444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada switchgear market represents a critical component of the nation’s electrical infrastructure, encompassing a comprehensive range of electrical switching devices, protective equipment, and control systems. Market dynamics indicate robust growth driven by increasing investments in renewable energy infrastructure, grid modernization initiatives, and expanding industrial automation across various sectors. The market demonstrates significant expansion potential with growing at a compound annual growth rate (CAGR) of 6.2% through the forecast period.

Infrastructure development across Canada’s provinces continues to fuel demand for advanced switchgear solutions, particularly in urban centers like Toronto, Vancouver, and Montreal. The market encompasses various voltage categories, including low voltage, medium voltage, and high voltage switchgear systems, each serving distinct applications in residential, commercial, and industrial settings. Technological advancement in smart grid technologies and digital switchgear solutions positions Canada as a progressive market for innovative electrical infrastructure.

Regional distribution shows Ontario commanding approximately 38% market share, followed by Quebec and British Columbia as significant contributors. The market benefits from Canada’s commitment to clean energy transition, with renewable energy integration driving approximately 25% of new switchgear installations. Industrial sectors including oil and gas, mining, manufacturing, and utilities represent primary demand drivers, while emerging applications in data centers and electric vehicle charging infrastructure create new growth opportunities.

The Canada switchgear market refers to the comprehensive ecosystem of electrical switching, protection, and control equipment designed to safely manage electrical power distribution across residential, commercial, and industrial applications throughout Canadian territories. Switchgear systems encompass circuit breakers, disconnect switches, fuses, protective relays, and control panels that ensure reliable and safe electrical power management.

Market scope includes various switchgear categories based on voltage levels, installation types, and application requirements. Low voltage switchgear typically operates below 1kV and serves residential and light commercial applications, while medium voltage systems (1kV-35kV) support industrial facilities and distribution networks. High voltage switchgear above 35kV primarily serves transmission systems and large industrial installations requiring robust power management capabilities.

Technological evolution within the market encompasses traditional air-insulated switchgear (AIS), gas-insulated switchgear (GIS), and emerging hybrid solutions that combine multiple technologies for enhanced performance. Digital integration represents a growing segment, incorporating smart monitoring, remote control capabilities, and predictive maintenance features that align with Industry 4.0 principles and smart grid development initiatives across Canada.

Strategic analysis reveals the Canada switchgear market experiencing substantial transformation driven by infrastructure modernization, renewable energy integration, and technological advancement. Market leadership remains concentrated among established international manufacturers while domestic companies strengthen their positions through specialized solutions and regional expertise. The market demonstrates resilience despite economic fluctuations, supported by essential infrastructure requirements and government investment in electrical grid enhancement.

Growth drivers include Canada’s commitment to achieving net-zero emissions by 2050, necessitating significant electrical infrastructure upgrades and renewable energy integration. Industrial expansion across key sectors, particularly in resource extraction and manufacturing, continues generating demand for reliable switchgear solutions. Urbanization trends and population growth in major metropolitan areas drive residential and commercial construction activities, creating sustained demand for electrical infrastructure components.

Competitive dynamics feature both global technology leaders and specialized regional providers competing across different market segments. Innovation focus centers on digitalization, environmental sustainability, and enhanced safety features, with manufacturers investing in research and development to meet evolving customer requirements. Market consolidation activities and strategic partnerships shape the competitive landscape, enabling companies to expand their technological capabilities and market reach.

Market intelligence reveals several critical insights shaping the Canada switchgear landscape. Primary insights include:

Market segmentation analysis indicates medium voltage switchgear representing the largest segment, driven by industrial applications and distribution network requirements. Application diversity spans utilities, industrial facilities, commercial buildings, and infrastructure projects, each presenting unique technical requirements and growth opportunities.

Infrastructure modernization serves as the primary catalyst driving Canada’s switchgear market expansion. Aging electrical infrastructure across provinces requires systematic replacement and upgrading to meet current safety standards and operational efficiency requirements. Government initiatives supporting grid modernization and smart city development create substantial opportunities for advanced switchgear deployment.

Renewable energy transition represents another significant driver, with Canada’s commitment to clean energy requiring extensive electrical infrastructure adaptation. Solar and wind installations necessitate specialized switchgear solutions for grid integration, power conditioning, and safety protection. Hydroelectric expansion in provinces like Quebec and British Columbia drives demand for high-voltage switchgear systems capable of handling substantial power generation capacity.

