444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada transformers market represents a critical component of the nation’s electrical infrastructure, encompassing power distribution, transmission, and specialized industrial applications. Market dynamics indicate robust growth driven by modernization initiatives, renewable energy integration, and infrastructure upgrades across provinces. The Canadian electrical grid transformation is experiencing unprecedented momentum, with transformer technology playing a pivotal role in ensuring reliable power distribution from coast to coast.

Growth projections suggest the market is expanding at a compound annual growth rate of 6.2%, reflecting strong demand from utility companies, industrial sectors, and renewable energy projects. Provincial governments are investing heavily in grid modernization, creating substantial opportunities for transformer manufacturers and suppliers. The market encompasses various transformer types, including power transformers, distribution transformers, and specialty units designed for specific Canadian climate conditions.

Regional distribution shows Ontario and Quebec commanding approximately 45% of market share, followed by Alberta and British Columbia with significant contributions. The energy transition toward cleaner sources is driving demand for advanced transformer technologies capable of handling variable renewable energy inputs while maintaining grid stability and efficiency.

The Canada transformers market refers to the comprehensive ecosystem of electrical transformer manufacturing, distribution, installation, and maintenance services across Canadian provinces and territories. This market encompasses all types of electrical transformers used for voltage conversion, power distribution, and grid management within Canada’s electrical infrastructure network.

Transformer applications span multiple sectors including utility power distribution, industrial manufacturing, renewable energy integration, mining operations, and commercial building systems. The market includes both domestic production facilities and imported transformer units, with emphasis on products designed to withstand Canada’s diverse climate conditions ranging from Arctic temperatures to humid coastal environments.

Market participants include international transformer manufacturers, domestic production companies, utility service providers, electrical contractors, and specialized maintenance organizations. The definition extends to encompass emerging technologies such as smart transformers, digital monitoring systems, and environmentally sustainable transformer designs that align with Canada’s environmental commitments.

Market performance demonstrates strong fundamentals driven by Canada’s commitment to infrastructure modernization and clean energy transition. The transformers market is experiencing robust demand across multiple sectors, with particular strength in renewable energy integration projects and aging infrastructure replacement initiatives. Utility companies are prioritizing grid reliability and efficiency improvements, creating sustained demand for advanced transformer technologies.

Key growth drivers include government infrastructure spending, renewable energy mandates, and industrial expansion in resource-rich provinces. The market benefits from regulatory support for grid modernization, with federal and provincial programs providing funding for electrical infrastructure upgrades. Technology advancement is accelerating adoption of smart transformers and digital monitoring systems that enhance grid management capabilities.

Competitive landscape features both established international players and emerging Canadian manufacturers, with companies focusing on product innovation, service excellence, and climate-adapted designs. Market consolidation trends are evident as larger players acquire specialized manufacturers to expand their technological capabilities and market reach. The outlook remains positive with sustained growth expected across all major transformer categories and applications.

Strategic insights reveal several critical factors shaping the Canadian transformers market landscape:

Primary market drivers are creating sustained momentum for transformer demand across Canada. Infrastructure investment represents the most significant driver, with federal and provincial governments allocating substantial resources for electrical grid modernization. The aging infrastructure challenge affects most Canadian provinces, where transformer installations from previous decades require systematic replacement to maintain reliability standards.

Renewable energy expansion continues driving specialized transformer demand, particularly for wind farms in prairie provinces and hydroelectric projects in Quebec and British Columbia. Grid integration of renewable sources requires advanced transformer technologies capable of managing variable power flows while maintaining system stability. The clean energy transition is creating opportunities for transformer manufacturers specializing in renewable energy applications.

Industrial growth in mining, oil and gas, and manufacturing sectors generates consistent demand for industrial-grade transformers. Resource development projects in northern regions require specialized transformers designed for harsh environmental conditions and remote operation. Urban development in major metropolitan areas drives demand for distribution transformers supporting residential and commercial construction projects.

Regulatory mandates for improved energy efficiency are promoting adoption of advanced transformer technologies. Government incentives for grid modernization provide financial support for utility companies investing in transformer upgrades. Climate resilience requirements are driving demand for transformers engineered to withstand extreme weather events and temperature variations.

