444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The candy and snack food pouches market represents a dynamic and rapidly evolving segment within the global flexible packaging industry. This specialized market encompasses innovative packaging solutions designed specifically for confectionery products, snack foods, and related consumables. Market dynamics indicate substantial growth driven by changing consumer preferences, technological advancements in packaging materials, and increasing demand for convenient, portable food packaging solutions.

Consumer behavior has fundamentally shifted toward on-the-go consumption patterns, creating unprecedented demand for flexible pouch packaging that maintains product freshness while offering superior convenience. The market demonstrates remarkable resilience with consistent growth rates of approximately 6.2% CAGR across major regional markets. Packaging innovation continues to drive market expansion, with manufacturers investing heavily in sustainable materials, enhanced barrier properties, and consumer-friendly designs.

Industry transformation is evident through the adoption of advanced materials including biodegradable films, recyclable substrates, and smart packaging technologies. Major food manufacturers increasingly recognize flexible pouches as essential components of their product differentiation strategies, leading to expanded market opportunities across diverse product categories.

The candy and snack food pouches market refers to the specialized segment of flexible packaging designed for confectionery products, snack foods, nuts, dried fruits, and similar consumable items. These pouches utilize advanced polymer films, laminates, and barrier materials to provide optimal product protection while ensuring convenience and visual appeal.

Flexible pouch packaging encompasses various formats including stand-up pouches, flat pouches, spouted pouches, and resealable options. The technology integrates multiple material layers to achieve specific barrier properties against moisture, oxygen, light, and other environmental factors that could compromise product quality. Manufacturing processes involve sophisticated lamination, printing, and converting techniques to create customized packaging solutions.

Market scope includes both primary packaging applications where pouches directly contain products and secondary packaging uses for portion control, gift packaging, and promotional purposes. The definition extends to various closure mechanisms, printing technologies, and sustainability features that enhance consumer experience and brand differentiation.

Market performance demonstrates exceptional growth momentum driven by fundamental shifts in consumer purchasing behavior and food consumption patterns. The candy and snack food pouches market benefits from increasing urbanization, busy lifestyles, and growing preference for convenient packaging formats. Key growth drivers include rising disposable incomes, expanding retail channels, and continuous product innovation in both packaging materials and food products.

Technological advancement plays a crucial role in market expansion, with manufacturers developing enhanced barrier properties, improved sustainability profiles, and innovative closure systems. The market shows strong performance across multiple product categories, with particularly robust growth in premium snack segments and organic confectionery products. Regional analysis reveals significant opportunities in emerging markets where changing dietary habits and retail modernization drive demand.

Competitive landscape features both established packaging giants and innovative specialty manufacturers competing through technology differentiation, sustainability initiatives, and customer service excellence. Market participants focus on developing cost-effective solutions while meeting increasingly stringent regulatory requirements and consumer expectations for environmental responsibility.

Market intelligence reveals several critical insights shaping industry development and strategic decision-making:

Consumer lifestyle changes represent the primary driver of market expansion, with increasing urbanization and busy schedules creating demand for portable, convenient packaging solutions. Modern consumers prioritize products that offer easy consumption, storage efficiency, and portion control capabilities. Demographic trends including growing millennial and Gen Z populations favor innovative packaging formats that align with their values and lifestyle preferences.

Retail evolution significantly impacts market growth through the expansion of convenience stores, vending machines, and e-commerce channels that favor flexible packaging formats. Traditional retail environments increasingly allocate premium shelf space to products featuring attractive, functional pouch packaging that enhances brand visibility and consumer appeal. Supply chain efficiency drives adoption as retailers recognize the storage and transportation advantages of flexible pouches.

Technological innovation in packaging materials enables manufacturers to develop solutions with enhanced barrier properties, extended shelf life, and improved sustainability profiles. Advanced printing technologies allow for high-quality graphics and brand differentiation opportunities that were previously unavailable with traditional packaging formats. Manufacturing efficiency improvements reduce production costs while enabling greater customization capabilities.

Health consciousness among consumers drives demand for portion-controlled packaging and transparent ingredient communication, both facilitated by flexible pouch formats. The growing organic and natural food segments particularly benefit from packaging solutions that preserve product integrity while communicating premium positioning.