Industrial growth across key sectors including mining, oil and gas, manufacturing, and technology continues generating demand for reliable electrical infrastructure. Resource extraction activities require robust switchgear solutions capable of operating in challenging environments while maintaining safety and reliability standards. Manufacturing expansion and automation initiatives drive demand for sophisticated electrical control and protection systems.

Regulatory compliance requirements and safety standards evolution compel facility owners to upgrade existing switchgear installations. Canadian Electrical Code updates and provincial regulations mandate enhanced safety features and performance standards, driving replacement cycles and technology adoption.

High capital investment requirements represent a significant constraint limiting market growth, particularly for small and medium-sized enterprises. Initial costs associated with advanced switchgear systems, installation, and commissioning can be substantial, creating barriers to adoption despite long-term operational benefits. Budget constraints in public sector projects may delay infrastructure upgrades and modernization initiatives.

Technical complexity associated with modern switchgear systems requires specialized expertise for design, installation, and maintenance. Skills shortage in electrical engineering and technical trades creates challenges for project implementation and ongoing system support. Training requirements for personnel working with advanced digital switchgear systems add to operational costs and complexity.

Supply chain disruptions and component availability issues can impact project timelines and costs. Global supply chain dependencies for specialized components and materials create vulnerability to international market fluctuations and geopolitical factors. Lead times for custom switchgear solutions may extend project schedules and increase costs.

Environmental regulations and restrictions on certain insulating gases like SF6 require technology transitions that may involve additional costs and complexity. Disposal requirements for legacy switchgear systems containing hazardous materials add to replacement project costs and regulatory compliance burden.

Smart grid development presents substantial opportunities for advanced switchgear solutions incorporating digital monitoring, control, and communication capabilities. Grid modernization initiatives across Canadian provinces create demand for intelligent switchgear systems that enhance operational efficiency and enable remote management capabilities. Integration opportunities with renewable energy sources and energy storage systems expand market potential.

Electric vehicle infrastructure expansion creates new market segments for specialized switchgear solutions supporting charging stations and grid integration. EV adoption growth necessitates electrical infrastructure upgrades in residential, commercial, and public charging applications. Fast-charging networks require robust switchgear systems capable of handling high power loads safely and efficiently.

Data center expansion driven by digital transformation and cloud computing growth generates demand for reliable, high-capacity switchgear solutions. Critical infrastructure requirements in data centers demand redundant protection systems and advanced monitoring capabilities. Edge computing deployment creates opportunities for compact, efficient switchgear solutions in distributed locations.

Industrial automation and Industry 4.0 adoption drive demand for intelligent switchgear systems with advanced communication and control features. Process optimization initiatives require switchgear solutions that integrate seamlessly with automated systems and provide real-time operational data. Predictive maintenance capabilities create value propositions for digitally-enabled switchgear systems.

Market forces shaping the Canada switchgear landscape reflect complex interactions between technological advancement, regulatory requirements, and economic factors. Technology evolution drives continuous innovation in switchgear design, materials, and functionality, creating competitive advantages for early adopters while potentially obsoleting existing solutions. Digital transformation initiatives across industries influence switchgear selection criteria, emphasizing connectivity and intelligence features.

Competitive intensity varies across market segments, with established manufacturers competing on technology leadership, reliability, and service capabilities. Price competition remains significant in commodity segments, while specialized applications command premium pricing for advanced features and performance. Market consolidation activities reshape competitive dynamics through acquisitions and strategic partnerships.

Customer behavior evolution reflects increasing sophistication in switchgear selection, with buyers emphasizing total cost of ownership, environmental impact, and digital capabilities. Procurement processes increasingly consider lifecycle costs, sustainability factors, and integration capabilities rather than focusing solely on initial purchase price. Service requirements expand beyond traditional maintenance to include digital services and performance optimization.

Supply chain dynamics influence market stability and growth potential, with manufacturers adapting to global component sourcing challenges and regional content requirements. Local manufacturing initiatives and supply chain localization efforts aim to reduce dependencies and improve responsiveness to market demands.

