444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The capillary underfill material market serves as a critical component within the semiconductor packaging industry, providing solutions for void-free encapsulation and protection of integrated circuits (ICs). These materials fill the gap between the IC and its package, enhancing mechanical stability, thermal performance, and reliability. With the increasing demand for compact and high-performance electronic devices, the capillary underfill material market has witnessed significant growth, driven by advancements in semiconductor technologies and the proliferation of mobile devices, automotive electronics, and IoT applications.

Meaning

Capillary underfill materials are epoxy-based compounds specifically formulated for semiconductor packaging applications. They are designed to flow through narrow gaps by capillary action, filling voids and spaces between the IC and its package during the encapsulation process. These materials provide mechanical reinforcement, stress relief, and moisture protection, ensuring the long-term reliability and performance of semiconductor devices in harsh operating environments.

Executive Summary

The capillary underfill material market has experienced robust growth, propelled by the expanding semiconductor industry and the increasing adoption of advanced packaging technologies. Market players are focusing on product innovation, customization, and strategic partnerships to address evolving customer requirements and gain a competitive edge. Key trends such as miniaturization, 5G adoption, and electric vehicle proliferation are driving market dynamics, shaping the future outlook of the capillary underfill material market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The global Capillary Underfill Material market is forecast to achieve double-digit growth rates, reflecting the rapid adoption of advanced packaging technologies such as FOWLP and SiP in electronics manufacturing.

Automotive electronics represent the fastest-growing end-use segment, as underfills become critical for ensuring the longevity of power modules, sensors, and control units in electric vehicles and ADAS applications.

Demand for underfills with improved thermal conductivity and low CTE is rising sharply in high-performance computing systems and 5G infrastructure to manage heat dissipation and reduce thermal stress.

Shifts toward lead-free soldering and stricter reliability standards under environmental regulations are driving the replacement of traditional assembly methods with underfill-based packaging.

Innovations in material chemistry—such as no-flow underfills compatible with panel-level packaging and moisture-resistant formulations for harsh environments—are creating new application niches and boosting market growth.

Market Drivers

Several factors are propelling the growth of the Capillary Underfill Material market:

Advanced Packaging Proliferation: The widespread adoption of flip-chip, wafer-level packaging, and panel-level solutions necessitates underfill to maintain solder joint integrity and package reliability.

Automotive Electrification: Electrified powertrains and ADAS impose rigorous thermal and mechanical stress requirements, driving automotive OEMs and Tier 1 suppliers to integrate high-performance underfills in power electronics and sensor modules.

5G and High-Performance Computing: Enhanced thermal management needs in 5G base stations, servers, and data centers spur demand for underfills with superior thermal conductivity and low thermal resistance.

Miniaturization and Form Factor Reduction: Consumer electronics manufacturers continue to shrink package footprints, increasing solder joint vulnerability and reinforcing the necessity for reliable underfill materials to mitigate stress.

Regulatory Compliance: The transition to lead-free solder and stringent reliability standards (e.g., JEDEC, IEC) underscore the requirement for underfills to compensate for the mechanical limitations of tin-based solder alloys.

Market Restraints

Despite its growth potential, the market faces several challenges:

Raw Material Volatility: Fluctuations in the cost of epoxy resins, curing agents, and specialty fillers (e.g., silica, alumina) can impact underfill pricing and margins for manufacturers.

Processing Complexity: Achieving void-free underfill flow demands precise control of dispensing parameters, substrate cleanliness, and cure profiles, increasing process complexity and capital investment for manufacturers.

Compatibility Issues: Underfill formulations must be carefully matched to a wide variety of substrates, solder alloys, and surface finishes, complicating inventory management and quality control.

Supply Chain Disruptions: Global supply chain uncertainties, such as pandemics or geopolitical tensions, can delay raw material shipments, impacting production schedules and market growth.

Environmental Concerns: Some traditional underfill materials contain hazardous substances and volatile organic compounds (VOCs), prompting regulatory scrutiny and driving the need for greener formulations that may require higher R&D investment.

