444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canadian health insurance market represents a sophisticated blend of public and private healthcare coverage systems that serve over 38 million Canadians. This comprehensive market encompasses provincial health insurance plans, supplementary private insurance, and employer-sponsored benefit programs that collectively ensure healthcare accessibility across the nation. Market dynamics indicate robust growth in private supplementary insurance segments, with adoption rates increasing by 6.2% annually as consumers seek enhanced coverage beyond basic provincial plans.

Healthcare coverage in Canada operates through a unique dual-system approach where universal public insurance covers essential medical services while private insurance addresses gaps in coverage including prescription drugs, dental care, vision care, and extended health benefits. The market demonstrates significant regional variations, with Ontario and Quebec representing approximately 62% of total insurance enrollment due to their substantial population bases and diverse economic landscapes.

Digital transformation continues reshaping the Canadian health insurance landscape, with insurers investing heavily in telemedicine integration, mobile health applications, and artificial intelligence-driven claims processing. These technological advancements have improved customer satisfaction rates by 34% while reducing administrative costs and processing times across major insurance providers.

The Canadian health insurance market refers to the comprehensive ecosystem of public and private insurance providers, policies, and services that deliver healthcare coverage to Canadian residents through provincial health plans, supplementary private insurance, group benefits, and specialized health coverage products.

Health insurance coverage in Canada encompasses multiple layers of protection, beginning with universal healthcare provided through provincial and territorial health insurance plans that cover medically necessary hospital and physician services. Private health insurance supplements this foundation by covering services not included in public plans, such as prescription medications, dental treatments, vision care, paramedical services, and premium hospital accommodations.

Market participants include major insurance companies, employee benefit providers, health maintenance organizations, and specialized health service organizations that collectively serve diverse consumer segments ranging from individual policyholders to large corporate groups seeking comprehensive employee benefit packages.

Market expansion in the Canadian health insurance sector reflects evolving consumer expectations, demographic shifts, and regulatory developments that continue driving demand for comprehensive healthcare coverage solutions. The market demonstrates resilience through economic uncertainties while adapting to changing healthcare delivery models and consumer preferences for personalized insurance products.

Key growth drivers include an aging population requiring enhanced healthcare services, increasing awareness of healthcare gaps not covered by provincial plans, and rising healthcare costs that motivate consumers to seek additional protection. Employer-sponsored benefits represent the largest segment of private health insurance, with 78% of working Canadians having access to some form of workplace health coverage.

Competitive dynamics feature established insurance giants competing alongside emerging insurtech companies that leverage technology to deliver innovative coverage solutions. The market shows strong consolidation trends, with major players expanding their service offerings through strategic acquisitions and partnerships that enhance their ability to serve diverse customer segments effectively.

Strategic market insights reveal several critical trends shaping the Canadian health insurance landscape:

Demographic transformation serves as the primary catalyst driving Canadian health insurance market expansion. The aging baby boomer population requires increasingly comprehensive healthcare services, creating sustained demand for supplementary insurance coverage that addresses gaps in provincial health plans. Population aging trends indicate that Canadians over 65 will represent 25% of the population by 2030, significantly impacting healthcare utilization patterns.

Healthcare cost inflation continues motivating consumers and employers to seek comprehensive insurance protection against rising medical expenses. Prescription drug costs, dental treatments, and specialized medical services experience annual cost increases that exceed general inflation rates, making supplementary insurance increasingly valuable for Canadian families and individuals.

Employment market dynamics drive significant growth in group health insurance as employers compete for talent by offering comprehensive benefit packages. Talent retention strategies increasingly include enhanced health benefits, with companies recognizing that superior health coverage helps attract and retain skilled employees in competitive labor markets.

Consumer awareness of healthcare coverage gaps has increased substantially, particularly regarding services not covered by provincial health plans. Educational initiatives and healthcare experiences have heightened understanding of the importance of supplementary coverage for prescription drugs, dental care, vision services, and alternative therapies.

Regulatory complexity presents significant challenges for health insurance providers operating across multiple provinces with varying regulatory requirements and coverage mandates. Compliance costs associated with meeting diverse provincial regulations can limit market entry for smaller insurers and increase operational expenses for established providers.

Economic sensitivity affects consumer purchasing decisions regarding supplementary health insurance, particularly during economic downturns when individuals and small businesses may reduce discretionary insurance spending. Premium affordability concerns can limit market penetration, especially among lower-income demographics who would benefit most from additional coverage.

Healthcare system integration challenges arise from the complex interaction between public and private healthcare delivery systems. Coordination difficulties between provincial health plans and private insurers can create administrative burdens and customer confusion that may discourage insurance adoption.

Technology implementation costs represent substantial investments for insurance providers seeking to modernize their operations and improve customer service. Smaller insurance companies may struggle to compete with larger organizations that have greater resources for digital transformation initiatives.