Comprehensive research approach employed for analyzing the Canada switchgear market combines primary and secondary research methodologies to ensure accurate and reliable market intelligence. Primary research activities include structured interviews with industry executives, technical experts, and key stakeholders across the switchgear value chain, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure consistency and reliability of market insights by cross-referencing multiple information sources and analytical approaches.

Market sizing methodology utilizes bottom-up and top-down approaches to estimate market dimensions and growth projections. Bottom-up analysis aggregates demand from individual market segments and applications, while top-down analysis considers macroeconomic factors and industry trends. Statistical modeling techniques project future market scenarios based on historical trends and identified growth drivers.

Quality assurance processes include peer review of analytical findings, validation of data sources, and sensitivity analysis of key assumptions. Expert consultation with industry specialists ensures technical accuracy and market relevance of research conclusions and recommendations.

Ontario dominance in the Canada switchgear market reflects the province’s industrial concentration, population density, and infrastructure development activities. Manufacturing sector strength in automotive, steel, and technology industries drives substantial switchgear demand, while urban development in Toronto and surrounding areas creates ongoing commercial and residential infrastructure requirements. Market share of approximately 38% positions Ontario as the leading regional market.

Quebec’s contribution stems from significant hydroelectric infrastructure, manufacturing activities, and urban development in Montreal and Quebec City. Renewable energy leadership in hydroelectric generation requires specialized high-voltage switchgear solutions for power transmission and distribution. Industrial diversity across aerospace, aluminum, and forestry sectors creates varied switchgear application requirements.

British Columbia represents a growing market driven by resource extraction, technology sector expansion, and renewable energy development. Mining activities in copper, gold, and other minerals require robust switchgear solutions for remote and challenging operating environments. Clean energy initiatives including hydroelectric and emerging wind projects drive infrastructure investment.

Alberta’s market reflects the province’s energy sector dominance, with oil and gas operations requiring specialized switchgear for upstream, midstream, and downstream applications. Industrial diversification efforts and renewable energy development create new market opportunities beyond traditional energy sectors.

Atlantic provinces demonstrate steady growth driven by infrastructure modernization, renewable energy projects, and industrial development. Offshore wind potential and tidal energy initiatives create emerging opportunities for specialized marine-rated switchgear solutions.

Market leadership in Canada’s switchgear sector features a combination of global technology leaders and specialized regional providers, each competing across different segments and applications. Competitive positioning varies based on technology capabilities, market reach, and customer relationships.

Competitive strategies emphasize technological differentiation, service excellence, and market-specific solutions. Innovation investments focus on digitalization, environmental sustainability, and enhanced safety features to meet evolving customer requirements and regulatory standards.

Voltage-based segmentation represents the primary classification method for Canada’s switchgear market, reflecting distinct technical requirements and application characteristics across different voltage ranges.

By Voltage Level:

By Installation Type:

By Insulation Type:

By End-User Industry:

Medium voltage switchgear dominates the Canadian market, representing approximately 52% of total installations due to widespread industrial applications and distribution network requirements. Industrial facilities across manufacturing, mining, and energy sectors rely heavily on medium voltage systems for reliable power distribution and equipment protection. Grid integration of renewable energy sources increasingly utilizes medium voltage switchgear for efficient power conditioning and transmission.

Low voltage switchgear maintains steady demand driven by residential construction, commercial development, and light industrial applications. Building automation trends and smart building initiatives drive adoption of intelligent low voltage switchgear with advanced monitoring and control capabilities. Modular designs gain popularity for their flexibility and ease of installation in diverse applications.

High voltage switchgear serves specialized applications in transmission systems, large industrial facilities, and power generation plants. Utility modernization projects and renewable energy integration drive demand for advanced high voltage solutions with enhanced reliability and digital capabilities. Environmental considerations influence technology selection, with growing preference for SF6-free alternatives.

Digital switchgear emerges as a growing category, incorporating IoT connectivity, predictive analytics, and remote monitoring capabilities. Industry 4.0 adoption drives demand for intelligent switchgear systems that integrate with broader automation and control systems. Predictive maintenance capabilities provide significant value propositions through reduced downtime and optimized operational costs.

Manufacturers benefit from expanding market opportunities driven by infrastructure modernization and technological advancement. Innovation leadership in digital switchgear and sustainable technologies creates competitive advantages and premium pricing opportunities. Market diversification across multiple end-user segments reduces dependency risks and provides stable revenue streams.

