444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canadian plant based food and beverage market represents one of the most dynamic and rapidly evolving sectors within the country’s food industry landscape. Consumer preferences are shifting dramatically toward sustainable, health-conscious alternatives to traditional animal-based products, driving unprecedented growth across multiple product categories. This transformation reflects broader societal changes encompassing environmental awareness, health optimization, and ethical consumption patterns that are reshaping the Canadian food ecosystem.

Market dynamics indicate robust expansion across diverse plant-based segments, including meat alternatives, dairy substitutes, protein beverages, and innovative food products. The sector demonstrates remarkable resilience and adaptability, with adoption rates increasing by approximately 23% annually among Canadian consumers. Regional distribution shows particularly strong performance in urban centers, where health-conscious demographics drive demand for premium plant-based alternatives.

Innovation leadership characterizes the Canadian market, with domestic manufacturers and international brands collaborating to develop products specifically tailored to Canadian taste preferences and dietary requirements. The market encompasses traditional categories like soy-based products while expanding into cutting-edge alternatives featuring pea protein, oat-based beverages, and novel ingredient combinations that deliver superior nutritional profiles and sensory experiences.

The Canadian plant based food and beverage market refers to the comprehensive ecosystem of food and drink products derived entirely from plant sources, designed to replace or complement traditional animal-based alternatives while meeting consumer demands for nutrition, taste, and sustainability. This market encompasses diverse product categories including meat substitutes, dairy alternatives, plant-based beverages, protein supplements, and innovative food formulations that leverage advanced processing technologies to deliver authentic taste experiences and optimal nutritional profiles.

Product categories within this market span from basic commodity items like plant milks and meat alternatives to sophisticated culinary products featuring complex flavor profiles and premium ingredients. Manufacturing processes involve advanced food science techniques, including protein isolation, fermentation technologies, and innovative ingredient combinations that create products closely mimicking traditional animal-based counterparts while offering unique nutritional advantages.

Market participants include established food manufacturers, specialized plant-based companies, innovative startups, and retail chains that collectively create a comprehensive value chain serving diverse consumer segments across Canada. The market definition encompasses both direct replacement products and entirely new food categories that emerge from plant-based innovation.

Strategic positioning of the Canadian plant based food and beverage market reflects exceptional growth potential driven by converging trends in health consciousness, environmental sustainability, and culinary innovation. Market penetration has reached significant levels across key demographic segments, with particularly strong adoption among millennials and Generation Z consumers who prioritize sustainable consumption patterns.

Competitive landscape features both international brands and domestic innovators creating diverse product portfolios that address specific Canadian market preferences. Distribution channels have expanded beyond traditional health food stores to encompass mainstream grocery retailers, foodservice establishments, and direct-to-consumer platforms that collectively serve growing demand across urban and suburban markets.

Investment activity demonstrates strong confidence in long-term market potential, with venture capital, private equity, and strategic corporate investments supporting innovation and capacity expansion. Regulatory environment provides supportive framework for product development while maintaining rigorous safety and labeling standards that protect consumer interests and promote market transparency.

Growth projections indicate sustained expansion across multiple product categories, with compound annual growth rates exceeding 18% annually for key segments. Market maturation is expected to drive product sophistication, price optimization, and broader mainstream adoption throughout the forecast period.

Consumer behavior analysis reveals fundamental shifts in purchasing patterns, with Canadian consumers increasingly prioritizing plant-based options for health, environmental, and ethical reasons. Demographic trends show strongest adoption among urban professionals, health-conscious families, and environmentally aware consumers who view plant-based products as essential components of modern lifestyle choices.

Health consciousness represents the primary catalyst driving Canadian plant based food and beverage market expansion, with consumers increasingly recognizing connections between dietary choices and long-term wellness outcomes. Medical research supporting plant-based nutrition benefits creates strong foundation for sustained market growth, particularly among health-focused demographic segments seeking preventive healthcare approaches through dietary optimization.

Environmental sustainability concerns motivate significant consumer segments to adopt plant-based alternatives as part of broader lifestyle changes aimed at reducing personal carbon footprints. Climate change awareness drives purchasing decisions, with consumers recognizing that plant-based food production typically requires fewer natural resources and generates lower greenhouse gas emissions compared to traditional animal agriculture.