Market Opportunities

The Capillary Underfill Material market presents numerous avenues for expansion:

Next-Generation Underfills: The development of underfills with nano-engineered fillers for enhanced thermal conductivity, electromagnetic shielding, and flame retardancy offers opportunities for differentiation and premium pricing.

Flexible Electronics: Emerging applications in flexible displays, wearable sensors, and foldable devices demand underfills with high elongation, low modulus, and reversible mechanical properties to accommodate bending without failure.

Panel-Level and ACF Integration: No-flow underfills compatible with anisotropic conductive film (ACF) bonding processes enable large-area packaging, reducing cycle times and enabling new high-throughput manufacturing paradigms.

Circular Economy Initiatives: Development of recyclable and reworkable underfills aligns with sustainability goals and may open new markets among eco-conscious OEMs and government procurement agencies.

Emerging Geographies: Rapid growth in electronics manufacturing in Southeast Asia, Latin America, and Eastern Europe creates new demand centers, encouraging local underfill suppliers and partnerships with global material providers.

Market Dynamics

The Capillary Underfill Material market is shaped by several key trends and dynamics:

Collaborative R&D: Material suppliers are partnering with semiconductor foundries, substrate manufacturers, and OEMs to co-develop application-specific underfill formulations, shortening time-to-market and ensuring compatibility.

Customization and Formulation Flexibility: Vendors are offering a broad portfolio of underfills—standard, low-stress, no-flow, and flexible—allowing manufacturers to choose materials tailored to specific process flows and reliability requirements.

Equipment Innovations: Advances in dispensing systems—such as jetting, valve-dispensing, and micro-needle technologies—enable precise underfill placement, reduced cycle times, and minimized material waste.

Digitalization of Packaging Lines: Integration of Industry 4.0 standards, real-time monitoring, and predictive maintenance in packaging equipment improves yield and consistency in underfill processes.

Regulatory Alignment: As environmental and reliability standards evolve globally, underfill suppliers are proactively reformulating products to comply with RoHS3, REACH, and future sustainability directives.

Regional Analysis

The Capillary Underfill Material market exhibits distinct regional dynamics:

Asia-Pacific: Dominant market share driven by major electronics manufacturing hubs in China, Taiwan, South Korea, and Japan. High-volume consumer electronics, automotive electronics manufacturing, and growing semiconductor fabs bolster underfill demand.

North America: Strong demand from aerospace, defense, and high-performance computing sectors, coupled with the resurgence of semiconductor manufacturing, is fueling market growth. Local R&D investments and stringent reliability requirements drive premium underfill adoption.

Europe: Focus on automotive electronics, industrial automation, and medical devices supports steady underfill consumption. Regulatory emphasis on sustainability is accelerating the shift to low-VOC and bio-based underfill chemistries.

Latin America: Emerging market with growing electronics assembly and automotive production. Infrastructure development and increasing consumer electronics penetration provide new growth avenues, though underfill adoption lags relative to mature regions.

Middle East & Africa: Nascent underfill market, primarily in telecommunications infrastructure and defense applications. Government investments in smart city projects and energy sector digitalization offer long-term growth prospects.

Competitive Landscape

Leading Companies in the Capillary Underfill Material Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

