444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada surveillance storage market represents a rapidly expanding sector within the nation’s security infrastructure landscape. Digital transformation initiatives across government, commercial, and residential sectors are driving unprecedented demand for sophisticated surveillance storage solutions. The market encompasses a comprehensive range of technologies including network video recorders, cloud-based storage systems, hybrid storage architectures, and advanced video analytics platforms.

Market dynamics indicate robust growth driven by increasing security concerns, regulatory compliance requirements, and technological advancements in video compression and storage efficiency. The Canadian market demonstrates significant adoption rates of intelligent video surveillance systems, with organizations prioritizing scalable storage solutions that can accommodate high-definition and ultra-high-definition video streams. Growth projections suggest the market will experience a compound annual growth rate of 8.2% over the forecast period, reflecting strong demand across multiple industry verticals.

Regional distribution shows concentrated activity in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, where urban security initiatives and smart city projects are driving substantial investments in surveillance infrastructure. Technology adoption patterns reveal increasing preference for cloud-hybrid storage models, with approximately 42% of organizations implementing hybrid architectures to balance cost-effectiveness with performance requirements.

The Canada surveillance storage market refers to the comprehensive ecosystem of hardware, software, and service solutions designed to capture, store, manage, and analyze video surveillance data across Canadian territories. This market encompasses traditional on-premises storage systems, cloud-based platforms, and hybrid architectures that enable organizations to maintain comprehensive video surveillance capabilities while ensuring data security and regulatory compliance.

Core components include network video recorders, digital video recorders, storage area networks, cloud storage platforms, video management software, and analytics engines. The market serves diverse applications ranging from critical infrastructure protection and law enforcement to retail loss prevention and residential security monitoring. Modern surveillance storage solutions integrate artificial intelligence capabilities, enabling automated threat detection, behavioral analysis, and predictive security insights.

Strategic analysis of the Canada surveillance storage market reveals a dynamic landscape characterized by technological innovation, regulatory evolution, and increasing security awareness across all sectors. The market benefits from Canada’s robust telecommunications infrastructure, supportive regulatory framework, and growing emphasis on public safety and security.

Key market drivers include rising crime rates in urban centers, increasing terrorist threats, growing adoption of smart city initiatives, and mandatory compliance with privacy and data protection regulations. Technology trends show accelerating adoption of artificial intelligence-powered analytics, edge computing solutions, and software-defined storage architectures. The market demonstrates strong growth momentum with adoption rates increasing by 15% annually across commercial and government sectors.

Competitive dynamics feature both international technology leaders and specialized Canadian solution providers, creating a diverse ecosystem that serves various market segments from enterprise-scale deployments to small business applications. Investment patterns indicate substantial capital allocation toward next-generation storage technologies and cloud infrastructure development.

Market intelligence reveals several critical insights shaping the Canada surveillance storage landscape:

Security concerns represent the primary driver propelling Canada’s surveillance storage market forward. Rising crime rates in major metropolitan areas, coupled with increasing awareness of terrorism threats, are compelling organizations across all sectors to invest in comprehensive surveillance infrastructure. Government initiatives supporting smart city development and public safety enhancement are creating substantial demand for scalable storage solutions.

Regulatory requirements are significantly influencing market growth, with organizations required to maintain video surveillance records for extended periods to ensure compliance with various federal and provincial regulations. Digital transformation initiatives across industries are driving adoption of intelligent surveillance systems that require sophisticated storage architectures capable of handling massive data volumes while providing real-time analytics capabilities.

Technological advancement in video resolution and compression technologies is creating new storage requirements, with 4K and 8K video streams demanding more robust storage infrastructure. Cost optimization pressures are encouraging organizations to adopt cloud-based and hybrid storage models that offer improved cost-effectiveness compared to traditional on-premises solutions. Business continuity requirements are driving demand for redundant storage systems that ensure continuous surveillance operations even during system failures or maintenance periods.

High implementation costs represent a significant barrier to market expansion, particularly for small and medium-sized enterprises that may lack sufficient capital for comprehensive surveillance storage deployments. Technical complexity associated with integrating modern surveillance storage systems with existing infrastructure creates challenges for organizations with limited IT expertise and resources.

Privacy concerns and regulatory compliance requirements create additional complexity and costs for organizations implementing surveillance storage solutions. Data sovereignty requirements may limit options for cloud-based storage, particularly for government and critical infrastructure applications that require data to remain within Canadian borders. Bandwidth limitations in remote areas can restrict the effectiveness of cloud-based surveillance storage solutions.