Digital health innovation presents tremendous opportunities for insurance providers to differentiate their offerings through integrated health technology platforms. Telemedicine integration, mobile health apps, and AI-powered health coaching services can enhance customer engagement while potentially reducing claims costs through preventive care initiatives.

Underserved market segments offer significant growth potential, particularly among self-employed individuals, gig economy workers, and small business owners who lack access to traditional group insurance benefits. Flexible insurance products designed for non-traditional employment arrangements could capture substantial market share in evolving labor markets.

Cross-provincial expansion opportunities exist for regional insurers seeking to broaden their market presence. Strategic partnerships with healthcare providers, technology companies, and employee benefit consultants can facilitate market entry and service enhancement across different provinces.

Specialized coverage areas such as mental health services, alternative medicine, and international health coverage represent growing market niches with limited competition. Niche market development allows insurers to establish expertise in specific coverage areas while building strong customer relationships.

Competitive intensity in the Canadian health insurance market reflects the presence of established multinational insurers, regional specialists, and emerging technology-driven companies competing for market share across diverse customer segments. Market consolidation trends continue as larger insurers acquire smaller competitors to expand geographic coverage and enhance service capabilities.

Customer expectations have evolved significantly, with policyholders demanding seamless digital experiences, transparent pricing, and personalized coverage options. Service quality has become a key differentiator, with insurers investing heavily in customer service technology and claims processing efficiency to maintain competitive advantages.

Regulatory environment dynamics influence market strategies as provincial governments periodically review and modify health insurance regulations. Policy changes regarding coverage mandates, premium regulations, and market entry requirements can significantly impact insurer operations and strategic planning.

Healthcare delivery evolution affects insurance product development as new treatment modalities, diagnostic technologies, and care delivery models emerge. Innovation adaptation requires insurers to continuously evaluate and update their coverage policies to remain relevant and competitive in changing healthcare landscapes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Canadian health insurance market. Primary research includes extensive surveys of insurance providers, healthcare professionals, employers, and consumers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government statistics, industry reports, regulatory filings, and academic studies to provide comprehensive market context. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification of key findings and market projections.

Quantitative analysis utilizes statistical modeling techniques to identify market patterns, growth trends, and correlation factors that influence market dynamics. Qualitative insights complement numerical data through in-depth interviews with industry experts, regulatory officials, and key market participants.

Market segmentation analysis examines various customer demographics, geographic regions, and product categories to provide detailed insights into market composition and growth opportunities. Competitive intelligence gathering includes analysis of major market players, their strategies, market positioning, and performance metrics.

Ontario market dominance reflects the province’s substantial population and economic activity, representing approximately 38% of national health insurance enrollment. Toronto metropolitan area serves as a major hub for insurance company headquarters and regional operations, benefiting from concentrated corporate presence and diverse demographics requiring comprehensive health coverage solutions.

Quebec’s unique position in the Canadian health insurance market stems from distinct regulatory requirements and cultural preferences that influence insurance product design and marketing strategies. Provincial regulations in Quebec mandate specific coverage requirements that differ from other provinces, creating specialized market dynamics and opportunities for insurers.

Western provinces including British Columbia, Alberta, and Saskatchewan demonstrate strong growth potential driven by resource industry employment, population growth, and increasing awareness of supplementary health coverage benefits. Economic diversification in these regions supports sustained demand for comprehensive employee benefit programs.

Atlantic provinces present unique market characteristics with aging populations and rural healthcare challenges that create specific insurance needs. Market penetration in these regions remains lower than national averages, representing growth opportunities for insurers developing targeted products for underserved communities.

