444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada telecom towers market represents a critical infrastructure backbone supporting the nation’s rapidly evolving telecommunications landscape. As Canada continues its digital transformation journey, the demand for robust telecom tower infrastructure has intensified significantly. Market dynamics indicate substantial growth driven by the nationwide deployment of 5G networks, increasing mobile data consumption, and expanding rural connectivity initiatives.

Telecom towers serve as essential infrastructure elements that enable wireless communication services across Canada’s vast geographical expanse. The market encompasses various tower types including lattice towers, monopole towers, guyed towers, and stealth towers, each serving specific deployment requirements. Growth projections suggest the market will experience a compound annual growth rate of 8.2% over the forecast period, driven primarily by 5G network expansion and rural broadband initiatives.

Regional distribution shows concentrated activity in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, while significant expansion is occurring in underserved rural regions. The market benefits from supportive government policies promoting digital infrastructure development and private sector investments in next-generation wireless technologies. Technology adoption rates indicate that approximately 45% of new tower installations are specifically designed to support 5G network requirements.

The Canada telecom towers market refers to the comprehensive ecosystem of wireless communication infrastructure including tower construction, maintenance, sharing, and related services across Canadian territories. This market encompasses the physical infrastructure that enables mobile network operators to provide voice, data, and emerging digital services to consumers and businesses throughout the country.

Telecom towers function as elevated structures that house antennas, transmitters, and other radio frequency equipment necessary for wireless communication. These structures facilitate signal transmission and reception across designated coverage areas, enabling seamless connectivity for mobile devices, IoT applications, and emerging technologies. The market includes various stakeholder categories including tower companies, mobile network operators, equipment manufacturers, and service providers.

Infrastructure sharing represents a fundamental aspect of the market, where multiple operators utilize common tower facilities to optimize costs and reduce environmental impact. This collaborative approach has become increasingly important as operators seek to accelerate network deployment while managing capital expenditure requirements effectively.

Market fundamentals demonstrate robust growth potential driven by accelerating digital transformation initiatives and expanding wireless connectivity requirements. The Canadian telecom towers market benefits from strong regulatory support, technological advancement, and increasing demand for high-speed mobile services across diverse geographical regions.

Key growth drivers include the nationwide 5G network rollout, rural connectivity expansion programs, and increasing mobile data consumption patterns. Market penetration rates show that 72% of urban areas have access to advanced tower infrastructure, while rural coverage continues expanding through targeted investment programs. The market demonstrates resilience through diversified revenue streams including tower leasing, maintenance services, and infrastructure sharing arrangements.

Competitive dynamics feature established tower companies, telecommunications operators, and emerging technology providers competing across various market segments. Strategic partnerships and infrastructure sharing agreements have become prevalent, enabling market participants to optimize resource utilization while accelerating network deployment timelines.

Future prospects remain highly favorable with projected growth supported by emerging technologies including Internet of Things applications, smart city initiatives, and advanced mobile services requiring enhanced network capacity and coverage.

Strategic insights reveal several critical factors shaping the Canada telecom towers market landscape:

Primary growth drivers propelling the Canada telecom towers market include accelerating 5G network deployment initiatives across major urban centers and rural regions. Network operators are investing heavily in tower infrastructure to support next-generation wireless services, with deployment rates increasing significantly year-over-year.

Mobile data consumption continues expanding exponentially, driven by streaming services, remote work applications, and digital entertainment platforms. This surge in data usage necessitates enhanced network capacity and coverage, directly translating to increased tower infrastructure requirements. Consumer behavior patterns show mobile data usage growing at approximately 25% annually, creating sustained demand for network expansion.

Government initiatives supporting rural connectivity and digital infrastructure development provide substantial market momentum. Federal and provincial programs aimed at bridging the digital divide are generating significant investment in tower construction across underserved regions. These initiatives create long-term growth opportunities while addressing critical connectivity gaps.

Technological advancement in wireless communication standards, particularly 5G technology adoption, requires comprehensive network infrastructure upgrades. The transition to 5G networks demands higher tower density and enhanced equipment capabilities, driving substantial capital investment in tower infrastructure development and modernization projects.

Regulatory challenges present significant constraints including complex approval processes for tower construction and zoning restrictions in certain jurisdictions. Municipal regulations and environmental assessment requirements can extend project timelines and increase development costs, potentially limiting market expansion in specific regions.

High capital requirements for tower construction and equipment installation create barriers for smaller market participants. The substantial upfront investment needed for tower development, combined with ongoing maintenance costs, can strain financial resources and limit market entry opportunities for emerging companies.

Environmental concerns and community opposition to tower construction in residential areas pose ongoing challenges. Public perception issues regarding visual impact and health concerns can complicate approval processes and delay project implementation, affecting market growth momentum.