Cost considerations present significant challenges for market expansion, particularly in price-sensitive product categories where packaging costs must remain minimal. Initial investment requirements for specialized converting equipment and material inventory can be substantial for smaller manufacturers entering the market. Economic pressures on food manufacturers may limit willingness to invest in premium packaging solutions despite their long-term benefits.

Technical limitations in certain applications restrict market growth, particularly for products requiring extended shelf life or extreme barrier properties. Some confectionery products with specific texture or moisture requirements may not be suitable for flexible pouch packaging without significant product reformulation. Manufacturing complexity increases with advanced features like resealable closures and multi-layer constructions.

Regulatory challenges vary significantly across global markets, creating compliance complexity for manufacturers serving international customers. Food contact regulations, recycling requirements, and labeling standards differ between regions, potentially limiting market expansion opportunities. Environmental concerns regarding plastic waste and recycling infrastructure create consumer resistance in some market segments.

Supply chain vulnerabilities include dependence on specialized raw materials and converting capabilities that may be limited in certain geographic regions. Quality control requirements for food packaging applications demand sophisticated testing and validation processes that increase operational complexity and costs.

Sustainability innovation presents tremendous opportunities for market expansion through development of biodegradable, compostable, and recyclable pouch materials. Consumer demand for environmentally responsible packaging creates premium pricing opportunities for manufacturers offering sustainable solutions. Circular economy initiatives by major food brands drive investment in innovative materials and recycling technologies.

Emerging markets offer substantial growth potential as retail modernization and changing consumer preferences create demand for convenient packaging formats. Rising disposable incomes in developing economies enable premium packaging adoption across broader consumer segments. Market penetration remains relatively low in many regions, indicating significant expansion opportunities.

Product category expansion beyond traditional applications creates new market segments, including pharmaceutical products, pet foods, and industrial applications. Cross-industry technology transfer enables innovative solutions that address previously unmet packaging requirements. Premium positioning opportunities exist in luxury confectionery and artisanal snack segments where packaging significantly influences purchase decisions.

Digital integration through smart packaging technologies, QR codes, and interactive features creates opportunities for enhanced consumer engagement and brand differentiation. E-commerce growth drives demand for packaging solutions optimized for direct-to-consumer shipping and unboxing experiences.

Supply and demand dynamics demonstrate strong growth momentum with demand consistently outpacing supply capacity in key market segments. Manufacturing capacity expansion requires significant capital investment and technical expertise, creating temporary supply constraints that support pricing stability. Market equilibrium shifts toward premium segments where value-added features justify higher pricing.

Competitive intensity increases as traditional rigid packaging manufacturers enter flexible packaging markets while established flexible packaging companies expand into specialized applications. Innovation cycles accelerate as companies compete through technological advancement and sustainability leadership. Market consolidation trends create larger, more capable organizations with enhanced research and development capabilities.

Raw material dynamics significantly impact market conditions, with polymer resin prices and availability affecting manufacturing costs and product development timelines. Sustainability requirements drive investment in alternative materials that may initially carry cost premiums but offer long-term competitive advantages. Supply chain integration becomes increasingly important for managing material costs and ensuring consistent quality.

Regulatory evolution shapes market dynamics through changing requirements for food safety, environmental impact, and consumer protection. Proactive compliance strategies create competitive advantages while reactive approaches may limit market access and growth opportunities.

Comprehensive analysis of the candy and snack food pouches market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, packaging engineers, and procurement professionals across the value chain. Data collection encompasses both quantitative metrics and qualitative insights to provide complete market understanding.

Secondary research leverages industry publications, regulatory filings, patent databases, and trade association reports to validate primary findings and identify emerging trends. Market sizing methodologies incorporate bottom-up analysis based on production capacity, consumption patterns, and regional market characteristics. Statistical modeling techniques ensure robust projections and trend analysis.

Industry validation processes include expert review panels and cross-referencing with multiple independent sources to verify key findings and assumptions. Geographic coverage spans major markets including North America, Europe, Asia-Pacific, and emerging regions to provide global perspective. Temporal analysis examines historical trends, current conditions, and future projections across multiple time horizons.

Quality assurance protocols ensure data accuracy through systematic verification procedures and peer review processes. Research limitations and assumptions are clearly documented to provide transparency regarding analytical scope and methodology constraints.

North America maintains market leadership with approximately 35% global market share, driven by advanced retail infrastructure, high consumer spending on convenience foods, and strong sustainability initiatives. The region demonstrates particular strength in premium snack segments and innovative packaging technologies. United States dominates regional consumption while Canada shows robust growth in organic and natural product categories.

