444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The capital restructuring services market plays a crucial role in the financial landscape, offering companies strategic solutions to optimize their capital structure. Capital restructuring involves altering a company’s financial framework to enhance its operational efficiency, financial stability, and overall value. This market is driven by factors such as changing market dynamics, mergers and acquisitions, debt management, and the pursuit of sustainable growth strategies. Capital restructuring services have become essential for businesses seeking to adapt to evolving market conditions and secure long-term success.

Meaning:

Capital restructuring services encompass a range of financial strategies aimed at optimizing a company’s capital mix. These services involve assessing a company’s existing capital structure, including equity, debt, and hybrid instruments, and making strategic adjustments to enhance financial performance. Capital restructuring can involve debt refinancing, equity issuance, divestitures, mergers, and other financial maneuvers designed to align a company’s financial structure with its business goals.

Executive Summary:

The capital restructuring services market is experiencing a transformative phase, driven by the need for businesses to adapt to changing financial landscapes. Companies are seeking expert guidance to navigate complex scenarios, such as mergers, acquisitions, and debt management. The market’s growth is fueled by the demand for specialized financial strategies that optimize capital allocation, reduce financial risk, and position companies for sustainable growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

The capital restructuring services market emphasizes financial expertise, strategic planning, and a deep understanding of market dynamics. Service providers offer tailored solutions that address a company’s unique financial challenges, helping them optimize their financial structure for improved performance. As businesses face increasing pressure to manage debt, enhance shareholder value, and pursue growth opportunities, capital restructuring services become pivotal in their decision-making process.

Market Drivers:

The growth of the capital restructuring services market is influenced by several factors. One of the primary drivers is the dynamic nature of the business environment, where companies often face changing market conditions, regulatory shifts, and technological disruptions. These factors can necessitate financial restructuring to ensure agility, competitiveness, and financial resilience.

Market Restraints:

While capital restructuring services offer valuable benefits, challenges exist. One major restraint is the complexity of financial maneuvering involved in restructuring. Companies may encounter resistance from stakeholders, regulatory hurdles, or difficulties in aligning financial decisions with business objectives. Navigating these obstacles requires expertise and careful planning.

Market Opportunities:

The market presents opportunities driven by the increasing need for specialized financial advice. As companies navigate uncertain economic conditions, pursue growth strategies, or manage debt burdens, they require expert insights to make informed financial decisions. Service providers that offer comprehensive capital restructuring solutions can position themselves as essential partners in a company’s financial journey.

Market Dynamics:

The capital restructuring services market is characterized by the interplay of financial expertise, market insights, and strategic foresight. The ability to assess a company’s financial health, identify opportunities for improvement, and devise tailored restructuring plans positions service providers as key players in shaping a company’s financial trajectory.

Regional Analysis:

The demand for capital restructuring services varies across different regions and industries. Economically diverse regions experience varying levels of corporate restructuring needs. Industries undergoing transformation, such as technology and finance, often require capital restructuring services to align their financial structures with their growth strategies.

Competitive Landscape:

Leading Companies in the Capital Restructuring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

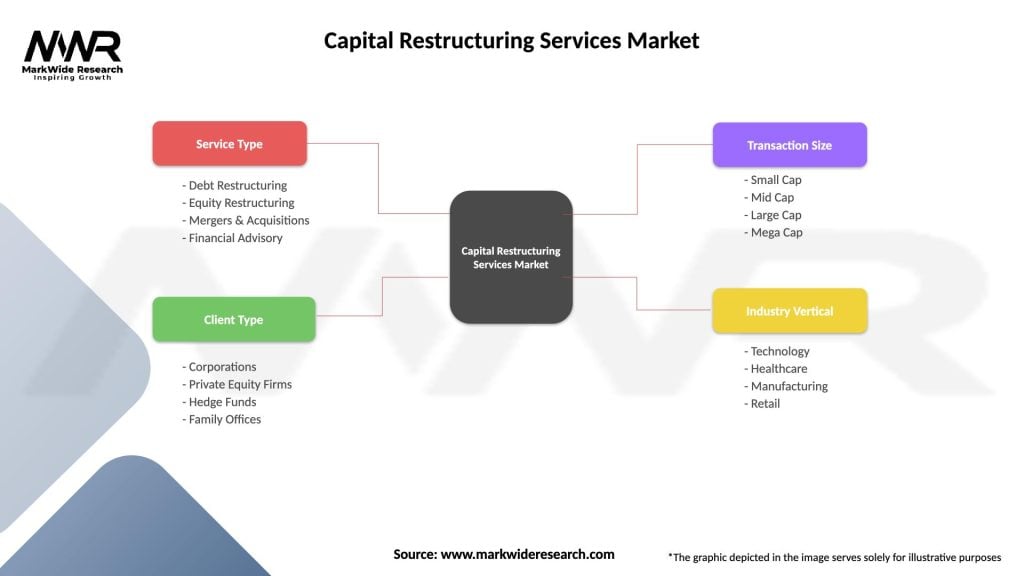

Segmentation:

The capital restructuring services market can be segmented based on factors such as service type, industry, company size, and geographic region. Service types may include debt restructuring, equity refinancing, mergers and acquisitions advisory, and distressed asset management. Industries seeking capital restructuring solutions span sectors such as manufacturing, healthcare, energy, and finance.