Geographic constraints specific to Canada’s vast territory and challenging terrain conditions increase construction complexity and costs. Remote locations often require specialized equipment and logistics solutions, resulting in higher per-site development expenses that can impact project viability and profitability.

Emerging opportunities in the Canada telecom towers market include expanding 5G network coverage to rural and remote communities through targeted infrastructure development programs. Government funding initiatives and private sector partnerships create favorable conditions for accelerated tower deployment in previously underserved regions.

Smart city development projects across major Canadian municipalities present substantial growth opportunities for advanced tower infrastructure supporting IoT applications, traffic management systems, and public safety networks. These initiatives require dense, high-capacity tower networks with integrated edge computing capabilities.

Infrastructure sharing expansion offers significant opportunities for optimizing resource utilization and reducing deployment costs. Collaborative arrangements between operators enable faster network rollout while improving return on investment for tower infrastructure development projects.

Technology integration opportunities include incorporating renewable energy solutions, edge computing capabilities, and advanced monitoring systems into tower infrastructure. These enhancements create additional revenue streams while improving operational efficiency and environmental sustainability.

Market dynamics in the Canada telecom towers sector reflect the complex interplay between technological advancement, regulatory frameworks, and competitive pressures. Supply and demand equilibrium is influenced by accelerating 5G deployment requirements and expanding mobile service coverage expectations across diverse geographical regions.

Competitive intensity has increased as established tower companies, telecommunications operators, and infrastructure investors compete for market share. Market consolidation trends show increasing merger and acquisition activity as companies seek to achieve economies of scale and expand geographical coverage capabilities.

Investment patterns demonstrate strong capital flows from both domestic and international sources, with foreign investment accounting for approximately 35% of major tower development projects. This international participation brings advanced technologies and operational expertise while accelerating market development.

Technological evolution continues reshaping market dynamics as operators transition from legacy networks to advanced 5G infrastructure. This transformation requires substantial tower upgrades and new construction, creating sustained demand for infrastructure development services and equipment.

Research approach for analyzing the Canada telecom towers market incorporates comprehensive primary and secondary research methodologies to ensure accurate market assessment and reliable forecasting. Data collection encompasses industry interviews, regulatory filings, company reports, and market surveys conducted across key stakeholder categories.

Primary research includes structured interviews with tower company executives, telecommunications operators, equipment manufacturers, and regulatory officials. These interactions provide insights into market trends, competitive dynamics, and future development plans that inform market analysis and projections.

Secondary research utilizes industry publications, government statistics, regulatory documents, and company financial reports to validate primary findings and establish comprehensive market understanding. Data triangulation ensures accuracy and reliability of market insights and growth projections.

Analytical frameworks employ quantitative and qualitative assessment methodologies including market sizing, competitive analysis, trend identification, and scenario planning. These approaches enable comprehensive market evaluation and strategic insight development for industry stakeholders.

Regional distribution across Canada shows concentrated tower infrastructure development in major metropolitan areas including the Greater Toronto Area, Vancouver metropolitan region, and Montreal urban corridor. Urban markets account for approximately 68% of total tower installations, reflecting population density and high mobile service demand.

Western Canada demonstrates strong growth momentum driven by resource sector connectivity requirements and expanding urban populations in Calgary, Edmonton, and Vancouver. The region benefits from supportive provincial policies and significant private sector investment in telecommunications infrastructure development.

Eastern Canada markets including Ontario, Quebec, and the Atlantic provinces show steady expansion supported by government rural connectivity initiatives and urban network densification projects. Market penetration rates in these regions indicate mature infrastructure coverage of 78% in urban areas with ongoing rural expansion.

Northern territories present unique opportunities and challenges with vast geographical coverage requirements and specialized infrastructure needs. Government programs supporting northern connectivity create targeted investment opportunities while addressing critical communication infrastructure gaps in remote communities.

Market leadership in the Canada telecom towers sector features several key players competing across different segments and geographical regions:

Competitive strategies emphasize infrastructure sharing, technology integration, and geographical expansion to capture market opportunities. Strategic partnerships between operators and tower companies are becoming increasingly common to optimize resource utilization and accelerate network deployment.