Innovation acceleration in food technology enables manufacturers to develop increasingly sophisticated products that closely replicate traditional animal-based foods while offering superior nutritional profiles. Processing advancements allow creation of plant-based products with authentic textures, flavors, and cooking characteristics that satisfy even traditional consumers seeking familiar culinary experiences.

Demographic shifts toward younger, more educated, and environmentally conscious consumer bases create favorable market conditions for plant-based product adoption. Generational preferences show strong alignment with sustainable consumption patterns, indicating long-term growth potential as these demographics mature and increase purchasing power.

Price premiums associated with many plant-based products create barriers for price-sensitive consumers, particularly in economic segments where cost considerations significantly influence purchasing decisions. Manufacturing costs for specialized ingredients and processing technologies often result in retail prices that exceed traditional animal-based alternatives, limiting market penetration among budget-conscious households.

Taste preferences and sensory expectations present ongoing challenges for plant-based product developers seeking to satisfy consumers accustomed to traditional animal-based foods. Texture differences and flavor profiles that don’t fully replicate familiar products can create resistance among potential adopters, particularly in demographic segments with strong culinary traditions.

Nutritional concerns regarding protein completeness, vitamin B12 content, and mineral bioavailability create hesitation among health-conscious consumers seeking optimal nutritional outcomes. Dietary misconceptions and limited nutritional education can prevent consumers from fully understanding plant-based nutrition benefits and appropriate dietary planning strategies.

Supply chain limitations for specialized ingredients and processing equipment can constrain production capacity and create supply disruptions that affect product availability and pricing stability. Infrastructure development requirements for plant-based food production may limit rapid market expansion in certain regions or product categories.

Product innovation opportunities abound in developing next-generation plant-based foods that address current market limitations while expanding into new product categories. Technological advancement in fermentation, protein extraction, and food processing creates possibilities for breakthrough products that could revolutionize consumer perceptions and market adoption rates.

Foodservice expansion represents significant untapped potential, with restaurants, institutional catering, and quick-service establishments increasingly seeking plant-based menu options to meet evolving consumer demands. Commercial partnerships between plant-based manufacturers and foodservice operators can accelerate market penetration while introducing products to new consumer segments.

Export opportunities leverage Canada’s reputation for high-quality food production and innovation to access international markets seeking premium plant-based products. Trade relationships and Canadian agricultural expertise create competitive advantages for domestic manufacturers seeking global expansion opportunities.

Functional food development combining plant-based nutrition with specific health benefits like enhanced protein content, probiotic cultures, or targeted nutrient fortification can create premium product categories serving specialized consumer needs. Personalized nutrition trends create opportunities for customized plant-based products addressing individual dietary requirements and health objectives.

Supply chain evolution demonstrates increasing sophistication as manufacturers develop specialized sourcing relationships, processing capabilities, and distribution networks optimized for plant-based products. Vertical integration strategies enable companies to control quality, costs, and innovation while building sustainable competitive advantages in rapidly evolving market conditions.

Consumer education initiatives by manufacturers, retailers, and advocacy organizations contribute to market expansion by addressing misconceptions and highlighting benefits of plant-based nutrition. Marketing strategies increasingly focus on mainstream appeal rather than niche positioning, reflecting market maturation and broader consumer acceptance.

Regulatory developments continue shaping market structure through labeling requirements, health claims regulations, and food safety standards that affect product development and marketing approaches. Policy support for sustainable agriculture and environmental protection creates favorable conditions for plant-based food industry growth.

Competitive intensity drives continuous innovation and improvement as established food companies and specialized plant-based manufacturers compete for market share through product differentiation, pricing strategies, and brand positioning. Market consolidation trends may reshape industry structure as successful companies acquire complementary businesses or technologies.