End-users gain significant operational advantages through modern switchgear solutions including improved reliability, enhanced safety, and reduced maintenance requirements. Digital capabilities enable predictive maintenance, remote monitoring, and operational optimization that reduce total cost of ownership. Energy efficiency improvements contribute to sustainability goals and operational cost reduction.

System integrators and engineering firms benefit from growing complexity in switchgear systems requiring specialized expertise for design, installation, and commissioning. Service opportunities expand beyond traditional installation to include ongoing digital services, performance optimization, and system upgrades.

Utilities and infrastructure operators achieve improved grid reliability, enhanced operational visibility, and reduced maintenance costs through advanced switchgear solutions. Smart grid capabilities enable better demand management, fault detection, and system optimization. Regulatory compliance becomes more manageable through automated monitoring and reporting capabilities.

Government stakeholders benefit from improved infrastructure resilience, enhanced public safety, and progress toward environmental goals through modern switchgear deployment. Economic development opportunities arise from infrastructure investment and technology adoption across various sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration represents the most significant trend reshaping Canada’s switchgear market, with manufacturers integrating IoT sensors, cloud connectivity, and artificial intelligence into traditional electrical equipment. Smart switchgear solutions provide real-time monitoring, predictive maintenance capabilities, and remote control functions that enhance operational efficiency and reduce maintenance costs. Data analytics integration enables optimization of electrical systems and proactive identification of potential issues.

Sustainability focus drives adoption of environmentally friendly switchgear technologies, including SF6-free insulation alternatives and recyclable materials. Circular economy principles influence product design and end-of-life management strategies. Energy efficiency improvements in switchgear design contribute to overall system optimization and reduced environmental impact.

Modular design adoption increases across all voltage categories, providing flexibility for installation, expansion, and maintenance. Standardization efforts reduce costs and improve interoperability while maintaining customization capabilities for specific applications. Plug-and-play solutions simplify installation and commissioning processes.

Safety enhancement continues as a primary focus, with arc-resistant designs, advanced protection systems, and improved operator safety features becoming standard requirements. Remote operation capabilities reduce personnel exposure to electrical hazards while maintaining operational control and monitoring capabilities.

Integration complexity increases as switchgear systems connect with broader automation, control, and monitoring systems across industrial and utility applications. Cybersecurity considerations become critical as digital connectivity expands, requiring robust security measures and protocols.

Technology partnerships between switchgear manufacturers and digital technology companies accelerate innovation in smart grid solutions and industrial automation applications. Collaborative development initiatives focus on integrating artificial intelligence, machine learning, and advanced analytics into switchgear systems.

Manufacturing expansion activities include establishment of new production facilities and capacity increases to meet growing market demand. Local production initiatives aim to reduce supply chain dependencies and improve responsiveness to regional market requirements. Investment announcements in research and development facilities demonstrate commitment to innovation and market leadership.

Acquisition activities reshape the competitive landscape as companies seek to expand technological capabilities, market reach, and customer bases. Strategic partnerships enable access to complementary technologies and market segments while sharing development costs and risks.

Regulatory developments include updates to electrical codes, safety standards, and environmental regulations that influence product design and market requirements. Government initiatives supporting grid modernization and renewable energy integration create new market opportunities and requirements.

Product launches featuring advanced digital capabilities, improved environmental performance, and enhanced safety features demonstrate ongoing innovation in the switchgear sector. Technology demonstrations and pilot projects validate new concepts and accelerate market adoption of innovative solutions.

Strategic recommendations for market participants emphasize the importance of digital transformation and sustainability initiatives in maintaining competitive positioning. MarkWide Research analysis suggests that companies investing in IoT integration, predictive analytics, and environmental sustainability will achieve superior market performance and customer loyalty.

Technology investment priorities should focus on developing comprehensive digital ecosystems that integrate switchgear with broader automation and control systems. Cybersecurity capabilities require immediate attention as digital connectivity expands, necessitating robust security measures and ongoing monitoring capabilities.

Market expansion strategies should consider regional specialization and application-specific solutions that address unique Canadian market requirements. Service capabilities development becomes increasingly important as customers seek comprehensive solutions including installation, commissioning, maintenance, and digital services.