Europe represents a mature market with 28% market share, characterized by stringent regulatory requirements and strong environmental consciousness among consumers. The region leads in sustainable packaging innovation and circular economy initiatives. Germany, France, and United Kingdom constitute primary markets with significant opportunities in Eastern European countries experiencing retail modernization.

Asia-Pacific demonstrates the highest growth rates with 25% current market share and expanding rapidly due to urbanization, rising disposable incomes, and changing dietary habits. China and India represent enormous growth opportunities while developed markets like Japan and Australia show strong demand for premium packaging solutions. Manufacturing capacity expansion in the region supports both domestic consumption and export opportunities.

Latin America and Middle East & Africa collectively account for 12% market share but show promising growth potential as retail infrastructure develops and consumer preferences evolve toward convenient packaging formats. Brazil, Mexico, and South Africa lead regional development with increasing investment in modern packaging technologies.

Market leadership is distributed among several categories of companies, each bringing distinct competitive advantages and market positioning strategies:

Competitive strategies emphasize technological innovation, sustainability leadership, and customer service excellence. Companies invest heavily in research and development to create differentiated products while building strategic partnerships with major food manufacturers. Market positioning varies from cost leadership to premium innovation depending on target customer segments and geographic focus.

By Product Type:

By Material Type:

By Application:

Confectionery Applications demonstrate strong demand for premium packaging solutions that preserve product quality while enhancing visual appeal. Chocolate products require specialized barrier properties to prevent bloom and maintain texture, driving adoption of advanced laminate structures. Seasonal packaging creates opportunities for customized designs and limited-edition formats that command premium pricing.

Savory Snacks represent the fastest-growing application segment with 8.4% annual growth driven by increasing consumption of convenient, portable food products. Potato chips and similar products require excellent moisture barrier properties and puncture resistance to maintain crispness and prevent damage. Portion control packaging gains popularity as health-conscious consumers seek smaller serving sizes.

Sweet Snacks benefit from flexible packaging solutions that accommodate various product shapes and sizes while providing adequate protection during distribution. Cookie and bar applications increasingly adopt resealable pouches to maintain freshness after opening. Premium positioning drives demand for high-quality printing and innovative closure mechanisms.

Specialty Products including organic and natural foods command premium pricing that supports investment in sustainable packaging materials and advanced features. These products often require enhanced barrier properties to maintain quality without artificial preservatives. Transparency requirements for ingredient communication favor flexible packaging with excellent printability.

Food Manufacturers benefit from flexible pouch packaging through reduced packaging costs, improved supply chain efficiency, and enhanced brand differentiation opportunities. Lightweight packaging reduces transportation costs while superior barrier properties extend shelf life and reduce product waste. Marketing advantages include excellent printability for brand communication and innovative formats that attract consumer attention.

Retailers appreciate the space efficiency of flexible pouches, which maximize shelf utilization and reduce storage requirements. The packaging format facilitates efficient inventory management and reduces handling costs throughout the distribution chain. Consumer appeal of convenient, resealable packaging drives sales velocity and customer satisfaction.

Consumers enjoy the convenience, portability, and freshness preservation offered by flexible pouch packaging. Resealable features enable portion control and extended consumption periods while lightweight formats enhance portability. Environmental benefits of reduced packaging waste and improved recyclability align with growing sustainability consciousness.

Packaging Manufacturers benefit from growing demand, premium pricing opportunities for innovative solutions, and long-term customer relationships. The market offers opportunities for technological differentiation and value-added services that support sustainable competitive advantages. Growth potential in emerging markets and new applications provides expansion opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Leadership emerges as the dominant trend shaping market development, with manufacturers investing heavily in biodegradable materials, recyclable structures, and circular economy initiatives. Consumer demand for environmentally responsible packaging drives premium pricing opportunities while regulatory requirements increasingly favor sustainable solutions. Innovation focus shifts toward materials that maintain performance while reducing environmental impact.

Smart Packaging Integration gains momentum through incorporation of freshness indicators, temperature monitoring, and interactive features that enhance consumer experience. Digital technologies enable traceability, authentication, and engagement opportunities that create additional value for brands and consumers. Technology adoption accelerates in premium market segments where enhanced functionality justifies cost premiums.