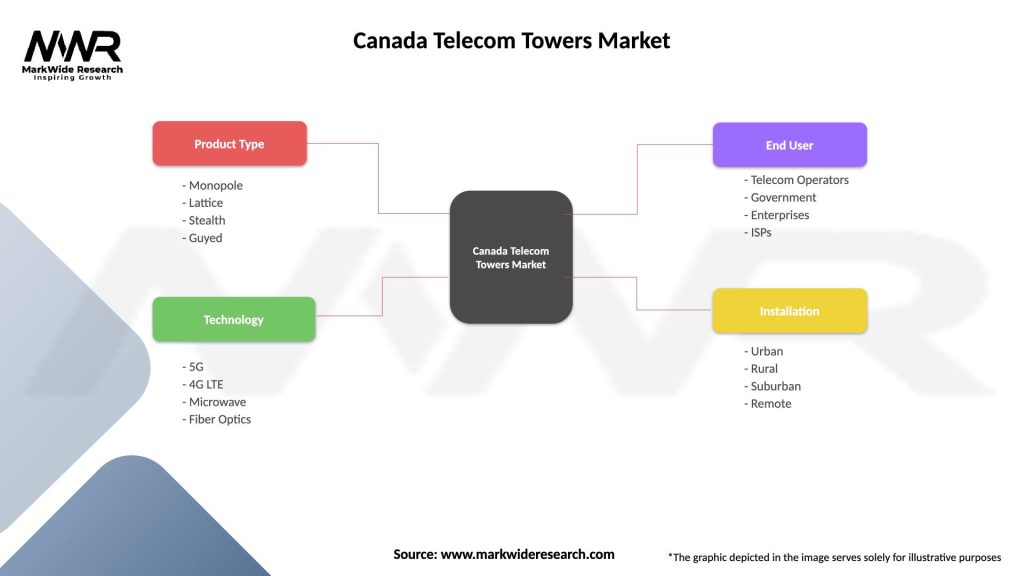

Market segmentation analysis reveals distinct categories based on tower type, technology, application, and ownership structure:

By Tower Type:

By Technology:

By Application:

Technology category analysis shows 5G infrastructure representing the fastest-growing segment with deployment rates increasing 42% annually. This growth reflects operator priorities for next-generation network capabilities and enhanced service offerings requiring advanced tower infrastructure.

Ownership structure categories demonstrate increasing preference for infrastructure sharing arrangements and third-party tower companies. Shared infrastructure models are gaining traction as operators seek to optimize capital allocation while maintaining competitive network coverage and capacity.

Geographic categories reveal distinct investment patterns with urban markets focusing on network densification and capacity enhancement, while rural markets emphasize coverage expansion and connectivity gap resolution. These different requirements drive varied tower specifications and deployment strategies.

Service categories show growing demand for comprehensive tower services including construction, maintenance, optimization, and technology integration. Full-service providers are capturing increased market share by offering integrated solutions that reduce complexity and improve operational efficiency for network operators.

Network operators benefit from enhanced coverage capabilities, improved service quality, and accelerated network deployment through strategic tower infrastructure investments. Operational advantages include reduced maintenance costs, improved network reliability, and enhanced capacity to support growing mobile data demands.

Tower companies realize substantial revenue opportunities through long-term lease agreements, infrastructure sharing arrangements, and value-added services. Business model advantages include predictable cash flows, scalable operations, and opportunities for portfolio expansion across diverse geographical markets.

Equipment manufacturers benefit from sustained demand for advanced tower equipment, 5G-compatible systems, and technology upgrade solutions. Market opportunities include recurring revenue from maintenance services and technology refresh cycles driven by evolving wireless standards.

Government stakeholders achieve policy objectives including rural connectivity expansion, digital infrastructure development, and economic growth through improved telecommunications capabilities. Social benefits include enhanced emergency services communication, educational connectivity, and economic development opportunities in underserved regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Infrastructure sharing acceleration represents a dominant trend as operators collaborate to reduce costs and accelerate network deployment. Shared infrastructure adoption is increasing rapidly, with collaborative arrangements becoming standard practice for new tower construction projects.

5G network densification continues driving tower deployment in urban areas where enhanced capacity and reduced latency requirements necessitate closer antenna spacing. Small cell integration with traditional tower infrastructure creates hybrid network architectures optimized for 5G service delivery.

Sustainability initiatives are gaining prominence as tower companies implement renewable energy solutions, energy-efficient equipment, and environmentally responsible construction practices. Green tower development addresses environmental concerns while reducing operational costs through improved energy efficiency.

Technology convergence trends show increasing integration of edge computing, IoT capabilities, and advanced monitoring systems within tower infrastructure. These enhancements create additional revenue opportunities while improving network performance and operational efficiency.

Recent developments in the Canada telecom towers market include significant infrastructure sharing agreements between major operators aimed at accelerating 5G network deployment while optimizing capital expenditure. Strategic partnerships are enabling faster market expansion and improved service coverage across diverse geographical regions.

Technology integration initiatives show increasing deployment of smart tower solutions incorporating renewable energy systems, remote monitoring capabilities, and predictive maintenance technologies. These advancements improve operational efficiency while reducing environmental impact and maintenance costs.