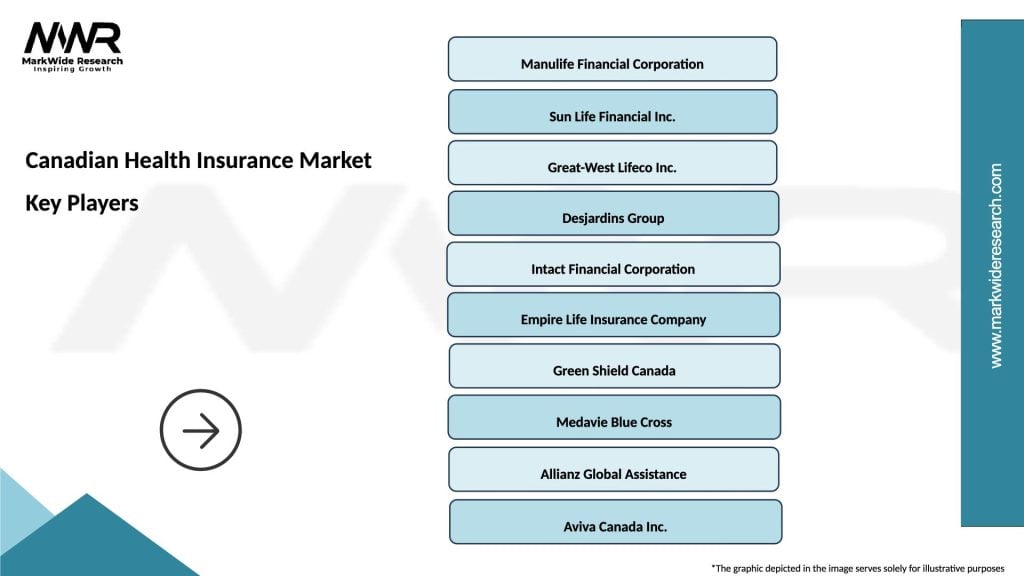

Market leadership in the Canadian health insurance sector features several dominant players with extensive national presence and comprehensive service offerings:

Competitive strategies emphasize digital transformation, customer service excellence, and product innovation to differentiate offerings in an increasingly crowded marketplace. Market positioning varies among competitors, with some focusing on large corporate clients while others target small businesses or individual consumers.

Market segmentation in the Canadian health insurance sector reflects diverse customer needs and coverage requirements across multiple dimensions:

By Coverage Type:

By Customer Segment:

Group health insurance represents the largest market category, driven by employer demand for competitive benefit packages that help attract and retain skilled employees. Corporate benefits typically include comprehensive health and dental coverage, prescription drug benefits, and extended health services that supplement provincial health plans effectively.

Individual health insurance serves self-employed professionals, early retirees, and individuals without access to group coverage. Product customization in this segment allows consumers to select specific coverage components based on personal health needs and budget considerations, creating opportunities for insurers to develop innovative product offerings.

Prescription drug coverage has emerged as a critical category due to rising medication costs and limited provincial coverage for many therapeutic drugs. Pharmaceutical benefits represent a significant portion of health insurance claims, with specialty medications driving increased demand for comprehensive drug coverage plans.

Dental insurance maintains strong growth as oral health awareness increases and dental treatment costs continue rising. Preventive dental care coverage helps reduce long-term treatment costs while improving overall health outcomes for policyholders and their families.

Insurance providers benefit from stable revenue streams generated by recurring premium payments and opportunities for cross-selling additional coverage products to existing customers. Risk diversification across large customer bases helps insurers manage claims volatility while maintaining profitability through careful underwriting and pricing strategies.

Employers gain significant advantages through group health insurance offerings that enhance their ability to attract and retain talented employees while potentially reducing overall compensation costs. Tax benefits associated with employer-provided health benefits create additional value for companies investing in comprehensive employee benefit programs.

Healthcare providers benefit from improved patient access to necessary treatments and services through insurance coverage that reduces financial barriers to care. Payment certainty from insurance reimbursements helps healthcare facilities manage cash flow and invest in advanced medical technologies and services.

Consumers receive financial protection against unexpected healthcare costs while gaining access to services not covered by provincial health plans. Peace of mind provided by comprehensive health insurance coverage allows individuals and families to focus on health and recovery rather than financial concerns during medical emergencies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the Canadian health insurance landscape as providers invest heavily in mobile applications, online portals, and artificial intelligence-powered customer service systems. Customer engagement through digital channels has improved significantly, with mobile app usage increasing by 42% among policyholders seeking convenient access to their coverage information and claims processing.

Personalized insurance products represent a growing trend as consumers demand coverage options tailored to their specific health needs and lifestyle preferences. Flexible benefit design allows policyholders to customize their coverage by selecting specific services and adjusting deductibles and co-payment levels based on individual circumstances.

Mental health coverage expansion reflects increased awareness of psychological wellness importance and growing demand for mental health services. Comprehensive mental health benefits now include coverage for psychologists, counselors, and digital mental health platforms that provide accessible support for various mental health conditions.

Preventive care emphasis has gained momentum as insurers recognize the long-term cost benefits of supporting preventive health measures. Wellness programs integrated with insurance coverage encourage healthy behaviors through incentives, health screenings, and lifestyle coaching services that help reduce future claims costs.

Strategic partnerships between insurance providers and healthcare technology companies have accelerated, creating integrated solutions that combine coverage with digital health services. Collaboration initiatives focus on developing comprehensive platforms that provide policyholders with seamless access to healthcare services, claims processing, and health management tools.

Regulatory modernization efforts across provinces aim to streamline insurance regulations and improve market efficiency while maintaining consumer protection standards. Policy updates address emerging healthcare technologies, telemedicine coverage, and digital health services that require updated regulatory frameworks.

