444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The carbon black in Europe market represents a critical segment of the global specialty chemicals industry, experiencing robust growth driven by increasing demand from automotive, tire manufacturing, and industrial applications. Carbon black, a fine black powder produced through the incomplete combustion of petroleum products, serves as an essential reinforcing agent and pigment across multiple industries throughout European markets.

Market dynamics indicate that Europe maintains a significant position in global carbon black consumption, with the region accounting for approximately 22% of worldwide demand. The European market demonstrates strong growth potential, driven by expanding automotive production, increasing tire replacement demand, and growing applications in plastics and coatings industries. Germany, France, and Italy emerge as leading consumers, collectively representing over 60% of regional consumption.

Industrial applications continue to diversify, with carbon black finding increased usage in conductive plastics, printing inks, and specialty rubber products. The market benefits from Europe’s strong manufacturing base and stringent quality standards that favor premium carbon black grades. Sustainability initiatives across the region are driving innovation in production processes and creating opportunities for bio-based and recycled carbon black alternatives.

Technological advancements in production methods and growing emphasis on environmental compliance shape market development. European manufacturers are investing heavily in cleaner production technologies and developing specialized grades to meet evolving customer requirements across automotive, industrial, and consumer applications.

The carbon black in Europe market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of carbon black products across European countries. Carbon black is a manufactured material consisting of elemental carbon in the form of colloidal particles, produced through controlled combustion or thermal decomposition of gaseous or liquid hydrocarbons.

Primary characteristics of carbon black include its exceptional reinforcing properties, UV protection capabilities, electrical conductivity, and intense black coloration. These properties make it indispensable in tire manufacturing, where it enhances durability and performance, and in various industrial applications requiring strength enhancement or coloration.

Market scope encompasses multiple carbon black grades, including furnace black, channel black, lamp black, and specialty grades designed for specific applications. The European market includes both domestic production facilities and imported products, serving diverse end-use industries from automotive and aerospace to electronics and construction materials.

Value chain participants include raw material suppliers, carbon black manufacturers, distributors, and end-users across various industrial sectors. The market operates within a framework of European Union regulations governing chemical safety, environmental protection, and product quality standards that influence production methods and market dynamics.

Strategic positioning of the carbon black market in Europe reflects the region’s industrial strength and commitment to technological innovation. The market demonstrates resilience and growth potential, supported by robust demand from key end-use sectors and ongoing investments in production capacity and technology upgrades.

Key growth drivers include expanding automotive production, increasing tire replacement rates, and growing demand for specialty carbon black grades in emerging applications. The market benefits from Europe’s position as a major automotive manufacturing hub, with countries like Germany, France, and the United Kingdom driving significant demand for high-performance carbon black products.

Market challenges include volatile raw material costs, environmental regulations, and competition from alternative materials. However, these challenges also create opportunities for innovation and development of sustainable production methods. Regulatory compliance drives demand for premium grades and environmentally friendly production processes.

Competitive landscape features both global players and regional specialists, with companies focusing on product differentiation, customer service, and sustainable practices. The market shows increasing consolidation trends, with larger players acquiring smaller operations to expand geographic reach and technical capabilities.

Future prospects remain positive, supported by ongoing industrialization, infrastructure development, and growing applications in emerging technologies such as electric vehicles and renewable energy systems. The market is expected to maintain steady growth, driven by innovation and expanding end-use applications.

Market segmentation reveals diverse applications and customer requirements across the European carbon black landscape. Understanding these key insights provides valuable perspective on market dynamics and growth opportunities:

Automotive industry expansion serves as the primary driver for carbon black demand in Europe. The region’s position as a global automotive manufacturing hub, with major production facilities across Germany, France, Spain, and Eastern European countries, creates substantial demand for high-quality carbon black products used in tire manufacturing and automotive components.

Tire replacement market growth provides consistent demand drivers, supported by increasing vehicle ownership, longer driving distances, and aging vehicle fleets requiring tire replacements. European tire manufacturers emphasize performance and safety, driving demand for premium carbon black grades that enhance tire durability and performance characteristics.

