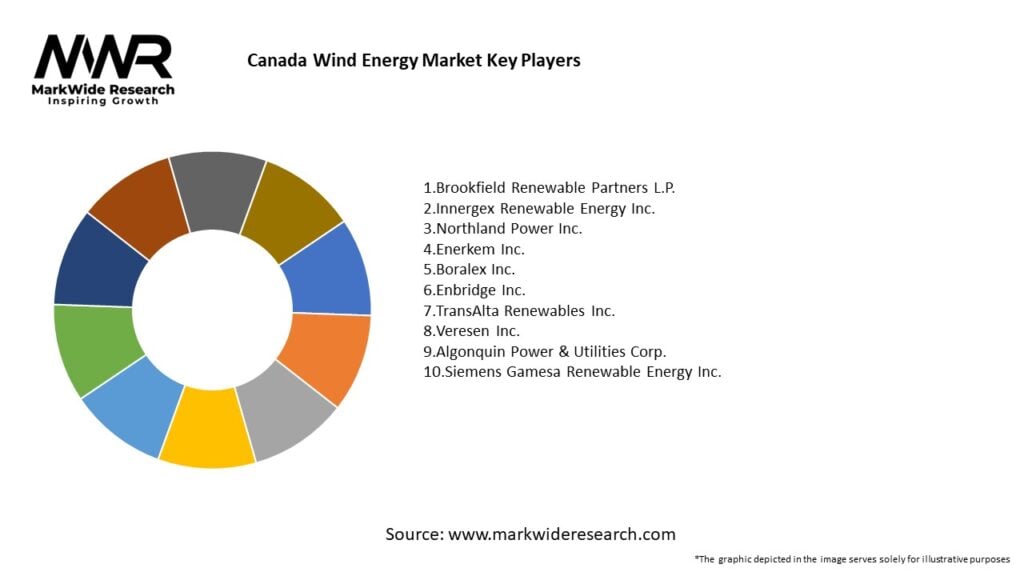

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Canada’s total installed wind capacity grew by over 10% year-on-year in 2023, driven by record installations in Alberta and Ontario.

-

Capacity factors for onshore projects average 30–40%, with new sites leveraging taller towers and larger rotors reaching 45%+ in prime locations.

-

Offshore wind pipeline exceeds 5 GW, with Nova Scotia’s leasing rounds and federal floating turbine grants accelerating development.

-

Community and Indigenous partnerships are increasing, with revenue-sharing agreements and co-ownership models fostering local benefits and social license.