Market challenges present obstacles to transformer market growth despite overall positive trends. High capital costs associated with transformer procurement and installation create budget constraints for utility companies and industrial users. The complex approval process for major electrical infrastructure projects can delay transformer deployments and impact market timing.

Supply chain disruptions have affected transformer availability and pricing, particularly for specialized units requiring long manufacturing lead times. Raw material costs for copper, steel, and insulating materials create pricing pressures that impact project economics. Skilled labor shortages in electrical installation and maintenance sectors constrain market growth potential.

Regulatory complexity across different provincial jurisdictions creates compliance challenges for transformer manufacturers and installers. Environmental regulations regarding transformer oil and disposal requirements add operational complexity and costs. Grid interconnection standards vary between provinces, requiring customized transformer specifications that increase manufacturing complexity.

Technology transition periods create uncertainty as utilities evaluate competing transformer technologies and standards. Maintenance requirements for existing transformer installations consume resources that could otherwise support new deployments. Geographic challenges in remote areas increase installation and service costs, limiting market accessibility in certain regions.

Emerging opportunities are creating new avenues for growth within the Canadian transformers market. Smart grid development presents substantial opportunities for manufacturers specializing in intelligent transformer technologies with advanced monitoring and control capabilities. The digital transformation of electrical infrastructure creates demand for transformers integrated with IoT sensors and communication systems.

Renewable energy expansion continues generating opportunities for specialized transformer applications, particularly in offshore wind projects and large-scale solar installations. Energy storage integration requires transformers designed for battery system connections and grid-scale storage applications. Electric vehicle infrastructure development creates new market segments for transformers supporting charging networks and fleet operations.

Export potential exists for Canadian transformer manufacturers to serve international markets, leveraging expertise in cold-climate designs and harsh environment applications. Indigenous community electrification projects present opportunities for transformer suppliers specializing in remote installation and sustainable energy solutions. Industrial electrification trends in mining and manufacturing create demand for specialized transformer applications.

Retrofit and upgrade opportunities exist throughout Canada’s aging electrical infrastructure, with efficiency improvements driving systematic transformer replacement programs. Climate adaptation requirements create opportunities for manufacturers developing transformers specifically designed for extreme weather resilience. Circular economy initiatives present opportunities for transformer refurbishment and recycling services.

Market dynamics reflect the complex interplay of technological advancement, regulatory evolution, and economic factors shaping the Canadian transformers landscape. Demand patterns show seasonal variations aligned with construction cycles and utility maintenance schedules, with peak activity during spring and summer months when weather conditions favor installation activities.

Competitive dynamics are intensifying as manufacturers differentiate through technology innovation, service capabilities, and climate-specific designs. Price competition remains significant, particularly for standard distribution transformers, while specialized applications command premium pricing. Market consolidation trends are evident as larger players acquire smaller manufacturers to expand technological capabilities and market coverage.

Technology evolution is accelerating adoption of digital monitoring systems, with predictive maintenance capabilities becoming standard features in new transformer installations. Efficiency standards are driving product development toward lower-loss designs that reduce operational costs over transformer lifecycles. Environmental considerations are influencing material selection and design approaches, with emphasis on recyclable components and reduced environmental impact.

Supply chain dynamics show increasing emphasis on domestic sourcing and supply chain resilience following recent global disruptions. Customer relationships are evolving toward long-term partnerships encompassing design, installation, and lifecycle maintenance services. Regional variations in demand patterns reflect different provincial energy policies, industrial development patterns, and infrastructure investment priorities.

Research approach employed comprehensive primary and secondary data collection methodologies to ensure accurate market analysis and insights. Primary research included structured interviews with utility executives, transformer manufacturers, electrical contractors, and industry association representatives across major Canadian markets. Survey methodology captured quantitative data on market trends, purchasing patterns, and technology preferences from key market participants.

Secondary research encompassed analysis of government infrastructure reports, utility company annual reports, industry publications, and regulatory filings. Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market projections. Market sizing methodologies utilized bottom-up analysis of transformer installations, replacement cycles, and demand forecasting models.