Partnership opportunities with technology companies, system integrators, and end-users can accelerate innovation and market penetration. Collaborative approaches to research and development reduce costs while improving solution effectiveness and market relevance.

Sustainability initiatives should encompass product design, manufacturing processes, and end-of-life management to meet evolving environmental requirements and customer expectations. Circular economy principles provide opportunities for differentiation and cost optimization.

Market trajectory for Canada’s switchgear sector indicates sustained growth driven by infrastructure modernization, renewable energy integration, and digital transformation initiatives. Growth projections suggest continued expansion at a CAGR of 6.2% through the forecast period, supported by government investment in electrical infrastructure and private sector modernization activities.

Technology evolution will accelerate digitalization trends, with artificial intelligence and machine learning integration becoming standard features in advanced switchgear systems. Predictive maintenance capabilities will achieve efficiency improvements of 30-40% compared to traditional maintenance approaches. Cybersecurity measures will become increasingly sophisticated to address evolving threat landscapes.

Market consolidation activities are expected to continue as companies seek scale advantages and technological capabilities through acquisitions and partnerships. Regional specialization may emerge as companies focus on specific geographic markets or application segments where they can achieve competitive advantages.

Regulatory environment will continue evolving to address environmental concerns, safety requirements, and grid modernization objectives. Standards harmonization efforts may simplify compliance requirements while maintaining safety and performance standards.

Investment opportunities will expand in emerging applications including electric vehicle infrastructure, data centers, and renewable energy integration. MWR projections indicate these segments could represent 25-30% of market growth over the next five years, creating substantial opportunities for innovative companies and solutions.

Canada’s switchgear market demonstrates robust growth potential driven by infrastructure modernization, renewable energy transition, and digital transformation initiatives across multiple sectors. Market dynamics reflect the complex interplay between technological advancement, regulatory requirements, and economic factors that shape demand patterns and competitive positioning.

Strategic opportunities abound for companies that successfully navigate the transition toward digital, sustainable, and intelligent switchgear solutions. Innovation leadership in areas such as IoT integration, predictive analytics, and environmental sustainability will determine long-term market success and competitive advantage.

Regional diversity across Canada’s provinces creates varied market opportunities and requirements, necessitating flexible approaches to product development and market strategy. Industry collaboration between manufacturers, technology providers, and end-users will accelerate innovation and market development while addressing evolving customer needs and regulatory requirements.

Future success in Canada’s switchgear market will depend on companies’ ability to balance technological innovation with practical application requirements, cost considerations, and sustainability objectives. Market participants that invest in comprehensive digital ecosystems, maintain strong customer relationships, and adapt to evolving market conditions will achieve sustainable growth and market leadership in this dynamic and essential industry sector.

What is Switch Gear?

Switch gear refers to the combination of electrical disconnect switches, fuses, or circuit breakers used to control, protect, and isolate electrical equipment in power systems. It plays a crucial role in ensuring the safety and reliability of electrical distribution networks.