Industrial diversification expands carbon black applications beyond traditional uses. Growing demand from plastics, coatings, and specialty chemicals industries creates new market opportunities. Conductive plastics for electronics applications and specialty inks for printing industries represent rapidly growing segments with higher value propositions.

Infrastructure development across Europe, particularly in Eastern European countries, drives demand for construction materials, automotive products, and industrial goods containing carbon black. Government investments in transportation infrastructure and urban development projects support sustained market growth.

Technological advancement in production processes enables manufacturers to develop specialized carbon black grades with enhanced properties. These innovations open new application areas and allow premium pricing for superior products, supporting market value growth and profitability improvements.

Raw material price volatility presents significant challenges for carbon black manufacturers in Europe. Fluctuating petroleum feedstock costs directly impact production expenses and profit margins, creating uncertainty in pricing strategies and long-term planning. Energy cost fluctuations further compound these challenges, particularly given Europe’s energy market dynamics.

Environmental regulations impose increasing compliance costs and operational constraints on carbon black production facilities. European Union environmental standards require substantial investments in emission control systems, waste management, and process optimization. These regulatory requirements, while promoting sustainability, increase operational complexity and costs.

Competition from alternatives challenges traditional carbon black applications. Silica-based reinforcing agents in tire manufacturing and alternative pigments in various applications create competitive pressure. Bio-based alternatives and recycled materials gain market acceptance, potentially displacing conventional carbon black in certain applications.

Economic uncertainty affects demand patterns across key end-use industries. Economic downturns impact automotive production, construction activity, and industrial manufacturing, directly affecting carbon black consumption. Brexit implications and trade policy changes create additional uncertainty for market participants.

Supply chain disruptions pose operational challenges, particularly for companies dependent on imported raw materials or serving international markets. Transportation costs, logistics complexity, and potential trade restrictions affect market dynamics and profitability.

Electric vehicle growth creates new opportunities for specialized carbon black applications. While electric vehicles may reduce traditional tire demand, they require advanced materials for battery components, conductive plastics, and specialized rubber products. Battery technology applications represent emerging high-value market segments.

Sustainable production methods offer competitive advantages and market differentiation opportunities. Companies investing in cleaner production technologies, waste reduction, and circular economy principles can capture environmentally conscious customers and comply with evolving regulations. Bio-based carbon black development presents significant growth potential.

Specialty applications expansion provides higher-margin opportunities beyond traditional tire and rubber applications. Growing demand for conductive plastics, advanced coatings, and specialty inks creates premium market segments with less price sensitivity and stronger customer relationships.

Eastern European market development offers substantial growth potential as these economies continue industrialization and infrastructure development. Expanding automotive production, improving living standards, and increasing industrial activity drive carbon black demand growth in these emerging markets.

Technology partnerships and collaborative innovation with end-users enable development of customized solutions and strengthen customer relationships. Research and development investments in advanced materials and production processes create competitive advantages and market leadership opportunities.

Supply-demand balance in the European carbon black market reflects complex interactions between production capacity, import flows, and end-use demand patterns. The market demonstrates cyclical characteristics aligned with automotive production cycles and broader economic conditions, with capacity utilization rates typically ranging between 75-85% during normal operating conditions.

Pricing mechanisms incorporate raw material costs, energy expenses, and market competition factors. European carbon black pricing often follows global trends while reflecting regional supply-demand dynamics and currency fluctuations. Contract pricing predominates in large-volume applications, while spot pricing applies to specialty grades and smaller volumes.

Competitive intensity varies across market segments, with commodity grades experiencing intense price competition while specialty applications offer better margins and customer loyalty. Product differentiation through quality, service, and technical support becomes increasingly important for maintaining competitive positions.

Innovation cycles drive market evolution, with companies investing in new production technologies, product development, and application research. Customer collaboration in product development strengthens relationships and creates barriers to competitor entry in specialized applications.