Customization Demand increases as brands seek differentiation through unique packaging formats, specialized printing, and innovative closure mechanisms. Mass customization capabilities enable smaller production runs and seasonal variations that support marketing strategies. Personalization trends create opportunities for limited editions and targeted consumer segments.

E-commerce Optimization drives development of packaging solutions specifically designed for direct-to-consumer shipping, including enhanced protection, unboxing experience, and return logistics considerations. Online retail growth creates new requirements for packaging performance and consumer interaction. Digital commerce influences package design and functionality requirements.

Material Innovation continues advancing through development of new polymer formulations, bio-based materials, and enhanced barrier technologies. Recent breakthroughs in recyclable multi-layer structures address sustainability requirements while maintaining performance characteristics. Research investment by major manufacturers focuses on next-generation materials that combine environmental benefits with superior functionality.

Manufacturing Technology evolution includes advanced printing capabilities, precision converting equipment, and quality control systems that enable higher productivity and consistency. Automation integration reduces labor costs while improving product quality and consistency. Industry 4.0 technologies enable predictive maintenance and real-time quality monitoring.

Strategic Partnerships between packaging manufacturers and food companies create collaborative innovation opportunities and long-term supply relationships. Joint development projects focus on customized solutions that address specific product requirements and market positioning objectives. Vertical integration trends enable better control over quality and costs.

Regulatory Evolution includes new requirements for food safety, environmental impact, and consumer protection that influence product development and market access. Proactive compliance strategies create competitive advantages while regulatory harmonization facilitates international market expansion. Standards development supports industry growth and consumer confidence.

Investment Priorities should focus on sustainable material development, advanced manufacturing capabilities, and digital integration technologies that create long-term competitive advantages. Companies should prioritize research and development spending on biodegradable materials and circular economy solutions. MarkWide Research analysis indicates that sustainability investments generate superior returns through premium pricing and market share gains.

Market Entry Strategies for new participants should emphasize niche applications and specialized customer segments where established competitors may have limited presence. Geographic expansion opportunities exist in emerging markets where local partnerships can facilitate market access and regulatory compliance. Differentiation strategies should focus on unique value propositions rather than direct price competition.

Technology Development recommendations include investment in smart packaging capabilities, advanced barrier materials, and manufacturing automation that enhance productivity and product quality. Companies should develop capabilities across the entire value chain from material science to customer service. Innovation partnerships with research institutions and technology companies can accelerate development timelines.

Customer Relationship Management should emphasize long-term partnerships with major food manufacturers through collaborative innovation and comprehensive service offerings. Understanding customer requirements and market trends enables proactive solution development and competitive positioning. Value-based pricing strategies should focus on total cost of ownership rather than unit price comparisons.

Market trajectory indicates continued robust growth driven by fundamental shifts in consumer behavior, retail evolution, and sustainability requirements. The candy and snack food pouches market is positioned for sustained expansion with projected growth rates of 6.8% CAGR over the next five years. Long-term prospects remain highly favorable due to structural advantages of flexible packaging and ongoing innovation in materials and technologies.

Technology evolution will continue advancing through development of next-generation materials, smart packaging features, and manufacturing automation that enhance performance while reducing costs. Sustainability innovations will become increasingly important competitive differentiators as regulatory requirements and consumer preferences drive market transformation. MWR projections suggest that sustainable packaging solutions will capture 55% market share within the next decade.

Geographic expansion opportunities remain substantial in emerging markets where retail modernization and changing consumer preferences create demand for convenient packaging formats. Developed markets will focus on premium segments and sustainability leadership while emerging markets drive volume growth. Regional dynamics will increasingly influence global market development and competitive strategies.

Industry consolidation trends may accelerate as companies seek scale advantages and technological capabilities required for next-generation packaging solutions. Strategic partnerships and acquisitions will likely reshape competitive landscape while creating opportunities for specialized players in niche applications. Market evolution will favor companies with strong innovation capabilities and customer relationships.

The candy and snack food pouches market represents a dynamic and rapidly expanding segment with exceptional growth prospects driven by fundamental changes in consumer behavior, retail evolution, and sustainability requirements. Market analysis reveals strong underlying demand supported by technological innovation, geographic expansion opportunities, and increasing adoption across diverse product categories.