Cybersecurity threats pose ongoing challenges for surveillance storage systems, requiring continuous investment in security measures and updates to protect against evolving attack vectors. Skills shortage in cybersecurity and surveillance technology expertise limits the ability of organizations to effectively implement and maintain advanced storage solutions. Interoperability issues between different vendor systems can create integration challenges and increase deployment costs.

Smart city initiatives across Canadian municipalities present substantial opportunities for surveillance storage solution providers. Government investment in public safety infrastructure is creating demand for large-scale, integrated surveillance storage platforms that can support city-wide monitoring and analytics capabilities.

Artificial intelligence integration offers significant opportunities for developing next-generation surveillance storage solutions that provide automated threat detection, behavioral analysis, and predictive security insights. Edge computing deployment presents opportunities for developing distributed storage architectures that reduce bandwidth costs while improving response times.

Industry-specific solutions represent growing opportunities, with sectors such as healthcare, education, retail, and transportation requiring specialized surveillance storage capabilities tailored to their unique operational requirements. Managed services offerings present opportunities for solution providers to develop recurring revenue streams while helping organizations overcome technical expertise limitations. International expansion opportunities exist for Canadian surveillance storage companies to leverage their expertise in privacy-compliant solutions for global markets.

Technology evolution continues to reshape the Canada surveillance storage market, with artificial intelligence, machine learning, and advanced analytics becoming integral components of modern storage platforms. Market consolidation trends are evident as larger technology companies acquire specialized surveillance storage providers to expand their solution portfolios and market reach.

Customer expectations are evolving toward comprehensive platforms that integrate storage, analytics, and management capabilities in unified solutions. Pricing pressures are driving innovation in cost-effective storage architectures, with cloud-based and hybrid models gaining preference over traditional on-premises deployments. Regulatory changes continue to influence market dynamics, with privacy protection requirements creating both challenges and opportunities for solution providers.

Partnership strategies are becoming increasingly important as surveillance storage providers collaborate with system integrators, security consultants, and technology partners to deliver comprehensive solutions. Innovation cycles are accelerating, with new storage technologies and capabilities being introduced regularly to address evolving customer requirements and market demands.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies. Primary research involved extensive interviews with key industry stakeholders including surveillance storage vendors, system integrators, end-user organizations, and technology consultants across Canada’s major metropolitan areas.

Secondary research encompassed analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market baseline data and identify key trends. Market sizing was performed through bottom-up analysis of individual market segments, validated through top-down industry analysis and expert consultation.

Data validation processes included cross-referencing multiple sources, conducting expert interviews, and performing statistical analysis to ensure accuracy and reliability of market insights. Trend analysis incorporated historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics. Regional analysis was conducted through province-by-province examination of market conditions, regulatory environments, and competitive landscapes.

Ontario dominates the Canada surveillance storage market, accounting for approximately 45% of national demand, driven by the concentration of major corporations, government facilities, and urban centers in Toronto and Ottawa. Technology adoption rates in Ontario exceed national averages, with organizations implementing advanced cloud-based and hybrid storage solutions at accelerated rates.

British Columbia represents the second-largest regional market, with Vancouver’s technology sector and growing smart city initiatives driving substantial demand for innovative surveillance storage solutions. Quebec demonstrates strong growth in government and public sector applications, with Montreal serving as a key hub for surveillance technology deployment and French-language solution requirements.

Alberta shows significant market activity driven by oil and gas industry security requirements and Calgary’s growing technology sector. Prairie provinces demonstrate increasing adoption of surveillance storage solutions for agricultural and resource industry applications. Atlantic Canada presents emerging opportunities as regional governments invest in public safety infrastructure and smart city initiatives. Northern territories show specialized demand for ruggedized surveillance storage solutions capable of operating in extreme environmental conditions.

Market leadership is distributed among several key categories of solution providers, creating a diverse and competitive ecosystem:

Competitive strategies focus on technology innovation, strategic partnerships, and specialized market segment targeting to differentiate offerings and capture market share.

By Technology:

By Application:

By Storage Type:

Network Video Recorders continue to dominate the market due to their superior image quality, network integration capabilities, and scalability advantages. Technology advancement in NVR platforms is driving adoption of 4K and higher resolution recording capabilities, creating demand for high-capacity storage solutions.

Cloud-based storage represents the fastest-growing category, with organizations attracted to the scalability, cost-effectiveness, and reduced maintenance requirements. Hybrid architectures are gaining preference as they allow organizations to balance security requirements with cost optimization by storing critical footage locally while leveraging cloud storage for long-term archival.