Regulatory influence shapes market dynamics through environmental standards, safety requirements, and trade policies. Companies must balance compliance costs with competitive positioning while adapting to evolving regulatory landscapes across different European countries.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European carbon black market. The research approach combines quantitative data analysis with qualitative industry expertise to provide complete market understanding.

Primary research involves extensive interviews with industry participants across the value chain, including manufacturers, distributors, end-users, and industry experts. These interviews provide insights into market trends, competitive dynamics, and future outlook that complement quantitative data analysis.

Secondary research encompasses analysis of industry publications, company reports, government statistics, and trade association data. This research provides historical context, market sizing information, and trend analysis that supports primary research findings.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and statistical analysis. Market estimates undergo rigorous validation to provide confidence in research conclusions and recommendations.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend analysis that provide actionable insights for market participants. The methodology ensures comprehensive coverage of market dynamics and growth opportunities.

Western Europe dominates carbon black consumption, led by Germany which accounts for approximately 25% of regional demand. German automotive industry strength, including major manufacturers like BMW, Mercedes-Benz, and Volkswagen, drives substantial tire and automotive component demand. The country’s advanced manufacturing sector also creates significant demand for specialty carbon black applications.

France represents the second-largest market, with strong automotive production and diverse industrial applications. French tire manufacturers and automotive suppliers create consistent demand for high-quality carbon black products. The country’s focus on sustainable manufacturing practices drives innovation in production methods and alternative materials.

Italy and Spain contribute significantly to regional consumption, with growing automotive production and expanding industrial sectors. These markets demonstrate increasing demand for specialty grades and value-added applications beyond traditional tire manufacturing.

Eastern European countries, including Poland, Czech Republic, and Hungary, represent rapidly growing markets with expanding automotive production and industrial development. These regions attract international investment in manufacturing facilities, driving carbon black demand growth at rates exceeding 5% annually.

United Kingdom maintains significant market presence despite Brexit challenges, with established automotive and industrial sectors creating steady demand. The market focuses increasingly on high-value applications and sustainable production methods.

Nordic countries demonstrate strong demand for premium carbon black grades, driven by advanced manufacturing sectors and environmental consciousness. These markets often serve as testing grounds for new sustainable products and production technologies.

Market leadership in European carbon black is characterized by a mix of global players and regional specialists, each competing through different strategies including cost leadership, product differentiation, and customer service excellence.

Competitive strategies vary significantly across market participants, with established players focusing on product innovation and customer relationships while newer entrants compete primarily on price and availability. Vertical integration trends enable better cost control and supply chain management.

Market consolidation continues as companies seek scale advantages and geographic expansion. Strategic acquisitions and partnerships enable access to new markets and technologies while improving operational efficiency.

By Product Type:

By Application:

By End-Use Industry:

Furnace Black Category dominates the European market through its versatility and cost-effectiveness. This category serves primarily tire manufacturing applications where reinforcement properties and durability are critical. Production efficiency improvements and quality enhancements continue to strengthen this segment’s market position.

Specialty Carbon Black represents the highest growth potential category, driven by emerging applications in electronics, advanced materials, and sustainable technologies. These products command premium pricing and offer better margins, making them attractive for manufacturers seeking value-added opportunities.

Conductive Carbon Black emerges as a rapidly growing subcategory, driven by electronics industry demand and electric vehicle applications. This segment requires specialized production capabilities and technical expertise, creating barriers to entry and supporting premium pricing.

Sustainable Grades gain increasing market attention as environmental consciousness grows. Bio-based carbon black and products from recycled materials represent emerging categories with significant long-term potential, despite current limited commercial availability.

High-Performance Grades for automotive applications continue expanding as vehicle manufacturers demand improved performance and efficiency. These specialized products require close customer collaboration and technical support, strengthening supplier-customer relationships.

Manufacturers benefit from diverse application opportunities and growing demand across multiple end-use industries. The European market offers stable demand, premium pricing opportunities for specialty products, and access to advanced manufacturing technologies and skilled workforce.