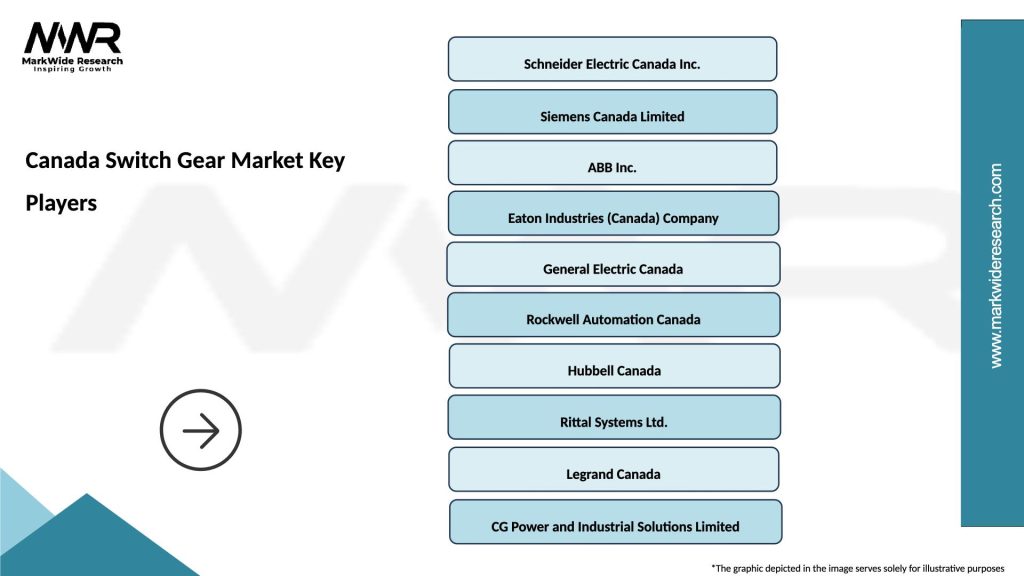

What are the key players in the Canada Switch Gear Market?

Key players in the Canada Switch Gear Market include Schneider Electric, Siemens, ABB, and Eaton, which are known for their innovative solutions and extensive product offerings in electrical distribution and control systems.

What are the drivers of growth in the Canada Switch Gear Market?

The growth of the Canada Switch Gear Market is driven by increasing demand for reliable power supply, the expansion of renewable energy sources, and the modernization of aging electrical infrastructure. Additionally, the rise in industrial automation and smart grid technologies contributes to market expansion.

What challenges does the Canada Switch Gear Market face?

The Canada Switch Gear Market faces challenges such as high installation and maintenance costs, the complexity of integrating new technologies with existing systems, and regulatory compliance issues. These factors can hinder market growth and adoption.

What opportunities exist in the Canada Switch Gear Market?

Opportunities in the Canada Switch Gear Market include the increasing adoption of smart grid technologies, the growth of electric vehicle infrastructure, and the rising focus on energy efficiency. These trends present avenues for innovation and investment in advanced switch gear solutions.

What trends are shaping the Canada Switch Gear Market?

Trends shaping the Canada Switch Gear Market include the shift towards digitalization and automation, the integration of IoT technologies for enhanced monitoring, and the development of eco-friendly switch gear solutions. These trends are influencing product design and functionality.

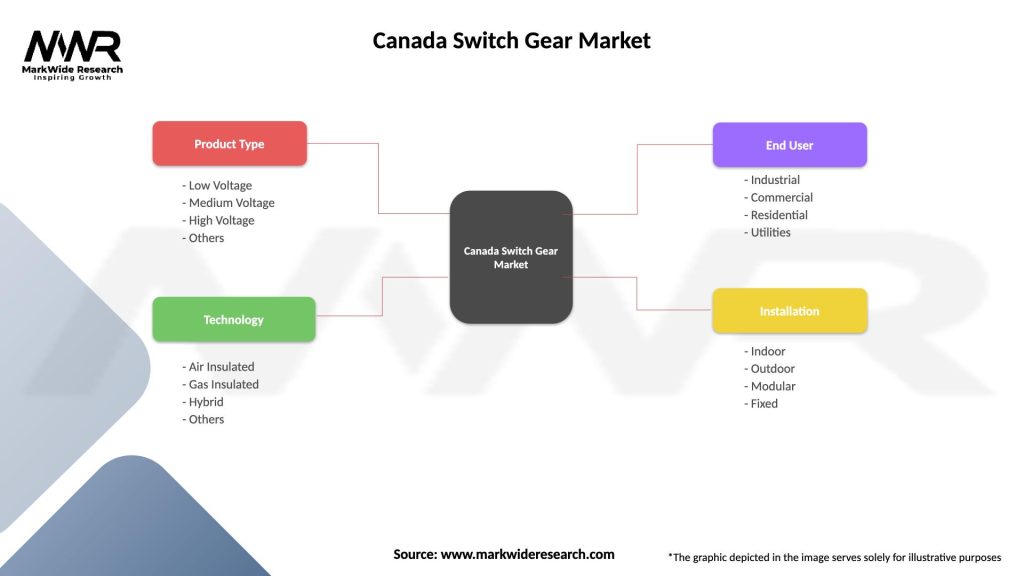

Canada Switch Gear Market

| Segmentation Details | Description |

|---|---|

| Product Type | Low Voltage, Medium Voltage, High Voltage, Others |

| Technology | Air Insulated, Gas Insulated, Hybrid, Others |

| End User | Industrial, Commercial, Residential, Utilities |

| Installation | Indoor, Outdoor, Modular, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Switch Gear Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at