Market consolidation activities continue as larger insurers acquire smaller competitors to expand their geographic presence and enhance service capabilities. Acquisition strategies focus on gaining access to specialized expertise, customer bases, and technology platforms that strengthen competitive positioning.

Innovation investments in artificial intelligence, machine learning, and data analytics enable insurers to improve underwriting accuracy, fraud detection, and customer service delivery. Technology adoption helps reduce operational costs while enhancing the overall customer experience through faster claims processing and more accurate risk assessment.

MarkWide Research analysis indicates that insurance providers should prioritize digital transformation initiatives to meet evolving customer expectations and improve operational efficiency. Technology investment in mobile platforms, artificial intelligence, and data analytics will become increasingly critical for maintaining competitive advantages in the evolving marketplace.

Market expansion strategies should focus on underserved customer segments, particularly gig economy workers and small business owners who lack access to traditional group insurance benefits. Product development for these segments requires flexible coverage options and innovative pricing models that accommodate non-traditional employment arrangements.

Partnership development with healthcare providers, technology companies, and employee benefit consultants can enhance service delivery while creating new revenue opportunities. Strategic alliances enable insurers to offer comprehensive solutions that address broader customer needs beyond traditional insurance coverage.

Regulatory compliance preparation for potential healthcare policy changes requires proactive monitoring of government initiatives and industry developments. Adaptive strategies help insurers respond effectively to regulatory modifications while maintaining operational efficiency and customer service quality.

Market growth prospects remain positive for the Canadian health insurance sector, driven by demographic trends, healthcare cost inflation, and increasing consumer awareness of coverage gaps in provincial health plans. Long-term expansion is expected to continue at a steady pace of 5.8% annually as market fundamentals support sustained demand for supplementary health coverage.

Technology integration will accelerate significantly over the next decade, with insurers investing heavily in digital platforms that provide seamless customer experiences and improved operational efficiency. Artificial intelligence and machine learning applications will enhance underwriting accuracy, claims processing speed, and fraud detection capabilities across the industry.

Product innovation will focus on personalized coverage options, integrated wellness programs, and comprehensive mental health benefits that address evolving consumer needs. Flexible insurance solutions designed for changing employment patterns and lifestyle preferences will create new market opportunities for forward-thinking insurers.

Regulatory evolution may include expanded public healthcare coverage in certain areas, requiring private insurers to adapt their product offerings and market strategies accordingly. MWR projections suggest that successful insurers will be those who can effectively navigate regulatory changes while continuing to provide valuable supplementary coverage that complements public healthcare systems.

The Canadian health insurance market represents a dynamic and essential component of the nation’s healthcare system, providing critical supplementary coverage that enhances the accessibility and comprehensiveness of healthcare services for millions of Canadians. Market resilience through economic uncertainties and evolving healthcare landscapes demonstrates the fundamental value that health insurance provides to consumers, employers, and healthcare providers across the country.

Future success in this market will depend on insurers’ ability to embrace digital transformation, develop innovative products that meet changing consumer needs, and maintain operational efficiency while navigating complex regulatory environments. Strategic positioning through technology adoption, customer service excellence, and targeted market expansion will differentiate successful providers in an increasingly competitive landscape.

Market opportunities remain substantial, particularly in underserved segments and emerging coverage areas such as mental health services, digital health integration, and personalized insurance solutions. The continued evolution of healthcare delivery models and consumer expectations will create ongoing demand for innovative insurance products that provide comprehensive protection and enhanced value for Canadian policyholders seeking optimal health coverage solutions.

What is Canadian Health Insurance?

Canadian Health Insurance refers to the various insurance plans that provide coverage for medical expenses in Canada, including hospital stays, physician services, and prescription medications.

What are the key players in the Canadian Health Insurance Market?

Key players in the Canadian Health Insurance Market include Manulife Financial, Sun Life Financial, and Great-West Lifeco, among others.

What are the main drivers of growth in the Canadian Health Insurance Market?

The main drivers of growth in the Canadian Health Insurance Market include an aging population, increasing healthcare costs, and a growing awareness of health and wellness among Canadians.

What challenges does the Canadian Health Insurance Market face?

Challenges in the Canadian Health Insurance Market include regulatory changes, rising claims costs, and competition from alternative health coverage options.

What opportunities exist in the Canadian Health Insurance Market?

Opportunities in the Canadian Health Insurance Market include the expansion of telehealth services, the integration of technology in health management, and the development of personalized insurance plans.

What trends are shaping the Canadian Health Insurance Market?

Trends shaping the Canadian Health Insurance Market include a shift towards digital health solutions, increased focus on mental health coverage, and the rise of value-based care models.

Canadian Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Group Plans, Supplemental Coverage |

| End User | Individuals, Families, Employers, Government Programs |

| Coverage Type | Comprehensive, Basic, Catastrophic, Preventive |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canadian Health Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at