Strategic positioning in this market requires focus on sustainability leadership, technological innovation, and customer partnership development. Companies that successfully navigate the transition toward environmentally responsible packaging while maintaining superior performance characteristics will capture disproportionate market share and profitability. Investment priorities should emphasize research and development, manufacturing capabilities, and market expansion strategies that create sustainable competitive advantages.

Future success will depend on the ability to anticipate and respond to evolving customer requirements, regulatory changes, and technological opportunities. The market offers substantial rewards for companies that demonstrate innovation leadership, operational excellence, and strategic vision in developing next-generation packaging solutions that meet the complex requirements of modern food marketing and distribution.

What is Candy And Snack Food Pouches?

Candy and snack food pouches are flexible packaging solutions designed to hold various types of confectionery and snack products. These pouches are often used for their convenience, portability, and ability to preserve freshness.

What are the key players in the Candy And Snack Food Pouches Market?

Key players in the Candy And Snack Food Pouches Market include companies like Mondelēz International, Nestlé, and Mars, Incorporated, which are known for their extensive range of snack and candy products, among others.

What are the growth factors driving the Candy And Snack Food Pouches Market?

The Candy And Snack Food Pouches Market is driven by increasing consumer demand for on-the-go snacks, the rise of e-commerce, and innovations in packaging technology that enhance product shelf life and appeal.

What challenges does the Candy And Snack Food Pouches Market face?

Challenges in the Candy And Snack Food Pouches Market include rising raw material costs, environmental concerns regarding plastic waste, and competition from alternative packaging solutions.

What opportunities exist in the Candy And Snack Food Pouches Market?

Opportunities in the Candy And Snack Food Pouches Market include the growing trend of healthy snacking, the introduction of sustainable packaging options, and the expansion of product lines to cater to diverse consumer preferences.

What trends are shaping the Candy And Snack Food Pouches Market?

Trends in the Candy And Snack Food Pouches Market include the increasing popularity of resealable pouches, the use of biodegradable materials, and the rise of personalized packaging to enhance consumer engagement.

Candy And Snack Food Pouches Market

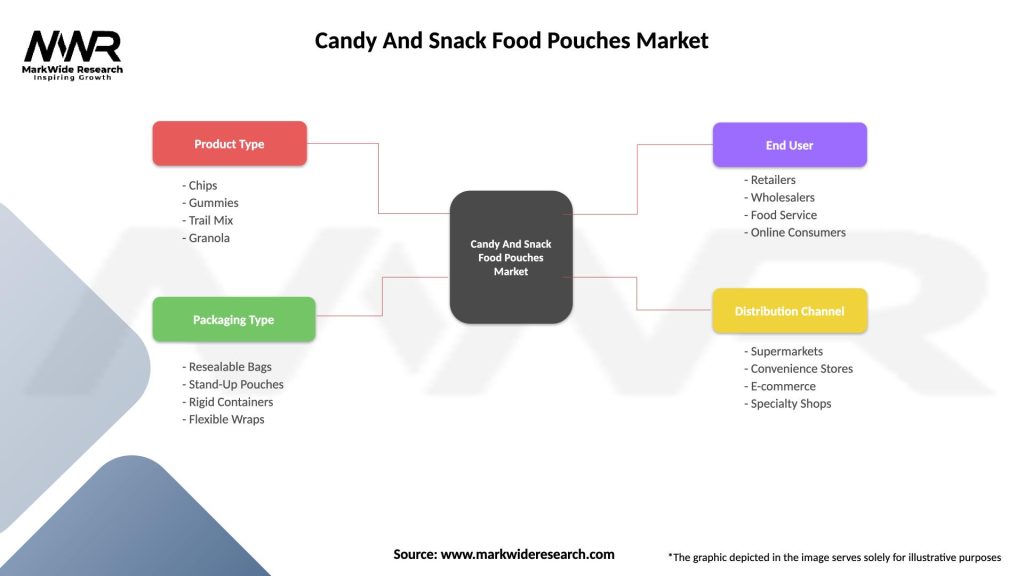

| Segmentation Details | Description |

|---|---|

| Product Type | Chips, Gummies, Trail Mix, Granola |

| Packaging Type | Resealable Bags, Stand-Up Pouches, Rigid Containers, Flexible Wraps |

| End User | Retailers, Wholesalers, Food Service, Online Consumers |

| Distribution Channel | Supermarkets, Convenience Stores, E-commerce, Specialty Shops |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Candy And Snack Food Pouches Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at