Comprehensive analysis of the Canadian plant based food and beverage market employs multiple research methodologies to ensure accurate, reliable, and actionable market intelligence. Primary research includes extensive consumer surveys, industry interviews, and expert consultations that provide direct insights into market trends, consumer preferences, and industry dynamics affecting market development.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and academic studies that provide historical context and supporting data for market projections. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert review of findings and conclusions.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop realistic projections for market growth and evolution. Quantitative analysis combines with qualitative insights to create comprehensive understanding of market dynamics and future opportunities.

Industry expertise from MarkWide Research analysts with specialized knowledge of food industry trends, consumer behavior, and market dynamics ensures professional interpretation of data and development of actionable insights for market participants and stakeholders.

Ontario market leads Canadian plant based food and beverage adoption, accounting for approximately 42% of national consumption, driven by large urban populations, diverse demographics, and strong retail infrastructure supporting product availability and consumer education. Toronto metropolitan area demonstrates particularly high adoption rates among health-conscious professionals and environmentally aware consumers seeking sustainable food alternatives.

British Columbia shows exceptional growth potential with 38% higher per-capita consumption compared to national averages, reflecting strong environmental consciousness and health-focused lifestyle preferences among provincial residents. Vancouver region serves as innovation hub for plant-based food development and testing, with numerous local manufacturers and distributors serving regional and national markets.

Quebec market presents unique opportunities and challenges, with cultural food preferences and language considerations affecting product development and marketing strategies. Montreal area demonstrates growing acceptance of plant-based alternatives, particularly among younger demographics and health-conscious consumers seeking premium food experiences.

Prairie provinces show emerging growth potential as awareness increases and product availability expands through major retail chains and specialty food stores. Agricultural heritage in these regions creates interesting dynamics as traditional farming communities explore plant-based food production opportunities while consumers gradually adopt alternative protein sources.

Atlantic Canada represents developing market opportunity with increasing consumer interest in plant-based products, though adoption rates remain below national averages. Regional distribution challenges and limited product availability affect market penetration, creating opportunities for targeted expansion strategies.

Market leadership reflects diverse competitive dynamics with international brands, domestic manufacturers, and innovative startups competing across multiple product categories and price points. Strategic positioning varies from mass-market accessibility to premium positioning targeting health-conscious and environmentally aware consumer segments.

Innovation strategies emphasize product development, taste improvement, nutritional enhancement, and sustainable packaging solutions that address evolving consumer preferences and market demands. Partnership approaches include collaborations with retailers, foodservice operators, and ingredient suppliers to accelerate market penetration and product development.

Product category segmentation reveals diverse market structure with distinct growth patterns and consumer preferences across different plant-based food and beverage categories. Market distribution shows varying adoption rates and competitive dynamics depending on product type, price positioning, and consumer familiarity with alternatives.

By Product Type:

By Distribution Channel:

Plant-based meat alternatives demonstrate exceptional innovation and consumer acceptance, with products increasingly matching traditional meat in taste, texture, and cooking characteristics. Technology advancement enables creation of sophisticated products using pea protein, soy protein, and novel ingredients that deliver authentic culinary experiences while providing superior nutritional profiles and environmental benefits.

Dairy alternative beverages represent mature market segment with established consumer base and diverse product offerings addressing different taste preferences and nutritional requirements. Innovation focus includes protein enhancement, flavor development, and sustainable packaging solutions that maintain product quality while reducing environmental impact.

Plant-based dairy products show significant growth potential as manufacturers develop increasingly sophisticated cheese alternatives, yogurt products, and frozen desserts that satisfy consumer expectations for taste and functionality. Fermentation technologies enable creation of products with authentic dairy-like characteristics and beneficial probiotic cultures.

Protein beverages and supplements serve growing fitness and health optimization markets with products specifically formulated for athletic performance, weight management, and nutritional supplementation. Functional ingredients including plant proteins, vitamins, and minerals create products addressing specific health and wellness objectives.

Ready-to-eat plant-based foods address convenience demands with prepared meals, snacks, and quick-preparation products that fit busy lifestyles while maintaining nutritional quality and taste appeal. Packaging innovation ensures product freshness and convenience while supporting sustainability objectives.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and alignment with consumer trends toward health and sustainability. Innovation advantages include opportunities to develop breakthrough products, build brand loyalty, and establish market leadership in rapidly growing categories with strong long-term potential.