End-users gain access to high-quality carbon black products that enhance their product performance and competitiveness. European suppliers typically offer superior technical support, consistent quality, and reliable supply chains that support customer success.

Distributors benefit from growing market demand and opportunities to add value through technical services, inventory management, and customer support. The market’s complexity creates opportunities for specialized distribution services and customer relationship management.

Technology providers find opportunities to develop and supply advanced production equipment, environmental control systems, and process optimization solutions. The industry’s focus on sustainability and efficiency creates demand for innovative technologies.

Investors can access a stable, growing market with opportunities for both established players and emerging companies. The market’s essential nature and diverse applications provide defensive characteristics while specialty segments offer growth potential.

Research institutions benefit from industry collaboration opportunities in developing new materials, production processes, and applications. The industry’s innovation focus creates partnerships and funding opportunities for advanced research projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as the dominant trend shaping the European carbon black market. Companies increasingly invest in cleaner production technologies, waste reduction initiatives, and circular economy approaches. Bio-based carbon black development gains momentum as companies seek alternatives to petroleum-based feedstocks.

Digitalization and Industry 4.0 transform production processes and customer relationships. Smart manufacturing systems, predictive maintenance, and digital supply chain management improve efficiency and reduce costs. Data analytics enable better demand forecasting and inventory optimization.

Specialty Product Focus drives market evolution as companies seek higher-margin opportunities beyond commodity grades. Customized solutions for specific customer requirements become increasingly important for competitive differentiation and customer retention.

Supply Chain Localization trends emerge as companies seek to reduce dependency on distant suppliers and improve supply security. Regional sourcing strategies and local production investments gain priority following recent supply chain disruptions.

Collaborative Innovation between suppliers and customers accelerates product development and application expansion. Technical partnerships enable development of specialized solutions and strengthen customer relationships in competitive markets.

Circular Economy Implementation creates opportunities for waste-to-carbon-black technologies and recycled content integration. Companies explore tire pyrolysis and other waste conversion technologies to create sustainable supply sources.

Production Capacity Expansions continue across Europe as companies respond to growing demand and seek to improve supply security. Major investments in Eastern European facilities provide cost advantages while serving growing regional markets.

Technology Acquisitions accelerate as companies seek to enhance their capabilities in specialty products and sustainable production. Strategic partnerships with technology providers enable access to advanced production methods and new applications.

Sustainability Certifications become increasingly important as customers demand verified environmental performance. Companies invest in third-party certifications and sustainability reporting to meet customer requirements and regulatory expectations.

Research and Development investments focus on bio-based alternatives, advanced production processes, and new applications. University partnerships and government-funded research programs support innovation in sustainable technologies.

Market Consolidation continues through strategic acquisitions and mergers as companies seek scale advantages and geographic expansion. Vertical integration strategies enable better cost control and supply chain management.

Digital Transformation initiatives improve operational efficiency and customer service capabilities. Companies implement digital platforms for customer interaction, order management, and technical support services.

MarkWide Research analysis indicates that European carbon black market participants should prioritize sustainability initiatives and specialty product development to maintain competitive advantages. Companies should invest in cleaner production technologies and develop bio-based alternatives to address growing environmental concerns.

Strategic recommendations include focusing on high-value applications where technical expertise and customer relationships provide competitive protection. Companies should develop specialized grades for emerging applications in electronics, electric vehicles, and advanced materials.

Geographic expansion into Eastern European markets offers significant growth opportunities, particularly for companies with cost-competitive production capabilities. Local partnerships and distribution agreements can provide market access while minimizing investment requirements.

Technology investments in digitalization and automation can improve operational efficiency and reduce production costs. Companies should implement predictive maintenance systems and digital supply chain management to enhance competitiveness.

Customer collaboration in product development strengthens relationships and creates opportunities for customized solutions. Companies should invest in technical support capabilities and application development to differentiate their offerings.

