444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Carbon Battery Bank market is experiencing significant growth and is expected to expand at a substantial rate in the coming years. With increasing concerns about environmental sustainability and the need for clean energy solutions, carbon battery banks have gained traction as an efficient and eco-friendly alternative to traditional battery systems.

Meaning

A carbon battery bank refers to a collection of interconnected carbon-based batteries that store electrical energy. These batteries utilize carbon as a primary material for both the anode and cathode, which enhances their performance and reduces their environmental impact. Carbon battery banks are designed to provide reliable and sustainable power storage solutions for various applications, including renewable energy integration, electric vehicles, and off-grid systems.

Executive Summary

The Carbon Battery Bank market has witnessed remarkable growth in recent years due to the rising demand for clean energy solutions and the increasing adoption of electric vehicles. These battery banks offer numerous advantages over conventional battery technologies, such as improved energy density, longer lifespan, and reduced carbon footprint. The market is highly competitive, with several key players investing in research and development activities to enhance the performance and efficiency of carbon battery banks.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Carbon Battery Bank market is highly dynamic and influenced by various factors, including technological advancements, government regulations, and consumer preferences. Rapid advancements in battery technologies, coupled with the increasing adoption of clean energy solutions, are driving the market forward. However, challenges related to cost, energy density, and scalability need to be addressed to unlock the full potential of carbon battery banks. The market is competitive, with key players investing in research and development activities to gain a competitive edge.

Regional Analysis

The Carbon Battery Bank market can be analyzed across various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are currently the leading markets, driven by favorable government policies, significant investments in renewable energy, and a mature electric vehicle market. Asia Pacific is expected to witness substantial growth due to the rapid industrialization, urbanization, and increasing focus on clean energy sources in countries like China and India. Latin America and the Middle East and Africa offer untapped opportunities for market players, with increasing investments in renewable energy infrastructure.

Competitive Landscape

Leading Companies in the Carbon Battery Bank Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Carbon Battery Bank market can be segmented based on battery type, application, and end-use industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Carbon Battery Bank market. While the initial phase of the pandemic resulted in disruptions in the supply chain and manufacturing activities, the market rebounded quickly due to the growing demand for clean energy solutions. The pandemic highlighted the importance of reliable energy storage systems, particularly for remote areas and critical infrastructure. As governments and industries emphasize sustainable recovery and resilience, the adoption of carbon battery banks is expected to accelerate.

Key Industry Developments

The Carbon Battery Bank Market is evolving with key developments, including:

Analyst Suggestions

Future Outlook

The future outlook for the Carbon Battery Bank market is highly promising. The market is expected to witness robust growth driven by increasing investments in renewable energy, the rising adoption of electric vehicles, and the need for sustainable energy storage solutions. Technological advancements and ongoing research and development efforts will play a crucial role in improving the performance, efficiency, and cost-effectiveness of carbon battery banks. As the world strives for a greener and cleaner future, carbon battery banks are set to become an integral part of the energy landscape.

Conclusion

The Carbon Battery Bank market is poised for significant growth, driven by the increasing demand for clean energy solutions and the rapid adoption of electric vehicles. These battery banks offer several advantages, including enhanced energy storage capabilities, reduced carbon footprint, and longer lifespan. While challenges exist, such as high initial investment costs and lower energy density compared to some conventional batteries, ongoing research and development efforts are addressing these limitations. With favorable government policies, technological advancements, and growing market awareness, carbon battery banks are expected to play a vital role in the transition towards a sustainable and low-carbon future.

What is Carbon Battery Bank?

A Carbon Battery Bank refers to a type of energy storage system that utilizes carbon-based materials to store and release electrical energy. These systems are designed to provide efficient energy management for various applications, including renewable energy integration and grid stabilization.

What are the key players in the Carbon Battery Bank market?

Key players in the Carbon Battery Bank market include companies like Tesla, Panasonic, and A123 Systems, which are known for their advancements in battery technology and energy storage solutions. These companies are actively involved in developing innovative carbon battery technologies, among others.

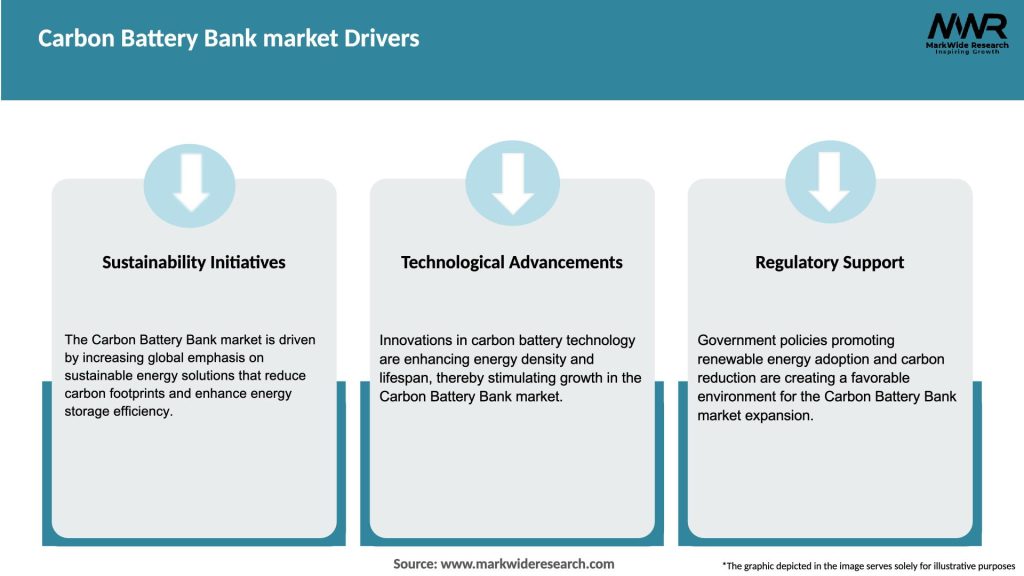

What are the main drivers of the Carbon Battery Bank market?

The main drivers of the Carbon Battery Bank market include the increasing demand for renewable energy sources, the need for efficient energy storage solutions, and advancements in carbon-based battery technologies. These factors contribute to the growing adoption of carbon battery systems in various sectors.

What challenges does the Carbon Battery Bank market face?

The Carbon Battery Bank market faces challenges such as high production costs, limited awareness of carbon battery technology, and competition from established battery technologies like lithium-ion. These factors can hinder market growth and adoption in certain applications.

What opportunities exist in the Carbon Battery Bank market?

Opportunities in the Carbon Battery Bank market include the potential for integration with electric vehicles, the expansion of renewable energy projects, and the development of smart grid technologies. These areas present significant growth prospects for carbon battery solutions.

What trends are shaping the Carbon Battery Bank market?

Trends shaping the Carbon Battery Bank market include the increasing focus on sustainability, innovations in carbon material usage, and the rise of hybrid energy storage systems. These trends are driving research and development efforts in the field of carbon-based energy storage.

Carbon Battery Bank market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Systems, Portable Units, Stationary Solutions, Hybrid Models |

| End User | Residential Users, Commercial Facilities, Industrial Plants, Renewable Energy Providers |

| Technology | Graphene-Based, Lithium-Ion, Solid-State, Flow Batteries |

| Application | Energy Storage, Backup Power, Grid Stabilization, Electric Vehicle Charging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Carbon Battery Bank Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at