Retailers gain from higher margin products, increased customer traffic, and positioning as forward-thinking establishments serving evolving consumer preferences. Category management opportunities include expanded shelf space allocation, premium product placement, and customer education initiatives that drive sales and loyalty.

Consumers receive health benefits, environmental impact reduction, and expanded food choices that align with personal values and lifestyle preferences. Nutritional advantages include reduced cholesterol, increased fiber intake, and access to products fortified with essential vitamins and minerals.

Investors access high-growth market opportunities with strong demographic tailwinds and increasing mainstream acceptance. Portfolio diversification benefits include exposure to sustainable food trends, innovation-driven companies, and markets with significant expansion potential across multiple product categories.

Environmental stakeholders benefit from reduced resource consumption, lower greenhouse gas emissions, and decreased environmental impact associated with plant-based food production compared to traditional animal agriculture. Sustainability outcomes support broader environmental protection and climate change mitigation objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Protein innovation drives development of next-generation plant-based products utilizing novel protein sources, advanced processing techniques, and improved nutritional profiles that address consumer demands for complete nutrition and authentic taste experiences. Ingredient diversity expands beyond traditional soy and wheat proteins to include pea, hemp, algae, and other innovative protein sources.

Functional food integration combines plant-based nutrition with specific health benefits including probiotics, omega-3 fatty acids, vitamins, and minerals that create premium products addressing targeted health and wellness objectives. Personalized nutrition trends influence product development toward customizable options serving individual dietary requirements and preferences.

Sustainability focus intensifies across packaging, production processes, and supply chain management as companies seek to minimize environmental impact while meeting consumer expectations for responsible business practices. Circular economy principles influence product design and waste reduction strategies throughout the value chain.

Convenience enhancement addresses busy lifestyle demands through ready-to-eat products, meal kits, and quick-preparation options that maintain nutritional quality while providing time-saving benefits. Digital integration includes online ordering, subscription services, and mobile apps that improve customer experience and accessibility.

Mainstream positioning shifts marketing strategies from niche health food targeting toward broad consumer appeal emphasizing taste, convenience, and value rather than exclusively focusing on health or environmental benefits. Brand partnerships with established food companies accelerate market penetration and consumer acceptance.

Investment acceleration demonstrates strong confidence in market potential, with venture capital, private equity, and strategic corporate investments supporting innovation, capacity expansion, and market development initiatives across multiple product categories and geographic regions.

Manufacturing expansion includes new production facilities, equipment upgrades, and capacity increases that support growing demand while improving operational efficiency and cost competitiveness. Technology partnerships enable access to advanced processing equipment and innovative production techniques.

Retail partnerships expand distribution reach through agreements with major grocery chains, specialty retailers, and online platforms that increase product availability and consumer accessibility. Category management initiatives improve product placement, merchandising, and consumer education at point of sale.

Product launches introduce innovative formulations, improved taste profiles, and expanded product lines that address evolving consumer preferences and market opportunities. Reformulation efforts focus on reducing sodium, improving texture, and enhancing nutritional content based on consumer feedback and market research.

Regulatory approvals for new ingredients, health claims, and product categories create opportunities for innovation and market expansion while ensuring consumer safety and product quality standards. Industry standards development promotes market transparency and consumer confidence.

Strategic positioning recommendations emphasize importance of balancing innovation with mainstream appeal, ensuring products meet both health-conscious early adopters and traditional consumers seeking familiar taste experiences. Market entry strategies should focus on product differentiation, competitive pricing, and strong retail partnerships that support sustainable market penetration.

Investment priorities should include research and development, manufacturing capacity, and marketing initiatives that build brand awareness and consumer education. Technology development investments in processing equipment, ingredient innovation, and quality control systems create competitive advantages and operational efficiency.

Partnership strategies with established food companies, retailers, and foodservice operators can accelerate market access while providing resources and expertise for product development and distribution. Supply chain partnerships ensure reliable ingredient sourcing and cost management in rapidly growing market conditions.

Consumer education initiatives addressing nutritional benefits, cooking instructions, and product versatility can overcome adoption barriers and build long-term customer loyalty. Marketing approaches should emphasize taste, convenience, and value alongside health and environmental benefits to appeal to broader consumer segments.