Video management software is evolving beyond basic storage management to incorporate advanced analytics, artificial intelligence, and integration capabilities. Mobile accessibility features are becoming standard requirements, enabling remote monitoring and management of surveillance storage systems. Integration capabilities with other security systems and business applications are increasingly important for comprehensive security platform deployments.

Solution Providers benefit from growing market demand, opportunities for recurring revenue through managed services, and potential for technology innovation leadership. System Integrators gain access to expanding project opportunities and the ability to offer comprehensive security solutions that differentiate their service offerings.

End Users benefit from improved security capabilities, cost-effective storage solutions, and access to advanced analytics that provide operational insights beyond basic surveillance. Government Organizations achieve enhanced public safety capabilities while ensuring compliance with privacy and data protection regulations.

Technology Partners benefit from collaboration opportunities and the ability to integrate surveillance storage capabilities into broader technology platforms. Investors gain access to a growing market with strong fundamentals and multiple expansion opportunities across various industry verticals and geographic regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming surveillance storage from passive recording systems to intelligent platforms capable of automated threat detection, behavioral analysis, and predictive insights. Cloud-First Strategies are becoming prevalent as organizations seek to reduce infrastructure costs while improving scalability and accessibility.

Edge Computing Deployment is accelerating to address bandwidth limitations and improve real-time response capabilities in distributed surveillance networks. Privacy-by-Design approaches are becoming standard as organizations implement surveillance storage solutions that incorporate privacy protection features from the initial design phase.

Subscription-Based Models are gaining traction as organizations prefer operational expense models over large capital investments for surveillance storage infrastructure. Mobile-First Design is becoming essential as users demand comprehensive mobile access to surveillance storage systems for remote monitoring and management. Integration Platforms are evolving to connect surveillance storage with broader security ecosystems and business intelligence systems.

Technology partnerships between surveillance storage providers and cloud infrastructure companies are creating new hybrid solution offerings that combine the benefits of local and cloud-based storage. Regulatory updates at federal and provincial levels are influencing market requirements and creating opportunities for compliant solution providers.

Acquisition activity is increasing as larger technology companies seek to expand their surveillance storage capabilities through strategic acquisitions of specialized providers. Research and development investments are accelerating in areas such as artificial intelligence, edge computing, and advanced video compression technologies.

Standards development initiatives are progressing to establish interoperability requirements and security standards for surveillance storage systems. Pilot programs in major Canadian cities are demonstrating the effectiveness of next-generation surveillance storage solutions and driving broader market adoption. International collaboration projects are enabling Canadian companies to expand their market reach while bringing global best practices to the domestic market.

MarkWide Research analysis suggests that organizations should prioritize hybrid storage architectures that provide flexibility to adapt to changing requirements while optimizing costs. Investment strategies should focus on solutions that integrate artificial intelligence capabilities to maximize the value derived from surveillance data beyond basic security monitoring.

Technology selection should emphasize platforms that offer strong integration capabilities with existing security systems and business applications. Vendor evaluation should include assessment of long-term viability, ongoing support capabilities, and commitment to privacy compliance requirements. Implementation planning should incorporate comprehensive cybersecurity measures and regular security updates to protect against evolving threats.

Market entry strategies for new providers should focus on specialized market segments or unique technology capabilities that differentiate offerings from established competitors. Partnership development with system integrators and technology consultants can accelerate market penetration and provide access to established customer relationships.

Market projections indicate continued strong growth driven by increasing security awareness, technological advancement, and regulatory requirements. Technology evolution will likely focus on artificial intelligence integration, edge computing capabilities, and enhanced cybersecurity features. MWR forecasts suggest the market will experience sustained growth with compound annual growth rates exceeding 8% over the next five years.

Innovation trends point toward more intelligent, automated surveillance storage solutions that provide actionable insights rather than simply storing video data. Market consolidation is expected to continue as larger technology companies acquire specialized providers to build comprehensive security platform offerings.

Regulatory evolution will likely create both challenges and opportunities as privacy protection requirements become more stringent while security needs continue to grow. International expansion opportunities for Canadian surveillance storage companies are expected to increase as global markets seek privacy-compliant solutions. Investment levels in surveillance storage infrastructure are projected to remain strong, supported by government initiatives and private sector security requirements.

The Canada surveillance storage market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing security requirements, technological advancement, and supportive regulatory frameworks. Market fundamentals remain strong with diverse growth drivers spanning government, commercial, and residential applications.