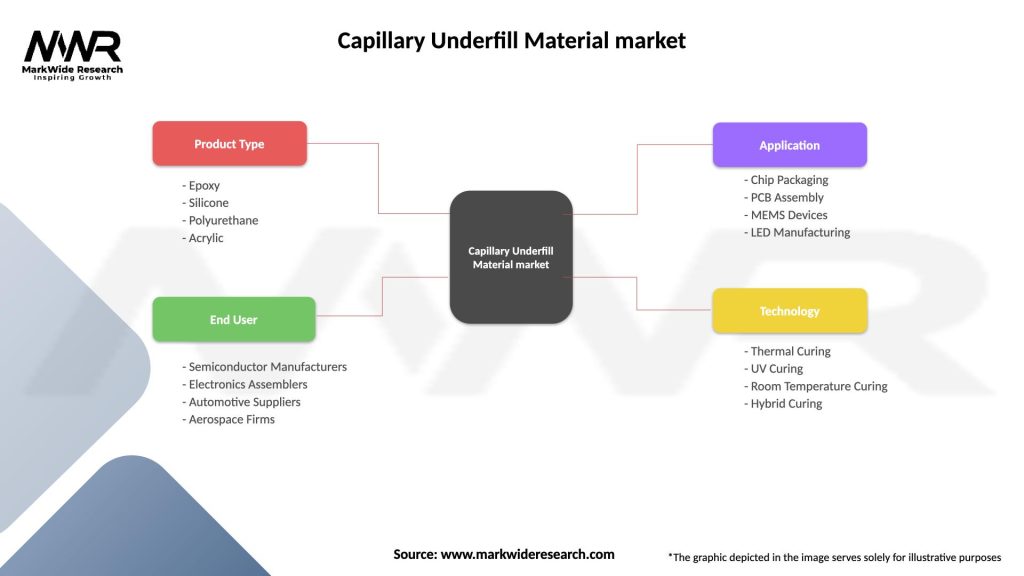

Segmentation

The Capillary Underfill Material market can be segmented on the following bases:

By Material Chemistry: Standard Epoxy Underfills, Low-Stress Epoxy Underfills, No-Flow Underfills, Flexible Underfills, Thermally Conductive Underfills.

By Application: Flip-Chip Packaging, Chip-Scale Packaging (CSP), Ball Grid Array (BGA), Wafer-Level Packaging (WLP), Fan-Out WLP (FOWLP), System-in-Package (SiP).

By End-Use Industry: Automotive, Consumer Electronics, Telecommunications, Industrial, Aerospace & Defense, Medical Devices.

By Region: Asia-Pacific, North America, Europe, Latin America, Middle East & Africa.

Category-wise Insights

Standard Epoxy Underfills: Balancing flow performance and mechanical reinforcement, these products serve mainstream flip-chip and BGA applications in consumer and industrial electronics. They offer moderate Tg and CTE matching for general-purpose use.

Low-Stress Epoxy Underfills: Engineered with flexible networks and lower modulus to reduce stress on solder joints, these underfills are preferred in multi-chip modules and large die packages commonly found in telecommunications and computing hardware.

No-Flow Underfills: Designed for panel-level packaging processes, these materials are dispensed before reflow and cure simultaneously with solder, enabling high-throughput manufacturing and reducing handling steps in mass production of mobile devices.

Flexible Underfills: Incorporating elastomeric components to provide stretchability, these formulations cater to flexible and wearable electronics, foldable displays, and bendable sensors that undergo repeated mechanical deformation.

Thermally Conductive Underfills: Loaded with ceramic or metal fillers, these underfills offer high thermal conductivity (>5 W/m·K) to dissipate heat from high-power components in automotive power modules, LED lighting, and high-performance computing.

Key Benefits for Industry Participants and Stakeholders

Enhanced Reliability: Underfills significantly extend solder joint lifecycle by mitigating thermal and mechanical stresses, reducing field failures and warranty costs for OEMs and contract manufacturers.

Thermal Management: Thermally conductive underfills help maintain optimal operating temperatures for high-power devices, improving performance and safety in automotive and telecom applications.

Process Efficiency: Advanced underfill chemistries with rapid cure cycles and optimized flow characteristics reduce assembly cycle times, boosting throughput and lowering manufacturing costs.

Design Flexibility: A diverse portfolio of underfills enables designers to select materials tailored to specific package types, substrates, and use-case environments, accelerating product development.

Regulatory Compliance: Modern underfill formulations are RoHS-compliant, low in VOC emissions, and designed to meet evolving environmental and reliability standards, facilitating market access and reducing compliance risk.