Geographic coverage included all Canadian provinces and territories, with particular focus on major markets in Ontario, Quebec, Alberta, and British Columbia. Segmentation analysis examined transformer types, applications, voltage ratings, and end-user categories to provide comprehensive market understanding. Competitive analysis included evaluation of market share, product portfolios, and strategic positioning of major market participants.

Trend analysis incorporated historical data spanning five years to identify growth patterns and market evolution trajectories. Forecasting methodology utilized multiple scenario analysis considering various economic, regulatory, and technological factors affecting market development. Quality assurance processes ensured data accuracy and reliability through multiple validation checkpoints and expert review procedures.

Regional market distribution reveals significant variations in transformer demand patterns across Canadian provinces and territories. Ontario represents the largest regional market, accounting for approximately 28% of national demand, driven by extensive industrial activity, urban development, and aging infrastructure replacement requirements. The province’s diverse economy creates demand across all transformer categories, from distribution units serving residential areas to large power transformers supporting industrial operations.

Quebec commands approximately 22% market share, with strong demand driven by hydroelectric power generation, aluminum smelting operations, and manufacturing industries. The province’s emphasis on renewable energy and grid modernization creates opportunities for advanced transformer technologies. Hydro-Quebec’s extensive transmission network requires specialized transformers designed for high-voltage applications and harsh winter conditions.

Alberta represents roughly 18% of the market, with demand driven by oil and gas operations, mining activities, and renewable energy projects. The province’s energy sector transformation toward cleaner sources is creating demand for transformers supporting wind farms and solar installations. Industrial applications in the oil sands region require specialized transformers designed for harsh environmental conditions and continuous operation.

British Columbia accounts for approximately 15% market share, with demand driven by mining operations, forestry industries, and hydroelectric power generation. The province’s mountainous terrain creates unique challenges for transformer installation and maintenance. Coastal regions require transformers designed for high humidity and salt air exposure, while interior regions demand units capable of extreme temperature variations.

Prairie provinces including Saskatchewan and Manitoba collectively represent about 12% of market demand, with agricultural processing, mining, and renewable energy driving transformer requirements. Atlantic provinces account for approximately 5% market share, with demand primarily from utility infrastructure upgrades and industrial applications in forestry and fishing industries.

Market competition features a diverse mix of international manufacturers, domestic producers, and specialized service providers competing across different transformer segments and applications. Competitive positioning varies significantly between commodity distribution transformers and specialized high-voltage units, with different success factors and market dynamics.

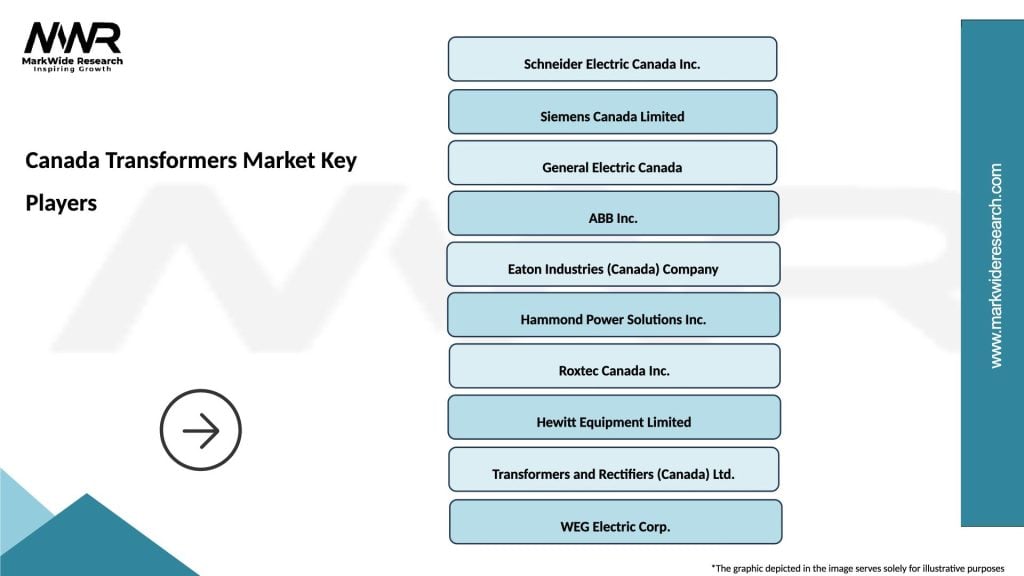

Leading market participants include:

Competitive strategies emphasize technology innovation, service excellence, and climate-specific product development. Market differentiation occurs through specialized applications, digital integration capabilities, and comprehensive lifecycle services. Strategic partnerships between manufacturers and utility companies are becoming increasingly important for major project wins and long-term market positioning.