Technology trends toward artificial intelligence integration, cloud-based solutions, and hybrid architectures are reshaping the competitive landscape and creating new opportunities for innovation and market differentiation. Strategic positioning in this market requires understanding of complex regulatory requirements, evolving customer needs, and rapidly advancing technology capabilities.

Future success in the Canada surveillance storage market will depend on the ability to deliver comprehensive, secure, and cost-effective solutions that address the diverse needs of Canadian organizations while ensuring compliance with privacy and data protection requirements. Market participants who can effectively combine technology innovation with deep understanding of Canadian market requirements are positioned to capture significant opportunities in this expanding sector.

What is Surveillance Storage?

Surveillance Storage refers to the systems and technologies used to store video and data generated by surveillance cameras and security systems. This includes various storage solutions such as cloud storage, Network Video Recorders (NVRs), and Digital Video Recorders (DVRs).

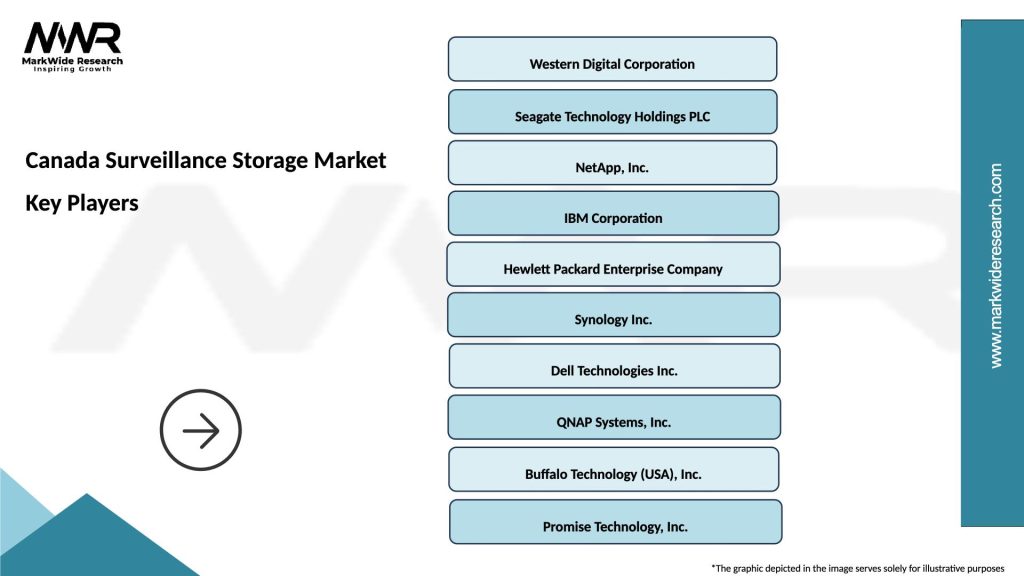

What are the key players in the Canada Surveillance Storage Market?

Key players in the Canada Surveillance Storage Market include companies like Hikvision, Dahua Technology, and Axis Communications, which provide a range of surveillance storage solutions. These companies are known for their innovative technologies and extensive product offerings, among others.

What are the growth factors driving the Canada Surveillance Storage Market?

The growth of the Canada Surveillance Storage Market is driven by increasing security concerns, the rise in crime rates, and the growing adoption of smart city initiatives. Additionally, advancements in storage technologies and the demand for high-definition video surveillance are contributing to market expansion.

What challenges does the Canada Surveillance Storage Market face?

The Canada Surveillance Storage Market faces challenges such as data privacy concerns and the high costs associated with advanced storage solutions. Additionally, the rapid evolution of technology can lead to compatibility issues and the need for continuous upgrades.

What opportunities exist in the Canada Surveillance Storage Market?

Opportunities in the Canada Surveillance Storage Market include the integration of artificial intelligence for enhanced analytics and the growing demand for cloud-based storage solutions. Furthermore, the expansion of IoT devices in surveillance systems presents new avenues for growth.

What trends are shaping the Canada Surveillance Storage Market?

Trends in the Canada Surveillance Storage Market include the shift towards cloud storage solutions and the increasing use of edge computing for real-time data processing. Additionally, there is a growing emphasis on cybersecurity measures to protect stored surveillance data.

Canada Surveillance Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Network Video Recorders, Digital Video Recorders, Cloud Storage Solutions, Hybrid Storage Systems |

| Technology | IP Surveillance, Analog Surveillance, Wireless Technology, Cloud-Based Solutions |

| End User | Retail Stores, Educational Institutions, Government Facilities, Healthcare Providers |

| Deployment | On-Premises, Cloud-Based, Hybrid, Remote Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Surveillance Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at