Regulatory developments include streamlined approval processes for tower construction and enhanced support for rural connectivity initiatives. Government programs continue expanding with increased funding allocation for telecommunications infrastructure development in underserved regions.

Investment activity remains robust with both domestic and international capital supporting market expansion. MarkWide Research analysis indicates continued strong investor interest in Canadian telecommunications infrastructure assets, driven by stable regulatory environment and growth prospects.

Strategic recommendations for market participants include prioritizing infrastructure sharing arrangements to optimize resource utilization and accelerate network deployment timelines. Collaborative approaches enable companies to achieve better returns on investment while reducing individual capital requirements and operational risks.

Technology investment should focus on 5G-compatible infrastructure and future-ready solutions that can accommodate evolving wireless standards. Forward-looking infrastructure development ensures long-term asset value and competitive positioning in rapidly changing technology environments.

Geographic expansion strategies should balance urban densification requirements with rural connectivity opportunities supported by government programs. Portfolio diversification across different market segments and regions provides stability and growth potential while mitigating concentration risks.

Sustainability integration becomes increasingly important for long-term market success as environmental considerations influence regulatory approval processes and community acceptance. Green infrastructure development aligns with policy objectives while reducing operational costs and improving corporate reputation.

Market prospects for the Canada telecom towers sector remain highly favorable with sustained growth expected through the forecast period. Growth projections indicate the market will continue expanding at a robust pace of 8.2% CAGR, driven by 5G network deployment, rural connectivity expansion, and emerging technology applications.

Technology evolution will continue shaping market dynamics as 5G networks mature and next-generation wireless standards emerge. Infrastructure requirements will evolve to support advanced applications including autonomous vehicles, smart cities, and industrial IoT implementations requiring enhanced network capabilities.

Investment momentum is expected to remain strong with continued capital flows from domestic and international sources supporting market expansion. MWR projections suggest sustained investor interest in Canadian telecommunications infrastructure driven by stable regulatory environment and attractive long-term returns.

Regional development will continue emphasizing rural connectivity expansion while urban markets focus on network densification and capacity enhancement. Balanced growth across different geographical segments ensures comprehensive market development and sustainable long-term expansion opportunities.

The Canada telecom towers market represents a dynamic and rapidly expanding sector driven by technological advancement, regulatory support, and increasing connectivity demands across diverse geographical regions. Market fundamentals demonstrate strong growth potential supported by 5G network deployment, rural connectivity initiatives, and emerging technology applications requiring enhanced infrastructure capabilities.

Strategic opportunities abound for market participants willing to invest in advanced infrastructure, collaborative arrangements, and sustainable development practices. The combination of supportive government policies, strong investor interest, and evolving technology requirements creates favorable conditions for sustained market expansion and profitability.

Future success in this market will depend on companies’ ability to adapt to changing technology requirements, optimize resource utilization through strategic partnerships, and maintain focus on sustainable development practices. MarkWide Research analysis suggests that organizations embracing these principles will be well-positioned to capitalize on the substantial growth opportunities ahead in Canada’s evolving telecommunications infrastructure landscape.

What is Telecom Towers?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication for mobile networks, broadcasting, and data transmission.

What are the key players in the Canada Telecom Towers Market?

Key players in the Canada Telecom Towers Market include companies like Rogers Communications, Bell Canada, and Telus, which are significant providers of telecommunications infrastructure and services, among others.

What are the main drivers of growth in the Canada Telecom Towers Market?

The growth of the Canada Telecom Towers Market is driven by the increasing demand for mobile data services, the expansion of 5G networks, and the rising need for improved connectivity in urban and rural areas.

What challenges does the Canada Telecom Towers Market face?

Challenges in the Canada Telecom Towers Market include regulatory hurdles, the high cost of infrastructure development, and public opposition to new tower installations due to aesthetic concerns.

What opportunities exist in the Canada Telecom Towers Market?

Opportunities in the Canada Telecom Towers Market include the potential for partnerships with municipalities for smart city initiatives, the integration of renewable energy sources, and the expansion of Internet of Things (IoT) applications.

What trends are shaping the Canada Telecom Towers Market?

Trends in the Canada Telecom Towers Market include the shift towards small cell technology for urban areas, the adoption of shared infrastructure models, and the increasing focus on sustainability and energy efficiency in tower design.

Canada Telecom Towers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Monopole, Lattice, Stealth, Guyed |

| Technology | 5G, 4G LTE, Microwave, Fiber Optics |

| End User | Telecom Operators, Government, Enterprises, ISPs |

| Installation | Urban, Rural, Suburban, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Telecom Towers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at