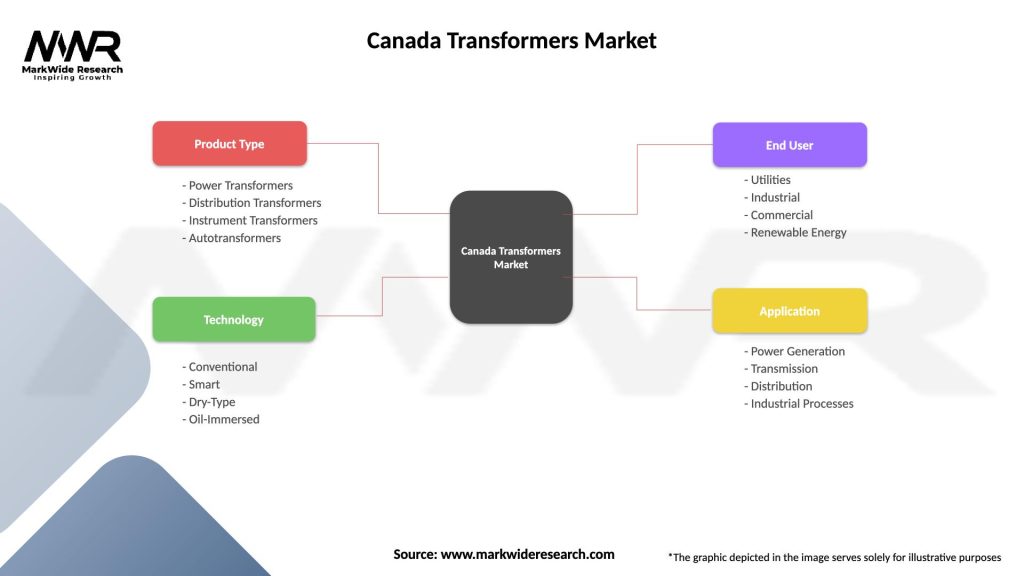

Market segmentation reveals distinct categories based on transformer type, application, voltage rating, and end-user requirements. Product segmentation provides insights into demand patterns and growth opportunities across different transformer categories.

By Transformer Type:

By Application:

By Voltage Rating:

Power transformers represent the highest-value market segment, with demand driven by utility infrastructure upgrades and industrial expansion projects. Growth trends show increasing adoption of high-efficiency designs that reduce energy losses and operational costs. Technology advancement in power transformers focuses on digital monitoring capabilities, improved cooling systems, and enhanced reliability features.

Distribution transformers constitute the largest volume segment, with steady demand from utility companies and electrical contractors. Market dynamics show increasing preference for pad-mounted units in urban areas and pole-mounted designs in rural applications. Efficiency standards are driving adoption of amorphous core transformers that offer superior energy performance compared to conventional silicon steel designs.

Specialty transformers show strong growth potential, particularly in mining, oil and gas, and renewable energy applications. Custom engineering capabilities become critical success factors for manufacturers serving specialized industrial applications. Environmental considerations drive demand for transformers designed for extreme temperatures, high altitudes, and corrosive atmospheres.

Smart transformers represent an emerging category with significant growth potential as utilities invest in grid modernization. Digital integration capabilities enable remote monitoring, predictive maintenance, and automated grid management functions. Technology adoption is accelerating as utilities recognize the operational benefits of intelligent transformer systems.

Utility companies benefit from improved grid reliability, reduced maintenance costs, and enhanced operational efficiency through advanced transformer technologies. Smart monitoring capabilities enable predictive maintenance strategies that minimize unplanned outages and extend equipment lifecycles. Energy efficiency improvements reduce transmission losses and support sustainability objectives.