SWOT Analysis

Strengths:

Critical enabler for advanced electronics packaging reliability.

Mature material chemistries with proven performance and broad industry acceptance.

Strong supplier ecosystems and integrated process solutions.

Weaknesses:

Dependence on volatile raw material markets (epoxies, fillers).

Complex processing requirements increase capital and operational expenditures.

Inventory management challenges due to wide formulation variety.

Opportunities:

Growth in electric and autonomous vehicle electronics.

Expansion of 5G infrastructure and edge computing hardware.

Emergence of flexible and wearable device underfills.

Threats:

Supply chain disruptions affecting resin and filler availability.

Competitive pressure from low-cost regional suppliers.

Technological shifts toward solderless or adhesive-free packaging that may reduce underfill demand.

Market Key Trends

Nano-Filler Integration: The incorporation of nano-sized ceramic and metallic fillers is enhancing thermal conductivity and mechanical properties without dramatically increasing viscosity, enabling faster flow and improved heat dissipation.

Rapid-Cure Formulations: UV and dual-cure chemistries are being introduced to shorten underfill processing times and enable room-temperature handling, benefiting high-volume assembly lines.

Digital Twins and Simulation: Adoption of predictive modeling tools to simulate underfill flow, cure behavior, and stress distribution is optimizing material selection and process parameters, reducing trial-and-error in production.

Sustainability Focus: Development of bio-based resins, solvent-free formulations, and recyclable underfills aligns with corporate sustainability goals and regulatory pressures to reduce environmental footprint.

Integration with Advanced Dispensing Systems: Collaborative development between underfill suppliers and dispensing equipment manufacturers is yielding precision jetting and valve dispensing solutions that minimize material waste and improve placement accuracy.

Covid-19 Impact

The Covid-19 pandemic caused temporary disruptions in raw material supply chains and electronics assembly operations worldwide, leading to underfill shortages and production slowdowns in early 2020. However, accelerated demand for medical devices, remote computing infrastructure, and telecommunications equipment during the pandemic rebound drove strong underfill consumption in 2021–2022. Manufacturers prioritized securing inventory of critical materials—including underfills—to insulate against future disruptions. The crisis also prompted increased investment in automation and process digitalization, reducing dependence on manual underfill application and improving overall manufacturing resilience. Post-pandemic, the underfill market recovered swiftly, with pent-up demand in automotive, consumer electronics, and data center segments underpinning robust growth.

Key Industry Developments

Henkel-AMD Collaboration (2023): Joint development of a thermally conductive underfill for high-bandwidth memory modules in data centers, achieving a 30% reduction in thermal resistance compared to legacy materials.

Dow’s Rapid Underfill Launch (2024): Introduction of a UV-dual cure underfill that reduces cure cycle to under 60 seconds, enabling manufacturers to double throughput on flip-chip lines.

3M Acquisition of XYZ Materials (2022): Expanded 3M’s portfolio with flexible underfill technologies for foldable smartphone and wearable device applications.

Sumitomo Bakelite’s APAC Expansion (2023): Commissioned a new underfill manufacturing facility in Vietnam to serve Southeast Asia’s growing electronics assembly market.

Master Bond’s Aerospace Approval (2024): Secured qualification for a low-outgassing underfill in satellite and defense electronics, opening defense procurement channels.

Analyst Suggestions

Diversify Supply Chains: Companies should establish multi-sourcing strategies for key resin and filler materials to mitigate risks from geopolitical tensions and pandemic-induced disruptions.

Invest in Simulation Tools: Adoption of CFD and FEA software to model underfill behavior can accelerate optimization of material formulations and production parameters, reducing costly trial runs.

Focus on Niche Differentiation: Vendors can command premium pricing by specializing in high-performance underfills for automotive, aerospace, and flexible electronics, where reliability demands outweigh cost sensitivity.