According to MarkWide Research analysis, companies should prioritize sustainable growth strategies that balance rapid market expansion with profitability and operational efficiency to build lasting competitive advantages in evolving market conditions.

Growth trajectory indicates sustained expansion across all major product categories, with particularly strong potential in plant-based meat alternatives and functional food products that address specific health and wellness objectives. Market maturation is expected to drive product sophistication, price optimization, and broader mainstream adoption throughout the forecast period.

Innovation acceleration will continue driving product development, with breakthrough technologies in fermentation, protein extraction, and food processing creating next-generation products that could revolutionize consumer perceptions and market adoption rates. Ingredient diversity expansion beyond traditional plant proteins creates opportunities for unique product positioning and nutritional enhancement.

Distribution expansion through foodservice channels, online platforms, and international markets provides significant growth opportunities for established players and new market entrants. Export potential leverages Canada’s reputation for high-quality food production and innovation to access global markets seeking premium plant-based products.

Consumer adoption is projected to accelerate as product quality improvements, price competitiveness, and increased availability address current market barriers. Demographic trends support long-term growth as environmentally conscious and health-focused consumer segments expand their purchasing power and influence.

Market consolidation may reshape industry structure as successful companies acquire complementary businesses, technologies, or distribution capabilities to strengthen competitive positioning. Strategic partnerships between plant-based specialists and established food companies will likely accelerate innovation and market penetration while providing resources for sustainable growth.

The Canadian plant based food and beverage market represents exceptional growth opportunity driven by converging trends in health consciousness, environmental sustainability, and culinary innovation. Market dynamics demonstrate strong consumer demand, increasing product sophistication, and expanding distribution channels that collectively support sustained market expansion across diverse product categories and geographic regions.

Strategic advantages for market participants include premium pricing potential, brand loyalty opportunities, and alignment with long-term demographic and lifestyle trends that favor sustainable and health-conscious consumption patterns. Innovation leadership and operational excellence will determine competitive success as the market matures and mainstream adoption accelerates.

Investment opportunities abound for companies, investors, and stakeholders seeking exposure to high-growth food industry segments with strong fundamentals and significant expansion potential. Market evolution toward mainstream acceptance creates favorable conditions for sustained growth while maintaining premium positioning and profitability potential across multiple product categories and consumer segments.

What is Canadian Plant based Food and Beverage?

Canadian Plant based Food and Beverage refers to food and drink products made primarily from plants, including fruits, vegetables, grains, nuts, and seeds, designed to provide alternatives to traditional animal-based products.

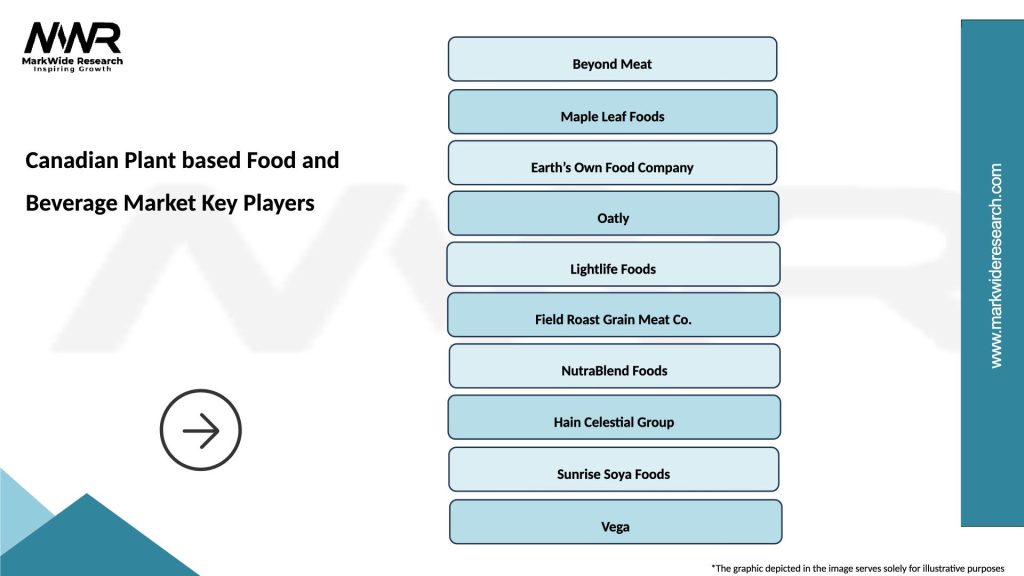

What are the key players in the Canadian Plant based Food and Beverage Market?