Industrial users gain from reliable power supply, reduced downtime, and improved operational efficiency through properly specified transformer installations. Custom solutions address specific industrial requirements while optimizing total cost of ownership. Maintenance services ensure optimal performance and extend equipment lifecycles.

Manufacturers benefit from growing market demand, technology advancement opportunities, and expanding service revenue streams. Product innovation creates competitive differentiation and premium pricing opportunities. Digital transformation enables new business models based on performance monitoring and predictive maintenance services.

Government stakeholders achieve infrastructure modernization objectives, improved energy security, and economic development through transformer market growth. Job creation in manufacturing and service sectors supports economic development goals. Environmental benefits from efficient transformers contribute to climate change mitigation efforts.

End consumers benefit from reliable electricity supply, improved power quality, and reduced environmental impact through efficient transformer technologies. Grid modernization enables integration of renewable energy sources and supports sustainable energy transition objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Canadian transformers market. Smart transformers equipped with IoT sensors and communication capabilities are becoming standard for new installations, enabling real-time monitoring and predictive maintenance. Data analytics applications help utilities optimize transformer performance and extend equipment lifecycles through condition-based maintenance strategies.

Sustainability focus is driving adoption of environmentally friendly transformer designs and materials. Energy efficiency requirements are promoting high-performance transformer technologies that reduce operational losses. Circular economy principles are influencing transformer design for improved recyclability and refurbishment potential. Bio-based insulating fluids are gaining acceptance as alternatives to traditional mineral oil systems.

Modular design approaches are gaining popularity for their flexibility and reduced installation complexity. Prefabricated substations incorporating transformers enable faster deployment and improved quality control. Standardization efforts across provinces are reducing design complexity and improving cost efficiency for manufacturers and utilities.

Grid resilience considerations are driving demand for transformers designed to withstand extreme weather events and cyber security threats. Climate adaptation features include enhanced cooling systems, improved insulation materials, and robust monitoring capabilities. Cybersecurity measures are becoming essential for smart transformers connected to digital grid management systems.

Recent developments demonstrate the dynamic nature of the Canadian transformers market and ongoing evolution toward advanced technologies. MarkWide Research analysis indicates accelerating adoption of digital transformer technologies across major utility companies, with implementation rates increasing by approximately 35% annually in smart grid pilot projects.

Manufacturing expansion initiatives include new production facilities and capacity upgrades by major transformer manufacturers. Technology partnerships between Canadian utilities and international manufacturers are advancing development of climate-specific transformer designs. Research collaborations with universities and technology institutes are driving innovation in transformer materials and monitoring systems.

Regulatory developments include updated efficiency standards and environmental requirements affecting transformer specifications. Government funding programs are supporting grid modernization projects that incorporate advanced transformer technologies. Indigenous partnerships are expanding electrification projects in remote communities, creating demand for specialized transformer solutions.

Acquisition activity continues as larger manufacturers expand their technological capabilities and market coverage through strategic purchases. Service expansion initiatives include comprehensive lifecycle management programs that encompass design, installation, monitoring, and maintenance services. Export development programs are helping Canadian manufacturers access international markets with specialized cold-climate transformer designs.

Strategic recommendations for market participants focus on positioning for long-term growth and competitive advantage. Technology investment in digital monitoring and smart transformer capabilities represents essential preparation for future market requirements. Service expansion into comprehensive lifecycle management creates recurring revenue opportunities and strengthens customer relationships.

Geographic diversification across Canadian provinces reduces market concentration risk and captures regional growth opportunities. Specialization strategies in climate-adapted designs, renewable energy applications, or industrial segments can create competitive differentiation. Partnership development with utility companies, electrical contractors, and technology providers enhances market access and capability development.

Supply chain resilience initiatives including domestic sourcing and inventory management help mitigate disruption risks. Workforce development programs addressing skilled labor shortages support market growth and service quality objectives. Sustainability integration in product design and operations aligns with customer requirements and regulatory trends.

Market intelligence systems enabling rapid response to changing customer needs and competitive dynamics become increasingly important. Innovation investment in emerging technologies such as solid-state transformers and advanced materials positions companies for future market evolution. Customer education programs highlighting the benefits of advanced transformer technologies can accelerate adoption and market growth.