Category-wise Insights:

In the manufacturing sector, capital restructuring services help companies optimize their financial structure to invest in modernizing operations, R&D, and expansion. In healthcare, financial advisors assist in managing debt and optimizing capital to support investments in medical technology and patient care. In finance, companies seek strategies to enhance shareholder value and adapt to regulatory changes.

Key Benefits for Industry Participants and Stakeholders:

Industry participants and stakeholders in the capital restructuring services market stand to gain from the increasing demand for financial expertise. By providing tailored capital restructuring solutions, service providers can help companies navigate challenges, seize growth opportunities, and enhance their financial performance. Stakeholders benefit from optimized capital allocation and improved long-term financial stability.

SWOT Analysis:

Market Key Trends:

The capital restructuring services market is witnessing several key trends:

Covid-19 Impact:

The Covid-19 pandemic had significant implications for the capital restructuring services market. Many businesses faced liquidity challenges, debt burdens, and disruptions to their operations. As a result, the demand for expert financial advice and capital restructuring solutions surged, enabling companies to navigate the economic uncertainties.

Key Industry Developments:

Industry developments include the emergence of innovative financial instruments for restructuring, as well as the integration of ESG considerations into capital restructuring strategies. Financial advisory firms are also leveraging data analytics and technology to offer more accurate and impactful restructuring solutions.

Analyst Suggestions:

Analysts suggest that capital restructuring service providers should focus on building holistic solutions that address not only immediate financial challenges but also align with a company’s long-term strategic goals. By staying updated on market trends, regulations, and industry shifts, service providers can offer timely and relevant advice to their clients.

Future Outlook:

The future outlook for the capital restructuring services market is positive, as businesses continue to navigate complex financial landscapes. The demand for specialized financial expertise is expected to grow, particularly as industries adapt to changing market conditions and pursue sustainable growth strategies. The integration of technology, data analytics, and sustainable finance principles will likely shape the market’s trajectory.

Conclusion:

In conclusion, the capital restructuring services market plays a vital role in guiding businesses through financial challenges and opportunities. As companies strive for financial resilience, efficient capital allocation, and sustainable growth, the expertise of capital restructuring service providers becomes invaluable. By offering strategic advice, tailored solutions, and insights into evolving market dynamics, these providers are positioned to facilitate the financial success and longevity of businesses in a dynamic and ever-changing economic landscape.

The capital restructuring services market stands as a vital pillar in the realm of financial management and corporate strategy. As businesses navigate through the complexities of ever-changing economic landscapes, the demand for effective capital restructuring solutions has surged. This market plays a pivotal role in assisting companies in optimizing their financial structures, enhancing liquidity, and achieving sustainable growth.

What is Capital Restructuring Services?

Capital Restructuring Services refer to the financial strategies and advisory services aimed at reorganizing a company’s capital structure. This can involve debt restructuring, equity financing, and optimizing financial resources to improve overall business performance.

What are the key players in the Capital Restructuring Services Market?

Key players in the Capital Restructuring Services Market include firms like Lazard, Houlihan Lokey, and Rothschild & Co. These companies provide expert advisory services to businesses undergoing financial restructuring, among others.

What are the main drivers of growth in the Capital Restructuring Services Market?

The growth of the Capital Restructuring Services Market is driven by increasing corporate debt levels, the need for financial optimization, and the rising number of mergers and acquisitions. Additionally, economic uncertainties often prompt companies to seek restructuring services to enhance financial stability.

What challenges does the Capital Restructuring Services Market face?

Challenges in the Capital Restructuring Services Market include regulatory complexities, the potential for market volatility, and the difficulty in accurately assessing a company’s financial health. These factors can complicate the restructuring process and impact service demand.

What opportunities exist in the Capital Restructuring Services Market?

Opportunities in the Capital Restructuring Services Market include the growing trend of digital transformation in financial services and the increasing demand for sustainable financing solutions. Companies are also looking for innovative restructuring strategies to adapt to changing market conditions.

What trends are shaping the Capital Restructuring Services Market?

Trends in the Capital Restructuring Services Market include a shift towards more integrated financial advisory services and the use of advanced analytics for decision-making. Additionally, there is a rising focus on environmental, social, and governance (ESG) factors in restructuring strategies.

Capital Restructuring Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Debt Restructuring, Equity Restructuring, Mergers & Acquisitions, Financial Advisory |

| Client Type | Corporations, Private Equity Firms, Hedge Funds, Family Offices |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

| Industry Vertical | Technology, Healthcare, Manufacturing, Retail |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Capital Restructuring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at