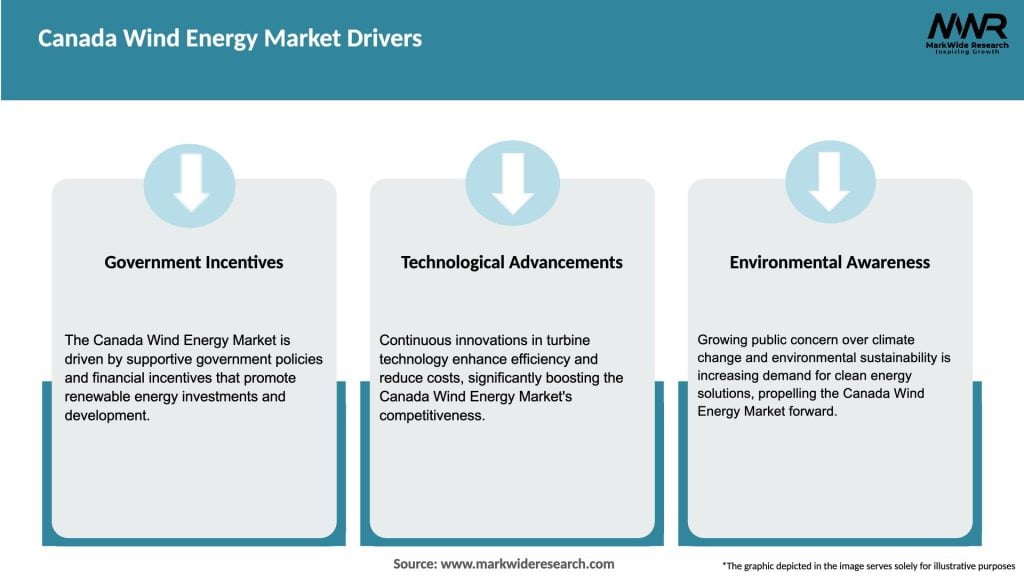

Market Drivers

-

Policy Support: Federal carbon pricing, tax incentives (e.g., accelerated Capital Cost Allowance), and provincial renewable standards (e.g., Ontario’s Renewable Energy Standard Offer Program) underpin project economics.

-

Cost Declines: Levelized Cost of Energy (LCOE) for onshore wind in Canada has fallen by over 40% since 2010, making it among the cheapest new generation sources.

-

Grid Decarbonization Goals: Major utilities and government agencies are procuring large quantities of wind power to replace retiring coal and reduce natural gas reliance.

-

Technological Advances: Larger rotor diameters, improved blades, and digital monitoring enhance efficiency and lower operating expenses.

-

Indigenous and Community Engagement: Collaborative project structures improve permitting timelines, community acceptance, and benefit sharing, smoothing development processes.

Market Restraints

-

Transmission Constraints: Limited high-voltage transmission corridors in wind-rich regions (e.g., Alberta’s southern plains) can delay project connections and increase congestion costs.

-

Intermittency and Integration: Variable wind output requires grid upgrades, energy storage solutions, and flexible generation backup to maintain reliability.

-

Environmental and Land-Use Concerns: Wildlife impacts (birds, bats), noise, and visual considerations can lead to local opposition and extended environmental assessments.

-

Supply Chain Bottlenecks: Global demand for turbines and components can lead to lead-time delays and price volatility in a tight market.

-

Financing Complexity: Securing PPAs or off-take agreements in provinces without auction frameworks can be challenging, affecting project bankability.

Market Opportunities

-

Offshore Wind Development: Floating turbines off Atlantic Canada and British Columbia’s West Coast unlock access to higher wind speeds and large-scale capacity.

-

Repowering Existing Farms: Replacing older 1–2 MW turbines with modern 4–5 MW units can double capacity using existing infrastructure, reducing costs.

-

Hybrid Projects: Co-locating wind with solar and energy storage systems enhances capacity factor, smooths output profiles, and optimizes land use.

-

Export Markets: Green hydrogen production powered by remote wind farms and inter-provincial/US export via new transmission lines present emerging revenue streams.

-

Digitalization and O&M Services: Advanced analytics, predictive maintenance, and drone inspections reduce downtime and lower operating expenses for owners.

Market Dynamics

-

Auction-Based Procurement: Provinces like Alberta and Nova Scotia are moving toward competitive bidding processes to achieve cost-effective wind additions.

-

Corporate PPAs: Large industrial and tech customers (e.g., data centers) entering into direct PPAs with wind developers to procure renewable energy.

-

Indigenous Partnerships: Equity stakes and revenue-sharing models with First Nations and Métis groups are becoming standard practice, enhancing project viability.

-

Grid Modernization: Investments in transmission expansion (e.g., Alberta’s ATCO “Heartland HVDC Link”) and smart grid technologies improve renewable integration.

-

Financial Innovation: Green bonds, sustainability-linked loans, and tax equity finance structures are broadening funding sources for wind projects.

Regional Analysis

-

Prairie Provinces (Alberta, Saskatchewan, Manitoba): Account for over 60% of installed capacity due to expansive wind resources and deregulated markets fostering competitive procurement.

-

Ontario: Second-largest market, leveraging robust transmission infrastructure and corporate PPA frameworks following the phase-out of feed-in tariffs.

-

Quebec: Growing capacity additions in Gaspésie and Bas-Saint-Laurent regions, supported by provincial renewable targets and hydropower-wind hybrid projects.