Strengthen Customer Partnerships: Close collaboration with OEMs and contract manufacturers on co-development projects ensures underfills meet evolving reliability and process integration needs.

Pursue Sustainability: Investing in green chemistry and recyclable underfill technologies will future-proof offerings against tightening environmental regulations and align with customer ESG commitments.

Future Outlook

Looking ahead, the Capillary Underfill Material market is set to maintain an upward trajectory, supported by sustained investment in electric vehicles, 5G deployment, artificial intelligence hardware, and flexible electronics. Breakthroughs in material science—such as self-healing underfills, conductive polymer composites, and bio-based resins—will drive next-generation performance and environmental sustainability. The proliferation of panel-level packaging and advanced wafer-level integration techniques will expand underfill application scopes, while digital manufacturing and smart factory initiatives will improve process yield and consistency. As global electronics production continues to diversify geographically, underfill suppliers with localized manufacturing and strong technical support networks will be best positioned to capture new growth opportunities. Overall, the market is poised for resilient, innovation-driven expansion through 2030 and beyond.

Conclusion

The Capillary Underfill Material market stands as an essential pillar of modern electronics packaging, underpinning the reliability and longevity of devices spanning automotive, consumer, industrial, and telecommunications sectors. Fueled by advanced packaging trends, regulatory shifts to lead-free solders, and the relentless push toward miniaturization and high performance, underfill materials have evolved into highly engineered solutions addressing mechanical, thermal, and processing challenges. While raw material volatility and process complexity present hurdles, strategic R&D investments, collaborative partnerships, and sustainability initiatives are driving continuous innovation. With robust growth expected across regions—particularly Asia-Pacific and North America—and burgeoning opportunities in flexible electronics and green chemistry, stakeholders across the value chain have ample avenues to differentiate and expand. By embracing digital process optimization, niche specialization, and sustainable practices, underfill suppliers and electronics manufacturers can collectively ensure that the next generation of devices achieves unmatched reliability and performance in an increasingly demanding technological landscape.

What is Capillary Underfill Material?

Capillary Underfill Material is a type of adhesive used in semiconductor packaging to fill the gaps between the chip and the substrate. It enhances the mechanical strength and thermal performance of electronic devices, particularly in applications like flip-chip assemblies.

What are the key companies in the Capillary Underfill Material market?

Key companies in the Capillary Underfill Material market include Henkel, Dow, and Namics, which are known for their innovative adhesive solutions for electronics. These companies focus on developing materials that improve reliability and performance in various electronic applications, among others.

What are the growth factors driving the Capillary Underfill Material market?

The growth of the Capillary Underfill Material market is driven by the increasing demand for miniaturized electronic devices and advancements in semiconductor technology. Additionally, the rise in consumer electronics and automotive applications is contributing to the market’s expansion.

What challenges does the Capillary Underfill Material market face?

The Capillary Underfill Material market faces challenges such as the high cost of advanced materials and the complexity of manufacturing processes. Additionally, the need for stringent quality control in semiconductor applications can hinder market growth.

What opportunities exist in the Capillary Underfill Material market?

Opportunities in the Capillary Underfill Material market include the development of eco-friendly materials and the increasing adoption of advanced packaging technologies. The growing demand for high-performance electronics in sectors like telecommunications and healthcare also presents significant growth potential.

What trends are shaping the Capillary Underfill Material market?

Trends in the Capillary Underfill Material market include the shift towards automation in manufacturing processes and the integration of nanotechnology to enhance material properties. Additionally, the focus on sustainability is driving the development of greener underfill solutions.

Capillary Underfill Material market

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Silicone, Polyurethane, Acrylic |

| End User | Semiconductor Manufacturers, Electronics Assemblers, Automotive Suppliers, Aerospace Firms |

| Application | Chip Packaging, PCB Assembly, MEMS Devices, LED Manufacturing |

| Technology | Thermal Curing, UV Curing, Room Temperature Curing, Hybrid Curing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Capillary Underfill Material Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at