Market projections indicate sustained growth for the Canadian transformers market driven by infrastructure modernization, renewable energy expansion, and digital grid transformation. Long-term trends suggest continued evolution toward intelligent, efficient, and environmentally sustainable transformer technologies. Growth momentum is expected to accelerate as government infrastructure programs and utility modernization initiatives gain momentum.

Technology evolution will continue advancing transformer capabilities, with artificial intelligence and machine learning applications enhancing predictive maintenance and grid optimization functions. Materials science developments promise improved transformer performance, efficiency, and environmental compatibility. Integration capabilities with renewable energy systems and energy storage will become increasingly sophisticated.

Market expansion opportunities exist in emerging applications such as electric vehicle charging infrastructure, data center power systems, and industrial electrification projects. Export potential for Canadian manufacturers specializing in cold-climate designs and harsh environment applications continues growing as global infrastructure development accelerates. Service evolution toward comprehensive asset management and performance optimization creates new revenue opportunities.

Regulatory evolution will likely emphasize efficiency standards, environmental requirements, and grid resilience capabilities. MWR forecasts indicate the market will maintain robust growth trajectories, with annual expansion rates projected at 6-8% through the next decade. Investment requirements for grid modernization and renewable energy integration will sustain transformer demand across all major market segments and regional markets.

The Canada transformers market demonstrates strong fundamentals and positive growth prospects driven by infrastructure modernization, renewable energy expansion, and digital grid transformation initiatives. Market dynamics reflect the essential role of transformers in Canada’s electrical infrastructure, with sustained demand across utility, industrial, and specialized applications creating opportunities for manufacturers, service providers, and technology innovators.

Competitive positioning requires focus on technology advancement, service excellence, and climate-specific product development to succeed in this evolving market landscape. Regional variations in demand patterns and regulatory requirements necessitate flexible approaches that can address diverse provincial market conditions and customer needs. Strategic success depends on balancing commodity market efficiency with specialized application expertise and comprehensive service capabilities.

Future growth will be driven by continued infrastructure investment, renewable energy integration, and smart grid development across Canadian provinces. Technology trends toward digital integration, improved efficiency, and environmental sustainability will shape product development and market positioning strategies. The Canada transformers market represents a critical component of the nation’s energy infrastructure, with sustained growth potential supporting economic development and energy security objectives nationwide.

What is Transformers?

Transformers are electrical devices that transfer electrical energy between two or more circuits through electromagnetic induction. They are essential in power distribution and voltage regulation in various applications, including industrial, commercial, and residential sectors.

What are the key players in the Canada Transformers Market?

Key players in the Canada Transformers Market include Siemens, ABB, Schneider Electric, and General Electric, among others. These companies are known for their innovative transformer solutions and extensive service networks across the country.

What are the growth factors driving the Canada Transformers Market?

The Canada Transformers Market is driven by the increasing demand for electricity, the expansion of renewable energy sources, and the modernization of aging electrical infrastructure. Additionally, the growth of electric vehicles and smart grid technologies is contributing to market expansion.

What challenges does the Canada Transformers Market face?

The Canada Transformers Market faces challenges such as high initial costs of advanced transformer technologies and the need for skilled labor for installation and maintenance. Additionally, regulatory compliance and environmental concerns can pose obstacles to market growth.

What opportunities exist in the Canada Transformers Market?

Opportunities in the Canada Transformers Market include the increasing investment in smart grid technologies and the integration of renewable energy sources. Furthermore, the growing focus on energy efficiency and sustainability presents avenues for innovation and development.

What trends are shaping the Canada Transformers Market?

Trends in the Canada Transformers Market include the adoption of digital transformers, advancements in materials for improved efficiency, and the shift towards eco-friendly designs. Additionally, the rise of IoT applications in energy management is influencing transformer technology and usage.

Canada Transformers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Power Transformers, Distribution Transformers, Instrument Transformers, Autotransformers |

| Technology | Conventional, Smart, Dry-Type, Oil-Immersed |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Application | Power Generation, Transmission, Distribution, Industrial Processes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Transformers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at