-

Atlantic Canada: Nova Scotia and New Brunswick exploring offshore zones; onshore installations near coastal corridors show high capacity factors.

-

British Columbia: Emerging onshore market around Peace River and West Kootenays; floating offshore potential under study for west coast deep waters.

Competitive Landscape

Leading Companies in the Canada Wind Energy Market:

- Brookfield Renewable Partners L.P.

- Innergex Renewable Energy Inc.

- Northland Power Inc.

- Enerkem Inc.

- Boralex Inc.

- Enbridge Inc.

- TransAlta Renewables Inc.

- Veresen Inc.

- Algonquin Power & Utilities Corp.

- Siemens Gamesa Renewable Energy Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

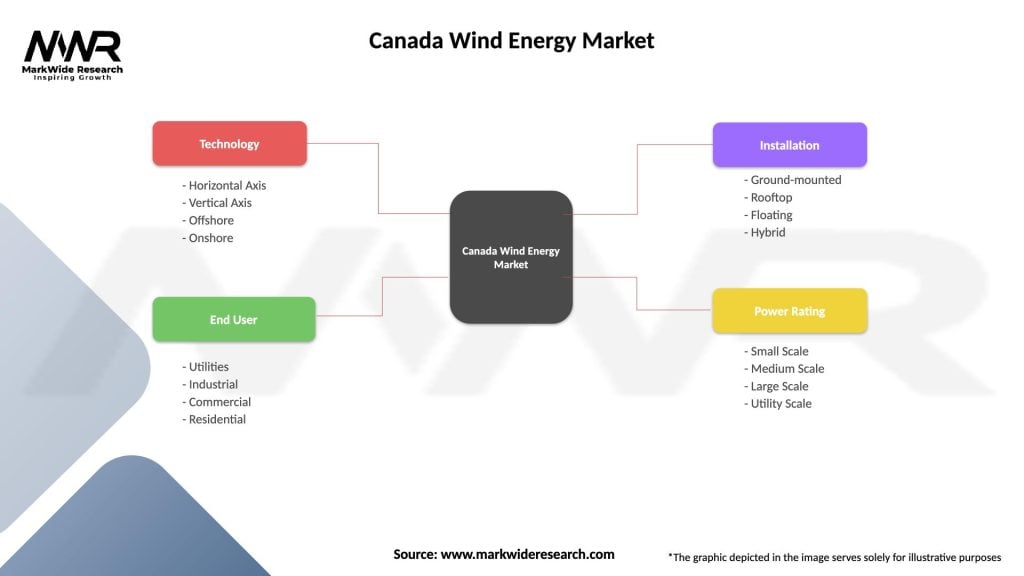

Segmentation

-

By Type: Onshore Wind, Offshore Wind (fixed-bottom, floating)

-

By Turbine Capacity: <3 MW, 3–5 MW, >5 MW

-

By End User: Utilities, Corporate Off-takers (PPAs), Industrials, Community Energy Projects

-

By Service: Project Development, Equipment Supply, Operations & Maintenance, Repowering

Category-wise Insights

-

Onshore Wind: Backbone of the market, benefitting from mature technology, streamlined permitting in some provinces, and lower capital costs.

-

Fixed-Bottom Offshore Wind: Early-stage in Canada, with shallow-water sites off Nova Scotia targeting first commercial arrays by 2030.

-

Floating Offshore Wind: Potential for West Coast deep-water farms leveraging European technology partnerships for floating foundations.

-

Repowering: High-value niche enabling capacity upgrades at minimal additional land-use and transmission expense.

-

Community and Hybrid Projects: Smaller-scale installations co-owned by municipalities or Indigenous groups, often paired with storage.

Key Benefits for Industry Participants and Stakeholders

-

Emission Reductions: Displacing fossil-fuel generation, wind power cuts CO₂ emissions by over 1 Mt per GW-year, aiding climate goals.