Supply chain diversification reduces risks associated with raw material availability and price volatility. Companies should develop multiple supplier relationships and consider backward integration opportunities where economically viable.

Market growth prospects remain positive for the European carbon black market, supported by continued industrial development, automotive production, and emerging applications. MWR projections indicate steady growth driven by specialty applications and sustainable product development.

Technology evolution will continue shaping market dynamics, with bio-based production methods and advanced materials applications gaining commercial viability. Electric vehicle adoption creates new demand patterns while potentially reducing traditional tire-related consumption.

Regulatory developments will increasingly influence market structure and competitive dynamics. Companies investing early in sustainable technologies and compliance capabilities will gain competitive advantages as regulations become more stringent.

Market consolidation trends are expected to continue as companies seek scale advantages and geographic expansion. Strategic partnerships and acquisitions will reshape competitive landscapes while creating opportunities for specialized players.

Innovation focus on sustainability and specialty applications will drive market value growth even if volume growth moderates. Companies developing advanced materials and sustainable production methods will capture premium market segments.

Regional development in Eastern Europe will continue providing growth opportunities, while Western European markets focus increasingly on high-value applications and sustainable solutions. The market is expected to maintain its position as a global leader in quality and innovation.

The carbon black in Europe market demonstrates resilience and growth potential despite facing challenges from raw material volatility, environmental regulations, and competitive pressures. The market’s foundation in essential applications across automotive, industrial, and specialty sectors provides stability while emerging opportunities in sustainable technologies and advanced materials offer significant growth potential.

Strategic positioning for success requires balancing traditional market strengths with innovation in sustainability and specialty applications. Companies that invest in cleaner production technologies, develop bio-based alternatives, and focus on high-value market segments will be best positioned for long-term success in the evolving European market landscape.

Market evolution toward sustainability and specialization creates both challenges and opportunities for industry participants. The companies that successfully navigate regulatory requirements, customer demands for sustainable products, and competitive pressures while maintaining operational excellence will emerge as market leaders in the next phase of industry development.

What is Carbon Black?

Carbon black is a fine black powder made from burning hydrocarbons in insufficient air. It is primarily used as a reinforcing agent in rubber products, particularly tires, and as a pigment in various applications including coatings and plastics.

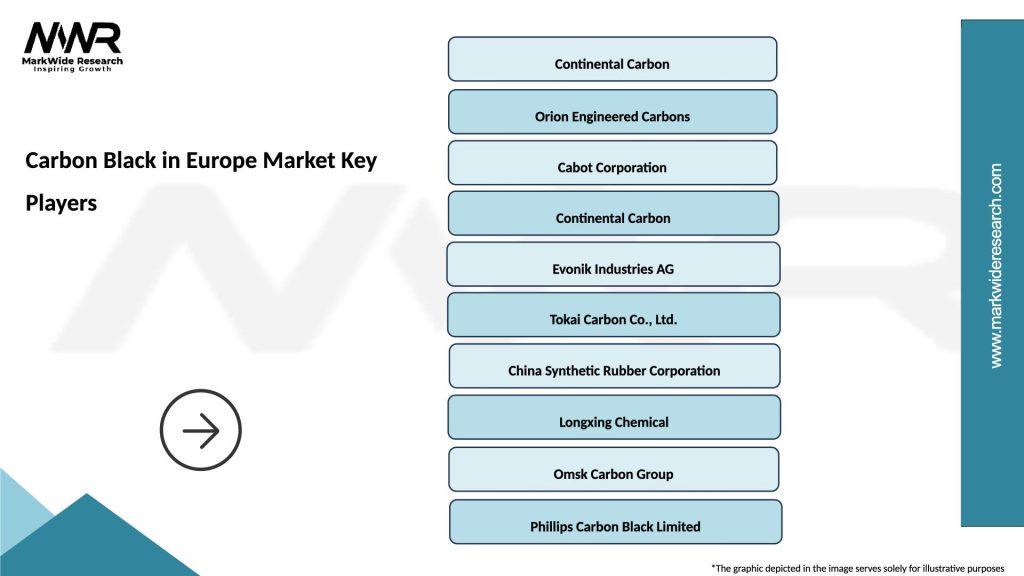

What are the key players in the Carbon Black in Europe Market?

