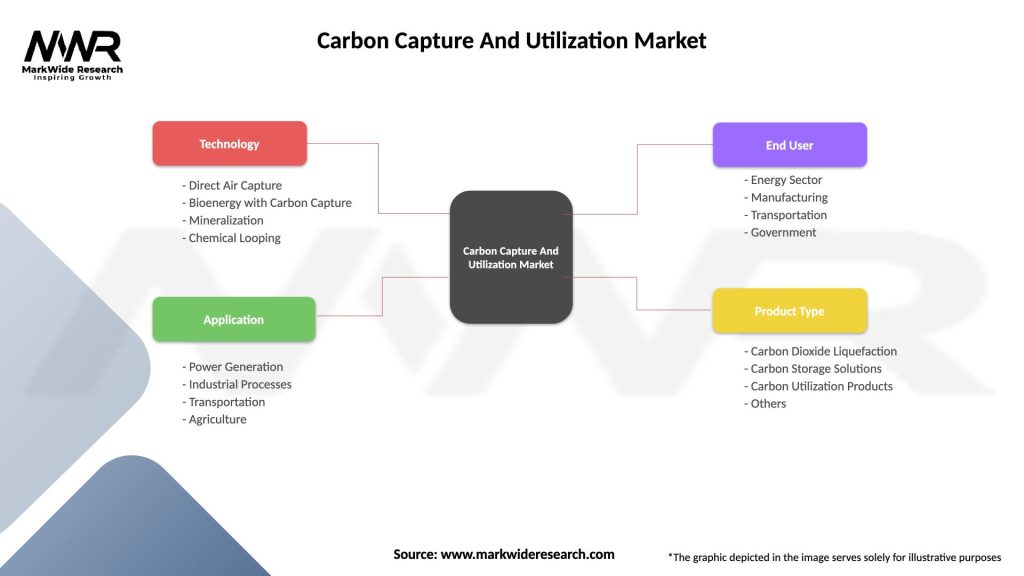

| Segmentation Details | Description |

|---|---|

| Technology | Direct Air Capture, Bioenergy with Carbon Capture, Mineralization, Chemical Looping |

| Application | Power Generation, Industrial Processes, Transportation, Agriculture |

| End User | Energy Sector, Manufacturing, Transportation, Government |

| Product Type | Carbon Dioxide Liquefaction, Carbon Storage Solutions, Carbon Utilization Products, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Carbon Capture And Utilization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at