-

Economic Development: Wind farm projects inject capital into rural economies through land leases, local jobs, and community benefit agreements.

-

Energy Security: Diversifying the generation mix enhances resilience against fuel price volatility and external supply disruptions.

-

Innovation Ecosystem: Growth in manufacturing, digital services, and floating technology fosters Canadian clean tech capabilities and export potential.

-

Social License: Community engagement models and shared revenue streams build local support and streamline permitting processes.

SWOT Analysis

Strengths

-

Abundant, high-quality wind resources across multiple provinces.

-

Strong policy frameworks and carbon pricing reinforcing revenue stability.

Weaknesses

-

Transmission bottlenecks delaying projects in resource-rich zones.

-

Intermittency requiring complementary storage or dispatchable backup.

Opportunities

-

Emergence of offshore wind, unlocking coastal resource potential.

-

Corporate and community PPAs expanding market beyond traditional utilities.

Threats

-

Competition for capital from solar, hydro upgrades, and emerging SMR nuclear projects.

-

Global turbine supply chain constraints leading to cost escalations and schedule risks.

Market Key Trends

-

Declining LCOE: Continued cost reductions through larger turbines, economies of scale, and improved financing.

-

Hybrid Renewables + Storage: Co-located battery systems or pumped hydro storage smoothing wind variability and enabling dispatchability.

-

Digital Twins & AI: Real-time turbine performance modeling and predictive maintenance reducing downtime and operating costs.

-

Green Hydrogen Integration: Using curtailed wind power for electrolytic hydrogen production, adding flexibility and value streams.

-

Circular Economy Practices: Recycling of blades and components, extending asset lifecycles, and reducing decommissioning waste.

Covid-19 Impact

While initial lockdowns in 2020 caused minor delays in construction and supply chains, the Canadian wind sector rebounded quickly, aided by designation of energy projects as essential services. Remote commissioning, digital inspections, and flexible workforce arrangements minimized long-term disruptions. Post-pandemic stimulus spending on green infrastructure further accelerated project pipelines.

Key Industry Developments

-

Offshore Leasing Rounds: Nova Scotia’s 2023 call for expressions of interest attracted over 15 GW in proposals, with lease awards expected in 2025.

-

Transmission Upgrades: Alberta’s “Heartland HVDC Link” project will carry surplus wind power south to US markets, improving grid integration.

-

Scale-Up Partnerships: Northland Power’s agreement with EDF Renewables to co-develop Canada’s first major floating wind farm off British Columbia.

-

Repowering Tenders: Saskatchewan’s 2024 procurement includes earmarked capacity for repowered sites, incentivizing life-extension projects.

Analyst Suggestions

-

Accelerate Grid Investments: Prioritize transmission expansions in high-wind regions to unlock latent capacity and reduce curtailment.

-

Enhance Storage Coupling: Implement incentive frameworks for hybrid wind-plus-battery projects to firm output and improve grid reliability.

-

Streamline Permitting: Harmonize federal and provincial environmental review processes for offshore wind to shorten development timelines.

-

Foster Local Supply Chains: Encourage domestic manufacturing of turbine components and floating foundation elements through targeted incentives.

Future Outlook

The Canada Wind Energy market is set to sustain double-digit growth through 2030 as both onshore and offshore segments mature. Federal net-zero mandates and provincial clean-electricity requirements will drive procurement of large-scale wind capacity. Technological advances in floating offshore and hybrid renewable-storage systems will broaden application scopes. With stable policy frameworks, growing domestic expertise, and strong export prospects, Canada is positioned to remain a global leader in wind energy deployment and innovation.

Conclusion

Wind energy’s role in Canada’s clean-power transition cannot be overstated. Leveraging vast resource potential, supportive policies, and evolving technology, the sector is delivering environmental, economic, and social benefits. Addressing remaining challenges—transmission bottlenecks, intermittency, and permitting complexities—through targeted investments and regulatory reforms will ensure wind continues to power Canada’s journey toward a sustainable, resilient energy future.