Key players in the Canadian Plant based Food and Beverage Market include companies like Beyond Meat, Daiya Foods, and Oatly, which are known for their innovative plant-based products, among others.

What are the main drivers of growth in the Canadian Plant based Food and Beverage Market?

The main drivers of growth in the Canadian Plant based Food and Beverage Market include increasing consumer demand for healthier options, rising awareness of environmental sustainability, and the growing trend of veganism and vegetarianism.

What challenges does the Canadian Plant based Food and Beverage Market face?

Challenges in the Canadian Plant based Food and Beverage Market include competition from traditional animal-based products, potential supply chain issues, and consumer skepticism regarding the taste and texture of plant-based alternatives.

What opportunities exist in the Canadian Plant based Food and Beverage Market?

Opportunities in the Canadian Plant based Food and Beverage Market include expanding product lines to cater to diverse dietary preferences, increasing distribution channels, and leveraging e-commerce for better consumer reach.

What trends are shaping the Canadian Plant based Food and Beverage Market?

Trends shaping the Canadian Plant based Food and Beverage Market include the rise of clean label products, innovations in plant-based protein sources, and the incorporation of functional ingredients that promote health benefits.

Canadian Plant based Food and Beverage Market

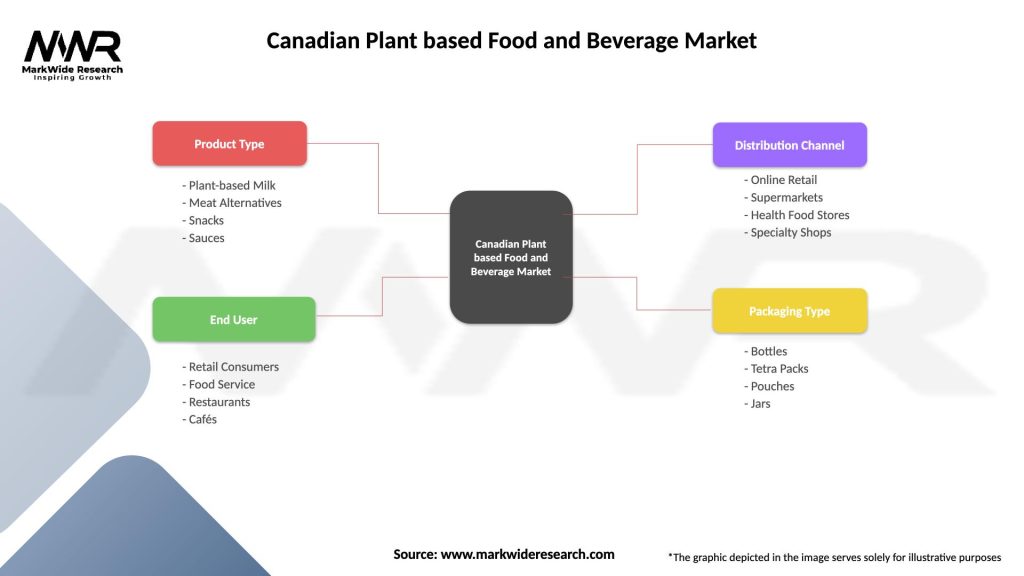

| Segmentation Details | Description |

|---|---|

| Product Type | Plant-based Milk, Meat Alternatives, Snacks, Sauces |

| End User | Retail Consumers, Food Service, Restaurants, Cafés |

| Distribution Channel | Online Retail, Supermarkets, Health Food Stores, Specialty Shops |

| Packaging Type | Bottles, Tetra Packs, Pouches, Jars |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canadian Plant based Food and Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at