Key players in the Carbon Black in Europe Market include Continental Carbon, Orion Engineered Carbons, and Cabot Corporation, among others. These companies are involved in the production and supply of carbon black for various applications such as automotive, industrial, and consumer goods.

What are the growth factors driving the Carbon Black in Europe Market?

The growth of the Carbon Black in Europe Market is driven by the increasing demand for tires in the automotive industry and the rising use of carbon black in coatings and plastics. Additionally, the expansion of the construction and electronics sectors contributes to market growth.

What challenges does the Carbon Black in Europe Market face?

The Carbon Black in Europe Market faces challenges such as environmental regulations regarding emissions and the volatility of raw material prices. These factors can impact production costs and sustainability efforts within the industry.

What opportunities exist in the Carbon Black in Europe Market?

Opportunities in the Carbon Black in Europe Market include the development of sustainable carbon black alternatives and innovations in production technologies. Additionally, the growing demand for electric vehicles presents new avenues for carbon black applications.

What trends are shaping the Carbon Black in Europe Market?

Trends shaping the Carbon Black in Europe Market include a shift towards eco-friendly products and the integration of advanced manufacturing technologies. Furthermore, the increasing focus on recycling and circular economy practices is influencing the market landscape.

Carbon Black in Europe Market

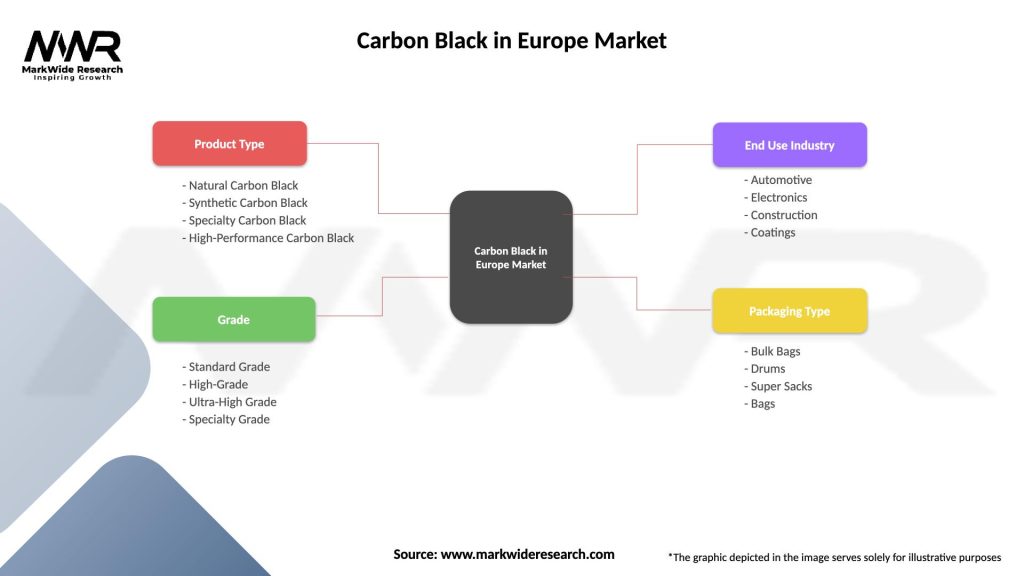

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Carbon Black, Synthetic Carbon Black, Specialty Carbon Black, High-Performance Carbon Black |

| Grade | Standard Grade, High-Grade, Ultra-High Grade, Specialty Grade |

| End Use Industry | Automotive, Electronics, Construction, Coatings |

| Packaging Type | Bulk Bags, Drums, Super Sacks, Bags |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Carbon Black in Europe Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at